TIDMMIRI

RNS Number : 2918Y

Mirriad Advertising PLC

12 May 2021

12 May 2021

Mirriad Advertising plc

("Mirriad" or the "Company")

Results for the year ended 31 December 2020

Mirriad, the leading in-content advertising company, announces

its audited results for the year ended 31 December 2020.

Financial overview

-- 2020 revenue up 91% to GBP2.18m (2019: GBP1.14m)

-- Operating loss reduced by 25% to GBP9.09m (2019: GBP12.17m)

-- Cash consumption down 27% to GBP8.06m (2019: GBP11.01m)

-- Net assets at 31 December 2020 up 84% GBP35.3m (2019: GBP19.2m)

-- Cash and cash equivalents at 31 December 2020 up 85% to GBP35.4m (2019: GBP19.1 million)

Operational highlights

-- Broadcast and digital distributor supply partners under contract up 33% to 20 (2019: 15)

-- Framework agreement signed with Tier One US entertainment giant in October 2020

-- Launched Music Alliance with globally renowned record labels and independent music companies

-- Achieved an OTCQB cross listing in September 2020, under ticker symbol "MMDDF"

-- Executed an oversubscribed Placing and Open Offer, raising

GBP26.2 million (gross) in December 2020, positioning the business

for future growth

Post period highlights

-- Framework agreement reached with one of the world's leading

food and beverage companies to incentivise spend on in-video

campaigns in the US market.

-- Commercial negotiations complete to replace the expired

contract with Tencent Video and detailed contractual terms are now

being discussed

-- Appointment of new CTO in February 2021 and new CRO in May 2021

-- Appointment of Kelsey Lynn Skinner as non-executive director in February 2021

-- Boosted US sales capabilities with the appointment of an

additional senior sales manager and an outsourced sales enablement

company in February 2021

-- Upgraded to OTCQX listing in the US in April 2021

Stephan Beringer, CEO of Mirriad, said: "In 2020 we provided

operational stability during a challenging period, with adverse

effects of the Covid-19 pandemic affecting the wider advertising

and content industries. We have been able to reduce our own costs

through prudent management and also drive additional revenue,

underlining our commitment to building long-term shareholder

value.

" Mirriad is now well placed to benefit from the expected

advertising sector recovery in the second half of this year. Thanks

to our technology's ability to create new revenue opportunities

whilst addressing established consumer aversion to interruptive

advertising, we can offer more in-content opportunities to a rising

number of advertisers and agencies, showing a clear pathway to

scale in 2021 and beyond.

"The industry increasingly recognises the fantastic results our

format delivers as we further develop the protected Mirriad

technology that will ultimately define the in-content advertising

space. With these factors considered, we are confident about the

future growth of our proposition and business."

S

For further information please visit www.mirriad.com or

contact:

Mirriad Advertising plc Tel: +44 (0)207 884 2530

Stephan Beringer, Chief Executive

Officer

David Dorans, Chief Financial

Officer

Nominated Adviser & Broker: Tel: +44 (0)20 7523 8000

Canaccord Genuity Limited

Simon Bridges

Richard Andrews

Thomas Diehl

Financial Communications:

Charlotte Street Partners

Tom Gillingham Tel: +44 (0) 7741 659021

Andrew Wilson Tel: +44 (0) 7810 636995

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014 ("MAR"). Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Notes to Editors

About Mirriad

Mirriad's award-winning solution unleashes new revenue for

content producers and distributors by creating new advertising

inventory in content. Our patented, AI and computer vision

technology dynamically inserts products and innovative signage

formats after content is produced. Mirriad's market-first solution

seamlessly integrates with existing subscription and advertising

models, and dramatically improves the viewer experience by limiting

commercial interruptions.

Mirriad currently operates in the US, Europe and China.

