RNS Number:6702I

Wetherspoon (JD) PLC

08 September 2006

J D WETHERSPOON PLC

PRESS RELEASE

J D Wetherspoon plc announces its preliminary results for the 53 weeks ended 30

July 2006.

FINANCIAL HIGHLIGHTS

Excluding 53 week

-------------------

Turnover up 5% to #847.5m +2.5%

Operating margin 9.9% -v- 8.8% last year -

Profits before tax up 24% to #58.4m +20%

Earnings per share up 43% to 24.1p +38%

Free cash flow #69.7m (2005: #68.8m)

Free cash flow per share 42.1p (2005: 37.1p)

Dividend per share increased by 10%

9 pubs opened, 7 sold, creating a total of 657

Commenting on the results, Tim Martin, chairman of J D Wetherspoon plc, said:

"I am pleased to report a year of good progress for the company. Sales for the

year increased by #37.7 million to #847.5 million, a rise of 5%. Earnings per

share increased by 43% to 24.1p.

We continue to open non-smoking pubs and now have a total of 92 which represents

14% of our estate. Wetherspoon has strongly supported the principle of pubs

becoming non-smoking, and is confident about the company's medium and long term

prospects in this environment. Typically, however, the short term effect of a

change to non-smoking results in a drop in sales and profits. Although the

adjustment to a non-smoking environment can be difficult, the company is

confident that the long term benefits will outweigh the short term issues.

The company has had an encouraging start to the new financial year, with

continued sales improvements, combined with a tight grip on costs. As a result

of our strong cash flow and our dedicated management team, we remain confident

of our prospects. "

John Hutson Chief Executive Officer 01923 477777

Jim Clarke Finance Director 01923 477777

Eddie Gershon Company Spokesman 07956 392234

Photographs are available at: www.newscast.co.uk 8 September 2006

2006 CHAIRMAN'S STATEMENT AND OPERATING REVIEW

I am pleased to report a year of good progress for the company. Sales for the

year increased by #37.7 million to #847.5 million, a rise of 5% (+2.5%)*. Helped

by good cost control, operating margins were 9.9%, compared with 8.8% in the

previous year. Operating profit increased by 17% (+14%)* to #83.6 million, and

profit before tax by 24% (+20%)* to #58.4 million. Earnings per share increased

by 43% (+38%)* to 24.1p.

*Excluding 53rd week

All increases are based on 2005 results before exceptional items.

Net interest was covered 3.3 times (2005: 2.9 times) by operating profit. Free

cash flow, after payments of tax, interest, share purchases under the company's

share plans and capital investment of #20.8 million in existing pubs, increased

by 1% to #69.7 million, resulting in free cash flow per share of 42.1p (2005:

37.1p).

We opened 9 pubs during the year, compared with 13 in the previous year. The

total number of pubs now operated by the company is 657. Average sales per pub

increased by 3% in the year under review, with like-for-like sales increasing by

2%. We intend to open about 15 pubs in the current year.

Dividends

The board proposes, subject to shareholders' consent, to pay a final dividend of

3.1p per share on 24 November 2006 to those shareholders on the register on 27

October 2006, bringing the total dividend for the year to 4.7p per share, a 10%

increase on the previous year.

Finance

The company had #116.6 million (2005: #53.1 million) of unutilised banking

facilities and cash balances as at the balance sheet date, with total facilities

of #472.2 million (2005: #387.2 million). The year's capital expenditure on new

pub developments was more than covered by free cash flow. In the current

financial year, any cash surplus the company generates, after capital

expenditure and dividends, will be available for debt reduction, share buybacks

or a combination of both.

Return of capital

During the year, 21,560,000 shares (representing approximately 12% of the issued

share capital) were purchased by the company for cancellation, at a cost of

#78.7 million, representing an average cost per share of 365p.

Further Progress

The company continues to try and make improvements in every area of the

business. In the 2006 Good Beer Guide published by CAMRA, 120 of the company's

pubs received nominations - a greater number, we believe, than any other pub

company.

