TIDMKRS

RNS Number : 3388J

Keras Resources PLC

26 April 2022

26 April 2022

Keras Resources plc ('Keras' or 'the Company')

Placing of GBP1.2m and Broker Option of GBP0.75m, Cornerstone

Investment in Keras & Management Change

-- GBP1.2m placed with cornerstone investor and Board at a premium to current share price

-- Broker Option available to raise a further GBP0.75m to allow

new and existing shareholders to participate

-- Graham Stacey appointed as CEO with Russell Lamming moving to

Non-Exec Chairman to ensure key management is based in US

-- Funds will be utilised to enhance current operations and

maximise future potential of the Diamond Creek asset

Keras Resources plc (AIM: KRS) is pleased to announce that, post

securing 100% of Falcon Isle Resources LLC and Falcon Isle Holdings

LLC (collectively 'Falcon Isle') on 30 March 2022, which owns the

high-grade Diamond Creek organic phosphate mine ("Diamond Creek'),

the Company intends to raise a total of GBP1,950,000 (before

expenses) (the 'Fund Raising') by the issue of up to 1,625,000,000

new ordinary shares of 0.01p each ('Ordinary Shares') at a price of

0.12p per Ordinary Share ('Placing Price'). 1,000,000,000 new

Ordinary Shares have been placed for cash consideration to raise

GBP1,200,000 (the 'Placing Shares') (the 'Placing') and the balance

of up to 625,000,000 new Ordinary Shares are intended to be issued

through a Broker Option (the 'Broker Option Shares'). The purpose

of the Broker Option is to allow existing shareholders and other

investors to participate in the Fund Raising.

Each Placing Share and Broker Option Share subscribed will

receive a warrant to subscribe for 1 new Ordinary Share at any time

up to 31 May 2024, at an exercise price of 0.18p per new Ordinary

Share ('Warrants').

Shareholders should note that the placing price of 0.12p per

share represents a premium of approx. 7% over the closing price of

0.1125p and 20% over the 5-Day VWAP of 0.1004p on 25 April 2022,

the day before the Placing was announced.

As part of the Placing, the Company has secured a cornerstone

investor, with First Uranium Resources (CSE: URNM) (KMMIF:OTC)

('First Uranium') subscribing for 800,000,000 Placing Shares,

raising funds of GBP960,000. First Uranium recently raised C$10m to

develop a portfolio of assets in the North American phosphate

market as it sees this as a key growth commodity within the

resource sector.

In addition, the Keras Board of Directors have again co-invested

in the Fund Raising and have subscribed for 200,000,000 Placing

Shares in aggregate. Brian Moritz, Russell Lamming and Dave Reeves,

have subscribed for 35,000,000 (GBP42,000), 45,000,000 (GBP54,000)

and 120,000,000 (GBP144,000) new Ordinary Shares respectively (the

'Director Subscription Shares'), (the 'Director Subscription').

While it remains the intention that payments for the Falcon Isle

transaction will be financed primarily from Falcon Isle cashflow,

the funds being raised will be used for the First Tranche of

US$800,000, the establishment of a N1 43-101 compliant Mineral

Resource at Diamond Creek, expansion of the Falcon Isle business

into other fields of activity and general working capital.

As Keras now focusses on the North American phosphate market, it

intends to locate its key management in that region and reduce the

costs outside of the US. As such, from 1 June 2022 Graham Stacey

(Chief Operating Officer) will be appointed Chief Executive Officer

of the Company and Russell Lamming will become a Non-Executive

Director. On 1 September 2022, Russell will assume the role of

Non-Executive Chairman. Brian Moritz, current Non-Executive

Chairman, will continue his role as Non-Executive Director and

Company Secretary post the transition and will continue to provide

oversight of the Company's finances.

Russell Lamming, CEO of Keras, commented, "The past few months

have been a transformative period for Keras. We recently secured

100% of Falcon Isle - the strategically located, high grade organic

phosphate mine - which is now past its capex peak-funding period

and poised to start ramping up production into the growing organic

agricultural sector underpinned by the macro-economic tailwinds of

the global fertiliser markets. We are now delighted to have secured

a cornerstone investor with First Uranium at a premium to our

current share price, who shares our conviction in the upward

trajectory of the phosphate market and the inherent value of the

Diamond Creek project within this sector.

We as a Board remain very much aligned with shareholders as we

continue to invest in the Company and we welcome the opportunity

for other investors to participate alongside us. This placing

ensures we have a solid cash position to enhance our current

operations and consolidate the long term future of both the project

and Company. We are fully focussed on building this platform and

driving further shareholder value through maximizing the asset

potential, optimizing efficiencies and generating cash flows.

