TIDMMARS

RNS Number : 5265Y

Marston's PLC

18 May 2016

18 May 2016

MARSTON'S PLC

INTERIM RESULTS FOR THE 26 WEEKSED 2 APRIL 2016

Profit and cash flow growth from high quality pub and beer

business

-- Strong trading performance:

- Underlying Group revenue up 11.5% to GBP428.7 million

- Underlying profit before tax up 11.8% to GBP33.1 million

- Underlying earnings per share up 11.9% to 4.7 pence per

share

- Profit growth in all trading segments

- Operating cash flow up GBP23.1 million to GBP81.3 million

- Leverage reduced 0.4x to 5.0x. Fixed charge cover up 0.2x to

2.6x

- Statutory profit before tax up GBP50.3 million to GBP22.8

million

-- High quality pub estate delivering strong growth:

- Like-for-like sales growth of 3% across managed and franchised

pubs

- Seven pubs and three lodges opened in the period

- First new-build Tavern successfully opened under franchise

model

- High quality Leased business delivered like-for-like profit

and rental growth

- Average profit per pub up 13% in 2016, up 44% since 2012

-- Market-leading beer business continues to grow strongly:

- Underlying operating profit growth of 16% driven by Thwaites acquisition

- Strong brand portfolio continues to outperform market with volumes up 22%

- Market share up 1.5% in premium cask ale and 1.1% in bottled ale

- Hobgoblin Gold (2014 launch) now a 'top 15' premium bottled ale

-- Interim dividend up 4% to 2.6p per share; cover of 1.8 times improved vs H1 2015

-- Full year plans on track

- Performance to date in line with expectations

- At least 20 new pubs this financial year, including two Revere bars

- Five new lodges

Commenting, Ralph Findlay, CEO said:

"We are encouraged by our first half performance and are on

track to meet our expectations for the year. In pubs, we have

driven our growth by the organic development of pub-restaurants and

franchise-style pubs, and more recently through investment in

lodges and premium bars, widening our appeal. In Brewing, we had an

excellent first half year and achieved good growth through our

industry-leading brands and service."

ENQUIRIES:

Marston's PLC Tel: 01902 Instinctif Partners Tel:

329516 020 7457 2020

Ralph Findlay, Chief Executive Justine Warren

Officer

Andrew Andrea, Chief Financial Matthew Smallwood

Officer

An audio webcast of the results presentation will be available

at

http://webcast.instinctif.tv/886-1178-17197 on 18 May 2016.

NOTES TO EDITORS

-- Marston's is a leading pub operator and independent

brewer.

-- It has an estate of around 1,600 pubs situated

nationally, comprising managed, franchised and

leased pubs.

-- It is the UK's leading brewer of premium cask

and bottled ales, including Marston's Pedigree

and Hobgoblin. The portfolio also includes Banks's,

Jennings, Wychwood, Ringwood, Brakspear, Thwaites

and Mansfield beers.

-- Marston's employs around 13,500 people.

o The underlying results reflect the performance

of the Group before exceptional and other adjusting

items. The Directors consider that these figures

provide a useful indication of the underlying

performance of the Group.

o Leverage excludes property leasing.

o Average profit per pub is on an MAT basis.

GROUP OVERVIEW

We are pleased to report good progress in implementing our

strategy, including double digit growth in underlying earnings and

profit growth in all of our trading segments.

Total underlying revenue increased by 11.5% reflecting

like-for-like growth in our pubs, the positive impact of new

openings, growth in our beer brands, and the acquisition of

Thwaites' beer business. Underlying operating margin increased in

both our Destination and Premium and Leased businesses, with Group

operating margin 0.9% below last year as a consequence of the

acquisition in 2015.

Underlying operating profit of GBP70.5 million (2015: GBP66.5

million) was up 6.0%.

Underlying profit before tax was up 11.8% to GBP33.1 million

(2015: GBP29.6 million) principally reflecting the contribution

from new pub-restaurants and the benefits of the Thwaites

acquisition. Basic underlying earnings per share for the period

increased by 11.9% to 4.7 pence per share (2015: 4.2 pence per

share).

On a statutory basis profit before tax was GBP22.8 million

(2015: loss of GBP27.5 million) and earnings per share were 4.2

pence per share (2015: loss of 4.2 pence per share).

Operating cash flow improved by GBP23.1 million to GBP81.3

million in the period principally reflecting improvements in both

EBITDA and working capital.

Net debt at the period end was GBP1,273 million. Excluding

property leases with freehold reversion entitlement, the ratio of

net debt to underlying EBITDA was 5.0 times at the period end

(2015: 5.4 times) and net debt to EBITDA is expected to reduce over

time as our long-term debt amortises. In addition, fixed charge

cover has increased to 2.6 times (2015: 2.4 times).

Outlook and Dividend

After the first few weeks of the second half year, performance

remains in line with expectations. Despite more challenging

comparatives in the second half year, we remain confident of

achieving our targets for the full financial year and are on track

to complete the new-build and lodge expansion plans outlined below.

We are pleased to declare an interim dividend of 2.6 pence per

share representing a 4.0% increase on 2015.

There are two pieces of Government legislation that come into

effect in the second half year. The planned introduction of the

Pubs Code in the second half-year will impact the tenanted and

leased pub sector. Marston's Leased pubs generate approximately 15%

of our total pub profits, and we are therefore not materially

exposed to potential adverse consequences of the legislation. The

Living Wage was introduced on 1(st) April and will increase staff

costs in pubs. We had anticipated that staff costs would increase

over time, and that the Minimum Wage and Living Wage would

converge, so the impact over and above our existing forecasts was

relatively modest. We have no plans to review other staff benefits

as a consequence of the introduction of the Living Wage.

Strategy

Marston's strategic objectives remain focused on delivering

sustainable growth and maximising return on capital, with five key

components as described below.

1. Operating a high quality pub estate.

We have an outstanding range of food-led, community and premium

pubs and bars. We derive many benefits by operating across the full

breadth of the market. We have more investment opportunities

available to us, our risk is spread, and we anticipate market

trends and can respond quickly to change. Our main areas of

operation are:

-- Destination and Premium - 403 pubs. Our Destination pubs

offer family dining and great value in a relaxed pub environment.

We aim to retain strong pub values while reflecting modern tastes

and trends in a fast moving and competitive market. We operate

several formats depending upon local preferences: Marston's "Two

for One", "Milestone Rotisserie", "Milestone Carvery" and "Generous

George", allowing us to have the right consumer offer in each

pub.

Our Pitcher & Piano bars and Revere pubs offer premium food

and drink in attractive town centre and suburban locations, with a

preference for iconic settings.

-- Taverns - 828 pubs. Our community pubs are great locals with

a more traditional pub ambience in strong locations. The

contribution of the licensee is critical to success as atmosphere

is promoted by strong community engagement, with entertainment,

teams and games often at the heart of the pub's activities.

-- Leased - 339 pubs. These distinctive pubs benefit from a high

degree of independence and committed licensees. The leased model,

with longer-term assignable agreements, attracts skilled

entrepreneurs who build value through developing their own

businesses. We contribute through our expertise in attracting the

right lessee, dealing in a fair manner and providing business

support.

-- Marston's Inns. We offer high quality accommodation in 51

pubs and 10 lodges within the Destination and Premium segment. In

total, we have around 850 rooms and we have opened three lodges

during the first half year.

