TIDMKLR

RNS Number : 8279F

Keller Group PLC

26 February 2018

For immediate release Monday, 26 February 2018

Keller Group plc

Results for the year ended 31 December 2017

Keller Group plc ("Keller" or "the group"), the world's largest

geotechnical contractor, announces its results for the year ended

31 December 2017.

Constant currency

2017 2016 % change

GBPm GBPm % change

---------------------------------- -------- -------- ----------- ------------------

Revenue 2,070.6 1,780.0 +16% +10%

Underlying EBITDA(1) 177.2 158.6 +12% +7%

Underlying operating profit(1) 108.7 95.3 +14% +10%

Underlying profit before tax(1) 98.7 85.1 +16% +12%

Underlying earnings per share(1) 102.2p 75.9p +35% +30%

Total dividend per share 34.2p 28.5p +20% n/a

Statutory operating profit 121.3 85.2 +42% +39%

Statutory profit before tax 110.6 73.9 +50% +46%

Statutory earnings per share 121.0p 65.7p +84% +82%

---------------------------------- -------- -------- ----------- ------------------

(1) Before pre-tax non-underlying credits of GBP11.9m (2016:

costs of GBP11.2m). Details of the non-underlying items are set out

in note 5 of the consolidated financial information.

2017 summary:

-- Record revenue of GBP2,070.6m, up 16%, driven by strong organic growth

-- Underlying profit before tax up 16% to GBP98.7m

-- Divisional performance

-- EMEA: very strong profit growth (over 70% up to GBP53.3m)

with excellent execution of large contracts

-- North America: underlying profit decline of 14% to GBP78.7m,

reflecting some ongoing regional softness and the negative impact

of the hurricanes in the third quarter

-- APAC: GBP16.5m operating loss, reduced slightly year on year,

with progress held back by two contract losses

-- Net debt decreased to GBP229.5m (2016: GBP305.6m), representing 1.3x EBITDA

-- Year-end order book, excluding the Caspian project, up 5% giving confidence for 2018

-- Good progress against target of GBP50m gross benefits from

strategic initiatives - one third achieved in first of four

years

-- Underlying earnings per share increased 35% to 102.2p, in

part due to a one-off tax credit of GBP9.7m

-- Total dividend per share of 34.2p, up 20%, reflecting

confidence in the group's prospects and higher expected future

earnings following the recent US tax reforms

Alain Michaelis, Chief Executive, said:

"Overall Keller has had a positive year with good growth in

group revenue and profits. The results were extremely strong in

EMEA and solid in North America, but disappointing in APAC. Ongoing

operational improvements, strengthened leadership and market

recovery should lead to APAC returning to profitability in 2018.

Our confidence in group fundamentals and the recent US tax changes

have allowed us to significantly raise the dividend to

shareholders.

The order book of over GBP1bn gives us confidence as we start

2018. Most of our markets remain robust and bidding activity is at

a healthy level. Overall, despite the completion of our excellent

Caspian project, we expect 2018 to be another year of underlying

progress".

Basis of preparation

The group's results as reported under International Financial

Reporting Standards (IFRS) and presented in the financial

statements (the "statutory results") are significantly impacted by

movements in exchange rates relative to sterling, as well as by

exceptional items and non-trading amounts relating to

acquisitions.

As a result, adjusted performance measures have been used

throughout this report to describe the group's underlying

performance. The Board and Executive Committee use these adjusted

measures to assess the performance of the business because they

consider them more representative of the underlying ongoing trading

result and allow more meaningful comparison to prior year. Where

not presented on the face of the consolidated income statement or

cash flow statement, the adjusted measures are defined and

reconciled to the amounts reported under IFRS in the Adjusted

performance measures section at the end of this statement.

The constant currency basis ("constant currency") adjusts the

comparative to exclude the impact of movements in exchange rates

relative to sterling on the translation of the results of overseas

operations. Retranslating at 2017 average exchange rates increases

2016 revenue and underlying operating profit by GBP106.0m and

GBP3.5m respectively.

The term 'underlying' excludes the impact of exceptional items,

amortisation of acquired intangible assets and other non-trading

amounts relating to acquisitions (collectively 'non-underlying

items'), net of any associated tax. Non-underlying items mainly

comprise a GBP21.0m exceptional credit relating to a historic

contract dispute on a project in Avonmouth, in the UK, and GBP9.0m

of amortisation of acquired intangible assets.

Group overview

Financial results

Group revenue for the year was GBP2,070.6m, up 16% on 2016.

Constant currency revenue was up 10%, primarily as a result of

strong organic growth in the EMEA and APAC regions. Constant

currency revenue in North America was down 4% year on year.

Underlying operating profit was GBP108.7m, an increase of 14% on

the GBP95.3m generated in 2016. On a constant currency basis

underlying operating profit was up 10%. The group underlying

operating margin decreased from 5.4% to 5.2%, mainly due to lower

margins in North America offset by improved profitability in EMEA.

Pre-tax return on capital employed was stable at 15.1% (2016:

15.3%).

After taking account of GBP9.0m of amortisation of acquired

intangible assets, a GBP21.0m exceptional credit relating to a

historical contract dispute and other non-underlying items,

totalling a net GBP0.6m credit, the statutory operating profit was

GBP121.3m (2016: GBP85.2m). Further details on non-underlying items

are given after the discussion of divisional results.

On an underlying basis, after net finance costs of GBP10.0m

(2016: GBP10.2m), the profit before tax was GBP98.7m, up 16% on the

previous year's GBP85.1m. The underlying effective tax rate

decreased from 35.0% in 2016 to 25.0% in 2017, mainly due to a

GBP9.7m credit for the revaluation of US deferred tax liabilities

following the recent US tax reforms.

Underlying earnings per share for the year were 102.2p (2016:

75.9p), an increase of 35%. On a constant currency basis,

underlying earnings per share were up 30%.

The statutory profit before tax was up 50% at GBP110.6m (2016:

GBP73.9m). After the statutory tax charge of GBP23.1m (2016:

GBP25.9m), statutory profit after tax was GBP87.5m (2016: GBP48.0m)

and statutory earnings per share were 121.0p, compared with 65.7p

in 2016.

Net debt at the year-end was GBP229.5m (2016: GBP305.6m),

representing 1.3x underlying EBITDA. The financial position of the

group remains strong with undrawn borrowing facilities totalling

GBP194.9m. The group continues to operate well within all of its

financial covenants.

Cash generated from operations before non-underlying items was

GBP136.1m, which represents 77% of EBITDA. This cash conversion

rate is lower than previous years due to a GBP28.8m increase in

working capital mainly as a result of the fourth quarter's

like-for-like revenue being 16% ahead of the same period in

2016.

The group continues to invest in growing and upgrading its

equipment capability, with net capital expenditure of GBP74.5m in

2017, representing 1.1x depreciation.

Dividends

As noted above, the group's underlying earnings per share

increased by 35% from 75.9p in 2016 to 102.2p in 2017. About 12p of

this increase was due to the one-off revaluation of US deferred tax

liabilities as a result of the recently enacted US tax reforms. As

previously announced, these changes are expected to reduce the

group's future effective tax rate from a percentage number in the

mid-thirties to a number in the high twenties, resulting in an

ongoing earnings per share enhancement of between 5p and 10p per

share each year.

As a result, and reflecting confidence in the group's prospects,

the Board has decided to rebase future dividends and accordingly

recommends a 20% increase in the 2017 full year dividend to 34.2p

(2016: 28.5p). Full year 2017 dividend cover, before non-underlying

items, is 3.0x (2016: 2.7x).

