TIDMINV

RNS Number : 5407C

Investment Company PLC

11 February 2020

THE INVESTMENT COMPANY PLC

Half-Yearly Financial Report (Unaudited) for the six months

ended 31 December 2019

SUMMARY OF RESULTS

At 31 December At 30 June

2019 2019

(unaudited) (audited) Change %

---------------------------- ----------------- ------------- ----------

Equity shareholders' funds

(GBP) 17,885,130 16,620,311 7.61

Number of ordinary shares

in issue 4,772,049 4,772,049 -

Net asset value ("NAV")

per ordinary share 374.79p 348.28p 7.61

Ordinary share price (mid) 346.00p 298.00p 16.11

Discount to NAV 7.68% 14.44% -

---------------------------- ----------------- ------------- ----------

12 months

to

6 months to 30 June 2019

31 December 2019

(unaudited) (audited)

---------------------------- ----------------- -------------

Total return per ordinary

share 34.01p 3.24p

Dividends paid per ordinary

share 7.50p 16.25p

---------------------------- ----------------- -------------

INVESTMENT OBJECTIVE

The Company's investment objective is to provide shareholders

with an attractive level of dividends coupled with capital growth

over the long term through investment in a portfolio of equities,

preference shares, loan stocks, debentures and convertibles.

FINANCIAL CALAR

February Payment of quarterly interim

dividend.

February/March Announcement of Half-Yearly

Financial Report.

May Payment of quarterly interim

dividend.

August Payment of quarterly interim

dividend.

September/October Announcement of Annual Results.

November Payment of quarterly interim

dividend.

November/December Annual General Meeting.

CHAIRMAN'S STATEMENT

Half-Year to 31 December 2019

During the period under review the FTSE All-Share Index

increased by 3.44%. The Company's NAV was up by 26.51p, an increase

of 7.61 %, which can be analysed as follows:

At December 2019 At June 2019

Pence per share % Pence per %

share

Opening net assets 348.28 100.00 363.24 100.00

Investment income 10.39 2.98 24.19 6.66

Expenses (4.19) (1.20) (8.63) (2.37)

Portfolio outturn 27.81 7.98 (12.53) (3.45)

Dividends paid (7.50) (2.15) (17.99) (4.95)

--------------- ------- --------- ------

Closing net assets 374.79 107.61 348.28 95.89

--------------- ------- --------- ---------

The Investment Manager has continued to make sound progress in

recovering value from the legacy portfolio. In particular, I draw

shareholders attention to the Manager's successful endeavours in

securing an offer for our Liberty 6% & 9.5% preference shares,

a welcome offer for our Aggregated Micro Power Holdings PLC equity

holding, and the redemption of our Newcastle Building Society

3.886% Subordinated Notes. Cash proceeds from these sales have been

recycled into higher yielding fixed interest and equity holdings.

The Investment Managers' Report is set out on pages 4 and 5.

Current income projections anticipate that after covering the

costs of running the Company, sufficient income will be available,

such that it is likely we will be able to cover the cost of the

dividends. This has been a key objective since July 2018, and I am

delighted that the Investment Manager has managed the affairs of

the Company such that it is likely this objective will be met in

this prevailing year.

Your Board believes individuals' capital is scarce, and as such

should be respected for its irreplaceability. We have seen savers

in recent times suffer at the hands of hubris and unaccountability.

We as a Board are conscious that the Company is still too small

relative to its relatively fixed cost base, but we will only seek

out opportunities that are likely to attract like-minded

shareholders, and capital that has a long-term time horizon.

I. R. Dighé

Chairman

10 February 2020

INVESTMENT MANAGER'S REPORT

Performance

During the six month period to 31 December 2019 the NAV

increased by 7.61% whilst the share price rose by 16.11%, which was

ahead of major UK indices.

The period under review was dominated by two factors. Firstly

concerns continued to build over the outlook for US/China trade

tariffs and the impact they were having on the global economy. As a

result the Federal Reserve took decisive action and cut interest

rates three times during the period in order to shield the US

economy from the impact of trade wars and the global economic

slowdown. Towards the end of the period, following 18 months of

fraught trade war negotiations, the US and Chinese administrations

have agreed a preliminary phase one trade agreement. This was a

major boost for the global economy and investor confidence.