2. Targeting growth: building pub-restaurants, lodges and Premium pubs.

New pub-restaurants. In our Destination business, we have opened

over 130 pub-restaurants since 2009, offering family dining at

reasonable prices. These pubs generate high turnover, with target

sales of GBP25,000 per week and a food sales mix in excess of 60%.

We have an experienced site acquisition team, and a

well-established site selection process and strong relationships

with the major property developers. This expansionary investment

has generated consistent returns and enabled us to extend our

trading geography to include southern England and Scotland. New pub

investment creates significant value for shareholders, as

demonstrated in the 2015 pub estate valuation. This year we have

opened seven new-build pub-restaurants in the first half year, and

are targeting at least 20 for the full year and each year

thereafter.

Competition and differentiation are key considerations. We

operate in a market with significant investment in casual dining,

fast food and restaurants, therefore our pub-restaurant investment

is targeted in areas that are less exposed to intense competition,

particularly outside London and city centres. We benefit from the

broad appeal of the "pub" brand which occupies a unique position in

the market and has demonstrated longevity.

New lodges. Investment in new-build lodges adjacent to pubs has

been increased in 2016. Having opened three in 2015, we will open

at least five in 2016, with three open in the first half year.

Looking forward, we expect accommodation to be increasingly

important to our investment plans, and we are acquiring sites for

development in 2017 and thereafter. The combination of

pub-restaurant with an adjacent lodge is attractive in the context

of increasing business and leisure travel.

New Premium pubs. In recent years we have invested in, and

developed our skills and expertise in, our Premium pub business,

comprising Pitcher & Piano and Revere. In 2016 we have

converted one pub from the existing estate to our Revere format,

with a further two sites acquired for development and opening in

the second half year.

Development of the franchise model. We pioneered the

introduction of franchise-style agreements in the pub sector. We

believe that the franchise operating model in community pubs

creates the best experience for our customers and is the most

flexible and attractive model for licensees. It is our intention to

convert most of our pubs in the Taverns business to this model over

time.

We have also been successful in expanding franchise-style

agreements into higher turnover pubs. This year some of our most

successful franchisees have generated turnover levels similar to

those in the Destination estate, with weekly sales exceeding

GBP30,000 per week over the Christmas period. Furthermore, we have

opened our first new-build Tavern operating under the franchise

operating model, with early trading in line with expectations. We

are also evaluating the potential for franchise-style agreements in

the Destination estate and anticipate trialling this in the next

two years.

3. Offering the best consumer experience: quality, service, value and innovation.

Quality of food and drink. Given the pace of change and

competition in the sector, we prioritise quality and target a food

offer with appeal spanning a broad range of age groups and

demographics. Traditional favourites such as fish and chips are

staple pub classics but we continue to develop and evolve our food

offers and introduce new tastes and flavours. Pizza Kitchen is a

good example: in 2016 we have continued the rollout of Pizza

Kitchen, offering fabulous fresh-made pizza with theatre, which now

operates in 60 pubs. Equally, in Premium we have developed new

'better burger and pizza' and 'smokehouse' concepts which are

proving successful.

We are also well-placed to benefit from current trends in beer,

wines, spirits and non-alcoholic drinks. Growth in premium drinks

continues, with strong consumer interest in new brands and styles,

including non-alcoholic drinks. In Destination and Premium, premium

beer accounts for over 56% of beer sold. We sell 15 million glasses

of wine and five million cups of coffee a year, and soft drinks

account for 25% of total drinks volume. In our Revere pubs,

cocktails account for 13% of drinks sales, reflecting the premium

nature of the experience.

We aim to be the best place locally for our drinks range and

quality, underpinned through initiatives such as "Masters of Cask"

in our Taverns pubs, and supported by the fact that we have our own

beer quality specialists visiting pubs to help ensure we only serve

top quality beer.

Service. We measure service on a pub-by-pub basis through a

combination of internal and external mechanisms. We are in the

process of investing significantly in high speed broadband and

state of the art EPOS equipment (to be completed in 2017) which

will provide us with better customer information and contribute to

improved service. We have recently developed a social media

listening tool which provides our pub managers with the ability to

respond quickly to any customer feedback.

Value. Value for money is a key element of our offer. We do not

aim to offer the lowest prices in the market but aim to offer a

fantastic experience that represents great value for money.

4. Leadership in the UK beer market.

The UK beer market is evolving with consumers seeking a wider

choice of beers with local provenance and taste, including craft

beers. The off-trade continues to grow, with the strongest growth

in the premium bottled ale segment.

Our established strategy is well positioned in respect of these

trends. We have a wide portfolio of beers from our five breweries,

a national distribution network and a local approach to beer brand

management. Around 1 in 5 bottled ales and almost 1 in 5 premium

cask ales in the UK are Marston's brands. Premium ales now account

for around 74% of sales and the mix of sales to the off-trade is

54%.

Our position as category leaders has been recognised across the

industry, most recently by being awarded the Publican National Cask

Ale Supplier of the Year for the third year in succession. Our own

annual publications, the Cask Ale Report and Premium Bottled Ale

Report, continue to be highly valued by both our on-trade and

off-trade customers, for insight into current and future market

trends.

Innovation is key to maintaining our competitive advantage. We

continue to introduce new beers into the market with the most

notable recent launch being Wychwood King Star Craft Lager, the

latest in a series of new beers which includes Hobgoblin Gold,

Shipyard and the Revisionist range.

5. Our People - 'Marston's - The Place to Be'.

Marston's employs around 13,500 people and it is our intention

to build on being 'The Place to Be' not just for our customers but

also for all our employees. Following the appointment of a Group

People Director in 2015 we have reviewed and reinvigorated our

approach to ways of working, aiming to modernise and build on the

excellent values and culture the business has developed over many

years. The output of that is a very clear set of ambitions, values

and ways of working that apply across the business, promoting a

culture of "People at the Heart" of everything we do.

PERFORMANCE AND FINANCIAL REVIEW

Underlying Underlying

revenue operating Margin

profit

2016 2015 2016 2015 2016 2015

GBPm GBPm GBPm GBPm % %

Destination and

Premium 204.8 187.2 34.8 31.6 17.0 16.9

Taverns 107.1 104.4 24.2 24.1 22.6 23.1

Leased 24.2 25.1 12.7 12.4 52.5 49.4

Brewing 92.6 67.8 10.0 8.6 10.8 12.7

Group Services - - (11.2) (10.2) (2.6) (2.7)

---------- ---------- ----------- ----------- -------- ----------

Group 428.7 384.5 70.5 66.5 16.4 17.3

---------- ---------- ----------- ----------- -------- ----------

Destination and Premium

Total revenue increased by 9.4% to GBP204.8 million reflecting

the continued strong performance of our new-build, pub-restaurants

and growth in like-for-like sales. Underlying operating profit of

GBP34.8 million was up 10.1% (2015: GBP31.6 million).

Total like-for-like sales were 3.0% above last year, with

like-for-like food sales up by 2.2%, assisted by strong growth in

sales of starters, desserts and coffee. In addition, like-for-like

room income was up 11.8%. In Destination pubs, food now accounts

for 59% of total sales (2015: 58%) and in Premium pubs and bars

food is 29% of sales (2015: 28%).

Like-for-like wet sales increased by 3.5%, outperforming the

declining UK on-trade drinks market. We continue to see growth in

more premium products, with own-brewed premium ale volumes up 7%

and premium lager up 15%.

