Medoro Resources Announces First Quarter Results

TORONTO, May 26 /CNW/ - Medoro Resources Ltd. (TSX-V/AIM:MRL) announced

today its 2005 first quarter results for the period ending March 31, 2005.

For the quarter ended March 31, 2005, Medoro reported a loss of

$0.5 million or $0.01 per share as compared to a loss of $1.1 million or

$0.02 per share in the first quarter of 2004. The loss in the quarter largely

reflects ongoing general and administrative costs, which are approximately

half the amount in the same period last year as a result of the disposal of

the majority of the former Gold Mines of Sardinia assets. At March 31, 2005

the company had cash of $2.6 million, undiscounted receivables of

$10.6 million and no debt. Subsequent to the end of the quarter, Medoro

completed a private placement for gross proceeds of $3.9 million.

At Monte Ollasteddu, a geophysical survey to follow up on last year's

drilling results and help better identify targets for this year's program was

completed. Gold Fields expects to commence a 2,000 metre diamond drilling

program in July, subject to the receipt of a Research Permit. Drill targets

include previously identified geophysical anomalies as well as high-grade

veins to the south which were not tested in last year's drill program.

The company continues to seek a joint venture partner for its Pestarena

project and is actively pursuing other opportunities elsewhere in Europe.

Financial Statements follow

MEDORO RESOURCES LTD.

(formerly Full Riches Investments Ltd.)

Consolidated Balance Sheets

(Expressed in Canadian dollars)

-------------------------------------------------------------------------

March 31, December 31,

2005 2004

------------- -------------

(Unaudited) (Audited)

ASSETS

CURRENT

Cash and cash equivalents $ 2,563,986 $ 2,448,813

Accounts receivable 77,720 75,981

Prepaid and deposits 28,808 -

Current portion of note receivable 743,473 747,908

-------------------------------------------------------------------------

3,413,987 3,272,702

NOTE AND SHARES RECEIVABLE (Note 2) 5,868,942 5,882,880

MINERAL PROPERTIES 5,979,873 5,979,873

-------------------------------------------------------------------------

$ 15,262,802 $ 15,135,455

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LIABILITIES

CURRENT

Accounts payable and accrued liabilities $ 40,587 $ 401,534

FUTURE INCOME TAXES 2,130,031 2,130,031

-------------------------------------------------------------------------

2,170,618 2,531,565

-------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

Share capital (Note 3) 30,161,976 29,161,976

Contributed surplus (Note 3) 584,622 584,622

Deficit (17,654,414) (17,142,708)

-------------------------------------------------------------------------

13,092,184 12,603,890

-------------------------------------------------------------------------

$ 15,262,802 $ 15,135,455

-------------------------------------------------------------------------

-------------------------------------------------------------------------

These unaudited interim consolidated financial statements for the period

ended March 31, 2005 have not been reviewed by the Company's auditors.

See accompanying Notes to the unaudited interim Consolidated Financial

Statements.

MEDORO RESOURCES LTD.

(formerly Full Riches Investments Ltd.)

Consolidated Statements of Operations and Deficit

(Expressed in Canadian dollars)

(Unaudited)

-------------------------------------------------------------------------

Three Two

months ended months ended

March 31, March 31,

2005 2004

------------- -------------

OPERATING EXPENSES

General and administration $ 505,448 $ 990,276

Exploration - 117,412

-------------------------------------------------------------------------

505,448 1,107,688

-------------------------------------------------------------------------

OTHER INCOME (EXPENSES)

Accreted interest on note receivable 214,580 -

Foreign exchange gain (loss) (232,566) 26,705

Interest income 11,727 16,967

-------------------------------------------------------------------------

(6,259) 43,672

-------------------------------------------------------------------------

NET LOSS FOR THE PERIOD (511,707) (1,064,016)

-------------------------------------------------------------------------

DEFICIT, BEGINNING OF PERIOD (17,142,708) (6,708,811)

CUMULATIVE EFFECT OF CHANGE IN ACCOUNTING

POLICY - (245,000)

DEFICIT, END OF PERIOD $(17,654,415) $ (8,017,827)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

BASIC AND DILUTED LOSS PER SHARE $ (0.01) $ (0.02)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

BASIC AND DILUTED WEIGHTED-AVERAGE NUMBER OF

COMMON SHARES OUTSTANDING 93,176,513 51,533,596

-------------------------------------------------------------------------

-------------------------------------------------------------------------

See accompanying notes to the unaudited interim Consolidated Financial

Statements.

MEDORO RESOURCES LTD.

(formerly Full Riches Investments Ltd.)

