TIDMJIM

RNS Number : 8352R

Jarvis Securities plc

11 March 2021

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE EU MARKET ABUSE REGULATION (596/2014). UPON THE PUBLICATION OF

THE ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS

INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

11 March 2021

Jarvis Securities plc

("Jarvis" or "the Company" or "the Group")

RESULTS FOR THE YEARED 31 DECEMBER 2020

HIGHLIGHTS

-- 43% increase in profit before tax

-- 8% increase in year on year interest income

-- 69% growth in interim dividend per share (excludes 2019 special dividend)

-- 42% increase in EPS

CHAIRMAN'S STATEMENT

Few would have predicted how 2020 would unfold with Brexit and

the COVID pandemic impacting industries in different ways. For

stockbrokers trade volumes have increased, but it would be an

oversimplification to attribute these excellent financial results

to this alone. At the beginning of 2020 it felt like we were on the

cusp of volumes returning to normal, and clearly they have exceeded

that prediction. Over the past few years the business has continued

to maintain its organic growth and commercial success as the

following statement will disclose.

I expect our trade volumes to continue at higher levels than we

experienced in 2020 and the years leading up to that. I also see no

signs of organic growth slowing as we move into 2021 with a healthy

pipeline of potential new outsourcing contracts. Client numbers and

cash under administration continue to increase, we are seeing

profitable growth in international settlement and our relationship

with Primary Bid.

We undertook a 4:1 share split during the year to facilitate and

encourage more liquidity in Jarvis shares and encourage a wider

shareholder base. The business model remains unaltered - Jarvis

will continue with a strategy of profitable organic growth whilst

improving internal efficiencies. At present, many of our staff are

working from home, which, whilst presenting some challenges also

creates additional opportunities to review the way we operate where

office space can be a restricting factor. I am proud of the fact we

have been able to maintain our high standard of client service to

both our retail and commercial clients in spite of the disruption

caused by COVID. Our IT infrastructure has been constantly

monitored and tailored to cope with the increased trade volumes and

different working practices and our phone lines have remained

open.

Historically the dividend policy has been relatively formulaic

with a fixed proportion of profit after tax being retained within

the business to maintain our level of FCA capital adequacy or

re-investment where required. This retention accumulates and has

then led to the payment of special dividends. We are required to

retain regulatory capital far in excess of the normal working

capital required to run the business, but in the absence of

requirements for investment in the business it is the Directors'

intention that cash will be paid out in dividends when available.

The sale of Treasury shares has also added to the reserves

available to be distributed over the period and this is likely to

continue which should also increase the free float or liquidity of

shares in the market.

As always, I would like to thank Jarvis staff for their

continued hard work.

Andrew Grant

Chairman

Annual General Meeting

The Company will today dispatch to shareholders its Annual

Report and Accounts for the year ended 31 December 2020, together

with a notice convening the Annual General Meeting ("AGM"), to be

held at the Company's offices on Thursday 22(rd) April at 9am. The

Annual Report and Accounts and Notice of AGM will also be available

from

the Company's website, www.jarvissecurities.co.uk .

During the Covid-19 pandemic, the UK Government has introduced

new laws to prevent individuals engaging in non-essential travel

and attending public gatherings of more than six people, save where

essential for work purposes. Having taken legal advice, the Board

has concluded that, in these exceptional circumstances and for as

long as the current restrictions remain in place, shareholders

should not be permitted to attend the Annual General Meeting but

instead will be asked to vote by proxy by appointing the Chairman

of the meeting as their proxy. The Board has arranged for three

persons to be physically present at the Annual General Meeting to

meet the quorum obligations under the Company's articles of

association but other than these individuals, no other shareholders

will be allowed to attend.

Enquiries :

Jarvis Securities plc

Tel: 01892 510515

Andrew Grant

Jolyon Head

WH Ireland Limited

Tel: 0113 394 6619

Katy Mitchell

Darshan Patel

Consolidated income statement for the year ended 31 december

2020

Year to Year to

31/12/20 31/12/19

Notes

GBP GBP

Continuing operations:

Revenue 3 13,341,136 10,521,806

Administrative expenses (6,465,029) (5,708,739)

Lease finance costs (5,993) (8,393)

Profit before income tax 5 6,870,114 4,804,674

Income tax charge 7 (1,310,424) (893,944)

Profit for the period 5,559,691 3,910,730

Attributable to equity holders

of the parent 5,559,691 3,910,730

Earnings per share 8 P P

Basic and diluted 12.71 8.96

Consolidated statement of comprehensive income for the year

Notes Year to Year to

31/12/20 31/12/19

GBP GBP

Profit for the period 5,559,691 3,910,730

------------------------------------------------ ---------- ----------

Total comprehensive income for the period 5,559,691 3,910,730

============================================== ========== ==========

Attributable to equity holders

of the parent 5,559,691 3,910,730

================================================ ========== ==========

Consolidated STATEMENT OF FINANCIAL POSITION at 31 december

2020

31/12/20 31/12/19

Notes

GBP GBP

Assets

Non-current assets

Property, plant and equipment 9 379,814 461,471

Intangible assets 10 102,019 105,428

Goodwill 10 342,872 342,872

824,705 909,771

Current assets

Trade and other receivables 12 6,923,154 3,373,427

Investments held for trading 14 4,183 4,600

Cash and cash equivalents 15 3,794,980 5,290,961

----------------------------------- ------ --- --- ----------- -----------

10,722,317 8,668,988

Total assets 11,547,022 9,578,759

=================================== ====== === === =========== ===========

Equity and liabilities

Capital and reserves

Share capital 16 111,828 111,828

Share premium 1,655,640 1,576,669

Merger reserve 9,900 9,900

Capital redemption reserve 9,845 9,845

Retained earnings 5,672,848 4,949,467

Own shares held in treasury 16 (886,113) (981,136)

