TIDMHLMA

RNS Number : 7489S

Halma PLC

18 November 2021

Halma plc

HALF YEAR RESULTS 2021/22

Record first half results and continued dividend growth

Halma, the global group of life-saving technology companies focused

on growing a safer, cleaner and healthier future for everyone, every

day, today announces results for the 6 months to 30 September 2021.

Highlights

Change 2021 2020

Revenue +19% GBP737.2m GBP618.4m

Adjusted Profit before Taxation(1) +27% GBP154.9m GBP122.0m

Adjusted Earnings per Share(2) +25% 31.96p 25.54p

Statutory Profit before Taxation +74% GBP167.5m GBP96.3m

Statutory Earnings per Share +76% 35.83p 20.37p

Interim Dividend per Share(3) +7% 7.35p 6.87p

Return on Sales(4) 21.0% 19.7%

Return on Total Invested Capital(5) 14.9% 12.6%

Net Debt GBP280.2m GBP315.0m

* Record revenue and profit: revenue up 19%; 23% on an

organic constant currency(6) basis. Adjusted(1)

Profit before Taxation up 27%; 32% on an organic

constant currency(6) basis.

* High Return on Sales of 21.0% (2020/21: 19.7%) given

robust gross margins with a slower-than-expected

return of variable overhead costs.

* Statutory Profit before Taxation up 74%, including a

GBP34.0m gain on the disposal of Texecom.

* Strong organic constant currency(6) revenue and

profit growth in all sectors and major regions; very

strong growth in the UK and Asia Pacific, against

weaker comparatives.

* Increased returns and investment: ROTIC(5) of 14.9%,

and R&D expenditure up 20 %, representing 5.6% of

revenue.

* Ten acquisitions completed in the first half and one

further small acquisition completed since the period

end; a healthy acquisition pipeline across all

sectors.

* Solid cash conversion of 85% and a robust balance

sheet supporting sustained investment in organic

growth and acquisitions, and a 7% increase in the

interim dividend.

Andrew Williams, Group Chief Executive of Halma, commented:

"Halma made strong progress in the first half, delivering record

revenue, profit and interim dividend, with substantial growth

compared to both the first half of last financial year and 2019/20.

Our full year outlook is unchanged, despite variable overhead

costs returning and continued impacts on revenue, costs and working

capital from increased supply chain, logistics and labour market

disruption. In the second half of the year, we expect more typical

rates of revenue growth and Return on Sales, with the latter

more in line with historical levels.

Our Sustainable Growth Model continues to drive our success,

including its focus on global niche markets with long-term growth

drivers. Our strong purpose and culture, our portfolio and geographic

diversity, together with our agile business model enable us to

perform well in varied market conditions and sustain growth and

returns over the longer term."

Notes:

1 Adjusted to remove the amortisation of acquired intangible

assets, acquisition items and profit or loss on disposal of

operations, totalling GBP(12.6)m (2020/21: GBP25.7m). See

note 2 to the Condensed Interim Financial Statements for details.

2 Adjusted to remove the amortisation of acquired intangible

assets, acquisition items, profit or loss on disposal of operations

and the associated taxation thereon. See note 2 to the Condensed

Interim Financial Statements for details.

3 Interim dividend paid and declared per share.

4 Return on Sales is defined as Adjusted(1) Profit before Taxation

from continuing operations expressed as a percentage of revenue

from continuing operations.

5 Return on Total Invested Capital (ROTIC) is defined as post-tax

Adjusted(1) Profit as a percentage of average Total Invested

Capital.

6 Organic constant currency measures exclude the effect of movements

in foreign exchange rates on the translation of revenue and

profit(1) into Sterling, as well as acquisitions in the year

following completion and disposals.

7 Adjusted(1) Profit before Taxation, Adjusted(2) Earnings per

Share, organic growth rates, Return on Sales and ROTIC are

alternative performance measures used by management. See notes

2, 6 and 9 to the Condensed Interim Financial Statements for

details.

For further information, please contact:

Halma plc

Andrew Williams, Group Chief

Executive +44 (0)1494 721 111

Marc Ronchetti, Chief Financial

Officer

Charles King, Head of Investor

Relations +44 (0)7776 685948

MHP Communications

Andrew Jaques/Rachel Farrington +44 (0)20 3128 8572

A copy of this announcement, together with other information

about Halma, may be viewed on its website: www.halma.com . The

webcast of the results presentation will be available on the

Halma website later today: www.halma.com

NOTE TO EDITORS

1. Halma is a global group of life-saving technology companies,

focused on growing a safer, cleaner and healthier future for

everyone, every day. Its purpose defines the three broad market

areas where it operates:

-- Safety Protecting life as populations grow and

protecting worker safety.

-- Environment Improving food and water quality, and monitoring

air pollution.

-- Medical Meeting rising healthcare demand as growing

populations age and lifestyles change.

Halma employs over 7,000 people in more than 20 countries,

with major operations in the UK, Mainland Europe, the USA and

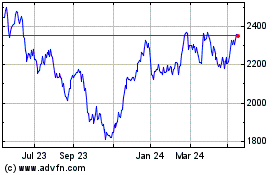

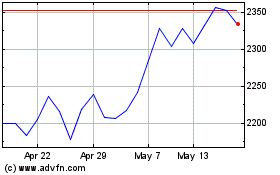

Asia Pacific. Halma is listed on the London Stock Exchange

(LON: HLMA) and is a constituent of the FTSE 100 index.

In January 2021, Halma was named Britain's Most Admired Company

2020 by Management Today.

2. You can view or download copies of this announcement and the

latest Half Year and Annual Reports from the website at www.halma.com

or request free printed copies by contacting halma@halma.com

.

3. This announcement contains certain forward-looking statements

which have been made by the Directors in good faith using information

available up until the date they approved the announcement.

Forward-looking statements should be regarded with caution

as by their nature such statements involve risk and uncertainties

relating to events and circumstances that may occur in the

future. Actual results may differ from those expressed in such

statements, depending on the outcome of these uncertain future

events .

Review of Operations

Record half year results

Halma made strong progress in the first half of the year,

reflecting the benefits of our Sustainable Growth Model with its

strong purpose and culture, and our leading positions in global

niche markets with long-term growth drivers. The benefits of a

diverse portfolio and the agility of our business model have

enabled our companies to respond rapidly to changing conditions in

their end markets and to increased supply chain, logistics and

labour market disruption.

We achieved record results, with strong growth across all our

sectors and all major regions. We delivered substantial growth in

revenue and profit compared to the weaker period in the first half

of the 2020/21 financial year, when we saw the largest impacts from

the COVID-19 pandemic, and the equivalent period in the 2019/20

financial year.

Revenue increased by 19%, to GBP737.2m (2020/21: GBP618.4m),

reflecting a substantial recovery in demand in those end markets

most impacted by lockdowns in the first half of last year.

Adjusted(1) Profit before Taxation grew even more strongly, by 27%

to GBP154.9m (2020/21: GBP122.0m), benefiting from robust gross

margins and a slower-than-expected return in variable overhead

costs.

As a result, Return on Sales(1) was above expectations, at 21.0%

(2020/21: 19.7%). This comprised an exceptionally strong

performance in the first quarter, with Return on Sales(1) of 22.5

%. Return on Sales(1) moderated to 19. 5 % in the second quarter ,

with variable overhead costs returning as COVID-related

restrictions eased. Variable overhead costs included expenditure of

approximately GBP1m in information technology upgrades. Investment

in these programmes in the full year is now expected to be around

GBP11m.

Statutory Profit before Taxation increased by 74% to GBP167.5m

(2020/21: GBP96.3m) and included a GBP34.0m gain on the disposal of

a Safety sector business in the period. Details of this are given

later in this review.

