TIDMKIBO

RNS Number : 2994V

Kibo Energy PLC

01 December 2023

Kibo Energy PLC (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

LEI Code: 635400WTCRIZB6TVGZ23

Share code on the JSE Limited: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

('Kibo' or 'the Company')

Dated: 1 December 2023

Kibo Energy PLC ('Kibo' or the 'Company')

Kibo Subsidiary Announces Update of Joint Venture Agreement

Kibo Energy PLC (AIM: KIBO; AltX: KBO), the renewable

energy-focused development company, announces that further to its

previous announcements dated 23 October 2023 and 13 November 2023,

respectively, its subsidiary Mast Energy Developments PLC ('MED'),

a UK-based multi-asset owner, developer and operator in the rapidly

growing flexible market, announces that, under the terms of the

binding Joint Venture Agreement (JVA'), Proventure Holdings (UK)

Ltd, part of the Proventure Group ('Proventure'), has failed to

meet the conditions to complete the transaction by the

contractually agreed completion long-stop date of 30 November

2023.

Under the terms of the JVA, Proventure is required to make an

initial interim payment of GBP2m (the 'Interim Payment') as well as

payment of the balance of the investment due of c. GBP3.9m to the

Joint Venture Special Purpose Vehicle ('SPV'). Unless or until the

JVA has been completed, Proventure remains contractually bound

under the JVA, and remains in breach of its obligations thereto. As

a result of Proventure not performing, MED has given Proventure

formal notice of enforcement and Proventure now has seven (7) days

to remedy the position. If Proventure fails to do so within the

remedial timeline, MED will consider all its available options,

including, but not limited to, terminating the JVA save for MED's

right to claim damages and costs, commencing proceedings against

Proventure and affected parties as well as alternative investment

opportunities. MED has furthermore made the decision to grant no

further extensions with respect to the deadline for the completion

of the JV.

As announced in the Company RNS dated 13 November 2023, MED

provided an extension in respect of the Interim Payment deadline

and Proventure has thus incurred a total late payment penalty

amounting to GBP60,000 as well as liquidated damages of 0.25% of

the total investment balance due plus any additional costs and

expenses incurred by MED in respect of the JV projects, all of

which are due and payable by Proventure to MED. Under the terms of

the JVA, in addition to the foregoing penalties, should the JVA be

terminated, Proventure shall furthermore pay to MED liquidated

damages as a sum equal to 5% of the total investment value due and

any reasonable costs and expenses incurred by MED in connection

with the agreement.

In consideration of the delays, MED has proceeded with advanced

discussions with an alternative institutional investor to secure

the necessary funding required to advance MED's development

plans.

Further details can be found in the full MED announcement, which

is available below and at med.energy :

-------------------------

Dated: 01 December 2023

Mast Energy Developments PLC ('MED' or 'the Company')

MED Binding Joint Venture Agreement Completion Update

Mast Energy Developments PLC, the UK-based multi-asset owner,

developer and operator in the rapidly growing flexible power

market, announces that further to its previous announcements dated

23 October 2023 and 13 November 2023 respectively, under the terms

of the binding JVA, Proventure is required to make an initial

interim payment of GBP2m (the 'Interim Payment') as well as payment

of the balance of the investment of c. GBP3.9m to the Joint Venture

SPV, in order to complete the transaction by the contractually

agreed completion long-stop date of 30 November 2023.

Proventure has not met the abovementioned conditions under the

JVA and unless or until the JVA has been completed, Proventure

remains contractually bound under the JVA and is yet to perform its

obligations thereof. As a result of Proventure not performing such

obligations, MED has given Proventure formal notice of enforcement

and Proventure now has seven (7) days to remedy the position. If

Proventure fails to do so within the remedial timeline, MED will

consider all its available options, including, but not limited to,

terminating the JVA save for MED's right to claim damages and

costs, commencing proceedings against Proventure and associated

parties, as well as alternative investment opportunities.