Total equity attributable to

the equity holders of the parent 6,573,948 5,676,573

Non-current liabilities

Deferred tax 45,617 38,664

Lease liabilities 7 64,653 148,633

13

110,270 187,297

Current liabilities

Trade and other payables 17 4,176,030 3,184,059

Lease liabilities 13 83,980 81,507

Income tax 17 602,794 449,323

----------------------------------- ------ --- --- ----------- -----------

4,862,804 3,714,889

Total liabilities 4,973,074 3,902,186

Total equity and liabilities 11,547,022 9,578,759

=================================== ====== === === =========== ===========

CoMPANY STATEMENT OF FINANCIAL POSITION at 31 december 2020

31/12/20 31/12/19

Notes

GBP GBP

Assets

Non-current assets

Property, plant and equipment 9 379,814 461,471

Intangible assets 10 102,019 105,428

Goodwill 10 342,872 342,872

Investment in subsidiaries 11 284,239 284,239

1,108,944 1,194,010

Current assets

Trade and other receivables 12 388,288 636,340

Cash and cash equivalents 15 2,222,469 2,181,403

------------------------------- ------ --- --- ----------- -----------

2,610,757 2,817,743

Total assets 3,719,701 4,011,753

=============================== ====== === === =========== ===========

Equity and liabilities

Capital and reserves

Share capital 16 111,828 111,828

Share premium 1,655,640 1,576,669

Capital redemption reserve 9,845 9,845

Retained earnings 1,481,763 1,776,865

Own shares held in treasury 16 (886,113) (981,136)

Total equity attributable to

the equity holders 2,372,963 2,494,071

Non-current liabilities

Deferred tax 46,253 38,664

Lease liabilities 7 64,653 148,633

13

110,906 187,297

Current liabilities

Trade and other payables 17 801,020 891,435

Lease liabilities 13 83,980 81,507

Income tax 17 350,832 357,443

------------------------------- ------ --- --- ----------- -----------

1,235,832 1,330,385

Total liabilities 1,346,738 1,517,682

Total equity and liabilities 3,719,701 4,011,753

=============================== ====== === === =========== ===========

The parent company's profit for the financial year was

GBP4,541,208 (2019: GBP3,946,513).

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital Retained Total

Share Share Merger redemption earnings equity

capital premium reserve reserve Own

shares

held in

Treasury

------------------------------------------ --------- ---------- --------- ----------- ------------ ----------- ------------

GBP GBP GBP GBP GBP GBP GBP

At 1 January 2019 111,828 1,576,669 9,900 9,845 5,523,363 (859,587) 6,372,018

Adjustment from the adoption of IFRS 16 - - - - (5,600) - (5,600)

Profit for the financial year - - - - 3,910,730 - 3,910,730

Purchase of own shares held in treasury - - - - - (227,002) (227,002)

Sale of own shares held in treasury

- - - - 23,254 105,453 128,707

Dividends - - - - (4,502,280) - (4,502,280)

At 31 December 2019 111,828 1,576,669 9,900 9,845 4,949,467 (981,136) 5,676,573

------------------------------------------ --------- ---------- --------- ----------- ------------ ----------- ------------

Profit for the financial year - - - - 5,559,691 - 5,559,691

Sale of own shares held in treasury - 78,971 - - - 95,023 173,994

Dividends - - - - (4,836,310) - (4,836,310)

At 31 December 2020 111,828 1,655,640 9,900 9,845 5,672,848 (886,113) 6,573,948

------------------------------------------ --------- ---------- --------- ----------- ------------ ----------- ------------

COMPANY STATEMENT OF CHANGES IN EQUITY

Share Share premium Capital Retained Own shares Total equity

capital redemption earnings held in

reserve treasury

--------------------------- --------- -------------- ------------ ------------- ----------- -------------

GBP GBP GBP GBP GBP GBP

At 1 January 2019 111,828 1,576,669 9,845 2,314,978 (859,587) 3,153,733

Adjustment from the

adoption of IFRS 16 - - - (5,600) - (5,600)

Profit for the financial

year - - - 3,946,513 - 3,946,513

Purchase of own shares - - - - (227,002) (227,002)

held in treasury

Sale of own shares - - - 23,254 105,453 128,707

held in treasury

Dividends - - - (4,502,280) - (4,502,280)

--------------------------- --------- -------------- ------------ ------------- ----------- -------------

At 31 December 2019 111,828 1,576,669 9,845 1,776,865 (981,136) 2,494,071

--------------------------- --------- -------------- ------------ ------------- ----------- -------------

Profit for the financial

year - - - 4,541,208 - 4,541,208

Sale of own shares

held in treasury - 78,971 - - 95,023 173,994

Dividends - - - (4,836,310) (4,836,310)

--------------------------- --------- -------------- ------------ ------------- ----------- -------------

At 31 December 2020 111,828 1,655,640 9,845 1,481,763 (886,113) 2,372,963

--------------------------- --------- -------------- ------------ ------------- ----------- -------------

statement OF cashflows for the year ended 31 december 2020

CONSOLIDATED COMPANY

Year to Year to Year to Year to

31/12/20 31/12/19 31/12/20 31/12/19

Notes

------ ------------- ------------- ------------- -------------

GBP GBP GBP GBP

Cash flow from operating activities

Profit before income tax 6,870,114 4,804,674 5,250,277 4,608,692

Depreciation and amortisation 5 142,908 153,161 142,908 153,161

Lease finance cost 5,993 8,393 5,993 8,393

7,019,015 4,966,228 5,399,178 4,770,246

(Increase) /Decrease in trade and other receivables (3,465,602) 1,663,939 248,051 85,140

(Decrease) /Increase in trade payables 907,847 (308,217) (90,415) 191,348

Cash generated from operations 4,461,260 6,321,950 5,556,814 5,046,734

Income tax (paid)/received (1,150,000) (891,251) (708,090) (661,251)

Net cash from operating activities 3,311,260 5,430,699 4,848,724 4,385,483

Cash flows from investing activities

Purchase of property, plant and equipment (11,837) (31,567) (11,837) (31,567)

Purchase of investments held for trading (1,060,177) (758,021) - -

Proceeds from sale of investments held for trading

Purchase of intangible assets 1,060,594 755,377 - -

(46,005) (72,925) (46,005) (72,925)

Cash flows from financing activities (57,425) (107,136) (57,842) (104,492)

Repurchase of ordinary share capital - (227,002) - (227,002)