Forward looking statements

Certain information contained in this announcement, including

any information as to the Group's strategy, plans or future

financial or operating performance, constitutes "forward-looking

statements". These forward-looking statements may be identified by

the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "projects", "expects",

"intends", "aims", "plans", "predicts", "may", "will", "seeks"

"could" "targets" "assumes" "positioned" or "should" or, in each

case, their negative or other variations or comparable terminology,

or by discussions of strategy, plans, objectives, goals, future

events or intentions. These forward-looking statements include all

matters that are not historical facts. They appear in a number of

places throughout this announcement and include statements

regarding the intentions, beliefs or current expectations of the

Directors concerning, among other things, the Group's results of

operations, financial condition, prospects, growth, strategies and

the industries in which the Group operates. The directors of the

Company believe that the expectations reflected in these statements

are reasonable, but may be affected by a number of variables which

could cause actual results or trends to differ materially. Each

forward-looking statement speaks only as of the date of the

particular statement.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future or are beyond

the Group's control. Forward-looking statements are not guarantees

of future performance. Even if the Group's actual results of

operations, financial condition and the development of the

industries in which the Group operates are consistent with the

forward-looking statements contained in this document, those

results or developments may not be indicative of results or

developments in subsequent periods.

Chairman's statement

Last year, I said that the priority for 2020 would be converting

positive sentiment towards Mirriad into tangible engagement.

Despite the disrupting influence of the COVID-19 pandemic, I am

delighted with the progress that has been made against this central

ambition.

Continuing confidence from investors and shareholders has

allowed Mirriad to become the market leader in in-content.

advertising, but there is - of course - more work to be done.

The signing of a new framework agreement with a tier one US

entertainment giant in October was a major milestone for the

Company, a validation of our technology and a demonstration of how

far we have come after resetting the Company in 2019.

This was followed by the announcement of the Mirriad Music

Alliance, a partnership with globally renowned record labels and

leading independent music companies to bring brands immediate

access to millions of consumers through over a thousand global

artists.

Both announcements demonstrate the flexibility of Mirriad's

technology and its ability to adapt with ease to reach into new

growth markets. The team is excited about the potential of the

music sector in particular for 2021.

Over the summer we saw an increasing level of activity in China

via our partner Tencent. This demonstrates how effective Mirriad

can be when it is integrated with a partner's systems, and this

offers a blueprint of how we can drive real scale in the

future.

The year closed with a heavily oversubscribed fundraising round,

offering another indication of the enthusiasm for the Mirriad

solution amongst existing and new investors. The money raised gives

us the resources required to drive further scale.

The ongoing backdrop of a global pandemic makes all of these

achievements all the more significant, and I would like to pay

tribute to the hard work across the business that has made all of

this possible.

Engaging with our stakeholders

The Board, Stephan and I take our responsibilities to

shareholders and wider stakeholders seriously. In line with

pandemic restrictions, face-to-face events other than our

technology showcase in January 2020 have been limited, but we have

continued our engagement through digital platforms.

The management team is also actively engaged with broadcasters

and digital content platforms, advertising agencies and senior

international advertisers.

As well as undertaking many virtual meetings over the course of

the year, we have sought to maintain exceptional standards of

communication around significant events by offering our

stakeholders opportunities to join webinars presented by the

management team.

The Company has continued to demonstrate its resilience in the

COVID-19 environment with all staff working effectively from home

or in line with local restrictions. In this environment, engagement

is more critical than ever and Mirriad actively communicates with

its employees via regular staff surveys and monthly virtual Town

Hall meetings.

The year ahead

The focus for the year ahead will be building Mirriad as the

media solution for a new era in audience engagement. This will be

achieved by stimulating direct demand and putting in place the

sales architecture and data capability to scale within this

competitive market.

While the macroeconomic outlook is still uncertain, our recent

activity has given me confidence that the Mirriad solution is well

positioned to respond to changing viewing habits and to provide

value in what is a growing addressable market. The fundamental fact

that audiences prefer the Mirriad format to other more disruptive

advertising types, and the fact that it is proven to drive

increased brand consideration, gives us a compelling competitive

advantage at a time when broadcasters, content creators and

distributors are all looking for new sources of revenue.

