TIDMIQE

RNS Number : 0784M

IQE PLC

12 September 2023

IQE plc

Cardiff, UK

12 September 2023

Unaudited Results for the six months ended 30 June 2023

Investing for growth and managing costs to navigate temporary

industry downturn

IQE plc (AIM: IQE, "IQE" or the "Group"), the leading supplier

of compound semiconductor wafer products and advanced material

solutions to the global semiconductor industry , announces its

interim results for the six months ended 30 June 2023.

Revenue for the period was GBP52.0m with a reported operating

loss of GBP19.6m, an adjusted non-GAAP LBITDA of (GBP5.7m) and

adjusted net funds position of GBP5.3m.

Americo Lemos, Chief Executive Officer of IQE, commented:

"IQE has delivered H1 revenue in line with our revised market

guidance. In a challenging macro environment, we have taken

decisive action to manage costs and deliver immediate efficiencies

and longer-term margin benefits. We are accelerating our

diversification strategy with new customer designs in GaN Power

electronics and broadening our market penetration into the China

wireless market. By expanding our customer base across the breadth

of our product portfolio and ramping in strategic growth areas, we

are focused on improving future business performance."

H1 2023 Financial Results

H1 2023 H1 2022

GBP'm* GBP'm*

Revenue 52.0 86.2

Adjusted EBITDA** (5.7) 12.3

Operating loss (19.6) (7.4)

Adjusted operating loss** (17.5) (1.4)

Reported loss after tax (21.3) (8.3)

Diluted EPS (2.57p) (1.03p)

Adjusted diluted EPS** (2.30p) (0.36p)

Cash generated from operations 2.4 6.2

Adjusted cash from operations** 4.3 8.3

Capital Investment (PP&E) 5.2 3.8

Net funds / (debt)*** 5.3 (6.7)

* All figures GBP'm excluding diluted and adjusted diluted EPS.

** Adjusted Measures: Alternative performance measures are

disclosed separately after a number of non-cash charges,

non-operational items and significant infrequent items that would

distort period on period comparability . Adjusted items are

material items of income or expense that have been shown separately

due to the significance of their nature or amount as detailed in

note 8.

*** Net funds/debt excludes IFRS16 lease liabilities and fair

value gains/losses on derivative instruments.

The following highlights of the first half results are based on

these adjusted performance measures, unless otherwise stated.

Strategic Highlights

-- Commenced sampling for GaN Power with two new customers for 650 V devices

-- Design wins with multiple customers to deliver wireless

products to leading China cellular and Wi-Fi suppliers for growing

China and India smartphone market

-- Customer qualifications for high-speed data centre

applications, with next-generation VCSELs to enable and support

growth in the artificial intelligence (AI) markets

-- Customer sampling and qualification in progress to supply

automotive-grade LiDAR VCSELs for a major China-based customer

-- Production of second generation, high performance VCSELs used

in consumer mobile 3D Sensing applications for customers

-- Developing industry's first 150mm (6") Indium Phosphide (InP)

Photonics device platform, targeting customers in the Cloud/AI data

centre markets

-- Development of new laser materials technologies for a leading

handset manufacturer for next-generation longer-wavelength consumer

sensing applications

-- Development of 200mm (8") Red, Green and Blue (RGB) epitaxial

wafer products for microLED display qualification

-- Developing frameworks and processes to adopt and align with

the Task Force on Climate-Related Financial Disclosures (TCFD) with

first TCFD Statement published in the 2023 Annual Report and

Financial Statements

-- Developing emissions targets in accordance with the Science

Base Targets initiative (SBTi) with IQE on track to submit targets

within the 24 month commitment window

H1 2023 Financial Highlights

-- Revenue of GBP52.0m (H1 2022: GBP86.2m) down 39.7% on a

reported basis and 42.6% at constant currency

-- Wireless revenue of GBP22.4m (H1 2022: GBP46.6m) down 51.9%

on a reported basis, largely as a result of weakness in global

handset demand and supply chain inventory build

-- Photonics revenue of GBP28.0m (H1 2022: GBP38.5m) down 27.2%

on a reported basis, primarily as a result of softness in the

handset market and a slowdown in Asian telecoms infrastructure

programmes

-- CMOS++ revenue of GBP1.6m (H1 2022: GBP1.1m) up 43.1% on a

reported basis, due to growth in Silicon-based switches for power

control

-- Adjusted LBITDA of (GBP5.7m) (H1 2022: GBP12.3m EBITDA) down

146.5% on a reported basis, adversely impacted by a reduction in

sales and under-utilisation of capacity, particularly in the

Wireless business

-- Reported operating loss of GBP19.6m (H1 2022: GBP7.4m loss)

-- Adjusted cash inflow from operations of GBP4.3m (H1 2022:

GBP8.3m) benefitting from management of working capital

-- Total net cash capex and cash investment in intangibles of GBP8.5m (H1 2022: GBP7.6m)

-- GBP5.2m investment in PP&E capex (H1 2022: GBP3.8m)

prioritising high growth GaN power and display capacity as set out

at the time of the equity raise

-- Purchase of intangibles of GBP1.7m (H1 2022: GBP2.3m) primarily relates to ongoing systems transformation programme

-- Ongoing investment in R&D with GBP1.6m (H1 2022: GBP1.6m)

of development costs in the period focused on power electronics and

microLEDs

-- Adjusted net funds of GBP5.3m as at 30 June 2023 (net debt of

GBP15.2m as at 31 Dec 2022, net debt of GBP6.7m as at 30 June 2022)

with an undrawn Revolving Credit Facility of $35m (GBP27.3m)

available to the Group

-- Equity raise of GBP29.7m (net proceeds) completed in May in

order to strengthen the balance sheet and underpin strategic

investment

-- Cost optimisation

-- Optimised manufacturing plan for improved asset utilisation

-- Headcount reductions delivering c.10% in year savings, while

retaining key skills for growth with associated H1 2023

restructuring costs of GBP1.2m

-- Reduction in non-labour costs to deliver greater than 20% in year savings

-- Global site optimisation programme

-- US MBE operations consolidation within North Carolina site on

track to be completed by H1 2024

-- Ongoing review into global footprint optimisation to improve

operational efficiency and profitability

Current trading and outlook

The current temporary semiconductor industry downturn is

stabilising, with continued pockets of recovery expected in H2

2023, albeit more slowly than anticipated at the time of the FY

2022 results.

Improvement is expected in 2024 as the supply chain normalises

and customer demand recovers.

The Group anticipates double digit revenue growth in H2 2023

versus H1 2023, and expects to be profitable at an adjusted EBITDA

level for FY 2023.