Sale of treasury shares 95,023 105,453 95,023 105,453

Profit on sale of treasury shares 78,971 23,254 78,971 23,254

Dividends paid (4,836,310) (4,502,280) (4,836,310) (4,502,280)

Lease finance cost (5,993) (8,393) (5,993) (8,393)

Repayment of finance leases (81,507) (79,107) (81,507) (79,107)

----------------------------------------------------- ------ ------------- ------------- ------------- -------------

Net cash used in financing activities (4,749,816) (4,688,075) (4,749,816) (4,688,075)

Net (decrease)/ increase in cash & cash equivalents (1,495,981) 635,488 41,066 (407,084)

Cash and cash equivalents at the start of the year 5,290,961 4,655,473 2,181,403 2,588,487

------------------------------------------------------------- ------------- ------------- ------------- -------------

Cash and cash equivalents at the end of the year 3,794,980 5,290,961 2,222,469 2,181,403

------------------------------------------------------------- ------------- ------------- ------------- -------------

Cash and cash equivalents:

Balance at bank and in hand 6,320,942 5,374,229 2,222,469 2,181,403

Cash held for settlement of market transactions (2,525,962) (83,268) - -

3,794,980 5,290,961 2,222,469 2,181,403

------------------------------------------------------------- ------------- ------------- ------------- -------------

NOTES FOR THE YEARED 31 DECEMBER 2020

1. Basis of preparation

The company has adopted the requirements of International

Financial Reporting Standards (IFRS) and IFRIC interpretations

endorsed by the European Union (EU) and those parts of the

Companies Act 2006 applicable to companies reporting under IFRS.

The financial statements have been prepared under the historical

cost convention as modified by the revaluation of financial assets

at fair value through profit or loss.

These financial statements have been prepared in accordance with

the accounting policies set out below, which have been consistently

applied to all the years presented.

New standards, not yet effective

There are no standards that are issued but not yet effective

that would be expected to have a material impact on the entity in

the current or future reporting periods and on foreseeable future

transactions.

Significant judgements and estimates

The areas involving a high degree of judgement or complexity, or

areas where the assumptions and estimates are significant to the

consolidated financial statements, are disclosed in Note 20.

Going concern

The group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Strategic Report on pages 2 to 5. The financial

position of the group, its cash flows, liquidity position and

borrowing facilities are described within these financial

statements. In addition, note 26 of the financial statements

includes the group's objectives, policies and processes for

managing its capital; its financial risk management objectives;

details of its financial instruments and hedging activities; and

its exposure to credit risk and liquidity risk.

The group has considerable financial resources, long term

contracts with all its significant suppliers and a diversified

income stream. The group does not have any current borrowing or any

anticipated borrowing requirements. As a consequence, the directors

believe that the group is well placed to manage its business risks

successfully.

The directors have a reasonable expectation that the group has

adequate resources to continue in operational existence for the

foreseeable future. Thus they continue to adopt the going concern

basis of accounting in preparing the annual financial

statements.

2. Accounting policies

(a) IFRS 15 'Revenue from Contracts with Customers'

Commission - the group charges commission on a transaction

basis. Commission rates are fixed according to account type. When a

client instructs us to act as an agent on their behalf (for the

purchase or sale of securities) our commission is recognised as

income on a point in time basis when the instruction is executed in

the market. Our commission is deducted from the cash given to us by

the client in order to settle the transaction on the client's

behalf or from the proceeds of the sale in instance where a client

sells securities.

Management fees - these are charged quarterly or bi-annually

depending on account type. Fees are either fixed or are a

percentage of the assets under administration. Management fees

income is recognised over time as they are charged using a day

count and most recent asset level basis as appropriate.

Interest income - this is accrued on a day count basis up until

deposits mature and the interest income is received. The deposits

pay a fixed rate of interest. In accordance with FCA requirements,

deposits are only placed with banks that have been approved by our

compliance department. Interest income is recognised over time as

the deposits accrue interest on a daily basis.

(b) Basis of consolidation

Subsidiaries are all entities over which the Group has the power

to govern the financial and operating policies generally

accompanying a shareholding of more than half of the voting rights.

The existence and effect of potential voting rights that are

currently exercisable or convertible are considered when assessing

whether the Group controls another entity. Subsidiaries are fully

consolidated from the date on which control is transferred to the

Group. They are deconsolidated from the date on which control

ceases. The group financial statements consolidate the financial

statements of Jarvis Securities plc, Jarvis Investment Management

Limited, JIM Nominees Limited, Galleon Nominees Limited and Dudley

Road Nominees Limited made up to 31 December 2020.

The Group uses the purchase method of accounting for the

acquisition of subsidiaries. The cost of an acquisition is measured

as the fair value of the assets given, equity instruments issued

and liabilities incurred or assumed at the date of exchange.

Identifiable assets acquired and liabilities and contingent

liabilities assumed in a business combination are measured

initially at their fair values at the acquisition date,

irrespective of the extent of any minority interest. The cost of

acquisition over the fair value of the Group's share of

identifiable net assets acquired is recorded as goodwill. If the

cost of acquisition is less than the fair value of the Group's

share of the net assets of the subsidiary acquired, the difference

is recognised in the income statement.

Intra-group sales and profits are eliminated on consolidation

and all sales and profit figures relate to external transactions

only. No profit and loss account is presented for Jarvis Securities

plc as provided by S408 of the Companies Act 2006.

(c) Property, plant and equipment

All property, plant and equipment is shown at cost less

subsequent depreciation and impairment. Cost includes expenditure

that is directly attributable to the acquisition of the items.

Depreciation is provided on cost in equal annual instalments over

the lives of the assets at the following rates:

Leasehold improvements - 33% on cost, or over the lease period

if less than 3 years

Office equipment - 20% on cost

Land & Buildings - Buildings are depreciated at 2% on cost.

Land is not depreciated.

Right of use asset - Straight line basis over the lease

period

The assets' residual values and useful lives are reviewed, and

adjusted if appropriate, at each balance sheet date. Gains and

losses on disposals are determined by comparing proceeds with

carrying amount. These are included in the income statement.

Impairment reviews of property, plant and equipment are undertaken

if there are indications that the carrying values may not be

recoverable or that the recoverable amounts may be less than the

asset's carrying value.