Secondly, in the UK Brexit has dominated the agenda and the

debate has pivoted around the potential of a satisfactory

'withdrawal agreement' being passed by Parliament. As the period

progressed investor expectation grew of a potential withdrawal

agreement being passed through Parliament and as a result Sterling

strengthened against the US Dollar & Euro. The decisive general

election result saw the government returned to power with a healthy

majority which should ensure a resolution to the Brexit saga and a

more market friendly agenda. Sterling initially surged on the

result but has since drifted back. As we have mentioned in previous

reports the general election outcome provides the much sought after

clarity that international and UK investors were seeking as they

assess the relatively attractive valuations of some UK assets. The

FTSE 250, which is dominated by domestic equities such as -

housebuilders, utilities and financials - performed strongly in

December.

Portfolio

Towards the end of the period we received a takeover bid in cash

for Aggregated Micro Power Holdings PLC which is a good outcome for

the Company. Firstly we were having difficulty selling the shares

in the market and secondly they were not paying a dividend. We have

deployed this c.GBP500,000 of capital into existing portfolio

holdings which will generate in excess of GBP30,000 of income per

annum.

In August, we received a cash bid for Greene King from CK Asset

Holdings Limited in Hong Kong at a significant premium to our

purchase price. As a result, we sold the position at an attractive

profit and have reinvested the proceeds into existing holdings such

as Vistry (formerly Bovis), Polar Capital, Phoenix Group and New

River REIT.

We also had a satisfactory resolution to the two preference

share holdings in Liberty Limited and Liberty Retail Limited. These

Liberty preference share issues have not been paying interest for a

number of years and as a result they were a drag on the Company.

More importantly, we have been able to deploy the capital received

into existing fixed interest and equity holdings which will provide

a significant boost towards covering the administration costs and

paying the dividend.

During the period we also increased our exposure to

housebuilders - Bellway, Persimmon and Vistry due to the

increasingly favourable operating environment which was further

enhanced by the well-received general election result and Brexit

resolution. The housebuilders are currently paying generous and

well covered dividends - both ordinary and specials - and are

attractively valued.

We took the opportunity to take some profits in Restaurant Group

as the price rise from our initial purchase made the yield less

attractive and the company is still in the midst of restructuring

itself in order to attract customers in the increasingly

competitive casual dining market. We also took the opportunity to

add to existing holdings in New River REIT, Phoenix Group and

Standard Life Aberdeen. We were fully invested ahead of the general

election due to the widely anticipated Conservative majority and

this has been a boost for the portfolio.

In the fixed interest part of the portfolio we sold the EI Group

7.5% March 2024 at an attractive level following a strong

performance over the last year. EI Group has been acquired by the

Stonegate Pub Company. The bond is callable in September 2020 at a

level below our sale price.

The Newcastle Building Society 3.886% December 2019 Subordinated

Notes were redeemed by the company as planned. The yield was

relatively low and the redemption has allowed us to re-allocate the

returned capital into existing holdings within the portfolio that

offer higher yields. These include additions to Lloyds Bank 7.625%

Perpetual, Premier Oil 6.5% 2021 and Ecclesiastical Insurance

8.625% Preference shares.

Future Prospects

Fears of a global recession have eased somewhat with better

economic data from the UK and US. In response, bond yields have

backed off from their lows. Notwithstanding geo-political risks,

the backdrop is generally supportive for equity markets although

investors have become more discriminating in their evaluation of

growth company ratings. This has led to a better period of

performance for more value oriented stocks.

With the UK General Election now decided, the political

uncertainty has been largely removed. However, the finer details of

Brexit still need to be negotiated and there will undoubtedly be

continuing concerns about the UK's long-term relationship with

Europe and the progress made in agreeing trade deals with the rest

of the world. With the Conservatives having such a large working

majority, the major risk to the UK economy would appear to be a

hard or no deal Brexit. This will no doubt be reflected in how

Sterling moves against other currencies over the coming year.

