TIDMLFI

London Finance & Investment Group P.L.C.

Interim Results

Lonfin (LSE: LFI, JSE: LNF) today announces its unaudited interim results for

the six months ended 31st December 2014 and dividend declaration

Introduction

As an investment company our target is to achieve growth in shareholder value

in real terms over the medium to long term. In the short term our results can

be influenced by overall stock market performance, particularly the valuation

of our Strategic Investments. We continue to believe that a combination of

Strategic Investments and a General Portfolio is the most effective way of

achieving our aims. Strategic Investments are significant investments in

smaller UK quoted companies where we have expectations of above average growth

over the medium to longer term and these are balanced by a General Portfolio

which consists of investments in major U.S., U.K. and European equities.

At 31st December 2014, we held two Strategic Investments in which we have board

representation: our associated company Western Selection P.L.C. and Finsbury

Food Group plc. Detailed comments on our Strategic Investments are given below.

Results

Our net assets per share increased 6.9% to 47.8p at 31st December 2014 from

44.7p at 30th June 2014. Our Strategic Investments, adjusting for the

additional investment in Finsbury Foods, increased in value by 13.4% during the

period, reflecting a strong performance in both Western's and Finsbury Food's

share prices. Our General Portfolio increased by 1%, compared with decreases of

2.6% in the FTSE 100 index, and 0.2% in the FTSEurofirst 300 Index over the

half year. At the close of business on 26th February 2015, our net asset value

was 49.9p per share.

The Group profit before tax for the half year was GBP1,017,000 compared to a

profit of GBP385,000 for the same period last year, which reflects the unrealised

profit arising from the strong performances in the Strategic Investments. Our

profit after tax and minority interest was GBP810,000 (2013 - profit: GBP355,000)

giving profits per share of 2.6p (2013 - 1.1p).

Strategic Investments

Western Selection P.L.C. ("Western")

The Group owns 7,860,515 Western shares, representing 43.8% of Western's issued

share capital.

On 26th February 2014, Western announced a profit after tax of GBP336,000 for its

half year to 31st December 2014 and a profit per share of 1.2p (2013: profit

1.9p). Western's net assets at market value were GBP16,647,000 equivalent to 93p

per share, a decrease of 9% from 102p at 30th June 2014. Western has announced

an interim dividend of 1.05p per share (prior year: 0.95p).

The market value of the Company's investment in Western at 31st December 2014

was GBP4,559,000 representing 31% of the net assets of Lonfin. The underlying

value of the investment in Western, valuing Western's own investments at market

value, was GBP7.3 million (30th June 2014: GBP8.0 million).I am the Chairman of

Western and Mr. Robotham is a Non-Executive Director. Western's principal core

holdings are in Creston plc, Northbridge Industrial Services PLC, Swallowfield

plc and Hartim Limited. Extracts from Western's announcement on its core

holdings are set out below:

Creston plc ("Creston")

Creston is a marketing services group whose strategy is to grow within its

sector both by organic growth and through selective acquisition to become

a substantial, diversified marketing services group. Further information

about Creston is available on their website: www.creston.com.

Creston's results for the half-year to 30th September 2014 show a profit

after tax of GBP3,123,000 (2013: GBP1,148,000). Creston declared an interim

dividend of 1.35p per share, an increase of 13% on the prior year.

Western owns 3,000,000 shares in Creston (5.0%) with a market value at

31st December 2014 of GBP3,840,000 (30th June 2014: GBP3,150,000), being 23%

of Western's assets.

Northbridge Industrial Services plc ("Northbridge")

Northbridge hires and sells specialist industrial equipment to a

non-cyclical customer base. With offices or agents in the U.K., U.S.A.,

Dubai, Germany, Belgium, France, Australia, Singapore, India, Brazil,

Korea and Azerbaijan, Northbridge has a global customer base. This

includes utility companies, the oil and gas sector, shipping, construction

and the public sector. The product range includes loadbanks, transformers,

generators, compressors, loadcells and oil tools. Further information

about Northbridge is available on their website:

www.northbridgegroup.co.uk.

Northbridge's latest results, for the half year to 30th June 2014, showed

profit after tax of GBP2,568,000 (2013: GBP1,949,000). Northbridge declared an

interim dividend of 2.20p per share, an increase of 10% on the prior year.