Revenue growth comprised organic constant currency(1) revenue

growth of 23%, a 2% positive contribution from acquisitions (net of

the effects of disposals) completed in this and the previous half

year, and a negative currency translation effect of 6%. This strong

growth compared with a decline of 11% on an organic constant

currency(1) basis in the first half of the last financial year.

The 27% increase in Adjusted(1) Profit before Taxation included

organic constant currency(1) growth of 32%, a 2% positive

contribution from acquisitions (net of the effects of disposals)

completed in this half year and the second half of last year, and a

negative currency translation effect of 7%. As with revenue, this

strong profit performance compared with an 11% decline on an

organic constant currency(1) basis in the first half of last

year.

We have a strong balance sheet and ended the period with net

debt of GBP280.2m, equivalent to 0.76 times the last 12 months'

EBITDA (31 March 2021: net debt of GBP256.2m; 0.76 times EBITDA). A

solid cash conversion of 85 % was lower than the exceptionally

strong 111% in the first half of last year, and reflected the

working capital required to support the strong growth in the

period. Our strong balance sheet and continued cash generation

underpin our ongoing investment in future organic growth, give us

substantial capacity for acquisitions, and support our progressive

dividend policy.

We made substantial investments in the first half, both

organically and through acquisitions, to support future growth.

R&D expenditure increased 20% to GBP41.3m, representing 5.6% of

Group revenue (2020/21: 5.6%). We made ten acquisitions, for a

maximum total consideration of GBP107m, while disposing of one

business for GBP65m. Since the period end, we have made one further

acquisition, of Clayborn Lab, for a maximum total consideration of

US$6m (GBP4.4m).

The Board has declared an increase of 7% in the interim dividend

to 7.35p per share (2020/21: 6.87p per share). The interim dividend

will be paid on 4 February 2022 to shareholders on the register on

24 December 2021.

Strong organic constant currency(1) growth in all major

regions

External revenue by destination

Half year 2021 Half year 2020

---------------- ----------------

% organic

growth

% of % of Change % at constant

GBPm total GBPm total GBPm growth currency(1)

------------------------- ------- ------- ------- ------- ------ ------- ------------

United States of America 280.9 38% 255.1 41% 25.8 10% 19%

Mainland Europe 146.6 20% 127.2 21% 19.4 15% 18%

United Kingdom 136.2 18% 87.6 14% 48.6 55% 46%

Asia Pacific 124.8 17% 100.0 16% 24.8 25% 30%

Other regions 48.7 7% 48.5 8% 0.2 1% 6%

------------------------- ------- ------- ------- ------- ------ ------- ------------

737.2 100% 618.4 100% 118.8 19% 23%

------------------------- ------- ------- ------- ------- ------ ------- ------------

Our growth in the period was broad-based, and revenue grew

strongly in all four major regions, both on a reported and organic

constant currency(1) basis. Growth rates in each region, were also

impacted to differing extents by acquisitions (net of disposals),

and a negative effect from foreign currency translation, given the

relative strength of Sterling.

The USA remains our largest sales destination and contributed

38% of total revenue. Revenue increased by 10%, or by 19% on an

organic constant currency(1) basis, with all sectors delivering a

strong organic constant currency(1) performance.

Reported revenue growth in the USA included the effect of the

acquisition of PeriGen and the disposal in the prior year of

Fiberguide Industries, as well as a negative effect from currency

translation. The strongest growth was in the Environmental &

Analysis sector, led by strong performances in Optical Analysis and

Gas Detection. The Safety sector also delivered strong organic

constant currency(1) growth, led by Fire Detection and Industrial

Access Control. Growth in the Medical sector reflected an increase

in demand for products and services related to elective healthcare

procedures, partly offset by a decline, from last year's

exceptionally high levels, in the demand for products and services

related to the diagnosis or treatment of COVID-19.

Mainland Europe revenue increased by 15%, or 18% on an organic

constant currency(1) basis, with strong performances across all

sectors. Reported revenue benefited from a number of acquisitions,

including Sensitron and Orca, partly offset by the disposal of

Texecom in August. There was a negative effect from currency

translation.

Revenue in the UK grew 55%, or 46% on an organic constant

currency(1) basis, with an exceptionally strong contribution from

the Safety sector, against a very weak comparative in the first

half of last year. The Environmental & Analysis sector also

grew strongly, while the smaller Medical sector revenues more than

tripled, benefiting from the prior year acquisition of Static

Systems.

Asia Pacific's revenue grew 25%, or 30% on an organic constant

currency(1) basis. Organic constant currency(1) growth reflected

very strong performances across all sectors, against a weaker

comparative in the first half of last year. This included a very

strong performance in China, as well as in a number of other

smaller markets in the region.

In other regions, which represent only 7% of Group revenue,

revenue was broadly flat, although growing 6% on an organic

constant currency(1) basis. There was modest growth in the Africa,

Near and Middle East territories, while revenue declined in Other

countries.

Substantial revenue and profit growth in all sectors

From 1 April 2021, we operate and report under three sectors,

Safety, Environmental & Analysis and Medical, aligned with our

purpose and our focus on safety, environmental and health

markets.

External revenue by sector

Half year Half year

2021 2020

--------- ---------

% organic

growth at

Change % constant

GBPm GBPm GBPm growth currency(1)

------------------------- --------- --------- ------ ------- ------------

Safety 320.2 268.6 51.6 19% 25%

Environmental & Analysis 209.5 178.0 31.5 18% 25%

Medical 208.0 172.4 35.6 21% 18%

Inter-segmental revenue (0.5) (0.6) 0.1

------------------------- --------- --------- ------ ------- ------------

737.2 618.4 118.8 19% 23%

------------------------- --------- --------- ------ ------- ------------

Profit by sector

Half year Half year

2021 2020

--------- ---------

% organic

growth at

Change % constant

GBPm GBPm GBPm growth currency(1)

------------------------- --------- --------- ------ ------- ------------

Safety 73.5 58.0 15.5 27% 32%

Environmental & Analysis 53.1 42.9 10.2 24% 31%

Medical 46.3 38.2 8.1 21% 20%

------------------------- --------- --------- ------ ------- ------------

Sector profit(2) 172.9 139.1 33.8 24% 28%

------------------------- --------- --------- ------ ------- ------------

Central administration

costs (14.0) (11.3) (2.7)

------------------------- --------- --------- ------ ------- ------------

Net finance expense (4.0) (5.8) 1.8

------------------------- --------- --------- ------ ------- ------------

Adjusted(1) profit

before taxation 154.9 122.0 32.9 27% 32%

------------------------- --------- --------- ------ ------- ------------

Safety sector

Revenue increased by 19% to GBP320.2m (2020/21: GBP268.6m) and

organic constant currency(1) revenue increased by 25%. There was a

positive contribution from acquisitions of 1%, and negative effects

from the disposal of Texecom of 3% and currency translation of

4%.

The sector delivered a strong performance across all major

regions, supported by the agility of our companies in successfully

responding to new opportunities in their markets and to the

substantial increases in customer demand following the easing of

lockdown restrictions. This agility also resulted in our companies

meeting the challenges arising in the period from supply chain and

logistics disruptions and in labour markets. For example, they

leveraged their close relationships with suppliers to ensure

continued delivery of materials and components, redesigned products

and used alternative materials where necessary, selectively

increased prices, and formed collaborative teams across functions,

companies and geographies to solve specific issues.

This strong performance was led by substantial growth in our

Fire Detection businesses. These businesses were affected in the

first half of last year by lockdown restrictions and the

furloughing of customer employees. This year they benefited from a

recovery in demand as construction activity resumed, from an

improvement in the ability to gain physical access to customer

sites, and from the return to work of previously furloughed

customer employees. The same dynamics also led to very strong

growth in our Elevator Safety business in the UK, and, together

with increasing regulation, our emergency communications business

in the USA.