M. Foster, J. Harrison, J Dieppe

Fiske plc

10 February 2020

TWENTY LARGEST INVESTMENTS

At 31 December 2019

Market

or Directors'

Book cost valuation % of total

Stock Number GBP GBP portfolio

GlaxoSmithKline

1. Ordinary 25p# 35,450 519,438 630,514 3.80%

600 Group

2. 8% cov loan notes 14/02/20 500,000 500,000 539,475 3.25%

20p Warrants 2,500,000 - - -

----------------- --------------------- ---------------

500,000 539,475 3.25%

Nationwide Building

Society

10.25% core capital

3. deferred shares (variable) 3,100 490,536 514,656 3.10%

4. BP

Ordinary USD 0.25# 109,000 558,246 514,044 3.10%

Premier Oil

5. 6.5% 31/05/21 510,000 503,652 511,805 3.09%

6. Phoenix Group

Ordinary 10p# 68,115 471,445 509,977 3.07%

7. Unilever

Ordinary 3.11p# 11,135 448,710 484,428 2.92%

8. The Fishguard & Rosslare

Railways and Harbours

Company

2.45% guaranteed preference

stock 790,999 441,810 474,599 2.86%

Virgin Money UK

9. 8% variable perpetual 450,000 415,497 471,762 2.84%

National Westminster

10. 9% Non Cum Pref 300,000 217,752 471,000 2.84%

New River REIT

11. NPV# 231,150 504,737 463,456 2.79%

Aggregated Micro

Power

12. Ordinary 0.50p# 554,286 388,000 460,057 2.77%

14. Intercede

13. 8% Secured Conv Loan 450,000 450,000 450,000 2.71%

Lloyds Banking

14. 7.625% Variable Perprtual 400,000 305,836 447,968 2.70%

15. Amalgamated Metal

Corporation

5.4% cum pref GBP1 256,065 144,049 235,580 1.42%

6% cum pref GBP1 213,510 103,844 211,375 1.28%

----------------- --------------------- -----------------

247,893 446,955 2.70%

Punch Taverns

16. 7.75% 30/12/25 450,000 447,545 446,733 2.69%

Bovis Homes

17. Ordinary 50p# 32,800 360,550 445,424 2.69%

18. M&G

Ordinary 5p# 182,000 403,920 431,340 2.60%

Legal & General

19. Ordinary 2.5p# 141,300 316,384 428,139 2.58%

Polar Capital

20. Ordinary 2.5p# 76,300 404,897 412,020 2.48%

----------------- --------------------- -----------------

8,396,848 9,554,352 57.58%

----------------- --------------------- -----------------

# Issues with unrestricted voting rights.

The Group has a total of 59 portfolio investments holdings in 56

companies

INTERIM MANAGEMENT REPORT AND DIRECTORS' RESPONSIBILITY

STATEMENT

Interim Management Report

The important events that have occurred during the period under

review and their impact on the financial statements are set out in

the Chairman's Statement on page 3 and the Investment Manager's

Report on pages 4 and 5.

In the view of the Board, the principal risks facing the Group

are substantially unchanged since the date of the Report and

Accounts for the year ended 30 June 2019 and continue to be as set

out in that report. Risks faced by the Group include, but are not

limited to, market risk (which comprises market price risk,

interest rate risk and liquidity risk). Details of the Company's

management of these risks and exposure to them is set out in the

Company's Report and Accounts for the year ended 30 June 2019.

There have been no significant changes in the related party

disclosures set out in the Annual Report.

Responsibility Statement

The Directors confirm that to the best of their knowledge:

-- the condensed set of financial statements has been prepared

in accordance with International Accounting Standard 34, Interim

Financial Reporting, and gives a true and fair view of the assets,

liabilities, financial position and profit or loss of the Group;

and

-- this Half-Yearly Financial Report includes a fair review of the information required by:

a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules,

being related party transactions that have taken place in the first

six months of the current financial year and that have materially

affected the financial position or performance of the Group during

that period; and any changes in the related party transactions that

could do so.

