TIDMLOOP

RNS Number : 9000X

LoopUp Group PLC

01 September 2022

1 September 2022

LOOPUP GROUP PLC

("LoopUp" or the "Group")

Material Contract Win; Business and Trading Update

LoopUp Group plc (AIM: LOOP), the cloud platform for premium

hybrid communications, is pleased to announce a new material

contract win for the Group, and provide both a strategic business

update for Cloud Telephony, its primary growth line of business,

and a trading update for the six months ended 30 June 2022.

Highlights

-- Meetings: New material contract win expected to generate

c.GBP10 million of revenue and c.GBP5 million of net cash

in the 12 months from October 2022 to September 2023

-- Cloud Telephony: 133% increase in customer wins and 252%

increase in individual contract wins during the second

year post service launch

New material contract win

The Group has entered into a revenue sharing and customer

transfer agreement with American Teleconferencing Services, Ltd.

and Audio Telecommunications Technology II LLC (together "PGi

Connect"), a provider of conferencing services. Under the

agreement, LoopUp has the rights (but not the obligation) to

transfer materially all of PGi Connect's conferencing services

customers (but not its webcasting customers) over to LoopUp.

There is no initial or fixed consideration payable to PGi

Connect for the transfer of its customers to LoopUp. Instead, the

Group has agreed to pay PGi Connect a share of revenue invoiced and

received from successfully transferred customers for a period of

three years.

This is a highly material contract for the Group in terms of its

expected cash generation. After making prudent assumptions for the

expected timing of customer transfers, customer losses due to the

transfer, and general ongoing business attrition, the Group

nevertheless expects this contract:

-- to increase LoopUp's revenues materially from October

2022 onwards, with revenue run rate ramping up thereafter

through to the FY2022 year-end; and

-- in the twelve months from October 2022 to September 2023,

to generate revenue of approximately GBP10 million, at

a gross margin of approximately 60% after both LoopUp's

cost of goods sold and payment of PGi Connect's revenue

share(1) , and provide net cash contribution to the Group

of approximately GBP5 million over the period after other

associated cash costs.

It is not possible to quantify the historical profit from

customers that will ultimately transfer given that inter alia: (i)

the agreement gives LoopUp the option but not the obligation to

transfer customers; (ii) there will be churn of PGi Connect

customers prior to transfer; and (iii) some customers are expected

to be lost during the transfer.

The Group emphasises that while this contract is clearly

material and highly cash generative, it does not alter the Group's

strategic transition towards hybrid communications solutions,

namely Cloud Telephony and Hybridium, and to the contrary, provides

the Group with valuable investment capacity into these long-term

growth lines of business.

Steve Flavell and Michael Hughes, co-CEOs of LoopUp,

commented:

"This is clearly a very significant transaction for the Group as

we continue to manage our business through its strategic transition

to premium hybrid communications. In addition to the material

expected cash generation, it will also bring telecommunications

purchasing scale that will benefit our growing Cloud Telephony

business. PGi Connect has a long history of leadership in the

conferencing services industry and we are excited to bring LoopUp

Meetings to their customers. We thank the PGi Connect team for

working so productively with us to conclude the agreement, and we

look forward to continuing to do so during the customer transition

project ahead."

Michele Dobnikar, President of PGi Connect, commented:

"We are pleased to announce this transaction with LoopUp, who is

one of very few operators capable of taking on and looking after

such a sizable and global customer book to the exacting standards

expected by our customers. We look forward to continuing to work

with the LoopUp team for a smooth and timely transition of the

business."

Cloud Telephony strategic business update

In Q3 2020, the Group launched its Cloud Telephony solution,

which has since developed into its primary growth line of business

for the long-term future of the Group. The Cloud Telephony market

is forecast to grow to GBP29 billion by 2025(2) , and the Group's

aspiration is to become one of a small number of winners in the

multinational mid-market and enterprise segment, providing

customers with single-vendor service provision globally rather than

the status quo of multiple telecommunications carriers in specific

countries and regions.

Since launch, the Group has secured 60 customer wins, comprising

131 individual contracts, and has done so at an accelerating win

rate:

-- 133% increase in customer wins, with 42 won during the

second year post service launch ending August 2022 (18

during the first year post service launch ending August

2021); and

-- 252% increase in individual contract wins, with 102 won

during the second year post service launch ending August

2022 (29 during the first year post service launch ending

August 2021). The greater acceleration in contract wins

versus customer wins reflects the 'layering effect' from

progressive geographic customer rollouts - i.e. approximately

one third of the contract wins in the second year post

launch were from customers won in the first year post

launch.