(d) Intangible assets

Intangible assets are carried at cost less accumulated

amortisation. If acquired as part of a business combination the

initial cost of the intangible asset is the fair value at the

acquisition date. Amortisation is charged to administrative

expenses within the income statement and provided on cost in equal

annual instalments over the lives of the assets at the following

rates:

Databases - 4% on cost

Customer relationships - 7% on cost

Software developments - 20% on cost

Website - 33% on cost

Impairment reviews of intangible assets are undertaken if there

are indications that the carrying values may not be recoverable or

that the recoverable amounts may be less than the asset's carrying

value.

(e) Goodwill

Goodwill represents the excess of the fair value of the

consideration given over the aggregate fair values of the net

identifiable assets of the acquired trade and assets at the date of

acquisition. Goodwill is tested annually for impairment and carried

at cost less accumulated impairment losses. Any negative goodwill

arising is credited to the income statement in full

immediately.

(f) Deferred income tax

Deferred income tax is provided in full, using the liability

method, on differences arising between the tax bases of assets and

liabilities and their carrying amounts in the consolidated

financial statements. The deferred income tax is not accounted for

if it arises from initial recognition of an asset or liability in a

transaction, other than a business combination, that at the time of

the transaction affects neither accounting or taxable profit or

loss. Deferred income tax is determined using tax rates that have

been enacted or substantially enacted by the balance sheet date and

are expected to apply when the related deferred income tax asset is

realised or the deferred income tax liability is settled.

Deferred income tax assets are recognised to the extent that it

is probable that future taxable profit will be available against

which the temporary differences can be utilised.

Deferred income tax is provided on temporary differences arising

on investments in subsidiaries except where the timing of the

reversal of the timing difference is controlled by the Group and it

is probable that the temporary differences will not reverse in the

foreseeable future.

(g) Segmental reporting

A business segment is a group of assets and operations engaged

in providing products or services that are subject to risks and

returns that are different from those of other business segments.

The directors regard the operations of the Group as a single

segment.

(h) Pensions

The group operates a defined contribution pension scheme.

Contributions payable for the year are charged to the income

statement.

(i) Trading balances

Trading balances incurred in the course of executing client

transactions are measured at initial recognition at fair value. In

accordance with market practice, certain balances with clients,

Stock Exchange member firms and other counterparties are included

as trade receivables and payables. The net balance is disclosed

where there is a legal right of set off.

(j) Leases

The following was applicable in 2019. Costs in respect of

operating leases are charged on a straight line basis over the

lease term in arriving at the profit before income tax. Where the

company has entered into finance leases, the obligations to the

lessor are shown as part of borrowings and the rights in the

corresponding assets are treated in the same way as owned fixed

assets. Leases are regarded as finance leases where their terms

transfer to the lessee substantially all the benefits and burdens

of ownership other than right to legal title.

(k) Investments

Investments held for trading

Under IFRS investments held for trading are recognised as

financial assets measured at fair value through profit and

loss.

Investments in subsidiaries

Investments in subsidiaries are stated at cost less provision

for any impairment in value.

(l) Foreign exchange

The group offers settlement of trades in sterling as well as

various foreign currencies. The group does not hold any assets or

liabilities other than in sterling and converts client currency on

matching terms to settlement of trades realising any currency gain

or loss immediately in the income statement. Consequently the group

has no foreign exchange risk.

(m) Share capital

Incremental costs directly attributable to the issue of new

shares or options are shown in equity as a deduction from proceeds,

net of income tax. Where the company purchases its equity share

capital (treasury shares), the consideration paid, including any

directly attributable incremental costs (net of income tax), is

deducted from equity attributable to the company's equity holders

until the shares are cancelled, reissued or disposed of. Where such

shares are subsequently sold or reissued, any consideration

received, net of any directly incremental transaction costs and the

related income tax effects, is included in equity attributable to

the company's equity holders.

(n) Cash and cash equivalents

Cash and cash equivalents comprise:

Balance at bank and in hand - cash in hand and demand deposits,

together with other short-term, highly liquid investments that are

readily convertible into known amounts of cash and which are

subject to an insignificant risk of changes in value.

Cash held for settlement of market transactions - this balance

is cash generated through settlement activity, and can either be a

surplus or a deficit. A surplus arises when settlement liabilities

exceed settlement receivables. This surplus is temporary and is

accounted for separately from the balance at bank and in hand as it

is short term and will be required to meet settlement liabilities

as they fall due. A deficit arises when settlement receivables

exceed settlement liabilities. In this instance Jarvis will place

its own funds in the client account to ensure CASS obligations are

met. This deficit is also temporary and will reverse once

settlement receivables are settled.

(o) Current income tax

Current income tax assets and/or liabilities comprise those

obligations to, or claims from, fiscal authorities relating to the

current or prior reporting periods, that are unpaid at the balance

sheet date. They are calculated according to the tax rates and tax

laws applicable to the fiscal periods to which they relate based on

the taxable profit for the year.

(p) Dividend distribution

Dividend distribution to the company's shareholders is

recognised as a liability in the group's financial statements in

the period in which interim dividends are notified to shareholders

and final dividends are approved by the company's shareholders.

(q) IFRS 9 'Financial Instruments'

The group currently calculates a "bad debt" provision on

customer balances based on 25% of overdrawn client accounts which

are one month past due date and are not specifically provided for.

Under IFRS 9 this assessment is required to be calculated based on

a forward - looking expected credit loss ('ECL') model, for which a

simplified approach will be applied. The method uses historic

customer data, alongside future economic conditions to calculate

expected loss on receivables

(r) IFRS 16 'Leases'

The lease liability is measured at the present value of the

lease payments that are not paid at the commencement date,

discounted using the interest rate implied in the lease or, if that

rate cannot be readily determined, the Group's incremental

borrowing rate.

The Group has applied judgement to determine the lease term for

contracts with options to renew or exit early.

The carrying amount of right-of-use assets recognised was

GBP404,863 at the lease start date of 27 September 2017. The

retained earnings include a GBP5,600 transitional adjustment in

respect of the modified retrospective approach.