This Half-Yearly Financial Report was approved by the Board of

Directors on 10 February 2020 and the above responsibility

statement was signed on its behalf by I. R. Dighé, Chairman.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 December 2019

6 months to 31 6 months to 31 Year ended 30 June

December 2019 December 2018 2019

Notes (unaudited) (uaudited) (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP GBP GBP GBP GBP GBP GBP GBP GBP

---------- ---------- ---------- ---------- ------------ ------------ ---------- ---------- ----------

Realised

gains

on investments - 666,812 666,812 - 330,847 330,847 - 267,049 267,049

Unrealised

gains/(losses)

on gains

on investments

held

at fair

value

through

profit

or loss - 660,624 660,624 - (1,730,156) (1,730,156) - (864,171) (864,171)

Exchange

losses

on

capital

items - (163) (163) - (58) (58) - (137) (137)

Investment

income 2 495,930 - 495,930 379,490 - - 1,154,271

Investment

management

fee (63,992) - (63,992) (45,000) - (45,000) (98,697) (98,697)

Other

expenses (136,135) (353) (136,488) (134,030) (321) (134,351) (301,825) (646) (302,471)

---------- ---------- ---------- ---------- ------------ ------------ ---------- ---------- ----------

Return

before

finance

costs

and taxation 295,803 1,326,920 1,622,723 200,460 (1,399,688) (1,199,228) 753,749 (597,905) 155,844

Bank

debit

interest - - - - - - - - -

---------- ---------- ---------- ---------- ------------ ------------ ---------- ---------- ----------

Return

before

taxation 295,803 1,326,920 1,622,723 200,460 (1,399,688) (1,199,228) 753,749 (597,905) 155,844

Taxation - - - (1,574) - (1,574) (1,113) - (1,113)

Total

comprehensive

income

after

taxation 295,803 1,326,920 1,622,723 198,886 (1,399,688) (1,200,802) 752,636 (597,905) 154,731

---------- ---------- ---------- ---------- ------------ ------------ ---------- ---------- ----------

Return

on total

comprehensive

income

per

50p ordinary

share

Basic

and diluted 3 6.20p 27.81p 34.01p 4.17p (29.33p) (25.16p) 15.77p (12.53p) 3.24p

---------- ---------- ---------- ---------- ------------ ------------ ---------- ---------- ----------

The total column of this statement is the condensed Consolidated

Statement of Total Comprehensive Income of the Group prepared in

accordance with International Financial Reporting Standards

("IFRS").The supplementary revenue and capital columns are prepared

in accordance with the Statement of Recommended Practice issued by

the Association of Investment Companies ("AIC SORP").

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

during the period.

The notes on pages 13 to 16 form part of these condensed

financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 31 December 2019

Issued

ordinary Capital

share Share redemption Revaluation Capital Revenue

capital premium reserve reserve reserve reserve Total

GBP GBP GBP GBP GBP GBP GBP

--------------- ------------ ------------- ----------- ------------ ------------ -----------

Balance at 1

July 2019 2,386,025 4,453,903 2,408,820 - 8,629,630 (1,258,067) 16,620,311

Total

comprehensive

income

Net return for

the year - - - - 1,326,920 295,803 1,622,723

Transactions

with shareholders

recorded directly

to equity

Ordinary dividends

paid - - - - - (357,904) (357,904)

--------------- ------------ ------------- ----------- ------------ ------------ -----------

Balance at 31

December 2019 2,386,025 4,453,903 2,408,820 - 9,956,550 (1,320,168) 17,885,130

--------------- ------------ ------------- ----------- ------------ ------------ -----------

Balance at 1

July 2018 2,386,025 4,453,903 2,408,820 1,917,418 7,310,117 (1,142,190) 17,334,093

Transition to

IFRS 9 - - - (1,917,418) 1,917,418 - -

Total

comprehensive

income

Net return for

the year - - - - (1,399,688) 198,886 (1,200,802)

Transactions

with shareholders

recorded directly

to equity

Ordinary dividends

paid - - - - - (510,609) (510,609)

--------------- ------------ ------------- ----------- ------------ ------------ -----------

Balance at 31

December 2018 2,386,025 4,453,903 2,408,820 - 7,827,847 (1,453,913) 15,622,682

--------------- ------------ ------------- ----------- ------------ ------------ -----------

Balance at 1

July 2018 2,386,025 4,453,903 2,408,820 1,917,418 7,310,117 (1,142,190) 17,334,093

Transition to

IFRS 9 - - - (1,917,418) 1,917,418 - -

Total

comprehensive

income

Net return for

the year - - - - (597,905) 752,636 154,731

Transactions

with shareholders

recorded directly

to equity

Ordinary dividends

paid - - - - - (868,513) (868,513)