Consolidated Statements of Cash Flows

(Expressed in Canadian dollars)

(Unaudited)

-------------------------------------------------------------------------

Three Two

months ended months ended

March 31, March 31,

2005 2004

------------- -------------

OPERATING ACTIVITIES

Net loss from operations $ (511,706) $ (1,064,016)

Items not affecting cash:

Foreign exchange (gain) loss on note

receivable 215,260 (26,705)

Accreted interest on note receivable (196,887) -

-------------------------------------------------------------------------

(493,333) (1,090,721)

Changes in non-cash working capital items

Accounts receivable (1,739) (240,853)

Prepaid and deposits (28,808) 9,422

Inventories - 1,633

Other long-term liabilities - 641,858

Accounts payable and accrued liabilities (360,947) 343,441

-------------------------------------------------------------------------

(884,827) (335,220)

-------------------------------------------------------------------------

INVESTING ACTIVITIES

Acquisition of mineral properties - (1,006,042)

Acquisition of property plant & equipment - (15,875)

-------------------------------------------------------------------------

- (1,021,917)

-------------------------------------------------------------------------

FINANCING ACTIVITIES

Issuance of common shares for cash 1,000,000 -

-------------------------------------------------------------------------

1,000,000 -

-------------------------------------------------------------------------

NET INCREASE IN CASH 115,173 (1,357,137)

CASH, BEGINNING OF PERIOD 2,448,813 9,249,605

-------------------------------------------------------------------------

CASH, END OF PERIOD $ 2,563,986 $ 7,892,468

-------------------------------------------------------------------------

-------------------------------------------------------------------------

See accompanying notes to the unaudited interim Consolidated Financial

Statements.

MEDORO RESOURCES LTD.

(formerly Full Riches Investments Ltd.)

Notes to the unaudited Consolidated Financial Statements

Three months ended March 31, 2005 and two months ended March 31, 2004

(Expressed in Canadian dollars)

-------------------------------------------------------------------------

1. SIGNIFICANT ACCOUNTING POLICIES

The unaudited interim consolidated financial statements are prepared

in accordance with Canadian generally accepted accounting principles

("GAAP") for interim financial statements. These interim financial

statements do not contain all disclosures required under GAAP and,

accordingly, should be read in conjunction with the Company's audited

financial statements for the fourteen month period ended December 31,

2004. These interim consolidated financial statements have been

prepared following the same accounting policies and method of

computations as the Company's audited financial statements for the

fourteen month period ended December 31, 2004.

Stock-based compensation

Effective November 1, 2003, the Company adopted the recommendations

of the amended Handbook Section 3870, "Stock-based Compensation and

Other Stock-based Payments" ("Section 3870") for stock options issued

on or after November 1, 2002. Section 3870 established standards for

recognition, measurement and disclosure of stock-based compensation

and other stock-based payments made in exchange for goods and

services provided by employees and non-employees. The standard

requires that a fair value-based method of accounting be applied to

all stock-based payments to non-employees and to employee awards that

are direct awards of stock that call for settlement in cash or other

assets or are appreciation rights that call for settlement by the

issuance of equity instruments. Accordingly the Company has restated

and adjusted the opening deficit of the comparative period to reflect

the cumulative effect of the change in 2003.

Previously, the Company provided note disclosure of pro forma net

loss as if the fair value based method had been used on stock options

granted to employees and directors after January 1, 2002. The

amended recommendations have been applied using the retroactive

method without restatement and had the effect of increasing

contributed surplus and opening deficit at November 1, 2003 by

$245,000.

2. NOTES AND SHARES RECEIVABLE

The discounted value as at March 31, 2005 of the notes and

shares receivable from Sargold Resources Corporation

("Sargold") is as follows:

Note receivable (i) $ 6,046,514

Shares receivable (ii) 565,901

---------------------------------------------------------------

6,612,415

Current portion of note receivable (743,473)

---------------------------------------------------------------

$ 5,868,942

---------------------------------------------------------------

---------------------------------------------------------------

(i) $8,961,150 ((euro) 5.5 million) discounted using a 3.75%

risk free interest rate and a 10% risk premium.

The following schedule represents the amounts receivable,

discounted at March 31, 2005 and the percentage of shares

to be released upon each individual payment:

March 31, 2005

% of Shares --------------------------

Released Discounted Discounted

Upon Value Value

Date Amount Payment (Euros) ($)

--------------- ---------------- --------- ---------------- ------------

August 30, 2005 (euro) 500,000 8.3% (euro) 473,881 $ 743,472

August 30, 2006 1,000,000 16.7% 833,198 1,307,204

August 30, 2007 1,000,000 16.7% 732,482 1,149,191

August 30, 2008 1,500,000 25.0% 965,569 1,514,881

August 30, 2009 1,500,000 25.0% 848,852 1,331,766

---------------------------------------------------------

(euro) 5,500,000 91.7% (euro) 3,853,982 $ 6,046,514

---------------------------------------------------------

---------------------------------------------------------

(ii) Common shares of Sargold to be issued on or by August 30,

2009 for a value equal to $1 million, to be valued at the

market price (as determined according to TSX Venture

Exchange policy) as at August 30, 2009, subject to a

minimum price of $0.225. At March 31, 2005 Sargold shares

had a ten day closing average of $0.302. The discounted

value as at March 31, 2005, using a 13.75% discount rate,

was $565,901.