John Pearson

Non-executive chairman

12 May 2021

CEO's statement

Much of last year's focus was on taking the Mirriad story to

external audiences in the market and building momentum for the new

advertising format after our strategic reset. Following a

successful fundraise and increasing our profile, we will now focus

our efforts on creating a Mirriad architecture that will ultimately

build and define the in-content advertising space.

COVID-19 related filming and travel restrictions have added to

the ongoing upheaval of the advertising ecosystem, and with

inventory at a premium, Mirriad is well placed to benefit from the

steady increase in streaming and sustained consumer aversion to

interruptive advertising. We are confident that our in-content

solution marks a step change from established advertising formats,

giving producers, advertisers and content creators a bold and

sustainable new format to drive engagement.

Increased demand and momentum

We have worked hard to increase momentum through engagement with

senior stakeholders at advertising clients, agency groups as well

as the linear and digital content platforms and companies, and now

the time is right to renew our focus on three key areas for

2021.

Firstly our technology and platform will be at the heart of

everything we do in the year ahead - it is vital we press on and

further refine our infrastructure to allow it to be effectively

'plugged' into our partners' platforms and the entire ad buying and

delivery ecosystem.

Secondly, to support this drive for scale, we will further ramp

up automation. Improved automation will transform the scale,

precision and speed at which Mirriad and our partners look at and

plan inventory; decide on the insertion opportunities; process

in-content ads, eventually in multiple variations; and track

delivery and results for the purpose of optimisation.

This is particularly true for our expansion into the music

sector and other content areas where Mirriad is in charge of the

inventory transaction. New levels of data intelligence, automation

and integration will be the pivot into a scaled media proposition.

We have a great technical team that we are supplementing with

strategic hires. The addition of an experienced new CTO, Philip

Mattimoe, at the start of this year is the latest piece in our

technology jigsaw.

US sales

Finally, we must drive more sales in the US in particular. We

have added to our US sales capability and this will improve our

ability to stimulate direct demand. Alongside this, we will

continue to seek opportunities in sectors like music to realise

growth potential in our expanding addressable markets.

Our technology is patent-protected and industry-defining. With

strong fundamentals now in place, I look forward to sharing more

detailed updates in this area throughout, what I believe will be,

another exciting year for Mirriad. The advertising and media

industries are going through times of profound change. From the

shift to more streaming services to the sunsetting of the cookie,

engaging with consumers needs a new approach and formula.

In-content advertising and contextual targeting are the keys to a

new era, and the continuous improvements in our protected and

awarded technology, as well as the integration with the ecosystem,

will ultimately drive the mass adoption of the new format that

Mirriad is leading with.

Stephan Beringer

Chief Executive Officer

12 May 2021

Financial review

Introduction

Figures published by Zenith suggest that Worldwide advertising

expenditure declined by 9.1% in 2020 with declines experienced in

all of Mirriad's operating markets as Covid-19 impacted the global

content and advertising business. In contrast 2020 saw Mirriad

achieve our highest ever revenue despite the impact of Covid-19.

The Company completed a successful fundraising of GBP26.2 million

(gross) at the end of December 2020 which gives us the financial

resources to continue to invest in our technology and building our

sales capability, particularly in the US. All three of the

Company's KPIs improved substantially over the year with revenues

up 91.3%, cash consumption down by 26.6% and customers under

contract up by 33.3%.

Current year results

Revenue for the year was almost double the prior year at GBP2.18

million (2019: GBP1.14 million) largely based on the revenue

guaranteed in the Tencent contract. During the year the Group

continued to focus on developing its operations in the US, the

world's largest advertising market, and Europe. In the US, we

announced a deal with a major tier one entertainment giant in the

final quarter and ran the first campaign for that partner in

December. This deal adds to the existing supply partner

relationships in the US with Univision, Condé Nast and Tastemade.

We also concluded a new deal with A&E Networks in the US

shortly before the year end having added deals with Meredith and

Fuse Media earlier in 2020. In Europe, we focussed on France where

the Company continues to work with the major broadcasters and we

ran a number of campaigns for France Televisions. As in previous

years we caution that sales cycles with large broadcasters and

distributors are long and therefore it will take time to scale

revenues.