Western owns 1,875,000 shares, representing 10% of Northbridge's share

capital. The market value of this investment at 31st December 2014 was GBP

7,406,000 (30th June 2014: GBP9,750,000), representing 44% of Western's

assets.

I am a Non-Executive Director of Northbridge.

Swallowfield plc ("Swallowfield")

Swallowfield is a market leader in the development, formulation,

manufacture and supply of cosmetics, toiletries and related household

products for global brands and retailers operating in the cosmetics,

personal care and household goods market. Further information about

Swallowfield is available on its website: www.swallowfield.com.

Swallowfield announced its annual results to 30th June 2014 on 18th

September 2014 showing a profit after tax of GBP157,000 compared to a loss

of GBP910,000 (restated) for the comparable period last year. No dividends

were received from Swallowfield during the year (2013 - GBP118,000).

Western owns 1,869,149 shares in Swallowfield (16.5% of their issued share

capital). The market value of the Company's holding in Swallowfield on

31st December 2014 was GBP1,589,000 (30th June 2014: GBP1,813,000)

representing 10% of the Company's assets.

Mr E.J. Beale is a Non-Executive Director of Swallowfield.

Hartim Limited ("Hartim")

Hartim offers a complete export sales, marketing and logistical service to

a number of well known UK branded fast moving consumer goods companies.

This investment is accounted for as an associated company.

Our share of Hartim's estimated results for the period ended 31st December

2014 is a profit after tax of GBP23,000 (2013 - GBP161,000, plus an

exceptional profit in 2013 of GBP167,000 due to the release of surplus

provisions relating to the closure of its Australian subsidiary).

At 31st December 2014, Western owned 49.5% of Hartim. The carrying value

of the Company's equity investment in Hartim on 31st December 2014 was GBP

591,000 (31st December 2013: GBP514,000) representing 3% of the Company's

assets. In addition, loans of GBP660,000 (equivalent to a further 4% of the

Company's assets) have been made to Hartim and its executive directors.

Mr L.H. Marshall and Mr. E.J. Beale are Non-Executive Directors of Hartim.

Finsbury Food Group plc ("Finsbury Food")

Finsbury Food is a leading manufacturer of cakes and bread to the major UK

multiple grocers and recently acquired the Fletchers Group, suppliers of fresh

and frozen bread and morning goods to the major UK multiple grocers and the UK

foodservice sector. Further information about Finsbury Food is available on its

website: www.finsburyfoods.co.uk.

The Group acquired a further 1,000,000 shares in Finsbury Food for GBP593,000

during the period and now holds 10,000,000 shares, representing 7.9% of their

share capital. The Group interest has reduced from 13.7% at June 2014 following

Finsbury's acquisition of Fletchers Group for GBP56m by way of GBP35m of shares and

new debt facilities. The market value of our holding was GBP5,900,000 on 31st

December 2014 compared to a cost of GBP2,876,000; this represents 40% of the net

assets of Lonfin.

Finsbury Food will be announcing their interim results on 23rd March 2015.

Mr E.J. Beale is a Non-Executive Director of Finsbury Food.

General Portfolio

The list of investments included in the General Portfolio is set out at the end

of this announcement. We continue to hold 29 investments having taken GBP67,000

out of the amount invested.

Dividends

The Board has declared an interim dividend of 0.50p per share (prior year:

0.45p)

Outlook

Despite only modest improvements in global economic conditions, world indices

are at record levels. As a result the Board remains cautious about the

remainder of the year.

David C. Marshall

Chairman

Interim Dividend

The declared interim dividend is 0.5p per share (ZAR 8.86735 cents) (prior

year: 0.45p) and will be paid on Friday, 10th April 2015 to those members

registered at the close of business on Friday 20th March 2015 (SA and UK).

Shareholders on the South African register will receive their dividend in South

African Rand converted from sterling at the closing rate of exchange on 26th

February 2015.

The issued number of shares as at the declaration date is 31,207,479.

The Company's UK Income Tax reference number is 948/L32120.

