RNS Number:4427E

Montpellier Group PLC

31 May 2001

Montpellier Group plc

Announcement of Interim Results for the six months ended 31 March

The directors of Montpellier Group plc are delighted to announce the following

highlights of the Company's performance for the six months to 31 March 2001

compared with the six months to 31 March 2000:

* Turnover increased by 37 per cent

* Profits before tax increased by 50 per cent

* Earnings per share increased by 57 per cent

* Net asset value per share increased by 20 per cent

The imminent purchase of the building contracting division of Allen plc

exemplifies your Board's commitment to seek attractive opportunities for

further growth. Your Board has confidence in the prospects of the enlarged

Group.

Chairman's Statement

I am pleased to be able to report that the Group has continued to make

progress over the last six months. The acquisitions made last year of

Britannia plc, David Lodge & Sons Limited and Hatchpaines Limited have been

integrated successfully and are making contributions to Group profits. The

imminent purchase of the building contracting division of Allen plc

exemplifies your Board's commitment to seek attractive opportunities for

further growth.

Financial Review

Profits before tax for the six months to 31 March 2001 were #1.5m (2000 :

#1.0m) on turnover of #116.7m (2000 : #85.1m). Earnings per share were 2.2p

(2000 : 1.4p) with the net asset value per share increasing to 35.0p (2000 :

29.1p).

The Group is reporting net cash in its balance sheet of #3.7m (2000 : #5.1m)

with the total net cash, including off balance sheet borrowing, being #0.3m

(2000: #2.2m).

Change of Name

At the Extraordinary General Meeting held on 7 March 2001, shareholders

resolved that the name of the Company be changed to Montpellier Group plc,

retaining the YJL identity for the Construction Division.

Dividends

Your Board continues to hold the view that the Group's financial resources,

for the time being, are best devoted to the development of a sound and

enlarged base of future earnings, and that this policy will in due course

create better long-term shareholder value. For this reason, your Board is not

recommending the payment of an interim dividend.

The Board

Paul Sellars was appointed Managing Director of the Montpellier Group on 25

January 2001, and for the time being will continue to be responsible for Group

Finance, land and property development, and investment activities. It is the

intention of your Board to appoint a Group Finance Director and a third

non-executive director in due course.

Acquisitions

It was announced on 4 April 2001 that there was an agreed cash bid for the

building contracting division of Allen plc (Allenbuild). This is conditional

upon shareholders' approval at the Extraordinary General Meeting to be held on

1st June 2001. Allenbuild's turnover for the year ended 2 April 2000 was #156

million and your Board believes that Allenbuild's businesses are complementary

to the Group's businesses and that this acquisition represents an exciting and

logical step in achieving Montpellier's objectives. It is anticipated that

the net assets acquired will be around #3.5m. The consideration is #1m.

Prospects

The Group's trading performance in the first half has been fully in line with

management's expectations and your Board is confident that the good

performance will continue during the second half. The Group's companies have

continued to secure work at acceptable margins.

The property development businesses have made further land sales with others

in negotiation. Lovell America continues to generate useful cash.

Your Board has confidence in the prospects of the enlarged Group and will

continue to seek further opportunities that will contribute to the Group's

profitability and growth.

GROUP PROFIT AND LOSS ACCOUNT

for the six months ended 31 March 2001

Notes Year

Six months ended ended

31 March 30 Sept.

2001 2000 2000

#000 #000 #000

Turnover: Group and share of joint

ventures' turnover

118,726 92,956 202,089

Less share of joint ventures'

turnover - continuing operations

(2,035) (7,898) (6,840)

Continuing operations 116,691 85,054 191,819

Discontinued operations - 4 3,430

Group turnover 1 116,691 85,058 195,249

Cost of sales (107,341) (78,543) (176,637)

Gross profit 9,350 6,515 18,612

Other operating income 1,510 - -

Group operating profit before

administrative expenses 10,860 6,515 18,612

Administrative expenses (9,574) (4,906) (16,619)

Group operating profit 1,286 1,609 1,993

Income from joint ventures 137 126 313

Share of associates' operating loss (386) - -

Continuing operations 1,037 1,735 1,860

Discontinued operations - - 446

Total operating profit including

share of joint ventures 1,037 1,735 2,306

Profit on sale of fixed assets 379 - 485

Loss on disposal of discontinued

businesses - (314) (414)

Profit on ordinary activities before

interest and taxation 1,416 1,421 2,377

Net interest receivable 97 (384) (346)

Profit on ordinary activities before

taxation 1,513 1,037 2,031

Taxation payable on ordinary

activities - - (563)

Profit for the period 1,513 1,037 1,468

Basic and diluted earnings per

ordinary share 2 2.2p 1.4p 1.9p

GROUP STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

Year

Six months ended ended

31 March 30 Sept.

2001 2000 2000

#000 #000 #000

Profit for the year excluding share of 1,376 911 1,155

income from joint ventures

Share of income from joint ventures 137 126 313

Currency translation differences on

foreign currency net investments (64) 717 2,000

Total recognised gains and losses relating

to the period 1,449 1,754 3,468

GROUP BALANCE SHEET

at 31 March 2001

Year

Six months ended ended

31 March 30 Sept.

2001 2000 2000

#000 #000 #000

Fixed assets

Intangible assets 693 - 770

Tangible assets 6,429 3,416 7,810

Investments 611 - 1,006

Investments in joint ventures:

Loans to joint ventures 7,705 12,973 9,194

Share of gross assets 22,130 21,975 21,045

Share of gross liabilities (16,480) (16,307) (14,866)

