RNS Number : 2398E

Hampden Underwriting Plc

25 September 2008

Hampden Underwriting PLC ("Hampden Underwriting" or the "Company")

Interim results for the six months ended 30 June 2008

Hampden Underwriting, which provides investors with a limited liability direct investment into the Lloyd's insurance market, announces

its unaudited results for the six months ended 30 June 2008.

Highlights

* Commenced underwriting with an allocated capacity of �5.1m.

* Premium written during the period totalled �2.8m.

* Group's first acquisition of a Lloyd's corporate member during the period.

* Net assets increased to �7.2m.

Commenting upon these results the Chairman, Sir Michael Oliver, said:

"While it's too early to comment on the likely result for the 2008 year of account, the Group has had a satisfactory result for the six

month period. The insurance industry has generally fared well through the global crisis and Lloyd's continues to outperform its peer groups.

We expect Lloyd's to continue to remain an attractive investment for 2009 and beyond."

Hampden Underwriting Jeremy Evans 020 7863 6567

Smith & Williamson Corporate Finance Azhic Basirov 020 7131 4000

Limited David Jones

Joanne du Plessis

Cardew Group Tim Robertson 0207930 0777

Shan Shan

Willenbrock

David Roach

Chairman's statement

The Group's first period of underwriting has resulted in a profit before tax of �148,000. This has been achieved despite the fact that

the first six months underwriting has been hit by costs which are unlikely to recur in the second half of the year. This is typical of any

new start up in the Lloyd's market.

The above together with the investment income generated from the funds held by the group has contributed to a satisfactory result for

the period.

It is too early to comment on the likely result for the 2008 year of account which will be dependent on major loss activity, in

particular the insured loss from Hurricane Ike, which may be the third largest insured hurricane loss in history.

The recent turmoil in the credit markets has precipitated the difficulties encountered by the world's largest property/casualty

insurance group, which has obtained a loan from the Federal Reserve Bank of New York of $85bn. Together with losses from Hurricane Ike

estimated at up to $18bn, there are grounds for improved profit potential for 2009 and 2010 on the syndicates backed by the Company at

Lloyd's. This is supported by the fact that Managing Agency Partners, which manages the second best performing syndicate in the Company's

portfolio, Syndicate 2791, has recently announced that it proposes to renew its "sidecar" reinsurance Syndicate 6103 for a third year. The

business case is based on reinsurance rates remaining steady for 2009, which we view as a conservative assumption.

So far, the insurance industry, with some notable exceptions, has fared well through the global credit crisis. The operating performance

of Lloyd's continues to outperform its peer groups with an 84% combined ratio on an annual accounted basis for the 2007 financial year. The

syndicates on which we participate have historically outperformed the Lloyd's average by a considerable margin. Lloyd's has emerged since

2002 and particularly since the establishment of the Franchise Performance Board in 2003 with its reputation enhanced and we expect this to

continue with Lloyd's remaining an attractive investment for 2009 and beyond.

Condensed Group Income Statement

Six months ended 30 June 2008

6 months ended 30 June 4 months ended 31

December

2008 2007

Note �'000 �'000

Gross premium written 2,788 -

Reinsurance premium ceded (562) -

Net premiums written 2,226 -

Change in unearned gross (1,940) -

premium provision

Change in unearned reinsurance 395 -

premium provision

(1,545) -

Net earned premium 2 681 -

Net investment income 2,3 195 174

Other income 2,9 23 -

Revenue 899 174

Gross claims paid (120) -

Reinsurance share of gross 17 -

claims paid

Claims paid, net of (103) -

reinsurance

Change in provision for gross (359) -

claims

Reinsurance share of change in 32 -

provision for gross claims

Net change in provision for (327) -

claims

Net insurance claims and loss 2 (430) -

adjustment expenses

Expenses incurred in insurance 2 (165) -

activities

Other operating expenses 2 (156) (85)

Operating expenses (321) (85)

Operating profit before tax 2 148 89

Income tax expense 4 (40) (27)

Profit attributable to equity 8 108 62

shareholders

Earnings per share

attributable to equity

shareholders

Basic and diluted 5 1.46p 0.83p

The profit and earnings per share set out above are in respect of continuing operations.