This recommendation results in a proposed 2017 final dividend of

24.5p per share (2016: 19.25p per share), a 27% increase, to be

paid on 22 June 2018 to shareholders on the register as at the

close of business on 1 June 2018.

The group intends to maintain a progressive dividend policy in

the future.

Outlook

Our group order book of over GBP1bn gives us confidence as we

start 2018. Most of our markets remain robust, bidding activity is

at a healthy level and Keller is well positioned to address the

market trends of urbanisation and infrastructure growth. Two

significant loss-making contracts in APAC in 2017 masked some good

progress in the region and we continue to expect the division to

return to profit in 2018. Overall, despite the completion of our

excellent Caspian project, we expect 2018 to be another year of

underlying progress, albeit with recent currency movements expected

to result in translational headwinds on reported profits.

We are now seeing tangible results from a number of the

strategic initiatives launched in the last two years. We are

confident that a combination of these improvement initiatives, our

technical leadership, wide product portfolio, broad branch network

and operational strength will continue to drive our business

forward.

Strategic progress

In 2017 we consolidated our positions in our key markets by

extending our branch network, as well as extending our product

range. Examples include new branches in Hamburg and Charlotte,

bringing our soil mixing capability into Singapore and Malaysia,

our first diaphragm wall jobs in India and introducing new ground

improvement techniques into South Africa. We also invested in a new

Keller Marine team to leverage our experience in Australia in

near-shore marine construction into new geographies. This team is

already actively bidding work in India and Africa.

We completed two small acquisitions: Geo Instruments in North

America to enhance our instrumentation and monitoring capability

and, via our Finnish joint venture, Sotkamon Porapaalu, expanding

our regional footprint in Finland and gaining capability in a

specific type of drilled piling. In January, we announced our

intention to acquire Moretrench, a geotechnical contractor in the

US. If completed, this acquisition will further strengthen our US

East Coast presence and add new specialist technical capabilities

to the group.

During the year we completed the roll-out of our standard

strategic planning model to all 21 business units. All business

units now have detailed strategic plans in a common structure,

incorporating specific action plans which are being implemented. In

addition, we continue to strengthen our business units through

functional engagement and active benchmarking of our key KPIs.

Our procurement capability continues to gain strength and

traction, with teams now established in each division. Significant

benefits from this investment are already being realised. We have

also created one global IT organisation. This pulls together our

efforts on infrastructure and applications, reducing the burden on

local teams as well as creating economies of scale.

Our Global Product Teams are helping us focus on R&D

opportunities, developing product strategies and continuing to

share best practice and innovations. We also continued to make

progress on operational productivity, with our 5S roll-out

implemented across Keller and starting to become part of the

cultural norm. We will continue to build our "lean" capabilities in

2018.

We executed 6,300 projects throughout the world in 2017. These

continue to set the standard in the industry and enhance Keller's

strong reputation for providing innovative solutions, combined with

excellent execution focused on our customers' needs. Average

project size is still comparatively small at GBP300k per project.

Local and smaller projects remain the foundation of Keller,

supported by our extensive branch network (around 180 locations)

and our skilled local teams who know their markets and customers

well. We also had significant success in the large project domain

with many market leading projects across all regions. Most notably,

the Caspian project has set the benchmark internally for a very

well-conceived and executed effort in a challenging

environment.

The vast majority of our projects were executed well and,

between them, they generated around GBP370m of gross profit in

2017. In APAC, however, where the difficult pricing and contractual

environment of the 2015/16 downturn left little project

contingency, we have underperformed our expectations notably on two

major Australian projects. Risk and opportunity management remain

an enduring focus area and we are confident that lessons learned

from all loss-making projects are being shared and absorbed around

the group.

Throughout the year we have continued to strengthen our business

unit leadership. We have appointed new leaders in a number of our

business units: Canada, Middle East, North East Europe, Case and

Brazil. We also launched our global Project Manager Academy. The

Academy will take our younger project managers to the next level in

their careers, focusing on people, commercial and technical

leadership skills.

We continued to make progress in our safety accident frequency

rate (AFR) performance, with another significant decline in the

frequency rate from 0.34 in 2016 to 0.23 in 2017. We have cut our

AFR by around 80% since the introduction of our Think Safe

programme in 2013. We received many safety accolades from customers

around the world, with one of our Australian business units winning

the Rio Tinto worldwide safety award. However, we take nothing for

granted in this domain, sadly illustrated by the tragic road

traffic accident in South Africa where 18 of our colleagues lost

their lives. We thank our whole community in South Africa for the

support and humanity they showed to all the bereaved and their

relatives in the difficult time last summer.

We said in our 2016 preliminary results announcement that we

expected to realise GBP50m of annualised total gross benefits from

the group's strategic initiatives by 2020, around half of which was

expected to be reflected as improved profitability. We broke this

down as GBP20m to come from procurement, GBP20m from operational

improvements and GBP10m from growth. Progress against this target

at the end of 2017 is set out below:

GBPm Gross benefits

-------------------------- -----------------------

2020 target Progress

to date

-------------------------- ------------ ---------

Procurement 20.0 11.3

-------------------------- ------------ ---------

Operational improvements 20.0 1.3

-------------------------- ------------ ---------

Growth 10.0 4.6

-------------------------- ------------ ---------

50.0 17.2

-------------------------- ------------ ---------

In the first year of a four year programme we have achieved

around one-third of the targeted gross benefits. We estimate that

between GBP5m and GBP7m of the benefits realised to date have

directly impacted profit and are sustainable. Of the rest, either

their sustainability is as yet unproven or they have been leveraged

to win more work, or offset by incremental investment in strategic

initiatives.

Meaningful procurement savings have been achieved from national

and regional agreements on categories as diverse as equipment

rental, IT, haulage, spares/consumables and lodging. The benefits

from operational improvements to date mainly relate to equipment

management and maintenance, as the programme to introduce lean

techniques to project sites is in its infancy. Benefits under

growth include both those from new offices and from a more

structured approach to the transfer of technology.

Divisional results - underlying

North America

2017 2016 Constant

currency

----------

GBPm GBPm

---------------------- ------ ------ ----------

Revenue 968.7 952.9 -4%

Underlying operating

profit 78.7 86.9 -14%

Underlying operating

margin 8.1% 9.1%

---------------------- ------ ------ ----------

In North America, which accounts for around half the group's

revenue, reported revenue increased by 2%, although constant

currency revenue was down 4%. Underlying operating profit was

GBP78.7m, down 14% on a constant currency basis and the underlying

operating margin decreased from 9.1% to 8.1%.

After first half 2017 constant currency revenue decreased 10%

year-on-year, the division returned to year-on-year revenue growth

in the second half. Whilst the second half profitability was lower

than in 2016, this was largely due to the impact of hurricanes

Harvey and Irma in the third quarter, which together had an

estimated negative one-off profit impact of GBP3m.

Looking forward, the year-end North American order book of work

to be undertaken over the next twelve months was 5% above last

year. This, together with the improving trend in underlying

trading, gives us confidence for 2018.

US

The US construction market as a whole remains solid, but with

significant regional and sectoral variations. Total construction

spend in the US in 2017 was up 4% on 2016, driven by residential

construction which grew by 10%. Residential construction has the

most impact on the group's Suncoast business. Elsewhere, public

expenditure on construction was down 3% year-on-year whilst private

non-residential spend was flat.

Keller's US business had a mixed year, with varying performances

across the business units. Our largest North American business,

Hayward Baker, had a very strong year, producing record results.

Its business model of undertaking a wide variety of small to medium

sized contracts across a broad range of products and geographies

across the US continues to produce good results. Following some

management changes early in 2017, there was a significant

improvement in Hayward Baker's Western region, an area which has

disappointed in the last two years.