We achieved a 0.1% improvement in operating margin through a

disciplined approach to discounting and tight cost management.

Taverns

Total revenue increased by 2.6% to GBP107.1 million, principally

reflecting the continued conversion of pubs to our franchise model.

Operating profit was up 0.4% on last year, reflecting the strong

performance of franchised pubs within our estate, offset by the

impact of disposals.

In our managed and franchised pubs like-for-like sales were up

3.0% and operating margins up 0.1% versus last year, reflecting the

continued success of pubs operating under the franchise model.

Operating margin was 0.5% below last year at 22.6%, primarily

reflecting the impact of franchise conversions.

Leased

Total revenue decreased by 3.6% to GBP24.2 million and

underlying operating profit of GBP12.7 million was up 2.4% on last

year. The performance of the core estate was strong with rental

income growth of 2%. Operating margin of 52.5% was up 3.1%,

reflecting a higher mix of rental income and sales from premium

products.

Brewing

Total revenue increased by 36.6% to GBP92.6 million, primarily

reflecting the benefits of the Thwaites acquisition described

above. Underlying operating profit increased by 16.3% to GBP10.0

million.

Overall ale volumes were up 22% on last year reflecting the

benefits of the Thwaites acquisition. Premium cask ale volumes were

up 22% and bottled ale volumes up 10%. Hobgoblin, our largest

brand, continues to grow with sales up 15% on last year, supported

by the introduction of Hobgoblin Gold. We have maintained our

position as "category market leader" in both the premium bottled

ale and premium cask ale markets.

Operating margin was down versus last year at 10.8% which, as

previously described, reflects the impact of the pub supply

arrangement with Thwaites which generates a positive profit

contribution, albeit at a low margin percentage.

Capital expenditure and disposals

Capital expenditure was GBP72.9 million in the first half year

(2015: GBP70.9 million) including GBP33.6 million on new pubs. We

expect that capital expenditure will be around GBP140 million this

financial year, including around GBP70 million for the construction

of at least 20 pub-restaurants, two Revere bars and five

lodges.

Proceeds of GBP27.1 million of cash have been received from the

sale of 34 pubs and other assets.

Financing

At 2 April 2016, the Group had a GBP257.5 million bank facility

to November 2018. In addition, we have a GBP30 million two-year

facility for the Thwaites acquisition. These facilities, together

with a long-term securitisation of approximately GBP850 million and

the lease financing arrangements described below, provide us with

an appropriate level of financing headroom for the medium term. The

Group has sufficient headroom on both the banking and

securitisation covenants and also has flexibility to transfer pubs

between the banking and securitisation groups.

The Group has entered into lease financing arrangements which

have a total value of GBP223 million as at 2 April 2016. This

financing is a form of sale and leaseback agreement whereby the

freehold reverts to the Group at the end of the term at nil cost,

consistent with our preference for predominantly freehold asset

tenure. The agreements range from 35 to 40 years and provide the

Group with an extended debt maturity profile at attractive rates of

interest. Unlike a traditional sale and leaseback, the associated

liability is recognised as debt on the balance sheet due to the

reversion of the freehold.

Net debt excluding lease financing of GBP1,049 million at 2

April 2016 is broadly in line with last year, despite the

additional GBP30 million facility for Thwaites taken out in April

2015. Operating cash flow of GBP81.3 million was 40% above last

year due to improved profit performance and working capital

management.

For the period ended 2 April 2016 the ratio of net debt before

lease financing to underlying EBITDA was 5.0 times (2015: 5.4

times). It remains our intention to reduce this ratio over time,

principally through EBITDA growth generated from our new-build

investment programme.

Pensions

The deficit on our final salary scheme was GBP1.6 million which

compares to the GBP15.0 million surplus at the year end.

Taxation

The underlying rate of taxation of 18.7% in 2016 is below the

standard rate of corporation tax primarily due to credits in

respect of deferred tax on property.

Non-underlying items

There is a net non-underlying charge of GBP3.0 million after

tax. This includes charges of GBP0.7 million relating to non-core

estate disposal and reorganisation costs, GBP1.2 million in respect

of the change in the rate assumptions used in calculating our

onerous lease provisions, GBP0.9 million in respect of relocation,

reorganisation and integration costs and GBP7.0 million in respect

of the mark-to-market movement in the fair value of certain

interest rate swaps. The revenue of GBP15.6 million and expenses of

GBP15.6 million in respect of the ongoing management of the pubs

from the portfolio disposal in December 2013 have also been

included within non-underlying items. Following the agreement of

the tax treatment of certain items with HM Revenue & Customs,

the Group has recognised a non-underlying tax credit of GBP4.1

million in respect of the additional tax relief claimed by the

Group for previous periods, along with a non-underlying charge of

GBP0.5 million in respect of the associated advisory fees. In

addition, there is a non-underlying deferred tax credit of GBP1.1

million in relation to the change in corporation tax rate and a

credit of GBP2.1 million relating to the tax on non-underlying

items.

Independent review report to Marston's PLC

Report on the interim financial information

Our conclusion

We have reviewed the interim financial information, defined

below, in the Interim Report of Marston's PLC for the 26 weeks

ended 2 April 2016. Based on our review, nothing has come to our

attention that causes us to believe that the interim financial

information is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the European Union and the Disclosure and Transparency Rules of the

United Kingdom's Financial Conduct Authority.

This conclusion is to be read in the context of what we say in

the remainder of this report.

What we have reviewed

The interim financial information, which is prepared by

Marston's PLC, comprises:

-- the Group balance sheet as at 2 April 2016;

-- the Group income statement and Group statement of

comprehensive income for the period then ended;

-- the Group cash flow statement for the period then ended;

-- the Group statement of changes in equity for the period then ended; and

-- the explanatory notes to the interim financial information.

As disclosed in note 1, the financial reporting framework that

has been applied in the preparation of the full annual financial

statements of the Group is applicable law and International

Financial Reporting Standards (IFRS) as adopted by the European

Union.

The interim financial information included in the Interim Report

has been prepared in accordance with International Accounting

Standard 34, 'Interim Financial Reporting', as adopted by the

European Union and the Disclosure and Transparency Rules of the

United Kingdom's Financial Conduct Authority.

What a review of interim financial information involves

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK and

Ireland) and, consequently, does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

We have read the other information contained in the Interim

Report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial information.

Responsibilities for the interim financial information and the

review

Our responsibilities and those of the Directors

The Interim Report, including the interim financial information,

is the responsibility of, and has been approved by, the Directors.

The Directors are responsible for preparing the Interim Report in

accordance with the Disclosure and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

Our responsibility is to express to the Company a conclusion on

the interim financial information in the Interim Report based on

our review. This report, including the conclusion, has been

prepared for and only for the Company for the purpose of complying

with the Disclosure and Transparency Rules of the Financial Conduct

Authority and for no other purpose. We do not, in giving this

conclusion, accept or assume responsibility for any other purpose

or to any other person to whom this report is shown or into whose

hands it may come save where expressly agreed by our prior consent

in writing.