Condensed Group Balance Sheet

At 30 June 2008

30 June 31 December

2008 2007

Note �'000 �'000

Assets

Intangible assets 1,052 981

Financial investments 4,213 2,486

Reinsurance share of insurance liabilities

- Reinsurers' share of outstanding claims 416 -

- Reinsurers' share of unearned premiums 184 -

Other receivables, including insurance 1,278 112

receivables

Prepayments and accrued income 303 -

Cash and cash equivalents 4,037 3,552

Total assets 11,483 7,131

Liabilities

Insurance liabilities

- Claims outstanding 2,272 -

- Unearned premiums 1,124 -

Other payables, including insurance payables 798 40

Accruals and deferred income 30 -

Current income tax liabilities 72 27

Deferred income tax liabilities 15 -

Total liabilities 4,311 67

Shareholders' equity

Share capital 7 741 741

Share premium 7 6,261 6,261

Retained earnings 8 170 62

Total shareholders' equity 7,172 7,064

Total liabilities and shareholders' equity 11,483 7,131

Condensed Group Cash Flow Statement

Six months ended 30 June 2008

6 months 4 months ended 31

ended 30 December

June

2008 2007

�'000 �'000

Cash flow from operating activities

Results of operating activities 148 89

Recognition of negative goodwill (23) -

Amortisation of intangible assets 4 -

Change in fair value of investments 38 (101)

recognised in the income statement

Changes in working capital:

Increase in other receivables (1,469) (112)

Increase in other payables 803 40

Net increase in technical provisions 2,796 -

Net cash inflow/(outflow) from operating 2,297 (84)

activities

Cash flows from investing activities

Purchase of intangible assets - (981)

Purchase of financial investments (1,727) (2,385)

Acquisition of subsidiary, net of cash (85) -

acquired

Net cash used in investing activities (1,812) (3,366)

Cash flows from financing activities

Net proceeds from issue of ordinary share - 7,002

capital

Net cash used in financing activities - 7,002

Net increase in cash, cash equivalents and 485 3,552

bank overdrafts

Cash, cash equivalents and bank overdrafts at 3,552 -

beginning of period

Cash, cash equivalents and bank overdrafts at 4,037 3,552

end of period

Condensed Group Statement of Changes in Shareholders' Equity

Six months ended 30 June 2008

Ordinary Share Share Premium Retained Earnings Total

Capital

�'000 �'000 �'000 �'000

At 1 January 2008 741 6,261 62 7,064

Profit for the period - - 108 108

attributable to equity

shareholders

At 30 June 2008 741 6,261 170 7,172

Notes to the Interim Financial Statements

Six months ended 30 June 2008

1. Accounting policies

Basis of preparation

The Interim Financial Statements have been prepared using accounting policies consistent with International Financial Reporting

Standards (IFRSs) and in accordance with International Accounting Standard (IAS) 34 Interim Financial Reporting.

The Interim Financial Statements are prepared for the six months ended 30 June 2008. These are the first set of Interim Financial

Statements prepared by the Group.

The Interim Financial Statements incorporate the results of Hampden Underwriting plc and Hampden Corporate Member Limited for the six

months ended 30 June 2008 and the results of Nameco (No. 365) Limited for the five months ended 30 June 2008.

The Interim Financial Statements are unaudited, but have been subject to review by the Group's auditors. The Interim Financial

Statements have been prepared in accordance with the accounting policies adopted for the period ended 31 December 2007.

The comparative figures are based upon the Group Financial Statements for the period ended 31 December 2007 and represent the period

from admission to AIM to 31 December 2007. The Group Financial Statements for the period ended 31 December 2007 have been reported on by the

Group's auditors and were delivered to the Registrar of Companies on 8 April 2008.