This strong performance however was more than offset by lower

profits at both Case and HJ Foundation which, between them,

reported 2017 underlying operating profits around GBP16m down on

2016 and account for the margin decrease in North America. For HJ

Foundation, the reduction reflects a return to more normal levels

of profitability after the boom period in its home city of Miami in

2015 and 2016, which attracted a major competitor to enter the

south Florida market. Case had a very disappointing year with

revenue well down as a result of fewer large projects than in

previous years, particularly in its Chicago base, as well as some

difficult projects. Case starts 2018 with a strong order book and

performance is expected to improve in 2018.

Bencor, acquired in 2015 to give the group access to diaphragm

wall technology and expertise, had a steady 2017, continuing work

on the major remediation project at East Branch Dam. The business

is actively helping the group to bid and execute diaphragm wall

jobs outside North America. McKinney, which had a disappointing

2016, reported an improved result in 2017.

Suncoast, the group's post-tension business which mainly serves

the residential construction market, had healthy revenue growth in

2017, benefitting from the continued increase in housing starts

where it operates, particularly in its home state of Texas.

However, having benefitted from raw material price decreases in

2016, in 2017 the business faced some significant raw material

price increases which it was unable to recover from customers in

full. As a result, profits were significantly down

year-on-year.

We announced in January that the group was in discussions to

acquire Moretrench, a geotechnical contracting company operating

predominantly along the east coast of the US. Moretrench has a

strong heritage of complex geotechnical projects and, in 2016, had

revenue of US$170m, normalised operating profit of US$9.3m and

EBITDA of US$13.9m. Due diligence is ongoing and the acquisition is

expected to complete before the end of March.

Canada

Keller Canada continues to operate in a difficult market and in

June we announced changes in leadership and some further cost

saving measures. These, together with good progress on the major

C$43m subway contract in Toronto and the refocusing of the business

towards urban areas, have resulted in the business returning to

profit in the second half and for 2017 as a whole.

Europe, Middle East & Africa (EMEA)

2017 2016 Constant

currency

----------

GBPm GBPm

---------------------- ------ ------ ----------

Revenue 737.2 552.6 +26%

Underlying operating

profit 53.3 30.2 +74%

Underlying operating

margin 7.2% 5.5%

---------------------- ------ ------ ----------

In EMEA, constant currency revenue increased by 26% and

underlying constant currency operating profit increased by 74%. As

a result, the underlying operating margin improved from 5.5% to

7.2%.

This significantly higher result is largely the result of two

large projects, both of which were substantially complete at the

year-end; the Caspian project and Zayed City in Abu Dhabi. Between

them, these projects accounted for around GBP100m of revenue and

GBP30m of operating profit in 2017, and together account for most

of the year-on-year profit increase. As these are now essentially

complete, EMEA's 2018 revenue and profitability will be well down

on that achieved in 2017. The 2018 result however is still expected

to be better than that achieved in 2016, which also benefitted

significantly from the Caspian project, as a result of a healthy

order book and actual and further expected improvements in the

underlying business.

Our core businesses in central Europe all performed well,

reflecting strong project disciplines and growing construction

markets in Germany, Austria and Poland. Our South East Europe

business unit, centred around Austria, had its best ever year with

record revenue, operating profit and operating margin. These

business units have good momentum and are all also leading the way

in helping business units elsewhere in the world to expand their

product ranges, offering them significant expertise, resources and

training.

The UK had a solid year in 2017, working on a wide variety of

commercial and infrastructure projects. We have seen a notable

slowdown in orders in recent months and expect 2018 to be a

challenging year. However, the major infrastructure projects coming

up in the UK, most notably HS2, should mean that the market for

geotechnical work picks up noticeably in 2019 and 2020.

The excellent execution of the major project in the Caspian

region, currently the group's largest project, continued throughout

2017. At the year-end however, the project, which is now expected

to exceed US$200m in total, was over 90% complete.

The group had a very busy year in the Middle East, largely due

to working on two major projects; an urban development project in

Zayed City, Abu Dhabi, which is now complete, and the East Port

Said Development Complex in Egypt, which will complete in the first

half of 2018. As a result, revenue in 2017 was more than double

that in 2016 and the operating margin was healthy. There are a

number of good prospects in the region and the current challenge

for the business unit is to replenish the order book.

We have now fully integrated Tecnogeo, the business we acquired

in Brazil in 2016, with Keller's existing Brazilian operation. The

business continues to struggle in what remains a very difficult

market.

Franki Africa performed well in 2017, increasing both revenue

and profitability. The GBP40m design and build contract for a

foundation solution at the Clairwood Logistics Park development

near Durban has been an excellent example of knowledge and skill

transfer within Keller, with the project using a technique new to

the South African market. Performance is exceeding original

expectations.

The EMEA division's order book at the end of 2017, while at a

healthy level, was around 20% down on this time last year

reflecting the run off of the large projects. Excluding these,

however, the year-end order book of work to be undertaken over the

next twelve months was around 10% up year-on-year.

Asia-Pacific (APAC)

2017 2016 Constant

currency

----------

GBPm GBPm

---------------------- ------- ------- ----------

Revenue 364.7 274.5 +25%

Underlying operating

loss (16.5) (18.0) +15%

Underlying operating

margin (4.5)% (6.6)%

----------------------- ------- ------- ----------

In APAC, constant currency revenue was up 25% with significant

increases in both Asia and Australia. However the operating loss

was only slightly less than in 2016, largely as a result of two

major contracts in Australia, where adverse ground conditions,

technical issues and a contractual dispute resulted in a total loss

on these contracts of GBP14m.

We are changing our leadership of the APAC division. Peter Wyton

joined the business from AECOM in mid-February 2018 and will take

over from Mark Kliner as President of APAC with effect from 1 April

2018.

Our difficult markets in APAC are slowly recovering, with

encouraging signs of new Australian mining and infrastructure

projects. The year-end APAC order book was more than 20% above last

year which, combined with our ongoing internal improvements, means

we remain confident of a return to divisional profitability in

2018.

Australia

The Group's geotechnical business in Australia had an improved

year, with revenue significantly up on 2016. Losses were materially

reduced despite the loss making joint venture mentioned in the 2017

interim results announcement. Pricing remains challenging, but

investment in infrastructure in Australia is robust, the business

has a good order book and we are hopeful of winning some major work

on the A$11bn Melbourne Metro extension project. As a result, we

are confident that this business will return to profit in 2018.

It was a very mixed year for the near-shore marine businesses.

Waterway was already having a difficult year in a tough east coast

market, before being hit by a surprisingly negative arbitration

outcome in December in connection with a contractual dispute on a

project in New South Wales. We have subsequently negotiated a

settlement with the customer and are undertaking remedial

works.

Austral, which was acquired in 2015 and operates mainly in the

west leveraging good relationships with major mining groups, had an

improved year and has been very busy bidding work in recent months

as investment in the resources industry returns. The business has

an excellent order book and is poised for a strong 2018.

Asia

Revenue in ASEAN was broadly flat year-on-year, with a

significant increase in Malaysia as a result of an improving market

and our introduction of new products, offset by a significant

decrease in Singapore following the substantial downsizing of the

piling business.

The ASEAN business was still loss-making in 2017, but at a lower

level than in 2016. The business continued to be challenged by a

very difficult pricing environment for heavy foundations projects,

some legacy Resource Piling contracts and additional costs and

teething problems associated with introducing new products. On the

positive side, project execution improved significantly in the

second half. The ground improvement side of the business was

profitable, helped by the successful large vibro-compaction

contract at Changi airport.