Results Presentation

IQE will present its H1 2023 Results via webcast at 9:00am BST

today, Tuesday 12 September 2023. If you would like to view this

webcast, please register by using the below link and following the

instructions:

https://stream.brrmedia.co.uk/broadcast/64df6b6ae4c3ecf0bd56f5e4

Glossary

Term Definition

Artificial intelligence (AI) A simulation of human intelligence

in machines, including machines

which are programmed to mimic

human action or exhibit humanistic

traits such as learning or problem-solving

--------------------------------------------

GaN Gallium Nitride

--------------------------------------------

InP Indium Phosphide

--------------------------------------------

LiDAR Light detection and ranging

- a method for measuring distances

by illuminating the target with

a laser light

--------------------------------------------

MicroLED Emerging display technology

consisting of arrays of microscopic

light emitting diodes (LEDs)

--------------------------------------------

VCSEL Vertical Cavity Surface Emitting

Laser, an opto-electronic component

used in a variety

of applications

--------------------------------------------

Contacts:

IQE plc

+44 (0) 29 2083 9400

Americo Lemos

Neil Rummings

Amy Barlow

Peel Hunt (Nomad and Joint Broker)

+44 (0) 20 7418 8900

Paul Gillam

Richard Chambers

James Smith

Numis (Joint Broker)

+44 (0) 20 7260 1000

Simon Willis

Hugo Rubinstein

Iqra Amin

Headland Consultancy (Financial PR)

+ 44 (0) 20 38054822

Andy Rivett-Carnac: +44 (0) 7968 997 365

Chloe Francklin: +44 (0)78 3497 4624

ABOUT IQE

http://iqep.com

IQE is the leading global supplier of advanced compound

semiconductor wafers and materials solutions that enable a diverse

range of applications across:

-- Smart Connected Devices

-- Communications Infrastructure

-- Automotive and Industrial

-- Aerospace and Security

As a scaled global epitaxy wafer manufacturer, IQE is uniquely

positioned in this market which has high barriers to entry. IQE

supplies the global market and is enabling customers to innovate at

chip and OEM level. By leveraging the Group's intellectual property

portfolio including know-how and patents, it produces epitaxy

wafers of superior quality, yield and unit economics.

IQE is headquartered in Cardiff UK, with employees across eight

manufacturing locations in the UK, US and Taiwan, and is listed on

the AIM Stock Exchange in London.

Financial Review

Restated

6 months 6 months 12 months

to to to

30 Jun 30 Jun 31 Dec

Consolidated Income Statement 2023 2022 2022

(All figures GBP'000s) Note Unaudited Unaudited Audited

------------------------------------- ----- ----------- ---------- ------------

Revenue 7 52,016 86,198 167,494

Cost of sales (56,241) (71,845) (141,111)

------------------------------------- ----- ----------- ---------- ------------

Gross (loss)/profit (4,225) 14,353 26,383

Selling, general and administrative

expenses (16,404) (16,514) (31,211)

Impairment loss on intangible

assets - (3,363) (66,155)

Impairment reversal/(loss)

on trade receivables and contract

assets 355 - (2,300)

(Loss)/profit on disposal of

intangible assets and property,

plant and equipment - (590) 688

Other gains/(losses) 4 640 (1,317) (381)

Operating loss 7 (19,634) (7,431) (72,976)

Finance costs (1,832) (1,100) (2,427)

Adjusted loss before income

tax (19,291) (2,540) (5,984)

Adjustments 8 (2,175) (5,991) (69,419)

------------------------------------- ----- ----------- ---------- ------------

Loss before income tax 7 (21,466) (8,531) (75,403)

Taxation 141 279 862

------------------------------------- ----- ----------- ---------- ------------

Loss for the period (21,325) (8,252) (74,541)

-------------------------------------------- ----------- ---------- ------------

Loss attributable to:

Equity shareholders (21,325) (8,252) (74,541)

(21,325) (8,252) (74,541)

-------------------------------------------- ----------- ---------- ------------

Loss per share attributable to

owners of the parent during the

period

Basic loss per share 10 (2.57p) (1.03p) (9.27p)

Diluted loss per share 10 (2.57p) (1.03p) (9.27p)

-------------------------------------------- ----------- ---------- ------------

Adjusted basic and diluted earnings per share are presented in

Note 10.

All items included in the loss for the period relate to

continuing operations.

The comparative financial information for 6 months to 30 June

2022 has been restated to reclassify GBP3,363,000 from 'Selling,

general and administrative expenses' to 'Impairment loss on

intangible assets' in order to adopt a consistent presentation with

the audited financial statements for the year ended 31 December

2022. The reclassification has had no impact on net assets, cash

flows or loss after tax for the 6 months to 30 June 2022.

Consolidated statement of comprehensive 6 months 6 months 12 months

income to to to

30 Jun 30 Jun 31 Dec

2023 2022 2022

(All figures GBP'000s) Unaudited Unaudited Audited

----------------------------------------- ----------- ----------- ------------

Loss for the period (21,325) (8,252) (74,541)

Exchange differences on translation

of foreign operations* (7,682) 16,776 14,500

----------------------------------------- ----------- ----------- ------------

Total comprehensive (expense) /

income for the period (29,007) 8,524 (60,041)

----------------------------------------- ----------- ----------- ------------

Total comprehensive (expense) /

income attributable to:

Equity shareholders (29,007) 8,524 (60,041)

(29,007) 8,524 (60,041)

----------------------------------------- ----------- ----------- ------------

* Balance might subsequently be reclassified to the income

statement when it becomes realised.

Consolidated Balance Sheet

As At As At As At

30 Jun 30 Jun 31 Dec

2023 2022 2022

(All figures GBP'000s) Note Unaudited Unaudited Audited

--------------------------------------- ----- ---------- ---------- ----------

Non-current assets

Intangible assets 35,061 99,616 37,014

Property, plant and equipment 121,640 126,971 127,055

Right of use assets 38,918 43,350 41,432

Total non-current assets 195,619 269,937 205,501

--------------------------------------- ----- ---------- ---------- ----------

Current assets

Inventories 25,874 34,706 34,161

Trade and other receivables 36,996 53,246 44,828

Derivative financial instruments 12 259 - -

Cash and cash equivalents 12 12,314 15,390 11,620

--------------------------------------- ----- ---------- ---------- ----------

Total current assets 75,443 103,342 90,609

--------------------------------------- ----- ---------- ---------- ----------

Total assets 271,062 373,279 296,110

--------------------------------------- ----- ---------- ---------- ----------

Current liabilities

Trade and other payables (33,458) (44,016) (37,545)

Current tax liabilities (65) (1,230) (690)

Bank borrowings 12 (6,123) (14,912) (6,225)

Derivative financial instruments 12 - (1,327) (381)

Lease liabilities 12 (7,140) (5,287) (4,843)

Provisions for other liabilities

and charges (2,194) (3,803) (1,625)

Total current liabilities (48,980) (70,575) (51,309)

--------------------------------------- ----- ---------- ---------- ----------

Non-current liabilities

Bank borrowings 12 (845) (7,205) (20,643)

Lease liabilities 12 (42,826) (48,372) (46,026)

Provisions for other liabilities

and charges (710) (1,464) (1,065)