The company has also made strenuous efforts in recent years to enhance its

reputation as a 'responsible' retailer and in 2006 we were named 'Responsible

Drinks Retailer of the Year', by the trade publication the Morning Advertiser.

Wetherspoon is the only substantial pub company which does not, for example,

offer a discount for double measures of spirits; does not permit 2 for 1, or

similar offers; and offers food from 9am to 10pm every day.

In the area of training, Wetherspoon continues to lead the way in the UK pub

industry. We have been nominated in several categories for the upcoming

Institute of Innkeeping awards and 38 of our employees have recently graduated

with a diploma in Leisure Retail Management from Nottingham Trent University. As

well as concentrating on high standards of training, the Wetherspoon incentive

system for pub employees spent #13 million in bonuses in the year under review,

and purchased #3.5 million of our own shares for employees under our employee

share plan scheme.

Wetherspoon is aware of its responsibilities to the environment and was one of 3

finalists in the National Recycling Awards for 2005. During the year we recycled

2,300 tonnes of cardboard, 1,420 tonnes of cooking oil, 230 tonnes of paper, 70

tonnes of plastic and 27 tonnes of aluminium.

We have also been keen to promote the sales of non-alcoholic drinks in our pubs.

A major push on coffee in the last 18 months means that our UK coffee sales now

approximately match those of Caffe Nero in volume and are about a quarter of

Starbucks. We believe that we now have approximately 6 per cent of the UK

'chain' coffee market. In a similar area, Wetherspoon has pioneered the

availability of breakfasts across all our pubs and we now sell approximately

200,000 breakfasts per week.

Non-smoking

We continue to open non-smoking pubs and now have a total of 92 which represents

14% of our estate. Wetherspoon has strongly supported the principle of pubs

becoming non-smoking, and is confident about the company's medium and long term

prospects in this environment. Typically, however, the short term effect of a

change to non-smoking results in a drop in sales and profits.

We converted 17 pubs in England and Wales to non-smoking in the first half of

the period under review and their sales declined by 6.5% (on a like-for-like

basis) in the second half of the year. In the remainder of our non-smoking pubs

in England and Wales, a like-for-like picture is difficult to quantify, as pubs

were converted to non-smoking at different times during the previous 6 months.

Overall, we believe that sales started to improve in those pubs after the

initial 12 months but remain below the levels of 2 years ago and represents a

mixed picture.

In our 39 pubs in Scotland, like for like sales over the last quarter (May -

July 2006), declined by 0.3%, and pub operating profits, before head office

costs, declined by 11%.

Although the adjustment to a non-smoking environment can be difficult, the

company is confident that the long term benefits will outweigh the short term

issues.

Board changes

Suzanne Baker resigned from the board on 20 December 2005 after 13 years at the

company and we would like to thank her very much for her efforts.

The company would like to welcome Debra van Gene who was appointed a

non-executive director on 1 March 2006.

People

I would like once again to thank our employees, partners and suppliers for their

excellent work in the last year.

International financial reporting standards (IFRS)

These accounts are the first accounts prepared under International Financial

Reporting Standards (IFRS). This has involved restating the previous year and

has significantly changed the layout of the financial accounts. A separate press

release was issued in January 2006 restating the previous year's results under

IFRS.

Current trading and outlook

The company has had an encouraging start to the new financial year, with

continued sales improvements, combined with a tight grip on costs.

We continue with our efforts to improve the business and have, for example,

recently introduced an enhanced range of bottled beers, wines and spirits and

are about to introduce an upgraded menu. We continue to invest in our pubs,

with plans to spend around #15m on a new cooling system for draught beers

designed to produce lower temperatures of dispense than are currently achieved

by any major pub company.

In addition, we continue to invest heavily in repairs and improvements to our

pubs and in head office and pub IT systems. The concentration on both investment

and improvement in the business will help to put the company in a strong

position for the smoking ban in England, Wales and Northern Ireland expected in

the course of the next year.

As a result of our strong cash flow and our dedicated management team, we remain

confident of our prospects.