The underwriting data on which these Interim Financial Statements are based upon has been supplied by the managing agents of those

syndicates which the Group supports. The data supplied is the 100% figures for each syndicate. The Group has applied its share of the

syndicate participations to the gross figures to derive its share of the syndicates transactions, assets and liabilities. The underwriting

transactions in respect of Syndicate 2020 have not been included in these Interim report and accounts as these figures are not available to

the Board. The directors are of the opinion that the exclusions of these underwriting transactions do not materially affect the results for

the period or the Group's condensed balance sheet.

Significant accounting policies

The Interim Financial Statements have been prepared under the historical cost convention. The same accounting policies, presentation and

methods of computation are followed in these Interim Financial Statements as were applied in the preparation of the Group Financial

Statements for the period ended 31 December 2007.

The Group will adopt International Financial Reporting Standard (IFRS) 4 Insurance Contracts for the first time in 2008 as the Group

commenced underwriting on 1 January 2008. There is no impact of that change in accounting policy on these Interim Financial Statements. Full

details will be included in the Group Financial Statements for the year ended 31 December 2008.

2. Segmental information

Primary segment information

The Group has three primary segments which represent the primary way in which the Group is managed:

* Syndicate participation;

* Investment management;

* Other corporate activities.

6 months ended 30 June 2008 Syndicate Investment Other corporate activities Total

participation management

�'000 �'000 �'000 �'000

Net earned premium 681 - - 681

Net investment income 8 187 - 195

Other income (note 9) - - 23 23

Net insurance claims and loss (430) - - (430)

adjustment expenses

Expenses incurred in insurance (165) - - (165)

activities

Other operating expenses - - (156) (156)

Results of operating 94 187 (133) 148

activities

4 months ended 31 December Syndicate Investment Other corporate activities Total

2007 participation management

�'000 �'000 �'000 �'000

Net earned premium - - - -

Net investment income - 174 - 174

Other income - - - -

Net insurance claims and loss - - - -

adjustment expenses

Expenses incurred in insurance - - - -

activities

Other operating expenses - - (85) (85)

Results of operating - 174 (85) 89

activities

Secondary segment information

The Group does not have any secondary segments as it considers all of its activities to arise from trading within the UK.

3. Net investment income

6 months ended 30 4 months ended 31

June December 2007

2008

�'000 �'000

Investment income at fair 79 -

value through income statement

Realised gains on financial 46 -

investments at fair value

through income statement

Unrealised gains on financial - 101

investments at fair value

through income statement

Bank interest 70 73

Net investment income 195 174

4. Income tax expense

6 months ended 30 June 4 months ended 31 December

2008 2007

�'000 �'000

Current tax 40 27

Income tax expense at 28% 40 27

(2007: 30%)

5. Earnings per share

Basic earnings per share is calculated by dividing the earnings attributable to ordinary shareholders by the weighted average number of

ordinary shares outstanding during the period.

The Group has no dilutive potential ordinary shares.

Earnings per share have been calculated in accordance with IAS 33.

Reconciliation of the earnings and weighted average number of shares used in the calculation is set out below.

6 months 4 months ended 31 December 2007

ended 30

June

2008

Profit for the period (�) 108,000 61,676

Weighted average number of 7,413,376 7,413,376

shares in issue

Basic and diluted earnings per 1.46 0.83

share (p)

6. Dividends

No equity dividends were proposed, declared or paid in the period (2007 - �Nil).

7. Share capital and share premium

Ordinary Preference Share Total

Share Capital

Capital

Authorised �'000 �'000 �'000

Ordinary shares of 10p each 2,950 50 3,000

and preference shares of 50p

each at 1 January 2008

Ordinary shares of 10p each 2,950 50 3,000

and preference shares of 50p

each at 30 June 2008

Allotted, called up and fully Ordinary Share Preference Share Premium Total

paid Capital Share �'000 �'000

�'000 Capital

�'000

Ordinary share capital, 741 - 6,261 7,002

preference share capital and

share premium at 1 January

2008

Ordinary share capital, 741 - 6,261 7,002

preference share capital and

share premium at 30 June 2008

8 Retained earnings

30 June 31 December

2008 2008

�*000 �*000

At 1 January 2008 62 -

Profit attributable to equity shareholders 108 62

At 30 June 2008 170 62

9. Acquisition of Nameco (No. 365) Limited

On 31 January 2008 Hampden Underwriting plc acquired 100% of the issued share capital of �1 ordinary shares of Nameco (No. 365) Limited

for �158,700. Nameco (No. 365) Limited is incorporated in England and Wales and is a corporate member of Lloyd's.

