Medoro Resources Announces 2007 Year-end Results

TORONTO, April 30 /CNW/ - Medoro Resources Ltd. ("Medoro") (TSX-V:

MRS/AIM: MRL) announced today results for the year ended December 31, 2007.

For the year ended December 31, 2007, Medoro reported a net loss of

$1.5 million or $0.03 per share as compared to a net loss of $2.1 million or

$0.05 per share in the previous year. The 2007 decrease in net loss of $0.6

million was primarily a result of a increase in operating costs of $0.1

million offset by an increase in other income of $0.6 million and an increase

in future tax recovery of $0.1 million. The loss in the previous year included

a gain on the sale of the Monte Ollasteddu property of $0.3 million, a

recovery on note and share receivable of $0.9 million, foreign exchange gains

and other income of $1.2 million, partially offset by corporate and operating

costs of $4.8 million. Net earnings for the fourth quarter ended December 31,

2007 was $1.0 million or $0.02 per share compared to a net loss of $0.9

million or $0.04 per share in the previous year. As at December 31, 2007 the

company had cash and short-term investments of $2.0 million and no debt.

Subsequent to year-end, the company completed a brokered private

placement of 30,810,000 units at a price of $0.40 per unit, for gross proceeds

of $12,324,000.

The company is continuing its diamond drilling program at its Lo

Increible gold property in Venezuela. The program is intended to increase and

enhance existing resources at La Cruz, La Sofia and Tapon. The company expects

to prepare an updated resource estimate in the fourth quarter of this year. A

drilling program is expected to commence at its Sindo property in Mali this

week.

The company also announced that its report and accounts for the year

ended December 31, 2007 and the information circular, notice of meeting and

proxy for the company's annual meeting to be held on May 27, 2008 at 10:00

a.m. (Toronto time) in the Thames Room at the offices of Blake, Cassels &

Graydon LLP, 199 Bay Street, Suite 2800, Commerce Court West, Toronto Ontario,

Canada, have been sent to its shareholders. Copies of these documents may be

obtained during normal business hours on weekdays (except Saturdays, Sundays

and public holidays) free of charge from the Secretary of the company at the

company's head office at 220 Bay Street, Suite 1400, Toronto, Ontario, M5J

2W4, (416) 603-4653. In addition, these documents are also available on the

SEDAR website at www.sedar.com.

Medoro Resources is a gold exploration and development company focused on

acquiring properties of merit for potential joint ventures with senior

producers. The company holds a 100% interest in the Lo Increible 4A and 4B

concessions in Venezuela and interests in eleven gold exploration areas in the

Republic of Mali. Additional information on the company can be found by

visiting the company's website at www.medororesources.com. Medoro's Nominated

Adviser for the purposes of AIM is Canaccord Adams Ltd. (Ryan Gaffney/Robin

Birchall), +44 (0) 20 7050 6500.

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT

RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE

This press release contains forward-looking statements based on

assumptions, uncertainties and management's best estimates of future events.

Actual results may differ materially from those currently anticipated.

Investors are cautioned that such forward-looking statements involve risks and

uncertainties. Important factors that could cause actual results to differ

materially from those expressed or implied by such forward looking statements

are detailed from time to time in the company's periodic reports filed with

the British Columbia Securities Commission and other regulatory authorities.

The company has no intention or obligation to update or revise any

forward-looking statements, whether as a result of new information, future

events or otherwise.

Consolidated financial statements of

Medoro Resources Ltd.

December 31, 2007

Auditors' Report

To the Shareholders of

Medoro Resources Ltd.

We have audited the consolidated balance sheets of Medoro Resources Ltd.

as at December 31, 2007 and 2006 and the consolidated statements of

operations, comprehensive loss and deficit and of cash flows for the years

then ended. These financial statements are the responsibility of the Company's

management. Our responsibility is to express an opinion on these financial

statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted

auditing standards. Those standards require that we plan and perform an audit

to obtain reasonable assurance whether the financial statements are free of

material misstatement. An audit includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements. An audit

also includes assessing the accounting principles used and significant

estimates made by management, as well as evaluating the overall financial

statement presentation.

In our opinion, these consolidated financial statements present fairly,

in all material respects, the financial position of the Company as at December

31, 2007 and 2006 and the results of its operations and its cash flows for the

years then ended in accordance with Canadian generally accepted accounting

principles.

(Signed) "Deloitte & Touche LLP"

Chartered Accountants

Licensed Public Accountants

Toronto, Ontario

April 29, 2008

Medoro Resources Ltd.