Our People and Vehicle Flow businesses also performed strongly.

Significant road safety contracts in the UK and China drove very

strong growth at Navtech. BEA, which had delivered a resilient

performance in the first half of last year, also grew strongly, as

construction activity increased and demand for its touchless and

automated entry devices continued to grow to meet the changing

needs of our customers as a result of the pandemic.

We also saw benefits from increasing activity in several other

market segments and from the ability of our companies to swiftly

adapt and scale for changing customer needs. Examples included

meeting strong demand from logistics customers for our interlock

products in the Industrial Access Control segment and prioritising

those technologies which support the decarbonisation of our energy

sources in Pressure Management.

However, some business areas, such as those focused on larger

projects with longer lead times, such as in Safe Storage and

Transfer, are taking longer to recover from the effects of the

pandemic. Elsewhere, weakness in some specific markets, such as the

aerospace market within Fire Suppression, resulted in revenue

declines in a limited number of companies, principally smaller ones

within the sector.

The sector's revenue performance by geography reflected these

themes. The UK and Asia Pacific grew exceptionally strongly, with

organic constant currency(1) revenue growth of 69% and 25%

respectively, driven by strong growth in Fire Detection and People

and Vehicle Flow. The UK's lower revenue growth on a reported

basis, at 57%, reflected the net effect of acquisitions and the

disposal.

The other two larger regions, the USA and Mainland Europe, also

grew strongly, each increasing revenue by 18% on an organic

constant currency(1) basis. This included strong growth in Fire

Detection and in People and Vehicle Flow in Europe, and in the USA

in emergency communications, Industrial Access Control and Pressure

Management.

Revenue declines in the much smaller regions, of 9% in total (on

an organic constant currency(1) basis), principally reflected the

timing of project-based business and a continued shift away from

oil and gas-related business in these regions and the sector as a

whole.

Profit(2) was 27% higher at GBP73.5m (2020/21: GBP58.0m), and

included 32% organic constant currency(1) growth, and negative

effects of 1% from the Texecom disposal (net of a small

contribution from acquisitions) and 4% from currency translation.

Return on Sales(1) increased to 23.0% (2020/21: 21.6%), benefiting

from the slower-than-expected return of variable overhead costs in

the first quarter and a stable gross margin. R&D expenditure of

GBP18.0m remained at a good level, with a significant increase in

absolute investment representing 5.6% of revenue (2020/21:

5.5%).

Our current expectation is for the sector to make further

progress in the second half, against a stronger comparative

(notably at the profit level). Although risks remain in relation to

supply chain, logistics and labour market disruptions, it is

expected to deliver a strong full year performance.

Environmental & Analysis sector

Revenue increased by 18% to GBP209.5m (2020/21: GBP178.0m),

comprising 25% organic constant currency(1) growth, a 4%

contribution from acquisitions, and the negative effects of 4% from

last year's disposal of Fiberguide Industries and 7% from currency

translation.

While many sector companies experienced supply chain and labour

market challenges to varying degrees in the period, the sector

delivered strong revenue growth in all segments and regions, as our

companies responded to substantial increases in customer demand for

their products and services. This demand was driven by higher

activity as COVID-19 restrictions eased, and by increasing focus on

protecting the environment and scarce natural resources. These

trends supported a strong recovery in the Gas Detection subsector

and greater demand for wastewater solutions within our Water

Analysis & Treatment segment. Photonics also performed very

well on an organic constant currency(1) basis and continued to

benefit from increasing demand for technologies that support the

building of digital and data capabilities.

In the USA, revenue grew 27% on an organic constant currency(1)

basis, driven by further growth in a continuing large Photonics

contract, and in Gas Detection. The latter reflected its customers'

increasing focus on the minimisation of emissions of methane, a

potent greenhouse gas, and an ever-increasing desire to improve

public safety.

Asia Pacific revenue growth was also very strong, at 34% on an

organic constant currency(1) basis, including substantial revenue

growth in China, with several other smaller markets in the region,

such as India, Japan, Singapore and Australasia also performing

strongly. The Water Analysis and Treatment segment's continued

focus on the region led to increased market penetration, while the

recovery in industrial activity, as pandemic restrictions eased,

supported strong growth in the Optical Analysis segment.

Organic constant currency(1) revenue growth of 14% in the UK

reflected the continued focus of our customers on the integrity of

water and wastewater infrastructure, which supported a strong

performance in our pipeline inspection business. However, this was

partly offset by weakness in our water pressure and leak detection

business against a strong comparative in the first half of last

year, reflecting reduced demand from UK water utilities as they

focus more on addressing their wastewater challenges.

Mainland Europe delivered strong organic constant currency(1)

revenue growth and, on a reported basis, also benefited from the

acquisitions of Sensitron, Orca and Dancutter. Other regions, which

represent less than 10% of sector revenue, delivered a very strong

growth, led by Gas Detection.

Profit(2) increased by 24% to GBP53.1m (2020/21: GBP42.9m).

Organic constant currency(1) profit growth was 31% and there was a

3% contribution from acquisitions and negative effects of 2% from

prior year disposals and 8% from currency translation. Return on

Sales(1) improved from 24.1% to 25.4%, due to proactive overhead

management, despite a decline in gross margin driven by business

mix. Despite such strong revenue growth, R&D expenditure of

GBP10.3m was maintained at a good level at 4.9% of sales (2020/21:

5.8%).

The sector is currently expected to perform strongly over the

full year. In the second half, we expect strong revenue growth,

albeit with continued risks from supply chain, logistics and labour

market disruption. We expect a more typical level of Return on

Sales(1) given a more normal business mix and increased

investment.

Medical sector

Revenue increased by 21% to GBP208.0m (2020/21: GBP172.4m).

Organic constant currency(1) revenue growth was 18%, and there was

an 8% negative effect from currency translation and an 11% positive

contribution from acquisitions, primarily Static Systems and

PeriGen.

There was growth across all segments and geographies, reflecting

a gradual improvement in demand for elective surgeries and

discretionary ophthalmic diagnostic procedures as the effects of

the pandemic on healthcare systems moderated. As expected, this was

partly offset by a reduction in demand for products and services

related to the treatment of COVID-19 from the very high levels

experienced in the first half of last year. Sector companies have

successfully responded to these varying market conditions and to

continuing operational challenges. These include supply chain and

labour market disruption, and a varying ability to access hospitals

in Sensors & Analytics.

These trends were reflected in the performance of the individual

segments. Health Assessment saw the strongest growth, supported by

recent acquisitions. On an organic basis, the recovery in demand

for ophthalmic diagnostic procedures and growth in Sensors &

Analytics supporting care systems' focus on greater efficiency and

ensuring the effectiveness of hygiene protocols, were key growth

drivers. However, revenue from products focused on the monitoring

of vital signs declined. In Therapeutic Solutions, strong growth in

demand for products supporting elective surgeries was partly offset

by a reduction for products supporting the oxygenation of patients.

Life Sciences revenue also grew, notably in China, but growth was

more subdued in other regions which continue to be impacted by the

ongoing focus on COVID-19 testing and point-of-care

diagnostics.

The USA, the sector's largest region, grew revenue by 9% (12% on

an organic constant currency(1) basis). This was a good performance

when compared to the strong growth of 14% in the first half of last

year. On a reported basis, USA revenue also benefited from the

acquisition of PeriGen, although this was more than offset by the

negative effect of currency translation.

In the other major regions, Mainland Europe revenue grew

strongly, by 17% on an organic constant currency(1) basis, against

growth of 6% in the comparable period last year. Growth rates were

highest in the UK and Asia Pacific, at 52% and 32% respectively on

an organic constant currency(1) basis, reflecting a recovery in

demand and a weaker comparative in the first half of last year. On

a reported basis, UK revenue more than tripled, reflecting the

recent acquisition of Static Systems, as well as very strong

organic constant currency(1) growth off a small base.

