TIDMMBT

RNS Number : 4175R

Mobile Tornado Group PLC

01 March 2023

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended.

1 March 2023

Mobile Tornado Group plc

("Mobile Tornado", the "Company" and, together with its

subsidiary undertakings, the "Group")

Subscription to raise GBP500,000, debt conversion and trading

update

Mobile Tornado (AIM: MBT) today announces a subscription for

25,000,000 new ordinary shares of 2 pence each ("Ordinary Shares"),

representing approximately 6.6 per cent. of the existing issued

ordinary share capital of the Company (the "Subscription Shares")

at a price of 2 pence per Subscription Share (the "Issue Price") to

raise approximately GBP500,000 (before expenses) (the

"Subscription"). The Company also announces the capitalisation of

GBP259,490 of indebtedness owed by the Company to InTechnology plc

("InTechnology") into 12,974,492 new Ordinary Shares, also at the

Issue Price.

Jeremy Fenn, Chairman and acting CEO of Mobile Tornado,

commented:

"Since we announced the Board changes on 9 January 2023, I'm

pleased to report that the business has moved quickly to scale up

its sales and business development operation and is now actively

engaged with a number of potential new partners and customers.

"Having combined our robust and reliable push to talk over

cellular ("PTToC") platform with the very latest in workforce

management technology, our solution gives organisations everything

they need to seamlessly communicate with and manage their team

members using one application and one device, wherever they are in

the world. This is a first for our global market and creates

exciting growth opportunities for the Company and our partners.

"This small fundraise will allow us to accelerate our business

development activities further, with the recruitment of additional

sales professionals in key markets and the execution of a much more

intensive outreach campaign. I look forward to further updating the

market with our 2022 results during the week commencing 17

April."

Enquiries:

Mobile Tornado Group plc +44 (0)7734 475 888

Jeremy Fenn, Chairman and acting CEO www.mobiletornado.com

Allenby Capital Limited (Nominated Adviser

& Broker) +44 (0)20 3328 5656

James Reeve/Piers Shimwell (Corporate

Finance)

David Johnson (Sales and Corporate Broking)

Background to and reasons for the Subscription

Mobile Tornado plc has developed the world's first PTToC

platform with integrated workforce management technology.

The Company's established PTToC platform uses cellular and

broadband networks to provide always-on instant communications for

mission critical requirements in challenging environments. It has

been deployed in more than 30 countries worldwide with mobile

network operators, government agencies and enterprises in Europe,

the Middle East, Africa and the Americas.

The platform's PTToC integration with workforce management

technology gives organisations a single application to communicate

with and manage remote and mobile operatives using a single device:

either an Android or iOS smartphone or ruggedised handset. The

solution increases safety, productivity and performance while

cutting paperwork and total cost of ownership.

Developed in-house, the workforce management technology enables

the digital transformation of multiple manual tasks and assignments

and generates advanced business intelligence for the streamlining

of operations and enhanced allocation of resources. The workforce

management technology offers tools including attendance and time

monitoring, forms and checklists, reporting, scheduling and task

creation. These are available via a dispatch console, which allows

organisations to manage teams from a control room.

The Directors consider it appropriate to undertake the

Subscription at the current time in order to provide the Company

with the resources to increase its business development

capabilities through the recruitment of additional sales

professionals and the development and execution of a much broader

outreach campaign.

Trading update and notice of results

The Company expects to announce its audited results for the 12

months ended 31 December 2022 in the week commencing 17 April 2023.

Total revenue for the year is expected to be approximately GBP2.28

million, compared to GBP2.59 million in 2021, a reduction of 12%.

Gross profit is expected to be approximately GBP2.23 million (2021:

GBP2.49 million), a reduction of 11%. EBITDA loss is expected to be

approximately GBP0.29 million, compared to a loss of GBP0.03

million for 2021.

Recurring revenues for the year are expected to be approximately

GBP1.97 million, compared to GBP2.11 million in 2021, a reduction

of 7%. Our previous customer in Canada which ceased at the end of

2021 as previously reported, accounted for 20% of total revenue and

10% of recurring revenues in the prior year comparative figures. It

is pleasing to report therefore, that outside of this, we recorded

a modest increase in both our total and recurring revenues across

the remainder of our customer base.

