Instem plc Trading Update and Notice of Results (1328X)

January 08 2014 - 2:00AM

UK Regulatory

TIDMINS

RNS Number : 1328X

Instem plc

08 January 2014

8 January 2014

Instem plc

("Instem")

Trading Update and Notice of Results

Instem plc (AIM: INS), a leading provider of IT solutions to the

global early development healthcare market, announces its pre close

trading update for the year ended 31 December 2013.

At the time of our update on 22 November 2013 when we acquired

Perceptive Instruments Limited, we noted that the outcome for the

full year would rely on the placing of certain anticipated

contracts. Several of these contracts were secured, however

contractual discussions regarding a single perpetual licence with

one large potential client remained ongoing at the year end and

consequently results for the year ended 31 December 2013 are

expected to be below market forecasts with profitability in line

with the year ended 31 December 2012. Discussions with the client

are on-going and, if successfully concluded, will increase the

Board's expectations for 2014.

Overall order intake in the final quarter of the year was

encouraging, with a mix of perpetual licence business and four

additional Software-as-a-Service (SaaS) deals, the latter making

negligible financial contribution in 2013 but will enhance

performance in later years. We see the trend in SaaS sales as

encouraging and going forward will help to balance the impact of

single perpetual licence sales and improve future visibility.

High renewal rates for recurring revenue and receipts from new

business ensure Instem's balance sheet remains strong, with net

cash ahead of market expectations at GBP2.0m at 31 December 2013

(31 December 2012: GBP2.2m) after investing GBP1.7m on acquisitions

during 2013.

Contracts signed were across all of Instem's product lines,

including:

-- Two of the SaaS deals being with top 10 pharma companies

-- Further momentum for the growing Centrus product suite

-- Strong order intake for our recently acquired clinical business

We are also pleased to report that following a strong period of

trading, the first tranche of deferred consideration in respect of

the acquisition of Logos Technologies is due at the end of January

2014, comprising GBP200,000 of cash and GBP250,000 in ordinary

shares in Instem.

Instem will announce preliminary results for the year ended 31

December 2013 on 26 March 2014.

Phil Reason, CEO of Instem plc, commented: "Whilst it is

disappointing that results for 2013 are expected to be below

expectations due to the extended contract negotiations noted above,

overall the year has seen Instem significantly enhance its market

position. The new SaaS deals are particularly pleasing as we are

increasingly steering clients and prospects in that direction.With

the benefit of a full year's contribution from both the Logos

Technologies and more recent Perceptive Instruments acquisitions,

we look forward with confidence to 2014."

For further information, please contact:

Instem plc +44 (0) 1785 825 600

Phil Reason, CEO

Nigel Goldsmith, CFO

N+1 Singer (Nominated Adviser

& Broker) +44 (0) 20 7496 3000

Richard Lindley

Nick Owen

Newgate Threadneedle +44 (0) 20 7653 9850

Fiona Conroy

Caroline Evans-Jones

Jasper Randall

About Instem plc

Instem is a leading supplier of IT applications to the early

development healthcare market delivering compelling solutions for

data collection, management and analysis across the R&D

continuum. Instem applications are used by customers worldwide,

meeting the rapidly expanding needs of life science and healthcare

organisations for data-driven decision making leading to safer,

more effective products.

Instem's established portfolio of software solutions increases

client productivity in drug development by automating study-related

processes and enabling high integrity data sharing. The product

suite also offers the unique ability to generate new knowledge

through the extraction and harmonisation of actionable scientific

information.

Instem supports its clients through full service offices in the

United States, United Kingdom and China with additional locations

in India and a full service distributor based in Japan.

To learn more about Instem solutions and its mission, please

visit www.instem.com or its investor centre

http://investors.instem.com/

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTDGGDBRBGBGSR

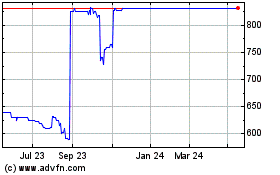

Instem (LSE:INS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Instem (LSE:INS)

Historical Stock Chart

From Jul 2023 to Jul 2024