Profit(2) increased by 21% to GBP46.3m (2020/21: GBP38.2m).

Return on Sales(1) increased to 22.3% (2020/21: 22.1%), reflecting

a benefit to gross margin from favourable product mix and a

slower-than-expected increase in overheads as customer-facing

employees began to return to normal activity. R&D spend of

GBP12.8m reflected a significant increase in investment in new

product development, with the increase to 6.2% of revenue (2020/21:

5.5%) being attributable to changes in business mix and investment

by recently acquired companies.

The Medical sector is currently expected to make further

progress in the second half, and to deliver a good performance for

the year as a whole.

Eleven acquisitions and one disposal completed to enhance our

growth opportunities

We continue to actively manage our portfolio of global

businesses to ensure that it is aligned with our purpose of growing

a safer, cleaner, healthier future for everyone, every day, and can

deliver strong and sustainable growth and returns. We have a

healthy acquisition pipeline across all three sectors and continue

to find attractive, high-quality businesses to enhance our existing

market strengths as well as to enter emerging market

opportunities.

We made 10 acquisitions in the period, for a maximum total

consideration of GBP107m (on a cash- and debt-free basis), in core

and adjacent markets to expand our future growth opportunities and

geographical reach. These were broadly spread across all three

sectors and our four major geographical regions. They comprised

three companies which will be standalone within the Halma group,

and seven bolt-on acquisitions which will strengthen the

technologies and capabilities of existing Halma companies.

In April and May 2021, we completed six acquisitions (including

five bolt-on acquisitions).

-- PeriGen, Inc., whose advanced technology protects mothers and

their unborn babies during childbirth by alerting doctors, midwives

and nurses to potential problems, was acquired for a cash

consideration of US$58m (approximately GBP41m) on a cash- and

debt-free basis.

-- Assets and IP associated with monitored safety valves were

purchased from FluidSentry Pty for A$0.6m (GBP0.3m), and added to

Fortress Interlocks.

-- Argus Security S.R.L. acquired its Italian distributor for EUR0.6m (GBP0.5m).

-- Anton Industrial Services, Crowcon's UK flue gas analyser

distribution partner, was purchased for GBP1.9m.

-- Orca GmbH, a German manufacturer of ultraviolet disinfection

systems, joined our UV Group of companies for a maximum

consideration of EUR8.7m (GBP7.6m), on a cash- and debt-free

basis.

-- Assets and IP associated with the US-based RNK's digital

stethoscope used in telemedicine and augmented tele-auscultation,

were purchased by Riester for a consideration of US$3.0m

(GBP2.3m).

In August 2021, we announced that we had completed a further

three acquisitions, as follows:

-- the Ramtech group of companies, a UK-based supplier of

wireless fire systems for temporary sites, was purchased for a cash

consideration of GBP15.5m, on a cash- and debt-free basis.

-- Dancutter A/S, a Danish designer and manufacturer of

trenchless pipeline rehabilitation equipment, was acquired for a

cash consideration of EUR17.6m (GBP15.0m), on a cash- and debt-free

basis.

-- Sensitron S.R.L., an Italian gas detection company, joined

Halma for a cash consideration of EUR20.1m (GBP17.2m), on a cash-

and debt-free basis.

In September 2021, we acquired Meditech Kft, a Hungarian

manufacturer of ambulatory blood pressure monitors and ECG Holter

devices, for a maximum total consideration of EUR6.4m

(approximately GBP5.5m). It will be integrated with our SunTech

business.

Since the period end, we have made one further acquisition, of

Clayborn Lab, a provider of custom heat tape solutions primarily

for heated sample lines in the environmental monitoring market.

Clayborn Lab will become part of our Perma Pure business and was

acquired for an initial cash consideration of US$4.5m (GBP3.3m)

with an additional earn-out consideration of US$1.5m (GBP1.1m),

payable in cash, subject to performance over the next two

years.

We also made one disposal in the period, demonstrating our

disciplined approach to portfolio management and supporting our

strategy of maintaining a growth-oriented portfolio of companies.

In August 2021, we sold Texecom, a UK-based provider of electronic

security systems, for a total cash consideration of GBP65m on a

cash- and debt-free basis. Texecom was acquired by Halma in 2005

for a consideration of GBP26m.

Further progress aligned with our Sustainability Framework

We seek to create sustainable value for our stakeholders through

our Sustainable Growth Model. This is focused on delivering

consistently strong growth and returns with a positive impact in

the markets we serve and beyond, consistent with our purpose of

growing a safer, cleaner, healthier future for everyone, every day.

Our Sustainability Framework, which we launched in June this year,

is designed to amplify this positive impact through purpose-aligned

growth. It prioritises three Key Sustainability Objectives (KSOs),

namely Climate Change, the Circular Economy, and Diversity, Equity

and Inclusion (DEI). These KSOs are, in turn, supported by policies

and metrics that we consider essential to growing our business

responsibly.

During this half year, we have developed programmes to support

our companies' existing sustainability initiatives while further

raising awareness of Halma's KSOs within our Group and companies'

management teams. We are helping our companies to deliver against

our KSOs through the creation of collaboration and best practice

networks and the provision of tools and resources to raise

awareness and address specific challenges. These include launching

a new "Inclusive Leadership" programme for our Divisional Chief

Executives and Managing Directors, a new collaboration with

EcoVadis to enable our companies to assess the sustainability

credentials of their key suppliers, and a revised car policy that

encourages and incentivises the adoption of zero emission

vehicles.

To ensure that sustainability and climate change risks and

opportunities are integrated into company board discussions and are

ultimately fully incorporated into each company's sustainable

growth strategies, we have asked each of our companies to nominate

a board member responsible for sustainability. Each company is also

creating a KSO Action Plan over the next 12 months, which will

include their detailed plans to contribute towards the Group's

Scope 1 & 2 greenhouse gas emissions goals of Net Zero by 2040,

including a 42% absolute emissions reduction from our 2020 baseline

by 2030. A number of our companies have already made good progress

towards creating their KSO Action Plans and are implementing

workstreams to reduce energy consumption, switch to renewable

energy, reduce waste and investigate more circular product

solutions.

At the Group level, we made further progress in assessing the

possible materiality, impacts and timescales of potential risks and

opportunities associated with climate change, to fulfil our

commitment to report in line with the Task Force on Climate-related

Financial Disclosures (TCFD) framework in our next Annual Report.

In addition, we have commenced work on quantifying our Scope 3

emissions to establish the full value chain commitments and targets

that will be most appropriate for Halma as part of our Climate

Change KSO.

In support of our Diversity, Equity and Inclusion KSO, we

refreshed our DEI strategy and this now includes a stretching

target to achieve 40-60% gender diversity on our company boards by

the end of March 2024 (compared to the current 23% female

representation).

One of Halma's challenges is to minimise the sustainability

reporting burden on our relatively small operating companies, while

improving the breadth and robustness of information available to

both monitor our progress and enhance our disclosure to our

stakeholders as a FTSE 100 group. As part of our technology

transformation project, we are working towards identifying

solutions to collect this information more efficiently. Alongside

this, we are planning to incorporate sustainability targets related

to some of our KSOs into remuneration for our senior executives,

with effect from 1 April 2022.

Negative currency effects on reported revenue and profit

We report our results in Sterling with 46% of Group revenue

denominated in US Dollars and 12% in Euros during the period.

Average exchange rates are used to translate results in the Income

Statement. Sterling strengthened against the US Dollar and the Euro

during the first half of 2021/22. This resulted in a 6% negative

currency translation effect on Group revenue and 7% on profit in

the first half of 2021/22 relative to 2020/21. If exchange rates

remain at current levels, we expect a further, although smaller,

negative currency translation effect in the second half of

2021/22.