The Company is exploring new routes to market, to ensure that

its enhanced proposition is given the opportunity to deliver its

full potential, and the planned acceleration of our business

development activities will further support this. The Board will

update on these initiatives when the Company reports its full year

results during April 2023.

Details of the Subscription

The Company has raised GBP500,000 gross proceeds pursuant to the

Subscription. The Subscription will result in the issue of

25,000,000 Subscription Shares at the Issue Price representing, in

aggregate, 6.6 per cent. of the existing issued ordinary share

capital of the Company and have been subscribed for by certain new

and existing shareholders of the Company. The Subscription Shares

have been issued utilising the Company's existing share

authorities.

The Subscription Shares, when issued, will be fully paid and

will rank pari passu in all respects with the existing Ordinary

Shares, including the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

Settlement for the Subscription Shares is expected to take place

at 8.00 a.m. on 6 March 2023.

Capital Reorganisation

The Company announces the capitalisation of GBP259,490 of

short-term indebtedness owed by the Company to InTechnology at the

Issue Price, resulting in the issue of 12,974,492 new Ordinary

Shares (the "Capitalisation Shares") to InTechnology (the "Capital

Reorganisation"). The indebtedness comprises accrued interest over

preference shares held by InTechnology. The Directors believe that

it is in the best interests of the Company to take this opportunity

to strengthen its balance sheet by undertaking the Capital

Reorganisation.

The Capitalisation Shares, when issued, will be fully paid and

will rank pari passu in all respects with the existing Ordinary

Shares, including the right to receive all dividends and other

distributions declared, made or paid after the date of issue. The

Capitalisation Shares have been issued utilising the Company's

existing share authorities.

Related party transaction

As InTechnology is a substantial shareholder in the Company, the

Capital Reorganisation constitutes a related party transaction

pursuant to Rule 13 of the AIM Rules for Companies.

The Directors of the Company (excluding Peter Wilkinson, as he

is the controlling shareholder of InTechnology and therefore not

considered to be independent) consider, having consulted with the

Company's nominated adviser, Allenby Capital Limited, that the

terms of the Capital Reorganisation are fair and reasonable insofar

as the Company's shareholders are concerned.

Admission to trading and total voting rights

Application has been made for the Subscription Shares and

Capitalisation Shares to be admitted to trading on the AIM

("Admission"). It is anticipated that Admission will occur and

dealings will commence in the Subscription Shares and

Capitalisation Shares at 8:00 a.m. on 6 March 2023.

Following Admission, and for the purposes of the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules, the

Company's total issued share capital will consist of 417,719,415

Ordinary Shares.

The above figure may be used by shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, the Company, under the Disclosure Guidance and Transparency

Rules.

InTechnology shareholding

Following Admission, InTechnology will hold a total of

205,988,314 Ordinary Shares in the Company, equivalent to 49.3% of

the total issued ordinary share capital of the Company as enlarged

by Admission. In addition, Peter Wilkinson holds a further

38,146,141 Ordinary Shares, equivalent to 9.1% of the total issued

ordinary share capital of the Company on Admission. InTechnology

also holds 71,276,735 Preference Shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTPMMTMTBTTIJ

(END) Dow Jones Newswires

March 01, 2023 02:00 ET (07:00 GMT)

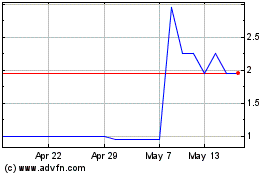

Mobile Tornado (LSE:MBT)

Historical Stock Chart

From Nov 2024 to Dec 2024

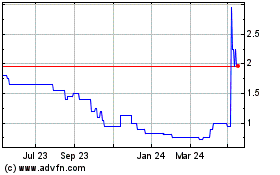

Mobile Tornado (LSE:MBT)

Historical Stock Chart

From Dec 2023 to Dec 2024