In consideration for MED previously granting an extension in

respect of the Interim Payment deadline, as set out in our

announcement dated 13 November 2023, Proventure has incurred a

total late payment penalty amounting to GBP60,000 as well as

liquidated damages of 0.25% of the total investment balance due,

plus any additional costs and expenses incurred by MED in respect

of the JV projects, all of which are due and payable by Proventure

to MED unless waived in part or in full by MED. Under the terms of

the JVA, in addition to the foregoing penalties, in the event that

the JVA is terminated, Proventure shall pay to MED liquidated

damages being a sum equal to 5% of the total investment value due,

plus any reasonable costs and expenses incurred by MED in

connection with the agreement. All of the foregoing penalties

exclude MED's right to claim further damages as a result of the

breach and potential misrepresentation by Proventure.

Further, MED is in advanced discussions with an alternative

institutional investor in order to secure the necessary funding

required to advance MED's development plans, should Proventure fail

to remedy the position referred to above. In the meantime, MED is

in the process of also assessing various short-term funding options

in order to ensure that the Company can meet its ongoing working

capital requirements.

Moreover, MED has decided to put its Pyebridge 9MW flexible

power generation asset (the 'Site') into care and maintenance, in

preparation for a significant overhaul work programme planned for

the Site's reciprocal generation engines, pending the necessary

funding. The planned work programme will result in the Site

reaching its full generation, efficiency and profitability

potential. Until such time that the work programme has been

completed, no further revenue from the Site is expected.

Pieter Krügel, MED CEO, commented: "We are, of course, very

disappointed with Proventure's continued inability to meet their

commitments within the agreed contractual timelines. MED has been

working tirelessly to assist and support Proventure and we have

done everything we possibly could to ensure successful delivery,

however, Proventure's performance is unfortunately outside of MED's

control. Based on the latest assurances from Proventure, the MED

Board remains cautiously optimistic that Proventure remains fully

committed to and should be able to remedy the position within the

remedial timeline to pave the way towards building a fruitful

partnership with them.

"In the meantime, we are engaged in advanced discussions with an

alternative institutional investor in order to secure the necessary

capex funding to advance MED's development plans should Proventure

fail to remedy the position referred to above and we are looking

forward to updating the market accordingly."

S

This announcement contains inside information for the purposes

of the UK version of the Market Abuse Regulation (EU No. 596/2014)

as it forms part of United Kingdom domestic law by virtue of the

European Union (Withdrawal) Act 2018 ('UK MAR'). Upon the

publication of this announcement, this inside information is now

considered to be in the public domain.

For further information please visit www.med.energy or

contact:

Pieter Krügel Info@med.energy Mast Energy Developments CEO

PLC

------------------------------ ------------------------- -----------------

Jon Belliss +44 (0)20 7399 9425 Novum Securities Corporate Broker

------------------- ------------------------------ ------------------------- -----------------

Zainab Slemang zainab@lifacommunications.com Lifa Communications Investor &

van Rijmenant Media Relations

Advisor

------------------- ------------------------------ ------------------------- -----------------

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulations (EU) no.

596/2014 as it forms part of United Kingdom domestic law by virtue

of the European Union (Withdrawal) Act 2018 ('UK MAR'). Upon the

publication of this announcement, this information is now

considered to be in the public domain.

**S**

For further information please visit www.kibo.energy or

contact:

Louis Coetzee info@kibo.energy Kibo Energy PLC Chief Executive

Officer

James Biddle +44 207 628 3396 Beaumont Cornish Nominated Adviser

Roland Cornish Limited

------------------------------ ----------------------- ----------------------

Claire Noyce +44 20 3764 2341 Hybridan LLP Joint Broker

------------------------------ ----------------------- ----------------------

Damon Heath +44 207 186 9952 Shard Capital Partners Joint Broker

LLP

------------------------------ ----------------------- ----------------------

Zainab Slemang zainab@lifacommunications.com Lifa Communications Investor and Media

van Rijmenant Relations Consultant

------------------------------ ----------------------- ----------------------

Johannesburg

1 December 2023

Corporate and Designated Adviser

River Group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

JVEFLFFTLDLIVIV

(END) Dow Jones Newswires

December 01, 2023 02:00 ET (07:00 GMT)

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Oct 2024 to Nov 2024

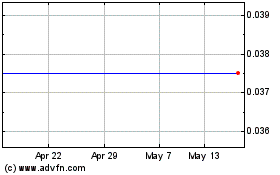

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Nov 2023 to Nov 2024