13,355 18,641 15,373

21,088 22,057 24,959

Current assets

Stocks and work in progress 11,458 18,502 10,932

Debtors: due within one year 46,551 29,498 37,051

due after more than one year 2,141 1,217 2,480

Current asset investments 3,431 - 3,152

Cash at bank and in hand 10,381 10,995 15,829

73,962 60,212 69,444

Creditors: amounts falling due within

one year 70,221 53,141 70,491

Net current assets / (liabilities) 3,741 7,071 (1,047)

Total assets less current liabilities 24,829 29,128 23,912

Creditors: amounts falling due after

more than one year

Long term debt 917 - 531

Other creditors 80 6,826 272

997 6,826 803

Net assets 23,832 22,302 23,109

Share capital 6,809 7,660 7,167

Share premium account 1,066 1,066 1,066

Revaluation reserve 393 1,348 1,119

Capital reserve 1,166 314 807

Profit and loss account 14,398 11,914 12,950

Equity shareholders' funds 23,832 22,302 23,109

GROUP STATEMENT OF CASH FLOW

for the six months ended 31 March 2001

Six months ended Year ended

31 March 30 Sept.

2001 2000 2000

Note #000 #000 #000

Net cash (outflow)/inflow from

operating activities 3 (8,405) 4,399 12,267

Returns on investments and servicing

of finance

Net interest received 97 104 509

Finance costs paid in relation to - - (855)

financial restructuring

Net cash inflow/(outflow) from

returns on investments and servicing

of finance 97 104 (346)

Taxation

Corporation tax paid (630) - -

Capital expenditure and financial

investment

Net sales/(purchases) of tangible

fixed assets 1,296 (138) 946

Net sales/(purchases) of current

asset investments 1,231 - (3,152)

Investment in and movements on loans

to joint ventures 1,762 (1,854) 2,768

Acquisition of own shares (727) - (907)

Net cash inflow/(outflow) for capital

expenditure and financial investment 3,562 (1,992) (345)

Acquisitions and disposals

Receipt from sale of business - - 8,573

Payments to acquire subsidiary

undertakings - - (14,048)

Cash acquired on acquisition of

subsidiary undertakings - - 3,771

Net cash outflow from acquisitions

and disposals - - (1,704)

Cash (outflow)/inflow before use of

liquid resources and financing (5,376) 2,511 9,872

Management of liquid resources

(Increase)/decrease in short-term

deposits with banks (5,000) 530 (5,495)

Financing

Movement in short-term borrowings (430) - -

Movement in long-term borrowings 386 (4,944) (5,107)

(44) (4,944) (5,107)

Decrease in cash (10,420) (1,903) (730)

As indicated above, funds of #5,000,000 were transferred to short-term

deposits with banks. The balance of such funds with banks at 31 March 2001 was

#11,000,000 (31 March 2000 - #nil).

NOTES TO THE ACCOUNTS

for the six months ended 31 March 2001

1. Segmental analysis

Six months ended Year

ended

31 March 30 Sept.

2001 2000 2000

#000 #000 #000

Construction 115,321 79,552 183,386

UK Developments 796 3,343 7,630

USA Developments 2,609 10,057 11,069

Spain - Discontinued - 4 4

Turnover: Group and share of joint

ventures 118,726 92,956 202,089

Less: Share of USA joint ventures'

turnover 2,035 7,898 6,840

116,691 85,058 195,249

2. Earnings per ordinary share

The earnings per ordinary share is based upon the profit for the Group of #

1,513,000 (2000 March profit of #1,037,000; September profit of #1,468,000)

divided by the weighted average of ordinary shares of 69,625,066 (2000 March

76,603,409; September 76,071,669) in issue over the respective periods.

A number of the share option schemes outstanding during the period were below

the average fair value of the Company's shares hence the options have a

dilutive effect on the Earnings per Ordinary share calculation.

3. Net cash (outflow)/inflow from operating activities

6 months ended Year

ended

31 March 30 Sept.

2001 2000 2000

#000 #000 #000

Operating profit 1,037 1,609 2,306

Depreciation 493 73 661

Amortisation of goodwill 77 - 70

Exchange gains - - (700)

Income from joint ventures (137) (126) (313)

Share of associates operating loss 386 - -

(Increase) / Decrease in stocks and work

in progress (758) 1,527 5,677

Profit on sale of current asset

investments (1,510) - -

(Increase) / Decrease in operating

debtors and prepayments (9,082) 111 4,978

Increase/ (Decrease) in creditors and

accruals 1,089 1,205 (412)

Net cash (outflow)/inflow from operating

activities (8,405) 4,399 12,267

4. Basis of preparation

a) The accounts for the six months ended 31 March 2001 and the

equivalent period in 2000 have not been audited by the company's auditors.

They have been prepared in accordance with applicable accounting standards

consistent with the accounting policies set out in the 2000 Annual Report.

b) The abridged information in this statement relating to the year ended

30 September 2000 is derived from full accounts upon which the auditors issued

an unqualified opinion and which have been delivered to the Registrar of

Companies.

This interim statement is being sent to all shareholders and is also available

upon request from the Company Secretary, Montpellier Group plc, Lovell House,

616 Chiswick High Road, London, W4 5RX.

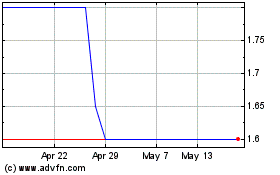

Mercantile Ports & Logis... (LSE:MPL)

Historical Stock Chart

From Jul 2024 to Aug 2024

Mercantile Ports & Logis... (LSE:MPL)

Historical Stock Chart

From Aug 2023 to Aug 2024