Monday, 28 July 2008

Keller Group plc

Interim Results for the six months ended 30 June 2008

Keller Group plc ("Keller" or "the Group"), the international ground

engineering specialist, is pleased to announce its interim results for the six

months ended 30 June 2008.

Highlights include:

- Revenue* of �568.7m (2007: �443.9m) up 28%, driven by excellent

organic growth outside the US

- Operating profit* of �56.1m (2007: �47.4m) up 18%

- Group now much more broadly based, with less exposure to

individual market cycles

- Profit before tax* of �54.2m (2007: �45.4m) up 19%

- Basic earnings per share* up 20% to 51.6p (2007: 42.9p)

- Interim dividend per share of 6.9p (2007: 6.0p), in line with the

policy of dividend increases of 15% per annum

* from continuing operations

Justin Atkinson, Keller Chief Executive said:

"I am pleased to report another excellent set of results which once

again demonstrates both the successful implementation of our strategy and our

robust business model.

"The trend of increased geographic diversification has continued,

particularly with our investment into the fastest-growing parts of the Group

in the Middle East, Eastern Europe and Australia, and as a result we are now

more broadly based than ever.

"We go into the second half of 2008 with a strong order book and

the Board anticipates that the Group's results for the year as a whole will be

broadly in line with last year's excellent performance."

For further information, please contact:

Keller Group plc www.keller.co.uk

Justin Atkinson, Chief Executive 020 7616 7575

James Hind, Finance Director

Smithfield

Reg Hoare/Rupert Trefgarne/Will Henderson 020 7360 4900

A presentation for analysts will be held at 9.15 for 9.30am at the

Theatre & Gallery,

London Stock Exchange, 10 Paternoster Square, London, EC4M 7LS

Print resolution images are available for the media to download from www.vismedia.co.uk

Chairman's Statement

Financial overview

I am pleased to report another excellent set of results for the six

months ended 30 June 2008, which once again demonstrates both the successful

implementation of our strategy and our robust business model.

In particular, our investment in recent years into the

fastest-growing parts of the Group, namely the Middle East, Eastern Europe and

Australia, has brought significant benefits as these regions continue their

rapid progress. The trend of increased geographic diversification has

continued, with over 60% of Group profit now derived from markets outside the

US, compared to less than 30% three years ago. As a result, the Group is now

more broadly based than ever and therefore less exposed to individual market

cycles.

Group revenue from continuing operations was up 28% at �568.7m

(2007: �443.9m) and the first-half operating profit on the same basis was up

18% at �56.1m (2007: �47.4m). On a constant currency basis, revenue increased

by 20% and operating profit was up 9%.

Profit before tax from continuing operations increased by 19% to

�54.2m (2007: �45.4m) and earnings per share from continuing operations were

up 20% at 51.6p (2007: 42.9p).

Cash generated from operations increased to �43.6m, compared to

last year's �40.2m, continuing our excellent record of converting profits into

cash. Net debt at 30 June 2008 stood at �74.4m, which compares to �53.8m at

the end of June 2007. The year-on-year increase is stated after expenditure of

�28.0m on acquisitions and capital expenditure of �55.3m over the last twelve

months. This increased level of capital expenditure has enabled us to make

further progress in modernising and expanding our equipment fleet,

particularly in those areas of the business offering the best growth

potential.

Net debt at 30 June 2008 represented 0.5 times annualised EBITDA

and EBITDA interest cover remains very comfortable at over 30 times.

Share buy-back programme

In our preliminary results announcement in March of this year we

said that, given the continuing strength of the Group's balance sheet, the

Board proposed to buy back up to 5% of the Company's ordinary shares

(equivalent to approximately 3 million shares) during the remainder of 2008.

During the first half, 1.1 million shares were purchased, all of which are

held in Treasury. In addition, a further 325,000 shares were purchased

specifically to satisfy Performance Share Plan awards. The average cost of

purchased shares was �6.50.

Dividend

The Board has declared an interim dividend of 6.9p per share (2007:

6.0p), in line with the policy announced in March 2007 of increasing the

dividend by 15% per annum for the foreseeable future, subject to maintaining

three times' dividend cover. The interim dividend will be paid on 3 November

2008 to shareholders on the register at 10 October 2008.

Operational overview

US

Overall, the US non-residential construction market remains

resilient, driven by strong demand from the power and industrial sectors and

year-on-year growth in public infrastructure spending. As expected, housing

starts were significantly down on 2007.