PricewaterhouseCoopers LLP

Chartered Accountants

18 May 2016

Birmingham

Notes:

a) The maintenance and integrity of the Marston's PLC website is

the responsibility of the Directors; the work carried out by the

auditors does not involve consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred to the financial statements since they were

initially presented on the website.

b) Legislation in the United Kingdom governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

Responsibility Statement of the Directors in respect of the

Interim Report

The Directors confirm that these condensed consolidated interim

financial statements have been prepared in accordance with IAS 34

as adopted by the European Union and that the interim management

report includes a fair review of the information required by DTR

4.2.7R and DTR 4.2.8R, namely:

-- an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed set of financial statements, and a description of the

principal risks and uncertainties for the remaining six months of

the financial year; and

-- material related party transactions in the first six months

of the financial year and any material changes in the related party

transactions described in the last Annual Report and Accounts.

The Directors of Marston's PLC are listed in the Marston's PLC

Annual Report and Accounts for 3 October 2015. A list of current

Directors is maintained on the Marston's PLC website:

www.marstons.co.uk.

By order of the Board:

Ralph Findlay Andrew Andrea

Chief Executive Officer Chief Financial Officer

18 May 2016 18 May 2016

GROUP INCOME STATEMENT (UNAUDITED)

for the 26 weeks ended 2 April 2016

52 weeks

to

26 weeks to 2 April 26 weeks to 4 April 3 October

2016 2015 2015

Non- Non-

Underlying underlying Underlying underlying

items items Total items items Total Total

Note GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------------- ----- ------------- ------------ -------- ------------- ------------ -------- -----------

2,

Revenue 3 428.7 15.6 444.3 384.5 16.0 400.5 878.6

Operating expenses* (358.2) (18.9) (377.1) (318.0) (64.5) (382.5) (764.8)

-------------------- ----- ------------- ------------ -------- ------------- ------------ -------- -----------

2,

Operating profit 3 70.5 (3.3) 67.2 66.5 (48.5) 18.0 113.8

-------------------- ----- ------------- ------------ -------- ------------- ------------ -------- -----------

Finance costs 4 (37.6) - (37.6) (37.1) - (37.1) (74.5)

Finance income 4 0.2 - 0.2 0.2 - 0.2 0.6

Movement in

fair value

of interest 3,

rate swaps 4 - (7.0) (7.0) - (8.6) (8.6) (8.6)

-------------------- ----- ------------- ------------ -------- ------------- ------------ -------- -----------

Net finance 3,

costs 4 (37.4) (7.0) (44.4) (36.9) (8.6) (45.5) (82.5)

Profit/(loss)

before taxation 33.1 (10.3) 22.8 29.6 (57.1) (27.5) 31.3

3,

Taxation 5 (6.2) 7.3 1.1 (5.8) 9.5 3.7 (8.0)

-------------------- ----- ------------- ------------ -------- ------------- ------------ -------- -----------

Profit/(loss)

for the period

attributable

to equity

shareholders 26.9 (3.0) 23.9 23.8 (47.6) (23.8) 23.3

-------------------- ----- ------------- ------------ -------- ------------- ------------ -------- -----------

Earnings/(loss)

per share:

Basic

earnings/(loss)

per share 6 4.2p (4.2)p 4.1p

Basic underlying

earnings per

share 6 4.7p 4.2p 12.9p

Diluted

earnings/(loss)

per share 6 4.1p (4.2)p 4.0p

Diluted underlying

earnings per

share 6 4.6p 4.1p 12.8p

GROUP STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

for the 26 weeks ended 2 April 2016

26 weeks 26 weeks 52 weeks

to to to

2 April 4 April 3 October

2016 2015 2015

GBPm GBPm GBPm

-------------------------------------------- --------- --------- -----------

Profit/(loss) for the period 23.9 (23.8) 23.3

--------------------------------------------- --------- --------- -----------

Items of other comprehensive income

that may subsequently be reclassified

to profit or loss

Losses arising on cash flow hedges (22.3) (56.4) (56.1)

Transfers to the income statement on

cash flow hedges 5.8 6.0 12.2

Tax on items that may subsequently

be reclassified to profit or loss (0.2) 10.1 8.7

--------------------------------------------- --------- --------- -----------

(16.7) (40.3) (35.2)

--------------------------------------------- --------- --------- -----------

Items of other comprehensive income

that will not be reclassified to profit

or loss

Remeasurement of retirement benefits (20.9) (22.2) (6.7)

Unrealised surplus on revaluation of

properties* 1.3 213.0 216.5

Reversal of past revaluation surplus* - (120.6) (120.6)

Tax on items that will not be reclassified

to profit or loss 14.9 (13.3) (17.1)

--------------------------------------------- --------- --------- -----------

(4.7) 56.9 72.1

--------------------------------------------- --------- --------- -----------

Other comprehensive (expense)/income

for the period (21.4) 16.6 36.9

--------------------------------------------- --------- --------- -----------

Total comprehensive income/(expense)

for the period 2.5 (7.2) 60.2

--------------------------------------------- --------- --------- -----------

* During the prior period a revaluation of the Group's freehold

and leasehold properties was undertaken, resulting in a net

increase in property values of GBP53.8 million. An unrealised

surplus on revaluation of GBP213.0 million and a reversal of past

revaluation surplus of GBP120.6 million were recognised in the

revaluation reserve, and a net charge of GBP38.6 million was

recognised in the income statement. Further detail is provided in

notes 3 and 7 to the interim financial information.

GROUP CASH FLOW STATEMENT (UNAUDITED)

for the 26 weeks ended 2 April 2016

26 weeks 26 weeks 52 weeks

to to to

2 April 4 April 3 October

2016 2015 2015

Note GBPm GBPm GBPm

-------------------------------------------- ----- --------- --------- -----------

Operating activities

Underlying operating profit 70.5 66.5 165.4

Depreciation and amortisation 20.1 18.4 37.9

-------------------------------------------- ----- --------- --------- -----------

Underlying EBITDA 90.6 84.9 203.3

Non-underlying operating items 3 (3.3) (48.5) (51.6)

-------------------------------------------- ----- --------- --------- -----------

EBITDA 87.3 36.4 151.7

Working capital movement 8.3 (1.3) 10.7

Non-cash movements (4.1) 36.7 30.0

(Decrease)/increase in provisions

and other non-current liabilities (2.7) 0.1 0.1

Difference between defined benefit

pension contributions paid and amounts

charged (4.1) (7.1) (14.0)

Income tax paid (3.4) (6.6) (16.2)

-------------------------------------------- ----- --------- --------- -----------

Net cash inflow from operating activities 81.3 58.2 162.3

-------------------------------------------- ----- --------- --------- -----------

Investing activities

Interest received 0.3 0.3 0.7

Sale of property, plant and equipment

and assets held for sale 27.1 26.4 69.6

Purchase of property, plant and equipment

and intangible assets (72.9) (70.9) (142.3)

Acquisition of business - - (28.8)

Movement in other non-current assets 0.8 0.5 2.4

Net cash outflow from investing activities (44.7) (43.7) (98.4)

-------------------------------------------- ----- --------- --------- -----------

Financing activities

Equity dividends paid (25.9) (24.6) (38.9)

Interest paid (37.6) (36.0) (71.8)

Arrangement costs of bank facilities - - (0.2)

Arrangement costs of other lease

related borrowings (1.2) (2.9) (2.9)

Proceeds from sale of own shares 0.2 0.1 1.5

Repayment of securitised debt (13.1) (12.4) (25.4)

Advance of bank loans 60.0 23.0 38.0

Capital element of finance leases

repaid - - (0.1)

Advance of other lease related borrowings 22.1 47.0 47.0

Net cash inflow/(outflow) from financing

activities 4.5 (5.8) (52.8)