Revenue was particularly strong in China based on our exclusive

deal with Tencent video announced in July 2019. This deal expired

in March 2021 and some of the revenue under the contract was

deferred from 2020 into 2021 as Covid impacted the volume of

campaigns booked during 2020.

As a result of the increased level of revenue gross margin

increased to GBP1.94 million (2019: GBP0.96 million). As noted in

previous years the Company is making steady progress in automating

key elements of its production process and our teams work with our

technology to deliver campaigns. The vast majority of our Cost of

Sales relates to our staff based in Mumbai. The staff element of

this work is largely fixed at current volumes which means that

margin is impacted by the throughput of work and has the potential

to improve significantly as these volumes increase.

The Group's principal cost is staff. We previously reported that

we had undertaken a significant volume of restructuring in 2019 and

the impact of these changes have now fed through to our income

statement. Over the course of 2020 administrative expenses

decreased to GBP11.22 million (2019: GBP13.16 million). The Company

took the decision not to furlough or put any staff on short working

during the year to allow us to maintain momentum and continue our

commitment to expanding scale.

The Company has continued to review and monitor the application

of IAS 38 with respect to the capitalisation of development cost.

The Company has continued to take the view that due to the

uncertainty of future revenue generation it will not capitalise any

development cost in 2020 even though technology remains key to the

Company's business and internally generated software and IP remains

a key focus for future development of the business. Accordingly,

the income statement includes GBP2.43 million (2019: GBP2.32

million) related to research and development ("R&D") activity.

In total expenditure on the Company's technology team increased by

GBP0.12 million as average headcount was modestly increased.

The reduction in operating costs and improvement in gross margin

fed through to EBITDA with the EBITDA loss decreasing to GBP8.63

million (2019: GBP11.51 million). Likewise, the loss for the year

before tax decreased to GBP9.09 million (2019: GBP12.15

million).

Tax

The Group has not recognised any tax assets in respect of

trading losses arising in the current financial year or accumulated

losses in previous financial years. The tax credit recognised in

the current and previous financial years arises from the receipt of

R&D tax credits.

Earnings per share

Loss per share was 4p per share (2019: loss of 8p per share) as

a result of the reduction in operating costs over the year and the

increase in the Company's issued share capital. This calculation is

based on the weighted average number of shares in issue during the

financial year.

Dividend

No dividend has been proposed for the year ended 31 December

2020 (2019: GBPnil).

Cash flow

Net cash used in operations was GBP8.06 million (2019: GBP10.95

million) as the benefits of the Group's restructuring flowed

through to cash. The Group incurred GBP25,202 (2019: GBP62,484) of

capital expenditure on tangible assets in the year. Net proceeds

from the issue of shares in December 2020 totalled GBP24.78 million

(2019: GBP15.29 million) following the successful fundraising.

Balance sheet

Net assets increased to GBP35.3 million (2019: GBP19.2 million)

as a result of the proceeds from the issue of shares net of the

losses for the year. Cash and cash equivalents at 31 December 2020

were GBP35.4 million (2019: GBP19.1 million).

Accounting policies

The Group's consolidated financial information has been prepared

in accordance with International Financial Reporting Standards in

conformity with the requirements of the Companies Act 2006.

Going concern

The financial statements have been prepared on a going concern

basis. This is supported by the Company's successful fundraise in

December 2020, where an additional GBP26.2m (gross) proceeds were

raised, the substantial cash balance of GBP35.42m at the year end,

the fact that the Company is debt free with no external borrowing

and the Company's net cash outflow of GBP8.06m for 2020. After

making enquiries and producing cash flow forecasts in a variety of

scenarios, the Directors have reasonable expectations, as at the

date of approving the financial statements, that the Company and

the Group will have adequate resources to fund the activities of

the Company and the Group for the next 12 months from the date of

the financial statements.