A finance charge of 3% APR is used to calculate the finance cost

of the lease.

3. Group revenue

The revenue of the group during the year was wholly in the

United Kingdom and the revenue of the group for the year derives

from the same class of business as noted in the Strategic

Report.

2020 2019

----------- -----------

GBP GBP

Gross interest earned from treasury deposits, cash

at bank and overdrawn client accounts 4,580,067 4,232,976

Commissions 5,279,932 3,320,160

Fees 3,481,138 2,968,670

13,341,136 10,521,806

=========== ===========

4. Segmental information

All of the reported revenue and operational results for the

period derive from the group's external customers and continuing

financial services operations. All non-current assets are held

within the United Kingdom.

The group is not reliant on any one customer and no customer

accounts for more than 10% of the group's external revenues.

As noted in 2 (g) the directors regard the operations of the

group as a single reporting segment on the basis there is only a

single organisational unit that is reported to key management

personnel for the purpose of performance assessment and future

resource allocation.

5. Profit before income tax 2020 2019

-------- --------

Profit before income tax is stated after charging/(crediting): GBP GBP

Directors' emoluments 723,545 671,690

Depreciation - right of use asset 80,973 80,973

Depreciation - owned assets 12,521 11,228

Amortisation (included within administrative expenses

in the consolidated income statement) 49,414 60,960

Operating lease rentals - hire of machinery 8,852 8,842

Impairment of receivable charge 30,305 23,398

Bank transaction fees 91,462 68,734

======== ========

Details of directors' annual remuneration as at 31 December 2020

are set out below:

2020 2019

---------- ----------

GBP GBP

Short-term employee benefits 654,362 589,642

Post-employment benefits 60,663 73,740

Benefits in kind 8,520 8,307

---------- ----------

723,545 671,690

========== ==========

Details of the highest paid director are as follows:

Aggregate emoluments 315,700 347,110

Company contributions to personal pension scheme - -

Benefits in kind 7,788 7,375

---------- ----------

323,488 354,485

========== ==========

Emoluments Pension Total

& Benefits

in kind

------------------- ---------- ----------

Directors GBP GBP GBP

Andrew J Grant 323,488 - 323,488

Nick J Crabb (resigned

6 July 2020) 83,015 24,109 107,124

Jolyon C Head 106,231 36,554 142,785

Graeme McAusland 26,000 - 26,000

------------------- ---------- ----------

TOTAL 538,734 60,663 599,397

=================== ========== ==========

During the year benefits accrued for two directors (2019: two directors)

under a money purchase pension scheme. Nick Crabb received a payment in

lieu of notice of GBP124,148 which is excluded in his emoluments for the

current year.

Staff Costs

The average number of persons employed by the group, including directors,

during the year was as follows:

2020 2019

---------- ----------

Management and administration 61 57

========== ==========

The aggregate payroll costs of these persons were GBP GBP

as follows:

Wages, salaries & social security 2,653,470 2,393,437

Pension contributions including salary sacrifice 93,766 102,923

2,747,236 2,496,360

========== ==========

Key personnel

The directors disclosed above are considered to be the key

management personnel of the group. The total amount of employers

NIC paid on behalf of key personal was GBP85,159 (2019:

76,621).

6. Auditors' remuneration

During the year the company obtained the following services from the company's

auditors as detailed below:

2020 2019

---------- ---------

GBP GBP

Fees payable to the company's auditors for the audit

of the company's annual financial statements 25,000 24,150

Fees payable to the company's auditors and its associates

for other services:

The audit of the company's subsidiaries, pursuant to

legislation 9,000 9,000

---------- ---------

Total audit fees 34,000 33,150

Taxation Compliance 5,000 4,800

39,000 37,950

========== =========

The audit costs of the subsidiaries were invoiced to and met by

Jarvis Securities plc.

7. Income and deferred tax charges - group 2020 2019

---------- --------

GBP GBP

Based on the adjusted results for the year:

UK corporation tax 1,303,937 902,524

Adjustments in respect of prior years (465) (9,793)

Total current income tax 1,303,472 892,731

Deferred income tax:

Origination and reversal of timing differences 3,039 9,560

Adjustment in respect of prior years (569) (4,923)

Adjustment in respect of change in deferred tax rates 4,482 (3,424)

---------- --------

Total deferred tax charge 6,952 1,213

---------- --------

1,310,424 893,944

========== ========

The income tax assessed for the year is more than the standard rate of corporation

tax in the UK (19%). The differences are explained below:

Profit before income tax 6,870,114 4,804,674

============ ==========

Profit before income tax multiplied by the standard

rate of corporation tax in the UK of

19% (2019 - 19%) 1,305,322 912,889

Effects of:

Expenses not deductible for tax purposes 1,486 -

IFRS 16 transitional adjustment (122) -

Adjustments to tax charge in respect of previous years (1,034) (14,716)

Ineligible depreciation 290 320

Adjust in respect of change in deferred tax rate 4,482 (3,424)

Deferred tax timing differences - (1,125)

Current income tax charge for the years 1,310,424 893,944

============ ==========

Movement in (assets) / provision - group:

Provision at start of year 38,664 37,451

Deferred income tax charged in the year 6,953 1,213

Provision at end of year 45,617 38,664

======= =======

Movement in (assets) / provision - company:

Provision at start of year 38,664 37,451

Deferred income tax charged in the year 7,589 1,213

Provision at end of year 46,523 38,664

======= =======

8. Earnings per share 2020 2019

----------- -----------

GBP GBP

Earnings:

Earnings for the purposes of basic and diluted

earnings per share

(profit for the period attributable to the

equity holders of the parent) 5,559,691 3,910,730

=========== ===========

Number of shares:

Weighted average number of ordinary shares for the

purposes of basic earnings per share 43,739,085 43,675,884

43,739,085 43,675,884

=========== ===========

On 29 October 2020 there was a capital reorganisation whereby

each of the company's issued and unissued ordinary shares of

GBP0.01 each were subdivided into 4 ordinary shares of GBP0.0025

each. The 2019 figures have been adjusted to reflect this

subdivision. Shares held in treasury are deducted for the purpose

of calculating earnings per share.