Tim Martin

Chairman

8 September 2006

Income Statement for the 53 weeks ended 30 July 2006

Notes 53 weeks ended 52 weeks 52 weeks 52 weeks

30 July 2006 ended ended ended

24 July 2005 24 July 2005 24 July 2005

Before After

exceptional Exceptional exceptional

Total items items items

#000 #000 #000 #000

------------------- ----- ----------- ---------- ---------- ----------

Revenue 847,516 809,861 - 809,861

Operating costs (763,900) (738,355) (7,380) (745,735)

------------------- ----- ----------- ---------- ---------- ----------

Operating profit 83,616 71,506 (7,380) 64,126

Net finance costs 2 (25,228) (24,329) - (24,329)

------------------- ----- ----------- ---------- ---------- ----------

Profit on ordinary 58,388 47,177 (7,380) 39,797

activities before

taxation

Tax expense 3 (18,487) (15,787) 1,920 (13,867)

------------------- ----- ----------- ---------- ---------- ----------

Profit for the 39,901 31,390 (5,460) 25,930

year

------------------- ----- ----------- ---------- ---------- ----------

Earnings per share 4

(pence)

------------------- ----- ----------- ---------- ---------- ----------

Earnings per 24.1 16.9 14.0

ordinary share

Fully diluted 24.0 16.9 14.0

earnings per share

All activities relate to continuing operations.

Statement of recognised income and expense for the 53 weeks ended 30 July 2006

53 weeks ended 52 weeks ended

30 July 2006 24 July 2005

#000 #000

---------------------------------- ---------- ----------

Cash flow hedges: gain taken to equity 4,871 -

Tax on items taken directly to equity (1,462) -

---------------------------------- ---------- ----------

Net gain recognised directly in equity 3,409 -

Profit for the year 39,901 25,930

---------------------------------- ---------- ----------

Total recognised income for the year 43,310 25,930

---------------------------------- ---------- ----------

Cash flow statement for the 53 weeks ended 30 July 2006

Notes 53 weeks ended 53 weeks ended 52 weeks ended 52 weeks ended

30 July 2006 30 July 2006 24 July 2005 24 July 2005

#000 #000 #000 #000

------------------------ ------ --------- --------- --------- ---------

Cash flows from operating

activities

Cash generated from 5 133,366 133,366 123,460 123,460

operations

Interest received 290 290 3,598 43

Interest paid (23,441) (23,441) (24,108) (24,108)

Refinancing cost paid (1,412) (1,412) - -

Corporation tax paid (14,812) (14,812) (12,632) (12,632)

Purchase of own shares (3,469) (3,469) (3,816) (3,816)

for Share Incentive

Plan

------------------------ ----- --------- --------- --------- ---------

Net cash inflow from 90,522 90,522 86,502 82,947

operating activities

------------------------ ----- --------- --------- --------- ---------

Cash flows from investing

activities

Purchase of property, (20,810) (20,810) (14,173) (14,173)

plant and equipment and

intangible assets for

existing pubs

Proceeds of sale of 4,645 8,547

property, plant and

equipment

Investment in new pubs (16,766) (24,495)

and pub extensions

------------------------ ----- --------- --------- --------- ---------

Net cash out flow from (32,931) (30,121)

investing activities

------------------------ ----- --------- --------- --------- ---------

Cash flows from financing

activities

Equity dividends paid 6 (7,367) (7,520)

Issue of ordinary 6,974 271

shares

Purchase of own shares (78,683) (45,718)

Advances under bank 304,504 29,999

loans

Repayments under bank (280,000) (25,000)

loans

------------------------ ----- --------- --------- --------- ---------

Net cash outflow from (54,572) (47,968)