Our US operations as a whole reported another good set of results.

Total US revenue was 5% ahead of last year at �245.5m (2007: �232.7m).

Operating profit of �22.1m compared with �29.4m in the first half of last year

mainly reflecting, as expected, a significant weakening of Suncoast's margins.

These results were not impacted by currency movements.

US Foundation Contracting

Hayward Baker, the largest and most diverse of our US businesses in

terms of both geography and product range, reported a very solid first half

result. The overall performance of the four US piling businesses - Anderson,

Case, HJ and McKinney - was also good and in line with our expectations at the

start of the year.

As the synergies between our foundation contracting businesses

develop, the growing tendency to pool resources and expertise enables them to

take on larger, more complex projects, often requiring a range of techniques.

For example, Case and Hayward Baker partnered on a contract to install

thousands of 18-inch diameter piles and 16,000 square feet of braced sheet

piles for a major industrial facility in Illinois. By working together, they

were able to meet a very demanding schedule, completing the work on time at

the end of March.

Case and McKinney also continued to work together regularly on

joint venture projects, such as the installation of foundations for the Fort

Martin Power Station in West Virginia, with more such work lined up for the

second half of this year.

Good progress was made in integrating HJ, the Florida-based

continuous flight auger (CFA) piling specialist, which we acquired in October

2007 to enable the Group to accelerate the introduction of CFA piling in our

other US companies. Although, as expected, the HJ business suffered from

weakness in the Florida market, co-operation between HJ and Keller's other US

companies continues to gather momentum.

A contract in Pittsburgh, Pennsylvania to install CFA piles for the

new Majestic Star Casino was successfully completed in the first half by HJ

and Case. Similarly, Hayward Baker teamed up with HJ to provide a complete

foundation support package for a four-storey parking garage in Largo, Florida.

Hayward Baker installed vibro stone columns across the site for ground

improvement and micropiles for higher loads in limited access or low headroom

areas, whilst HJ installed CFA piles in the open access areas.

Suncoast

Reduced volume in both its slab-on-grade and high rise products as

a result of the recession in US housing, together with steep increases in its

raw material costs, put further pressure on Suncoast's margins. Despite this,

the business reported a profit for the first half, reflecting management's

proactive approach to cost control and pricing.

The global supply and demand for steel remain unpredictable and the

fortunes of Suncoast in the second half of the year will be affected by its

ability to pass on any further increases in its raw materials. Nonetheless,

the business is expected to remain profitable and its strong reputation and

leading market position mean that it is better placed than most to ride out

these testing conditions.

Continental Europe, Middle East & Asia (CEMEA)

CEMEA had an excellent first half, with particularly significant

contributions from the Middle East and Eastern Europe. Revenue of �204.4m

(2007: �136.2m) was 50% ahead of the previous year, whilst operating profit of

�23.8m (2007: �13.7m) increased by over 70%, putting the division well on

track to deliver another year of extremely strong organic growth. On a

constant currency basis, revenue was 31% ahead, whilst operating profit was up

by more than 50%.

Continental Europe

In Western Europe, our business is well spread across four main

markets - Germany, Spain, France and Austria - where public infrastructure

projects make up a significant element of our work and only around 10% of the

business is exposed to the residential market.

In our German business, the steady improvement which started in

2006 continues. Its first-half result reflects full utilisation of its

equipment and people and good progress on a number of large infrastructure

projects, such as the Leipzig City Tunnel project, where we are using special

grouting techniques to support the city's buildings during tunnelling. Spain

fared less well in the first half, with reduced revenue and margins reflecting

the much weaker market conditions, which are not expected to improve in the

short term. Our French business gave a steady performance in the first half.

In Austria, the smallest of these markets, we remained busy, with the second

phase of the large slope stabilisation project on the A2 motorway between

Vienna and Graz making a good contribution.

An excellent first-half performance from Eastern Europe was once

again led by our business in Poland, where revenue was up more than 50% on the

same period in 2007. Over the past three years the Polish business has

transformed itself from a ground improvement specialist to a full-service

foundation business, deriving over 60% of its revenue in the first half of

this year from heavy foundations. Likewise, in the smaller Eastern European

markets, where to date we have restricted our offering to ground improvement

products, our strategic focus is now on building our heavy foundations

capacity, with significant recently-committed investment in piling rigs which

we will operate across these markets.