9. Property, plant & equipment

- group & company Right of Leasehold Office Total

use assets & Property Equipment

- Leasehold

-------------- ------------- ------------ --------

Cost: GBP GBP GBP

At 1 January 2019 - 222,450 264,716 487,166

Adjustments from

the adoption of

IFRS 16 303,648 - - 303,648

Additions - - 31,567 31,567

Disposals - - - -

-------------- ------------- ------------ --------

At 31 December

2019 303,648 222,450 296,283 822,381

Additions - - 11,837 11,837

Disposals - - - -

-------------- ------------- ------------ --------

At 31 December

2020 303,648 222,450 308,120 834,218

-------------- ------------- ------------ --------

Depreciation:

At 1 January 2019 - 13,156 255,553 268,709

Charge for the

year 80,973 1,949 9,279 92,201

On Disposal - - - -

-------------- ------------- ------------ --------

At 31 December

2019 80,973 15,105 264,832 360,910

Charge for the

year 80,973 1,949 10,572 93,494

On Disposal - - - -

-------------- ------------- ------------ --------

At 31 December

2020 161,946 17,054 275,404 454,404

-------------- ------------- ------------ --------

Net Book Value:

At 31 December

2020 141,702 205,396 32,716 379,814

============== ============= ============ ========

At 31 December

2019 222,675 207,345 31,451 461,471

============== ============= ============ ========

The net book value of non-depreciable land is GBP125,000 (2019:

GBP125,000).

10. Intangible assets & goodwill - group &

company Intangible assets

---------------------------------------------------- --------

Customer Databases Software Website Total

Goodwill Relationships Development

------------------ --------------- ---------- ------------- -------- --------

GBP GBP GBP GBP GBP GBP

Cost:

At 1 January 2019 342,872 177,981 25,000 226,361 261,713 691,055

Additions - - - 72,925 - 72,925

At 31 December 2019 342,872 177,981 25,000 299,286 261,713 763,980

Additions - - - 46,005 - 46,005

At 31 December 2020 342,872 177,981 25,000 345,291 261,713 809,985

------------------ --------------- ---------- ------------- -------- --------

Amortisation:

At 1 January 2019 - 175,181 15,719 219,129 187,563 597,592

Charge for the year - 2,800 1,000 19,470 37,690 60,960

At 31 December 2019 - 177,981 16,719 238,599 225,253 658,552

Charge for the year - - 1,000 20,289 28,125 49,414

At 31 December 2020 - 177,981 17,719 258,888 253,378 707,966

------------------ --------------- ---------- ------------- -------- --------

Net Book Value:

At 31 December 2020 342,872 - 7,281 86,403 8,335 102,019

================== =============== ========== ============= ======== ========

At 31 December 2019 342,872 - 8,281 60,687 36,460 105,428

================== =============== ========== ============= ======== ========

Goodwill represents the difference between the consideration

paid and the fair value of assets acquired on the acquisition of a

business in 2003. In accordance with the transitional provisions in

IFRS 1 the group elected not to apply IFRS 3 retrospectively to

past business combinations. Therefore the goodwill balance

represents an acquired customer base, that continues to trade with

the group to this day and, more fundamentally, systems, processes

and a registration that dramatically reduced the group's dealing

costs. These systems and the registration contributed significantly

to turning the group into the low cost effective provider of

execution only stockbroking solutions that it is today. The key

assumptions used by the directors in their annual impairment review

are that the company can benefit indefinitely from the reduced

dealing costs and the company's current operational capacity

remains unchanged. The recoverable amount of the goodwill has been

assessed using the value in use method and there is significant

headroom based on this calculation. There are no reasonable changes

in assumptions that would cause the cash generating unit value to

fall below its carrying amount.

11. Investments in subsidiaries Company

2020 2019

------------ --------

Unlisted Investments: GBP GBP

Cost:

At 1 January 284,239 284,239

As at 31 December 284,239 284,239

============ ========

Shareholding Holding Business

Jarvis Investment Management Limited 100% 25,000,000 1p Ordinary shares Financial administration

Dudley Road Nominees Limited* 100% 2 GBP1 Ordinary shares Dormant nominee company

JIM Nominees Limited* 100% 1 GBP1 Ordinary shares Dormant nominee company

Galleon Nominees Limited* 100% 2 GBP1 Ordinary shares Dormant nominee company

All subsidiaries are located in the United Kingdom and their

registered office is 78 Mount Ephraim, Tunbridge Wells, Kent, TN4

8BS.

* indirectly held

12. Trade and other receivables Group Company

Amounts falling due within one year: 2020 2019 2020 2019

---------- ---------- -------- --------

GBP GBP GBP GBP

Trade receivables 588,989 549,872 24,000 9,411

Settlement receivables 5,654,665 2,077,733 - -

Other receivables 352,864 637,814 343,125 624,550

Prepayments and accrued income 326,636 108,009 14,984 2,010

Other taxes and social security - - 6,179 369

6,923,154 3,373,427 388,288 636,340

========== ========== ======== ========

Settlement receivables are short term receivable amounts arising

as a result of the settlement of trades in an agency capacity. The

balances due are covered by stock collateral and bonds. An analysis

of trade and settlement receivables past due is given in note 26.

There are no amounts past due included within other receivables or

prepayments and accrued income.

13. Leases

Lease liabilities are secured by the related underlying

assets.

2020

Amounts recognised in the statement

of cash flows:

GBP

Repayment of capital element of leases 81,507

81,507

The undiscounted maturity analysis of lease liabilities as at 31

December 2020 is as follows:

< 1 year (GBP) 1-2 years (GBP) 2-3 years (GBP)

Lease payment 87,500 65,625 -

--------------- ---------------- ----------------

Finance charge 3,520 972 -

--------------- ---------------- ----------------

Net present value 83,980 64,653 -

--------------- ---------------- ----------------

The undiscounted maturity analysis of lease liabilities as at 31

December 2019 is as follows:

< 1 year (GBP) 1-2 years (GBP) 2-3 years (GBP)

Lease payment 87,500 87,500 65,625

--------------- ---------------- ----------------

Finance charge 5,993 3,520 972

--------------- ---------------- ----------------

Net present value 81,507 83,980 64,653

--------------- ---------------- ----------------

2020

Lease liabilities included in the current

statement of financial position

GBP

Current 83,980

Non-current 64,653

148,633

2020

Amounts recognised in income statement GBP

Interest on lease liabilities adopted under

IFRS 16 5,993

5,993

The company has a lease with Sion Properties Limited, a company

controlled by A J Grant, for the rental of 78 Mount Ephraim, a

self-contained office building. The lease has an annual rental of

GBP87,500, being the market rate on an arm's length basis, and

expires on 26 September 2027. The total cash outflow for leases in

2020 was GBP87,500. There is an option to terminate the lease on 26

September 2022 and therefore this is the discounted period.