financing activities

------------------------ ----- --------- --------- --------- ---------

Net increase in cash and 3,019 8,413

cash equivalents

------------------------ ----- --------- --------- --------- ---------

Opening cash and cash 18,073 9,660

equivalents

Closing cash and cash 21,092 18,073

equivalents

------------------------ ----- --------- --------- --------- ---------

Free cash flow 69,712 68,774

------------------------ ----- --------- --------- --------- ---------

Free cash flow per 42.1p 37.1p

ordinary share

Balance sheet as at 30 July 2006

Notes 30 July 24 July

2006 2005

#000 #000

---------------------------------- ------- -------- --------

Assets

Non-current assets

Property, plant and equipment 8 743,826 753,370

Intangible assets 2,858 3,156

Other non-current assets 10,004 8,674

---------------------------------- ------- -------- --------

Total non-current assets 756,688 765,200

Current Assets

Inventories 13,688 12,777

Trade and other receivables 9 10,027 12,195

Cash and cash equivalents 21,092 18,073

---------------------------------- ------- -------- --------

Total current assets 44,807 43,045

Assets held for sale 2,431 1,691

---------------------------------- ------- -------- --------

Total Assets 803,926 809,936

---------------------------------- ------- -------- --------

Liabilities

Current Liabilities

Trade and other payables 10 (118,130) (113,158)

Financial liabilities - (25,000)

Current income tax liabilities (10,809) (7,556)

--------------------------------- ------- -------- --------

Total Current Liabilities (128,939) (145,714)

Non-current Liabilities

Financial liabilities 11 (368,717) (319,518)

Other financial liability - (7,700)

Derivative financial instruments (15,156) -

Deferred tax liabilities 3 (82,958) (83,211)

Provisions and other liabilities (6,581) (7,048)

--------------------------------- ------- -------- --------

Total non-current liabilities (473,412) (417,477)

--------------------------------- ------- -------- --------

Net Assets 201,575 246,745

--------------------------------- ------- -------- --------

Shareholders Equity

Ordinary shares 3,076 3,458

Share premium account 135,532 128,607

Capital redemption reserve 1,305 874

Retained earnings 61,662 113,806

--------------------------------- ------- -------- --------

Total shareholders' equity 12 201,575 246,745

--------------------------------- ------- -------- --------

Notes to the accounts

for the 53 weeks ended 30 July 2006

The preliminary announcement for the 53 week period ended 30 July 2006 has been

prepared in accordance with International Financial Reporting Standards as

adopted by the European Union at 30 July 2006. Details of the accounting

policies adopted in this preliminary announcement are set out within the

investors section of the Company's website, www.jdwetherspoon.co.uk.

These preliminary statements do not constitute statutory accounts within the

meaning of Section 240 of the Companies Act 1985. They have, however, been

extracted from the statutory accounts for the period ended 30 July 2006 on which

an unqualified report has been made by the company's auditors.

The 2005 statutory accounts have been filed with the Registrar of Companies. The

2006 statutory accounts will be sent to shareholders in October 2006 and will be

filed with the Registrar of Companies following their adoption at the

forthcoming Annual General Meeting.

2 Net finance costs

53 weeks ended 52 weeks ended

30 July 2006 24 July 2005

#000 #000

------------------------------- ----------- ----------

Finance costs

Interest payable on bank loans and 22,407 18,837

overdrafts

Interest payable on US senior loan notes 2,769 5,724

Amortisation of bank loan issue costs 176 -

------------------------------- ----------- ----------

Finance costs 25,352 24,561

Bank interest receivable (124) (232)

------------------------------- ----------- ----------

Total net finance cost 25,228 24,329

------------------------------- ----------- ----------

3 Taxation

(a) Tax on profit on ordinary activities

Tax charged in the income statement

53 weeks ended 52 weeks ended

30 July 2006 24 July 2005

#000 #000

-------------------------------- ---------- ----------

Current income tax:

Current income tax charge 18,065 14,270

Current tax on exceptional items - (1,150)

-------------------------------- ---------- ----------

Total current income tax 18,065 13,120

Deferred tax:

Origination and reversal of timing 422 1,517

differences

Movement arising on disposals (exceptional - (770)

items)

-------------------------------- ---------- ----------

Total deferred tax 422 747

-------------------------------- ---------- ----------

Tax charge in the income statement 18,487 13,867

-------------------------------- ---------- ----------

Tax relating to items charged or credited to

equity

Deferred tax:

Tax charge on revaluation of cash flow 1,462 -

hedges

-------------------------------- ---------- ----------

Tax charge in the statement of recognised 1,462 -

income and expense

-------------------------------- ---------- ----------

b) Reconciliation of the total tax charge

The tax expense in the income statement for the year is more than the standard

rate of corporation tax in the UK of 30% (2005: 30%). The differences are

reconciled below.

