TIDMPMO

RNS Number : 1020S

Premier Oil PLC

07 March 2019

Premier Oil plc (Premier)

Full Year Results for the year ended 31 December 2018

Press Release

Tony Durrant, Chief Executive Officer, commented:

"2018 saw higher production, positive free cash flow and a

return to profitability. The Group is ahead of plans to restore

balance sheet strength and remains focused on consistently

delivering free cash flows. Growth projects such as Tolmount, Zama

and Sea Lion, together with promising exploration in Mexico and

Indonesia, are being advanced within a disciplined financial

framework."

2018 Operational highlights

-- Record production of 80.5 kboepd (2017: 75.0 kboepd)

-- Catcher oil plateau rates increased to 66 kbopd (gross)

-- Tolmount Main (UK) gas project sanctioned; estimated peak production of 58 kboepd (gross)

-- Highly prospective new licences secured offshore Mexico and Indonesia

-- US$73.4 million of cash receipts from non-core asset disposals

2018 Financial highlights

-- US$133.4 million post tax profit (2017: post tax loss of US$253.8 million)

-- EBITDAX increased to US$882.3 million, up 50% (2017: US$589.7 million)

-- Cash flows from operations of US$777.2 million, up 64% (2017: US$475.3 million)

-- Opex of US$10/boe with additional lease costs of US$7/boe; low cost base maintained

-- Total capex (development, exploration and abandonment) of US$353 million, below forecast

-- US$181 million debt reduction from accelerated conversion of convertible bonds

-- Year-end net debt of US$2.3 billion, down US$393 million (2017: US$2.7 billion)

-- Covenant leverage ratio reduced to 3.1x (2017: 6.0x)

2019 Outlook

-- Production guidance of 75 kboepd, a 5% increase after disposals; 89 kboepd year to date

-- Cash margins expected to be 30% higher at comparable commodity pricing

-- Opex (excluding lease costs) and capex guidance of US$13/boe

and US$340 million, respectively

-- Project sanction of Catcher Area additions (Catcher North and Laverda) anticipated 1H

-- Zama, Tolmount East appraisal programmes to complete Q3

-- Formal loan application for Sea Lion funding to be submitted in Q2

-- Material free cash flow, driving further debt reduction of US$250 million to US$350 million

ENQUIRIES

Premier Oil plc Tel: + 44 (0)20 7730 1111

Tony Durrant

Richard Rose

Camarco Tel: + 44 (0)20 3757 4980

Billy Clegg

Georgia Edmonds

A presentation to analysts will be held at 9.30am today at the

offices of Premier Oil, 23 Lower Belgrave Street, London SW1W 0NR

and will be webcast live on the company's website at

www.premier-oil.com. A copy of this announcement is available for

download from our website at www.premier-oil.com.

CEO REVIEW

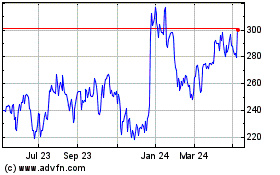

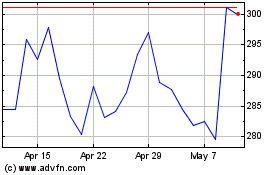

Oil prices increased during the first three quarters of 2018,

peaking at US$86.2/bbl in October before falling steeply to close

the year at US$50.2/bbl. Against this volatile backdrop, 2018 was

another year of solid operational delivery by Premier, resulting in

significantly higher cash flows and a return to profit.

Production increased year-on-year averaging 80.5 kboepd, despite

material asset sales. This was driven by new production from our

operated Catcher Area and continued high operating efficiency

across the portfolio.

Production (kboepd) Working interest Entitlement

2018 2017 2018 2017

--------- -------- ------ ------

Indonesia 13.2 14.1 8.7 10.3

--------- -------- ------ ------

Pakistan 5.3 6.5 5.3 6.4

--------- -------- ------ ------

UK 46.8 39.5 46.8 39.5

--------- -------- ------ ------

Vietnam 15.2 14.9 13.0 13.0

--------- -------- ------ ------

Total 80.5 75.0 73.8 69.2

--------- -------- ------ ------

Our production portfolio today is concentrated in two main

geographical areas: South East Asia (Indonesia and Vietnam) and the

UK Continental Shelf. Our operated Asian assets, driven by high

uptime and low cost structures, generated material free cash flows

for the Group. Singapore demand for our Indonesian gas remained

robust and the opportunity remains to develop and deliver

additional resource into the Singapore market under our long term

gas sales agreements. Our Chim Sáo field in Vietnam continued to

outperform and we again increased our reserves estimates for the

field at the end of 2018, a third increase since first oil in

2011.