Consolidated statements of operations, comprehensive loss and deficit

Year ended December 31, 2007 and 2006

(Expressed in thousands of Canadian dollars, except share and per share

amounts)

2007 2006

-------------------------------------------------------------------------

Operating expenses

General and administrative (Schedule) $ 4,811 $ 3,486

Stock-based compensation (Note 5) 140 1,333

-------------------------------------------------------------------------

4,951 4,819

-------------------------------------------------------------------------

Other income and expenses

Accreted interest on note and shares

receivable - 34

Foreign exchange gain 2,806 633

Interest income 8 529

Recovery on note and shares receivable - 881

Gain on disposal of mineral properties - 315

Other income 267 38

-------------------------------------------------------------------------

3,081 2,430

-------------------------------------------------------------------------

Net loss before income taxes (1,870) (2,389)

Future income tax recovery (Note 6) (393) (292)

-------------------------------------------------------------------------

Net loss and comprehensive loss for the year (1,477) (2,097)

Deficit, beginning of year (30,262) (28,165)

-------------------------------------------------------------------------

Deficit, end of year $ (31,739) $ (30,262)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Basic and diluted loss per share $ (0.03) $ (0.05)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Basic and diluted weighted average number

of common shares outstanding 51,329,196 46,018,943

-------------------------------------------------------------------------

-------------------------------------------------------------------------

The accompanying notes are an integral part of the consolidated financial

statements

Medoro Resources Ltd.

Consolidated balance sheets

as at December 31, 2007 and 2006

(Expressed in thousands of Canadian dollars)

2007 2006

-------------------------------------------------------------------------

Assets

Current assets

Cash and cash equivalents $ 2,026 $ 910

Short-term investments - 12,520

Prepaid and other assets 1,332 583

-------------------------------------------------------------------------

3,358 14,013

Property, plant and equipment, net (Note 4) 34,880 19,677

-------------------------------------------------------------------------

$ 38,238 $ 33,690

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Liabilities

Current liabilities

Accounts payable and accrued liabilities $ 1,881 $ 760

Future income taxes (Note 6) 5,118 5,759

-------------------------------------------------------------------------

6,999 6,519

-------------------------------------------------------------------------

Shareholders' equity

Share capital (Note 5) 57,937 53,663

Contributed surplus (Note 5) 5,041 3,770

Deficit (31,739) (30,262)

-------------------------------------------------------------------------

31,239 27,171

-------------------------------------------------------------------------

$ 38,238 $ 33,690

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Nature of operations (Note 1)

The accompanying notes are an integral part of the consolidated financial

statements

Medoro Resources Ltd.

Consolidated statements of cash flows

Year ended December 31, 2007 and 2006

2007 2006

-------------------------------------------------------------------------

Operating activities

Net loss $ (1,477) $ (2,097)

Items not affecting cash

Gain on disposal of mineral properties - (315)

Depreciation 50 61

Recovery on note and shares receivable - (881)

Future income tax recovery (393) (292)

Stock-based compensation 140 1,333

Unrealized foreign exchange (gain) loss (3,724) 185

Accreted interest on note and shares

receivable - (34)

Changes in non-cash working capital items

Prepaid and other assets (749) (518)

Accounts payable and accrued liabilities 321 412

-------------------------------------------------------------------------

(5,832) (2,146)

-------------------------------------------------------------------------

Investing activities

Short-term investments 12,520 (7,340)

Acquisition of Panwest - (1,402)

Proceeds on sale of Sardinia and SGM Ricerche - 2,867

Acquisition of African Gold Resources S.A (3,270) -

Acquisition of property, plant and equipment (4,700) (3,201)

-------------------------------------------------------------------------

4,550 (9,076)

-------------------------------------------------------------------------

Financing activities

Private placement (note 5(d)) 2,250 12,008

Issuance of common shares for cash 36 6

-------------------------------------------------------------------------

2,286 12,014

-------------------------------------------------------------------------

Effect of exchange rate changes on cash and

cash equivalents 112 -

-------------------------------------------------------------------------

Increase in cash and cash equivalents 1,116 792

Cash and cash equivalents, beginning of year 910 118

-------------------------------------------------------------------------

Cash and cash equivalents, end of year $ 2,026 $ 910

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Cash and cash equivalents are comprised of:

Cash $ 1,452 $ 910

Short-term money market instruments 574

-------------------------------------------------------------------------

$ 2,026 $ 910

-------------------------------------------------------------------------

-------------------------------------------------------------------------

See note 8 for supplemental cash flow information

The accompanying notes are an integral part of the consolidated financial

statements

Medoro Resources Ltd.

Notes to the consolidated financial statements

December 31, 2007

(Tabular amounts expressed in thousands of Canadian dollars, except share

and per share amounts)

1. Nature of operations

Medoro Resources Ltd. (the "Company") is currently engaged in the

exploration and development of mineral properties; as such, the

Company is considered to be in the development stage.

On May 24, 2006, the Company completed a share consolidation whereby

7 pre-consolidation shares were exchanged for 1 post-consolidation

share. All information related to common shares has been restated to

give effect to the share consolidation.

These financial statements have been prepared under the assumption

that the Company will be able to realize its assets and discharge its

liabilities in the normal course of business rather than through a

process of forced liquidation. To date, the Company has not generated

revenue from its principal business activities and has relied on

equity financings to meet its obligations. The ability of the Company

to continue as a going concern is dependent on the Company's ability

to receive continued financial support, the discovery of economically

recoverable reserves and the ability to obtain the necessary

financing to complete exploration and ultimately development, and

generate profitable operations in the future. If the going concern

assumption was not appropriate, the Company may not be able to

realize its assets and satisfy its liabilities in the normal course

of business.