The acquisition has been accounted for using the purchase method of accounting. After the alignment of accounting policies and other

adjustments to the valuation of assets and liabilities to reflect their fair value at acquisition, the fair value of the net assets was

�181,880. Negative goodwill of �23,180 arose on acquisition and has been immediately recognised as other income in the income statement.

The following table explains the fair value adjustments made to the carrying values of the major categories of assets and liabilities at the

date of acquisition.

Carrying value Adjustments Fair value

�'000 �'000 �'000

Intangible assets 2 73 75

Financial investments 557 - 557

Reinsurance share of insurance 209 - 209

liabilities

Other receivables, including 340 - 340

insurance receivables

Prepayments and accrued income 42 - 42

Cash and cash equivalents 74 - 74

Insurance liabilities (885) - (885)

Other payables, including insurance (203) - (203)

payables

Accruals and deferred income (12) - (12)

Deferred income tax liabilities (15) - (15)

Net assets acquired 109 73 182

Satisfied by:

Cash and cash equivalents 159 - 159

Positive/(negative) goodwill 50 - (23)

The profit of Nameco (No. 365) Limited for the period since the acquisition date to 30 June 2008 is �6,000.

The group revenue and profit for the period would have been �871,000 and �109,000 respectively if the acquisition date of Nameco (No.

365) Limited had been 1 January 2008.

10. Related party transactions

The table set out below illustrates the Parent Company inter-company balances at the period end.

30 June 31 December

2008 2007

Company �'000 �'000

Balances due from Group companies at the period

end:

Hampden Corporate Member Limited 3,123 3,040

Nameco (No. 365) Limited 120 -

Total 3,243 3,040

Hampden Underwriting plc has provided an inter-company loan to Hampden Corporate Member Limited, a 100% subsidiary of the company. The

amount outstanding as at 30 June 2008 is �3,123,000 (2007: �3,040,000). Interest is charged on the loan at base rate plus 0.125%. The loan

is repayable on three months notice provided it does not jeopardise the ability of Hampden Corporate Member Limited to meet its liabilities

as they fall due.

Hampden Underwriting plc has provided an intercompany loan to Nameco (No. 365) Limited, a 100% subsidiary of the Company. The amount

outstanding as at 30 June 2008 is �122,000 (2007: �nil). Interest is charged on the loan at base rate plus 0.125%. The loan is repayable on

three months' notice provided it does not jeopardise the ability of Nameco (No. 365) Limited to meet its liabilities as they fall due.

Hampden Underwriting plc and Hampden Corporate Member Limited, a 100% subsidiary of the company, have entered into a management

agreement with Nomina plc. Jeremy Richard Holt Evans, a Director of Hampden Underwriting plc and Hampden Corporate Member Limited is also a

Director of Nomina plc. Under the agreement, Nomina plc provides management and administration, financial tax and accounting services to the

Group for an annual fee of �10,000. No fees have been paid by the Group in the period.

Hampden Corporate Member Limited, a 100% subsidiary of the company, has entered into a member's agent agreement with Hampden Agencies

Limited. Jeremy Richard Holt Evans, a Director of Hampden Underwriting plc and Hampden Corporate Member Limited, and Sir James Michael

Yorrick Oliver, a Director of Hampden Underwriting plc, are also a Directors of Hampden Capital plc which controls Hampden Agencies Limited.

Under the agreement, Hampden Corporate Member Limited will pay Hampden Agencies Limited a fee of 1% of capacity (capped at �250,000) and a

profit commission on a sliding scale from 1% of net profit up to a maximum of 10%. No amounts have been paid by Hampden Corporate Member

Limited in the period.