Middle East

Our Middle Eastern business continued to build on the excellent

progress made in 2007, with UAE, Saudi Arabia and Bahrain all reporting

outstanding results for the first six months and the region anticipating a

very busy second half. The contract at the new Saudi Kayan petrochemical

complex in Saudi Arabia is nearing completion, with over 15,000 piles and

almost 300,000 linear metres of ground improvement successfully completed. In

the UAE, good progress continued at Palm Deira and we successfully undertook

our first piling contract, which we are confident will lead to further piling

work in the region. Across the Gulf, many more substantial development

projects are in the pipeline which should underpin future growth in the Middle

East.

Asia

In our Asian markets we are still seeing a good range of

infrastructure and industrial developments for which our ground improvement

products are well suited. Against this background, our business in the region

reported a solid result. With some sizeable contracts underway, such as ground

improvement works for the Ipoh to Pedang Besar railway project in Malaysia and

for a biodiesel tank farm in Singapore, the business is well positioned for

the remainder of the year.

Australia

A large proportion of the Australian construction market continues

to be extremely strong, particularly the public infrastructure and

commodities-related sectors. Whilst very recently we have seen some localised

tightening in the commercial sector, it is too early to say whether this is

the start of a trend.

Australian revenue of �74.0m (2007: �39.6m) was 87% ahead and, with

an exceptionally strong operating margin, operating profit was �10.7m,

compared to �4.6m in the first half last year. On a constant currency basis,

revenue was 64% ahead, whilst operating profit more than doubled.

All parts of the Australian business performed very well in the

first half, particularly Piling Contractors, our 2006 acquisition, which

managed to beat its excellent 2007 first-half performance. The Gateway Upgrade

project in Brisbane, where Piling Contractors is leading a joint venture

involving all four of our Australian companies, has progressed extremely well

and is now around 90% complete.

Our ground engineering subsidiary, set up in 2004 to introduce new

techniques to the Australian market, came of age with its largest ever

contract to provide ground improvement works at a coal-handling facility in

Newcastle and a contract for stone columns and dry soil mixing for a road

bypass scheme in northern New South Wales.

UK

Overall, the UK market remained quite resilient in the first six

months of the year, with the exception of the housing sector, from which

historically around 30% of our UK ground engineering revenue has been derived

and where we do not foresee improvement in the short term.

Reporting revenue of �44.8m (2007: �35.4m) and operating profit of

�2.2m (2007: �1.7m), our UK business had a good first half, despite a shortage

of ground improvement projects for the housing sector. This result was helped

by an excellent contribution from Phi and a good performance on the contract

to install the foundations for the 2012 Olympics Main Stadium. Our design and

construct solution for this site, presented as an alternative to the original

piled specification, combined three different techniques to deliver

significant cost and programme savings.

Makers

Having successfully completed the disposal of the vast majority of

the Makers business last year, we continue to resolve the legacy issues, which

resulted in a pre-tax loss of �1.5m in the period.

Outlook

Looking across the Group, we expect to see a continuation of the

positive momentum in our high growth markets and some moderate tightening in

certain of our Western European markets as the year progresses. Whilst

currently the US non-residential construction market remains resilient, the

medium term prospects for our US markets, particularly the commercial sector,

remain unclear.

We go into the second half of 2008 with a strong order book which

is around last year's record level. Based on this, and our robust current

trading, the Board anticipates that the Group's results for the year as a

whole will be broadly in line with last year's excellent performance.

Dr J. M. West

Chairman

28 July 2008

Consolidated Income Statement

for the half year ended 30 June 2008

Half year Half year Year to

to 30 June to 30 June 31

2008 2007 December

2007

Restated*

Note �m �m �m

Continuing operations

Revenue 3 568.7 443.9 955.1

Operating costs (512.6) (396.5) (847.7)

Operating profit 3 56.1 47.4 107.4

Finance income 1.0 1.4 2.5

Finance costs (2.9) (3.4) (6.7)

Profit before taxation 54.2 45.4 103.2

Taxation 4 (17.9) (16.1) (35.9)

Profit for the period from continuing operations 36.3 29.3 67.3

Discontinued operation

Loss from discontinued operation net of taxation (1.2) (3.7) (10.5)

Profit for the period 35.1 25.6 56.8

Attributable to:

Equity holders of the parent 32.9 24.5 54.0

Minority interests 2.2 1.1 2.8

35.1 25.6 56.8

Earnings per share from continuing operations

Basic earnings per share 51.6p 42.9p 97.6p

Diluted earnings per share 51.3p 42.2p 96.4p

Earnings per share

Basic earnings per share 49.9p 37.2p 81.8p

Diluted earnings per share 49.6p 36.7p 80.7p

* See note 1 Basis of preparation

Consolidated Statement of Recognised Income and Expense

for the half year ended 30 June 2008

Half year Half year Year to

to 30 June to 30 June 31

2008 2007 December

2007

�m �m �m

Foreign exchange translation differences 8.6 (0.1) 4.9

Actuarial gains on defined benefit pension schemes 0.3 1.8 2.0

Tax on items taken directly to equity (0.1) (0.5) (0.6)

Net income recognised directly in equity 8.8 1.2 6.3

Profit for the period 35.1 25.6 56.8

Total recognised income and expense for the period 43.9 26.8 63.1

Attributable to:

Equity holders of the parent 40.6 25.7 59.8

Minority interests 3.3 1.1 3.3

43.9 26.8 63.1

Consolidated Balance Sheet

as at 30 June 2008

As at As at As at 31

December

30 June 30 June 2007

2008 2007

Note �m �m �m

Assets

Non-current assets

Intangible assets 83.3 63.9 80.8

Property, plant and equipment 181.3 130.8 155.8

Deferred tax assets 8.1 8.3 9.2

Other assets 14.7 12.4 13.7

287.4 215.4 259.5

Current assets

Inventories 41.9 27.4 26.9

Trade and other receivables 320.2 260.5 273.6

Cash and cash equivalents 8 21.9 17.9 30.9

384.0 305.8 331.4

Total assets 671.4 521.2 590.9

Liabilities

Current liabilities

Loans and borrowings (3.3) (7.1) (7.6)

Current tax liabilities (18.0) (10.6) (12.4)

Trade and other payables (289.1) (222.2) (244.8)

(310.4) (239.9) (264.8)

Non-current liabilities

Loans and borrowings (93.0) (64.6) (77.8)

Employee benefits (14.8) (18.2) (14.6)

Deferred tax liabilities (5.3) (6.1) (5.4)

Other liabilities (12.4) (13.6) (16.8)

(125.5) (102.5) (114.6)

Total liabilities (435.9) (342.4) (379.4)

Net Assets 235.5 178.8 211.5

Equity

Share capital 6.6 6.6 6.6

Share premium account 37.6 37.4 37.6

Capital redemption reserve 7.6 7.6 7.6

Translation reserve 7.4 (4.5) (0.1)

Retained earnings 167.1 124.3 150.6

Equity attributable to equity holders of the 7 226.3 171.4 202.3

parent

Minority interests 9.2 7.4 9.2

Total equity 235.5 178.8 211.5

Consolidated Cash Flow Statement

for the half year ended 30 June 2008

Half year Half year Year to

to 30 June to 30 June 31

2008 2007 December

2007

�m �m �m

Cash flows from operating activities

Operating profit from continuing operations 56.1 47.4 107.4

Operating loss from discontinued operation (1.4) (5.3) (13.3)

54.7 42.1 94.1

Depreciation of property, plant and equipment 10.9 7.9 17.4

Amortisation of intangible assets 0.2 0.1 1.0

(Profit)/Loss on sale of property, plant and (0.1) (0.2) 0.4

equipment

Other non-cash movements 0.6 0.5 1.0

Foreign exchange (gains)/losses (1.1) (0.8) 0.2

Operating cash flows before changes in working 65.2 49.6 114.1

capital

Movement in long-term liabilities and employee (5.6) (3.1) 1.9

benefits

Increase in inventories (14.1) (2.2) (0.9)

Increase in trade and other receivables (32.3) (33.8) (32.8)

Increase in trade and other payables 30.4 29.7 34.9

Cash generated from operations 43.6 40.2 117.2

Interest paid (2.2) (2.5) (5.3)

Income tax paid (11.9) (14.0) (32.0)

Net cash inflow from operating activities 29.5 23.7 79.9

Cash flows from investing activities

Interest received 0.3 0.7 1.3

Proceeds from sale of property, plant and 0.5 1.0 1.0

equipment

Acquisition of subsidiaries, net of cash acquired (2.5) (9.0) (34.5)

Acquisition of property, plant and equipment (30.0) (22.8) (48.1)

Acquisition of other non-current assets (1.4) (1.7) (2.8)

Net cash outflow from investing activities (33.1) (31.8) (83.1)