14. Investments held for trading Group Company

2020 2019 2020 2019

------------ ---------- ---------- -----------------

Listed Investments: GBP GBP GBP GBP

Valuation:

At 1 January 4,600 1,956 - -

Additions 1,060,177 758,021 - -

Disposals (1,060,594) (755,377) - -

As at 31 December 4,183 4,600 - -

============ ========== ========== =================

Listed investments held for trading are stated at their market value at

31 December 2020 and are considered to be level one assets in accordance

with IFRS 13. The group does not undertake any principal trading activity.

15. Cash and cash equivalents Group Company

2020 2019 2020 2019

------------ ---------- ---------- -----------------

GBP GBP GBP GBP

Balance at bank and in hand

- group/company 6,320,942 5,374,229 2,222,469 2,181,403

Cash held for settlement of

market transactions (2,525,962) (83,268) - -

3,794,980 5,290,961 2,222,469 2,181,403

============ ========== ========== =================

In addition to the balances shown above the group has segregated

deposit and current accounts held in accordance with the client

money rules of the Financial Conduct Authority. The group also has

segregated deposits and current accounts on behalf of

Counterparties and elected Professional clients of GBP2,111,321

(2019: GBP695,474) not governed by client money rules therefore

they are also not included in the statement of financial position

of the group. This treatment is appropriate as the business is a

going concern however, were an administrator appointed, these

balances would be considered assets of the business.

16. Share capital 2020 2019

--------- ---------

160,000 160,000

Authorised:

64,000,000 Ordinary shares of 0.25p each 160,000 160,000

--------- ---------

2020 2019

GBP GBP

At 1 January 2020 111,828 111,828

Allotted, issued and fully paid:

44,731,000 (2019: 44,731,000) Ordinary shares of 1p

each 111,828 111,828

========= =========

The company has one class of ordinary shares which carry no

right to fixed income.

On 29 October 2020 there was a capital reorganisation whereby

each of the company's issued and unissued ordinary shares of

GBP0.01 each were subdivided into 4 ordinary shares of GBP0.0025

each. The 2019 figures have been adjusted to reflect this

subdivision. Shares held in treasury are deducted for the purpose

of calculating earnings per share. During the period 98,400 shares

were sold from treasury. As at the period end 917,600 shares are

held in treasury.

17. Trade and other payables Group Company

Amounts falling due within 2020 2019 2020 2019

one year:

---------- ---------- ---------- ----------

GBP GBP GBP GBP

Trade payables 188,688 58,300 10,554 977

Settlement payables 2,997,247 1,892,926 - -

Amount owed to group undertaking - - 750,866 840,458

Other taxes and social security 174,712 155,478 - -

Other payables 566,654 561,738 - -

Accruals 248,729 515,617 39,600 50,000

---------- ---------- ---------- ----------

Trade and other payables 4,176,030 3,184,059 801,020 891,435

Lease liabilities 83,980 81,507 83,980 81,507

Income tax 602,794 449,323 350,832 357,443

Total liabilities 4,862,804 3,714,889 1,235,832 1,330,385

========== ========== ========== ==========

Settlement payables are short term payable amounts arising as a

result of settlement of trades in an agency capacity. Trade

payables and other taxes and social security are all paid at the

beginning of the month after the invoice was received or the

liability created.

18. Dividends 2020 2019

---------- ----------

GBP GBP

Interim dividends paid on Ordinary 1p shares 4,836,310 4,502,280

========== ==========

Dividend per Ordinary 1p share 11.06 10.31

========== ==========

Please refer to the directors' report for dividends declared

post year end.

19. Financial Instruments

The group's principal financial instruments comprise cash, short

terms borrowings and various items such as trade receivables, trade

payables etc. that arise directly from operations. The main purpose

of these financial instruments is the funding of the group's

trading activities. Cash and cash equivalents and trade and other

receivables are categorised as held at amortised cost, and trade

and other payables are classified as held at amortised cost. Other

than investments held for trading all financial assets and

liabilities are held at amortised cost and their carrying value

approximates to their fair value.

The main financial asset of the group is cash and cash

equivalents which is denominated in Sterling and which is detailed

in note 14. The group operates a low risk investment policy and

surplus funds are placed on deposit with at least A rated banks or

equivalent at floating interest rates.

The group also holds investments in equities, treasury shares

and property.

20. Critical accounting estimates and judgements

The group makes estimates and assumptions concerning the future.

These estimates and judgements are based on historical experience

and other factors, including expectations of future events that are

believed to be reasonable under the circumstances. The resulting

accounting estimates will, by definition, seldom equal the related

actual results. The estimates and assumptions that have a

significant risk of causing a material adjustment to the carrying

amounts of assets within the next financial year relate to

goodwill, intangible assets and bad debts.

The group tests annually whether goodwill has suffered any

impairment, in accordance with the accounting policy stated in Note

2 (e). These calculations require the use of estimates. The

assumptions and sensitivity relating to the impairment tests are

detailed in note 10.

The group considers at least annually whether there are

indications that the carrying values of intangible assets may not

be recoverable, or that the recoverable amounts may be less than

the asset's carrying value, in which case an impairment review is

performed. These calculations require the use of estimates. The

group also calculates the implied levels of variables used in the

calculations at which impairment would occur.

21. Immediate and ultimate parent undertaking

There is no immediate or ultimate controlling party.