David Dorans

Chief Financial Officer

12 May 2020

Consolidated statement of profit or loss

For the year ended 31 December 2020

Year ended Year ended

31 December 31 December

2020 2019

Note GBP GBP

-------------------------------- ---- ------------ ------------

Revenue 3 2,179,919 1,139,538

Cost of sales (244,359) (178,091)

-------------------------------- ---- ------------ ------------

Gross profit 1,935,560 961,447

Administrative expenses (11,216,312) (13,159,812)

Other operating income 188,306 24,421

-------------------------------- ---- ------------ ------------

Operating loss 4 (9,092,446) (12,173,944)

Finance income 34,339 46,436

Finance costs (30,702) (23,627)

-------------------------------- ---- ------------ ------------

Finance income - net 3,637 22,809

Loss before income tax (9,088,809) (12,151,135)

Income tax credit 32,429 56,231

-------------------------------- ---- ------------ ------------

Loss for the year (9,056,380) (12,094,904)

-------------------------------- ---- ------------ ------------

Loss per Ordinary Share - basic 5 (4p) (8p)

-------------------------------- ---- ------------ ------------

All activities are classified as continuing.

Consolidated statement of comprehensive income

For the year ended 31 December 2020

Year ended Year ended

31 December 31 December

2020 2019

GBP GBP

---------------------------------------------------------- ----------- ------------

Loss for the financial year (9,056,380) (12,094,904)

---------------------------------------------------------- ----------- ------------

Other comprehensive (loss) / income

Items that may be reclassified to profit or loss:

Exchange differences on translation of foreign operations (646) 136,179

---------------------------------------------------------- ----------- ------------

Total comprehensive loss for the year (9,057,026) (11,958,725)

---------------------------------------------------------- ----------- ------------

Items in the statement above are disclosed net of tax.

Consolidated balance sheet

At 31 December 2020

Group

------------

As at As at

31 December 31 December

2020 2019

GBP GBP

--------------------------------- ------------ ------------

Assets

Non-current assets

Property, plant and equipment 636,543 912,983

Intangible assets - -

Investments - -

Trade and other receivables 186,021 212,143

---------------------------------- ------------ ------------

822,564 1,125,126

--------------------------------- ------------ ------------

Current assets

Trade and other receivables 1,475,785 1,024,996

Other current assets 72,993 76,754

Cash and cash equivalents 35,421,396 19,091,613

---------------------------------- ------------ ------------

36,970,174 20,193,363

--------------------------------- ------------ ------------

Total assets 37,792,738 21,318,489

---------------------------------- ------------ ------------

Liabilities

Non-current liabilities

Lease liabilities 204,437 423,328

---------------------------------- ------------ ------------

204,437 423,328

--------------------------------- ------------ ------------

Current liabilities

Trade and other payables 1,913,845 1,297,624

Current tax liabilities 13,361 24,809

Lease liabilities 390,220 373,227

---------------------------------- ------------ ------------

2,317,426 1,695,660

--------------------------------- ------------ ------------

Total liabilities 2,521,863 2,118,988

---------------------------------- ------------ ------------

Net assets 35,270,875 19,199,501

---------------------------------- ------------ ------------

Equity and liabilities

Equity attributable to owners of

the parent

Share capital 52,688 52,029

Share premium 65,710,297 40,932,183

Share-based payment reserve 2,850,571 2,500,944

Retranslation reserve (143,298) (142,652)

Accumulated losses (33,199,383) (24,143,003)

---------------------------------- ------------ ------------

Total equity 35,270,875 19,199,501

---------------------------------- ------------ ------------

Consolidated statement of changes in equity

For the year ended 31 December 2020

Year ended 31 December 2019

-------------------------------------------------------------------------------

Share-based Retranslation Accumulated

Share payment

capital Share premium reserve reserve losses Total equity

GBP GBP GBP GBP GBP GBP

-------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Balance at 1 January 2019 50,949 25,643,192 2,141,094 (278,831) (12,048,099) 15,508,305

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Loss for the financial

year - - - - (12,094,904) (12,094,904)

Other comprehensive income

for the year - - - 136,179 - 136,179

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Total comprehensive loss

for the year - - - 136,179 (12,094,904) (11,958,725)

