Kenwood Appliances - Restructuring Programme

June 07 1999 - 6:30AM

UK Regulatory

RNS No 3948j

KENWOOD APPLIANCES PLC

7 June 1999

Kenwood accelerates restructuring programme

Kenwood Appliances PLC announces today two further moves

marking the near completion of a radical strategy to

restructure Kenwood from a vertically integrated,

predominantly UK, manufacturing company into an agile

brand led business.

These moves are part of a three year programme which has

already seen Kenwood move out of metal stamping, die

casting, plastic moulding and printing in the UK in order

to drive down the cost base to more competitive levels.

Move to low cost manufacturing

The Company's remaining UK production is to be

transferred to high quality, low cost operations in

China with the exception of the flagship Kenwood

Chef and water filter business. These are being

retained in the UK for marketing and technological

reasons. This move will result in the closure and

sale of the 12 acre manufacturing site in Havant,

Hampshire with the loss of 260 jobs. The Group is

planning to relocate its remaining UK production and

head office to new, smaller premises in the area.

These moves will be completed by the end of 2000 and

will reduce product costs and release the value of

the Havant site.

Restructuring charges are forecast to be #10.7

million of which #7.0 million is in respect of asset

writedowns. The net cash proceeds of the disposal

of the Havant site, which are expected to exceed

#4.5 million, will be used to reduce borrowings.

Sale of Freshwater Business

The Group also announces the sale of its specialist

turned parts engineering business to the management

team for a cash consideration of #1.1 million. The

business is based in Freshwater on the Isle of Wight

and employs 137 people. In the year to 2nd April

1999, it had sales of #5.3 million and produced a

small loss. Approximately 60% of sales are to

customers outside the Kenwood Group.

The book loss on the disposal, resulting from asset

write downs, will be #2.3 million. The cash

proceeds will be used to reduce borrowings.

Financial implications

These developments, together with the sale of the

Company's UK plastic moulding machinery announced in

February 1999, will be completed by December 2000.

Together, they will progressively benefit profits

over the next two years and are projected to add

approximately #4 million per annum to profits before

tax in the financial year commencing April 2001.

In the trading statement issued on the 24 March

1999, the Kenwood Board indicated that there would

be significant exceptional charges relating to UK

and international restructuring. The UK element of

this will result in exceptional charges of

approximately #14 million largely resulting from non-

cash asset write-downs. #8.8 million will be charged

in the year ended 2 April 1999, of which #7.8

million will be non cash asset write downs,

principally addressing the value of UK properties.

The balance of #1.0 million is largely in respect of

redundancy costs.

Colin Gordon, Chief Executive said today: "With three

quarters of our sales overseas, UK manufacturing is no

longer a competitive option for us on most of our product

lines. I deeply regret the loss of jobs but in order to

safeguard the long-term competitiveness and success of

Kenwood there is no alternative.

"I am pleased that we have been able to agree terms with

the management team at Freshwater in a transaction that

offers both good value for our shareholders and

continuing employment to the workforce.

"These moves represent the most important step in the

restructuring of the company and mark one of the final

phases in the transformation of Kenwood from a vertically

integrated manufacturing business into an agile brand led

company."

Contact:

Simon Rigby Citigate Dewe Rogerson - 01705 392294

Alex Brown, Citigate Dewe Rogerson - 0171 282 2837

Colin Gordon Kenwood - 01705 476000

END

MSCABRRKKUKNRAR

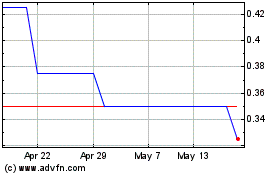

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

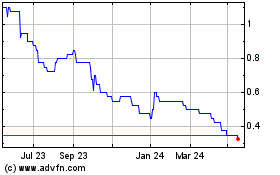

Kendrick Resources (LSE:KEN)

Historical Stock Chart

From Jul 2023 to Jul 2024