2. Significant accounting policies

These consolidated financial statements have been prepared by the

Company in accordance with Canadian generally accepted accounting

principles and are expressed in Canadian dollars. The principal

accounting policies are outlined below:

(a) Basis of consolidation

These consolidated financial statements include the accounts of

the Company and all of its incorporated subsidiaries. All

intercompany transactions and balances have been eliminated.

Variable interest entities ("VIE's"), which include, but are not

limited to, special purpose entities, trusts, partnerships, and

other legal structures, as defined by Canadian Institute of

Chartered Accountants ("CICA") Accounting Guideline 15,

Consolidation of Variable Interest Entities, are subject to

consolidation by the primary beneficiary who will absorb the

majority of the entities' expected losses and/or expected

residual returns. The Company does not have any entities that

qualify for treatment under this guidance.

(b) Use of estimates

The preparation of financial statements, in conformity with

Canadian generally accepted accounting principles, requires

management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and the disclosure of

contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses

during the reporting year. On an ongoing basis, management

evaluates its estimates, including those related to the

recoverability of mineral properties, mineral exploration and

development costs and volatility assumptions for stock

compensation valuation. Management bases its estimates on

historical experience and on various other assumptions that are

believed to be reasonable under the circumstances, the results of

which form the basis for making judgments about the carrying

values of assets and liabilities that are not readily available

from other sources. Actual results could differ from those

estimates under different assumptions or conditions.

(c) Cash and equivalents

Cash and cash equivalents consist of cash on hand, deposits in

banks and highly liquid investments, with an original term to

maturity of three months or less.

(d) Short-term investments

Short-term investments include those short-term money market

instruments which, on acquisition, have a term to maturity of

greater than three months but less than one year.

(e) Mineral properties

The Company considers its mineral properties to have the

characteristics of property, plant and equipment. As such, the

Company defers all exploration costs, including acquisition

costs, field exploration and field supervisory costs relating to

specific properties until those properties are brought into

production, at which time they will be amortized on a unit-of-

production basis based on proven and probable reserves or until

the properties are abandoned, sold or considered to be impaired

in value, at which time an appropriate charge will be made.

Administrative costs are expensed as incurred.

The recoverability of the amounts shown for mineral properties is

dependent on the existence of economically recoverable reserves,

the ability to obtain financing to complete the development of

such reserves and meet the Company's obligations under various

agreements and the success of future operations or dispositions.

(f) Impairment of long-lived assets

The Company monitors the recoverability of the carrying amount of

its long-lived assets by estimating the undiscounted cash flows

expected to result from their use and eventual disposition. This

assessment is based on the carrying amount of the asset at the

date it is tested for recoverability, whether it is in use or

under development. If the carrying amount exceeds the sum of the

undiscounted cash flows expected to result, an impairment loss is

recognized and the adjusted carrying amount becomes the new cost

basis.

Non-producing mineral properties are also evaluated for

impairment based on management's intentions and are written down

when the long-term expectation is that the net carrying amount

will not be recovered.

(g) Reclamation and site restoration costs

The Company records the present value of asset retirement

obligations, including reclamation costs, when the obligation is

incurred. It is recorded as a liability with a corresponding

increase in the carrying value of the related mining assets. The

carrying value is amortized over the life of the related mining

asset on a units-of-production basis commencing with initial

commercialization of the asset. The liability is accreted to the

actual liability on settlement through charges each period in the

statement of operations.

(h) Foreign currency translation

The Company's functional currency is the Canadian dollar. The

Company's foreign subsidiaries are considered to be integrated

operations. Accordingly, the Company utilizes the temporal method

to translate the financial statements of these subsidiaries into

Canadian dollars. An exchange gain or loss that arises on

translation or settlement of a foreign currency denominated

monetary item or a non-monetary item carried at market is

included in the determination of net income for the current

period. At each balance sheet date, monetary items denominated in

a foreign currency are adjusted to reflect the exchange rate in

effect at the balance sheet date. Revenues and expenses are

translated into Canadian dollars at the exchange rates prevailing

on the transaction dates. Non-monetary assets and liabilities are

translated using historical rates of exchange.

(i) Income taxes

Future income tax assets and liabilities are recognized for the

future income tax consequences attributable to differences

between the financial statement carrying amounts of existing

assets and liabilities and their respective tax bases, and for

net operating loss carryforwards. Future income tax assets and

liabilities are measured using enacted or substantively enacted

tax rates expected to apply to taxable income in the years in

which those temporary differences are expected to reverse or be

settled. The effect of a change in tax rates is recognized in the

year that includes the substantive enactment date. A valuation

allowance is recorded against any future income tax asset if it

is not more likely than not that the asset will be realized.

