TIDMLFI

London Finance & Investment Group P.L.C.

(the 'Company')

Unaudited Interim Results for the six months ended 31st December 2017 and

dividend declaration

The Company today announces its unaudited interim results and dividend

declaration for the six months ended 31st December 2017 (the 'Interim

Statement').

Chairman's Statement

Introduction

As an investment company our target is to achieve growth in shareholder value

in real terms over the medium to long term. In the short term our results can

be influenced by overall stock market performance, particularly the valuation

of our Strategic Investments. We continue to believe that a combination of

Strategic Investments and a General Portfolio is the most effective way of

achieving our aims. Strategic Investments are significant investments in

smaller UK quoted companies where we have expectations of above average growth

over the medium to longer term and these are balanced by a General Portfolio

which consists of investments in major U.S., U.K. and European equities.

At 31st December 2017, we held two Strategic Investments: Western Selection

P.L.C., and Finsbury Food Group plc. Detailed comments on our Strategic

Investments are given below.

Change in accounting policies

The Board has adopted IFRS 9, and the comparatives in the income statement have

been restated to reflect the resulting change in accounting policy. Strategic

investments are a fundamental part of the Company's investment strategy to

secure long term capital appreciation and by their very nature the investments

are largely illiquid. Consequently, the directors have elected to present the

unrealised changes in value of these specific investments as part of other

comprehensive income as it better reflects the underlying performance of the

Company within its primary statements. This does not change the basis of

valuation or the amounts reported in the statement of financial position. The

effect of the change in accounting policy is further described in Note 1 below.

Results

Our net assets per share increased 1.8% to 66.8p at 31st December 2017 from

65.6p at 30th June 2017. Our Strategic Investments decreased in value by 0.8%

during the period. Our General Portfolio increased by 4.9%, compared with

increases of 5.1% and 2.5% in the FTSE 100 index and the FTSEurofirst 300 Index

respectively, over the half year. At the close of business on 31st January

2018, our net asset value was 67.1p per share.

The Group profit before tax for the half year was GBP615,000 compared to a

restated profit of GBP426,000 for the same period last year. Our total

comprehensive income after tax and minority interest was GBP524,000 (2016: GBP

1,247,000 restated) giving earnings per share of 1.8p (2016: 0.2p restated).

On 4th October 2017, the Company entered into an interest rate swap agreement

with Coutts & Co, expiring on 30th September 2022, in the sum of GBP1,500,000 at

a fixed rate of 1.06% per annum over base rate and margin, with a view to

providing insurance against rising interest rates.

Strategic Investments

Western Selection P.L.C. ("Western")

The Group owns 7,860,515 Western shares, representing 43.8% of Western's issued

share capital. Western is a strategic investment which is technically a

subsidiary of the Company that has not been consolidated due to the application

of the investment entity exemption under IFRS 10.

On 5th February 2018, Western announced a profit before tax of GBP170,000 for its

half year to 31st December 2017 and earnings per share of 0.91p (2016: earnings

per share of 2.5p). Western's net assets at market value were GBP17,115,000

equivalent to 95p per share. Western also announced an interim dividend of 1.1p

per share (2016: 1.1p per share).

The market value of the Company's investment in Western at 31st December 2017

was GBP4,166,000 representing 20% of the net assets of Lonfin. The underlying

value of the investment in Western, valuing Western's own investments at market

value, was GBP5,266,000 (30th June 2017: GBP5,348,000).

I am the Chairman of Western and Edward Beale is a non-executive director.

Michael Robotham was a non-executive director of Western until his resignation

on 5th December 2017.

Western's main Core Holdings are Northbridge Industrial Services Plc,

Swallowfield Plc, Bilby Plc and Tudor Rose International Limited.

An extract from Western's interim results announcement relating to its main

Core Holdings is set out below:

Core Holdings

Northbridge Industrial Service plc ("Northbridge")

Northbridge hires and sells specialist industrial equipment to a non-cyclical

customer base. With offices or agents in the UK, USA, Dubai, Germany, Belgium,

France, Australia, New Zealand, Singapore, Brazil, Korea and Azerbaijan,

Northbridge has a global customer base. This includes utility companies, the

oil and gas sector, shipping, construction and the public sector. The product

range includes loadbanks, transformers and oil tools. Further information

about Northbridge is available on its website: www.northbridgegroup.co.uk

Northbridge's latest results, for the half year to 30th June 2017, showed a

loss after tax of GBP2,308,000 for the period (2016: loss after tax of GBP

2,338,000). No interim dividend was declared (2016: none).