Deferred tax liabilities (1,291) (1,317) (2,007)

--------------------------------------- ----- ---------- ---------- ----------

Total non-current liabilities (45,672) (58,358) (69,741)

--------------------------------------- ----- ---------- ---------- ----------

Total liabilities (94,652) (128,933) (121,050)

--------------------------------------- ----- ---------- ---------- ----------

Net assets 176,410 244,346 175,060

--------------------------------------- ----- ---------- ---------- ----------

Equity attributable to shareholders

of the parent

Share capital 13 9,614 8,046 8,048

Share premium 155,825 154,675 154,720

Retained earnings (39,413) 21,043 (45,246)

Exchange rate reserve 32,853 42,811 40,535

Other reserves 17,531 17,771 17,003

--------------------------------------- ----- ---------- ---------- ----------

Total equity 176,410 244,346 175,060

--------------------------------------- ----- ---------- ---------- ----------

Consolidated Statement of Changes in Equity

Unaudited Share Share Retained Exchange Other Total

capital premium earnings rate reserve reserves equity

(All figures GBP'000s)

At 1 January 2023 8,048 154,720 (45,246) 40,535 17,003 175,060

--------------------------- -------- -------- --------- ------------- --------- --------

Loss for the period - - (21,325) - - (21,325)

Other comprehensive

expense for the period - - - (7,682) - (7,682)

Total comprehensive

expense - - (21,325) (7,682) - (29,007)

Share based payments - - - - 528 528

Proceeds from shares

issued (net of expenses) 1,566 1,105 - - 27,158 29,829

Transfer of merger reserve

to retained earnings

(see note 13) - - 27,158 - (27,158) -

Total transactions

with owners 1,566 1,105 27,158 - 528 30,357

At 30 June 2023 9,614 155,825 (39,413) 32,853 17,531 176,410

--------------------------- -------- -------- --------- ------------- --------- --------

Unaudited Share Share Retained Exchange Other Total

capital premium earnings rate reserve reserves equity

(All figures GBP'000s)

At 1 January 2022 8,036 154,632 29,295 26,035 16,623 234,621

--------------------------- -------- -------- --------- ------------- --------- --------

Loss for the period - - (8,252) - - (8,252)

Other comprehensive

income for the period - - - 16,776 - 16,776

Total comprehensive

(expense)/income - - (8,252) 16,776 - 8,524

Share based payments - - - - 1,148 1,148

Proceeds from shares

issued 10 43 - - - 53

--------------------------- -------- -------- --------- ------------- --------- --------

Total transactions

with owners 10 43 - - 1,148 1,201

At 30 June 2022 8,046 154,675 21,043 42,811 17,771 244,346

--------------------------- -------- -------- --------- ------------- --------- --------

Audited Share Share Retained Exchange Other Total

capital premium earnings rate reserve reserves equity

(All figures GBP'000s)

At 1 January 2022 8,036 154,632 29,295 26,035 16,623 234,621

------------------------ -------- -------- --------- ------------- --------- --------

Loss for the year - - (74,541) - - (74,541)

Other comprehensive

income for the year - - - 14,500 - 14,500

Total comprehensive

(expense)/income - - (74,541) 14,500 - (60,041)

Share based payments - - - - 289 289

Tax relating to share

options - - - - 91 91

Proceeds from shares

issued 12 88 - - - 100

Total transactions

with owners 12 88 - - 380 480

At 31 December 2022 8,048 154,720 (45,246) 40,535 17,003 175,060

------------------------ -------- -------- --------- ------------- --------- --------

Consolidated Cash Flow Statement 6 months 6 months 12 months

to to to

30 Jun 30 Jun 31 Dec

2023 2022 2022

(All figures GBP'000s) Note Unaudited Unaudited Audited

----------------------------------- ----------- ----------- ----------- ------------

Cash flows from operating activities

------------------------------------------- --- ----------- ----------- ------------

Adjusted cash inflow from operations 4,296 8,349 15,652

Cash impact of adjustments 8 (1,864) (2,173) (6,779)

------------------------------------------- --- ----------- ----------- ------------

Cash generated from operations 11 2,432 6,176 8,873

Net interest paid (1,565) (1,100) (2,154)

Income tax paid (726) (628) (775)

------------------------------------------- --- ----------- ----------- ------------

Net cash generated from operating

activities 141 4,448 5,944

------------------------------------------------ ----------- ----------- ------------

Cash flows from investing activities

Purchase of property, plant and equipment (5,183) (3,751) (9,438)

Purchase of intangible assets (1,681) (2,254) (4,699)

Capitalised development expenditure (1,590) (1,567) (3,795)

Proceeds from disposal of property,

plant and equipment 12 4,091 7,203

------------------------------------------------ ----------- ----------- ------------

Adjusted cash used in investing

activities (8,442) (7,572) (16,802)

Cash impact of adjustments - proceeds

from disposal of property, plant

and equipment and intangible assets 8 - 4,091 6,073

------------------------------------------- --- ----------- ----------- ------------

Net cash used in investing activities (8,442) (3,481) (10,729)

------------------------------------------- --- ----------- ----------- ------------

Cash flows from financing activities

Proceeds from issuance of ordinary

shares 31,219 53 100

Expenses associated with issue (1,390) - -

of ordinary shares

Proceeds from borrowings 5,833 7,856 15,814

Repayment of borrowings (25,302) (3,156) (6,256)

Payment of lease liabilities (748) (1,923) (4,926)

------------------------------------------- --- ----------- ----------- ------------

Net cash generated from financing

activities 9,612 2,830 4,732

------------------------------------------------ ----------- ----------- ------------

Net increase / (decrease) in cash

and cash equivalents 1,311 3,797 (53)

Cash and cash equivalents at the

beginning of the period 11,620 10,791 10,791

Exchange (losses) / gains on cash

and cash equivalents (617) 802 882

------------------------------------------- --- ----------- ----------- ------------

Cash and cash equivalents at

the end of the period 12 12,314 15,390 11,620

------------------------------------------- --- ----------- ----------- ------------

1. REPORTING ENTITY

IQE plc is a public limited company incorporated in the United

Kingdom under the Companies Act 2006. The Company is domiciled in

the United Kingdom and is quoted on the Alternative Investment

Market (AIM).

These condensed consolidated interim financial statements

('interim financial statements') as at and for the six months ended

30 June 2023 comprise the Company and its Subsidiaries (together

referred to as 'the Group'). The principal activities of the Group

are the development, manufacture and sale of advanced semiconductor

materials.

2. BASIS OF PREPARATION

These interim financial statements have been prepared in

accordance with IAS 34 'Interim Financial Reporting', and should be

read in conjunction with the Group's last annual consolidated

financial statements as at and for the year ended 31 December 2022

which were approved by the Board of Directors on 23 May 2023 and

have been delivered to the Registrar of Companies. The report of

the auditors on those financial statements was unqualified, did not

contain an emphasis of matter paragraph and did not contain any

statement under section 498 of the Companies Act 2006.

