Iofina PLC H1 Update and Updated Loan Facilities (5782G)

July 20 2023 - 2:00AM

UK Regulatory

TIDMIOF

RNS Number : 5782G

Iofina PLC

20 July 2023

20 July 2023

Iofina plc

("Iofina", the "Company" or the "Group")

(AIM:IOF)

H1 Update and Updated Loan Facilities

Iofina plc (AIM:IOF), specialists in the exploration and

production of iodine and manufacturers of specialty chemical

products, today provides an update on H1 2023 (the "Period") iodine

production as well as an update on its loan facilities.

H1 2023 update

During the first half of 2023, Iofina Resources produced 241.5

metric tonnes ("MT") of crystalline iodine from its five IOsorb(R)

plants in NW Oklahoma, within the projected range of 235-250 MT for

the Period. This was an increase of 7.5 MT compared to H1 2022.

With IO#9 switched on in June and working through its start-up

phases and concentrating iodide, the Company anticipates a

significant increase in H2 2023 crystalline iodine production

totalling between 325-350 MT (H2 2022: 282 MT). This estimated

production range is larger than normal as IO#9 continues to ramp up

brine intake and is optimising parameters for its crystalline

iodine production. The new plant will be contributing to the

Group's total crystalline iodine production from this month.

The Company notes that the required configuration of IO#9

resulted in additional equipment and installation costs compared to

other IOsorb(R) plants, which increased total expenditure including

reused equipment to $5.5m. Future IOsorb(R) plant costs are

anticipated to be less moving forward. Construction of IO#9 was

funded entirely by cash generated from operations.

Iofina has continued to see strong demand for its crystalline

iodine and derivative chemical products. Spot iodine prices have

remained steady near $70/kg throughout the period, with iodine

demand for use in X-ray contrast media and pharmaceuticals

applications particularly strong. The Company expects these price

levels to continue through the second half of the year.

Loan Facilities

The Company has recently renegotiated its undrawn loan

facilities, securing a lower interest rate on agreements arranged

last year, as follows:

a) The $2.7 million and $1.66 million term loans, which had not

been utilized by Iofina, have been replaced by a $4 million term

loan with a drawdown period open now through to July 1, 2024 to be

used for IO#10 expenditures and other Capex projects as

appropriate. A seven-year term begins from July 1, 2024 with

interest payable during the drawdown period. The interest rate has

been reduced from 2.4% to 2.11% plus SOFR (1 month Secured

Overnight Financing Rate) subject to a minimum 1%.

b) The $6 million revolving line of credit has been extended by

a year to 16 September 2025. The interest rate has been reduced

from 2.4% to 2.11% plus SOFR subject to a minimum 1%. Iofina is

currently not drawing on this line of credit.

Commenting on the first half of the year, President and CEO of

Iofina Dr. Tom Becker, stated:

"I'm pleased to report on another successful period, with the

completion of the IO#9 plant being the key milestone of the first

half. With the ramp-up of IO#9 progressing, we are on course to

deliver a considerable uplift in second-half production.

Importantly, demand for our products remains high and we are

benefiting from the iodine spot price maintaining its $70/kg

level.

"Our discussions with prospective partners for IO#10 continue to

move forward and we will provide a detailed update once an

agreement has been reached. H1 has progressed well for the Group

and the Board is looking forward to the second half of 2023."

Enquiries:

Dr. Tom Becker

CEO & President

Iofina plc

Tel: +44 (0)20 3006 3135

Nomad & Broker:

Henry Fitzgerald-O'Connor/Patrick Dolaghan/Andrew Potts

Canaccord Genuity Limited

Tel: +44 (0)20 7523 8000

Financial Adviser:

Kingsley Wilson

Chrystal Capital Partners LLP

Tel: +44 (0)20 7850 4761

Media Contact:

Charles Goodwin/Shivantha Thambirajah/Jazmine Clemens

Yellow Jersey PR Limited

Tel: +44 (0)7747 788 221/+44 (0)7983 521 488

About Iofina:

Iofina plc (AIM:IOF) is a vertically integrated company that

specialises in the production of Iodine and the manufacturing of

specialty chemical products. Iofina is the second largest producer

of iodine in North America and operates the manufacturing entities

Iofina Resources and Iofina Chemical.

LEI: 213800QDMFYVRJYYTQ84

ISIN: GB00B2QL5C79

Iofina Resources

Iofina Resources develops, builds, owns, and operates iodine

extraction plants using Iofina's WET(R) IOsorb(R) technology.

Iofina currently operates five producing IOsorb(R) plants in

Oklahoma and is consistently using technology and innovation to

improve and expand its operations.

Iofina Chemical

Iofina Chemical has manufactured high quality halogen speciality

chemicals derived from raw iodine, as well as non-iodine-based

products. Iofina Chemical will be celebrating its 40 (th)

anniversary in 2023 as a preeminent halogen-based specialty

chemicals company.

www.iofina.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMZGMNRLMGFZM

(END) Dow Jones Newswires

July 20, 2023 02:00 ET (06:00 GMT)

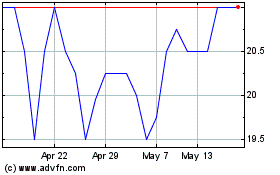

Iofina (LSE:IOF)

Historical Stock Chart

From Oct 2024 to Nov 2024

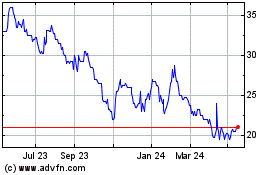

Iofina (LSE:IOF)

Historical Stock Chart

From Nov 2023 to Nov 2024