Production from our UK assets, which represents over half the

Group's production, grew materially during 2018. This was driven by

our Catcher Area which reached increased plateau rates of 66 kbopd

(gross) in the fourth quarter, considerably in excess of the 50

kbopd (gross) envisaged at sanction. This strong performance has

continued into 2019 and further underpins our confidence in the

longer term cash flow generation potential of this asset. At year

end, we revised upwards our Catcher Area reserves to include the

Catcher North and Laverda accumulations. In addition, with more

production history to calibrate our dynamic models and to

underwrite a higher recovery, we would hope to be able to revise

over time our estimate of the Catcher Area reserves. We also aim to

drill infill wells to target unswept areas of the reservoir to

extend plateau rates and to ensure that the Catcher Area FPSO

continues to operate at full capacity.

The sanction of our operated 500 Bcf (gross) Tolmount Main gas

field in August was a significant achievement for the Group.

Tolmount Main is, in barrel of oil equivalent terms, of similar

size to our Catcher project at sanction. By partnering with

infrastructure company Kellas Midstream, we have been able to

minimise our share of capital expenditure while retaining our

equity exposure to the upside in the project, significantly

enhancing the expected returns on our investment. Once on-stream,

Tolmount Main will provide the next phase of growth for the UK

business unit and will contribute materially to the Group's cash

flows, given our tax-advantaged position in the UK.

The HGS (Humber Gathering System) infrastructure through which

Tolmount Main volumes will flow has the potential to develop into a

significant new production hub over time. It is highly economic for

us to deliver additional equity gas resource over the HGS

infrastructure and we are on track to spud the Tolmount East

appraisal well, which is seeking to confirm resource potential of

up to 300 Bcf (gross), in July. We also plan to acquire seismic

data over the Greater Tolmount Area during the first half of 2019

to further define prospectivity in the area. In addition, there is

the potential to benefit from third party volumes transported over

the Tolmount Main platform.

Our largest pre-development project is the fully appraised Sea

Lion field which, at over 220 mmboe (gross) of resources in Phase 1

alone, represents a material opportunity for Premier. During 2018

we selected the key contractors for the project, many of whom also

worked on our operated Catcher project, and put in place LOIs for

the provision of services. Our key contractors, having carried out

extensive due diligence, agreed to provide up to US$400 million of

financing for Sea Lion Phase 1, underlining the robust nature of

the project and the opportunity to be involved in developing the

first field in a new basin. The critical path to a final investment

decision remains securing a senior debt funding structure, likely

involving a combination of export credit financing and project bank

funding. The industry continues to follow closely our progress and

it remains our preference to bring in an additional equity partner

to the project once we have finalised the funding structure.

Our exploration team has done an excellent job of refocusing our

portfolio towards lower risk but more impactful opportunities

whilst operating within significantly reduced budgetary

constraints. A notable success was the Zama discovery in 2017. Much

of 2018 was spent preparing for the Zama appraisal campaign as well

as progressing early engineering work on potential development

concepts. The programme is well underway with encouraging initial

results.

We have further enhanced our exploration portfolio through the

capture of additional acreage in our basins of choice. We were

particularly pleased to have secured the heavily contested Block 30

in Round 3.1 just prior to the new government placing a moratorium

on further licensing rounds. We were also successful in securing

the Andaman II licence offshore Indonesia in the highly prospective

North Sumatra basin. This has attracted considerable industry

attention with the opening up of a potential commercialisation

route via the onshore Arun gas terminal. Today, our exploration

portfolio is capable of delivering a series of high impact wells

which have the potential to augment materially the Group's resource

base. We have also continued to exit our more mature, legacy

positions which do not meet our internal investment hurdles.

At 31 December 2018, Group proven and probable (2P) reserves and

contingent (2C) resources, on a working interest basis, were 867

mmboe (2017: 902 mmboe), including the effect of 2018 production

and asset sales. The sanction of the Tolmount Main project added 46

mmboe to 2P reserves. In addition, Premier booked the 3 mmboe (net)

2P reserves related to the Catcher North and Laverda fields while

there were also reserve upgrades at Chim Sáo and Elgin

Franklin.

