Kennedy Ventures PLC Granting of Options and Issue of Equity (1712T)

July 16 2015 - 2:00AM

UK Regulatory

TIDMKENV

RNS Number : 1712T

Kennedy Ventures PLC

16 July 2015

16 July 2015

Kennedy Ventures plc

Granting of Options, Related Party Transaction and Issue of

Equity

Kennedy Ventures plc ("Kennedy Ventures" or the "Company"),

which is focused on tantalite production in Namibia through its 75%

holding in African Tantalum (Pty) Limited, announces the following

transactions in the Company's issued share capital.

Issue of Options

Further to the announcement by Kennedy Ventures on 26 March

2014, options have been granted to the following Directors of the

Company:

Director Number of Exercise Exercise

Options Price Expiry Date

(p)

--------------- ---------- --------- -------------

25 March

Giles Clarke 1,599,705 1.25 2018

--------------- ---------- --------- -------------

25 March

Nick Harrison 1,599,705 1.25 2018

--------------- ---------- --------- -------------

In addition, a further 1,066,470 options have been granted to

each of Peter Redmond and Colin Weinberg, both of whom are former

directors of Kennedy Ventures, on the same terms in recognition of

services provided to the Company.

Related Party Transaction

Further to the announcement by Kennedy Ventures on 3 July 2015

regarding the unsecured loan facility ("Loan Facility") provided to

the Company by Westleigh Investment Holdings Limited ("WIHL"), a

company in which Giles Clarke and Nick Harrison, both of whom are

directors of Kennedy Ventures, hold a beneficial interest of 73.28%

and 26.72% respectively, the Company confirms that it has agreed to

repay the Loan Facility in full as set out below:

-- GBP100,000 of the Loan Facility will be repaid through the

issue to WIHL of 1,904,762 new ordinary shares of GBP0.01

("Ordinary Shares") at a price of 5.25 pence per Ordinary Share

(representing a 2.5% premium to the closing price on 14 July 2015);

and

-- The balance of GBP42,000 will be repaid in cash from the

proceeds of the Company's recent placing.

The transaction above in respect of the Loan Facility is a

related party transaction under the AIM Rules for Companies and the

independent directors consider, having consulted with the Company's

nominated adviser, that the terms of the transaction are fair and

reasonable insofar as its shareholders are concerned.

Conversion of Accrued Fees

Further to the announcement by the Company on 15 July 2015

regarding board changes, Peter Redmond and Colin Weinberg have

agreed to convert accrued fees amounting to GBP10,000 each into new

Ordinary Shares at a price of 5.25 pence per Ordinary Share,

resulting in the issue of 380,952 new Ordinary Shares.

Application has been made for admission of the new Ordinary

Shares to trading on AIM ("Admission") and it is expected that

Admission will occur on or around 22 July 2015.

Following Admission, the Company's issued share capital will

consist of 105,268,129 Ordinary Shares, with each carrying the

right to one vote. The Company does not hold any ordinary shares in

treasury. This figure above may therefore be used by shareholders

in the Company as the denominator for the calculations by which

they will determine if they are required to notify their interest

in, or a change in their interest in, the share capital of the

Company under the FCA's Disclosure and Transparency Rules.

ENDS

For further information, please contact:

Kennedy Ventures plc 020 3757 4983

Peter Hibberd c/o Georgia Mann

Cenkos Securities (Nominated

Adviser and Joint Broker) 0131 220 6939

Derrick Lee / Nick Tulloch

Shore Capital (Joint Broker) 020 7408 4090

Mark Percy / Toby Gibbs (corporate

finance)

Jerry Keen (corporate broking)

Peterhouse Corporate Finance

(Joint Broker)

Duncan Vasey 020 7469 0935

Camarco

Billy Clegg / Georgia Mann 020 3757 6983

Notes to editors

Tantalite concentrates form the vast majority of feedstock for

all tantalum products. As such they are critical and unreplaceable

parts of a wide range of modern electronics including computers,

tablets, mobile phones, motor components and video game

systems.

Aside from electronics, tantalum has significant usage in super

alloys, specialised steels, corrosion resistant equipment and

medicine.

Tantalum's applications are based on its unique physio -

chemical properties. The oxides and metal have extremely high

melting points, high heat conductivity and strong resistance to

corrosive environments. Combined, these factors have entrenched its

international demand and made it an important component of numerous

research projects and new technologies.

Trade pricing is following tantalum markets as per Asian Metals

and Metal Pages.

In August 2012, the US Securities and Exchange Commission

adopted a rule mandated by the Dodd-Frank Wall Street Reform and

Consumer Protection Act to require companies reporting to the SEC

to publicly disclose the origins of the tantalum they buy in order

to restrict the use of conflict minerals that originated in the

Democratic Republic of the Congo or an adjoining country. As a

result, users of tantalum are encouraged to demonstrate that their

supply chain is transparent to ensure that conflict-free tantalum

is procured.

It is intended that the tantalum produced by Aftan will be

conflict-free.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEASXSFLLSEFF

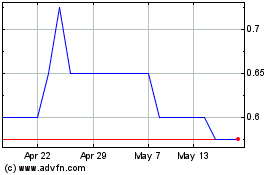

Kazera Global (LSE:KZG)

Historical Stock Chart

From Jul 2024 to Aug 2024

Kazera Global (LSE:KZG)

Historical Stock Chart

From Aug 2023 to Aug 2024