53 weeks ended 52 weeks ended

30 July 2006 24 July 2005

#000 #000

--------------------------------- --------- ----------

Accounting profit before income tax 58,388 39,797

Accounting profit multiplied by the UK 17,516 11,939

standard rate of corporation tax of 30% (2005

- 30%)

Abortive acquisition costs and disposals 254 142

Other disallowables 45 253

Other allowable deductions (10) (18)

Non qualifying depreciation 2,910 1,757

Deduction for share options and SIPs (2,165) (901)

Deferred tax on balance sheet only items (63) 695

--------------------------------- --------- ----------

Total tax expense reported in the income 18,487 13,867

statement

--------------------------------- --------- ----------

c) Deferred tax

The deferred tax in the balance sheet is as follows:

2006 2005

#000 #000

---------------------------------- --------- ----------

Deferred tax liability

Accelerated capital allowances 67,921 66,234

Revaluation of land and buildings 6,550 6,766

Other timing differences 8,487 10,211

---------------------------------- --------- ----------

Deferred tax liability 82,958 83,211

---------------------------------- --------- ----------

Deferred tax asset

Capital losses carried forward 885 1,560

Deferred tax on items taken directly to equity 2,145 -

---------------------------------- --------- ----------

Deferred tax asset 3,030 1,560

---------------------------------- --------- ----------

Deferred tax in the income statement:

Accelerated capital allowances 1,687 1,251

Origination and reversal of timing differences (1,940) 140

Capital losses carried forward 675 (644)

---------------------------------- --------- ----------

Deferred tax expense 422 747

---------------------------------- --------- ----------

4 Earnings and cash flow per share

Basic earnings per share has been calculated by dividing the profit attributable

to equity holders of #39,901,000 (2005: #25,930,000) by the weighted average

number of shares in issue during the year of 165,694,582 (2005: 185,524,467).

Diluted earnings per share has been calculated on a similar basis taking account

of 545,980 (2005: 236,187) dilutive potential shares under option, giving a

weighted average number of ordinary shares adjusted for the effect of dilution

of 166,240,832 (2005: 185,760,654).

Adjusted earnings per share excludes the effect of exceptional items and is

presented to show the underlying performance of the company on both a basic and

dilutive basis.

Adjusted Earnings Basic Earnings Per Share Diluted Earnings Per Share

earnings

per share

53 weeks ended 52 weeks ended 53 weeks ended 52 weeks ended 53 weeks ended 52 weeks ended

30 July 2006 24 July 2005 30 July 2006 24 July 2005 30 July 2006 24 July 2005

#000 #000 p p p p

------------- --------- --------- ---------- ---------- --------- ---------

Profit for the 39,901 25,930 24.1 14.0 24.0 14.0

year

Exceptionals - 5,460 - 2.9 - 2.9

------------- --------- --------- ---------- ---------- --------- ---------

Profit before 39,901 31,390 24.1 16.9 24.0 16.9

exceptionals

------------- --------- --------- ---------- ---------- --------- ---------

Cash flow per share

The calculation of free cash flow per share is based on the net cash generated

by business activities and available for investment in new pub developments and

extensions to existing pubs, after funding interest, tax, all other reinvestment

in pubs open at the start of the period and the purchase of own shares under the

employee Share Incentive Plan ('free cash flow'). It is calculated before taking

account of proceeds from property disposals and inflows and outflows of

financing from outside sources, dividend payments and is based on the same

number of shares in issue as that for the calculation of basic earnings per

share.