Keller India performed well in 2017. Revenue doubled, the

operating margin increased and the business continues to build its

structure and capabilities to enable it to grow further and

continue to introduce new products.

Other financial items

Non-underlying items

Non-underlying items before taxation totalled a credit of

GBP11.9m in 2017. These comprise:

Amortisation: GBP9.0m of amortisation of acquired intangible

assets (2016: GBP9.7m).

Exceptional contract dispute: A GBP21.0.m credit as a further

part reversal of a GBP54.0m exceptional charge taken in 2014 for a

contract dispute relating to a UK project completed in 2008. The

project was in connection with the construction of a major

warehouse and processing facility in Avonmouth, near Bristol.

As previously announced, the group acquired the relevant

property in May 2016 pursuant to the dispute settlement agreement

for GBP62.0m and subsequently sold it for the same amount in 2017.

The property was held on the group's 2016 balance sheet as a

non-current asset held for sale at a value of GBP54.0m. The sale

therefore realised an exceptional profit before costs of

GBP8.0m.

In addition, the group received GBP11.7m of insurance proceeds

in respect of this dispute in 2017.

As noted at the time, the original provision was expected to be

reduced by future insurance recoveries and the sale of the

property. Taking account of credits in both 2016 and 2017, the

group has recovered GBP35.3m of the original GBP54.0m provision. No

significant further recoveries are expected.

Other: A net credit of GBP0.6m (2016: GBP0.3m) relating to

changes in estimated contingent consideration payable in respect of

recent acquisitions, offset by finance charges of GBP0.7m.

Interest

Underlying net finance costs were GBP10.0m (2016: GBP10.2m).

Although net debt has declined over the course of 2017, average net

borrowings during the year were consistent with 2016. Statutory net

finance costs reduced from GBP11.3m in 2016 to GBP10.7m in

2017.

Tax

The group's underlying effective tax rate was 25.0%, a

significant reduction on the 2016 effective rate of 35.0%. This is

mainly attributable to a GBP9.7m non-cash credit as a result of the

revaluation of US deferred tax liabilities following the recent US

tax reforms, as well as, to a lesser extent, a lower proportion of

the group's profit before tax being earned in the US.

A non-underlying tax credit of GBP1.6m has been recognised,

representing the net tax impact of the 2017 non-underlying

items.

Cash flow and financing

In 2017, underlying cash generated from operations was GBP136.1m

(2016: GBP135.7m), representing 77% (2016: 86%) of EBITDA. The 2017

cash conversion is below that of previous years as a result of

constant currency fourth quarter revenue being 16% up on the

equivalent period in 2016, leading to higher levels of working

capital at the year-end, and an increased value of inventory at

Suncoast following steel price increases in the year. Historically,

the group has an excellent record of converting profits into cash,

with the aggregate of the last 10 years' of cash generated from

operations representing 96% of EBITDA (2016: 98%).

Net underlying capital expenditure totalled GBP74.5m (2016:

GBP73.0m), compared to depreciation and amortisation of GBP68.5m.

The group continues to invest in transferring technologies into new

geographies and to upgrade the equipment fleet.

At 31 December 2017, net debt amounted to GBP229.5m (2016:

GBP305.6m). The decrease in net debt is explained as follows:

GBPm

---------------------------- --------

Net debt at 1 January

2017 (305.6)

---------------------------- --------

Free cash flow 23.4

---------------------------- --------

Dividends (21.2)

---------------------------- --------

Foreign exchange movements 7.8

---------------------------- --------

Non-underlying items 72.6

---------------------------- --------

Acquisitions (6.5)

---------------------------- --------

Net debt at 31 December

2017 (229.5)

---------------------------- --------

Net debt represents 1.3x underlying EBITDA on a headline basis

or 1.5x calculated on a covenant basis, well within the covenant

limit of 3.0x.

Consolidated income statement

For the year ended 31 December 2017

2017 2016

--------------- --------------- ----------- --------------- --------------- -----------

Before Non-underlying Before Non-underlying

non-underlying items non-underlying items

items (note Statutory items (note Statutory

Note GBPm 5) GBPm GBPm 5) GBPm

GBPm GBPm

----------------- ------- --------------- --------------- ----------- --------------- --------------- -----------

Revenue 3 2,070.6 - 2,070.6 1,780.0 - 1,780.0

Operating costs (1,961.9) (1.6) (1,963.5) (1,684.7) (18.9) (1,703.6)

Amortisation of

acquired

intangible

assets - (9.0) (9.0) - (9.7) (9.7)

Other operating

income - 23.2 23.2 - 18.5 18.5

----------------- ------- --------------- --------------- ----------- --------------- --------------- -----------

Operating profit 3 108.7 12.6 121.3 95.3 (10.1) 85.2

Finance income 3.8 - 3.8 1.6 - 1.6

Finance costs (13.8) (0.7) (14.5) (11.8) (1.1) (12.9)

----------------- ------- --------------- --------------- ----------- --------------- --------------- -----------

Profit before

taxation 98.7 11.9 110.6 85.1 (11.2) 73.9

Taxation (24.7) 1.6 (23.1) (29.8) 3.9 (25.9)

----------------- -----------

Profit for the

period 74.0 13.5 87.5 55.3 (7.3) 48.0

----------------- ------- --------------- --------------- ----------- --------------- --------------- -----------

Attributable to:

Equity holders

of the parent 73.6 13.5 87.1 54.5 (7.3) 47.2

Non-controlling

interests 0.4 - 0.4 0.8 - 0.8

----------------- ------- --------------- --------------- ----------- --------------- --------------- -----------

74.0 13.5 87.5 55.3 (7.3) 48.0

----------------- ------- --------------- --------------- ----------- --------------- --------------- -----------

Earnings per

share

Basic 7 102.2p 121.0p 75.9p 65.7p

Diluted 7 101.8p 120.5p 74.8p 64.7p

----------------- ------- --------------- --------------- ----------- --------------- --------------- -----------

Consolidated statement of comprehensive income

For the year ended 31 December 2017

2017 2016

GBPm GBPm

------------------------------------------------- ------ -----

Profit for the period 87.5 48.0

-------------------------------------------------- ------ -----

Other comprehensive income

Items that may be reclassified subsequently

to profit or loss:

Exchange differences on translation of

foreign operations (27.0) 77.0

Net investment hedge losses (0.7) (3.8)

Cash flow hedge (losses)/gains taken to

equity (3.3) 1.9

Cash flow hedge transfers to income statement 3.4 (1.9)

Items that will not be reclassified subsequently

to profit or loss:

Remeasurements of defined benefit pension

schemes 1.4 (7.4)

Tax on remeasurements of defined benefit

pension schemes (0.3) 1.3

-------------------------------------------------- ------ -----

Other comprehensive (loss)/income for

the period, net of tax (26.5) 67.1

-------------------------------------------------- ------ -----

Total comprehensive income for the period 61.0 115.1

-------------------------------------------------- ------ -----

Attributable to:

Equity holders of the parent 61.0 113.7

Non-controlling interests - 1.4

-------------------------------------------------- ------ -----

61.0 115.1

------------------------------------------------- ------ -----

Consolidated balance sheet

As at 31 December 2017

2017 2016

Note GBPm GBPm

-------------------------------------- ---- ------- -------

Assets

Non-current assets

Intangible assets 170.9 188.0

Property, plant and equipment 399.2 405.6

Deferred tax assets 39.3 21.6

Other assets 27.4 30.2

-------------------------------------- ---- ------- -------

636.8 645.4

Current assets

Inventories 72.6 59.4

Trade and other receivables 589.2 528.5

Current tax assets 18.7 18.2

Cash and cash equivalents 67.7 84.4

-------------------------------------- ---- ------- -------

748.2 690.5

Non-current assets held for sale 9 - 54.0

Total assets 3 1,385.0 1,389.9

-------------------------------------- ---- ------- -------

Liabilities

Current liabilities

Loans and borrowings (48.3) (54.0)