2P reserves (mmboe) 2P reserves + 2C

resources (mmboe)

1 January 2018 302 902

-------------------- -------------------

Production (30) (30)

-------------------- -------------------

Net additions, revisions 66 21

-------------------- -------------------

Sea Lion recategorisation (134) -

-------------------- -------------------

Disposals, relinquishments (10) (26)

-------------------- -------------------

31 December 2018 194 867

-------------------- -------------------

Our proven and probable (2P) reserves, on a working interest

basis, reduced to 194 mmboe (2017: 302 mmboe), primarily due to the

recategorisation of Sea Lion Phase 1 2P reserves (134 mmboe) as 2C

resources following new guidelines issued by the Society of

Petroleum Engineers. These point to holding Sea Lion undeveloped

resources as contingent until financing for the project and formal

approvals have been secured. To rebook the 2C resources of Sea Lion

as 2P reserves the funding and other approvals would need to be in

place. The booking of the Tolmount Main field as 2P reserves,

following its sanction, and an upward revision in our estimate of

2P reserves at Catcher, Chim Sáo and Elgin Franklin, more than

offset the impact of 2018 production and disposals. This represents

a reserves replacement ratio of 220 per cent, excluding the

technical recategorisation of Sea Lion resources.

We are the operator of the majority of our assets which provides

us with strong control over future expenditure programmes and the

ability to flex our discretionary spend in the event of another

downturn in the commodity price. During 2018, development,

exploration and abandonment spend was US$353 million, below

original guidance, due to deferrals of appraisal and abandonment

expenditure and tight cost control. Total 2019 capital expenditure

(including abandonment) is expected to be US$340 million. Full year

2018 operating costs were US$10/boe while leasing costs associated

with our operated Chim Sáo, Huntington and Catcher FPSOs amounted

to US$7/boe. 2019 operating costs are forecast at US$13/boe,

slightly higher than 2018, reflecting the impact of disposals of

low cost gas production and expected natural decline from fixed

cost base assets, while lease costs are expected to be of the order

of US$7/boe.

Debt reduction remains a key corporate priority. The Group's

strong operational performance supported by its low cost base and a

disciplined capex programme resulted in us generating material free

cash flow during 2018. This, together with proceeds of US$73

million from selective disposals of non-core assets and the early

exchange of the convertible bond, resulted in a reduction of net

debt by US$393 million to US$2.33 billion, ahead of the plan agreed

with our lenders. We also significantly reduced our covenant

leverage ratio (covenant net debt / EBITDA) to 3.1x (2017: 6.0x)

comfortably within the covenant of 5.0x at year end and back in

line with many of our peers.

Looking to the year ahead, we have a highly cash generative

production base, which is supported by a substantial hedging

programme, an improved portfolio mix (underpinned by high margin

Catcher barrels) and a tightly controlled cost base. This positions

us well to deliver further debt reduction in 2019 while progressing

our future growth projects to create material value to all of our

stakeholders over the longer term.

We have considerable optionality within our portfolio to grow

organically and deliver value over the longer term. At the same

time, Premier has an excellent track record of delivering value

from acquisitions and we continue to evaluate potential acquisition

opportunities that enhance our asset base and create synergies with

the existing core businesses. With many of the majors and larger

independents looking to refocus their portfolios away from the UK

North Sea, there is an opportunity for Premier to acquire mid-life,

cash flow generative and profitable production assets with

potentially significant upsides, which have not been pursued by the

previous asset holders. Of course, any potential acquisitions have

to be measured against and compete for capital with the existing

organic opportunities within our portfolio.

It is our highest priority to continue to operate all of our

assets in a safe and responsible manner, to ensure the safety of

our workforce and to minimise potential risk to the environment.

Not only is it the right thing to do, it is also a prerequisite for

maintaining our social and legal licence to operate for the longer

term. We are pleased to report that we recorded no serious

injuries, no spills and no material process safety events during

2018. We also had record low Greenhouse Gas Intensity at Premier's

operated assets. In all our HSES metrics, we aim to deliver

continuous improvement and upper quartile performance against our

peer group.

The composition of the Board and its committees is continually

under review. As Jane Hinkley will reach the ninth anniversary of

her appointment during 2019 we are pleased to announce that Barbara

Jeremiah, subject to the approvals of shareholders at the AGM in

May, will join the Board. It is intended that, following a

transitional period, Barbara will take over as Chair of the

Remuneration Committee from Jane.