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Proceeds from shares issued 1,080 16,196,750 - - - 16,197,830

Share issue costs - (907,759) - - - (907,759)

Share-based payments recognised

as expense - - 359,850 - - 359,850

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Total transactions with

shareholders recognised

directly in equity 1,080 15,288,991 359,850 - - 15,649,921

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Balance at 31 December

2019 52,029 40,932,183 2,500,944 (142,652) (24,143,003) 19,199,501

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Year ended 31 December 2020

-------------------------------------------------------------------------------

Retained

earnings/

Share-based Retranslation (accumulated

Share payment

capital Share premium reserve reserve losses) Total equity

GBP GBP GBP GBP GBP GBP

-------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Balance at 1 January 2020 52,029 40,932,183 2,500,944 (142,652) (24,143,003) 19,199,501

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Loss for the financial

year - - - - (9,056,380) (9,056,380)

Other comprehensive loss

for the year - - - (646) - (646)

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Total comprehensive loss

for the year - - - (646) (9,056,380) (9,057,026)

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Proceeds from shares issued 659 26,228,815 - - - 26,229,474

Share issue costs - (1,450,701) - - - (1,450,701)

Share-based payments recognised

as expense - - 349,627 - - 349,627

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Total transactions with

shareholders recognised

directly in equity 659 24,778,114 349,627 - - 25,128,400

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Balance at 31 December

2020 52,688 65,710,297 2,850,571 (143,298) (33,199,383) 35,270,875

--------------------------------- -------- ------------- ----------- ------------- ------------ ------------

Consolidated statement of cash flows

For the year ended 31 December 2020

Group

-------------------------

2020 2019

GBP GBP

-------------------------------------- ----------- ------------

Cash used in operations (8,146,368) (11,222,098)

Tax credit received 99,886 291,502

Taxation paid (17,697) (43,288)

Interest received 34,339 46,436

Lease interest paid (30,702) (23,627)

--------------------------------------- ----------- ------------

Net cash used in operating activities (8,060,542) (10,951,075)

--------------------------------------- ----------- ------------

Cash flow from investing activities

Purchase of tangible assets (25,202) (62,484)

Proceeds from disposal of tangible

assets 100 236

--------------------------------------- ----------- ------------

Net cash used in investing activities (25,102) (62,248)

--------------------------------------- ----------- ------------

Cash flow from financing activities

Proceeds from issue of Ordinary

Share capital

(net of costs of issue) 24,778,773 15,290,071

Payment of lease liabilities (363,346) (389,055)

--------------------------------------- ----------- ------------

Net cash generated from financing

activities 24,415,427 14,901,016

--------------------------------------- ----------- ------------

Net increase in cash and cash

equivalents 16,329,783 3,887,693

Cash and cash equivalents at

the beginning of the year 19,091,613 15,203,920

--------------------------------------- ----------- ------------

Cash and cash equivalents at

the end of the year 35,421,396 19,091,613

--------------------------------------- ----------- ------------

Cash and cash equivalents consists

of

Cash at bank and in hand 35,421,396 19,091,613

--------------------------------------- ----------- ------------

Cash and cash equivalents 35,421,396 19,091,613

--------------------------------------- ----------- ------------

Notes to the consolidated financial statements

For the year ended 31 December 2020

1. Corporate Information

Mirriad Advertising plc is a public limited company incorporated

and domiciled in the UK and registered in England with company

registration number 09550311. The Company's registered office is

6th Floor, One London Wall, London, EC2Y 5EB.

2. Basis of preparation

The financial information set out above does not constitute the

Group's statutory accounts for the years ended 31 December 2020 or

2019 but is derived from those accounts. Statutory accounts for

2019 have been delivered to the registrar of companies, and those

for 2020 will be delivered in due course. The auditor has reported

on those accounts; their reports were (i) unqualified, (ii) did not

include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498 (2) or (3) of

the Companies Act 2006.