(j) Stock-based compensation

The Company has in effect a stock option plan which is described

in Note 5 - Share Capital. The Company accounts for stock options

granted using the fair value based method of accounting for

stock-based compensation. Accordingly, the fair value of the

options at the date of grant is accrued and charged to

operations, with a corresponding credit to contributed surplus,

on a straight-line basis over the vesting period. If and when the

stock options are ultimately exercised, the applicable amounts of

contributed surplus are transferred to share capital.

(k) Loss per share

Loss per share is computed by dividing the net loss available to

common shareholders by the weighted average number of shares

outstanding during the reporting year. Diluted loss per share is

computed similar to basic loss per share except that the weighted

average shares outstanding are increased to include additional

shares for the assumed exercise of stock options, warrants and

convertible debentures, if dilutive. The number of additional

shares is calculated by assuming that outstanding stock options

and warrants were exercised and convertible debentures converted

and that the proceeds from such exercises and conversion were

used to acquire common stock at the average market price during

the reporting years. Options and warrants as disclosed in Note 5

are anti-dilutive and, therefore, have not been taken into

account in the per share calculations.

(l) Financial instruments and financial risks

The fair values of cash and cash equivalents, short term

investments, and accounts payable and accrued liabilities

approximate their carrying values due to the short term to

maturity of these financial instruments. The Company has no

derivative financial instruments.

(m) Adoption of new accounting standards

Effective January 1, 2007, the Company adopted CICA Handbook

Section 1530, Comprehensive Income, CICA Handbook Section 3855,

Financial Instruments - Recognition and Measurement, CICA

Handbook Section 3861, Financial Instruments - Disclosure and

Presentation, CICA Handbook Section 3865, Hedges, and CICA

Handbook Section 3251, Equity. These accounting policy changes

were adopted on a retrospective basis with no restatement of

prior period financial statements. The new standards and

accounting policy changes are as follows:

(a) Comprehensive income (Section 1530)

Comprehensive income is the change in shareholders' equity

during a period from transactions and other events and

circumstances from non-owner sources. In accordance with

this new standard, the Company now reports a statement of

comprehensive income and a new category, accumulated other

comprehensive income, in the shareholders' equity section of

the consolidated balance sheet. The components of this new

category may include unrealized gains and losses on

financial assets classified as available-for-sale, exchange

gains and losses arising from the translation of financial

statements of a self-sustaining foreign operation and the

effective portion of the changes in fair value of cash flow

hedging instruments.

During the year ended December 31, 2007, there were no

changes in shareholders' equity that resulted from the non-

owner sources and consequently, the adoption of the standard

noted above had no material effect on the presentation of

the Company's consolidated financial statements.

(b) Financial instruments - recognition and measurement (CICA

Handbook Section 3855) and disclosure and presentation (CICA

Handbook Section 3861)

In accordance with these new standards, the Company now

classifies all financial instruments as either held-for-

trading, available for sale, held-to-maturity, loans and

receivables or other financial liabilities. Financial

instruments classified as held-for-trading are measured at

fair value with unrealized gains and losses recognized in

operating results. Financial instruments classified as

available for sale are measured at fair value with

unrealized gains and losses recognized in other

comprehensive income. Financial instruments classified as

held-to-maturity, loans and receivables or other financial

liabilities are measured at amortized cost.

Upon adoption of these new standards, the Company has

designated its cash and cash equivalents and short-term

investments as held-for-trading, which are measured at fair

value. Accounts payable and accrued liabilities are

classified as other liabilities, which are measured at

amortized cost. As at December 31, 2007, the Company did not

have any financial assets classified as available for sale

and did not undertake any hedging activities therefore, the

adoption of the standard noted above had no material effect

on the presentation of the Company's consolidated financial

statements.

(c) Equity (CICA Section 3251)

The Company's adoption of CICA section 3251 resulted in

expanded disclosure of its components of shareholders'

equity in the notes to the consolidated financial

statements.

(d) Hedges (CICA Section 3865)

This section establishes the standard for when and how hedge

accounting may be applied. The Company currently does not

have any hedges in place, and therefore this standard had no

impact on the consolidated financial statements

(e) Transaction costs

Transaction costs with respect to instruments not classified

as held-for-trading are recognized as an adjustment to the

cost of the underlying instruments and are recognized and

amortized using the effective interest method. Application

of this new accounting policy did not have a material impact

on the financial position or results of operations as at or

for the year ended December 31, 2007.

(n) New accounting pronouncements

In November 2006, the CICA issued the new handbook Section 1535,

"Capital Disclosures," effective for annual and interim periods

related to fiscal years beginning on or after October 1, 2007.

This section establishes standards for disclosing information

about a Company's capital and how it is managed in order that a

user of the financial statements may evaluate the Company's

objectives, policies, and processes for managing capital. This

new standard is not expected to have a material effect on the

Company's consolidated financial statements.

In March 2007, the CICA issued a new section 3031, "Inventories",

which is to replace the existing section 3030, "Inventories".