Western owns 3,223,632 Northbridge shares, representing 12.45% of Northbridge's

issued share capital. The market value of this investment at 31st December

2017 was GBP2,966,000 (30th June 2017: GBP3,320,000), representing 17% (2016: 24%)

of Western's net assets.

I am a non-executive director of Northbridge.

Swallowfield plc ("Swallowfield")

Swallowfield is a market leader in the development, formulation, manufacture

and supply of cosmetics, toiletries and related household products for global

brands and retailers operating in the cosmetics, personal care and household

goods market. Further information about Swallowfield is available on its

website: www.swallowfield.com

Swallowfield announced its annual results for the 52 weeks ended 24th June 2017

in September 2017 showing a profit after tax of GBP2,572,000 compared to a profit

of GBP2,001,000 for the comparable period last year. Swallowfield paid a final

dividend of 3.5p per share in December 2017 which provided us with income of GBP

52,500.

The market value of the Company's holding of shares in Swallowfield on 31st

December 2017 was GBP4,950,000 (30th June 2017: GBP5,700,000), representing 29% of

the Company's net assets.

Western owns 1,500,000 Swallowfield shares (representing 8.90% of

Swallowfield's issued share capital).

Edward Beale is a non-executive director of Swallowfield.

Bilby Plc ("Bilby")

Bilby is an established, and award winning, provider of gas installation,

maintenance and general building services to local authority and housing

associations across London and South East England. It has a strategy of

growing organically and by acquisition. Further information about Bilby is

available on its website: www.bilbyplc.com.

Bilby announced its interim results for the six month period to 30th September

2017 on 21st

November 2017 showing a loss after tax of GBP1,966,000 (2016: loss after tax of GBP

833,000). Bilby will pay an interim dividend of 0.5p per share in January 2018

which will provide us with income of GBP13,500.

Western owns 2,699,280 Bilby shares, which represent 6.8% of Bilby's issued

share capital. The market value of the Company's holding in Bilby on 31st

December 2017 was GBP3,051,000 representing 18% of the Company's net assets.

Tudor Rose International Limited (previously Hartim Limited) ("Tudor Rose

International")

Tudor Rose International works closely with a number of leading UK branded

fast-moving consumer goods companies, offering a complete sales, marketing and

logistical service. Based in Stroud, Gloucestershire, Tudor Rose International

sells into 78 countries worldwide including USA, Spain, Portugal, Italy, Czech

Republic, Russia, Turkey, South Africa, Saudi Arabia, UAE, Malaysia, Australia

and China.

Our share of Tudor Rose International's estimated results for the period ended

31st December 2017 is a profit after tax of GBP81,000 (2016: profit after tax of

GBP57,000).

At 31st December 2017, Western owned 49.5% of Tudor Rose International. The

carrying value of the Company's equity investment in Tudor Rose International

on 31st December 2017 was GBP1,674,000 (2016: GBP654,000) representing 9.8% of the

Company's net assets. In addition, loans of GBP191,756 (equivalent to a further

1% of the Company's net assets) were outstanding at 31st December 2017 from

Tudor Rose International's executive directors.

Western has two nominees on the board of Tudor Rose International: Edward Beale

and I are the directors.

Finsbury Food Group plc ("Finsbury")

Finsbury is one of the largest producers and suppliers of premium cakes, bread

and morning goods in the UK and currently supplies most of the UK's major

supermarket chains. Further information about Finsbury, which is admitted to

trading on AIM, is available on its website: www.finsburyfoods.co.uk

At 31st December 2017, Lonfin held 6,000,000 Finsbury shares, representing

approximately 4.6% of Finsbury's issued share capital. The market value of the

holding was GBP6,420,000 as at 31st December 2017 (cost - GBP1,724,000) and

represents approximately 31% (2016: 34%) of Lonfin's net assets.

On 18th September 2017, Finsbury announced audited profits on continuing

operations after tax and minority interests of GBP12,958,000 for the 52 weeks

ended 1st July 2017 (2016: GBP12,754,000).

Finsbury paid a final dividend of 2.0 per share, making 3.0p for the year

(2016: 2.8p). This provided the Company with further income of GBP120,000.