Current tax liabilities (19.1) (16.4)

Trade and other payables (480.5) (435.4)

Provisions (10.3) (9.9)

-------------------------------------- ---- ------- -------

(558.2) (515.7)

-------------------------------------- ---- ------- -------

Non-current liabilities

Loans and borrowings (248.9) (336.0)

Retirement benefit liabilities (29.2) (31.4)

Deferred tax liabilities (45.5) (33.5)

Provisions (13.0) (14.7)

Other liabilities (18.0) (29.0)

-------------------------------------- ---- ------- -------

(354.6) (444.6)

-------------------------------------- ---- ------- -------

Total liabilities 3 (912.8) (960.3)

-------------------------------------- ---- ------- -------

Net assets 3 472.2 429.6

-------------------------------------- ---- ------- -------

Equity

Share capital 8 7.3 7.3

Share premium account 38.1 38.1

Capital redemption reserve 8 7.6 7.6

Translation reserve 32.5 59.8

Other reserve 8 56.9 56.9

Hedging reserve - (0.1)

Retained earnings 326.0 255.8

-------------------------------------- ---- ------- -------

Equity attributable to equity holders

of the parent 468.4 425.4

Non-controlling interests 3.8 4.2

-------------------------------------- ---- ------- -------

Total equity 472.2 429.6

-------------------------------------- ---- ------- -------

Consolidated statement of changes in equity

For the year ended 31 December 2017

Attributable

to equity

holders

Share Capital of Non-

Share premium redemption Translation Other Hedging Retained the controlling Total

capital account reserve reserve reserve reserve earnings parent interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------- ------- ------- ---------- ----------- ------- ------- -------- ------------ ----------- -------

At 1 January

2016 7.3 38.1 7.6 (12.8) 56.9 (0.1) 233.5 330.5 3.5 334.0

Profit for the

period - - - - - - 47.2 47.2 0.8 48.0

--------------- ------- ------- ---------- ----------- ------- ------- -------- ------------ ----------- -------

Other

comprehensive

income

Exchange

differences

on translation

of foreign

operations - - - 76.4 - - - 76.4 0.6 77.0

Net investment

hedge losses - - - (3.8) - - - (3.8) - (3.8)

Cash flow hedge

gains taken to

equity - - - - - 1.9 - 1.9 - 1.9

Cash flow hedge

transfers to

income

statement - - - - - (1.9) - (1.9) - (1.9)

Remeasurements

of defined

benefit

pension

schemes - - - - - - (7.4) (7.4) - (7.4)

Tax on

remeasurements

of defined

benefit

pension

schemes - - - - - - 1.3 1.3 - 1.3

--------------- ------- ------- ---------- ----------- ------- ------- -------- ------------ ----------- -------

Other

comprehensive

income/(loss)

for the

period,

net of tax - - - 72.6 - - (6.1) 66.5 0.6 67.1

--------------- ------- ------- ---------- ----------- ------- ------- -------- ------------ ----------- -------

Total

comprehensive

income for the

period - - - 72.6 - - 41.1 113.7 1.4 115.1

Dividends - - - - - - (19.8) (19.8) (0.7) (20.5)

Share-based

payments - - - - - - 1.0 1.0 - 1.0

At 31 December

2016 and 1

January

2017 7.3 38.1 7.6 59.8 56.9 (0.1) 255.8 425.4 4.2 429.6

Profit for the

period - - - - - - 87.1 87.1 0.4 87.5

--------------- ------- ------- ---------- ----------- ------- ------- -------- ------------ ----------- -------

Other

comprehensive

income

Exchange

differences

on translation

of foreign

operations - - - (26.6) - - - (26.6) (0.4) (27.0)

Net investment

hedge losses - - - (0.7) - - - (0.7) - (0.7)

Cash flow hedge

losses taken

to

equity - - - - - (3.3) - (3.3) - (3.3)

Cash flow hedge

transfers to

income

statement - - - - - 3.4 - 3.4 - 3.4

Remeasurements

of defined

benefit

pension

schemes - - - - - - 1.4 1.4 - 1.4

Tax on

remeasurements

of defined

benefit

pension

schemes - - - - - - (0.3) (0.3) - (0.3)

--------------- ------- ------- ---------- ----------- ------- ------- -------- ------------ ----------- -------

Other

comprehensive

(loss)/income

for the

period,

net of tax - - - (27.3) - 0.1 1.1 (26.1) (0.4) (26.5)

--------------- ------- ------- ---------- ----------- ------- ------- -------- ------------ ----------- -------

Total

comprehensive

(loss)/income

for the period - - - (27.3) - 0.1 88.2 61.0 - 61.0

Dividends - - - - - - (20.8) (20.8) (0.4) (21.2)

Share-based

payments - - - - - - 2.8 2.8 - 2.8

--------------- ------- ------- ---------- ----------- ------- ------- -------- ------------ ----------- -------

At 31 December

2017 7.3 38.1 7.6 32.5 56.9 - 326.0 468.4 3.8 472.2

--------------- ------- ------- ---------- ----------- ------- ------- -------- ------------ ----------- -------

Consolidated cash flow statement

For the year ended 31 December 2017

2017 2016

Note GBPm GBPm

---------------------------------------------- ---- ------- -------

Cash flows from operating activities

Operating profit before non-underlying

items 108.7 95.3

Depreciation of property, plant and equipment 67.3 62.0

Amortisation of intangible assets 1.2 1.3

(Profit)/loss on sale of property, plant

and equipment (4.0) 2.3

Other non-cash movements 9.5 (5.2)

Foreign exchange losses 0.2 0.3

---------------------------------------------- ---- ------- -------

Operating cash flows before movements

in working capital 182.9 156.0

Increase in inventories (15.7) (3.1)

Increase in trade and other receivables (79.1) (7.4)

Increase/(decrease) in trade and other

payables 53.9 (2.7)

Change in provisions, retirement benefit

and other non-current liabilities (5.9) (7.1)

---------------------------------------------- ---- ------- -------

Cash generated from operations before

non-underlying items 136.1 135.7

Cash inflows from non-underlying items 12.7 9.0

Cash outflows from non-underlying items (2.1) (4.1)

---------------------------------------------- ---- ------- -------

Cash generated from operations 146.7 140.6

Interest paid (12.9) (12.3)

Income tax paid (26.0) (25.3)

---------------------------------------------- ---- ------- -------

Net cash inflow from operating activities 107.8 103.0

---------------------------------------------- ---- ------- -------

Cash flows from investing activities

Interest received 0.7 0.7

Proceeds from sale of property, plant

and equipment 10.5 5.8

Acquisition of subsidiaries, net of cash

acquired (6.5) (14.6)

Acquisition of property, plant and equipment (84.2) (78.2)

Disposal/(acquisition) of non-current

assets held for sale 9 62.0 (62.0)

Acquisition of intangible assets (0.8) (0.6)

---------------------------------------------- ---- ------- -------

Net cash outflow from investing activities (18.3) (148.9)

---------------------------------------------- ---- ------- -------

Cash flows from financing activities

New borrowings 41.6 103.1

Repayment of borrowings (135.7) (4.2)

Cash flows from derivative instruments 0.2 (28.0)

Payment of finance lease liabilities (1.5) (2.9)

Dividends paid (21.2) (20.5)

---------------------------------------------- ---- ------- -------

Net cash (outflow)/inflow from financing

activities (116.6) 47.5

---------------------------------------------- ---- ------- -------

Net (decrease)/increase in cash and cash

equivalents (27.1) 1.6

Cash and cash equivalents at beginning

of period 84.0 62.9

Effect of exchange rate fluctuations (5.6) 19.5

---------------------------------------------- ---- ------- -------

Cash and cash equivalents at end of period 51.3 84.0

---------------------------------------------- ---- ------- -------

1. Basis of preparation

The group's 2017 results have been prepared in accordance with

International Financial Reporting Standards ('IFRS') as adopted by

the EU.