Pension deficit reduced

On an IAS 19 basis the net deficit on the Group's defined

benefit plans at the half year end reduced to GBP5.3m (31 March

2021: GBP22.5m) before the related deferred tax asset. The plans'

liabilities increased due to a decrease in the discount rate used

to value those liabilities, but this was more than offset by

further employer contributions which, together with the return from

the plans' assets, resulted in the overall reduction in the plans'

deficit. The plans' actuarial valuation reviews, rather than the

accounting basis, determine any cash payments by the Group to

eliminate the deficit. We expect the aggregate cash contributions

in this regard for the two UK defined benefit plans in the 2021/22

financial year to be consistent with our previous guidance of

GBP14.2m.

Group tax rate higher as expected

The Group's effective tax rate on adjusted profit was 21.8%,

slightly higher than guidance, principally due to profit mix. This

is based on the forecast effective tax rate for the year as a whole

which, as expected, is higher than the prior year rate of

20.1%.

On 2 April 2019, the European Commission published its final

decision that the UK controlled Finance Company Partial Exemption

(FCPE) constituted State Aid. In common with many other UK

companies, Halma has benefited from the FCPE and has appealed

against the European Commission's decision, as has the UK

Government. Following receipt of charging notices from HM Revenue

& Customs (HMRC) we made a payment in February 2021 of GBP13.9m

to HMRC in respect of tax, and in May 2021 made a further payment

of approximately GBP0.8m in respect of interest. We expect these

payments to be refundable in the event of a successful appeal and

therefore have recognised a receivable of GBP14.7m in the balance

sheet.

Cash flow and funding

Cash conversion (adjusted operating cash flow as a percentage of

adjusted operating profit - see note 9) in the first half of the

year was 85%, which was below our annualised cash conversion target

of 90%. This was principally because of an increase in working

capital of GBP25.5m (2020/21: reduction of GBP6.4m) to fund the

Group's very strong growth, the full effects of which were partly

mitigated by continued strong working capital control.

Dividend payments increased to GBP40.8m (2020/21: GBP37.7m). Tax

payments were also higher at GBP27.6m, compared to GBP14.0m in the

first half of 2020/21, an unusually low level due to changes in the

timing of tax payments and one-off tax refunds.

Expenditure on acquisitions, which include acquisition costs and

contingent consideration for acquisitions made in prior years, plus

the net of proceeds from disposals, totalled GBP58.0m (2020/21:

GBP8.2m).

Capital expenditure (net of disposal proceeds) increased to

GBP14.2m, compared to GBP11.1m in the first half of 2020/21 when we

limited capital investment to essential projects and R&D only.

We continue to expect capital expenditure for the full year to be

around GBP30m.

Net debt at the end of the period was GBP280.2m (31 March 2021:

GBP256.2m). Gearing (the ratio of net debt to the last 12 months'

EBITDA) at half year end was 0.76 times (31 March 2021: 0.76

times), which is well within our typical operating range of up to

two times.

Board and senior leadership changes

As announced earlier this year and confirmed at our AGM in July

2021, Dame Louise Makin became Halma's Chair and Paul Walker, Adam

Meyers and Daniela Barone Soares retired from Halma's Board. The

Chair transition from Paul to Louise was completed smoothly and the

Board continues to work effectively.

Since the period end, we have announced the appointment of

Sharmila Nebhrajani OBE as an independent non-executive Director,

effective 1 December 2021. Sharmila brings a wealth of experience

gained across a variety of roles, spanning both the public and

private/NGO sectors, and has a particularly strong background in

sustainability and health.

Following the change to three sectors in April 2021, and the

promotion of Wendy McMillan and Constance Baroudel to the roles of

Sector Chief Executive (SCE) for the Safety and Environmental &

Analysis sectors respectively, Steve Brown has replaced Laura

Stoltenberg as SCE for our Medical sector. Steve has been a

Divisional Chief Executive since 2018, having previously served as

a successful Managing Director of one of our largest businesses,

Apollo Fire Detectors, since 2015. These appointments further

strengthen our Executive Board and demonstrate the strength of our

talent development and succession planning processes together with

our ambition for the future.

Principal risks and uncertainties

A number of potential risks and uncertainties exist, which could

have a material impact on the Group's performance over the second

half of the financial year and thereby cause actual results to

differ materially from expected and historical results.

The Group has processes in place for identifying, evaluating and

managing risk. As part of these processes, we are closely

monitoring and assessing the effects on revenue, costs and working

capital from the currently elevated levels of disruption in supply

chains, logistics and in labour markets. We expect that our

companies' agility, and the support they receive from across the

Group to share best practice in addressing these challenges, will

continue to mitigate any potential material effects.

Our principal risks, together with a description of our approach

to mitigating them, are set out on pages 78 to 83 of the Annual

Report and Accounts 2021, which is available on the Group's website

at www.halma.com. See note 17 to the Condensed Interim Financial

Statements for further details.

Going concern

After conducting a review of the Group's financial resources,

the Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. For this reason they continue to adopt the

going concern basis in preparing the Condensed Interim Financial

Statements.

Summary and Outlook

Halma made strong progress in the first half, delivering record

revenue, profit and interim dividend, with substantial growth

compared to both the first half of last financial year and

2019/20.

Our full year outlook is unchanged, despite variable overhead

costs returning and continued impacts on revenue, costs and working

capital from increased supply chain, logistics and labour market

disruption. In the second half of the year, we expect more typical

rates of revenue growth and Return on Sales, with the latter more

in line with historical levels.

Our Sustainable Growth Model continues to drive our success,

including its focus on global niche markets with long-term growth

drivers. Our strong purpose and culture, our portfolio and

geographic diversity, together with our agile business model enable

us to perform well in varied market conditions and sustain growth

and returns over the longer term.

Andrew Williams Marc Ronchetti

Group Chief Executive Chief Financial Officer

(1) See Highlights, page 1.

(2) See note 2 to the Condensed Interim Financial Statements.

Profit is Adjusted(1) operating profit before central

administration costs after share of associate.

Independent review report to Halma plc

Report on the Condensed Consolidated Interim Financial

Statements

Our conclusion

We have reviewed Halma plc's condensed consolidated interim

financial statements (the "interim financial statements") in the

Half Year Report of Halma plc for the 6 month period ended 30

September 2021 (the "period").

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with UK adopted

International Accounting Standard 34, 'Interim Financial Reporting'

and the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority.

What we have reviewed

The interim financial statements comprise:

- the Consolidated Balance Sheet as at 30 September 2021;

- the Consolidated Income Statement and the Consolidated

Statement of Comprehensive Income and Expenditure - for the period

then ended;

- the Consolidated Cash Flow Statement for the period then ended;

- the Consolidated Statement of Changes in Equity for the period then ended; and

- the explanatory notes to the interim financial statements.

The interim financial statements included in the Half Year

Report of Halma plc have been prepared in accordance with UK

adopted International Accounting Standard 34, 'Interim Financial

Reporting' and the Disclosure Guidance and Transparency Rules

sourcebook of the United Kingdom's Financial Conduct Authority.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The Half Year Report, including the interim financial

statements, is the responsibility of, and has been approved by the

directors. The directors are responsible for preparing the Half

Year Report in accordance with the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority.

Our responsibility is to express a conclusion on the interim

financial statements in the Half Year Report based on our review.

This report, including the conclusion, has been prepared for and

only for the company for the purpose of complying with the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority and for no other purpose. We

do not, in giving this conclusion, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

What a review of interim financial statements involves

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the Half Year

Report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial statements.