General Portfolio

The portfolio is diverse with material interests in Food and Beverages, Natural

Resources, Chemicals and Tobacco. We believe that the portfolio of quality

companies we hold has the potential to outperform the market in the medium to

long term.

At 31st December 2017, the number of holdings in the General Portfolio was 30

(2016: 26).

Board Change

On 31st January 2018, the Company announced the appointment of Warwick Marshall

to the Board. His substantial business experience in the development of the

Monteagle Group in South Africa and particularly its trading division will

assist the Board in the assessment of the performance of investments and will

complement the skills and experience of existing board members. He has

extensive investment experience in his private capacity and he now resides in

Zug, Switzerland.

Outlook

Although markets have shown resilience and strength over the course of the last

year, they are close to an all-time high. The Board remains cautious about the

potential impact of major geo-political risks. Accordingly, the Board expects

to see continued volatility in the equity and currency markets. These may have

a material impact on the value of our investments.

The Board has declared an interim dividend of 0.55p per share (2016: 0.55p).

6th February 2018

D.C. MARSHALL

Chairman

Interim Dividend

The Board recommends an interim gross dividend of 0.55p per share (9.36442 SA

cents) (2016: 0.55p) which will be paid on Friday 6th April 2018 to those

members registered at the close of business on Friday 16th March 2018 (SA and

UK). Shareholders on the South African register will receive their dividend in

SA Rand converted from sterling at the closing rate of exchange on Thursday 1st

February 2018 being GBP 1 = SA Rand 17.02622.

In respect of the normal gross cash dividend, and in terms of the South African

Tax Act, the following dividend tax ruling only applies to those shareholders

who are registered on the South African register on Friday 16th March 2018.

All other shareholders are exempt.

Shareholders registered on the South African register are advised that the

dividend withholding tax will be withheld from the gross final dividend amount

of 9.36442 SA cents per share at a rate of 20% unless a shareholder qualifies

for an exemption; shareholders registered on the South African register who do

not qualify for an exemption will therefore receive a net dividend of 7.49154

SA cents per share. The dividend withholding tax and the information contained

in this paragraph is only of direct application to shareholders registered on

the South African register, who should direct any questions about the

application of the dividend withholding tax to Computershare Investor Services

(Pty) Limited, Tel: +27 11 370 5000

* The number of shares in issue now and as at the dividend declaration date

is 31,207,479;

* The interim gross dividend in SA cents is 9.36442 cents.

* The dividend has been declared from income reserves, which funds are

sourced from the Company's main bank account in London and is regarded as a

foreign dividend by South African shareholders; and

* The Company's UK Income Tax reference number is 948/L32120.

Dividend dates:

Last day to trade (SA) Tuesday 13th March 2018

Shares trade ex-dividend (SA) Wednesday 14h March 2018

Shares trade ex-dividend (UK) Thursday 15th March 2018

Record date (SA and UK) Friday 16th March 2018

Pay date Friday 6th April 2018

Share certificates may not be de-materialised or re-materialised between

Wednesday 14th March 2018 and Friday 16th March 2018, both dates inclusive.

Shares may not be transferred between registers in London and South Africa

between Wednesday 14th March 2018 and Friday 16th March 2018, both dates

inclusive.

Statement of Directors' responsibility

The Directors confirm that, to the best of their knowledge:

- the unaudited interim results for the six months ended 31st December 2017,

have been prepared in accordance with IAS 34 as adopted by the EU; and

- the Interim Statement includes a fair review of the information required by

DTR 4.2.7R and DTR 4.2.8R of the Disclosure and Transparency Rules.

Neither this Interim Statement nor any future interim statements of the Company

will be posted to shareholders. The Interim Statement is available as follows:

* on the Company's website at www.city-group.com/

london-finance-investment-group-plc/; and

* by writing to City Group P.L.C., the Company Secretary, at 6 Middle Street,

London EC1A 7JA

This Interim Statement contains inside information for the purposes of Article

7 of EU Regulation 596/2014.

The Directors accept responsibility for the contents of this Interim Statement.

For further information, please contact:

London Finance & Investment Group P.L.C +44(0) 20 7796 9060

Sponsor:

Sasfin Capital (a member of the Sasfin group).