--------------- ------------ ------------- ----------- ------------ ------------ -----------

Balance at 30

June 2019 2,386,025 4,453,903 2,408,820 - 8,629,630 (1,258,067) 16,620,311

--------------- ------------ ------------- ----------- ------------ ------------ -----------

CONDENSED CONSOLIDATED BALANCE SHEET

As at 31 December 2019

31 December 31 December 30 June

2019 (unaudited) 2018 (unaudited) 2019 (audited)

Note GBP GBP GBP

------------------ ------------------ ---------------------

Non-current assets

Investments 16,593,672 13,709,874 15,777,113

------------------ ------------------ ---------------------

Current assets

Trade and other receivables 152,927 169,936 192,958

Cash and cash equivalents 1,251,156 1,826,565 785,703

------------------ ------------------ ---------------------

1,404,083 1,996,501 978,661

------------------ ------------------ ---------------------

Current liabilities

Trade and other payables (112,625) (83,693) (135,463)

------------------ ------------------ ---------------------

Net current assets 1,291,458 1,912,808 843,198

------------------ ------------------ ---------------------

Net assets 17,885,130 15,622,682 16,620,311

------------------ ------------------ ---------------------

Capital and reserves

Issued ordinary share

capital 5 2,386,025 2,386,025 2,386,025

Share premium 4,453,903 4,453,903 4,453,903

Capital redemption

reserve 2,408,820 2,408,820 2,408,820

Capital reserve 9,956,550 7,827,847 8,629,630

Revenue reserve (1,320,168) (1,453,913) (1,258,067)

------------------ ------------------ ---------------------

Shareholders' funds 17,885,130 15,622,682 16,620,311

------------------ ------------------ ---------------------

NAV per 50p ordinary

share 6 374.79p 327.38p 348.28p

------------------ ------------------ ---------------------

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 31 December 2019

31 December 30 June

31 December 2019 2018 (unaudited) 2019 (audited)

(unaudited) GBP GBP GBP

---------------------------------- ------------------ ---------------------

Cash flows from operating activities

Cash received from investments 373,655 335,085 1,203,692

Interest received 171,326 119,846 -

Investment management fees

paid (63,219) (45,000) (95,795)

Cash paid to and on behalf

of employees - (1,167) (1,167)

Other cash payments (162,223) (146,137) (263,981)

Tax recoverable (6,896) (1,919) -

---------------------------------- ------------------ ---------------------

Net cash inflow from operating

activities 312,643 260,708 842,749

---------------------------------- ------------------ ---------------------

Cash flows from financing activities

Dividends paid on ordinary

shares (357,904) (510,609) (868,513)

---------------------------------- ------------------ ---------------------

Net cash outflow from financing

activities (357,904) (510,609) (868,513)

---------------------------------- ------------------ ---------------------

Cash flows from investing activities

Purchase of investments (4,042,249) (2,321,667) (6,497,746)

Sale of investments 4,553,126 3,554,758 6,465,917

---------------------------------- ------------------ ---------------------

Net cash inflow/(outflow) from

investing activities 510,877 1,233,091 (31,829)

---------------------------------- ------------------ ---------------------

Net increase/(decrease) in

cash and cash equivalents 465,616 983,190 (57,593)

---------------------------------- ------------------ ---------------------

Reconciliation of net cash

flow to movement in net cash

Increase/(decrease) in cash 465,616 983,190 (57,593)

Exchange rate movements (163) (58) (137)

---------------------------------- ------------------ ---------------------

Increase/(decrease) in net

cash 465,453 983,132 (57,730)

Net cash at start of period 785,703 843,433 843,433

---------------------------------- ------------------ ---------------------

Net cash at end of period 1,251,156 1,826,565 785,703

---------------------------------- ------------------ ---------------------

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

At 31 December 2019

1. Significant accounting policies

Basis of Preparation

The condensed consolidated financial statements, which comprise

the unaudited results of the Company and its wholly owned

subsidiaries, Abport Limited and New Centurion Trust Limited,

together referred to as the "Group", have been prepared in

accordance with IFRS, as adopted by the United Kingdom, and as

applied in accordance with the provisions of the Companies Act

2006. The financial statements have been prepared in accordance

with the AIC SORP, except to any extent where it is not consistent

with the requirements of IFRS. The accounting policies are as set

out in the Report and Accounts for the year ended 30 June 2019.

