TIDMMLVN

RNS Number : 8951F

Malvern International PLC

10 November 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION (EU NO.

596/2014) AS IT FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018 ("UK MAR").

10 November 2022

Malvern International plc

( " Malvern" or the " Company " )

Placing

Total Voting Rights

Malvern International plc (AIM: MLVN), the global learning and

skills development partner, announces that it has undertaken a

placing of 2,500,000 new ordinary shares of 1p each ("New Ordinary

Shares") at a price of 8 pence per share (the "Placing Price") to

raise GBP200,000 (before expenses) which will be used principally

to redeem the final tranche of Company's outstanding loan notes

("Loan Notes").

The Placing Price represents a discount of approximately 3.03

per cent to the closing mid-market price of 8.25 pence per Ordinary

Share on 9 November 2022, being the latest practicable business day

prior to the publication of this Announcement.

The outstanding Loan Notes amounting to GBP178,102 are held by

Mr Ho Peng Cheong (the "Holder"). The Holder has agreed that the

outstanding principal of the Loan Notes may be redeemed at a five

per cent. discount. In addition, the Holder has agreed to sell all

the ordinary shares he holds in the ordinary share capital of the

Company (the "Sale"), amounting to 917,600 ordinary shares (the

"Sale Shares") at the Placing Price in transactions which are

expected to be executed today. Certain Directors of the Company

have indicated their intention to purchase in aggregate 547,004

Sale Shares amounting to GBP43,760 as follows:

Name Amount Number of Shares

Richard Mace GBP16,000 200,002

----------- -----------------

Daniel Fisher GBP1,500 18,750

----------- -----------------

Mark Elliott GBP13,130 164,126

----------- -----------------

Alan Carroll GBP13,130 164,126

----------- -----------------

Placing and Sale summary

-- The Placing has raised GBP200,000 (before expenses) through

the issue of 2,500,000 New Ordinary Shares at the Placing

Price.

-- The New Ordinary Shares represent approximately 10.2 per

cent. of the Enlarged Issued Ordinary Share Capital.

-- The Sale will generate proceeds to the Holder of GBP73,408

through the sale of 917,600 Sale Shares at the Placing Price.

-- The Sale Shares represent approximately 4.2 per cent. of the

Existing Issued Ordinary Share Capital and represent approximately

3.8 per cent of the Enlarged Issued Ordinary Share Capital

The net proceeds of the Placing will be used to satisfy the

outstanding principal of the Loan Notes, outstanding interest on

the Loan Notes at the date of redemption and to pay costs.

Reasons for the Loan Note redemption, Placing and Sale

The amount of principal outstanding on the Loan Notes is

GBP178,102. Under existing arrangements that amount is redeemable

on 31 December and if not settled by 31 January 2022 is convertible

into Ordinary Shares.

The Company has agreed with the Holder that full and final

settlement of the final tranche of the principal of outstanding

Loan Notes can be made for GBP169,196.90 which represents a five

per cent. discount. In addition, the Holder has agreed to the sale

of the Sale Shares, being all of his shares in the ordinary share

capital of the Company, at the Placing Price.

Previous tranches of Loan Notes have been converted and, when

possible, sold by the Holder which the Directors consider has been

a drag on the share price. The Directors believe a conversion of

the final tranche of loan notes would exacerbate this issue. They

are therefore pleased to have undertaken a successful placing to

fund the redemption of the Loan Notes while also facilitating the

Sale, which the Directors believe are in the best interests of

shareholders.

Placing information

WH Ireland Limited ("WH Ireland") acted as sole bookrunner in

connection with the Placing.

The Placing has not been underwritten by WH Ireland and is

conditional inter alia on the placing agreement dated 9 November

2022 between the Company and WH Ireland (the "Placing Agreement")

not having been terminated and Admission.

The New Ordinary Shares will be issued, credited as fully paid,

and will rank pari passu with the Ordinary Shares in issue in the

capital of the Company, including the right to receive all

dividends and other distributions (if any) declared, made or paid

on or in respect of such shares after the date of their issue.

Admission to trading

Application will be made to the London Stock Exchange for

Admission, which is expected to become effective and dealings in

the New Ordinary Shares to commence at, 8.00 a.m. on or around 14

November 2022.

Total Voting Rights

Following Admission, the Company's issued ordinary share capital

will consist of 24,442,400 Ordinary Shares of which none are held

in treasury. Therefore the total voting rights in the Company is

24,442,400 and Shareholders may use this figure as the denominator

by which they are required to notify their interest in, or change

to their interest in, the Company under the Disclosure Guidance and

Transparency Rules.

For further information please contact:

Malvern International Plc www.malverninternational.com

Mark Elliott - Chairman Via the website

Richard Mace - Chief Executive Officer

WH Ireland (NOMAD & Broker) www.whirelandcb.com

Mike Coe / Sarah Mather 0207 220 1666

Notes to Editors:

Malvern International is a learning and language skills

development partner, offering international students essential

academic and English language skills, cultural experiences and the

support they need to thrive in their academic studies, daily life

and career development.

University Pathways - on and off-campus university pathway

programmes helping students progress to a range of universities, as

well as in-sessional and pre-sessional courses.

Malvern House Schools - British Council accredited English

Language Training at English UK registered schools in London,

Brighton and Manchester.

Malvern Online Academy - British Council accredited online

school, offering supported tuition to students from around the

world in English language, higher education, and professional

education.

Juniors and summer camps - fully-immersive summer residential

English language camps and bespoke group programmes for 13 to 18

year olds.

For further investor information go to www.malverninternational.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEBLBRTMTJMBIT

(END) Dow Jones Newswires

November 10, 2022 02:00 ET (07:00 GMT)

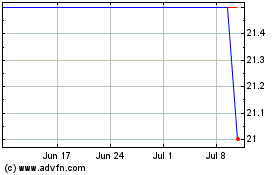

Malvern (LSE:MLVN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Malvern (LSE:MLVN)

Historical Stock Chart

From Nov 2023 to Nov 2024