Salient dates for dividend

Last day to trade (SA) Friday, 13th March 2015

Shares trade ex dividend (SA) Monday, 16th March 2015

Shares trade ex dividend (UK) Thursday, 19th March 2015

Record date (SA and UK) Friday, 20th March 2015

Pay date Friday, 10th April 2015

Shareholders are hereby advised that the exchange rate to be used will be GBP 1

= ZAR 17.7347. This has been calculated as the average of the bid/ask spread at

16.00 (United Kingdom time) being the close of business on 26th February 2015.

Consequently, the dividend of 0.50p will be equal to ZAR 8.86735 cents.

The JSE Listings Requirements require disclosure of additional information in

relation to any dividend payments.

Shareholders registered on the South African register are reminded that the

dividend withholding tax will be withheld from the gross final dividend amount

of ZAR 8.86735 cents per share at a rate of 15%, unless a shareholder qualifies

for an exemption; shareholders registered on the South African register who do

not quality for an exemption will receive a net dividend of ZAR 7.53725 cents

per share. The dividend is payable in cash as a `Dividend' (as defined in the

South African Income Tax Act, 58 of 1962, as amended) by way of a payment out

of income reserves. The dividend withholding tax and the information contained

in this paragraph is only of direct application to shareholders registered on

the Johannesburg register, who should direct any questions about the

application of the dividend withholding tax to Computershare Investor Services

(Pty) Limited, Tel: +27 11 373-0004.

No dematerialisation or rematerialisation of share certificates, nor transfer

of shares between the registers in London and South Africa will take place

between Monday, 16th March 2015 and Friday 20th March 2015 all dates inclusive.

Unaudited Consolidated Statement of Comprehensive Income

Half year ended Year ended

31st December 30th June

2014 2013 2014

GBP000 GBP000 GBP000

Operating Income

Dividends received 197 173 393

Rental and other income 41 41 82

Profit on sales of investments, including 91 205 205

provisions

329 419 680

Management services income 108 93 205

437 512 885

Administrative expenses

Investment operations (171) (158) (330)

Management services (111) (173) (321)

Total administrative expenses (282) (331) (651)

Operating profit 155 181 234

Unrealised changes in the carrying value of 879 206 (339)

investments

Interest payable (17) (2) (25)

Profit on ordinary activities before taxation 1,017 385 (130)

Tax on result of ordinary activities (188) (45) 71

Profit on ordinary activities after taxation 829 340 (59)

Non-controlling interest (19) 15 16

Total comprehensive income - profit 810 355 (43)

attributable to members of the holding

company

Reconciliation of headline earnings

Earnings/(Loss) per share 2.6p 1.1p (0.1)p

Adjustment for unrealised changes in the (2.8)p (0.6)p 0.8p

carrying value of investments and exceptional

items, net of tax

Headline (loss)/earnings per share (0.2)p 0.5p 0.7p

Interim dividend 0.50p 0.45p 0.45p

Final dividend 0.45p

Total in respect of the year 0.90p

Unaudited Consolidated Changes in Shareholders' Equity

31st December 30th June

2014 2013 2014

GBP000 GBP000 GBP000

Total comprehensive income attributable to 810 355 (43)

members

Dividends paid to equity shareholders (141) (125) (265)

669 230 (308)

Equity shareholders' funds at start of 13,950 14,258 14,258

period

Equity shareholders' funds at end of period 14,619 14,488 13,950

Unaudited Consolidated Statement of Financial Position

31st December 30th June

2014 2013 2014

GBP000 GBP000 GBP000

Non-current assets

Tangible assets 35 2 39

Principal investments:-

Finsbury Food Group Plc 5,900 5,400 4,860

Western Selection P.L.C. 4,559 4,323 4,166

10,494 9,725 9,065

Current assets

Listed investments 5,899 5,775 5,927

Trade and other receivables 252 254 245

Cash, bank balances and deposits 83 123 39

6,234 6,152 6,211

Total Assets 16,728 15,877 15,276

Capital and Reserves

Called up share capital 1,560 1,560 1,560

Share premium account 2,320 2,320 2,320

Unrealised profits and losses on investments 5,280 5,037 4,585

Share of undistributed profits and losses of (125) (387) (294)

subsidiaries and associates

Company's retained realised profits and 5,584 5,958 5,779

losses

Equity shareholders funds 14,619 14,488 13,950

Trade and other payables falling due within 1,729 1,067 1,150

one year

Deferred taxation 296 255 111

Non-controlling equity interest 84 67 65

16,728 15,877 15,276

Net assets per share 46.8p 46.4p 44.7p

Number of shares in issue 31,207,479 31,207,479 31,207,479

Unaudited Consolidated Statement of Cash Flow

Half year ended Year ended

31st December 30th June

2014 2013 2014

GBP000 GBP000 GBP000

Profit/(Loss) before taxation 1,017 385 (130)

