Numis Corporation PLC Trading Update (9488H)

March 30 2020 - 2:00AM

UK Regulatory

TIDMNUM

RNS Number : 9488H

Numis Corporation PLC

30 March 2020

Numis Corporation Plc ("Numis")

Trading Update

Numis Corporation Plc ("Numis") is today issuing a trading

update in respect of the six month period ending 31 March 2020.

Numis is expected to report revenue approximately 10% higher

than the first half of the prior year. The six month trading period

commenced during a period of elevated political uncertainty and

ended with global markets suffering significant declines in

reaction to the COVID-19 pandemic. The window available to execute

transactions during the first half was therefore limited, resulting

in subdued Investment Banking deal volumes for the period although

this was partially offset by an increase in our average fee. As

such, Investment Banking revenues are expected to be marginally

below the comparable period.

Equities delivered a materially stronger performance, more than

offsetting the Investment Banking revenue decline. Execution

revenues benefited from an improvement in activity levels

subsequent to the UK General Election; this has been sustained

through the current market volatility experienced in recent weeks.

In addition our trading book performance has been strong across the

period delivering gains materially ahead of the prior period.

Operationally we responded to COVID-19 promptly and successfully

implemented comprehensive remote working capability which has

enabled us to ensure both the safeguarding of our staff and the

ability to continue servicing our clients across the business

throughout this period of uncertainty.

We are working closely with our corporate clients to assess the

impact of COVID-19, and the unprecedented disruption that many of

them are currently experiencing. Whilst it is too early to predict

the timing of a recovery in our Investment Banking pipeline, we are

committed to supporting our corporate clients as they consider any

actions they may implement to insulate and protect their businesses

amid such uncertainty.

Numis benefits from a strong liquidity and capital position. Our

cash balance is currently higher than the position reported at year

end, in addition we have an undrawn, committed credit facility of

GBP35m. We believe that now, more than ever, our balance sheet

strength, market expertise and our long term partnership approach,

ensure we are well positioned to provide broad support to our

corporate and institutional clients during these unprecedented

times.

Due to the ongoing COVID-19 situation and in view of recent

regulatory communications regarding financial reporting, the

announcement date of Numis' half year results for the six months

ending 31 March 2020 will be confirmed in due course.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014

Contacts:

Numis Corporation:

Alex Ham & Ross Mitchinson, Co-Chief Executives 020 7260

1245

Andrew Holloway, Chief Financial Officer 020 7260 1266

Brunswick:

Nick Cosgrove 020 7404 5959

Simone Selzer 020 7404 5959

Grant Thornton UK LLP (Nominated Adviser):

Philip Secrett 020 7728 2578

Harrison Clarke 020 7865 2411

Niall McDonald 020 7728 2347

Notes for Editors

Numis is a leading independent investment banking group offering

a full range of research, execution, corporate broking and advisory

services to companies and their investors. Numis is listed on AIM,

and employs approximately 280 staff in London and New York.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKKOBDBBKBKNB

(END) Dow Jones Newswires

March 30, 2020 02:00 ET (06:00 GMT)

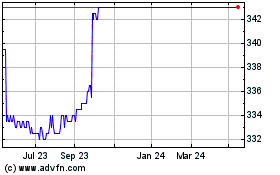

Numis (LSE:NUM)

Historical Stock Chart

From Dec 2024 to Jan 2025

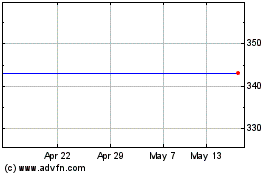

Numis (LSE:NUM)

Historical Stock Chart

From Jan 2024 to Jan 2025