The consolidated financial information has been prepared in

accordance with International Financial Reporting Standards (IFRS)

and IFRS Interpretations Committee ("IFRS IC") interpretations in

conformity with the requirements of the Companies Act 2006

applicable to companies reporting under IFRS,

The financial information contained in these financial

statements have been prepared under the historical cost convention,

and on a going concern basis.

The accounting policies applied are consistent with those of the

annual report and accounts for the year ended 31 December

2019.

(a) New standards, amendments and interpretations

The Group has applied the following standards and amendments for

the first time for the annual reporting period commencing 1 January

2020:

-- Definition of material - Amendments to IAS 1 and IAS 8;

-- Definition of a Business - Amendments to IFRS 3;

-- Interest Rate Benchmark Reform - Amendments to IFRS 7, IFRS 9 and IAS 39;

-- Revised Conceptual Framework for Financial Reporting;

The new standards listed above did not have any material impact

on the amounts recognised in the current period and are not

expected to significantly affect future periods.

(b) New standards, amendments and interpretations not yet

adopted

A number of new standards and amendments to standards and

interpretations are effective for annual periods beginning after 1

January 2021, and have not been applied in preparing these

financial statements. These standards are not expected to have a

material impact on the entity in the current or future reporting

periods or on foreseeable future transactions.

3. Segment information

Management mainly considers the business from a geographic

perspective since the same services are effectively being sold in

every Group entity. Therefore regions considered for segmental

reporting are where the Company and subsidiaries are based, namely

the UK, the USA, India, and China. The Singapore office was closed

in early 2020. The revenue is classified by where the sales were

booked not by the geographic location of the customer. For this

reporting purpose the Singapore and China entities are considered

together.

The only income outside of the primary business activity relates

to income received from grants which is recognised in other

operating income.

The amount of revenue from external customers by location of the

Group billing entity is shown in the tables below.

2020 2019

Revenue GBP GBP

---------------------- --------- ---------

Turnover by geography

China and Singapore 1,765,196 776,115

USA 313,967 160,432

UK 100,756 139,735

India - 38,549

Brazil - 24,707

---------------------- --------- ---------

Total 2,179,919 1,139,538

---------------------- --------- ---------

2020 2019

GBP GBP

---------------------- --------- ---------

Turnover by category

Rendering of services 2,179,919 1,139,538

---------------------- --------- ---------

Total 2,179,919 1,139,538

---------------------- --------- ---------

2020 2019

Revenues from external customers by country, based

on the destination of the customer GBP GBP

--------------------------------------------------- --------- ---------

China 1,780,905 834,887

USA 313,967 160,432

France 31,559 9,633

Turkey 22,010 -

UK 21,700 56,500

India - 38,549

Brazil - 24,707

Ireland - 7,750

Germany - 7,080

Other 9,778 -

--------------------------------------------------- --------- ---------

Total 2,179,919 1,139,538

--------------------------------------------------- --------- ---------

4. Operating loss

The Group operating loss is stated after

charging/(crediting):

2020 2019

GBP GBP

------------------------------------------------- ---------- ----------

Employee benefits 7,559,195 8,123,117

Depreciation of property, plant and equipment 466,097 498,411

Amortisation and impairment of intangible assets - 170,053

Foreign exchange movements 28,040 168,319

Other general and administrative costs 3,407,339 4,378,003

Other operating income (188,306) (24,421)

-------------------------------------------------- ---------- ----------

Total cost of sales, administrative expenses

and other operating income 11,272,365 13,313,482

-------------------------------------------------- ---------- ----------

Other operating income includes income received from government

grants and Research and development expenditure credits. The Group

has complied with all the conditions attached to these grant

awards.

Included within Employee benefits costs are share based payments

for the year ended 31 December 2020 of GBP0.4m (2019: GBP0.4m).

5. Loss per share

(a) Basic

Basic loss per share is calculated by dividing the loss for the

year by the weighted average number of Ordinary Shares in issue

during the year. Potential Ordinary Shares are not treated as

dilutive as the Group is loss making and such shares would be

anti-dilutive.

