TIDMMTVW

RNS Number : 5848T

Mountview Estates PLC

25 November 2021

Mountview Estates P.L.C.

Interim Results

25 November 2021

MOUNTVIEW ESTATES P.L.C.

("Mountview" or "the Group" or "the Company")

UNAUDITED INTERIM RESULTS FOR THE HALF YEARED 30 SEPTEMBER

2021

Mountview is pleased to announce its unaudited interim results

for the six months ended 30 September 2021.

OUR PERFORMANCE

Turnover at GBP30.7 million up by 36.4% (2020 - GBP22.5m)

Gross profit at GBP18.0 million up by 12.5% (2020 -

GBP16.0m)

Profit before tax at GBP15.6 million up by 15.5% (2020 -

GBP13.5m)

Earnings per share at 290.3 pence up by 3.5% (2020 - 280.4p)

Net assets per share at GBP101.9 up by 3.8% (2020 - GBP98.2)

DIVID INFORMATION

Mountview Estates P.L.C. advises its shareholders that,

following the issue of the interim results, the relevant dates in

respect of the exceptional interim dividend payment of 500p per

share (which includes a special dividend of 275p per share) are as

follows:

Ex-dividend date 17 February 2022

Record date 18 February 2022

Payment date 28 March 2022

CHIEF EXECUTIVE OFFICER'S STATEMENT

At the Annual General Meeting held on 11 August 2021 those

shareholders deemed to be independent exercised their right to

reject the re-election of Mr. Anthony Powell and Ms. Mhairi

Archibald as independent Non-Executive Directors. At the General

Meeting held in accordance with the Listing Rules of the Financial

Conduct Authority on 22 November 2021, when all shareholders were

entitled to vote, it was resolved to re-elect Mr. Anthony Powell

and Ms. Mhairi Archibald as Directors of the Company. Thus the

status quo is maintained.

TRADING

Brexit and Covid-19 have dominated the economic commentary this

year and the Government have announced the impending tax increases

by which they will seek to recover the vast sums of money which

they made available to keep the country afloat. This Company is

perhaps fortunate to be trading in a sector that has not been

heavily affected by the problems that have beset others and our

years of financial prudence have enabled us to continue to make

good profits.

Our year ending 31 March 2021 finished with a flourish because

all the auctioneers held extra sales in anticipation of the stamp

duty holiday finishing at 31 March 2021.

This year may have started quietly but the stamp duty holiday

was extended and phased out gently so that sales activity continues

strongly.

The results to 30 September 2021 are heavily influenced by the

need to provide for deferred taxation at 25%, the rate of

Corporation Tax which is to be levied from 1 April 2023. I must

emphasize that this taxation only becomes payable following the

disposal of the assets concerned and thus the necessary funding

will have been generated and this anticipated taxation has no

effect on present cash flow.

I am happy to repeat again that we have not furloughed any staff

or reduced staff numbers in any other way. The Company has

generated strong cash flow and we are thus in a good position to

shield ourselves from the difficult times that may lie ahead. I

believe that this should include not only our shareholders but also

our workforce whose hard work, loyalty and dedication makes all

this possible.

EXCEPTIONAL INTERIM DIVID

The interim dividend is at an exceptional rate of 500p per share

in respect of the year ending 31 March 2022 and is payable on 28

March 2022 to shareholders on the Register of Members as at 18

February 2022. This represents an increased interim dividend of

225p per share and a special dividend of 275p per share. Please

note that this will be made as one payment of 500p per share. The

Board believes a special dividend to be warranted this year because

of exceptional cash flow and this puts us in position to not only

pay this special dividend and all our regular outgoings but also to

be able to take advantage of any purchasing opportunities that may

arise. It is not anticipated that this interim dividend will limit

the final dividend payable in August 2022 in any way, but it would

be prudent to presume that the interim dividend payable in March

2023 will be maintained at the new increased level of 225p per

share.