PricewaterhouseCoopers LLP

Chartered Accountants

Watford

18 November 2021

Condensed Interim Financial Statements

Consolidated Income Statement

Audited

Year

Unaudited Unaudited to

Six months to Six months to 31 March

30 September 2021 30 September 2020 2021

----------------------------------- ----------------------------------- ---------

Adjustments* Adjustments*

Before (note Before (note

adjustments* 2) Total adjustments* 2) Total Total

Notes GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------- ----- ------------- ------------ ------ ------------- ------------ ------ ---------

Continuing operations

Revenue 2 737.2 - 737.2 618.4 - 618.4 1,318.2

-------------------------- ----- ------------- ------------ ------ ------------- ------------ ------ ---------

Operating profit 159.0 (21.4) 137.6 127.8 (25.7) 102.1 240.8

Share of results

of associates (0.1) - (0.1) - - - -

Gain on disposal

of operations 11 - 34.0 34.0 - - - 22.1

Finance income 3 0.6 - 0.6 1.0 - 1.0 1.0

Finance expense 4 (4.6) - (4.6) (6.8) - (6.8) (11.0)

-------------------------- ----- ------------- ------------ ------ ------------- ------------ ------ ---------

Profit before taxation 154.9 12.6 167.5 122.0 (25.7) 96.3 252.9

Taxation 5 (33.8) 2.0 (31.8) (25.1) 6.1 (19.0) (49.6)

-------------------------- ----- ------------- ------------ ------ ------------- ------------ ------ ---------

Profit for the period 121.1 14.6 135.7 96.9 (19.6) 77.3 203.3

-------------------------- ----- ------------- ------------ ------ ------------- ------------ ------ ---------

Attributable to:

Owners of the parent 135.8 77.3 203.4

Non-controlling interests (0.1) - (0.1)

Earnings per share

from continuing

operations 6

Basic and diluted 31.96p 35.83p 25.54p 20.37p 53.61p

Dividends in respect

of the period 7

Dividends paid and

proposed (GBPm) 27.8 26.1 66.8

Per share 7.35p 6.87p 17.65p

-------------------------- ----- ------------- ------------ ------ ------------- ------------ ------ ---------

* Adjustments include the amortisation and impairment of

acquired intangible assets; acquisition items; significant

restructuring costs; profit or loss on disposal of operations; and

the associated taxation thereon. Note 9 provides more information

on alternative performance measures.

Consolidated Statement of Comprehensive Income

and Expenditure

Unaudited Unaudited Audited

Six months Six months Year

to to to

30 September 30 September 31 March

2021 2020 2021

GBPm GBPm GBPm

------------------------------------------------------ ------------- ------------- ---------

Profit for the period 135.7 77.3 203.3

Items that will not be reclassified subsequently

to the Income Statement:

Actuarial gains/(losses) on defined benefit pension

plans 10.4 (46.3) (30.6)

Tax relating to components of other comprehensive

income that will not be reclassified (1.0) 8.8 5.9

Items that may be reclassified subsequently to

the Income Statement:

Effective portion of changes in fair value of cash

flow hedges (0.8) (0.6) 1.0

Deferred tax in respect of cash flow hedges accounted

for in the hedging reserve 0.2 0.1 (0.2)

Exchange gains/(losses) on translation of foreign

operations and net investment hedge 18.5 (14.9) (72.7)

Exchange gain on translation of foreign operations

recycled on disposal - - (2.8)

Other comprehensive income/(expense) for the period 27.3 (52.9) (99.4)

------------------------------------------------------ ------------- ------------- ---------

Total comprehensive income for the period 163.0 24.4 103.9

------------------------------------------------------ ------------- ------------- ---------

Attributable to:

Owners of the parent 163.1 24.4 104.0

Non-controlling interests (0.1) - (0.1)

------------------------------------------------------ ------------- ------------- ---------

The exchange gains of GBP18.5m (six months to 30 September 2020:

GBP14.9m loss; year to 31 March 2021: GBP72.7m loss) include losses

of GBP3.6m (six months to 30 September 2020: GBP4.2m gains; year to

31 March 2021: GBP19.9m gains), which relate to net investment

hedges.

Consolidated Balance Sheet

Unaudited Unaudited Audited

30 September 30 September 31 March

2021 2020 2021

Notes GBPm GBPm GBPm

---------------------------------------------- ----- ------------- ------------- ---------

Non-current assets

Goodwill 867.4 829.8 808.5

Other intangible assets 319.3 303.8 290.0

Property, plant and equipment 186.7 184.7 180.8

Interests in associates and other investments 9.9 4.8 9.3

Retirement benefit asset 13 4.8 - -

Tax receivable 14 14.7 - 13.9

Deferred tax asset 1.9 5.6 1.3

---------------------------------------------- ----- ------------- ------------- ---------

1,404.7 1,328.7 1,303.8

---------------------------------------------- ----- ------------- ------------- ---------

Current assets

Inventories 193.2 175.8 167.8

Trade and other receivables 279.2 245.3 268.0

Tax receivable 4.4 6.5 2.5

Cash and bank balances 131.1 125.5 134.1

Derivative financial instruments 12 0.6 0.4 1.7

---------------------------------------------- ----- ------------- ------------- ---------

608.5 553.5 574.1

---------------------------------------------- ----- ------------- ------------- ---------

Total assets 2,013.2 1,882.2 1,877.9

---------------------------------------------- ----- ------------- ------------- ---------

Current liabilities

Trade and other payables 206.1 158.7 186.7

Borrowings 3.0 76.1 3.0

Lease liabilities 14.2 13.0 13.3

Provisions 22.0 30.5 35.4

Tax liabilities 13.8 11.3 8.9

Derivative financial instruments 12 0.2 0.9 0.7

---------------------------------------------- ----- ------------- ------------- ---------

259.3 290.5 248.0

---------------------------------------------- ----- ------------- ------------- ---------

Net current assets 349.2 263.0 326.1

---------------------------------------------- ----- ------------- ------------- ---------

Non-current liabilities

Borrowings 340.7 300.0 322.3

Lease liabilities 53.4 51.4 51.7

Retirement benefit obligations 13 10.1 45.0 22.5

Trade and other payables 15.2 16.3 16.8

Provisions 6.3 14.3 8.4

Deferred tax liabilities 51.1 41.7 40.6

---------------------------------------------- ----- ------------- ------------- ---------

476.8 468.7 462.3

---------------------------------------------- ----- ------------- ------------- ---------

Total liabilities 736.1 759.2 710.3

---------------------------------------------- ----- ------------- ------------- ---------

Net assets 1,277.1 1,123.0 1,167.6

---------------------------------------------- ----- ------------- ------------- ---------

Equity

Share capital 38.0 38.0 38.0

Share premium account 23.6 23.6 23.6

Own shares (22.0) (5.2) (20.9)

Capital redemption reserve 0.2 0.2 0.2

Hedging reserve 0.1 (0.6) 0.7

Translation reserve 91.7 133.8 73.2

Other reserves (26.4) (18.9) (13.6)

Retained earnings 1,171.4 952.8 1,065.8

---------------------------------------------- ----- ------------- ------------- ---------

Equity attributable to owners of the Company 1,276.6 1,123.7 1,167.0

---------------------------------------------- ----- ------------- ------------- ---------

Non-controlling interests 0.5 (0.7) 0.6

---------------------------------------------- ----- ------------- ------------- ---------

Total equity 1,277.1 1,123.0 1,167.6

---------------------------------------------- ----- ------------- ------------- ---------

Consolidated Statement of Changes in Equity

For the six months to 30 September 2021

-----------------------------------------------------------------------------------------------

Share Capital

Share premium Own redemption Hedging Translation Other Retained Non-controlling

capital account shares reserve reserve reserve reserves earnings interest Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------- ------- ------- ------ ---------- ------- ----------- -------- -------- --------------- -------