5 Cash generated from operations

53 weeks ended 52 weeks

30 July 2006 ended

#000 24 July 2005

#000

------------------------------------ --------- ----------

Profit attributable to shareholders 39,901 25,930

Adjusted for:

Tax 18,487 13,867

Amortisation of intangible assets 1,079 2,851

Depreciation of Property, Plant and Equipment 42,127 44,213

Lease premium amortisation 187 192

Distribution start up costs - 2,984

Restructuring costs - 859

Impairment of Property, Plant and Equipment - 1,068

Net loss on disposal and anticipated disposal 2,306

of trading properties

Net loss on disposal and anticipated disposal - 163

of non-trading properties

Share based payments 2,480 985

Interest income (124) (232)

Interest expense 25,176 24,561

Amortisation of bank loan issue costs 176 -

------------------------------------ --------- ----------

129,489 119,747

Change in inventories (911) (768)

Change in receivables 2,003 (247)

Change in payables 2,785 8,571

------------------------------------ --------- ----------

Net cash inflow from operating activities pre 133,366 127,303

exceptional

Outflow related to exceptional items - (3,843)

------------------------------------ --------- ----------

Net cash inflow from operating activities 133,366 123,460

------------------------------------ --------- ----------

6 Dividends paid and proposed

53 weeks ended 52 weeks ended

30 July 2006 24 July 2005

#000 #000

-------------------------------- ---------- ----------

Declared and paid during the year:

Dividends on ordinary shares:

Final dividend for 2004/05: 2.82p (2003/04: 4,749 4,839

2.56p)

Interim for 2006: 1.6p (2005: 1.46p) 2,618 2,681

-------------------------------- ---------- ----------

Dividends paid 7,367 7,520

-------------------------------- ---------- ----------

Proposed for approval by shareholders at the

AGM:

Final dividend for 2005/06: 3.1p (2004/05: 5,137 4,749

2.82p)

-------------------------------- ---------- ----------

7 Analysis of changes in net debt

At 25 July Cash flows Non-cash At 30 July

2005 movement 2006

#000 #000 #000

#000

----------------- ---------- ---------- ---------- ----------

Cash at bank and in 18,073 3,019 - 21,092

hand

Debt due within one (25,000) - 25,000 -

year

Debt due after one (328,843) (24,504) (15,370) (368,717)

year

Derivative financial 1,625 - (9,630) (8,005)

instrument - fair

value hedge

----------------- ---------- ---------- ---------- ----------

(334,145) (21,485) - (355,630)

Derivative financial (12,022) 4,871 (7,151)

instrument - cash flow

hedge

----------------- ---------- ---------- ---------- ----------

(346,167) (21,485) 4,871 (362,781)

----------------- ---------- ---------- ---------- ----------

8 Property, Plant and Equipment

Freehold and Short leasehold Equipment, Expenditure on

long leasehold property fixtures and unopened

property fittings properties Total

#000 #000 #000 #000 #000

----------------- -------- -------- --------- --------- --------

Cost:

At 26 July 2004 415,334 322,865 217,215 17,993 973,407

Reclassification 8,182 1,103 - (9,285) -

Additions 10,929 3,363 14,493 3,349 32,134

Transfer to assets (1,073) (168) (2,926) - (4,167)

available for

sale

Disposals (1,066) - (589) (472) (2,127)

----------------- -------- -------- --------- --------- --------

At 24 July 2005 432,306 327,163 228,193 11,585 999,247

Additions 7,069 10,134 12,403 9,107 38,713

Reclassification 2,454 603 5 (3,062) -

Transfer to assets (2,604) 144 (336) - (2,796)

available for

sale

Disposals (2,930) (1,441) (3,747) (723) (8,841)

----------------- -------- -------- --------- --------- --------

At 30 July 2006 436,295 336,603 236,518 16,907 1,026,323

----------------- -------- -------- --------- --------- --------

Depreciation and

impairment:

At 26 July 2004 26,140 47,346 127,799 - 201,285

Provided during 7,538 7,400 29,275 - 44,213

the year

Transfer to assets (73) 874 (1,445) - (644)

available for

sale

Impairment loss - 1,068 - 413 1,481

Disposals (78) - (380) - (458)