The same accounting policies and presentation are followed in

the financial statements that were applied in the preparation of

the Company's published consolidated financial statements for the

year ended 31 December 2016, except for the adoption of:

- Amendments to IAS 12 - Recognition of Deferred Tax Assets for Unrealised Losses

- Amendments to IAS 7 - Disclosure Initiative

There is no significant impact on the group financial statements

as a result of adopting these amendments.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2017

or 2016 but is derived from the 2017 accounts. Statutory accounts

for 2016 have been delivered to the Registrar of Companies. Those

for 2017, prepared under IFRS as adopted by the EU, will be

delivered to the Registrar of Companies and made available on the

Company's website at www.keller.com in March 2018. The auditors

have reported on those accounts; their reports were (i)

unqualified, (ii) did not include references to any matters to

which the auditors drew attention by way of emphasis without

qualifying their reports and (iii) did not contain statements under

section 498(2) or (3) of the Companies Act 2006.

2. Foreign currencies

The exchange rates used in respect of principal currencies

are:

Average Period

for period end

------------------- -------------- ------------

2017 2016 2017 2016

------------------- ------ ------ ----- -----

US dollar 1.29 1.36 1.35 1.23

Canadian dollar 1.67 1.80 1.69 1.66

Euro 1.14 1.22 1.13 1.17

Singapore dollar 1.78 1.87 1.80 1.78

Australian dollar 1.68 1.82 1.73 1.71

------------------- ------ ------ ----- -----

3. Segmental analysis

The group is managed as three geographical divisions and has

only one major product or service: specialist ground engineering

services. This is reflected in the group's management structure and

in the segment information reviewed by the Chief Operating Decision

Maker.

2017 2017 2016 2016

Operating Operating

Revenue profit Revenue profit

GBPm GBPm GBPm GBPm

-------------------------------- --------- ----------- --------- -----------

North America 968.7 78.7 952.9 86.9

EMEA(1) 737.2 53.3 552.6 30.2

APAC(2) 364.7 (16.5) 274.5 (18.0)

2,070.6 115.5 1,780.0 99.1

Central items and eliminations - (6.8) - (3.8)

-------------------------------- --------- ----------- --------- -----------

Before non-underlying items 2,070.6 108.7 1,780.0 95.3

Non-underlying items (note 5) - 12.6 - (10.1)

-------------------------------- --------- ----------- --------- -----------

2,070.6 121.3 1,780.0 85.2

-------------------------------- --------- ----------- --------- -----------

2017 2017 2017 2017 2017 2017

Tangible

Depreciation and

Segment Segment Capital Capital and intangible

assets liabilities employed additions amortisation assets

GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------------- --------- ------------- ---------- ----------- -------------- ------------

North America 582.0 (185.3) 396.7 24.0 27.8 263.6

EMEA(1) 408.6 (249.7) 158.9 45.7 23.9 185.3

APAC(2) 261.7 (97.5) 164.2 15.3 16.7 120.7

1,252.3 (532.5) 719.8 85.0 68.4 569.6

Central items and eliminations(3) 132.7 (380.3) (247.6) - 0.1 0.5

----------------------------------- --------- ------------- ---------- ----------- -------------- ------------

1,385.0 (912.8) 472.2 85.0 68.5 570.1

----------------------------------- --------- ------------- ---------- ----------- -------------- ------------

2016 2016 2016 2016 2016 2016

Tangible

Depreciation and

Segment Segment Capital Capital and intangible

assets liabilities employed additions amortisation assets

GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------------- --------- ------------- ---------- ----------- -------------- ------------

North America 612.1 (206.1) 406.0 33.3 24.7 294.8

EMEA(1) 413.7 (213.3) 200.4 33.0 20.7 174.6

APAC(2) 229.3 (85.2) 144.1 12.3 17.8 123.6

1,255.1 (504.6) 750.5 78.6 63.2 593.0

Central items and eliminations(3) 134.8 (455.7) (320.9) 0.2 0.1 0.6

----------------------------------- --------- ------------- ---------- ----------- -------------- ------------

1,389.9 (960.3) 429.6 78.8 63.3 593.6

----------------------------------- --------- ------------- ---------- ----------- -------------- ------------

(1 Europe, Middle East and Africa.)

(2 Asia-Pacific.)

(3 Central items include net debt and tax balances.)

Revenue and non-current non-financial assets are analysed by

country below:

Non-current

non-financial

Revenue assets(4)

------------------ -----------------

2017 2016 2017 2016

GBPm GBPm GBPm GBPm

-------------------------------------- -------- -------- -------- -------

United States 886.6 870.3 225.7 245.8

Australia 238.7 171.0 73.7 73.5

Germany 95.9 82.7 32.1 42.7

Canada 80.2 80.1 59.4 69.3

United Kingdom (country of domicile) 61.2 64.7 22.4 23.7

Other 708.0 511.2 181.8 158.9

-------------------------------------- -------- -------- -------- ---------

2,070.6 1,780.0 595.1 613.9

-------------------------------------- -------- -------- -------- ---------

(4 Non-current non-financial assets comprise intangible assets,

property, plant and equipment and other non-current non-financial

assets.)

4. Acquisitions

2017 acquisitions

On 6 March 2017, the group acquired the assets and liabilities

of Geo Instruments, an instrumentation and monitoring company based

in North America, for cash consideration of GBP2.8m ($3.6m). The

purchase price is a premium of GBP0.5m ($0.7m) to the fair value of

the net assets acquired. This goodwill is attributable to the

knowledge and expertise of the assembled workforce, the expectation

of future contracts and customer relationships and the operating

synergies that arise from the group's strengthened market

position.

In the period to 31 December 2017, Geo Instruments contributed

GBP3.4m to revenue and a profit for the period of GBP0.4m. Had the

acquisition taken place on 1 January 2017, total group turnover

would have been GBP2,071.3m and total profit for the period before

non-underlying items would have been GBP74.1m.

The adjustments made in respect of acquisitions in the year to

31 December 2017 are provisional and will be finalised within 12

months of the acquisition date.

2016 acquisitions

Tecnogeo

--------------------------------

Carrying Fair Fair

amount value value

adjustment

GBPm GBPm GBPm

------------------------------- --------- ------------ -------

Net assets acquired

Intangible assets - 0.8 0.8

Property, plant and equipment 6.8 - 6.8

Cash and cash equivalents 1.2 - 1.2

Receivables 4.2 (0.7) 3.5

Other assets 0.3 - 0.3

Loans and borrowings (1.8) - (1.8)

Deferred tax - (0.3) (0.3)

Other liabilities (1.5) (2.2) (3.7)

------------------------------- --------- ------------ -------

9.2 (2.4) 6.8

Goodwill 6.6

------------------------------- --------- ------------ -------

Total consideration 13.4

------------------------------- --------- ------------ -------

Satisfied by

Initial cash consideration 12.8

Contingent consideration 0.6

------------------------------- --------- ------------ -------

13.4

------------------------------- --------- ------------ -------

On 29 February 2016, the group acquired 100% of the share

capital of the Tecnogeo group of companies, a business based in Sao

Paulo, Brazil, for an initial cash consideration of GBP12.8m (BRL

60.8m). The fair value of the intangible assets acquired represents

the fair value of customer contracts at the date of acquisition and

the trade name. Goodwill arising on acquisition is attributable to

the knowledge and expertise of the assembled workforce, the

expectation of future contracts and customer relationships and the

operating synergies that arise from the group's strengthened market

position.