-------------------------------------------- ----- --------- --------- -----------

Net increase in cash and cash equivalents 8 41.1 8.7 11.1

-------------------------------------------- ----- --------- --------- -----------

GROUP BALANCE SHEET (UNAUDITED)

as at 2 April 2016

2 April 4 April 3 October

2016 2015 2015

Note GBPm GBPm GBPm

---------------------------------- ----- ---------- ---------- ----------

Non-current assets

Goodwill 227.5 224.2 227.5

Other intangible assets 37.3 24.7 37.6

Property, plant and equipment 7 2,154.2 2,083.5 2,122.6

Deferred tax assets 64.8 61.1 67.8

Retirement benefit surplus - - 15.0

Other non-current assets 11.3 11.0 12.1

2,495.1 2,404.5 2,482.6

---------------------------------- ----- ---------- ---------- ----------

Current assets

Inventories 28.3 23.7 28.2

Trade and other receivables 74.7 72.6 84.3

Cash and cash equivalents* 8 231.9 189.1 193.1

---------------------------------- ----- ---------- ---------- ----------

334.9 285.4 305.6

---------------------------------- ----- ---------- ---------- ----------

Assets held for sale 18.8 27.1 18.0

---------------------------------- ----- ---------- ---------- ----------

Current liabilities

Borrowings* 8 (212.5) (151.8) (154.0)

Derivative financial instruments (31.5) (26.5) (25.7)

Trade and other payables (183.9) (155.7) (185.2)

Current tax liabilities (3.5) (10.1) (7.2)

(431.4) (344.1) (372.1)

---------------------------------- ----- ---------- ---------- ----------

Non-current liabilities

Borrowings 8 (1,291.9) (1,282.2) (1,284.1)

Derivative financial instruments (184.7) (172.7) (167.0)

Retirement benefit obligations (1.6) (7.3) -

Deferred tax liabilities (138.2) (140.2) (156.8)

Other non-current liabilities (1.2) (2.4) (1.8)

Provisions for other liabilities

and charges (39.9) (40.5) (41.5)

---------------------------------- ----- ---------- ---------- ----------

(1,657.5) (1,645.3) (1,651.2)

---------------------------------- ----- ---------- ---------- ----------

Net assets 759.9 727.6 782.9

Shareholders' equity

Equity share capital 44.4 44.4 44.4

Share premium account 334.0 334.0 334.0

Revaluation reserve 626.8 616.9 616.0

Capital redemption reserve 6.8 6.8 6.8

Hedging reserve (144.8) (133.2) (128.1)

Own shares (116.2) (126.3) (118.7)

Retained earnings 8.9 (15.0) 28.5

---------------------------------- ----- ---------- ---------- ----------

Total equity 759.9 727.6 782.9

---------------------------------- ----- ---------- ---------- ----------

* Cash and cash equivalents includes GBP120.0 million (3 October

2015: GBP120.0 million) drawn down under the liquidity facility and

borrowings includes the corresponding liability (note 8).

GROUP STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

for the 26 weeks ended 2 April 2016

Equity Share Capital

share premium Revaluation redemption Hedging Own Retained Total

capital account reserve reserve reserve shares earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

At 4 October

2015 44.4 334.0 616.0 6.8 (128.1) (118.7) 28.5 782.9

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

Profit for the

period - - - - - - 23.9 23.9

Remeasurement

of retirement

benefits - - - - - - (20.9) (20.9)

Tax on remeasurement

of retirement

benefits - - - - - - 4.0 4.0

Losses on cash

flow hedges - - - - (22.3) - - (22.3)

Transfers to

the income statement

on cash flow

hedges - - - - 5.8 - - 5.8

Tax on hedging

reserve movements - - - - (0.2) - - (0.2)

Property revaluation - - 1.3 - - - - 1.3

Deferred tax

on properties - - 10.9 - - - - 10.9

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

Total comprehensive

income/(expense) - - 12.2 - (16.7) - 7.0 2.5

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

Share-based

payments - - - - - - 0.2 0.2

Sale of own

shares - - - - - 2.5 (2.3) 0.2

Disposal of

properties - - (1.3) - - - 1.3 -

Tax on disposal

of properties - - 0.4 - - - (0.4) -

Transfer to

retained earnings - - (0.5) - - - 0.5 -

Dividends paid - - - - - - (25.9) (25.9)

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

Total transactions

with owners - - (1.4) - - 2.5 (26.6) (25.5)

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

At 2 April 2016 44.4 334.0 626.8 6.8 (144.8) (116.2) 8.9 759.9

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

for the 26 weeks ended 4 April 2015

Equity Share Capital

share premium Revaluation redemption Hedging Own Retained Total

capital account reserve reserve reserve shares earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

At 5 October

2014 44.4 334.0 545.9 6.8 (92.9) (126.8) 47.6 759.0

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

Loss for the

period - - - - - - (23.8) (23.8)

Remeasurement

of retirement

benefits - - - - - - (22.2) (22.2)

Tax on remeasurement

of retirement

benefits - - - - - - 4.4 4.4

Losses on cash

flow hedges - - - - (56.4) - - (56.4)

Transfers to

the income statement

on cash flow

hedges - - - - 6.0 - - 6.0

Tax on hedging

reserve movements - - - - 10.1 - - 10.1

Property revaluation - - 213.0 - - - - 213.0

Property impairment - - (120.6) - - - - (120.6)

Deferred tax

on properties - - (17.7) - - - - (17.7)

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

Total comprehensive

income/(expense) - - 74.7 - (40.3) - (41.6) (7.2)

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

Share-based

payments - - - - - - 0.2 0.2

Tax on share-based

payments - - - - - - 0.1 0.1

Sale of own

shares - - - - - 0.5 (0.4) 0.1

Disposal of

properties - - (4.0) - - - 4.0 -

Tax on disposal

of properties - - 0.6 - - - (0.6) -

Transfer to

retained earnings - - (0.3) - - - 0.3 -

Dividends paid - - - - - - (24.6) (24.6)

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

Total transactions

with owners - - (3.7) - - 0.5 (21.0) (24.2)

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

At 4 April 2015 44.4 334.0 616.9 6.8 (133.2) (126.3) (15.0) 727.6

---------------------- --------- --------- ------------ ------------ ---------- --------- ---------- ---------

NOTES

1 BASIS OF PREPARATION OF INTERIM FINANCIAL INFORMATION

This interim financial information has been prepared in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union. The same accounting policies, presentation and

methods of computation are followed in the interim financial

information as applied in the Group's audited financial statements

for the 52 weeks ended 3 October 2015, with the exception of new

standards and interpretations that were only applicable from the

beginning of the current financial year.

The audited financial statements for the 52 weeks ended 3

October 2015 contain details of the new standards and

interpretations now applicable to the Group. The adoption of these

standards and interpretations has had no impact on the interim

financial information.

The financial information for the 52 weeks ended 3 October 2015

is extracted from the audited accounts for that period, which have

been delivered to the Registrar of Companies. The Auditors' report

was unqualified and did not contain a statement under section 498

(2) or (3) of the Companies Act 2006.

The interim financial information does not constitute statutory

accounts within the meaning of section 434 of the Companies Act

2006. The interim financial information for the 26 weeks ended 2

April 2016 and the comparatives to 4 April 2015 are unaudited, but

have been reviewed by the Auditors.