The interim financial statements do not include all of the

information required for a complete set of IFRS financial

statements and do not constitute statutory accounts within the

meaning of section 434 of the Companies Act 2006. However, selected

explanatory notes are included to explain events and transactions

that are significant to an understanding of the changes in the

Group's financial position and performance since the last annual

financial statements.

Comparative information in the interim financial statements as

at and for the year ended 31 December 2022 has been taken from the

published audited financial statements as at and for the year ended

31 December 2022. All other periods presented are unaudited.

The Board of Directors and the Audit Committee approved the

interim financial statements on 12 September 2023.

3. GOING CONCERN

The Group is currently experiencing weaker customer demand and a

reduction in customer orders and forecasts as a result of the

global semiconductor industry downturn. The current industry

downturn has presented a temporary but significant challenge to

sales volumes in the first half of 2023 with market softness

expected to extend into H2FY23 prior to an anticipated gradual

improvement in market dynamics and customer demand from Q4

2023.

The Directors have taken steps to strengthen the balance sheet

of the Group in order to mitigate the financial impact of the

current semiconductor market downturn. Actions taken include:

-- The successful refinancing of the Group's GBP27,300,000

($35,000,000) multi-currency revolving credit facility provided by

HSBC Bank plc on 16 May 2023. The tenor of the facility has been

extended to 1 May 2026 with quarterly leverage and interest cover

covenant tests applicable to the facility, commencing at December

2023

-- The successful GBP31,098,546 equity fund raise (net proceeds

of GBP29,708,392) completed on 18 May 2023 in order to ensure that

the Company can continue to invest to execute on its strategy, meet

its near-term liquidity requirements and deliver a sustainable

balance sheet position going forward

-- The implementation of cost management actions, including

staff redundancies, operational efficiencies and reductions in

areas of discretionary expenditure which are under the control of

the Directors

-- Deferral of capital and intangible asset expenditure under the control of the Directors

In the six months to 30 June 2023, reported revenue declined 40%

and the group made a loss for the period of GBP21,325,000 (H1 2022:

GBP8,252,000, FY22: GBP74,541,000) . The cash impact of the loss

for the period has been mitigated by a combination of the Group's

successful equity fund raise, careful working capital management

and the deferral of certain capital and intangible asset

expenditure resulting in an improvement in the Group's net funds

position (excluding lease liabilities and fair value gains/losses

on derivative instruments) to GBP5,346,000 (H1 2022: GBP6,727,000

net debt, FY22: GBP15,248,000 net debt) At 30 June 2023 the Group

had undrawn committed funding of GBP27,300,000 ($35,000,000)

available under the terms of its credit facilities.

In assessing the going concern basis of preparation the

Directors have reviewed financial projections to 31 December 2024

('the going concern assessment period'), containing both a 'base

case' and a 'severe but plausible downside case'. The review period

extends beyond the minimum required 12-month period from the date

of approval of the interim financial statements to protect against

the recovery in the semiconductor market occurring later than

forecast by the Directors.

Base Case

The base case is the Group's latest 2023 Board approved 2023 and

2024 forecasts. The base case incorporates the impact of current

market softness, weak customer demand and cost management actions

implemented by the Board.

The base case was prepared with the following key

assumptions:

-- Revenue for 2023 in line with current analyst consensus, with

a forecast return to year-on-year growth in 2024

-- Direct wafer product margins for 2023 and 2024 consistent with H1 2023

-- Labour inflation in 2024 in line with labour market norms

-- Cost inflation in 2024 operating and administrative costs in

line with the current inflationary environment

-- c.GBP14,000,000 of capital expenditure in 2023 and 2024 which

includes investment in Gallium Nitride (GaN) related manufacturing

capacity, enabling diversification into the high-growth power

electronics and advanced display (uLED) markets

In the base case the Group is forecast to maintain significant

levels of funding headroom throughout the going concern assessment

period and is forecast to comply with its leverage and interest

cover banking covenants throughout the going concern assessment

period. A mid-single digit GBPm net debt (excluding lease

liabilities and fair value gains/losses on derivatives) position is

forecast at the end of 2023 and a high-single digit GBPm net debt

position is forecast at the end of 2024.

Severe but plausible downside case

The severe but plausible downside case was prepared using the

following key assumptions:

-- Revenue is assumed at 17% down on the base case for Q4 2023

and 10% down on the base case for FY24 with a return to growth

deferred to Q2FY24.

-- In line with the revenue reduction in both years, there is a

reflective reduction in variable operating costs for 2023 and 2024

along with additional incremental cost savings that primarily

include idling of tools, labour savings and reductions in certain

non-manufacturing related discretionary expenditure that can be

controlled by the Directors

In the severe but plausible downside case the Group's liquidity

is reduced to mid-single digit GBPm at the end of 2023, increasing

to low teen GBPm at the end of 2024 and is forecast to comply with

its leverage and interest cover banking covenants throughout the

going concern assessment period. A mid-single digit GBPm net debt

(excluding lease liabilities and fair value gains/losses on

derivatives) position is forecast at the end of 2023 and a low teen

GBPm net debt position is forecast at the end of 2024.

4. USE OF JUDGEMENTS AND ESTIMATES

In preparing these interim financial statements, management has

made judgements and estimates that affect the application of

accounting policies and the reported amounts of assets,

liabilities, income and expense. Actual results may differ from

these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those described in the last annual

financial statements except as follows:

Impairment of Cash Generating Units ('CGU')

At the end of each reporting period, the Group assesses whether

there is any indication of impairment of non-current assets

allocated to the Group's CGU's. Multiple production facilities and

production assets are included in a single CGU reflecting that

production can (and is) transferred between sites and production

assets for different operating segments to suit capacity planning

and operational efficiency. Given the interdependency of facilities

and production assets non-current assets are tested for impairment

by grouping operational sites and production assets into CGUs based

on type of production.

In the six months to 30 June 2023, the current industry downturn

has negatively impacted the Group's results with a loss for the

period of GBP21,325,000 and operating losses in each of its

Wireless and Photonics CGU's. As a result of this, non-current

assets allocated to the Wireless and Photonics CGUs have been

tested for impairment.

The recoverable amount of the CGUs has been determined based on

value in use calculations, using cash flow projections for a

five-year period plus a terminal value based upon a long-term

growth rate of 2% in line with The Bank of England's monetary

policy 2% inflation target.

Value in use calculations are based on the Group's latest Board

approved 2023 and 2024 forecast and five-year plan which has been

adjusted to exclude the impact of expansionary capital expenditure

and certain linked earnings and cash flows. Revenue assumptions in

year 1 reflect the impact of current market softness, a reduction

in customer demand, orders and forecasts, prior to an expected

improvement in market dynamics and customer demand in years 2 and

3. Revenue assumptions in the adjusted cash flow projections for

years 4 and 5 have typically been extrapolated from year 3 using

business segment growth rates that take account of industry trends

and external market research.