---------------- -------- -------- --------- --------- ---------

At 24 July 2005 33,527 56,688 155,249 413 245,877

Provided during 7,715 7,431 26,981 - 42,127

the year

Transfer to assets (109) 7 (422) - (524)

available for

sale

Disposals (209) (10) (4,638) (126) (4,983)

---------------- -------- -------- --------- --------- ---------

At 30 July 2006 40,924 64,116 177,170 287 282,497

---------------- -------- -------- --------- --------- ---------

Net book amount at 395,371 272,487 59,348 16,620 743,826

30 July 2006

---------------- -------- -------- --------- --------- ---------

Net book amount at 398,779 270,475 72,944 11,172 753,370

24 July 2005

---------------- -------- -------- --------- --------- ---------

Net book amount at 389,194 275,519 89,416 17,993 772,122

26 July 2004

---------------- -------- -------- --------- --------- ---------

9 Trade and other receivables

2006 2005

#000 #000

---------------------------------- --------- ----------

Amounts falling due within one year

Other debtors 3,327 2,666

Prepayments and accrued income 6,700 9,529

---------------------------------- --------- ----------

10,027 12,195

---------------------------------- --------- ----------

10 Trade and other payables

2006 2005

#000 #000

--------------------------------- --------- ----------

Trade creditors 57,637 54,025

Other creditors 6,569 5,493

Other tax and social security 22,373 22,224

Accruals and deferred income 31,551 31,416

---------------------------------- --------- ----------

118,130 113,158

---------------------------------- --------- ----------

11 Financial liabilities

2006 2005

#000 #000

---------------------------------- --------- ----------

Current

Short term borrowings - 25,000

---------------------------------- --------- ----------

- 25,000

---------------------------------- --------- ----------

Bank loans

Variable rate facility 2005 - 240,000

Variable rate facility 2010 289,503 -

US$ 140,000,000 senior loan notes 2009 79,214 79,518

--------------------------------- --------- ----------

368,717 319,518

--------------------------------- --------- ----------

12 Statement of changes in shareholders equity

Called up Share Capital

share premium redemption Retained

capital account reserve earnings Total

#000 #000 #000 #000 #000

---------------------- ------- ------- --------- -------- ---------

At 26 July 2004 3,783 128,340 545 141,489 274,157

Exercise of options 4 267 - - 271

Share based payments - - - 985 985

Purchase of shares held - - - (3,817) (3,817)

in trust

Purchase of shares (329) - 329 (43,261) (43,261)

Profit for the year - - - 25,930 25,930

Dividends - - - (7,520) (7,520)

---------------------- ------- ------- --------- -------- ---------

At 25 July 2005 3,458 128,607 874 113,806 246,745

Effect of adoption of - - - (12,022) (12,022)

IAS 32 and IAS 39

Tax on items taken - - - 3,607 3,607

directly to equity

---------------------- ------- ------- --------- -------- ---------

At 25 July 2005 3,458 128,607 874 105,391 238,330

(restated)

Exercise of options 49 6,925 - - 6,974

Re-purchase of shares (431) - 431 (78,683) (78,683)

Share based payments - - - 2,480 2,480

Purchase of shares held - - - (3,469) (3,469)

in trust

Profit for the year - - - 39,901 39,901

Cash flow hedges: gain - - - 4,871 4,871

taken to equity

Tax on items taken - - - (1,462) (1,462)

directly to equity

Dividends - - - (7,367) (7,367)

---------------------- ------- ------- --------- -------- ---------

At 30 July 2006 3,076 135,532 1,305 61,662 201,575

---------------------- ------- ------- --------- -------- ---------

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SSDFAWSMSEEU

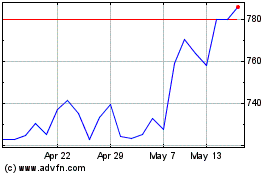

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Sep 2024 to Oct 2024

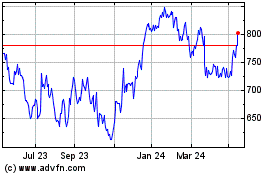

Wetherspoon ( J.d.) (LSE:JDW)

Historical Stock Chart

From Oct 2023 to Oct 2024