Consolidated Statement of Total Comprehensive Income (Unaudited)

Half year ended Year Ended

31st December 30th June

Restated Restated

2017 2016 2017

GBP000 GBP000 GBP000

Operating Income

Dividends received 311 265 608

Rental and other income 50 50 109

Profit on sales of investments, including 26 3 3

provisions

387 318 720

Management service fees 118 130 296

505 448 1,016

Administrative expenses

Investment operations (229) (190) (352)

Management services (162) (168) (389)

Total administrative expenses (391) (358) (741)

Operating profit 114 90 275

Unrealised changes in the carrying value of 501 335 989

General Portfolio investments

Interest payable (1) - (33)

Profit before taxation 615 425 1,231

Tax expense (49) (350) (121)

Profit after taxation 566 75 1,110

Non-controlling interest (3) (6) (7)

Profit attributable to shareholders 563 69 1,103

Other comprehensive income/(expense) -

Items that may subsequently be reclassified to

profit or loss

Unrealised changes in the carrying value of (87) 819 477

Strategic Investments

Profit on sale of strategic investments - 217 217

Deferred tax 48 142 99

Corporation tax - - (238)

Total other comprehensive income (39) 1,178 555

Total comprehensive income attributable to 524 1,247 1,658

shareholders

Basic and Diluted earnings per share 1.8p 0.2p 3.5p

Adjustment for the unrealised changes in the (1.5)p (1.1)p (2.5)p

carrying value of investments, net of tax

Headline earnings per share 0.3p (0.9)p 1.0p

Interim dividend 0.55p 0.55p 0.50p

Final dividend - - 0.55p

Total in respect of the period 0.55p 0.55p 1.05p

Consolidated Statement of Changes in Shareholders' Equity (Unaudited)

Half year ended Year ended

31st December 30th June

2017 2016 2017

GBP000 GBP000 GBP000

Total comprehensive income attributable to 531 1,247 1,658

shareholders

Dividends paid to equity shareholders (172) (171) (343)

359 1,076 1,315

Equity shareholders' funds at start of period 20,483 19,168 19,168

Equity shareholders' funds at end of period 20,842 20,244 20,483

Consolidated Statement of Financial Position (Unaudited)

31st December 30th June

2017 2016 2017

GBP000 GBP000 GBP000

Non-current assets

Property, plant and equipment 15 18 14

Strategic investments: -

Finsbury Food Group Plc 6,420 7,320 6,900

Western Selection P.L.C. 4,166 3,694 3,773

10,601 11,032 10,687

Current assets

Listed investments 11,295 8,836 10,766

Trade and other receivables 63 178 220

Cash, at bank 277 1,588 222

11,635 10,602 11,208

Total Assets 22,236 21,634 21,895

Capital and Reserves

Called up share capital 1,560 1,560 1,560

Share premium account 2,320 2,320 2,320

Unrealised profits and losses on investments 8,514 7,967 8,265

Share of retained profits and losses of 4,007 3,647 3,794

subsidiaries

Company's retained realised profits and losses 4,441 4,750 4,544

Total Capital and Reserves attributable to 20,842 20,244 20,483

owners

Trade and other payables falling due within 483 479 486

one year

Deferred taxation 818 815 829

Non-controlling equity interest 93 96 97

22,236 21,634 21,895

Net assets per share 66.8p 64.9p 65.9p

Number of shares in issue 31,207,479 31,207,479 31,207,479

Consolidated Statement of Cash Flows (Unaudited)

Half year ended Year ended

31st December 30th June

Restated Restated

2017 2016 2017

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit before tax 615 425 1,231

Adjustments for non-cash -

Finance expense 1 - 33

Depreciation charges 4 4 8

Unrealised changes in the fair value of (501) (335) (989)

investments

Decrease/(Increase)in trade and other 157 97 52

receivables

(Decrease)/Increase in trade and other payables (3) (74) (66)

Overseas Taxes paid (11) (7) (45)

Net cash inflow from operating activities 262 110 224

Cash flows from investment activity

(Increase)/Decrease in current asset (727) (1,376) (2,652)

investments

Disposal of investment 698 2,438 2,438

Purchase of IT software (5) - -

Net cash inflow/(outflow) from investment (34) 1,062 (214)

activity

Cash flows from financing

Interest paid (1) - (33)

Equity dividends paid (172) (172) (343)

Net cash outflow from financing (173) (172) (376)

