TIDMHLMA

RNS Number : 9295H

Halma PLC

09 August 2021

Halma plc ('Halma')

M&A Update

Halma, the global group of life-saving technology companies

focused on growing a safer, cleaner and healthier future, is

announcing that it has recently completed three acquisitions for a

total consideration of GBP48.8 million (including any deferred

consideration), and that it has completed the sale of Texecom

Limited ("Texecom") for a consideration of GBP65 million. These

actions demonstrate Halma's strategy of actively managing its

portfolio of global businesses to be aligned with the Group's

purpose and to maintain strong growth and returns over the long

term.

Acquisitions

Halma operates in three sectors - Safety, Environmental &

Analysis and Medical - which are aligned to its purpose. The

acquisitions, which span two of these three sectors, had an

aggregate reported revenue of approximately GBP20.5 million in the

year ended 31 March 2021 and GBP23.3 million in the year ended 31

March 2020. Their combined profitability is within Halma's target

range of 18%-22% Return on Sales.

In the Safety sector, Halma has acquired the Ramtech group of

companies ("Ramtech"), for a cash consideration of GBP15.5 million,

on a cash and debt free basis. Ramtech is headquartered in

Nottingham, UK and supplies wireless fire systems for temporary

sites, primarily in the construction markets. Ramtech's audited

revenue for the year ended 31 March 2021 was GBP9.3 million.

In the Environmental & Analysis sector, there have been two

acquisitions. Halma's pipeline inspection systems business,

Mini-Cam, has acquired Dancutter A/S ("Dancutter"), a Danish

designer and manufacturer of trenchless pipeline rehabilitation

equipment for a cash consideration of EUR18 million (GBP15.4

million(1) ), on a cash and debt free basis. Dancutter's unaudited

revenue for the year ended 31 March 2021 was EUR4.6 million (GBP3.9

million(1) ).

Halma has also acquired Sensitron S.r.l. ("Sensitron"), a gas

detection company based in Milan, Italy, for a cash consideration

of EUR21 million (GBP17.9 million(1) ), on a cash and debt free

basis. Sensitron's devices, which include detectors for hazardous

locations and for refrigerant gases, enhance safety and detect the

release of gases harmful to people and the environment. Sensitron

reported unaudited revenue of EUR8.5 million (GBP7.3 million(1) )

in the year ended 31 March 2021.

Disposal of Texecom

Halma has completed the sale of Texecom for a total cash

consideration of GBP65 million on a cash and debt free basis in a

management buyout supported by LDC, a UK based mid-market private

equity investor. Texecom is a provider of electronic security

systems, and is headquartered in Lancashire, UK. Texecom's

management team will continue to lead the business, which will

operate out of its current locations.

Texecom Limited was acquired by Halma in November 2005 for a

total cash consideration of GBP26.0 million. A gain will be

recognised on disposal. In the financial year ended 31 August 2005,

Texecom reported revenue of GBP19.2 million. In the financial year

ended 31 March 2020 it reported revenue of GBP39.9 million, and in

the financial year ended 31 March 2021 it reported audited revenue

of GBP33.3 million.

Texecom's management team will continue to build on its

market-leading position and international presence through

developing new products, enhancing its digital services and

exploring complementary acquisitions.

Andrew Williams, Group Chief Executive at Halma, commented:

"I am pleased that we have continued to find exciting new

companies to join Halma. Each acquisition is strongly aligned with

our purpose and financial model and will bring complementary

capabilities including new technologies and broader market reach.

We look forward to working with the leadership groups of Ramtech,

Dancutter and Sensitron as they seek to grow their businesses over

the long term.

It is also pleasing to have found a new home for Texecom, so

that it can continue to invest and grow under the existing

management team, who have served Halma well over many years. We

wish them and the whole Texecom workforce every success for the

future under their new ownership."

For further information, please contact:

Halma plc

Andrew Williams, Group Chief Executive +44 (0)1494 721111

Marc Ronchetti, Chief Financial Officer

Charles King, Head of Investor Relations +44 (0) 7776 685948

Clayton Hirst, Director of Corporate Affairs +44 (0) 7384 796

013

MHP Communications

Andrew Jaques / Rachel Farrington +44 (0)20 3128 8613

A copy of this announcement, together with other information

about Halma, may be viewed on its website: www.halma.com

About Halma

Halma is a global group of life-saving technology companies,

focused on growing a safer, cleaner, healthier future for everyone,

every day.

Its purpose defines the three broad market areas where it

operates:

-- Safety: protecting life as populations grow and protecting worker safety.

-- Environment: improving food and water quality, and monitoring air pollution.

-- Health: meeting rising healthcare demand as growing populations age and lifestyles change.

It employs over 7,000 people in more than 20 countries, with

major operations in the UK, Mainland Europe, the USA and Asia

Pacific. Halma is listed on the London Stock Exchange (LON: HLMA)

and is a constituent of the FTSE 100 index.

In January 2021, Halma was named Britain's Most Admired Company

by Management Today.

Notes:

1. At an exchange rate of GBP1 : EUR1.17.

2. Houlihan Lokey Capital, Inc. served as exclusive financial

advisor to Halma in respect of the disposal of Texecom.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAFPPEFXFEAA

(END) Dow Jones Newswires

August 09, 2021 02:00 ET (06:00 GMT)

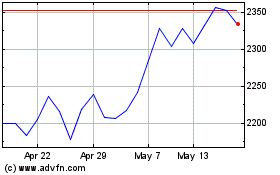

Halma (LSE:HLMA)

Historical Stock Chart

From Oct 2024 to Nov 2024

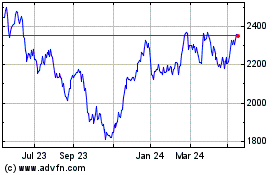

Halma (LSE:HLMA)

Historical Stock Chart

From Nov 2023 to Nov 2024