Group 2020 2019

---------------------------------------------------- ----------- ------------

Loss attributable to owners of the parent (GBP) (9,056,380) (12,094,904)

Weighted average number of Ordinary Shares in issue

(number) 215,687,030 150,165,094

---------------------------------------------------- ----------- ------------

The loss per share for the year was 4p (2019: 8p).

No dividends were paid during the year (2018: GBPnil).

(b) Diluted

Potential Ordinary Shares are not treated as dilutive as the

Group is loss making and such shares would be anti-dilutive.

6. Related party transactions

The Group is owned by a number of investors, the largest being

M&G Investment Management which owns approximately 13% of the

share capital of the Company. At 31 December 2019 the largest

shareholder was IP2IPO Portfolio (GP) Limited (as general partner

for IP2IPO Portfolio LP) which owned approximately 16% of the share

capital of the Company. Accordingly there is no ultimate

controlling party.

During the year the Company had the following significant

related party transactions which were carried out at arm's length.

No guarantees were given or received for any of these

transactions:

Transactions with Directors

As part of the fundraise in December 2020 the following

Directors purchased Ordinary Shares in the Company at a cost of

GBP0.40 per share:

Number

Director of shares

----------------- ----------

John Pearson 25,000

Stephan Beringer 25,000

David Dorans 2,500

Alastair Kilgour 25,000

Bob Head 50,000

----------------- ----------

Transactions with other related parties

IP2IPO Limited - a company which shares a parent company with

IP2IPO Portfolio (GP) Limited, a major shareholder in the Group,

and which also appoints a Director of the Group charged Mirriad

Advertising plc for the following transactions during the year: (1)

GBP20,000 for the services of Dr Mark Reilly as a Director during

the year. GBP1,667 of this amount was invoiced and unpaid as at 31

December 2020. These outstanding amounts were paid on 5 February

2021; (2) GBP12,000 for the services of the Company Secretary

during the year. GBP3,000 of this amount was invoiced and unpaid as

at 31 December 2020. This outstanding amount was paid on 5 February

2021; and (3) GBP250 for travel costs related to Dr Mark Reilly.

GBP22 of this amount was invoiced and unpaid as at 31 December

2020, and was paid on 5 February 2021.

Parkwalk Advisors Limited - a company which shares a parent

company with IP2IPO Portfolio (GP) Limited, a major shareholder in

the Group, charged Mirriad Advertising plc for the following

transactions during the year: (1) GBP20,000 for the services of

Alastair Kilgour as a Director during the year. GBP1,667 of this

amount was accrued and unpaid as at 31 December 2020, but was

invoiced in early January 2021 and subsequently paid on 5 February

2021.

Top Technology Ventures Limited - a company which shares a

parent company with IP2IPO Portfolio (GP) Limited, a major

shareholder in the Group. There were no transactions with Mirriad

Advertising plc during the year (2019: GBP9,498 for attendance and

travel costs for an employee's attendance at IP Group events in

China).

All the related party transactions disclosed above were settled

by 31 December 2020 except where stated.

During the year ended 31 December 2020, the Company entered into

transactions with its subsidiary companies for working capital

purposes, which net off on consolidation - these have not been

shown above.

The Directors have authority and responsibility for planning,

directing and controlling the activities of the Group and they

therefore comprise key management personnel as defined by IAS 24

"Related party disclosures". Remuneration of Directors and senior

management is disclosed in the Remuneration Report.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKDBDOBKDDPD

(END) Dow Jones Newswires

May 12, 2021 02:00 ET (06:00 GMT)

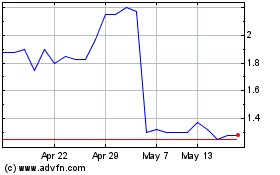

Mirriad Advertising (LSE:MIRI)

Historical Stock Chart

From Oct 2024 to Nov 2024

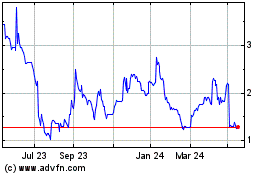

Mirriad Advertising (LSE:MIRI)

Historical Stock Chart

From Nov 2023 to Nov 2024