3. SHARE CAPITAL

(a) Common shares

Authorized: an unlimited number of common shares with

no par value

Issued and outstanding

Number of Contributed

Shares Amount Surplus

------------- ------------- -------------

Balance, October 31, 2003 and

2002 5,935,925 $ 6,706,001 $ -

Cumulative effect of change

in accounting policy 245,000

---------------------------- -------------

Adjusted balance, October 31,

2003 5,935,925 6,706,001 245,000

Issued prior to amalgamation 75,626,261 19,941,692 117,950

Fair value of options and

warrants exchanged - - 61,403

Issued as consideration for

services in connection with

the amalgamation 319,857 63,971 -

Issued in settlement of accrued

liabilities 140,624 70,312 -

Issued to acquire Miniere di

Pestarena srl 4,000,000 2,200,000 -

Issued as consideration for

services in connection with the

sale of GMS Australia 1,000,000 180,000 -

Stock-based compensation - - 160,269

-------------------------------------------------------------------------

Closing balance as at

December 31, 2004 87,022,667 $ 29,161,976 $ 584,622

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Issued under private placement 7,692,307 1,000,000 -

-------------------------------------------------------------------------

Balance at March 31, 2005 94,714,974 $ 30,161,976 $ 584,622

-------------------------------------------------------------------------

-------------------------------------------------------------------------

(b) Escrow shares

As at March 31, 2005, there were 963,000

(December 31, 2004 - 1,713,000) common shares of the Company

held in escrow.

(c) Warrants

A summary of the changes in the Company's incentive share

option plan for the periods ended March 31, 2005 and

December 31, 2004 are as follows:

Number Exercise

Price

---------------------------------------------------------------

Balance, October 31, 2003 - $ -

GMS England warrants exchanged 5,793,918 1.14

Agent's warrants 687,000 0.70

--------------------------

Balance, December 31, 2004 6,480,918 1.10

Expired (352,890) 3.30

--------------------------

Balance, March 31, 2005 6,128,028 $ 0.97

--------------------------

(d) Incentive stock option plan

March 31, 2005 December 31, 2004

-------------- ------------------

Options Exercise Options Exercise

Price Price

---------------------------------------------------------------

Outstanding,

beginning of

period 6,138,790 $ 0.79 2,500,000 $ 0.70

Granted - - 2,475,000 0.25

Cancelled (1,060,592) 1.95 (19,098) 2.76

GMS replacement

options - - 1,182,888 2.16

--------------------------------------------

Outstanding, end of

period 5,078,198 $ 0.55 6,138,790 $ 0.79

--------------------------------------------

4. RELATED PARTY TRANSACTIONS

During the three month period ended March 31, 2005 and the two month

period ended March 31, 2004, the Company paid the following amounts

to related parties:

(a) Consulting fees of $50,212 (2004 - $5,350) to a company in

which two directors of the Company are officers.

(b) Consulting fees of $23,930 (2004 - $62,800) to officers of the

Company for professional services.

(f) Consulting fees of $Nil (2004 - $70,650) to directors of the

Company.

These transactions are in the normal course of operations and are

measured at the exchange amounts, which is the amount of

consideration established and agreed to by the related parties.

5. SUBSEQUENT EVENTS

On April 15, 2005, the Company announced that it had completed a

private placement of 30,000,000 units for proceeds of approximately

$3.9 million after payment of agents' fees and expenses. Each unit

consisted of a share and one-half of a share purchase warrant, with

each whole warrant being exercisable for a period of two years at

$0.235. 300,000 agent's warrants were also issued in conjunction with

this placement, each agent's warrant entitling the holder to acquire

one share and one-half warrant of the Company on the same terms as

the units, except that the agent's warrants expire after 18 months.

For further information: Peter Volk, Assistant Secretary,

(416) 603-4653, info(at)medororesources.com

(MRL.)

END

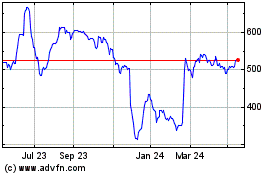

Marlowe (LSE:MRL)

Historical Stock Chart

From May 2024 to Jun 2024

Marlowe (LSE:MRL)

Historical Stock Chart

From Jun 2023 to Jun 2024