The Group does not consider that any standards or

interpretations issued by the International Accounting Standards

Board, but not yet applicable, will have a significant impact on

the financial statements for the 52 weeks ending 1 October

2016.

The Directors are satisfied that the Group has sufficient

resources to continue in operation for the foreseeable future, a

period of not less than 12 months from the date of this report.

Accordingly, they continue to adopt the going concern basis in

preparing this interim financial information.

2 SEGMENT REPORTING

2 April 4 April

2016 2015

Underlying revenue by segment GBPm GBPm

------------------------------- -------- --------

Destination and Premium 204.8 187.2

Taverns 107.1 104.4

Leased 24.2 25.1

Brewing 92.6 67.8

Group Services - -

------------------------------- -------- --------

Underlying revenue 428.7 384.5

Non-underlying items 15.6 16.0

------------------------------- -------- --------

Revenue 444.3 400.5

------------------------------- -------- --------

2 April 4 April

2016 2015

Underlying operating profit by segment GBPm GBPm

---------------------------------------- -------- --------

Destination and Premium 34.8 31.6

Taverns 24.2 24.1

Leased 12.7 12.4

Brewing 10.0 8.6

Group Services (11.2) (10.2)

---------------------------------------- -------- --------

Underlying operating profit 70.5 66.5

Non-underlying operating items (3.3) (48.5)

---------------------------------------- -------- --------

Operating profit 67.2 18.0

Net finance costs (44.4) (45.5)

---------------------------------------- -------- --------

Profit/(loss) before taxation 22.8 (27.5)

---------------------------------------- -------- --------

Underlying operating profit is a key measure of profitability

used by the chief operating decision maker.

3 NON-underlying items

In order to illustrate the underlying trading performance of the

Group, presentation has been made of performance measures excluding

those items which it is considered would distort the comparability

of the Group's results. These non-underlying items comprise

exceptional items and other adjusting items.

Exceptional items are defined as those items that, by virtue of

their nature, size or expected frequency, warrant separate

additional disclosure in the financial statements in order to fully

understand the underlying performance of the Group. As management

of the freehold and leasehold property estate is an essential and

significant area of the business, the threshold for classification

of property related items as exceptional is higher than other

items.

Other adjusting items comprise the revenue and expenses in

respect of the ongoing management of the portfolio of pubs disposed

of in the period ended 4 October 2014. Following their disposal

these pubs no longer form part of the Group's core activities and

the Group does not have the ability to make strategic decisions in

respect of them. As such it is considered appropriate to exclude

the results of these pubs from the Group's underlying results.

2 April 4 April

2016 2015

GBPm GBPm

------------------------------------------------- -------- --------

Exceptional operating items

Non-core estate disposal and reorganisation

costs 0.7 1.6

Impact of change in rate assumptions used

for onerous lease provisions 1.2 5.9

Relocation, reorganisation and integration

costs 0.9 0.9

Impairment of freehold and leasehold properties - 39.0

Tax advisory fees 0.5 -

3.3 47.4

------------------------------------------------- -------- --------

Other adjusting operating items

Results in respect of the ongoing management

of pubs in the portfolio disposal - 1.1

------------------------------------------------- -------- --------

- 1.1

------------------------------------------------- -------- --------

Non-underlying operating items 3.3 48.5

------------------------------------------------- -------- --------

Exceptional non-operating items

Movement in fair value of interest rate swaps 7.0 8.6

------------------------------------------------- -------- --------

7.0 8.6

------------------------------------------------- -------- --------

Total non-underlying items 10.3 57.1

------------------------------------------------- -------- --------

Non-core estate disposal and reorganisation costs

During the period ended 5 October 2013 the Group commenced a

restructuring of its pub estate and its operating segments. Costs

in respect of this restructuring were incurred in both the current

and prior period.

Impact of change in rate assumptions used for onerous lease

provisions

The update of the discount and inflation rate assumptions used

in the calculation of the Group's onerous property lease provisions

at the current period end resulted in an increase of GBP1.2 million

(2015: GBP5.9 million) in the total provision.

Relocation, reorganisation and integration costs

During the current and prior period a redevelopment of the

Group's head office building in Wolverhampton was undertaken along

with a reorganisation of certain head office functions. Costs of

GBP0.4 million (2015: GBP0.9 million) were incurred in respect of

temporarily relocating to alternative premises nearby during the

period of redevelopment and in undertaking the reorganisation.

The Group also incurred reorganisation and integration costs of

GBP0.5 million (2015: GBPnil) as a result of the acquisition of the

trading operations of Daniel Thwaites PLC's beer division in the

period ended 3 October 2015.

Portfolio disposal of pubs

During the period ended 4 October 2014 the Group disposed of a

portfolio of 202 pubs and subsequently entered into a four year

lease and five year management agreement in respect thereof. The

Group no longer has strategic control of these pubs and they do not

form part of its core activities. As such the results in respect of

the ongoing operation and management of these pubs post disposal

have been classified as a non-underlying item, comprised as

follows:

2 April 4 April

2016 2015

GBPm GBPm

-------------------- -------- --------

Revenue 15.6 16.0

Operating expenses (15.6) (17.1)

-------------------- -------- --------

- (1.1)

-------------------- -------- --------

Movement in fair value of interest rate swaps

The Group's interest rate swaps are revalued to fair value at

each balance sheet date. The movement in fair value of interest

rate swaps which are not designated as part of a hedging

relationship, and the ineffective portion of the movement in fair

value of interest rate swaps which are accounted for as hedging

instruments, are both recognised in the income statement. The net

loss of GBP7.0 million (2015: GBP8.6 million) is shown as an

exceptional item. In addition to this, a loss of GBP16.5 million

(2015: GBP50.4 million) has been recognised in the hedging reserve,

in relation to the effective portion of the movement in fair value

of interest rate swaps which are accounted for as hedging

instruments.

Impact of taxation

The current tax credit relating to the above non-underlying

items amounts to GBP0.5 million (2015: GBP1.5 million). The

deferred tax credit relating to the above non-underlying items

amounts to GBP1.6 million (2015: GBP8.0 million). In addition,

there is a non-underlying deferred tax credit of GBP1.1 million

(2015: GBPnil) in relation to the change in corporation tax rate

(note 5).

During the current period the Group agreed the tax treatment of

certain items with HM Revenue & Customs. The tax credit of

GBP4.1 million in respect of the additional tax relief claimed for

previous periods has been classified as a non-underlying item along

with the associated advisory fees of GBP0.5 million.

Prior period non-underlying items

At 1 February 2015 the Group's freehold and leasehold properties

were revalued by independent chartered surveyors on an open market

value basis. The resulting revaluation adjustments were recognised

in the revaluation reserve or income statement as appropriate. The

amount recognised in the income statement comprised:

4 April

2015

GBPm

--------------------------------------------- --------

Impairment of other intangible assets 0.1

Reversal of impairment of other intangible

assets (0.2)

Impairment of property, plant and equipment 60.1

Reversal of impairment of property, plant

and equipment (26.3)

Impairment of assets held for sale 5.0

Reversal of impairment of assets held

for sale (0.1)

Valuation fees 0.4

39.0

--------------------------------------------- --------

4 FINANCE COSTS AND INCOME

2 April 4 April

2016 2015

GBPm GBPm

----------------------------------------------- -------- --------

Finance costs

Unsecured bank borrowings 6.1 5.7

Securitised debt 24.1 24.7

Finance leases 0.5 0.5

Other lease related borrowings 6.0 5.1

Net finance cost in respect of retirement

benefits 0.2 -

Other interest payable 0.7 1.1

Total finance costs 37.6 37.1

----------------------------------------------- -------- --------

Finance income

Deposit and other interest receivable (0.2) (0.2)

Total finance income (0.2) (0.2)

----------------------------------------------- -------- --------

Movement in fair value of interest rate swaps

Loss on movement in fair value of interest

rate swaps 7.0 8.6

----------------------------------------------- -------- --------

7.0 8.6

----------------------------------------------- -------- --------

Net finance costs 44.4 45.5

----------------------------------------------- -------- --------

5 TAXATION

The underlying taxation charge for the 26 weeks ended 2 April

2016 has been calculated by applying an estimate of the underlying

effective tax rate for the 52 weeks ending 1 October 2016 of

approximately 18.7% (26 weeks ended 4 April 2015: approximately

19.6%).

