Sancus Lending Group Limited ZDP Share Buyback

April 29 2024 - 2:00AM

RNS Regulatory News

RNS Number : 3126M

Sancus Lending Group Limited

29 April 2024

The information contained within this

announcement is deemed to constitute inside information as

stipulated under the Market Abuse Regulation (EU) No. 596/2014 as

amended by The Market Abuse (Amendment) (EU Exit) Regulations 2019.

The person responsible for making this announcement on behalf of

the Company is Rory Mepham.

29 April 2024

Sancus Lending Group Limited

ZDP Share

Buyback

(the

"Company")

Sancus Lending Group Limited

announces that, in advance of the

suspension of its zero dividend preference shares

of no par value ("ZDP

Shares") on the Standard Segment of the Official List and to

trading on the Main Market of the London Stock Exchange from

07.30am on 1 May 2024 (as announced on 26

April 2024), it intends to offer to purchase ZDP Shares pursuant to

the authority granted to the Directors by shareholders at the

Company's AGM on 19 May 2023 (the "Buyback"). The Buyback is limited to an

aggregate purchase amount of £1.5 million and will continue until

4.30p.m. on 30 April 2024. The Buyback may benefit holders of ZDP

Shares requiring liquidity.

In accordance with the resolution

passed at the AGM, purchases made pursuant to the Buyback Programme

must be a) at a maximum price (exclusive of expenses) paid per ZDP

Share of 105% of the average of the middle market quotations (as

derived from the Daily Official List) of the ZDP Shares for the

five business days immediately preceding the date of purchase and

b) at a minimum price paid per ZDP Share of £0.01.

The Company has 8,782,388 ZDP Shares

in issue, of which 1,118,666 ZDP Shares are held in treasury. ZDP

Shares purchased pursuant to the Buyback Programme will be held in

treasury.

Shareholders should be aware that a

purchase of ZDP Shares by the Company on any trading day may

represent a significant proportion of the daily trading volume in

the ZDP Shares and could exceed 25 per cent. of the average daily

trading volume of the preceding 20 business days.

For further information, please

contact:

Sancus Lending Group Limited

Rory Mepham

Keith Lawrence

+44 (0)1481 708 280

Liberum Capital (Nominated Adviser and Corporate

Broker)

Chris Clarke

William King

+44 (0) 20 3100 2000

Instinctif Partners (PR Adviser)

Tim Linacre

Vivian Lai

+44 (0)207 457 2020

Apex

Group Ltd

Matt Falla

Nicola Momberg

+44 (0)1481 755530

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

POSMZGZDGRKGDZZ

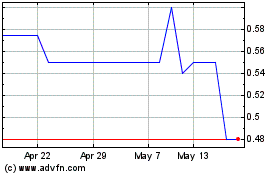

Sancus Lending (LSE:LEND)

Historical Stock Chart

From Nov 2024 to Dec 2024

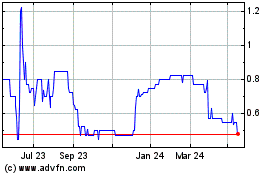

Sancus Lending (LSE:LEND)

Historical Stock Chart

From Dec 2023 to Dec 2024