On 4 April 2016, the group acquired assets and certain

liabilities of Smithbridge Group Pty Limited, a business based in

Brisbane, Australia, for an initial cash consideration of GBP1.8m

(A$3.4m). The purchase price reflects the fair value of the assets

and liabilities acquired.

5. Non-underlying items

Non-underlying items include items which are exceptional by

their size or are non-trading in nature and comprise the

following:

2017 2016

GBPm GBPm

----------------------------------------------- -------- ---------

Amortisation of acquired intangible assets (9.0) (9.7)

Exceptional restructuring costs - (14.3)

Contingent consideration: additional amounts

provided (1.6) (3.9)

Acquisition costs - (0.7)

Non-underlying items in operating costs (1.6) (18.9)

Exceptional contract dispute 21.0 14.3

Contingent consideration: provision released 2.2 4.2

----------------------------------------------- -------- ---------

Non-underlying items in other operating income 23.2 18.5

Total non-underlying items in operating profit 12.6 (10.1)

Non-underlying finance costs (0.7) (1.1)

----------------------------------------------- -------- ---------

Total non-underlying items before taxation 11.9 (11.2)

----------------------------------------------- -------- ---------

Amortisation of acquired intangible assets primarily relate to

Keller Canada, Austral, Bencor and Franki Africa.

Additional contingent consideration provided relates to the

Geo-Foundations and Ellington Cross acquisitions.

The GBP21.0m exceptional profit relating to the contract dispute

represents the gain on disposal of the freehold of the processing

and warehousing facility at Avonmouth, near Bristol, acquired in

2016 (note 9), rental income less operating costs to the date of

disposal and insurance recoveries in the period. The GBP14.3m

exceptional profit in 2016 relating to the contract dispute is

attributable to insurance proceeds received after an initial

settlement with insurers, rental income less operating costs from

the acquired processing and warehousing facility and the reversal

of impairment of the valuation of the property following an

external valuation at 31 December 2016.

Contingent consideration released relates to adjustments to

estimated amounts payable for the Austral and Ansah

acquisitions.

The GBP14.3m exceptional restructuring charge in 2016 relates to

asset write downs, redundancy costs and other reorganisation

charges in markets experiencing significantly depressed trading

conditions (Singapore, Australia, Canada and South Africa). This

includes the write-down of surplus equipment to current market

values where it is not being relocated to more active parts of the

group.

6. Dividends payable to equity holders of the parent

Ordinary dividends on equity shares:

2017 2016

GBPm GBPm

------------------------------------------------- ----- -----

Amounts recognised as distributions to equity

holders in the period:

Final dividend for the year ended 31 December

2016 of 19.25p (2015: 18.3p) per share 13.8 13.1

Interim dividend for the year ended 31 December

2017 of 9.7p (2016: 9.25p) per share 7.0 6.7

20.8 19.8

------------------------------------------------- ----- -----

The Board has recommended a final dividend for the year ended 31

December 2017 of GBP17.6m, representing 24.5p (2016: 19.25p) per

share. The proposed dividend is subject to approval by shareholders

at the AGM on 23 May 2018 and has not been included as a liability

in these financial statements.

7. Earnings per share

Basic and diluted earnings per share are calculated as

follows:

Earnings attributable Earnings attributable

to equity to equity

holders of holders of

the parent the parent

before non-underlying

items

---------------------------------- ------------------------- ------------------------

2017 2016 2017 2016

---------------------------------- ------------- ---------- ------------ ----------

Basic and diluted earnings

(GBPm) 73.6 54.5 87.1 47.2

---------------------------------- ------------- ---------- ------------ ----------

Weighted average number of

shares (million)

Basic number of ordinary shares

outstanding 72.0 71.8 72.0 71.8

Effect of dilutive potential

ordinary shares:

Share options and awards 0.3 1.1 0.3 1.1

---------------------------------- ------------- ---------- ------------ ----------

Diluted number of ordinary

shares outstanding 72.3 72.9 72.3 72.9

---------------------------------- ------------- ---------- ------------ ----------

Earnings per share

Basic earnings per share (pence) 102.2 75.9 121.0 65.7

Diluted earnings per share

(pence) 101.8 74.8 120.5 64.7

---------------------------------- ------------- ---------- ------------ ----------

8. Share capital and reserves

2017 2016

GBPm GBPm

------------------------------------------------- ------ ------

Allotted, called up and fully paid

Equity share capital:

73,099,735 ordinary shares of 10p each (2016:

73,099,735) 7.3 7.3

------------------------------------------------- ------ ------

The Company has one class of ordinary shares, which carries no

rights to fixed income. There are no restrictions on the transfer

of these shares.

The capital redemption reserve is a non-distributable reserve

created when the Company's shares were redeemed or purchased other

than from the proceeds of a fresh issue of shares.

The other reserve is a non-distributable reserve created when

merger relief was applied to an issue of shares under section 612

of the Companies Act 2006 to part fund the acquisition of Keller

Canada. The reserve becomes distributable should Keller Canada be

disposed of.

The total number of shares held in Treasury was 1.1m (2016:

1.1m).

9. Non-current assets held for sale

On 12 May 2016, the group acquired the freehold of a processing

and warehousing facility at Avonmouth, near Bristol, for a

consideration of GBP62m. As set out in the 2015 Annual Report and

Accounts, the group's final liability with regards to the historic

contract dispute involving the property was in part dependent on

the value of the property. In order to maximise this value, the

group decided to acquire the property with a view to marketing it

to third parties.

In accordance with IFRS 5, the property was being held at the

lower of carrying amount and fair value less costs to sell. At 30

June 2016, the fair value of the property was GBP48m, based on an

external valuation. The property was impaired by GBP14m at 30 June

2016, however the group previously held a GBP14m provision for the

diminution in value of the property as part of the overall contract

dispute provision, and therefore no additional impairment charge

was recognised. At 31 December 2016, the fair value of the property

based on an external valuation was GBP54m. The GBP6m reversal of

impairment was recognised in 2016 as exceptional other operating

income (note 5).

On 11 May 2017, the group disposed of the property for a

consideration of GBP62m. The GBP8m gain on disposal has been

recognised as an exceptional item within other operating income in

the period (note 5).

10. Related party transactions

Transactions between the parent, its subsidiaries and joint

operations, which are related parties, have been eliminated on

consolidation.

11. Post balance sheet events

There were no material post balance sheet events between the

balance sheet date and the date of this report.

Adjusted performance measures

The group's results as reported under International Financial

Reporting Standards (IFRS) and presented in the financial

statements (the "statutory results") are significantly impacted by

movements in exchange rates relative to sterling, as well as by

exceptional items and non-trading amounts relating to

acquisitions.

As a result, adjusted performance measures have been used

throughout this report to describe the group's underlying

performance. The Board and Executive Committee use these adjusted

measures to assess the performance of the business because they

consider them more representative of the underlying ongoing trading

result and allow more meaningful comparison to prior year.