The calculation of the recoverable amount of each CGU in the

value in use calculations is highly sensitive to small changes in

the following key assumptions applied in the 2023 cash flow

forecast:

5 Year

Year Year Year

Year 1 Year 2 3 4 5 CAGR

% % % % % %

======================= =============== ================ ===== ===== ===== =======

Risk adjusted discount

rate 19.2% 19.2% 19.2% 19.2% 19.2% N/A

Latest 2023 Latest 2023

and 2024 Board and 2024 Board

Photonics revenue approved approved

growth rate forecast forecast 34.3% 17.3% 18.1% 12.3%

Latest 2023 Latest 2023

and 2024 Board and 2024 Board

Wireless revenue approved approved

growth rate forecast forecast 29.7% 31.3% 11.5% 12.5%

======================= =============== ================ ===== ===== ===== =======

Wireless CGU

The recoverable amount of the Wireless CGU of GBP89,086,000,

determined based on value in use calculations is greater than the

carrying amount (GBP82,833,000) of the associated intangible

assets, property, plant and equipment and right of use assets

allocated to the CGU such that no impairment of Wireless CGU assets

has been identified.

The Group has carried out a sensitivity analysis on the

impairment test for the Wireless CGU, using various reasonably

plausible scenarios focused on changes in business segment growth

rates, direct wafer product margins and changes in the discount

rate applied in the value in use calculations.

-- Growth rates in the value in use calculations take account of

continuing market demand for compound semiconductors and associated

technology advancement, driven by macro trends of 5G and connected

devices where 5G network infrastructure and 5G mobile handsets are

being enabled by next generation wireless compound semiconductor

material. If the aggregated compound annual revenue growth rate

used in the value in use calculations to determine the recoverable

amount was to decrease by 1.0%, the magnitude of the adverse impact

on the recoverable amount of Wireless CGU non-current assets would

be GBP11,267,000

-- If the discount rate used in the value in use calculations to

determine the recoverable amount was to increase by 0.5%, the

magnitude of the adverse impact on the recoverable amount of

Wireless CGU non-current assets would be GBP3,416,000.

Photonics CGU

The recoverable amount of the Photonics CGU of GBP137,515,000,

determined based on value in use calculations is greater than the

carrying amount (GBP136,870,000) of the associated intangible

assets, property, plant and equipment and right of use assets

allocated to the CGU such that no impairment of Photonics CGU

assets has been identified.

The Group has carried out a sensitivity analysis on the

impairment test for the Photonics CGU, using various reasonably

plausible scenarios focused on changes in business segment growth

rates, direct wafer product margins and changes in the discount

rate applied in the value in use calculations.

-- Growth rates in the value in use calculations take account of

continuing market demand for compound semiconductors and associated

technology advancement, driven by macro trends of 5G and connected

devices, and the increasing proliferation of 3D and advanced

sensing end user applications that require enabling compound

semiconductor material. If the aggregated compound annual revenue

growth rate used in the value in use calculations to determine the

recoverable amount was to decrease by 1.0%, the magnitude of the

adverse impact on the recoverable amount of Photonics CGU

non-current assets would be GBP19,732,000

-- If the discount rate used in the value in use calculations to

determine the recoverable amount was to increase by 0.5%, the

magnitude of the adverse impact on the recoverable amount of

Photonics CGU non-current assets would be GBP5,158,000.

5. MATERIAL ACCOUNTING POLICIES

The accounting policies applied in these interim financial

statements are the same as those applied in the Group's

consolidated financial statements as at and for the year ended 31

December 2022. A number of new standards are effective from 1

January 2023 but they do not have a material effect on the Group's

financial statements.

Recent accounting developments and the policy for recognising

and measuring income taxes in the interim period are described

below.

5.1 Recent accounting developments

In preparing the interim financial statements, the Group has

adopted the following Standards, amendments and interpretations,

which are effective for 2023 and will be adopted in the financial

statements for the year ended 31 December 2023:

-- IFRS 17 'Insurance contracts' which establishes the

principles for the recognition, measurement and presentation and

disclosure of insurance contracts and supersedes IFRS 4 'Insurance

contracts'.

-- Amendments to IAS 1 'Presentation of financial statements' on

classification of liabilities which is intended to clarify that

liabilities are classified as either current or non-current

depending upon the rights that exist at the end of the reporting

period and amendments to the disclosure of accounting policies will

require disclosure of material rather than significant accounting

policies.

-- Amendment to IAS 8 'Accounting policies, changes in

accounting estimates and errors' to introduce a new definition for

accounting estimates which clarifies that an accounting estimate is

a monetary amount in the financial statements that is subject to

measurement uncertainty.

-- Amendment to IAS 12 'Income taxes' to clarify the accounting

treatment for deferred tax on certain transactions with a narrowing

of the scope of the initial recognition exemption so that it does

not apply to transactions that give rise to equal and offsetting

temporary differences.

The adoption of these standards and amendments has not had a

material impact on the interim financial statements.

5.2 Income tax expense

Income tax expense is recognised at an amount determined by

multiplying the loss before tax for the interim reporting period by

management's best estimate of the weighted-average annual income

tax rate expected for the full financial year, adjusted for the tax

effect of certain items recognised in full in the interim period.

As such, the effective tax rate in the interim financial statements

may differ from management's estimate of the effective tax rate for

the annual financial statements.

6. PRINCIPAL RISKS AND UNCERTAINTIES

The principal risks and uncertainties affecting the Group are

set out in the Strategic Report in the 2022 Annual report and

financial statements and remain unchanged at 30 June 2023.

The principal risks and uncertainties include health, safety and

environment, loss of key personnel, cybersecurity, infringement or

loss of intellectual property, legal and regulatory compliance,

changes in international export control laws, competition and/or

erosion of market opportunity, customer concentration, insufficient

cash or funding to underpin investment opportunities, the failure

of new products or technology to deliver expected levels of revenue

and profitability, disruption or inflation in global supply chains,

transformation of IT systems causing business disruption and

insufficient liquidity or cash funding to meet financial

obligations as they fall due.

7. SEGMENTAL INFORMATION

6 Months 6 Months 12 Months

to 30 June to 30 June to 31 Dec

2023 2022 2022

Revenue Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Wireless 22,438 46,629 76,016

Photonics 28,012 38,475 88,637

CMOS++ 1,566 1,094 2,841

Revenue 52,016 86,198 167,494

------------------------- ------------- ------------- ------------

Adjusted operating loss

Wireless (2,978) 5,533 4,705

Photonics (6,354) 1,899 11,162

CMOS++ (932) (704) (1,513)

Central corporate costs (7,195) (8,168) (17,911)

Adjusted operating loss (17,459) (1,440) (3,557)

Adjusted items

------------------------- ------------- ------------- ------------

Wireless (284) (943) (63,754)

Photonics (825) (3,883) (5,438)

CMOS++ (15) (7) (10)

Central corporate costs (1,051) (1,158) (217)

Operating loss (19,634) (7,431) (72,976)

Finance costs (1,832) (1,100) (2,427)

Loss before tax (21,466) (8,531) (75,403)

------------------------- ------------- ------------- ------------

8. ADJUSTED PERFORMANCE MEASURES

The Group's results report certain financial measures after a

number of adjusted items that are not defined or recognised under

IFRS including, adjusted earnings before interest, tax,

depreciation and amortisation, adjusted operating loss, adjusted

loss before income tax and adjusted losses per share. The Directors

believe that the adjusted performance measures provide a useful

comparison of business trends and performance and allow management

and other stakeholders to better compare the performance of the

Group between the current and prior year, excluding the effects of

certain non-cash charges, non-operational items and significant

infrequent items that would distort period on period comparability.