Under the new section, inventories are required to be measured at

the "lower of cost and net realizable value", which is different

from the existing guidance of the "lower of cost and market". The

new section also requires, when applicable, the reversal of any

write-downs previously recognized. The new accounting standard

and any consequential amendments will be effective for the

Company beginning January 1, 2008. The Company is currently

evaluating the implications of the new standard as it relates to

the financial statement presentation of its spare parts and

servicing equipment currently presented as Property, plant and

equipment.

CICA Section 1400, "General Standards of Financial Statement

Presentation", was amended June 2007 to include guidance on an

entity's ability to continue as a going concern. The revised

standard explicitly requires management to assess and disclose

the entity's ability to continue as a going concern. For

clarification, these financial statements have been prepared on

the basis of accounting policies applicable to a going concern,

which assumes that the Company will continue in operation for the

foreseeable future and will be able to realize its assets and

discharge its liabilities in the normal course of business. The

Company is not aware of any material circumstances that would

undermine this assumption.

In February 2008, the CICA issued Section 3064, Goodwill and

intangible assets, replacing Section 3062, Goodwill and other

intangible assets and Section 3450, Research and development

costs. Various changes have been made to other sections of the

CICA Handbook for consistency purposes. The new Sections will be

applicable to financial statements relating to fiscal years

beginning on or after October 1, 2008. Accordingly, the Company

will adopt the new standards for its fiscal year beginning

January 1, 2009. It establishes standards for the recognition,

measurement, presentation and disclosure of goodwill subsequent

to its initial recognition and of intangible assets by profit-

oriented enterprises. Standards concerning goodwill are unchanged

from the standards included in the previous Section 3062. The

Company is currently evaluating the impact of the adoption of

this new section on its consolidated financial statements. The

Company does not expect that the adoption of this new Section

will have a material impact on its consolidated financial

statements.

In 2006, Canada's Accounting Standards Board ratified a strategic

plan that will result in Canadian GAAP, as used by public

companies, being converged with International Financial Reporting

Standards in 2011. The impact of this transition on the Company's

consolidated financial statements is still being determined.

3. 2006 Acquisition

On July 10, 2006, the Company acquired all of the issued and

outstanding shares of Panwest Seas Corporation Ltd. ("Panwest", a

company incorporated in the British Virgin Islands), which holds the

right to the Lo Increible 4A and 4B exploration properties located in

the El Callao area of the State of Bolivar, Venezuela for $10,788,545

(including $276,645 in acquisition costs). In consideration for the

acquisition of Panwest, the Company issued 15,140,000 common shares,

paid $1,125,000 (US$1,000,000) in cash and also agreed to pay to the

sellers a royalty of US$15 per ounce of gold on all production from

the Lo Increible 4A and 4B mining properties. The properties are held

under mining contracts granted by Corporacion Venezolana de Guayana.

The common shares issued have been valued at a price of $0.62 per

common share, being the average closing price of the common shares of

the Company for the two days before, the day of, and two days after

the date of announcement of the acquisition agreement on June 12,

2006.

The business combination has been accounted for as a purchase

transaction with the Company as the acquirer of Panwest. The

allocation of the purchase price is based on the consideration paid

and the fair value of Panwest's net assets acquired.

Net assets acquired at fair values were as follows:

Mineral properties (included in

Property, plant and equipment) $ 16,346

Future income tax liability (5,557)

---------------------------------------------------------------------

$ 10,789

---------------------------------------------------------------------

---------------------------------------------------------------------

Total consideration paid consists of the following:

Cash $ 1,125

Common shares 9,387

Acquisition costs 277

---------------------------------------------------------------------

$ 10,789

---------------------------------------------------------------------

---------------------------------------------------------------------

4. Property, plant and equipment

a) Asset acquisition

On September 14, 2007 the Company exercised its option to acquire

all the issued and outstanding shares of African Gold Resources,

S.A. ("African Gold") a Panamanian company, which held the

options to acquire seven properties in Mali for $6,245,000

(including $163,000 in acquisition costs). In consideration for

the acquisition of African Gold, the Company paid $2,962,000

(US$2,810,000) and issued 5,200,000 common shares.

The cash consideration consisted of $808,000 (US$720,000) paid on

April 23, 2007 for the option to acquire all of the issued and

outstanding shares of African Gold, and $2,154,000 (US$2,090,000)

cash paid on the exercise of the option. The Company will also

assumed African Gold's obligations under the option arrangements

it has entered into with the holders of the properties, including

cash payments totalling US$224,000 and a one time payment of

US$9.00 per ounce of measured gold resources and US$4.00 per

ounce of indicated gold resources. The agreement also provides

that if any of the individual properties contain an aggregate of

500,000 ounces or more of measured and indicated gold resources,

then Gold Resources, the seller will receive a one-time payment

of US$6.00 per ounce of measured gold resources and US$4.00 per

ounce of indicated gold resources.

The common shares issued have been valued at a price of $0.60 per

common share, being the closing price on the day of the exercise

of the Company's option to acquire African Gold.