UNITED KINGDOM

The UK delivered record production in 2018 of 46.8 kboepd, up

almost 20 per cent on 2017, driven by increased Catcher Area

(Premier 50 per cent operated interest) production. In November and

December, UK production averaged over 60 kboepd, supported by high

uptime across the asset base and increased rates from the Catcher

Area, offset by the Babbage Area sale in early December. In August,

Premier sanctioned its next UK growth project, the 500 Bcf Tolmount

Main gas development (Premier 50 per cent operated interest) which

is now in the execution phase.

Production

The Catcher Area FPSO, which produces from the Catcher, Varadero

and Burgman fields, reached oil production rates of 60 kbopd

(gross) in May, as commissioning of the gas plant was completed. In

the fourth quarter, continued strong reservoir performance and

increased plant availability, following final commissioning of the

FPSO secondary systems, resulted in oil plateau production rates

being increased to 66 kbopd and Premier issuing the final

acceptance certificate to the FPSO provider. We have safely

delivered 38 Catcher cargoes since first oil.

Four further Catcher Area producer wells were drilled during

2018 with the 18(th) well, a Burgman field producer, completed in

October. This concluded a highly successful three year drilling

programme which was 33 per cent below budget and delivered well

productivity on average 30 per cent higher than forecast. In

addition, dynamic data continues to demonstrate good connectivity

between the reservoirs and strong pressure support provided by the

aquifer and injector wells. The Group remains highly encouraged

about the potential overall recovery from the Catcher Area and

expects to refine its estimates as more production data is

obtained.

The non-operated Elgin-Franklin field (Premier 5.2 per cent

non-operated interest) averaged 6.7 kboepd (net), ahead of

forecast. Production was boosted by a strong performance from the

new wells brought on-stream, successful remedial work on existing

wells and continued high operating efficiency. At year end, Premier

revised upwards its 2P reserves by 7 mmboe (net) which brings them

in line with the operator's estimates and reflecting the inclusion

of planned additional infill wells.

Premier's operated Huntington field (Premier 100 per cent

operated interest) averaged 5.8 kboepd (net) during 2018,

reflecting forecast natural decline and several unplanned shut

downs. Modifications to the FPSO were made to facilitate gas import

which, together with the conversion of a former production well to

a water injector, has improved reservoir deliverability and plant

stability. The Huntington field has continued to benefit from high

operating efficiency post period end with production averaging over

6 kboepd year to date in 2019.

Production from the Premier-operated Solan field (Premier 100

per cent operated interest) averaged 4.6 kboepd, ahead of forecast,

driven by high operating efficiency of over 90 per cent. Premier

expects to drill a new producer (P3) in 2020 targeted at increasing

production from the Central Northern part of the field. Separately,

Premier continues to review the potential for third party volumes

over the Solan infrastructure.

The Balmoral Area, comprising the Balmoral, Brenda, Nicol and

Stirling fields, delivered 1.3 kboepd (net) in 2018 with production

impacted by an extended summer maintenance shut down. Production

from the Kyle field (Premier 40 per cent non-operated interest)

averaged 1.6 kboepd (net). As a result of cost control and asset

performance, cessation of production from the Balmoral Area has now

been deferred until 2021 while the lease of the Banff FPSO, which

handles Kyle's production, has been extended to August 2019. In the

Southern North Sea, the Rita (Premier 74 per cent operated

interest) and Hunter (Premier 79 per cent operated interest) fields

ceased production in mid-2018 following closure of the

Theddlethorpe gas processing terminal.

UK unit field operating costs on a per barrel of oil equivalent

reduced to US$13/boe (2017: US$18/boe) while lease costs increased

to US$10/boe (2017: US$5/boe). These reflect new production from

the leased Catcher FPSO. In 2019, Premier expects UK operating

costs (including lease costs) to remain around US$23/boe with the

impact of a full year of Catcher production at increased rates

offset by natural decline on more mature, fixed cost base assets

such as Huntington, Kyle and the Balmoral Area.