Cash flows from financing activities

Proceeds from the issue of share capital - 0.4 0.5

Repurchase of own shares 7 (7.1) - -

New borrowings 20.0 8.8 22.2

Repayment of borrowings (5.3) - (0.7)

Payment of finance lease liabilities (0.8) (0.9) (1.9)

Dividends paid (10.2) (8.0) (12.3)

Net cash (outflow)/inflow from financing (3.4) 0.3 7.8

activities

Net (decrease)/increase in cash and cash (7.0) (7.8) 4.6

equivalents

Cash and cash equivalents at beginning of period 26.1 20.3 20.3

Effect of exchange rate fluctuations 1.9 0.1 1.2

Cash and cash equivalents at end of period 8 21.0 12.6 26.1

Notes to the Condensed Financial Statements

Half year ended 30 June 2008

1. Basis of preparation

The condensed financial statements included in this interim

financial report have been prepared in accordance with IAS 34 - Interim

Financial Reporting, as adopted by the European Union. They do not include all

of the information required for full annual financial statements, and should

be read in conjunction with the consolidated financial statements of the Group

as at and for the year ended 31 December 2007. The same accounting policies

and presentation are followed in the financial statements that were applied in

the preparation of the Company's published consolidated financial statements

for the year ended 31 December 2007.

The figures for the year ended 31 December 2007 are not statutory accounts but

have been extracted from the Group's statutory accounts for that financial

year. The auditor's report on those accounts was not qualified and did not

contain statements under section 237(2) or (3) of the Companies Act 1985. A

copy of the statutory accounts for that year has been delivered to the

Registrar of Companies.

The financial information in this interim financial report for the half years

ended 30 June 2008 and 30 June 2007 has neither been reviewed, nor audited.

The Board announced its decision to withdraw from Makers on 20

August 2007. The business was treated as a discontinued operation in the

consolidated financial statements for the year ended 31 December 2007, but was

not a discontinued operation or classified as held for sale as at 30 June

2007; consequently the comparative interim consolidated income statement has

been re-presented to show the loss from discontinued operation net of tax

separately from continuing operations.

The key risks and uncertainties facing the Group, as explained in

the Group's Annual Report for the year ended 31 December 2007, continue to be:

market cycles, acquisitions, technical risk and people.

2. Foreign currencies

The exchange rates used in respect of principal currencies are:

Average for Period

Period End

Half year Half year Year to 31 Half year Half Year to

to 30 June to 30 June December to 30 June year to 31

30 June December

2008 2007 2007 2008 2007 2007

US dollar: 1.98 1.97 2.00 2.00 2.00 2.00

Euro: 1.29 1.48 1.46 1.26 1.49 1.36

Australian dollar: 2.14 2.44 2.39 2.08 2.36 2.28

3. Segmental analysis

The Group considers that it has only one business activity:

specialist construction services. Revenue and operating profit by geographical

segment is presented below:

Revenue Operating

profit

Half year Half year Year to Half Half year Year to

to 30 June to 30 June 31 year to to 30 31

2008 2007 December 30 June June December

2007 2008 2007 2007

Restated

Restated

�m �m �m �m �m �m

United Kingdom 44.8 35.4 78.0 2.2 1.7 3.8

North America 245.5 232.7 473.2 22.1 29.4 61.6

CEMEA [1] 204.4 136.2 296.8 23.8 13.7 30.4

Australia 74.0 39.6 107.1 10.7 4.6 14.7

568.7 443.9 955.1 58.8 49.4 110.5

Central items and eliminations - - - (2.7) (2.0) (3.1)

Continuing operations 568.7 443.9 955.1 56.1 47.4 107.4

Discontinued operation [2] - 21.3 36.8 (1.4) (5.3) (13.3)

568.7 465.2 991.9 54.7 42.1 94.1

[1] Continental Europe, Middle East and Asia.

[2] Discontinued operation was previously reported in the United Kingdom

segment.

4. Taxation

Taxation from continuing operations, representing management's best

estimate of the average annual effective income tax rate expected for the full

year, based on the profit before tax is: 33.0% (half year ended 30 June 2007 -

restated: 35.5%; year ended 31 December 2007: 34.8%).

Taxation in the period relating to the discontinued operation was

�0.4m credit (half year ended 30 June 2007: �1.6m credit; year ended 31

December 2007: �3.7m credit).