I believe Graham's appointment as CEO is key to the Company's

transition to a US focussed business. His role in the development

of Diamond Creek has been integral since the initial acquisition in

2020 and the Board will continue to support his efforts as he

builds Falcon Isle into the premier organic phosphate producer in

the US."

Fee Shares and Fee Warrants

The Company has agreed to issue 12,500,00 new Ordinary Shares to

SP Angel at a deemed price of 0.12 pence per share in lieu of fees

due to SP Angel and to issue 40,000,000 new Ordinary Shares to

Shard Capital at a deemed price of 0.12 pence per share in lieu of

fees due to Shard Capital (together "Fee Shares"). Each Fee share

will have a warrant attached to subscribe for 1 new Ordinary Share

at any time up to 31 May 2024, at an exercise price of 0.18p per

new Ordinary Share ("Fee Warrants"). The issue of, in aggregate,

52,500,000 Fee Shares and new Ordinary Shares in respect of any Fee

Warrants will be conditional upon shareholders providing new

authorities for the Directors to issue such shares.

General Meeting

At the Annual General Meeting held on 30 March 2021 the

Directors were authorised to issue 1,000,000,000 new Ordinary

Shares for cash consideration. This is insufficient for the

purposes of the issue of Fee Shares, Broker Option Shares and new

Ordinary Shares in connection with the Fee Warrants. The issue of

the Fee Shares, Broker Option Shares and new Ordinary Shares

associated with the Warrants and Fee Warrants, are subject to the

passing of resolutions at a general meeting to be held by the

Company at 10am on 16 May 2022.

Broker Option

Under the Broker Option, up to 625,000,000 Broker Option Shares

are intended to be placed at 0.12p per share by the Company's joint

brokers, Shard Capital Partners LLP ('Shard') and SP Angel

Corporate Finance LLP ('SP Angel'), to raise up to GBP750,000

(before expenses).

To subscribe under the Broker Option, Shareholders should

communicate their interest to the Company, Shard or SP Angel by

5:00 pm on 29 April 2022 via their independent financial adviser,

stockbroker or other firm authorised by the Financial Conduct

Authority, as Shard cannot take orders from persons that are not

its clients and SP Angel cannot take direct orders from individual

private investors.

There is no guarantee that Shard or SP Angel will exercise the

Broker Option or that shareholders and investors will be able to

acquire any Broker Option Shares.

Application for admission

Application will be made for admission of the 1,000,000,000

Placing Shares to trading on the AIM market of the London Stock

Exchange ("AIM") which is expected to occur on or around 4 May

2022. The Placing Shares will rank pari passu with the existing

Ordinary Shares, which are currently traded on AIM.

Total voting rights

Following the admission of the Placing Shares, there will be

7,296,073,068 Ordinary Shares in issue with each share carrying the

right to one vote. There are no shares currently held in treasury.

The total number of voting rights in the Company will therefore be

7,296,073,068 and this figure may be used by shareholders as the

denominator for the calculations by which they determine if they

are required to notify their interest in, or a change to their

interest in, the Company under the Financial Conduct Authority's

Disclosure Rules and Transparency Rules.

Related Party

The Director Subscription by Dave Reeves, Russell Lamming and

Brian Moritz constitutes a related party transaction pursuant to

Rule 13 of the AIM Rules for Companies. Graham Stacey being the

director independent of the Director Subscription considers, having

consulted with the Company's Nominated Adviser, that the Director

Subscription by Dave Reeves, Russell Lamming and Brian Moritz is

fair and reasonable insofar as the shareholders of the Company are

concerned.

Following these Director Subscription and the admission of the

Placing Shares, the beneficial interests of the Directors in the

issued Ordinary Shares is as follows:

Director Interest in Ordinary % interest in Ordinary

Shares following Shares following Admission

Admission

Dave Reeves 981,942,616 13.46%

--------------------- ----------------------------

Russell Lamming 461,184,497 6.32%

--------------------- ----------------------------

Brian Moritz 212,582,118 2.91%

--------------------- ----------------------------

Total 1,655,709,231 22.69%

--------------------- ----------------------------

See the Appendix below for further information on dealings by

persons discharging managerial responsibilities.

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

Article 7 of the Market Abuse Regulation (EU) No. 596/2014 (as

amended) as it forms part of the domestic law of the United Kingdom

by virtue of the European Union (Withdrawal) Act 2018 (as amended).