Developments

Premier has identified several high value subsea tie-backs and

infill drilling locations to maintain and extend production rates

from the Catcher Area. Premier expects to sanction the development

of the Catcher North and Laverda oil accumulations (Premier 50 per

cent operated interest) during the first half of 2019 and, as a

result, at year end 2018 booked the 3 mmboe (net) reserves

associated with the two fields. The US$70 million (net) project

will entail two development wells drilled from a common drill

centre and tied back to the Varadero field. Drilling is scheduled

to commence in mid-2020 with first oil targeted for early 2021. In

addition, Premier expects to drill an infill well on the Varadero

field immediately before the Catcher North and Laverda drilling

programme to target resources beyond the reach of the initial

production wells. Premier plans to acquire 4D seismic across the

Catcher Area in the second quarter of 2020 to help confirm

additional future infill well locations.

In August, Premier and its partners sanctioned the development

of the Tolmount Main gas field (Premier 50 per cent operated

interest) in the Southern Gas Basin. The Tolmount Main gas field is

expected to produce around 500 Bcf (96 mmboe) (gross) of gas with

peak production of up to 300 mmscfd (58 kboepd) (gross).

The Tolmount Main gas project is now well into its execution

phase. Construction of the minimal facilities platform commenced in

Rosetti Marino's Ravenna yard in December 2018 with fabrication of

the primary structural steel and nodes as well as the rolling of

the tubulars underway and progressing to plan. Detailed engineering

and procurement of the trees, wellheads and subsea pipeline has

also started. At Easington, Centrica's onshore receiving terminal,

preparation for modifications required for Tolmount gas import has

started and significant purchase orders are being placed for

engineering work-scopes. The four well development drilling

programme is scheduled to commence mid-2020 with the first well

expected to come on-stream in the fourth quarter of that year.

Premier continues to estimate that its share of the capex to

develop Tolmount Main will be around US$120 million, comprising

project management and development drilling costs, with the

infrastructure joint venture between Kellas Midstream and Dana

Petroleum funding the platform, pipeline and the terminal

modifications.

Exploration and appraisal

Premier has contracted the Ensco 123 rig to drill the Tolmount

East appraisal well in July ahead of drilling the Tolmount Main

development wells in 2020. The well is targeting 220 Bcf to 300 Bcf

(P50 to P10) of gross unrisked resource in an area to the east of

the main Tolmount field which sits above the Tolmount Main gas

water contact. On success, the Tolmount East appraisal well will be

suspended for use as a future producer to be tied back to the HGS

infrastructure. A 3D seismic survey across the Greater Tolmount

Area is scheduled to commence later this month. The survey will be

used to help optimise development drilling at Tolmount Main as well

as the location of a potential Tolmount Far East exploration well,

in addition to defining further prospectivity in the area.

Portfolio management

During 2018 Premier continued its programme of non-core asset

disposals from the E.ON portfolio with the sale of its 30 per cent

interest in the Esmond Transportation System (ETS) to Kellas

Management Ltd for total cash proceeds of US$22.9 million (after

working capital adjustments). Premier also completed the sale of

its interests in the Babbage Area to Verus Petroleum SNS Ltd

(Verus) in December 2018 receiving cash proceeds of US$38.7

million, after adjustments for Babbage cash flows collected since

the effective date of 1 January 2018. The sale proceeds from both

transactions were used to pay down the Company's debt.

VIETNAM

The Vietnam business unit continued to generate material free

cash flow for the Group during 2018. This was driven by a strong

production performance, underpinned by a better than forecast

subsurface performance and sustained high operating efficiency,

combined with a continued low operating cost base. On the back of

this outperformance, Premier again increased its total recoverable

reserves estimate to over 120 mmboe.

Production

Production from Block 12W (Premier 53.13 per cent operated

interest), which contains the Chim Sáo and Dua fields, averaged

15.2 kboepd (net), up on the prior corresponding period and above

budget. This strong performance was driven by high operating

efficiency of the Chim Sáo FPSO and successful ongoing well

intervention programmes which offset natural decline from

established reservoir horizons.

The Chim Sáo and Dua fields continued to produce with a high

operating efficiency of over 90 per cent during 2018 with

maintenance programmes completed on schedule. Production from the

fields was also boosted by four well intervention campaigns, which

perforated new zones in the shallower reservoir sections of

existing production wells and resulted in an additional 1 kboepd

(net) of production during 2018. The two Chim Sáo infill wells,

drilled and completed in December 2017, have also continued to

perform strongly contributing over 1 million barrels of net oil

production since coming online. As a result of this strong

subsurface performance, Premier again increased its reserves

estimates of Chim Sáo by 5 mmboe (net) at year end 2018.