The Group uses these adjusted performance measures for internal

planning, budgeting, reporting and assessment of the performance of

the business. The tables below show the adjustments made to arrive

at the adjusted performance measures and the impact on the Group's

reported financial performance.

6 months Restated

to 30 Jun 6 months 2022

Adjusted Adjusted 2023 Adjusted Adjusted to 30 Jun Adjusted Adjusted Reported

Reported 2022

Reported

GBP'000s Results Items Results Results Items Results Results Items Results

---------------- --------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Revenue 52,016 - 52,016 86,198 - 86,198 167,494 - 167,494

Cost of sales (56,088) (153) (56,241) (71,475) (370) (71,845) (140,962) (149) (141,111)

---------------- --------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Gross

(loss)/profit (4,072) (153) (4,225) 14,723 (370) 14,353 26,532 (149) 26,383

Other

gains/(losses) 640 - 640 (1,317) - (1,317) (381) - (381)

SG&A (14,382) (2,022) (16,404) (14,252) (2,262) (16,514) (26,780) (4,431) (31,211)

Impairment of

intangibles - - - - (3,363) (3,363) - (66,155) (66,155)

Impairment

reversal/(loss)

of receivables 355 - 355 - - - (2,300) - (2,300)

(Loss)/profit

on disposal

of PPE - - - (594) 4 (590) (628) 1,316 688

---------------- --------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Operating loss (17,459) (2,175) (19,634) (1,440) (5,991) (7,431) (3,557) (69,419) (72,976)

Finance costs (1,832) - (1,832) (1,100) - (1,100) (2,427) - (2,427)

---------------- --------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Loss before

tax (19,291) (2,175) (21,466) (2,540) (5,991) (8,531) (5,984) (69,419) (75,403)

Taxation 141 - 141 (395) 674 279 64 798 862

--------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Loss for the

period (19,150) (2,175) (21,325) (2,935) (5,317) (8,252) (5,920) (68,621) (74,541)

---------------- --------- --------- --------- --------- --------- --------- ---------- ---------- ----------

6 months 6 months

to 30 Jun to 30 Jun 2022

Pre-tax Tax 2023 Pre-tax Tax 2022 Pre-tax Tax Reported

Reported Reported

GBP'000s Adjustment Impact Results Adjustment Impact Results Adjustment Impact Results

--------------------- ---------- ------ ---------- ---------- ------ ---------- ---------- ------ ----------

Share based

payments (460) - (460) (1,110) - (1,110) (223) (200) (423)

Share based

payments -

Chief Executive

Officer recruitment (6) - (6) (38) - (38) (109) - (109)

Chief Executive

Officer recruitment (147) - (147) (154) - (154) (96) - (96)

Chief Finance

Officer severance (326) - (326) - - - - - -

Impairment

- goodwill - - - - - - (62,716) - (62,716)

Impairment

-other intangibles - - - (3,363) 410 (2,953) (3,439) 724 (2,715)

Restructuring (1,236) - (1,236) (1,330) - (1,330) (4,152) - (4,152)

Restructuring

- profit on

disposal of

PPE - - - 4 264 268 1,316 274 1,590

Total (2,175) - (2,175) (5,991) 674 (5,317) (69,419) 798 (68,621)

--------------------- ---------- ------ ---------- ---------- ------ ---------- ---------- ------ ----------

The nature of the adjusted items is as follows:

Current period:

-- Share based payments - The charge recorded in accordance with

IFRS 2 'share based payment' of which GBP153,000 (H1 2022:

GBP370,000, FY22: GBP149,000) has been classified within cost of

sales in gross (loss)/profit and GBP307,000 (H1 2022: GBP740,000,

FY22: GBP74,000) in selling, general and administrative expenses

within operating loss.

-- Chief Executive Officer recruitment - The Chief Executive

Officer's starting bonus of GBP1,000,000, of which GBP200,000

relates to a share-based payment award and GBP800,000 relates to a

cash award is payable over the first three years of employment. The

charge of GBP153,000 (H1 2022: GBP192,000, FY22: GBP205,000)

includes share award and cash costs associated with the new Chief

Executive Officer's starting bonus of GBP153,000 (H2 2022:

GBP192,000, FY22: GBP435,000) and a credit of GBPnil (H1 2022:

GBPnil, FY22: GBP230,000) relating to external recruitment fees.

Cash costs defrayed in the period total GBP463,000 (H1 2022:

GBP582,000, FY22: GBP715,000).

-- Chief Finance Officer severance - The charge of GBP326,000

(H1 2022: GBPnil, FY22 GBPnil) consists of settlement costs and

legal fees in relation to the former Chief Financial Officer. Cash

costs defrayed in the period total GBP280,000 (H1 2022: GBPnil,

FY22: GBPnil).

-- Restructuring - The charge of GBP1,236,000 (H1 2022:

GBP1,330,000, FY22: GBP4,152,000) relates to restructuring costs

relating to labour cost reductions within the Group, the closure of

the Group's manufacturing facility in Pennsylvania, USA and the

closure of the Group's manufacturing facility in Singapore.

- Restructuring charges of GBP786,000 (H1 2022: GBPnil, FY22:

GBPnil) relate to employee related costs relating to labour cost

associated with employee redundancies across the Group (excluding

costs relating to facility closures separately disclosed). The

charge was classified as selling, general and administrative

expenses within operating loss. Cash costs defrayed in the period

total GBP786,000 (H1 2022: GBPnil, FY22: GBPnil).

- Restructuring charges of GBP450,000 (H1 2022: GBP323,000,

FY22: GBP1,136,000) relate to employee related costs relating to

the announced closure of the Group's manufacturing facility in

Pennsylvania, USA. The charge was classified as selling, general

and administrative expenses within operating loss. Cash costs

defrayed in the period total GBP186,000 (H1 2022: GBP131,000, FY22:

GBP606,000).

