Hermes Pacific Investments PLC Final Results (4319Z)

September 18 2015 - 2:00AM

UK Regulatory

TIDMHPAC

RNS Number : 4319Z

Hermes Pacific Investments PLC

18 September 2015

18 September 2015

HERMES PACIFIC INVESTMENTS PLC

(AIM: HPAC)

Final results for the year ended 31 March 2015

Hermes Pacific Investments Plc today reports its financial

results for the year ended 31 March 2015.

Contacts

Hermes Pacific Investments www.hermespacificinvestments.com

Plc

Haresh Kanabar, Non-Executive Tel: +44 (0) 207

Chairman 290 3340

WH Ireland Limited (Nominated www.wh-ireland.co.uk

Adviser & Broker)

Mike Coe/Ed Allsopp Tel: +44 (0) 117

945 3470

Chairman's Statement

I am pleased to report the results of Hermes Pacific Investments

Plc ("HPAC" or the "Company") for the 12- month period ended 31

March 2015. During the year, the Company had no revenues as it does

not have any operating business and the Company made a loss of

GBP115,000, which has been reduced from a recorded loss of

GBP117,000 during the previous financial year. We have continued to

focus on our cost base and aim to keep it low particularly whilst

we are in the process of looking for suitable investments. At the

year-end the Company had net assets of GBP4,117,000.

Review of the Company's Operations

The Company is an investing company and has made some

investments in line with its investing policy in companies involved

in financial activities within the emerging market sector. Our

principal focus is in the Far East as we believe that there are

good growth opportunities in that part of the world. These

investments have performed in line with our expectations. We are in

a strong position from a Balance Sheet perspective and our cash

balance as at 31 March 2015 stands at GBP4,008 million. We continue

to evaluate other suitable opportunities in emerging markets and

with our strong Balance Sheet expect to make further investments in

the near future. Our total comprehensive loss for the year was

GBP101,000 compared to a loss of GBP183,000 for the previous

financial year.

Emerging markets are becoming increasingly attractive for

foreign direct investment and do offer cost-effective investment

opportunities for businesses that are persistent and willing to

take a long-term view. These markets are expected to continue to

increase its spending over the coming years. The economies in the

Far East have shown increasing resilience and this region has been

an engine of global economic growth whist the developed markets

have been in some distress. Most emerging markets are expected to

continue to enjoy growth rates that are far superior to that of

developed markets. Political events in these countries have to date

not significantly affected appetite for investment.

Outlook

We remain in a strong position to take advantage of suitable

investment opportunities as they arise and look forward to the

future with confidence.

Haresh Kanabar

Chairman

15 September 2015

Year ended Year ended

31 March 31 March

Note 2015 2014

GBP'000 GBP'000

Continuing operations

Revenue - -

Cost of sales - -

gross profit - -

Other operating income - -

Administrative expenses 3 (130) (131)

Operating loss (130) (131)

Finance income 15 14

Finance costs - -

Loss on ordinary activities

before tax (115) (117)

Tax expense - -

Loss for the year from

continuing activities (115) (117)

Discontinued operations

Loss for the year from - -

discontinued operations

Loss for the year (115) (117)

Other comprehensive income

Available-for-sale financial

assets:

Gains/(losses) arising

in the year

14 (66)

Total comprehensive loss

for the year (101) (183)

Basic and diluted loss

per share

From continuing operations 8 (4.9)p (5)p

From discontinuing operations 8 - -

(4.9)p (5)p

statement OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 MARCH

2015

As at As at

31 March 31 March

2015 2014

GBP'000 GBP'000

ASSETS

Non-current assets

Investments 144 129

144 129

Current assets

Trade and other receivables 1 1

Cash and cash equivalents 4,008 4,127

4,009 4,128

LIABILITIES

Current liabilities

Trade and other payables (36) (40)

(36) (40)

Net current assets 3,973 4,088

NET ASSETS 4,117 4,218

SHAREHOLDERS' EQUITY

Issued share capital 3,576 3,576

Share premium account 5,781 5,781

Share based payments reserve 139 139

Revaluation reserve (29) (43)

Retained earnings (5,350) (5,235)

TOTAL EQUITY 4,117 4,218

STATEMENT OF FINANCIAL POSITION AS AT 31 MARCH 2015

CASH FLOW STATEMENT FOR THE YEAR ENDED 31 MARCH 2015

Year Year ended

ended 31 March

31 March 2014

2015

GBP'000 GBP'000

Cash flows from operating

activities (134) (104)

Cash flows from investing

activities

Acquisition of investments - -

Income from disposal of - -

subsidiary undertakings

Net cash (used in)/from - -

investing activities

Cash flows from financing

activities

Proceeds of share issues - 4,160

Other income 15 14

Cost of share issue - -

Net cash from financing

activities 15 4,174

(Decrease)/increase in

cash and cash equivalents (119) 4,070

Cash and cash equivalents

at start of period 4,127 57

Cash and cash equivalents

at end of period 4,008 4,127

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 MARCH

2015

Share Share

Ordinary Deferred premium based

share share payments Retained Revaluation

capital capital reserve earnings reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2013

Share 253 1,243 3,701 139 (5,118) 23 241

re-organisation - - - - - - -

Share issue 2,080 - 2,080- - - - 4,160

Total

comprehensive

loss for the

period - - - - (117) (66) (183)

At 1 April 2014 2,333 1,243 5,781 139 (5,235) (43) 4,218

Share - - - - - - -

re-organisation

Share issue - - - - - - -

Total

comprehensive

loss for the

period - - - - (115) 14 (101)

(MORE TO FOLLOW) Dow Jones Newswires

September 18, 2015 02:00 ET (06:00 GMT)

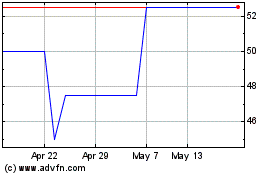

Hermes Pacific Investments (LSE:HPAC)

Historical Stock Chart

From Sep 2024 to Oct 2024

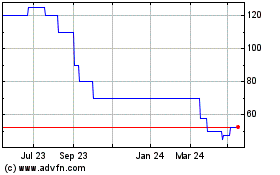

Hermes Pacific Investments (LSE:HPAC)

Historical Stock Chart

From Oct 2023 to Oct 2024