Operating costs from Block 12W have remained low at US$5/boe

while the lease cost of the FPSO averaged US$6/boe as Premier

continues to maintain tight control of its cost base in Vietnam.

Premier also continued to sell its Chim Sáo crude at a premium to

Brent during 2018.

INDONESIA

The Premier-operated Natuna Sea Block A (NSBA) fields delivered

a robust performance in 2018, underpinned by an increased market

share within GSA1. This, together with continued low operating

costs, led to the Indonesian business generating US$110 million of

net cash flows for the Group.

Production and development

Production from Indonesia in 2018 averaged 13.2 kboepd (net)

with the Natuna Sea Block A fields (Premier 28.67 per cent operated

interest) delivering 12.9 kboepd (net) and the Kakap field (Premier

18.75 non-operated interest), now sold, averaging 0.3 kboepd

(net).

Gas supply by contract

(BBtud, gross) GSA1 GSA2

---------- ----------

2018 2017 2018 2017

----------------------- ---- ---- ---- ----

Anoa, Pelikan 153 143 - -

----------------------- ---- ---- ---- ----

Gajah Baru, Naga - - 80 91

----------------------- ---- ---- ---- ----

Kakap 4 17 - -

----------------------- ---- ---- ---- ----

Total 157 160 80 91

----------------------- ---- ---- ---- ----

Premier sold an average of 233 BBtud (gross) (2017: 234 BBtud)

from its operated Natuna Sea Block A fields during 2018.

Singapore demand for gas sold under GSA1 remained robust,

averaging 292 BBtud (2017: 286 BBtud). Premier's Anoa and Pelikan

fields delivered 153 BBtud (gross) (2017: 143 BBtud), capturing

52.4 per cent (2017: 49.6 per cent) of GSA1 deliveries, above

Natuna Sea Block A's contractual share of 51.7 per cent. Gajah Baru

and Naga delivered production of 80 BBtud (gross) (2017: 91 BBtud)

under GSA2, representing 100 per cent nomination delivery by

Premier. Gross liquids production from the Anoa field was 1.2 kbopd

(2017: 1.1 kbopd).

Gas sales from the Kakap field averaged 4 BBtud (gross) (2017:

17 BBtud (gross)) while gross liquids production was 0.7 kbopd

(2017: 2.6 kbopd). The reduction on the prior corresponding period

reflects the sale of Kakap to Batavia Oil which completed in

April.

Premier continues to benefit from a low cost base in Indonesia

with operating costs averaging US$6.7/boe for the period.

Development

The development of the Bison, Iguana, Gajah-Pueri (BIG-P) gas

fields (Premier 28.67 per cent operated interest) involves a three

well subsea tie-back to existing infrastructure and is progressing

to budget and to schedule. The Naga and Pelikan deck extensions and

the Pelikan and AGX platform spools were successfully installed

offshore during the third quarter. Fabrication of the subsea

structures commenced in October and will be installed offshore

along with the flowlines, flexible risers and umbilicals in

mid-2019. A DSV will then complete the final hook up and tie-ins

during the second half of the year. Drilling of the three BIG-P

development wells is on track to commence in the first half of 2019

with first gas planned for late 2019. Once on-stream, the BIG-P gas

fields will support the Group's long term gas contracts into

Singapore and will help to maintain production from Natuna Sea

Block A.

Exploration and appraisal

In January, Premier was awarded a 40 per cent operated interest

in the Andaman II licence in the underexplored but proven North

Sumatra basin offshore Aceh in the 2017 Indonesian Licence Round.

PGS has commenced a 3D seismic acquisition programme designed to

mature the numerous prospects and leads identified on existing 2D

seismic, many of which exhibit direct hydrocarbon indicators.

Drilling is targeted for late 2020. The licence has the potential

to deliver significant gas volumes into North Sumatra and adds a

potentially material new gas play to Premier's Indonesian

portfolio.

On Natuna Sea Block A, Premier's exploration team is

reprocessing existing Anoa 3D datasets and analysing production

data from the WL-5X well to assess the ultimate potential of the

Lama play beneath the Anoa field and to identify potential infill

drilling locations within the Anoa main field.