At 1 April

2021

(audited) 38.0 23.6 (20.9) 0.2 0.7 73.2 (13.6) 1,065.8 0.6 1,167.6

Profit for

the period - - - - - - - 135.8 (0.1) 135.7

Other

comprehensive

income and

expense:

-------------- ------- ------- ------ ---------- ------- ----------- -------- -------- --------------- -------

Exchange

differences

on

translation

of foreign

operations - - - - - 18.5 - - - 18.5

Actuarial

gains

on defined

benefit

pension

plans - - - - - - - 10.4 - 10.4

Effective

portion

of changes

in fair value

of cash flow

hedges - - - - (0.8) - - - - (0.8)

Tax relating

to components

of other

comprehensive

income and

expense - - - - 0.2 - - (1.0) - (0.8)

-------------- ------- ------- ------ ---------- ------- ----------- -------- -------- --------------- -------

Total other

comprehensive

income and

expense - - - - (0.6) 18.5 - 9.4 - 27.3

Dividends paid - - - - - - - (40.8) - (40.8)

Share-based

payments

charge - - - - - - 4.0 - - 4.0

Deferred tax

on

share-based

payment

transactions - - - - - - (0.5) - - (0.5)

Excess tax

deductions

related to

share-based

payments on

exercised

awards - - - - - - - 1.2 - 1.2

Purchase of

own shares - - (10.4) - - - - - - (10.4)

Performance

share plan

awards vested - - 9.3 - - - (16.3) - - (7.0)

-------------- ------- ------- ------ ---------- ------- ----------- -------- -------- --------------- -------

At 30

September

2021

(unaudited) 38.0 23.6 (22.0) 0.2 0.1 91.7 (26.4) 1,171.4 0.5 1,277.1

-------------- ------- ------- ------ ---------- ------- ----------- -------- -------- --------------- -------

Own shares are ordinary shares in Halma plc purchased by the

Company and held to fulfil the Company's obligations under the

Company's share plans. As at 30 September 2021 the number of shares

held by the Employee Benefit Trust was 870,370 (30 September 2020:

262,551 and 31 March 2021: 891,622).

The Translation reserve is used to record the difference arising

from the retranslation of the financial statements of foreign

operations. The Hedging reserve is used to record the portion of

the cumulative net change in fair value of cash flow hedging

instruments that are deemed to be an effective hedge.

The Capital redemption reserve was created on repurchase and

cancellation of the Company's own shares. The Other reserves

represent the provision for the value of the Group's equity-settled

share plans.

For the six months to 30 September 2020

---------------------------------------------------------------------------------------------

Share Capital Non-

Share premium Own redemption Hedging Translation Other Retained controlling

capital account shares reserve reserve reserve reserves earnings interest Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------- ------- ------- ------- ---------- -------- ----------- -------- -------- ----------- -------

At 1 April

2020

(audited) 38.0 23.6 (14.3) 0.2 (0.1) 148.7 (7.7) 949.2 (0.7) 1,136.9

Profit for the

period - - - - - - - 77.3 - 77.3

Other

comprehensive

income and

expense:

-------------- ------- ------- ------- ---------- -------- ----------- -------- -------- ----------- -------

Exchange

differences

on

translation

of foreign

operations - - - - - (14.9) - - - (14.9)

Actuarial

gains

on defined

benefit

pension plans - - - - - - - (46.3) - (46.3)

Effective

portion

of changes in

fair value of

cash flow

hedges - - - - (0.6) - - - - (0.6)

Tax relating

to

components of

other

comprehensive

income and

expense - - - - 0.1 - - 8.8 - 8.9

-------------- ------- ------- ------- ---------- -------- ----------- -------- -------- ----------- -------

Total other

comprehensive

income and

expense - - - - (0.5) (14.9) - (37.5) - (52.9)

Dividends paid - - - - - - - (37.7) - (37.7)

Share-based

payments

charge - - - - - - 5.0 - - 5.0

Deferred tax

on

share-based

payment

transactions - - - - - - 0.4 - - 0.4

Excess tax

deductions

related to

share-based

payments on

exercised

awards - - - - - - - 1.5 - 1.5

Performance

share

plan awards

vested - - 9.1 - - - (16.6) - - (7.5)

-------------- ------- ------- ------- ---------- -------- ----------- -------- -------- ----------- -------

At 30

September

2020

(unaudited) 38.0 23.6 (5.2) 0.2 (0.6) 133.8 (18.9) 952.8 (0.7) 1,123.0

-------------- ------- ------- ------- ---------- -------- ----------- -------- -------- ----------- -------

For the year to 31 March 2021

-------------------------------------------------------------------------------------------

Share Capital Non-

Share premium Own redemption Hedging Translation Other Retained controlling

capital account shares reserve reserve reserve reserves earnings interest Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------- ------- ------- ------ ---------- ------- ----------- -------- -------- ----------- -------

At 1 April 2020

(audited) 38.0 23.6 (14.3) 0.2 (0.1) 148.7 (7.7) 949.2 (0.7) 1,136.9

Profit for the

year - - - - - - - 203.4 (0.1) 203.3

Other

comprehensive

income and

expense:

---------------- ------- ------- ------ ---------- ------- ----------- -------- -------- ----------- -------

Exchange

differences

on translation

of foreign

operations

and net

investment

hedge - - - - - (72.7) - - - (72.7)

Exchange loss

on translation

of foreign

operations

recycled to

income

statement on

disposal - - - - - (2.8) - - - (2.8)

Actuarial loss

on defined

benefit

pension plans - - - - - - - (30.6) - (30.6)

Effective

portion

of changes in

fair value of

cash flow

hedges - - - - 1.0 - - - - 1.0

Tax relating

to components

of other

comprehensive

income and

expense - - - - (0.2) - - 5.9 - 5.7

---------------- ------- ------- ------ ---------- ------- ----------- -------- -------- ----------- -------

Total other

comprehensive

income and

expense - - - - 0.8 (75.5) - (24.7) - (99.4)

Dividends paid - - - - - - - (63.7) - (63.7)

Share-based

payments

charge - - - - - - 11.9 - - 11.9

Deferred tax

on share-based

payment

transactions - - - - - - (0.4) - - (0.4)

Excess tax

deductions

related to

share-based

payments on

exercised

awards - - - - - - - 1.6 - 1.6

Purchase of own

shares - - (16.2) - - - - - - (16.2)

Performance

share

plan awards

vested - - 9.6 - - - (17.4) - - (7.8)

Adjustments to

non-controlling

interest

arising

on acquisition - - - - - - - - 1.4 1.4

---------------- ------- ------- ------ ---------- ------- ----------- -------- -------- ----------- -------

At 31 March 2021

(audited) 38.0 23.6 (20.9) 0.2 0.7 73.2 (13.6) 1,065.8 0.6 1,167.6

---------------- ------- ------- ------ ---------- ------- ----------- -------- -------- ----------- -------

Consolidated Cash Flow Statement

Unaudited Unaudited Audited

Six months Six months Year

to to to

30 September 30 September 31 March

2021 2020 2021

Notes GBPm GBPm GBPm

------------------------------------------------- ----- ------------- ------------- ---------

Net cash inflow from operating activities 8 112.0 137.1 277.6

------------------------------------------------- ----- ------------- ------------- ---------

Cash flows from investing activities

Purchase of property, plant and equipment (13.7) (10.2) (22.8)

Purchase of computer software (0.5) (0.5) (2.8)

Purchase of other intangibles (0.4) (0.9) (1.2)

Proceeds from sale of property, plant and

equipment and capitalised development costs 0.4 0.5 0.9

Development costs capitalised (6.8) (7.0) (15.4)

Interest received 0.2 0.1 0.8

Acquisition of businesses, net of cash acquired 10 (105.0) (6.7) (46.4)