22. Related party transactions

The company has a lease with Sion Properties Limited, a company

controlled by a director of the company, for the rental of 78 Mount

Ephraim, a self-contained office building. The lease has an annual

rental of GBP87,500, being the market rate on an arm's length

basis, and expires on 26 September 2027.

During the year Jarvis Investment Management Limited paid Jarvis

Securities Plc GBP7,000 (2019: GBP7,000) for rental of a disaster

recovery site.

Jarvis Securities plc owed Jarvis Investment Management Limited

GBP750,866 (2019: GBP751,208) at year end.

During the year, directors, key staff and other related parties

by virtue of control carried out share dealing transactions in the

normal course of business. Commissions for such transactions are

charged at various discounted rates. The impact of these

transactions does not materially or significantly affect the

financial position or performance of the company. At 31 December

2020, these same related parties had cash balances of GBP392,110

(2019: GBP1,307,212) and interest was earned during the year

amounting to GBP923 (2019: GBP2,203). In addition to cash balances

other equity assets of GBP49,950,739 (2019: GBP40,119,621) were

held by JIM Nominees Ltd as custodian.

During the year Jarvis Securities Plc charged GBP3,869,812

(2019: GBP3,844,388) to Jarvis Investment Management Limited for

use of intellectual properties.

23. Capital commitments

As of 31 December 2020, the company had no capital commitments

(2019: nil).

24. Fair value estimation

The fair value of financial instruments traded in active markets

is based on quoted market prices at the balance sheet date. The

quoted market price used for financial assets held by the company

is the current bid price. The carrying value less impairment

provision of trade receivables and payables are assumed to

approximate their fair values.

25. Financial risk management objectives and policies

The directors consider that their main risk management objective

is to monitor and mitigate the key risks to the group, which are

considered to be principally credit risk, compliance risk,

liquidity risk and operational risk. Several high-level procedures

are in place to enable all risks to be better controlled. These

include detailed profit forecasts, cash flow forecasts, monthly

management accounts and comparisons against forecast, regular

meetings of the full board of directors, and more regular senior

management meetings.

The group's main credit risk is exposure to the trading accounts

of clients. This credit risk is controlled via the use of credit

algorithms within the computer systems of the subsidiary. These

credit limits prevent the processing of trades in excess of the

available maximum permitted margin at 100% of the current portfolio

value of a client.

A further credit risk exists in respect of trade receivables.

The group's policy is to monitor trade and other receivables and

avoid significant concentrations of credit risk. Aged receivables

reports are reviewed regularly and significant items brought to the

attention of senior management.

The compliance risk of the group is controlled through the use

of robust policies, procedures, the segregation of tasks, internal

reviews and systems controls. These processes are based upon the

Rules and guidance notes of the Financial Conduct Authority and the

London Stock Exchange and are overseen by the compliance officer

together with the management team. In addition, regular compliance

performance information is prepared, reviewed and distributed to

management.

The group aims to fund its expansion plans mainly from existing

cash balances without making use of bank loans or overdraft

facilities. Financial risk is therefore mitigated by the

maintenance of positive cash balances and by the regular review of

the banks used by the group. Other risks, including operational,

reputational and legal risks are under constant review at senior

management level by the executive directors and senior managers at

their regular meetings, and by the full board at their regular

meetings.

The group derives a significant proportion of its revenue from

interest earned on client cash deposits and does not have any

borrowings. Hence, the directors do not consider the group to be

materially exposed to interest rate risk in terms of the usual

consideration of financing costs, but do note that there is a risk

to earnings. Given the current Bank of England base rate is at its

lowest level since its foundation in 1694, and the business has

remained profitable, this risk is not considered material in terms

of a threat to the long term prospects of the group.

The capital structure of the group consists of issued share

capital, reserves and retained earnings. Jarvis Investment

Management Limited has an Internal Capital Adequacy Assessment

Process ("ICAAP"), as required by the Financial Conduct Authority

("FCA") for establishing the amount of regulatory capital to be

held by that company. The ICAAP gives consideration to both current

and projected financial and capital positions. The ICAAP is updated

throughout the year to take account of any significant changes to

business plans and any unexpected issues that may occur. The ICAAP

is discussed and approved at a board meeting of the subsidiary at

least annually. Capital adequacy is monitored daily by management.

Jarvis Investment Management Limited uses the simplified approach

to Credit Risk and the standardised approach for Operational Risk

to calculate Pillar 1 requirements. Jarvis

Investment Management Limited observed the FCA's regulatory

requirements throughout the period. Information disclosure under

Pillar 3 of the Capital Requirements Directive is available from

the group's websites.

The directors do not consider that the group is materially

exposed to foreign exchange risk as the group does not run open

currency positions beyond the end of each working day.

As of 31 December 2020, trade receivables of GBP159,784 (2019:

GBP131,923) were past due and were impaired and partially provided

for. The amount of the provision was GBP131,456 as at 31 December

2020 (2019: GBP101,539). The individually impaired receivables

relate to clients who are in a loan position and who do not have

adequate stock to cover these positions. The amount of the

impairment is determined by clients' perceived willingness and

ability to pay the debt, legal judgements obtained in respect of,

charges secured on properties and payment plans in place and being

adhered to. Where debts are determined to be irrecoverable, they

are written off through the income and expenditure account. The

group does not anticipate future write offs of uncollectable

amounts will be significant as the group now imposes much more

restrictive rules on clients who utilise extended settlement

facilities.

Group Company

Provision of impairment of 2020 2019 2020 2019

receivables:

-------- --------- ----- -----

GBP GBP GBP GBP

At 1 January 101,539 105,470 - -

Charge / (credit) for the year 30,306 23,398 - -

Uncollectable amounts written

off (389) (27,329) - -

-------- --------- ----- -----

At 31 December 131,456 101,539 - -

======== ========= ===== =====

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BXGDXIUBDGBG

(END) Dow Jones Newswires

March 11, 2021 02:00 ET (07:00 GMT)

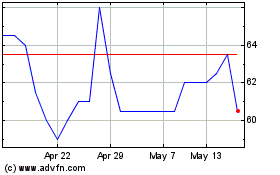

Jarvis Securities (LSE:JIM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Jarvis Securities (LSE:JIM)

Historical Stock Chart

From Jul 2023 to Jul 2024