2 April 4 April

2016 2015

GBPm GBPm

-------------- -------- --------

Current tax 0.6 3.9

Deferred tax (1.7) (7.6)

-------------- -------- --------

(1.1) (3.7)

-------------- -------- --------

The taxation credit includes a current tax credit of GBP0.5

million (2015: GBP1.5 million) and a deferred tax credit of GBP1.6

million (2015: GBP8.0 million) relating to the tax on

non-underlying items. In addition, there is a non-underlying

deferred tax credit of GBP1.1 million (2015: GBPnil) in relation to

the change in corporation tax rate. There is also a non-underlying

current tax credit of GBP3.7 million (2015: GBPnil) and a

non-underlying deferred tax credit of GBP0.4 million (2015: GBPnil)

in relation to the additional tax relief claimed by the Group for

previous periods following the agreement of the tax treatment of

certain items with HM Revenue & Customs (note 3).

6 EARNINGS PER ORDINARY SHARE

Basic earnings per share are calculated by dividing the

profit/(loss) attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the period,

excluding treasury shares and those held on trust for employee

share schemes.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. These represent share options

granted to employees where the exercise price is less than the

weighted average market price of the Company's shares during the

period.

Underlying earnings per share figures are presented to exclude

the effect of exceptional and other adjusting items. The Directors

consider that the supplementary figures are a useful indicator of

performance.

2 April 2016 4 April

2015

Per Per

share share

Earnings amount Earnings amount

GBPm p GBPm p

--------------------------------------- --------- -------- --------- --------

Basic earnings/(loss) per share 23.9 4.2 (23.8) (4.2)

Diluted earnings/(loss) per share* 23.9 4.1 (23.8) (4.2)

--------------------------------------- --------- -------- --------- --------

Underlying earnings per share figures

Basic underlying earnings per share 26.9 4.7 23.8 4.2

Diluted underlying earnings per

share 26.9 4.6 23.8 4.1

--------------------------------------- --------- -------- --------- --------

* The 2015 diluted loss per share is the same as the basic loss

per share, as the inclusion of the dilutive potential ordinary

shares would reduce the loss per share and as such is not dilutive

in accordance with IAS 33 'Earnings per Share'.

2 April 4 April

2016 2015

m m

------------------------------------------- -------- --------

Basic weighted average number of shares 574.4 572.0

Dilutive options 5.7 6.4

------------------------------------------- -------- --------

Diluted weighted average number of shares 580.1 578.4

------------------------------------------- -------- --------

7 PROPERTY, PLANT AND EQUIPMENT

GBPm

----------------------------------------------------- --------

Net book amount at 4 October 2015 2,122.6

Additions 71.9

Net transfers to assets held for sale and disposals (22.4)

Depreciation, revaluation and other movements (17.9)

----------------------------------------------------- --------

Net book amount at 2 April 2016 2,154.2

----------------------------------------------------- --------

GBPm

----------------------------------------------------- --------

Net book amount at 5 October 2014 1,990.0

Additions 71.4

Net transfers to assets held for sale and disposals (18.9)

Depreciation, revaluation and other movements 41.0

----------------------------------------------------- --------

Net book amount at 4 April 2015 2,083.5

----------------------------------------------------- --------

Revaluation/impairment

During the prior period independent chartered surveyors revalued

the Group's freehold and leasehold properties on an open market

value basis. These valuations were incorporated in the financial

statements and the resulting revaluation adjustments were

recognised in the revaluation reserve or income statement as

appropriate.

During the current period various properties were reviewed for

impairment and/or material changes in value.

The impact of the revaluations/impairments described above is as

follows:

2 April 4 April

2016 2015

GBPm GBPm

------------------------------------------------ -------- --------

Income statement:

Revaluation loss charged as an impairment - (60.1)

Reversal of past impairment - 26.3

------------------------------------------------ -------- --------

- (33.8)

Revaluation reserve:

Unrealised revaluation surplus 1.3 213.0

Reversal of past revaluation surplus - (120.6)

------------------------------------------------ -------- --------

1.3 92.4

------------------------------------------------ -------- --------

Net increase in shareholders' equity/property,

plant and equipment 1.3 58.6

------------------------------------------------ -------- --------

8 NET DEBT

Non-cash

movements

and

deferred

2 April Cash issue 3 October

2016 flow costs 2015

Analysis of net debt GBPm GBPm GBPm GBPm

-------------------------------- ---------- ------- ----------- ------------

Cash and cash equivalents

Cash at bank and in hand 231.9 38.8 - 193.1

Bank overdrafts (6.4) 2.3 - (8.7)

225.5 41.1 - 184.4

-------------------------------- ---------- ------- ----------- ------------

Debt due within one year

Unsecured bank borrowings (59.1) (30.0) (30.0) 0.9

Securitised debt (27.0) 13.1 (13.9) (26.2)

Finance leases (0.1) - - (0.1)

Other lease related borrowings 0.1 - - 0.1

Other borrowings (120.0) - - (120.0)

(206.1) (16.9) (43.9) (145.3)

-------------------------------- ---------- ------- ----------- ------------

Debt due after one year

Unsecured bank borrowings (248.7) (30.0) 29.5 (248.2)

Securitised debt (820.0) - 13.6 (833.6)

Finance leases (20.6) - - (20.6)

Other lease related borrowings (202.5) (22.1) 1.2 (181.6)

Preference shares (0.1) - - (0.1)

(1,291.9) (52.1) 44.3 (1,284.1)

-------------------------------- ---------- ------- ----------- ------------

Net debt (1,272.5) (27.9) 0.4 (1,245.0)

--------------------------------- ---------- ------- ----------- ------------

Other lease related borrowings represent amounts due under sale

and leaseback arrangements that do not fall within the scope of IAS

17 'Leases'.

Other borrowings represent amounts drawn down under the

securitisation's liquidity facility. During the period ended 4

October 2014 the facility's provider, the Royal Bank of Scotland

Group plc, had its short-term credit rating downgraded below the

minimum prescribed in the facility agreement and as such the Group

exercised its entitlement to draw the full amount of the facility

and hold it in a designated bank account. The corresponding balance

of GBP120.0 million (at 3 October 2015: GBP120.0 million) held in

this bank account is included within cash and cash equivalents. The

amounts drawn down can only be used for the purpose of meeting the

securitisation's debt service obligations should there ever be

insufficient funds available from operations to meet such payments.

As such these amounts are considered to be restricted cash.