- Restructuring charges of GBPnil (H1 2022: GBP1,007,000, FY22:

GBP3,016,000) consist of employee related costs of GBPnil (H1 2022:

GBP148,000, FY22: GBP220,000), site decommissioning costs of GBPnil

(H1 2022: GBP859,000, FY22: GBP1,512,000), asset write downs of

GBPnil (H1 2022: GBPnil, FY22: GBP863,000) and asset transfer costs

of GBPnil (H1 2022: GBPnil, FY22: GBP421,000) relating to the

closure of the Group's manufacturing facility in Singapore. The

prior period charge was classified as selling, general and

administrative expenses within operating loss. Cash costs defrayed

in the period total GBP108,000 (H1 2022: GBP1,075,000, FY22:

GBP5,088,000).

Prior periods:

-- Restructuring profit on disposal of PPE - The profit on

disposal of PPE of GBPnil (H1 2022: GBP4,000, FY22: GBP1,316,000)

consists of the sale of assets in Singapore following the cessation

of trade and the sale of assets in North Carolina to facilitate the

consolidation of the Group's manufacturing operations from

Pennsylvania. Cash proceeds received in the period for the sale of

plant and equipment total GBPnil (H1 2022: GBP4,091,000, FY22:

GBP6,073,000).

-- Impairment of goodwill - The non-cash charge of GBPnil (H1

2022: GBPnil, FY22: GBP62,716,000) relates to impairment costs

associated with the Wireless CGU of GBPnil (H1 2022: GBPnil, FY22:

GBP62,382,000) and the Photonics CGU of GBPnil (H1 2022: GBPnil,

FY22: GBP334,000).

-- Impairment of other intangibles - The non-cash charge of

GBPnil (H1 2022: GBP3,363,000, FY22: GBP3,439,000) relates to the

impairment of distributed feedback laser technology development

costs where the Group has taken the decision to discontinue the

development and commercialisation of the technology.

The cash impact of adjusted items in the consolidated cash flow

statement represent costs associated with the recruitment of the

group's Chief Executive Officer (GBP463,000), the recruitment and

severance of the group's Chief Finance Officer (GBP280,000),

onerous contract royalty payments related to the Group's cREO(TM)

technology (GBP41,000), payment of employee related costs

associated with labour cost reductions within the Group

(GBP786,000), payment of employee related costs associated with the

announced closure of the Group's site in Pennsylvania (GBP186,000)

and payment of employee and site related decommissioning costs

associated with the closure of the Group's manufacturing facility

in Singapore (GBP108,000).

Adjusted EBITDA (adjusted earnings before interest, tax,

depreciation and amortisation) has been calculated as follows:

(All figures GBP'000s) 6 months to 6 months to 12 months to

30 June 2023 30 June 2022 31 Dec 2022

Unaudited Unaudited Audited

----------------------------------------------- -------------- -------------- -------------

Loss attributable to equity shareholders (21,325) (8,252) (74,541)

Finance costs 1,832 1,100 2,427

Tax (141) (279) (862)

Depreciation of property, plant and equipment 6,073 7,359 14,529

Depreciation of right of use assets 1,898 1,989 3,981

Amortisation of intangible fixed assets 3,750 3,831 7,784

Loss on disposal of PPE and intangibles* - 590 628

Adjusted Items 2,175 5,995 69,419

----------------------------------------------- -------------- -------------- -------------

Share based payments 460 1,110 223

Share based payments - CEO recruitment 6 38 109

CEO recruitment 147 154 96

CFO recruitment & severance 326 - -

Restructuring 1,236 1,330 4,152

Restructuring - profit on disposal of PPE - - (1,316)

Impairment of intangibles - 3,363 66,155

Adjusted EBITDA (5,738) 12,333 23,365

Share based payments (460) (1,110) (223)

Share based payments - CEO recruitment (6) (38) (109)

CEO recruitment (147) (154) (96)

CFO recruitment & severance (326) - -

Restructuring (1,236) (1,330) (4,152)

EBITDA (7,913) 9,701 18,785

----------------------------------------------- -------------- -------------- -------------

*Excludes the adjustment 'Restructuring - profit on disposal of

PPE' which is separately disclosed as part of the groups adjusted

items

9. TAXATION

The Group's consolidated effective tax rate for the six months

ended 30 June 2023 was 0.7% (H1 2022: 3.3%, FY22: 1.1%). The

effective tax rate differs from the theoretical amount that would

arise from applying the standard corporation tax in the UK of 19.0%

(H1 2022: 19.0%, FY22: 19.0%) principally due to non-recognition of

current year tax losses in the UK and USA.

10. LOSS PER SHARE

6 months 6 months 12 months

to to to

30 June 30 June 31 Dec

2023 2022 2022

(All figures GBP'000s) Unaudited Unaudited Audited

Loss attributable to ordinary shareholders (21,325) (8,252) (74,541)

Adjustments to loss after tax (note

8) 2,175 5,317 68,621

Adjusted loss attributable to ordinary

shareholders (19,150) (2,935) (5,920)

-------------------------------------------- ------------ ------------ ------------

Number of shares:

Weighted average number of ordinary

shares 830,940,409 804,236,241 804,466,357

Dilutive share options 4,621,705 7,369,508 8,797,413

-------------------------------------------- ------------ ------------ ------------

835,562,114 811,605,749 813,263,770

-------------------------------------------- ------------ ------------ ------------

Basic loss per share (2.57p) (1.03p) (9.27p)

Adjusted loss per share (2.30p) (0.36p) (0.74p)

Diluted loss per share (2.57p) (1.03p) (9.27p)

Adjusted diluted loss per share (2.30p) (0.36p) (0.74p)

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of ordinary shares during the period.

Diluted loss per share is calculated by dividing the loss

attributable to ordinary shareholders by the weighted average

number of shares and 'in the money' share options in issue. Share

options are classified as 'in the money' if their exercise price is

lower than the average share price for the period. As required by

IAS 33, this calculation assumes that the proceeds receivable from

the exercise of 'in the money' options would be used to purchase

shares in the open market in order to reduce the number of new

shares that would need to be issued.

11. CASH GENERATED FROM OPERATIONS

(All figures GBP'000s) 6 months 6 months 12 months

to to to

30 June 30 June 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

-------------------------------------- ----------- ----------- ----------

Loss before tax (21,466) (8,531) (75,403)

Finance costs 1,832 1,100 2,427

Depreciation of property, plant

and equipment 6,073 7,359 14,529

Depreciation of right of use

assets 1,898 1,989 3,981

Amortisation of intangible assets 3,750 3,831 7,784

Impairment of intangible assets - 3,363 66,155

Inventory write downs 760 499 2,811

Loss/(profit) on disposal of

property, plant and equipment - 590 (688)

Movement on trade receivable

expected credit losses (355) - 2,300

Provision movements 404 (208) 3,049

Fair value (gain)/loss on derivative

financial instruments (640) 1,317 -

Share based payments 466 1,148 332

-------------------------------------- ----------- ----------- ----------

Cash inflow from operations

before changes in working capital (7,278) 12,457 27,277

Decrease/(increase) in inventories 5,946 (1,376) (2,904)

Decrease/(increase) in trade

and other receivables 7,185 (6,092) (5,534)