The total costs capitalized to Mineral properties on the asset

acquisition were as follow:

Cash paid for the option to purchase African Gold $ 808

Cash paid on the exercise of the option 2,154

Common shares issued 3,120

Acquisition costs 163

Future income tax liability 3,363

-----------------------------------------------------------------

$ 9,608

-----------------------------------------------------------------

-----------------------------------------------------------------

(b) The following table summarizes the Company's property, plant and

equipment:

December 31, 2007

-----------------------------------------------------------------

Accumulated Net book

Cost depreciation value

-----------------------------------------------------------------

Mineral properties

Lo Increible A

and B $ 24,674 $ - $ 24,674

Mali properties 9,438 - 9,438

Plant and equipment

Lo Increible A and B 484 130 354

Mali properties 433 19 414

-----------------------------------------------------------------

$ 35,029 $ 149 $ 34,880

-----------------------------------------------------------------

-----------------------------------------------------------------

December 31, 2006

-----------------------------------------------------------------

Accumulated Net book

Cost depreciation value

-----------------------------------------------------------------

Mineral properties

Lo Increible A

and B $ 19,180 $ - $ 19,180

Plant and equipment 558 61 497

-----------------------------------------------------------------

$ 19,738 $ 61 $ 19,677

-----------------------------------------------------------------

-----------------------------------------------------------------

During the year ended December 31, 2007, $38,031 (2006 - $14,312)

of depreciation of plant and equipment used in exploration

activities has been capitalized in mineral properties.

5. Share capital

(a) Common shares

Authorized: an unlimited number of common shares with no par

value

Issued and outstanding

Number of Contributed

shares Amount surplus

-----------------------------------------------------------------

$ $

Balance, December 31, 2005 17,816,425 34,111 587

Issued on acquisition of

Panwest

(Note 3) 15,140,000 9,387 -

Private placement

(Note 5 (b)) 14,285,714 8,305 890

Private placement

(Note 5 (c)) 2,150,000 1,852 962

Exercise of stock options 7,142 8 (2)

Stock-based compensation - - 1,333

-----------------------------------------------------------------

Balance, December 31, 2006 49,399,281 53,663 3,770

Issued on acquisition of

African Gold

(Note 4) 5,200,000 3,120

Private placement

(Note 5 (d)) 3,308,809 1,108 1,141

Exercise of stock options 70,000 46 (10)

Stock-based compensation - - 140

-----------------------------------------------------------------

Balance, December 31, 2007 57,978,090 57,937 5,041

-----------------------------------------------------------------

-----------------------------------------------------------------

(b) On February 28, 2006, the Company completed a private placement

of 14,285,714 common shares at $0.70 per share for net proceeds

of $9,195,045. In connection with the private placement, 857,143

agent compensation warrants were issued. Each agent compensation

warrant entitled the holder to purchase one common share of the

Company at a price of $0.70 per common share until August 28,

2007. All securities issued as part of this placement were

subject to a four-month hold. The agent compensation warrants

were fair valued using an option pricing model with the following

assumptions: no dividends are paid, a volatility of the Company's

share price of 140%, an expected life of the warrants of 18

months and an annual risk free rate of 3.96%.

(c) On July 21, 2006, the Company completed a private placement with

Gold Fields Ltd. of 2,150,000 units at a price of $1.40 for net

proceeds of $2,813,943. Each unit consisted of a share and one-

half of a warrant, with each whole warrant being exercisable for

two years at a price of $2.80. The warrants were fair valued

using an option pricing model with the following assumptions: no

dividends are paid, a volatility of the Company's share price of

134%, an expected life of the warrants of two years and an annual

risk free rate of 4.16%.

(d) On November 22, 2007 the Company completed a private placement of

3,308,809 units at a price of $0.68 per unit, for gross proceeds

of $2,249,990. Each unit consists of one common share of the

company and one common share purchase warrant exercisable at a

price of $1.00 for a period of two years. The warrants were fair

valued using an option pricing model with the following

assumptions: no dividends are paid, a volatility of the Company's

share price of 132%, an expected life of the warrants of two

years and an annual risk free rate of 4.22%.

(e) Warrants

December 31, December 31,

2007 2006

-----------------------------------------------------------------

Weighted Weighted

average average

Number exer- Number exer-

of cise of cise

warrants price warrants price

-----------------------------------------------------------------

$ $

Balance, outstanding

beginning of year 4,628,232 2.14 2,837,089 2.38

Issued on private

placement 3,308,809 1.00 1,932,143 1.87

Warrants expired

during the year (3,000,000) 1.40 (141,000) 3.92

-----------------------------------------------------------------

Balance, end of year 4,937,041 1.76 4,628,232 2.14

-----------------------------------------------------------------

-----------------------------------------------------------------

The following table summarizes information concerning outstanding

and exercisable warrants at December 31, 2007:

Outstanding

and Exercise

exercisable price Expiry date

-----------------------------------------

$

553,232 4.90 December 17, 2008

1,075,000 2.80 May 8, 2008

3,308,809 1.00 November 22, 2009

-----------------------------------------

4,937,041

-----------------------------------------

-----------------------------------------

(e) Incentive stock option plan

The Company has an incentive stock option plan. Under the plan,

the exercise price of each option should not be for less than the

discounted market price as defined in the policies of the TSX

Venture Exchange, and an option's maximum term is five years.