OUTLOOK

Good purchases are vital to the future prosperity of the Company

and our financial strength will enable us to compete when good

opportunities occur. We have a long and successful history and we

are all working hard for that to continue.

D.M. SINCLAIR

Chief Executive Officer

25 November 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

for the half year ended 30 September 2021

Half year ended Half year ended Year ended

30.09.2021 30.09.2020 31.03.2021

GBP000 GBP000 GBP000

Revenue 30,711 22,450 65,730

Cost of Sales (12,754) (6,477) (22,508)

Gross Profit 17,957 15,973 43,222

Administrative expenses (2,205) (2,168) (5,865)

Gain on sale of investment properties 53 - -

Operating profit before changes

in

fair value of investment properties 15,805 13,805 37,357

Increase in fair value of investment

properties - - 1,452

Profit from operations 15,805 13,805 38,809

Net finance costs (181) (319) (675)

Profit before taxation 15,624 13,486 38,134

Taxation - current (3,062) (2,555) (6,966)

Taxation - deferred (1,242) - (275)

Taxation (4,304) (2,555) (7,241)

Profit attributable to equity

shareholders and total comprehensive

income 11,320 10,931 30,893

Basic and diluted earnings per

share (pence) 290.3p 280.4p 792.3p

All items within the consolidated statement of comprehensive

income relate to continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (UNAUDITED)

for the half year ended 30 September 2021

Half year ended Half year ended Year ended

30.09.2021 30.09.2020 31.03.2021

GBP000 GBP000 GBP000

Assets

Non-current assets

Property, plant and equipment 1,576 1,638 1,606

Investment properties 25,007 24,122 25,574

26,583 25,760 27,180

Current assets

Inventories of trading properties 394,921 409,295 398,166

Trade and other receivables 1,298 1,825 1,417

Cash and cash equivalents 1,012 608 597

397,231 411,728 400,180

Total assets 423,814 437,488 427,360

Equity and liabilities

Capital and reserves attributable

to equity holders of the Company

Share capital 195 195 195

Capital redemption reserve 55 55 55

Capital reserve 25 25 25

Other reserves 56 56 56

Retained earnings 397,087 382,376 394,540

397,418 382,707 394,871

Non-current liabilities

Long-term borrowings 15,500 44,700 20,600

Deferred tax 5,593 4,076 4,351

21,093 48,776 24,951

Current liabilities

Bank overdrafts and other short

term loans 1,497 3,011 1,280

Trade and other payables 1,032 528 2,142

Current tax payable 2,774 2,466 4,116

5,303 6,005 7,538

Total liabilities 26,396 54,781 32,489

Total equity and liabilities 423,814 437,488 427,360

CONSOLIDATED CASHFLOW STATEMENT (UNAUDITED)

for the half year ended 30 September 2021

Half year Half year Year

ended ended ended

30.09.2021 30.09.2020 31.03.2021

GBP000 GBP000 GBP000

Cash flows from operating

activities

Profit from operations 15,805 13,805 35,809

Adjustment for:

Depreciation 30 32 64

(Gain) on sale of investment (53) - -

properties

(Increase) in fair value

of investment properties - - (1,452)

Operating cash flows

before movement in working

capital 15,782 13,837 37,421

Decrease/(Increase)

in inventories 3,245 (17,226) (6,097)

Decrease in receivables 119 1,851 2,259

(Decrease) in payables (1,110) (4,302) (2,688)

Cash generated from

operations 18,036 (5,840) 30,895

Interest paid (181) (319) (675)

Income taxes paid (4,404) (3,539) (6,300)

Net cash Inflow/(Outflow)from

operating activities 13,451 (9,698) 23,920

Investing activities

Proceeds from disposal 620 - -

of investment properties

Net cash inflow from 620 - -

investing activities

Cash flows from financing

activities

(Repayment)/Increase

of borrowings (4,552) 13,381 (10,116)