Included within cash and cash equivalents is an amount of GBP1.0

million (at 3 October 2015: GBP1.6 million), which relates to a

letter of credit with Royal Sun Alliance Insurance, an amount of

GBP1.4 million (at 3 October 2015: GBP1.0 million), which relates

to a letter of credit with Aviva, and an amount of GBP7.9 million

(at 3 October 2015: GBP7.8 million), which relates to collateral

held in the form of cash deposits. These amounts are also

considered to be restricted cash.

In addition, any other cash held in connection with the

securitised business is governed by certain restrictions under the

covenants associated with the securitisation.

2 April 4 April

2016 2015

Reconciliation of net cash flow to movement

in net debt GBPm GBPm

---------------------------------------------- ---------- ----------

Increase in cash and cash equivalents in the

period 41.1 8.7

Cash inflow from movement in debt (69.0) (57.6)

---------------------------------------------- ---------- ----------

Change in debt resulting from cash flows (27.9) (48.9)

Non-cash movements and deferred issue costs 0.4 2.2

---------------------------------------------- ---------- ----------

Movement in net debt in the period (27.5) (46.7)

Net debt at beginning of the period (1,245.0) (1,198.2)

---------------------------------------------- ---------- ----------

Net debt at end of the period (1,272.5) (1,244.9)

---------------------------------------------- ---------- ----------

2 April 4 April

2016 2015

Reconciliation of net debt before lease financing

to net debt GBPm GBPm

--------------------------------------------------- ---------- ----------

Cash and cash equivalents 231.9 189.1

Unsecured bank borrowings (including bank

overdrafts) (314.2) (239.2)

Securitised debt (847.0) (872.5)

Other borrowings (120.0) (120.0)

Preference shares (0.1) (0.1)

--------------------------------------------------- ---------- ----------

Net debt before lease financing (1,049.4) (1,042.7)

Finance leases (20.7) (20.8)

Other lease related borrowings (202.4) (181.4)

--------------------------------------------------- ---------- ----------

Net debt (1,272.5) (1,244.9)

--------------------------------------------------- ---------- ----------

9 FINANCIAL INSTRUMENTS

The only financial instruments which the Group holds at fair

value are derivative financial instruments, which are classified as

at fair value through profit or loss or derivatives used for

hedging.

Fair value hierarchy

IFRS 13 'Fair Value Measurement' requires fair value

measurements to be recognised using a fair value hierarchy that

reflects the significance of the inputs used in the measurements,

according to the following levels:

Level 1 - unadjusted quoted prices in active markets for

identical assets or liabilities.

Level 2 - inputs other than quoted prices included within Level

1 that are observable for the asset or liability, either directly

or indirectly.

Level 3 - inputs for the asset or liability that are not based

on observable market data.

The table below shows the level in the fair value hierarchy

within which fair value measurements have been categorised:

2 April 2016 3 October 2015

Level Level Level Level Level Level

1 2 3 Total 1 2 3 Total

Liabilities as per

the balance sheet GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- ------- ------ ------ ------ ------ ------ ------ ------

Derivative financial

instruments - 216.2 - 216.2 - 192.7 - 192.7

---------------------- ------- ------ ------ ------ ------ ------ ------ ------

There were no transfers between Levels 1, 2 and 3 fair value

measurements during the current or prior period.

The Level 2 fair values of derivative financial instruments have

been obtained using a market approach and reflect the estimated

amount the Group would expect to pay on termination of the

instruments. The Group obtains such valuations from counterparties

who use a variety of assumptions based on market conditions

existing at each balance sheet date.

The fair values of all non-derivative financial instruments are

equal to their book values, with the exception of borrowings. The

carrying amount less impairment provision of trade receivables,

other receivables and trade loans, and the carrying amount of trade

payables and other payables, are assumed to approximate their fair

values. The carrying amount (excluding unamortised issue costs) and

the fair value of the Group's borrowings are as follows:

Carrying amount Fair value

2 April 3 October 2 April 3 October

2016 2015 2016 2015

GBPm GBPm GBPm GBPm

-------------------------------- -------- ---------- -------- ----------

Unsecured bank borrowings 316.4 258.7 316.4 258.7

Securitised debt 853.1 866.2 853.1 892.2

Finance leases 20.7 20.7 20.7 20.7

Other lease related borrowings 217.2 195.1 217.2 195.1

Other borrowings 120.0 120.0 120.0 120.0

Preference shares 0.1 0.1 0.1 0.1

1,527.5 1,460.8 1,527.5 1,486.8

-------------------------------- -------- ---------- -------- ----------

10 MATERIAL TRANSACTIONS

Additional contributions of GBP4.5 million (26 weeks ended 4

April 2015: GBP6.6 million) were made in the period to the

Marston's PLC Pension and Life Assurance Scheme.

There were no significant related party transactions during the

period (26 weeks ended 4 April 2015: none).

11 CAPITAL COMMITMENTS

Capital expenditure authorised and committed at the period end

but not provided for in this interim financial information was

GBP11.6 million

(at 3 October 2015: GBP11.4 million).

12 CONTINGENT LIABILITIES

There have been no material changes to contingent liabilities

since 3 October 2015.

13 SEASONALITY OF INTERIM OPERATIONS

The Group's financial results and cash flows have, historically,

been subject to seasonal trends between the first and second half

of the financial year. Traditionally, the second half of the

financial year sees higher revenue and profitability, as a result

of better weather conditions.

There is no assurance that this trend will continue in the

future.

14 EVENTS AFTER THE BALANCE SHEET DATE

An interim dividend of GBP14.9 million, being 2.6p (2015: 2.5p)

per ordinary share, has been proposed and will be paid on 5 July

2016 to those shareholders on the register at the close of business

on 27 May 2016. This interim financial information does not reflect

this dividend payable.

15 PRINCIPAL RISKS AND UNCERTAINTIES

The Group set out on pages 22 and 23 of its 2015 Annual Report

and Accounts the principal risks and uncertainties that could

impact its performance. These remain unchanged since the Annual

Report and Accounts was published and are expected to remain

unchanged for the second half of the financial year. These risks

and uncertainties are summarised as follows:

-- Economic uncertainty

-- Changes in regulation impacting upon the cost of business or

obstructing growth

-- Investment plans not meeting expectations

-- Network outage or denial of service

-- Loss, theft or corruption of data

-- Failure to attract or retain the best people

-- Incorrect reporting of financial results

-- Unauthorised transactions

-- Breach of financial covenants with lenders

16 INTERIM RESULTS

The interim results were approved by the Board on 18 May

2016.

17 COPIES

Copies of these results are available on the Marston's PLC

website (www.marstons.co.uk) and on request from the Group

Secretary, Marston's PLC, Marston's House, Brewery Road,

Wolverhampton, WV1 4JT.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGUWWAUPQGQM

(END) Dow Jones Newswires

May 18, 2016 02:00 ET (06:00 GMT)

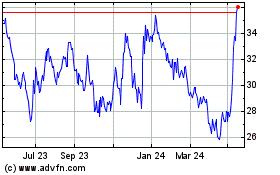

Marston's (LSE:MARS)

Historical Stock Chart

From Oct 2024 to Nov 2024

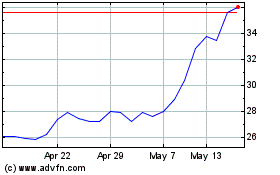

Marston's (LSE:MARS)

Historical Stock Chart

From Nov 2023 to Nov 2024