In aggregate, these 60 customer wins represent:

-- Minimum Annual Recurring Revenue (ARR) of GBP1.2 million

and minimum Total Contract Value (TCV) of GBP4.3 million,

based on minimum contracted levels;

-- Expected ARR of c.GBP2.4 million and expected TCV of c.GBP7.8

million, based on expected rollout levels, where LoopUp

has relatively strong visibility of customer intent based

on conversations, planning and pricing; and

-- Potential ARR of c.GBP5.2 million and potential TCV of

c.GBP16.1 million, based on identified potential rollout

levels but where LoopUp currently has less clear visibility

of customer intent.

Operationally, all customer deployments to date have been

successful, and all rollouts are progressing positively.

In addition to these 60 customer wins, the Group's sales

pipeline of potential new Cloud Telephony opportunities continues

to grow and now stands at more than GBP100 million of additional

potential ARR, of which approximately 15% is at written proposal

stage or later.

The Group is achieving this strong and accelerating commercial

traction in Cloud Telephony due to its differentiated offer for

multinational mid-market and enterprise customers versus

competition from telecommunications carriers and UC platform

calling plans. Specifically, this includes the Group's:

-- licensed and regulated geographic coverage;

-- highest quality and resilient audio routing across 19

tier-1 carrier partners;

-- customer connectivity options - UC-integrated / SIP /

hybrid - for future-proofed customer decision-making at

varied stages of the Cloud Telephony journey;

-- Microsoft 'Advanced Specialization' expertise (level above

gold) in Teams telephony for design, configuration and

implementation customer support;

-- Global Management Portal for consistent service visibility

and administration, globally; and

-- PerfectBundle pricing for spend commitment pooling across

global billing entities.

H1 2022 trading update and outlook

The Group expects revenues of approximately GBP6.6 million for

the six month period ended 30 June 2022, at a gross margin of

approximately 67%, and an EBITDA loss of approximately GBP1.5

million. Net debt was approximately GBP8.0 million at 30 June 2022,

prior to the receipt of an R&D tax credit of c.GBP1.9 million

that the Group expects to receive within the next 60 days.

Given the material contract announced today with PGi Connect,

combined with the development of ARR from Cloud Telephony, the

Group now expects:

-- FY2022 revenue to be marginally above market expectations,

at marginally lower profitability after some additional

required investment associated with the PGi Connect customer

transfer project; and

-- FY2023 revenue to be materially above market expectations

at materially higher profitability.

The Group will announce its unaudited interim results for the

period ended 30 June 2022 by the end of September 2022.

Market abuse regulation:

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act

2018.

(1) Expected to be approximately 13% on a weighted average basis

across different product categories

(2) Source: Gartner, 2022

For further information, please contact:

LoopUp Group plc via FTI

Steve Flavell, co-CEO

+44 (0) 20 7886

Panmure Gordon (UK) Limited 2500

Dominic Morley / Alina Vaskina (Corporate

Finance)

Erik Anderson (Corporate Broking)

+44 (0) 20 7397

Cenkos Securities Limited 8900

Giles Balleny / Dan Hodkinson (Corporate Finance)

Alex Pollen (Sales)

+44 (0) 20 3727

FTI Consulting, LLP 1000

Matt Dixon / Jamille Smith / Tom Blundell

About LoopUp Group plc

LoopUp (LSE AIM: LOOP) is a cloud platform for premium hybrid

communications. The Group's flagship Cloud Telephony solution for

Microsoft Teams enables multinational enterprises to consolidate

their global telecommunications into a single, consistently managed

cloud implementation rather than disparate implementations from

multiple carriers. The Group's hybrid auditorium and events

solution, Hybridium (www.hybridium.com), brings unrivaled

engagement and analytics to larger scale hybrid education, training

and events such as management onsites, departmental kick-offs,

capital markets days and thought leadership seminars.

The Group is listed on the AIM market of the London Stock

Exchange (LOOP) and is headquartered in London, with offices in the

US, Spain, Germany, Hong Kong, Barbados and Australia.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGUGDCIDGDGDB

(END) Dow Jones Newswires

September 01, 2022 02:02 ET (06:02 GMT)

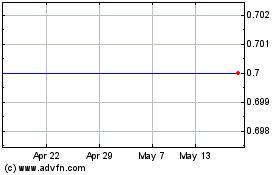

Loopup (LSE:LOOP)

Historical Stock Chart

From Jun 2024 to Jul 2024

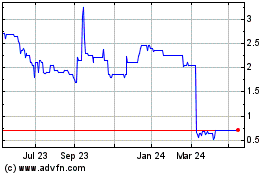

Loopup (LSE:LOOP)

Historical Stock Chart

From Jul 2023 to Jul 2024