The half-year financial statements have been prepared in

accordance with IAS 34 "Interim Financial Reporting".

The financial information contained in this half year financial

report does not constitute statutory accounts as defined by the

Companies Act 2006.The financial information for the periods ended

31 December 2019 and 31 December 2018 have not been audited or

reviewed by the Company's Auditor. The figures and financial

information for the year ended 30 June 2019 are an extract from the

latest published audited statements, and do not constitute the

statutory accounts for that year. Those accounts have been

delivered to the Registrar of Companies and include a report of the

Auditor, which was unqualified and did not contain a statement

under either Section 498(2) or 498(3) of the Companies Act

2006.

Going Concern

The Directors have made an assessment of the Group's ability to

continue as a going concern and are satisfied that the Group has

adequate resources to continue in operational existence for the

foreseeable future (being a period of 12 months from the date these

financial statements were approved). Furthermore, the Directors are

not aware of any material uncertainties that may cast significant

doubt upon the Group's ability to continue as a going concern,

having taken into account the liquidity of the Group's investment

portfolio and the Group's financial position in respect of its cash

flows, borrowing facilities and investment commitments (of which

there are none of significance).Therefore, the financial statements

have been prepared on the going concern basis and on the basis that

approval as an investment trust will continue to be met.

Segmental Reporting

The Directors are of the opinion that the Group is engaged in a

single segment of business, being investment business.

The Group primarily invests in companies listed in the UK.

2. Income

31 December 31 December 30 June

2019 2018 (unaudited) 2019 (audited)

(unaudited) GBP GBP

GBP

--------------------------------------------- ------------------ -------------------

Income from investments:

UK dividends 308,156 236,944 848,003

Un-franked dividend

income 24,964 25,583 46,335

UK fixed interest 162,810 117,094 259,933

--------------------------------------------- ------------------ -------------------

495,930 379,621 1,154,271

Other income:

Net dealing gains of

subsidiaries - (131) -

--------------------------------------------- ------------------ -------------------

Total income 495,930 379,490 1,154,271

--------------------------------------------- ------------------ -------------------

3. Return per Ordinary Share

Returns per share are based on the weighted average number of

shares in issue during the period. Normal and diluted return per

share are the same as there are no dilutive elements on share

capital.

Year ended

6 months to 31 6 months to 31

December 2019 December 2018 30 June 2019

(unaudited) (unaudited) (audited)

Net return Per share Net return Per share Net return Per share

GBP pence GBP pence GBP pence

----------- ---------- ------------ ---------- ----------- ----------

Return

on total

comprehensive

income

Revenue 295,803 6.20 198,886 4.17 752,636 15.77

Capital 1,326,920 27.81 (1,399,688) (29.33) (597,905) (12.53)

Total comprehensive

income 1,622,723 34.01 (1,200,802) (25.16) 154,731 3.24

----------- ---------- ------------ ---------- ----------- ----------

Weighted

average

number

of

ordinary

shares 4,772,049 4,772,049 4,772,049

----------- ---------- ------------ ---------- ----------- ----------

4. Dividends per Ordinary Share

Amounts recognised as distributions to equity holders in the

period.

6 months 6 months

to to

Year ended

31 December 31 December 30 June

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP GBP GBP

Ordinary Shares

Interim dividend of 5.70p

paid on 31 August 2018 - 272,007 272,007

Interim dividend of 5.70p

paid on 23 November 2018 - 238,602 178,952

Interim dividend of 3.75p

paid on 13 February 2019 - - 178,952

Interim dividend of 3.75p -

paid on 24 May 2019 -

Interim dividend of 3.75p 178,952 - -

paid on 30 August 2019

Interim dividend of 3.75p 178,952 - -

paid on 23 November 2019

Total income 357,904 510,609 868,513

The Board declared an interim dividend of 3.75p per ordinary

share, which was paid on 19 February 2020 to shareholders

registered at the close of business on 17 January 2020. This

dividend has not been included as a liability in these financial

statements.