(Decrease)/Increase in cash and cash 55 1,000 (366)

equivalents

Cash and cash equivalents at the beginning of 222 588 588

the year

Cash and cash equivalents at end of the year 277 1,588 222

Reconciliation of net cash flow to movement in net debt

At start Cash At end of

of Period Flow Period

Half year ended GBP000 GBP000 GBP000

31st December 2017

Cash and cash equivalents 222 205 427

Bank overdraft 0 (150) (150)

Net cash and cash equivalents 222 55 277

31st December 2016

Cash and cash equivalents 588 1,000 1,588

Year ended 30th June 2017

Cash and cash equivalents 588 (366) 222

Notes: -

1. Basis of preparation:

The results for the half-year are unaudited. The information contained in

this report does not constitute statutory accounts within the meaning of

the Companies Act 2006. The statutory accounts of the Group for the year

ended 30th June 2017 have been reported on by the Company's auditors and

have been delivered to the Registrar of Companies. The report of the

auditors was unqualified.

The Company has adopted IFRS 9. Under IFRS 9, the Company has elected to

classify its long term Strategic Investments as financial instruments which

are held at fair value with unrealised changes in value taken directly to

Other Comprehensive Income. General Portfolio investments are held at fair

value with unrealised changes in fair value recognised in Profit or Loss.

Strategic and General Portfolio investments are quoted investments, and

their fair value continues to be calculated using quoted prices.

This report has been prepared in accordance with the accounting policies

contained in the Group's 2017 Annual Report and Accounts and International

Financial Reporting Standards, and complies with IAS 34.

2. Earnings per share:

Earnings per share are based on the profit on ordinary activities after

taxation and non-controlling interests of GBP563,000 (2016: GBP70,000) and on

31,207,479 (2016: 31,207,479) shares being the weighted average of number

of shares in issue during the year. There are options outstanding over

80,000 shares.

Reconciliation of headline earnings

Headline earnings are required to be disclosed by the JSE. Headline

earnings per share are based on the profit attributable to the shareholders

after tax and non-controlling interests, before unrealised changes in the

fair value of investments net of tax, of GBP11,000 (2016: GBP279,000 loss) and

on 31,207,479 (2016: 31,207,479) shares being the weighted average of

number of shares in issue during the year.

3. Going Concern:

After making enquiries, the Board is satisfied that the Group will be able

to operate within the level of its facilities for the foreseeable future.

For this reason, the Board considers it appropriate for the Group to adopt

the going concern basis in preparing its financial statements.

4. Principal risks and uncertainties:

The principal risks and uncertainties which could impact the Group's

long-term performance are disclosed on pages 9-10 of the Group's 2017

Annual Report and Accounts, The key risks and mitigating activities have

not changed from these:

- Stock market vulnerability and economic uncertainty including

Brexit;

- Possible volatility of share prices of investments;

- Dividend income;

- Ability to make strategic investments; and

- Liquidity of equity investments in strategic investments.

Composition of General Portfolio

Value

GBP000 %

Investor

624 5.5

British American Tobacco

492 4.4

Schindler Holding

484 4.3

Diageo

463 4.1

LVMH Moet Hennessy

436 3.9

HSBC Holdings

422 3.7

Brown Forman

417 3.7

Heineken Holding

417 3.7

Unilever

416 3.7

Pernod Ricard

405 3.6

Henkel

405 3.6

Antofagasta

402 3.6

Phillip Morris

398 3.5

Nestle

384 3.4

3M

383 3.4

Danone

373 3.3

Chevron

361 3.2

Givaudan

358 3.2

Royal Dutch Shell

357 3.2

L'Oreal

346 3.1

BASF

342 3.0

Reckitt Benckiser

339 3.0

United Technologies

321 2.8

Exxon Mobil

309 2.7

Anheuser Busch

308 2.7

Procter & Gamble

306 2.7

Kimberley Clark

303 2.7

Imperial Brands

281 2.3

Compagnie Financiere Richemont

222 2.0

Becton Dickinson

221 2.0

11,295 100

END

(END) Dow Jones Newswires

February 06, 2018 02:00 ET (07:00 GMT)

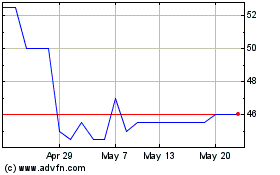

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Oct 2024 to Nov 2024

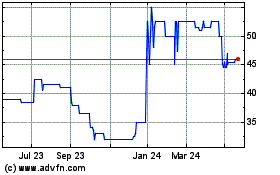

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Nov 2023 to Nov 2024