Elsewhere in Indonesia, Premier and its joint venture partners

continue to seek a farm in offer to the Tuna PSC (Premier 65 per

cent operated interest) ahead of a two well campaign to appraise

the Tuna field.

THE FALKLAND ISLANDS

During 2018, the focus has been on securing LOIs (Letters of

Intent) with key contractors and progressing the financing

structure for the first phase of the development of the Sea Lion

field in the North Falklands Basin ahead of a final investment

decision.

The Sea Lion project represents a material opportunity for the

Group with around 400 mmboe (net to Premier) to be developed over

several phases. Sea Lion Phase 1 (Premier 60 per cent operated

interest) will develop over 220 mmbbls of gross resources in PL032,

using a conventional FPSO based scheme, similar to Premier's

successful Catcher development.

During 2018, Premier completed the selection of its key

contractors and put in place LOIs for the provision of key

services, including an FPSO, the drilling rig, well services, SURF,

subsea production systems and installation services, as well as

vendor financing. Premier is now working with its selected

contractors to complete FEED and to convert the LOIs into fully

termed contracts.

Premier has also continued to progress discussions with senior

debt providers, including export credit finance agencies, around

the funding structure of the project. In particular, Premier is

preparing to submit an application for project funding once FEED

has been completed, scheduled for the second quarter of 2019. In

addition, it remains the Group's preference to optimise its level

of participation in the project by bringing in an additional equity

partner once the funding structure has been finalised.

PAKISTAN

Premier's Pakistan business continued to generate positive net

cash flows for the Group, supported by high operating efficiency of

over 95 per cent and a low cost base.

Production from Premier's six non-operated producing gas fields

in Pakistan averaged 5.3 kboepd (2017: 6.2 kboepd) during 2018. The

fall in production reflects natural decline in the main gas fields

partially offset by better than expected results achieved from the

new Kadanwari development wells brought onstream. Premier realised

an average price of US$3.4/mscf for its Pakistani gas during the

period while operating costs remained low at US$0.9/mscf

(US$4.9/boe).

In April 2017, Premier announced the sale of its Pakistan

business to Al-Haj Group for US$65.6 million. To date, Premier has

received US$40 million of deposits from the buyer and also

collected US$25 million in cash flows since the economic date of

the transaction (1 January 2017). Premier expects the sale to

complete on settlement of final working capital adjustments, which

is scheduled for the end of the first quarter of 2019.

EXPLORATION AND APPRAISAL

In recent years, Premier has sought to rebalance its exploration

portfolio away from traditional but now mature areas to

under-explored but proven hydrocarbon basins with the potential to

develop into new business units over the medium term.

MEXICO

In Mexico, pre-unitisation terms were agreed by all potential

partners in the Zama field and approved by the Mexican government

in September. The pre-unitisation agreement provides a framework to

enable the sharing of data to ensure the safe and optimal appraisal

of the Zama field and, in the event a shared reservoir is proven,

it establishes a defined process for the overall development of the

field and the initial participation of each party.

In September, the Mexican government approved the Block 7

(Premier 25 per cent non-operated interest) appraisal programme,

comprising two back-to-back wells and one side track. The first

appraisal well, Zama-2, spudded to the north of the Zama discovery

well at the end of November. The well penetrated 152 metres of net

pay above the oil water contact and encountered a better than

anticipated net to gross ratio. The rig subsequently spudded the

up-dip vertical Zama-2 well side-track and has encountered the main

reservoir on prognosis. A comprehensive coring programme is now

being undertaken ahead of a drill stem test with the results

expected in early April. The rig will then move to drill the second

appraisal well (Zama-3) to evaluate the southern part of the Zama

oil field. The results of the appraisal programme will feed into

the early engineering work, being undertaken by McDermott and IO,

and will help inform the concept select decision ahead of a final

investment decision which is targeted for 2020.

In March 2018, Premier was awarded three new licences in Round

3.1, significantly enhancing the Group's acreage position offshore

Mexico. Premier, together with its joint venture partners (DEA

(operator) and Sapura), secured the highly contested Block 30

(Premier 30 per cent non-operated interest) which is directly to

the south west of Premier's Zama discovery in the shallow water

Sureste Basin. A block wide 3D seismic acquisition programme is

scheduled to commence in June 2019. The programme will further

define potential exploration targets, including the high impact

Wahoo prospect, which exhibits a flat spot on 2D seismic analogous

to the Zama discovery, and the Cabrilla prospect ahead of a

drilling campaign in 2020.