5. Ordinary Share Capital

Year ended

6 months to 31 6 months to 31

December 2019 December 2018 30 June 2019

(unaudited) (unaudited) (audited)

Number GBP Number GBP Number GBP

---------- ---------- ---------- ---------- ---------- ----------

Ordinary

shares

of 50p

each 4,772,049 2,386,025 4,772,049 2,386,025 4,772,049 2,386,025

---------- ---------- ---------- ---------- ---------- ----------

The Company does not hold any shares in treasury as at 31

December 2019 (31 December 2018: Nil and 30 June 2019: Nil).

6. Net Asset Value per Ordinary Share

Net asset value per ordinary share is based on net assets at the

period end and 4,772,049 (31 December 2018: 4,772,049 and 30 June

2019: 4,772,049) ordinary shares in issue at the period end

excluding shares held in treasury if any.

7. Investment Management fee

The management fee payable monthly in arrears by the Company to

the Investment Manager, Fiske plc is calculated at the rate of

one-twelfth of 0.75% of the NAY as at the last business day of each

calendar month.

At 31 December 2019 an amount of GBP11,175 (31 December 2018:

GBP7,500 and 30 June 2019: GBP10,402) was outstanding and due to

the Investment Manager.

8. Fair Value Hierarchy

The fair value is the amount at which an asset could be sold in

an ordinary transaction between market participants at the

measurement date, other than a forced or liquidation sale. The

Group measures fair values using the following hierarchy that

reflects the significance of the inputs used in making the

measurements.

Categorisation within the hierarchy has been determined on the

basis of the lowest level input that is significant to the fair

value measurement of the relevant asset as follows:

Level 1 - valued using quoted prices, unadjusted in active

markets for identical assets and liabilities.

Level 2 - valued by reference to valuation techniques using

observable inputs for the asset or liability other than quoted

prices included in Level 1.

Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data for the asset

or liability.

The table below sets out fair value measurement of financial

instruments as at 31 December 2019, by the level in the fair value

hierarchy into which the fair value measurement is categorised.

At 31 December 2019 Level 1 Level 2 Level 3 Total

GBP GBP GBP GBP

Financial assets at fair

value through profit and

loss 13,474,671 287,477 2,831,524 16,593,672

---------- ------- --------- ----------

13,474,671 287,477 2,831,524 16,593,672

---------- ------- --------- ----------

At 31 December 2018

Financial assets at fair

value through profit and

loss 9,327,357 310,136 4,072,381 13,709,874

---------- ------- --------- ----------

9,327,357 310,136 4,072,381 13,709,874

---------- ------- --------- ----------

At 30 June 2019

Financial assets at fair

value through profit and

loss 12,524,512 300,353 2,952,248 15,777,113

---------- ------- --------- ----------

12,524,512 300,353 2,952,248 15,777,113

---------- ------- --------- ----------

Reconciliation of Level 3 investments

The following table summarises Level 3 investments that were

accounted for at fair value.

6 months to 6 months Year ended

31 December to 31 December 30 June

2019 (unaudited) 2018 (unaudited) 2019 (audited)

GBP GBP GBP

--------------------------- ------------------ ------------------

Opening balance 2,952,248 4,823,780 4,823,780

Transfer to level 1 - - (1,056,120)

Movement in unrealised gains/(losses)

on investments at fair value

through profit or loss 133,718 228,596 206,423

Realised gains/(losses) 120,660 (306,957) 45,398

Sales proceeds (375,102) (673,038) (1,067,233)

--------------------------- ------------------ ------------------

Closing balance 2,831,524 4,072,381 2,952,248

--------------------------- ------------------ ------------------

9. Transactions with the Investment Manager and related parties

As disclosed in note 7 a fee is paid to the Investment Manager

in respect of the services provided to the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SFLFMSESSELE

(END) Dow Jones Newswires

February 11, 2020 02:00 ET (07:00 GMT)

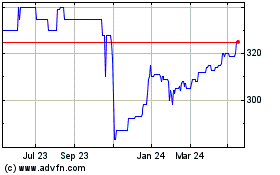

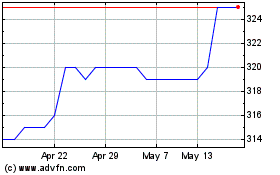

Investment (LSE:INV)

Historical Stock Chart

From Jul 2024 to Jul 2024

Investment (LSE:INV)

Historical Stock Chart

From Jul 2023 to Jul 2024