Annual Financial Report (0647A)

March 26 2012 - 6:22AM

UK Regulatory

TIDMKLR

RNS Number : 0647A

Keller Group PLC

26 March 2012

Keller Group plc

26 March 2012

Keller Group plc ("the Company") - Annual Financial Report

In accordance with the Listing Rules, copies of the following

documents have been submitted to the National Storage

Mechanism:

-- Annual report and accounts 2011 (incorporating the notice of annual general meeting 2012)

-- Form of Proxy

These documents will shortly be available for inspection at the

National Storage Mechanism at www.hemscott.com/nsm.do.

The annual report and accounts for the year ended 31 December

2011 is also available on the Company's website at

www.keller.co.uk. Hard copies have been sent to shareholders.

The annual general meeting will be held at 11.00am on Friday 18

May 2012 at the offices of RBS, 250 Bishopsgate, London EC2M

4AA.

In accordance with DTR 6.3.5, this announcement contains

information in the attached appendix of the principal risk factors,

a responsibility statement and details of related party

transactions which has been extracted in full unedited text from

the Annual Report and Accounts 2011. References to page numbers and

notes in the Appendix refer to those in the Annual Report and

Accounts 2011. A condensed set of financial statements were

appended to the Keller Group plc's preliminary results announcement

issued on 27 February 2012.

For further information please contact:

Jackie Holman

Company Secretary

Appendix

Unedited extract from Annual report and accounts 2011

Principal risks

Risk Description Controls

-------------------------- -------------------------- --------------------------------------------------------------

Market cycles Whilst our business

The Group's broad will always be subject * Strategy of geographic diversification:

base helps to mitigate to economic cycles,

against the risk market risk is reduced

of downturn in our by the diversity of * operations in over 30 countries

markets our markets, both

in terms of geography

and market segment. * growing presence in Australia and developing markets.

It is also partially

offset by opportunities

for consolidation * Broad customer base.

in our highly fragmented

markets. Typically,

even where we are * Services used across all industry segments:

the clear leader, infrastructure, industrial, commercial, residential

we still have a and environmental.

relatively

small share of the

market. Our ability

to exploit these

opportunities

through bolt-on

acquisitions

is reflected in our

track record of growing

sales, and doing so

profitably, across

market cycles.

-------------------------- -------------------------- --------------------------------------------------------------

Tendering and management It is in the nature

of projects. Project of our business that * Risk-based tender approval process, with clear

risk is managed we continually assess delegations of authority.

throughout and manage technical,

the life of a project and other operational,

from the tendering risks. Some of the * Independent review of tenders.

stage to completion controls we have in

place, particularly

at the crucial stage * Formal and informal training for staff in the typical

of tendering of risk issues they may face when tendering for jobs,

contracts, negotiating contracts and executing work.

are set out in the

table opposite. Given

the Group's relatively * Legal review of unusual or onerous contract terms.

small average contract

value (less than

GBP200,000), * Project staff selected on the basis of their skills,

it would be unusual experience of a particular type of project and their

for any one contract workload.

to materially affect

the results of the

Group. Our ability * Establishment of 'centres of excellence'.

to manage technical

risks will generally

be reflected in our * Pre-job meetings undertaken on site.

profitability.

* Formal daily reports generated and reviewed for each

contract in progress. Weekly cost reports produced

for all projects and reviewed by next level

management.

* Periodic reviews of poorly performing contracts to

establish lessons learned with the results

communicated to all relevant staff.

-------------------------- -------------------------- --------------------------------------------------------------

Acquisitions We recognise the risks

Our long-term growth associated with * Target companies are usually well known to Keller;

track record is built acquisitions and the operational and cultural differences and

on a combination and our approach to potential synergies are well understood.

of organic growth buying businesses

and acquisitions aims to manage these

to acceptable levels. * Robust due diligence process, mostly undertaken by

First, we try to get own management.

to know a target company,

often working in joint

venture, to understand * Clear integration plan, reflecting the unique

the operational and character of the target company.

cultural differences

and potential synergies.

This is followed by

a robust due diligence

process, most of which

is undertaken by our

own managers, and

we then develop a

clear integration

plan which takes account

of the unique character

of the target company.

-------------------------- -------------------------- --------------------------------------------------------------

People The risk of losing,

The accumulation or not being able * Excellent training and development opportunities.

of knowledge and to attract, good people

experience is essential is key. We pride

to helping our customers ourselves * Opportunities for career growth.

to find the best in having some of

solution the best professional

and skilled people * Good engagement and two-way communications.

in the industry, who

are motivated by our

culture and the * Employees treated with dignity and respect.

opportunities

for career growth.

-------------------------- -------------------------- --------------------------------------------------------------

Responsibility statement of the Directors in respect of the

annual report and the financial statements

We confirm that to the best of our knowledge:

- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

as a whole; and

- the Directors' report, including content contained by

reference, includes a fair review of the development and

performance of the business and the position of the Company and the

undertakings included in the consolidation taken as a whole,

together with a description of the principal risks and

uncertainties that they face.

25 Related party transactions

Transactions between the parent, jointly controlled operations

and its subsidiaries, which are related parties, have been

eliminated on consolidation and are not disclosed in this note.

During the year the Group undertook various contracts with a

total value of GBP2.3m (2010: GBP3.3m) for GTCEISU Construccion,

S.A., a connected person of Mr Lopez Jimenez, a Director of the

Company. An amount of GBP1.8m (2010: GBP2.3m) is included in trade

and other receivables in respect of amounts outstanding as at 31

December 2011.

During the year the Group made purchases from GTCEISU

Construccion, S.A. with a total value of GBP3.5m (2010: GBP3.6m).

An amount of GBP1.0m (2010: GBP2.8m) is included in trade and other

payables in respect of amounts outstanding as at 31 December

2011.

Related party transactions were made on an arms-length basis.

All amounts outstanding from related parties are unsecured and will

be settled in cash. No guarantees have been given or received. No

provisions have been made for doubtful debts in respect of the

amounts owed by related parties.

The remuneration of the Directors, who are the key management

personnel and related parties of the Group, is set out below in

aggregate for each of the relevant categories specified in IAS 24 -

Related Party Disclosures.

Key management personnel compensation comprised:

2011 2010

GBPm GBPm

------------------------------ ------ ------

Short-term employee benefits 2.1 1.9

Post-employment benefits 0.2 0.2

------------------------------ ------ ------

2.3 2.1

------------------------------ ------ ------

END

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSEAEDKAFKAEFF

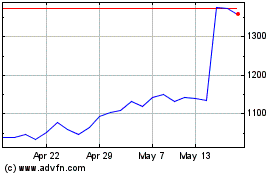

Keller (LSE:KLR)

Historical Stock Chart

From Jun 2024 to Jul 2024

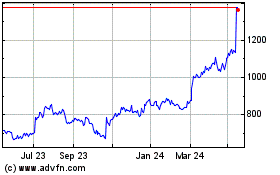

Keller (LSE:KLR)

Historical Stock Chart

From Jul 2023 to Jul 2024