Options may be granted by the board of directors at any time, to

directors, senior officers or employees of the Company and

consultants to the Company or any of its designated affiliates,

who, by the nature of their position or duties are, in the

opinion of the board, upon recommendation of the Compensation

Committee, in a position to contribute to the success of the

Company.

A summary of the changes in the Company's incentive stock option

plan are as follows:

December 31, December 31,

2007 2006

-----------------------------------------------------------------

Weighted Weighted

average average

exer- exer-

cise cise

Options price Options price

-----------------------------------------------------------------

Outstanding, beginning

of year 4,638,571 $ 0.92 720,097 $ 3.64

Options granted 257,000 0.73 3,970,000 0.52

Options cancelled (40,714) 0.71 (44,384) 8.05

Options exercised (70,000) 0.51 (7,142) 0.77

-----------------------------------------------------------------

Outstanding, end of

year 4,784,857 $ 0.92 4,638,571 $ 0.92

-----------------------------------------------------------------

-----------------------------------------------------------------

The following table summarizes information concerning outstanding

and exercisable options at December 31, 2007:

Options outstanding and exercisable

------------------------------------------------

Weighted Weighted

average average

Number remaining exercise

outstanding life in years price

------------------------------------------------

382,857 0.80 $ 4.90

2,144 0.77 2.66

272,856 1.63 1.26

100,000 4.40 0.91

90,000 3.63 0.82

77,000 4.74 0.70

80,000 4.03 0.53

3,725,000 3.55 0.51

10,000 3.82 0.48

45,000 3.79 0.45

------------------------------------------------

4,784,857 3.27 $ 0.92

------------------------------------------------

------------------------------------------------

The fair value of options issued by the Company in 2007 and 2006

was determined using the Black-Scholes option pricing model using

the following weighted average assumptions:

December 31, December 31,

2007 2006

-----------------------------------------------------------------

Weighted average risk-free rate 4.14% 4.10%

Dividend yield Nil Nil

Volatility factor of the expected

market price of the Company's shares 147% 110%

Average expected option life - years 2.5 2.5

Weighted average grant date fair value per

share of options issued during the year $0.54 $0.34

6. Income taxes

The provision for income taxes reported differs from the amounts

computed by applying the cumulative Canadian federal and provincial

income tax rates to the loss before tax provision due to the

following:

Years ended December 31,

---------------------------------------------------------------------

2007 2006

---------------------------------------------------------------------

$ $

Statutory tax rate 36.12% 36.12%

---------------------------------------------------------------------

---------------------------------------------------------------------

Recovery of income taxes from continuing

operations computed at standard rates 675 757

Differences in tax rates in foreign jurisdiction (9)

Effect of non-deductible income and expenses 1,323 (147)

Differences in future tax rates (552)

Tax losses not recognized in the period that the

benefit arose (1,044) (318)

---------------------------------------------------------------------

Future income tax recovery 393 292

---------------------------------------------------------------------

---------------------------------------------------------------------

The approximate tax effect of each type of temporary difference that

gives rise to the Company's future tax assets and liabilities are as

follows:

Years ended December 31,

---------------------------------------------------------------------

2007 2006

---------------------------------------------------------------------

$ $

Future income tax assets

Operating loss carryforwards 3,016 2,089

Capital loss carryforwards 1,297 1,182

Other temporary differences 315 324

---------------------------------------------------------------------

4,628 3,595

Less: Valuation allowance (4,628) (3,595)

---------------------------------------------------------------------

- -

---------------------------------------------------------------------

Future income tax liability

Accumulated cost base differences of assets $5,118 $5,759

---------------------------------------------------------------------

---------------------------------------------------------------------

The Company has reduced the value of the potential future income tax

asset to $Nil through the application of a valuation allowance as the

Company does not have any current source of income to which the tax

losses can be applied.

Included in the future income tax liability are future income taxes

relating to the 2006 Panwest acquisition (maintained in the

Venezuelan Bolivars currency) and the 2007 African Gold acquisition

(maintained in the Mali CFA currency). An unrealized foreign exchange

gain of $3.7 million resulted upon the translation at December 31,

2007 of these balances to the Canadian dollar.

At December 31, 2007, the Company has approximately $8,945,000 in

capital losses available to reduce future capital gains. At

December 31, 2007, the Company has approximately $8,191,000 in

Canadian loss carryforwards available for tax purposes that expire

between 2008 and 2027 as follows:

$

2008 94

2009 216

2010 230

2011 1,963

2012 1,455

2026 471

2027 3,948

---------------------------------------------------------------------

8,377

---------------------------------------------------------------------

---------------------------------------------------------------------

7. Related party transactions

During the years ended December 31, 2007 and 2006, the Company paid

the following amounts to related parties:

(a) Consulting fees of $ 62,640 (2006 - $50,058) to a company in

which a director of the Company is an officer;

(b) Consulting fees of $ nil (2006 - $337,637) to directors of the

Company; and

(c) The Company paid $133,956 (2006 - $323,000) to a related party

controlled by three directors of the Company in respect of its

office lease in Caracas, Venezuela.