Equity dividend paid (8,773) (7,798) (15,596)

Net cash (Outflow)/Inflow

from financing activities (13,325) 5,583 (25,712)

Net Increase/(Decrease)

in cash and cash equivalents 746 (4,115) (1,792)

Opening cash and cash

equivalents 266 2,058 2,058

Cash and cash equivalents

at end of period 1,012 (2,057) 266

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

for the half year ended 30 September 2021

Half year Half year Year

ended ended ended

30.09.2021 30.09.2020 31.03.2021

GBP000 GBP000 GBP000

Shareholders' funds

as at the beginning

of the period 394,871 379,574 379,574

Profit for the period 11,320 10,931 30,893

Dividends (8,773) (7,798) (15,596)

Shareholders' funds

at the end of the period 397,418 382,707 394,871

Notes to the Half Year Report

Basis of preparation

These condensed consolidated interim financial statements have

been prepared in accordance with the Disclosure and Transparency

Rules of the Financial Conduct Authority and in accordance with UK

adopted International Accounting Standard 34 (IAS 34) "Interim

Financial Reporting". The condensed consolidated interim financial

statements should be read in conjunction with the annual financial

statements for the year ended 31 March 2021 which have been

prepared in accordance with International Financial Reporting

Standards ("IFRS") as adopted by the European Union.

The accounting policies used are consistent with those contained

in the Group's last Annual Report and Accounts for the year ended

31 March 2021.

The Directors have reviewed the current and projected financial

position of the Group and are satisfied that the Group has adequate

resources to cover current liabilities. Therefore the Directors

continue to adopt the going concern basis in preparing the half

year report.

Basis of consolidation

The Group's financial statements incorporate the results of

Mountview Estates P.L.C. and all of its subsidiary undertakings

made up to the reporting date.

Subsidiaries are fully consolidated from the date on which

control is transferred to the Group.

Control is recognised when the Group is exposed to, or has

rights to, variable returns from its investment in the entity and

has the ability to affect these returns through its power over the

relevant activities of the entity.

On acquisition, the identifiable assets, liabilities and

contingent liabilities of a subsidiary are measured at their fair

values at the date of acquisition. The purchase method has been

used in consolidating the subsidiary financial statements.

All significant intercompany transactions and balances and

unrealised gains on transactions between Group companies are

eliminated on consolidation within the consolidated accounts.

Consistent accounting policies have been used across the

Group.

Status of the interim financial information

These condensed consolidated interim financial statements are

unaudited and do not constitute statutory accounts within the

meaning of Section 434 of the Companies Act 2006. The Group's

published financial statements for the year ended 31 March 2021

have been reported on by the Group's auditors and filed with the

Registrar of Companies. The report of the auditors was unqualified

and did not contain any statement under Section 498 of the

Companies Act 2006.

The condensed consolidated interim financial statements were

approved by the Board of Directors on 25 November 2021. The

preparation of the interim financial information requires

management to make assumptions and estimates about future events

which are uncertain, the actual outcome of which may result in a

materially different outcome from that anticipated.

Availability of the Half Year Report

Copies of this statement are being sent to Shareholders. Copies

may be obtained from the Company's registered office or from the

Company's website - www.mountviewplc.co.uk .

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. On publication of this announcement via a

Regulatory Information Service, this information is considered to

be in the public domain.

Ends

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGWUGUPGURA

(END) Dow Jones Newswires

November 25, 2021 03:19 ET (08:19 GMT)

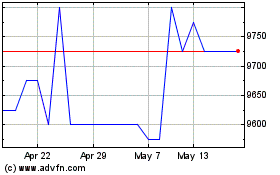

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Jun 2024 to Jul 2024

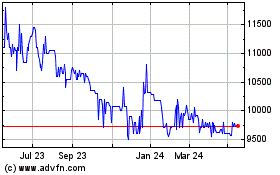

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Jul 2023 to Jul 2024