Disposal of business, net of cash disposed 57.5 - 26.1

Purchase of equity investments (0.7) - (3.4)

------------------------------------------------- ----- ------------- ------------- ---------

Net cash used in investing activities (69.0) (24.7) (64.2)

------------------------------------------------- ----- ------------- ------------- ---------

Cash flows from financing activities

Dividends paid 7 (40.8) (37.7) (63.7)

Purchase of own shares (10.4) - (16.2)

Interest paid (3.9) (5.7) (10.0)

Proceeds from bank borrowings 100.0 9.1 129.4

Repayments of bank borrowings (85.2) (52.7) (136.7)

Repayment of loan notes - - (72.2)

Repayment of lease liabilities (7.0) (7.1) (14.1)

------------------------------------------------- ----- ------------- ------------- ---------

Net cash used in financing activities (47.3) (94.1) (183.5)

------------------------------------------------- ----- ------------- ------------- ---------

(Decrease)/increase in cash and cash equivalents (4.3) 18.3 29.9

Cash and cash equivalents brought forward 131.1 105.4 105.4

Exchange adjustments 1.3 (0.3) (4.2)

------------------------------------------------- ----- ------------- ------------- ---------

Cash and cash equivalents carried forward 128.1 123.4 131.1

------------------------------------------------- ----- ------------- ------------- ---------

Unaudited Unaudited Audited

Six months Six months Year

to to to

30 September 30 September 31 March

2021 2020 2021

GBPm GBPm GBPm

---------------------------------------------------- ------------- ------------- ---------

Reconciliation of net cash flow to movement in

net debt

(Decrease)/increase in cash and cash equivalents (4.3) 18.3 29.9

Net cash (inflow)/outflow from (drawdown)/repayment

of bank borrowings (14.8) 43.6 7.3

Loan notes repaid - - 72.2

Lease liabilities additions (7.9) (11.9) (25.0)

Lease liabilities acquired (3.8) - (0.5)

Lease liabilities disposed of 2.1 - 1.8

Lease liabilities and interest repaid 8.1 8.2 16.4

Exchange adjustments (3.4) 2.1 17.0

---------------------------------------------------- ------------- ------------- ---------

(Increase)/decrease in net debt (24.0) 60.3 119.1

Net debt brought forward (256.2) (375.3) (375.3)

Net debt carried forward (280.2) (315.0) (256.2)

---------------------------------------------------- ------------- ------------- ---------

Notes to the Condensed Interim Financial Statements

1 Basis of preparation

General information

The Half Year Report, which includes the Interim Management

Report and Condensed Interim Financial Statements for the six

months to 30 September 2021, was approved by the Directors on 18

November 2021.

Basis of preparation

The Report has been prepared solely to provide additional

information to shareholders as a body to assess the Board's

strategies and the potential for those strategies to succeed. It

should not be relied on by any other party or for any other

purpose.

The Report contains certain forward-looking statements which

have been made by the Directors in good faith using information

available up until the date they approved the Report.

Forward-looking statements should be regarded with caution as by

their nature such statements involve risk and uncertainties

relating to events and circumstances that may occur in the future.

Actual results may differ from those expressed in such statements,

depending on the outcome of these uncertain future events.

The Report has been prepared in accordance with UK adopted

International Accounting Standard 34, 'Interim Financial Reporting'

and the Disclosure Guidance and Transparency Rules sourcebook of

the UK's Financial Conduct Authority. The Report should be read in

conjunction with the annual consolidated financial statements for

the year ended 31 March 2021 which were prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 and IFRS adopted pursuant to

Regulation (EC) No 1606/2002 as it applies in the European Union.

The same accounting policies and presentation that were applied in

the preparation of the Group's statutory accounts for the year to

31 March 2021 have also been applied to the interim consolidated

financial statements with the exception of the policy for taxes on

income, which in the interim period is accrued using the estimated

effective tax rates for the year on profits before tax before

adjustments, with the tax rates applied to the adjustments being

established on an individual basis for each adjustment.

The figures shown for the year to 31 March 2021 are based on the

Group's statutory accounts for that period and do not constitute

the Group's statutory accounts for that period as defined in

Section 434 of the Companies Act 2006. These statutory accounts,

which were prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006, have been filed with the Registrar of Companies. The audit

report on those accounts was not qualified, did not include a

reference to any matters to which the Auditor drew attention by way

of emphasis without qualifying the report, and did not contain

statements under Sections 498 (2) or (3) of the Companies Act

2006.

For the year to 31 March 2022 the annual financial statements

will be prepared in accordance with IFRS as adopted by the UK

Endorsement Board. This change in basis of preparation is required

by UK company law for the purposes of financial reporting as a

result of the UK's exit from the EU on 31 January 2020 and the

cessation of the transition period on 31 December 2020. This change

does not constitute a change in accounting policy but rather a

change in framework which is required to ground the use of IFRS in

company law. There is no impact on recognition, measurement or

disclosure between the two frameworks in the period reported.

Going concern

The Group's business activities, together with the main trends

and factors likely to affect its future development, performance

and position, and the financial position of the Group as at 30

September 2021, its cash flows, liquidity position and borrowing

facilities are set out on pages 2 to 7.

The financial statements have been prepared on a going concern

basis. In adopting the going concern basis the Directors have

considered all of the above factors, including potential scenarios

and its principal risks set out in note 17. Under the potential

scenarios considered, which includes a severe but plausible

downside scenario, the Group remains within its debt facilities and

the attached financial covenants for the foreseeable future and the

Directors therefore believe, at the time of approving the financial

statements, that the Company is well placed to manage its business

risks successfully and remains a going concern. The key facts and

assumptions in reaching this determination are summarised

below.

Our financial position remains robust with committed facilities

totalling approximately GBP656m which includes a GBP550m Revolving

Credit Facility maturing in November 2023 of which GBP315.8m

remains undrawn at the date of this Report. The earliest maturity

in these facilities is for GBP70.0m in January 2023. The financial

covenants on these facilities are for leverage (net debt/adjusted

EBITDA*) of not more than three times and for adjusted interest

cover of not less than four times.

* net debt and adjusted EBITDA are on a pre-IFRS 16 basis for covenant purposes

Our base case scenario has been prepared using forecasts from

each of our Operating Companies as well as cash outflows on

acquisitions in line with pre COVID-19 levels. In addition, a

severe but plausible downside scenario has been modelled showing

trading at similar levels to those in FY21. This reduction in

trading to that currently forecasted could be caused by further

significant, unexpected COVID-19 impacts or another significant

downside event. In mitigating the impacts of the downside scenario

there are actions that can be taken which are entirely

discretionary to the business such as acquisitions spend and

dividend growth rates. In addition, the Group has demonstrated

strong resilience and flexibility in the first half of the prior

year in managing overheads which could be used to further mitigate

the impacts of the downside scenario.

Neither of these scenarios result in a breach of the Group's

available debt facilities or the attached covenants and accordingly

the Directors believe there is no material uncertainty in the use

of the going concern assumption.

New accounting standards and policies

The following Standards, with an effective date of 1 January

2021 and 1 April 2021 respectively, have been adopted without any

significant impact on the amounts reported in these financial

statements:

- Interest Rate Benchmark Reform - Phase 2 - Amendments to IFRS

9, IAS 39, IFRS 7, IFRS 4 and IFRS 16

- Amendments to IFRS 16: COVID-19-Related Rent Concessions

2 Segmental analysis and revenue from contracts with

customers

Sector analysis

From 1 April 2021, the Group aligned its organisational

structure and financial reporting with its purpose and focus on

safety, environmental and health markets. The Group now has three

main reportable segments (Safety, Environmental & Analysis and

Medical), which are defined by markets rather than product type.

Each segment includes businesses with similar operating and market