Upon the publication of this Announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

For further information please visit www.kerasplc.com , follow

us on Twitter @kerasplc or contact the following:

Russell Lamming Keras Resources plc annabel @kerasplc.com

Annabel Redford

Nominated Adviser & Joint

Broker SP Angel Corporate Finance +44 (0) 20 3470

Ewan Leggat / Charlie LLP 0470

Bouverat

Joint Broker Shard Capital Partners +44 (0) 207 186

Damon Heath / Erik Woolgar LLP 9900

Appendix

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: 1. Dave Reeves

2. Brian Moritz

3. Russell Lamming

------------------------------------ ----------------------------------

2. Reason for the notification

------------------------------------------------------------------------

a) Position/status: 1. Non-executive Director

2. Non-Executive Chairman

3. CEO

------------------------------------ ----------------------------------

b) Initial notification/amendment: Initial notification

------------------------------------ ----------------------------------

3. Details of the issuer emission allowance market

participant, auction platform, auctioneer or auction

monitor

------------------------------------------------------------------------

a) Name: Keras Resources plc

------------------------------------ ----------------------------------

b) LEI: 213800OZFKFM2N4R4F47

------------------------------------ ----------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

------------------------------------------------------------------------

a) Description of the financial Ordinary shares of 0.01 pence

instrument, type of each

instrument:

ISIN: GB00B649J414

Identification code:

------------------------------------ ----------------------------------

b) Nature of the transaction: Acquisition of Placing Shares

------------------------------------ ----------------------------------

c) Price(s) and volume(s): Prices(s) Volume(s)

1. 0.12p 120,000,000

---------- ------------

2. 0.12p 35,000,000

---------- ------------

3. 0.12p 45,000,000

---------- ------------

------------------------------------ ----------------------------------

d) Aggregated information: Prices(s) Volume(s)

1. 0.12p 120,000,000

Aggregated volume: ---------- ------------

2. 0.12p 35,000,000

Price: ---------- ------------

3. 0.12p 45,000,000

---------- ------------

------------------------------------ ----------------------------------

e) Date of transaction: 2 5 /04/2022

------------------------------------ ----------------------------------

f) Place of transaction Outside a trading venue

------------------------------------ ----------------------------------

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: 1. Dave Reeves

2. Brian Moritz

3. Russell Lamming

----------------------------------- -----------------------------------

2. Reason for the notification

------------------------------------------------------------------------

a) Position/status: 1. Non-executive Director

2. Non-Executive Chairman

3. CEO

----------------------------------- -----------------------------------

b) Initial notification/amendment: Initial notification

----------------------------------- -----------------------------------

3. Details of the issuer emission allowance market

participant, auction platform, auctioneer or auction

monitor

------------------------------------------------------------------------

a) Name: Keras Resources plc

----------------------------------- -----------------------------------

b) LEI: 213800OZFKFM2N4R4F47

----------------------------------- -----------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type

of transaction; (iii) each date; and (iv) each

place where transactions have been conducted

------------------------------------------------------------------------

a) Description of the financial Ordinary shares of 0.01 pence

instrument, type of each

instrument:

ISIN: GB00B649J414

Identification code:

----------------------------------- -----------------------------------

b) Nature of the transaction: Grant of Warrants pursuant

to the Placing

----------------------------------- -----------------------------------

c) Price(s) and volume(s): Prices(s) Volume(s)

1. 0.18p 120,000,000

---------- ------------

2. 0.18p 35,000,000

---------- ------------

3. 0.18p 45,000,000

---------- ------------

----------------------------------- -----------------------------------

d) Aggregated information: Prices(s) Volume(s)

1. 0.18p 120,000,000

Aggregated volume: ---------- ------------

2. 0.18p 35,000,000

Price: ---------- ------------

3. 0.18p 45,000,000

---------- ------------

----------------------------------- -----------------------------------

e) Date of transaction: 2 5 /04/2022

----------------------------------- -----------------------------------

f) Place of transaction Outside a trading venue

----------------------------------- -----------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEPPUQWCUPPUAQ

(END) Dow Jones Newswires

April 26, 2022 02:02 ET (06:02 GMT)

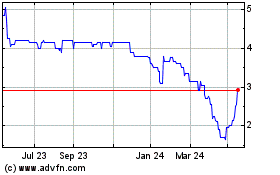

Keras Resources (LSE:KRS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Keras Resources (LSE:KRS)

Historical Stock Chart

From Jan 2024 to Jan 2025