Adjustments for non-cash and non-operating

expenses:-

Depreciation charges 4 1 3

Unrealised changes in the carrying value of (879) (206) 339

fixed asset investments

Net interest paid 17 2 25

(858) (203) 367

Taxation paid (4) (3) (22)

Changes in working capital:-

(Increase)/Decrease in debtors (8) 11 11

(Decrease)/Increase in creditors (244) 69 23

Decrease/(Increase) in current asset 67 (300) (272)

investments

(185) (220) (238)

Cash outflow on operating activities (30) (41) (39)

Investment activities

Purchase of additional shares in strategic (593) - -

investment

Net cash outflow from investment activities (593) - -

Cash flows from financing

Net interest paid (17) (2) (25)

Drawdown of loan facilities 825 175 275

Equity dividends paid (141) (125) (265)

Net cash inflow/(outflow) from financing 667 48 (15)

Increase/(Decrease) in cash and cash 44 7 (77)

equivalents

Cash and cash equivalents at start of period 39 116 116

Cash and cash equivalents at end of period 83 123 39

Reconciliation of net cash flow to movement in net debt

At start Cash At end

of period Flow of Period

Half year ended 31st December GBP000 GBP000 GBP000

2014

Cash at bank 39 44 83

Bank loan (650) (825) (1,475)

(611) (781) (1,392)

2013

Cash at bank 116 7 123

Bank loan (650) (175) (825)

(534) (168) (702)

Year ended 30th June 2014

Cash at bank 116 (77) 39

Bank loan (650) - (650)

(534) (77) (611)

Notes:-

1. The results for the half-year are unaudited. The information contained in

this report does not constitute statutory accounts within the meaning of

the Companies Act 2006. The statutory accounts of the Group for the year

ended 30th June 2014 have been reported on by the Company's auditors and

have been delivered to the Registrar of Companies. The report of the

auditors was unqualified.

2. This report has been prepared in accordance with the accounting policies

contained in the Company's Annual Report and Accounts 2014, International

Financial Reporting Standards and comply with IAS34.

3. The calculation of earnings per share is based on the weighted average

number of shares in issue for the period and the profit on ordinary

activities after tax.

Composition of General Portfolio

31st December 2014

Value

GBP000 %

Nestle 322 5.5

L'Oreal 322 5.5

British American Tobacco 305 5.2

Investor 304 5.1

Henkel 292 4.9

Diageo 271 4.6

Heineken 265 4.5

Reckitt Benckiser 265 4.5

Pernod-Ricard 255 4.3

Schindler-Holdings 252 4.3

Novartis 247 4.2

Imperial Tobacco 238 4.0

Philip Morris International 232 3.9

Unilever 231 3.9

Exxon 213 3.6

Procter & Gamble 194 3.3

BASF 193 3.3

Chevron 189 3.2

ABB 181 3.1

Danone 170 2.9

Holcim 169 2.9

Linde 145 2.5

Givaudan 144 2.4

Anheuser Busch Inbev 126 2.1

LVMH 106 1.8

3M 96 1.6

Glencore International 90 1.5

United Technologies 72 1.2

Hermes International 10 0.2

5,899 100.0

END

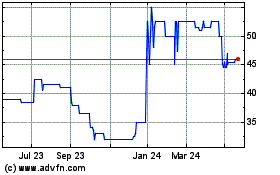

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Sep 2024 to Oct 2024

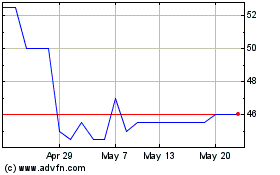

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Oct 2023 to Oct 2024