(Decrease)/increase in trade

and other payables (3,043) 1,187 (3,893)

Decrease in provisions (378) - (6,073)

-------------------------------------- ----------- ----------- ----------

Cash inflow from operations 2,432 6,176 8,873

-------------------------------------- ----------- ----------- ----------

12. ANALYSIS OF NET DEBT

(All figures GBP'000s)

6 months 6 months 12 months

to to to

30 June 30 June 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

------------------------------------ ------------ ------------ ------------

Bank borrowings due after one

year (845) (7,205) (20,643)

Bank borrowings due within one

year (6,123) (14,912) (6,225)

Lease liabilities due after one

year (42,826) (48,372) (46,026)

Lease liabilities due within one

year (7,140) (5,287) (4,843)

------------------------------------ ------------ ------------ ------------

Total borrowings (56,934) (75,776) (77,737)

Fair value of derivative financial

instruments 259 (1,327) (381)

Cash and cash equivalents 12,314 15,390 11,620

------------------------------------ ------------ ------------ ------------

Net debt (44,361) (61,713) (66,498)

------------------------------------ ------------ ------------ ------------

On 17 May 2023, the Company refinanced its GBP27,300,000

($35,000,000) multi-currency revolving credit facility, provided by

HSBC Bank plc. The facility is secured on the assets of IQE plc and

its subsidiary companies with a committed term to 1 May 2026.

Interest on the facility is payable at a margin of between 2.50 and

3.50 per cent per annum over SONIA on any drawn balances and the

facility is subject to quarterly leverage and Interest cover

covenants tests which commence at 31 December 2023.

On 29 August 2019, the Company agreed a new GBP30,000,000 asset

finance facility, provided by HSBC Bank plc that is secured over

various plant and machinery assets. The facility has a five-year

term and an interest rate margin of 1.65% per annum over base rate

on any drawn balances.

Bank borrowings relate to amounts drawn down on the Group's

asset finance facility.

Cash and cash equivalents comprise balances held in instant

access bank accounts and other short-term deposits with a maturity

of less than 3 months.

13. SHARE CAPITAL

6 months 6 months 12 months

Number of shares to to to

30 June 30 June 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

------------------------------------ ------------ ------------ ------------

As at 1 January 804,841,965 803,555,756 803,555,756

Employee share schemes 1,052,260 419,252 702,500

Placing 150,000,000 - -

Retail Offer 5,492,730 - -

Chief Executive Officer's starting

bonus - share award - 583,709 583,709

As at 30 June / 31 December 961,386,955 804,558,717 804,841,965

------------------------------------ ------------ ------------ ------------

6 months 6 months 12 months

(All figures GBP'000s) to to to

30 June 30 June 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

----------------------------- ----------- ----------- ----------

As at 1 January 8,048 8,036 8,036

Employee share schemes 11 10 12

Placing 1,500 - -

Retail Offer 55 - -

As at 30 June / 31 December 9,614 8,046 8,048

----------------------------- ----------- ----------- ----------

On 17 May 2023, IQE plc raised funds by way of a Placing and a

Retail Offer to all existing shareholders. In each case these were

offered at an issue price of 20 pence per share (the 'Issue

Price'). The Placing utilised a cashbox structure and therefore the

premium on the ordinary shares and associated costs, in accordance

with section 612 of the Companies Act 2006, were initially

recognised within the merger reserve (incorporated within 'Other

reserves'). The investment in the newly incorporated subsidiary

utilised within the cashbox structure has been fully impaired in

the period and the merger reserve has subsequently been transferred

into retained earnings as it is determined to be distributable in

accordance with the Companies Act 2006. The Placing and Retail

Offer raised net funds of GBP29,708,000 from the issue of

155,492,730 ordinary shares.

14. RELATED PARTY TRANSACTIONS

Transactions with Joint Ventures

Compound Semiconductor Centre Limited ('CSC')

The Group established CSC with its joint venture partner as a

centre of excellence for the development and commercialisation of

advanced compound semiconductor wafer products in Europe and on its

formation, the Group contributed assets to the joint venture valued

at GBP12m as part of its initial investment.

The activities of CSC include research and development into

advanced compound semiconductor wafer products, the provision of

contract manufacturing services for compound semiconductor wafers

to certain subsidiaries within the IQE plc Group and the provision

of compound semiconductor manufacturing services to other third

parties.

CSC operates from its manufacturing facilities in Cardiff,

United Kingdom and leases certain additional administrative

building space from the Group. During the period the CSC leased

this space from the Group for GBP58,000 (H1 2022: GBP58,000, FY22:

GBP115,000) and procured certain administrative support services

from the Group for GBP118,000 (H1 2022: GBP118,000, FY22:

GBP235,000). As part of the administrative support services

provided to CSC the Group procured goods and services, recharged to

CSC at cost, totalling GBP2,359,000 (H1 2022: GBP2,069,000, FY22:

GBP4,031,000).

CSC granted the Group the right to use its assets following its

formation for a minimum five-year period. Costs associated with the

right to use the CSC's assets are treated by the Group as operating

lease costs. Costs are charged by the CSC at a price which reflects

the CSC's cash cost of production (including direct labour,

materials and site costs) but excludes any related depreciation or

amortisation of the CSC's property, plant and equipment and

intangible assets respectively under the terms of the joint venture

agreement between the parties. Costs associated with the right to

use the CSC's assets totalled GBP3,488,000 (H1 2022: GBP3,288,000 ,

FY22: GBP6,822,000) in the period.

At 30 June 2023 an amount of GBP243,000 (H1 2022: GBP439,000,

FY22: GBP137,000) was owed from the CSC.

In the Groups balance sheet 'A' Preference Shares with a nominal

value of GBP8,800,000 (H1 2022: GBP8,800,000, FY22: GBP8,800,000)

are included in financial assets at an amortised cost of GBPnil (H1

2022: GBPnil, FY22: GBPnil) and the Group has a shareholder loan of

GBP248,000 (H1 2022: GBP246,000, FY22: GBP247,000) due from

CSC.

15. COMMITMENTS

The Group had capital commitments at 30 June 2023 of

GBP12,197,000 (H1 2022: GBP3,527,000, FY22: GBP1,740,000).

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted

for use in the UK;

-- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period; and any changes in the related party

transactions described in the last annual report that could do

so.

Americo Lemos Neil Rummings

Chief Executive Officer, IQE Interim Chief Financial Officer,

plc. IQE plc.

12 September 2023 12 September 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAXNFFLLDEFA

(END) Dow Jones Newswires

September 12, 2023 02:00 ET (06:00 GMT)

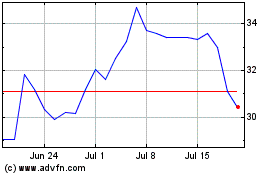

Iqe (LSE:IQE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Iqe (LSE:IQE)

Historical Stock Chart

From Nov 2023 to Nov 2024