5. Dividends paid to equity holders of the parent

Ordinary dividends on equity shares:

Half Half Year to

year to year to 31

30 June 30 June December

2008 2007 2007

�m �m �m

Amounts recognised as distributions to equity holders

in the period:

Final dividend for the year ended 31 December 2007 of 7.9 7.5 7.5

12.0p (2006: 11.4p) per share

Interim dividend for the year ended 31 December 2007 - - 4.0

of 6.0p per share

7.9 7.5 11.5

In addition to the above, an interim ordinary dividend of 6.9p per

share (2007: 6.0p) will be paid on 3 November 2008 to shareholders on the

register at 10 October 2008. This proposed dividend has not been included as a

liability in these financial statements and will be accounted for in the

period in which it is paid.

6. Earnings per share

Earnings for the purposes of calculating the basic and diluted

earnings per share from continuing operations were �34.1m (half year ended 30

June 2007: �28.2m; year ended 31 December 2007: �64.5m).

The weighted average number of shares for the purposes of

calculating the basic and diluted earnings per share from continuing

operations was 66.0m (half year ended 30 June 2007: 65.8m; year ended 31

December 2007: 66.0m) and 66.4m (half year ended 30 June 2007: 66.8m; year

ended 31 December 2007: 66.9m) respectively.

7. Reconciliation of movements in equity attributable to equity holders of the

parent

Half year Half year Year to 31

to 30 June to 30 June December

2008 2007 2007

�m �m �m

Equity at start of period 202.3 152.4 152.4

Total recognised income and expense 40.6 25.7 59.8

Dividends to shareholders (7.9) (7.5) (11.5)

Share based payments 0.6 0.4 1.1

Share capital issued 1 - 0.4 0.5

Shares repurchased (9.3) - -

Equity at end of period 226.3 171.4 202.3

1 Includes share premium

During the period, the Company has repurchased 1.1 million shares,

all of which are held in Treasury. In addition, the Company purchased a

further 325,000 shares specifically to satisfy Performance Share Plan awards.

The average cost of purchased shares was �6.50. All shares issued in

comparative periods related to share options exercised in those periods.

8. Analysis of closing net debt

As at As at As at 31

December

30 June 30 June 2007

2008 2007

�m �m �m

Bank balances 21.5 17.7 30.8

Short-term deposits 0.4 0.2 0.1

Cash and cash equivalents in the balance sheet 21.9 17.9 30.9

Bank overdrafts (0.9) (5.3) (4.8)

Cash and cash equivalents in the cash flow 21.0 12.6 26.1

statement

Bank and other loans (91.4) (62.7) (75.0)

Loan notes due within one year - - (1.1)

Finance leases (4.0) (3.7) (4.5)

Closing net debt (74.4) (53.8) (54.5)

9. Related party transactions

Transactions between the parent, jointly controlled operations and

its subsidiaries, which are related parties, have been eliminated on

consolidation and are not disclosed in this note.

During the period the Group undertook various contracts with a

total value of �4.8m (half year to 30 June 2007: �5.4m, year ended 31 December

2007: �11.6m) for GTCEISU Construcci�n, S.A., a connected person of Mr L�pez

Jim�nez, a Director of the Company. An amount of �5.9m (30 June 2007: �7.1m,

31 December 2007: �8.0m) is included in trade and other receivables in respect

of amounts outstanding as at 30 June 2008.

All amounts outstanding from related parties are unsecured and

will be settled in cash. No guarantees have been given or received. No

provisions have been made for doubtful debts in respect of the amounts owed by

related parties.

Responsibility statement

We confirm that to the best of our knowledge:

a) the condensed set of financial statements has been prepared in

accordance with IAS 34 - Interim Financial Reporting;

b) the interim management report includes a fair review of the

information required by DTR 4.2.7R - indication of important events during the

first six months and description of principal risks and uncertainties for the

remaining six months of the year; and

c) the interim management report includes a fair review of the

information required by DTR 4.2.8R - disclosure of related parties

transactions and changes therein.

By order of the Board

J M West Chairman

J W G Hind Finance Director

END

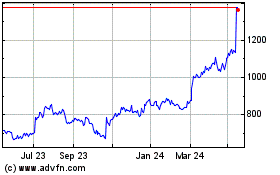

Keller (LSE:KLR)

Historical Stock Chart

From Jun 2024 to Jul 2024

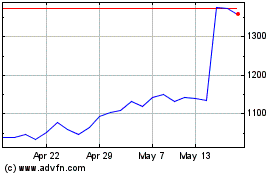

Keller (LSE:KLR)

Historical Stock Chart

From Jul 2023 to Jul 2024