Underlying measures

The term "underlying" excludes the impact of items which are

exceptional by their size or are non-trading in nature, including

amortisation of acquired intangible assets and other non-trading

amounts relating to acquisitions (collectively "non-underlying

items"), net of any associated tax. Underlying measures allow

management and investors to compare performance without the

potentially distorting effects of one-off items or non-trading

items. Non-underlying items are disclosed separately in the

financial statements where it is necessary to do so to provide

further understanding of the financial performance of the

group.

Constant currency measures

The constant currency basis ("constant currency") adjusts the

comparative to exclude the impact of movements in exchange rates

relative to sterling. This is achieved by retranslating the 2016

results of overseas operations into sterling at the 2017 average

exchange rates.

A reconciliation between the underlying results and the reported

statutory results is shown on the face of the consolidated income

statement, with non-underlying items detailed in note 5. A

reconciliation between the 2016 underlying result to the 2016

constant currency result is shown below and compared to the

underlying 2017 performance:

Revenue by segment

Impact

of exchange Constant Constant

Statutory Statutory movements currency Statutory currency

2017 2016 2016 2016 change change

GBPm GBPm GBPm GBPm % %

--------------- ---------- ---------- ------------- ---------- ---------- ----------

North America 968.7 952.9 53.7 1,006.6 +2% -4%

EMEA 737.2 552.6 34.2 586.8 +33% +26%

APAC 364.7 274.5 18.1 292.6 +33% +25%

--------------- ---------- ---------- ------------- ---------- ---------- ----------

Group 2,070.6 1,780.0 106.0 1,886.0 +16% +10%

--------------- ---------- ---------- ------------- ---------- ---------- ----------

Underlying operating profit by segment

Impact

of exchange Constant Constant

Underlying Underlying movements currency Underlying currency

2017 2016 2016 2016 change change

GBPm GBPm GBPm GBPm % %

------------------- ----------- ----------- ------------- ---------- ----------- ----------

North America 78.7 86.9 4.3 91.2 -9% -14%

EMEA 53.3 30.2 0.5 30.7 +76% +74%

APAC (16.5) (18.0) (1.3) (19.3) +8% +15%

Central items

and eliminations (6.8) (3.8) - (3.8) -79% -79%

------------------- ----------- ----------- ------------- ---------- ----------- ----------

Group 108.7 95.3 3.5 98.8 +14% +10%

------------------- ----------- ----------- ------------- ---------- ----------- ----------

Underlying operating margin

Underlying operating margin is underlying operating profit as a

percentage of revenue.

Other adjusted measures

Where not presented and reconciled on the face of the

consolidated income statement, consolidated balance sheet or

consolidated cash flow statement, the adjusted measures are

reconciled to the IFRS statutory numbers below:

EBITDA

2017 2016

GBPm GBPm

----------------------------------------- ------ -------

Operating profit before non-underlying

items 108.7 95.3

Depreciation of property, plant and

equipment 67.3 62.0

Amortisation of intangible assets 1.2 1.3

----------------------------------------- ------ -------

Underlying EBITDA 177.2 158.6

Non-underlying items in operating

costs (1.6) (18.9)

Non-underlying items in other operating

income 23.2 18.5

----------------------------------------- ------ -------

EBITDA 198.8 158.2

----------------------------------------- ------ -------

Net finance costs

2017 2016

GBPm GBPm

------------------------------------- ------ ------

Finance income (3.8) (1.6)

Finance costs before non-underlying

items 13.8 11.8

------------------------------------- ------ ------

Underlying net finance costs 10.0 10.2

Non-underlying finance costs 0.7 1.1

------------------------------------- ------ ------

Net finance costs 10.7 11.3

------------------------------------- ------ ------

Net capital expenditure

2017 2016

GBPm GBPm

--------------------------------------- ------- ------

Acquisition of property, plant and

equipment 84.2 78.2

Acquisition of intangible assets 0.8 0.6

Proceeds from sale of property, plant

and equipment (10.5) (5.8)

--------------------------------------- ------- ------

Net capital expenditure 74.5 73.0

--------------------------------------- ------- ------

Net debt

2017 2016

GBPm GBPm

---------------------------------- ------- -------

Current loans and borrowings 48.3 54.0

Non-current loans and borrowings 248.9 336.0

Cash and cash equivalents (67.7) (84.4)

---------------------------------- ------- -------

Net debt 229.5 305.6

---------------------------------- ------- -------

Order book

The group's disclosure of its order book is aimed to provide

insight into its backlog of work and future performance. The

group's order book is not a measure of past performance and

therefore cannot be derived from its financial statements. The

group's order book comprises the unexecuted elements of orders on

contracts that have been awarded. Where a contract is subject to

variations, only secured variations are included in the reported

order book.

For further information, please contact:

Keller Group plc www.keller.com

James Hind, Finance Director

Victoria Huxster, Head of

Investor Relations 020 7616 7575

Finsbury

Gordon Simpson

James Kavanagh 020 7251 3801

A presentation for analysts will be held at 9.30am at

The Great Hall, One Moorgate Place - Chartered Accountants

Hall,

1 Moorgate Place, London EC2R 6EA

A live webcast will be available from 9.30am and, on demand,

from 2.00pm at

http://www.investis-live.com/keller/5a61ec8f4799cb1300a0a374/yrhy

Notes to editors:

Keller is the world's largest geotechnical contractor, providing

technically advanced geotechnical solutions to the construction

industry. With annual revenue of around GBP2.0bn, Keller has

approximately 10,000 staff world-wide.

Keller is the clear market leader in the US, Canada, Australia

and South Africa; it has prime positions in most established

European markets and a strong profile in many developing

markets.

Cautionary statements:

This document contains certain 'forward looking statements' with

respect to Keller's financial condition, results of operations and

business and certain of Keller's plans and objectives with respect

to these items.

Forward looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

'anticipates', 'aims', 'due', 'could', 'may', 'should', 'expects',

'believes', 'intends', 'plans', 'potential', 'reasonably possible',

'targets', 'goal' or 'estimates'. By their very nature

forward-looking statements are inherently unpredictable,

speculative and involve risk and uncertainty because they relate to

events and depend on circumstances that will occur in the

future.

There are a number of factors that could cause actual results

and developments to differ materially from those expressed or

implied by these forward-looking statements. These factors include,

but are not limited to, changes in the economies and markets in

which the group operates; changes in the regulatory and competition

frameworks in which the group operates; the impact of legal or

other proceedings against or which affect the group; and changes in

interest and exchange rates.

All written or verbal forward looking statements, made in this

document or made subsequently, which are attributable to Keller or

any other member of the group or persons acting on their behalf are

expressly qualified in their entirety by the factors referred to

above. Keller does not intend to update these forward looking

statements.

Nothing in this document should be regarded as a profits

forecast.

This document is not an offer to sell, exchange or transfer any

securities of Keller Group plc or any of its subsidiaries and is

not soliciting an offer to purchase, exchange or transfer such

securities in any jurisdiction. Securities may not be offered, sold

or transferred in the United States absent registration or an

applicable exemption from the registration requirements of the US

Securities Act of 1933 (as amended).

LEI number: 549300QO4MBL43UHSN10

Classification: 1.1 (Annual financial and audit reports)

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EALADASEPEFF

(END) Dow Jones Newswires

February 26, 2018 02:00 ET (07:00 GMT)

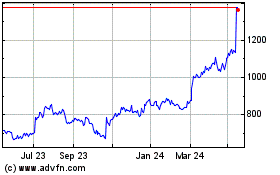

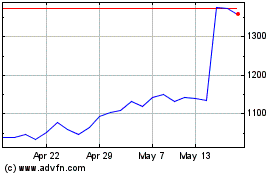

Keller (LSE:KLR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Keller (LSE:KLR)

Historical Stock Chart

From Nov 2023 to Nov 2024