These transactions are in the normal course of operations and are

measured at the exchange amounts, which is the amount of

consideration established and agreed to by the related parties.

8. Supplemental cash flow information

2007 2006

---------------------------------------------------------------------

a) Interest paid $ - $ -

Income taxes paid - -

b) Non-cash transactions

Acquisition of Panwest (note 3) $ - $ (14,944)

Acquisition of African Gold (note 4) (6,483)

Issue of common shares 3,120 9,387

Increase in future tax liability 3,363 5,557

9. Segmented information

(a) The Company currently operates in one reportable operating

segment, being the acquisition and exploration of mineral

properties.

(b) As at December 31, 2007 the Company's mineral properties are in

Venezuela and Mali. As at December 31, 2006 all of the Company's

mineral properties were in Venezuela. During the year ended

December 31, 2006, the Company disposed of all its properties in

Italy. The Company's assets and results of operations by

geographic areas are as follows:

As at December 31, 2007

Venezuela Mali Canada Total

---------------------------------------------------------------------

Property, plant and

equipment $ 25,028 $ 9,849 $ 3 $ 34,880

---------------------------------------------------------------------

---------------------------------------------------------------------

Total assets $ 25,955 $ 10,485 $ 1,798 $ 38,238

---------------------------------------------------------------------

As at December 31, 2006

Venezuela Mali Canada Total

---------------------------------------------------------------------

Property, plant and

equipment $ 19,678 $ - $ - $ 19,678

---------------------------------------------------------------------

---------------------------------------------------------------------

Total assets $ 20,004 $ - $ 13,686 $ 33,690

---------------------------------------------------------------------

For the year ended December 31, 2007

Venezuela Mali Canada Total

---------------------------------------------------------------------

General and administrative

expenses $ 547 $ 1,370 $ 2,894 $ 4,811

Stock based compensation - - 140 140

Other income (expenses) 4,302 (16) (1,205) 3,081

Future income tax (recovery) (393) - - (393)

---------------------------------------------------------------------

Net earnings (loss) $ 4,148 $ (1,386) $ (4,239) $ (1,477)

---------------------------------------------------------------------

---------------------------------------------------------------------

Capital expenditures

net of non-cash

transactions $ 4,581 $ 3,389 $ - $ 7,970

---------------------------------------------------------------------

For the year ended December 31, 2006

Venezuela Mali Canada Total

---------------------------------------------------------------------

General and administrative

expenses $ 611 $ - $ 2,875 $ 3,486

Stock based compensation - - 1,333 1,333

Other income (expenses) 173 - 2,257 2,430

Future income tax (recovery) - - (292) (292)

---------------------------------------------------------------------

Net earnings (loss) $ (438) $ - $(1,659) $ (2,097)

---------------------------------------------------------------------

---------------------------------------------------------------------

Capital expenditures

net of non-cash

transactions $ 4,603 $ - $ - $ 4,603

---------------------------------------------------------------------

10. Subsequent events

(i) On March 20, 2008 the Company completed a brokered private

placement of 30,810,000 units at a price of $0.40 per unit, for

gross proceeds of $12,324,000. Each unit consists of one common

share of the Company and one-half of a common share purchase

warrant, with each whole share purchase warrant being exercisable

at a price of $0.60 for a period of two years.

(ii) On April 2, 2008 the Company granted 1,832,000 stock option to

its employees. The options have an exercise price of $0.40,

vest

immediately and expire April 2, 2013.

Consolidated schedules of general and administrative expenses

Year ended December 31, 2007 and 2006

(Expressed in thousands of Canadian dollars)

2007 2006

---------------------------------------------------------------------

$ $

General and administrative

Office and administration 1,820 1,422

Consulting fees 1,689 714

Directors' fees 90 358

Investor relations, transfer agent

and filing fees 145 347

Legal and accounting fees 384 264

Salaries and benefits 437 191

Travel and promotion 171 137

Depreciation 50 47

Bank charges and interest 25 6

---------------------------------------------------------------------

4,811 3,486

---------------------------------------------------------------------

---------------------------------------------------------------------

For further information: Robert Doyle, Chief Executive Officer, (416)

603-4653, rdoyle(at)medororesources.com

(MRL MRS.)

END

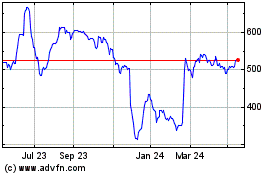

Marlowe (LSE:MRL)

Historical Stock Chart

From Sep 2024 to Oct 2024

Marlowe (LSE:MRL)

Historical Stock Chart

From Oct 2023 to Oct 2024