Nameco (No. 365) Limited has entered into a management agreement with Nomina Plc and a members agent agreement with Hampden Agencies

Limited. Under its management agreement Nameco (No. 365) Limited pays Nomina Plc �2,625 (2007: �2,625) for management and admiinstration,

financial, tax and accounting services. Under the members agencies agreement Nameco (No. 365) Limited will pay Hampden Agencies Lmited a fee

of �4,000 plus 0.25% of capacity and a profit commission on a sliding scale from 1% of net profit up to a maximum of 10%.

Hampden Underwriting plc has entered into a company secretarial agreement with Hampden Legal plc. Under the agreement, Hampden Legal plc

provides company secretarial services to the Group for an annual fee of �38,000. During the period, company secretarial fees of �18,000

(2007: �12,000) were charged to Hampden Underwriting plc. Hampden Holdings Limited has a controlling interest in both Hampden Legal Plc and

Hampden Capital Plc.

11. Syndicate participations

The syndicates and members' agent pooling arrangements ("MAPA") in which the Company's subsidiaries participate as corporate members of

Lloyd's as are follows:

Allocated capacity

Year of account

2006 2007 2008

Syndicate or Managing or Members' Agent �'000 �'000 �'000

MAPA Number

218 Equity Syndicates Management Limited 38,850 40,792 40,792

510 RJ Kiln & Co. Limited 44,000 45,000 36,000

609 Atrium Underwriters Limited 45,000 45,000 45,000

623 Beazley Furlonge Limited 45,198 42,673 40,145

1200 Heritage Managing Agency Limited 36,000 21,445 21,507

2020 Wellington U/W Agencies Limited 46,321 - -

6104 Hiscox Syndictes Limited - - 100,000

7200 Members' Agents Pooling Arrangement 15,150 16,059 14,964

7201 Members' Agents Pooling Arrangement 80,382 85,204 79,368

7202 Members' Agents Pooling Arrangement 29,460 30,638 28,687

7203 Members' Agents Pooling Arrangement 5,626 4,889 4,539

7208 Members' Agents Pooling Arrangement 5,000,000

Total 385,987 331,700 5,411,002

For the 2006 and 2007 years of account, the participation is through Nameco (No 365) Limited.

12. Group owned net assets

The Group balance sheet includes the following assets and liabilities held by the syndicates on which the Group participates. These

assets are subject to trust deeds for the benefit of the relevant syndicates' insurance creditors. The table below shows the split of the

Group balance sheet between group and syndicate assets and liabilities.

30 June 2008 31 December 2007

Group Syndicate Total Group Syndicate Total

�'000 �'000 �'000 �'000 �'000 �'000

Assets

Intangible assets 1,052 - 1,052 981 - 981

Financial investments 2,337 1,876 4,213 2,486 - 2,486

Reinsurance share of insurance

liabilities

- Reinsurers' share of - 416 416 - - -

outstanding claims

- Reinsurers' share of - 184 184 - - -

unearned premiums

Other receivables, including 77 1,201 1,278 112 - 112

insurance receivables

Prepayments and accrued income 33 270 303 - - -

Cash and cash equivalents 3,750 287 4,037 3,552 - 3,552

Total assets 7,249 4,234 11,483 7,131 - 7,131

Liabilities

Insurance liabilities

- Claims outstanding - 2,272 2,272 - - -

- Unearned premiums - 1,124 1,124 - - -

Other payables, including 57 741 798 40 - 40

insurance payables

Accruals and deferred income 21 9 30

Current income tax liabilities 72 - 72 27 - 27

Deferred income tax 15 - 15 - - -

liabilities

Total liabilities 165 4,146 4,311 67 - 67

Shareholders' equity

Share capital 741 - 741 741 - 741

Share premium 6,261 - 6,261 6,261 - 6,261

Retained earnings 82 88 170 62 - 62

Total shareholders' equity 7,084 88 7,172 7,064 - 7,064

Total liabilities and 7,249 4,234 11,483 7,131 - 7,131

shareholders' equity

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EZLFLVKBXBBL

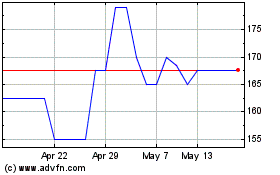

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Jul 2023 to Jul 2024