Premier also secured a 100 per cent operated interest in two

blocks - Blocks 11 and 13 - in the more frontier Burgos Basin,

which is directly inboard from the deep water Perdido fold belt. An

environmental baseline study across the two blocks was completed in

2018 and the forward plan is to reprocess existing 3D seismic

during 2019 with the aim of identifying potential drilling

targets.

On Block 2 (Premier 10 per cent non-operated interest) in the

Sureste Basin, Premier's option to participate and convert its

carried 10 per cent interest to a paying interest of up to 25 per

cent equity or to withdraw was triggered in May 2018. Premier has

opted to exit and received final government approval for its

withdrawal from the block in February 2019.

BRAZIL

Premier has continued to take an operational lead for

environmental licensing and well planning in the offshore Ceará

Basin, where the Group plans to drill two wells in 2020.

In the first quarter of 2018 Premier secured approval from the

ANP to replace the two well commitment on its operated Block 717

(Premier 50 per cent operated interest) with a single deeper well

targeting the stacked Berimbau and Maraca prospects. Premier

intends to drill this well in the first half of 2020 as part of a

two well campaign with Block 661 (Premier 30 per cent non-operated

interest). The 661 well will test the Itarema and Tatajuba

prospects. The two wells combined will test in excess of 500 mmbbls

of gross prospective resource.

Having matured and evaluated the prospectivity on Block 665

(Premier 50 per cent operated interest) utilising the high quality

3D seismic acquired by Premier and its partner, the decision has

been taken to relinquish the licence at the end of the initial term

in July 2019.

FINANCIAL REVIEW

Overview

2018 saw continuing oil price volatility. Brent crude opened the

year at US$66.9/bbl, rising to US$86.2/bbl in October before then

weakening considerably towards the end of the year to close at

US$50.2/bbl at 31 December 2018, which was the lowest observed

price in 2018. The average for 2018 was US$71.4/bbl against

US$54.2/bbl for 2017. Subsequent to the year-end, prices have

strengthened and averaged US$62/bbl in January and February

2019.

Against this economic backdrop we have achieved our best ever

full year of production, averaging 80.5 kboepd (2017: 75.0 kboepd),

resulting in total revenue from all operations of US$1,438.3

million compared with US$1,102 million in 2017. In addition, we

have reduced Net Debt to US$2,330.7 million, following the

successful conversion of the Group's convertible bond notes during

the year and strong cash flow generation.

Business performance

EBITDAX for the year from continuing operations was US$882.3

million compared to US$589.7 million for 2017. The increase in

EBITDAX is mainly due to higher production and realised prices

during the year.

Business Performance (continuing operations) 2018 2017

$ million $ million

Operating profit 531.0 33.8

----------- -----------

Add: Depreciation, depletion, amortisation and impairment 358.4 667.8

----------- -----------

Add: Exploration expense and pre-licence costs 35.2 17.1

----------- -----------

Less: Gain on disposal of assets (42.3) (129.0)

----------- -----------

EBITDAX 882.3 589.7

----------- -----------

Income statement

Production and commodity prices

Group production on a working interest basis averaged 80.5

kboepd compared to 75.0 kboepd in 2017. This was driven by a full

year of production from the Catcher field which achieved first oil

in December 2017 and outperformance from the Chim Sáo field.

Average entitlement production for the period was 73.8 kboepd

(2017: 69.2 kboepd).

Premier realised an average oil price for the year of

US$67.9/bbl (2017: US$52.9/bbl). Including the effect of oil swaps

which settled during 2018, the realised oil price was US$63.5/bbl

(2017: US$52.1/bbl). In the UK, average natural gas prices achieved

were 57 pence/therm (2017: 47 pence/therm), which included 58.2

million therms which were sold under fixed price master sales

agreements. Gas prices in Singapore, linked to high sulphur fuel

oil ('HSFO') pricing and in turn, therefore, linked to crude oil

pricing, averaged US$11.2/mscf (2017: US$8.4/mscf).

Realised prices 2018 2017

Oil price (US$/bbl) post hedging 63.5 52.1

---- ----

UK natural gas (pence/therm) 57 47

---- ----

Singapore HSFO (US$/mscf) 11.2 8.4

---- ----

Total revenue from all operations (including Pakistan) increased

to US$1,438.3 million (2017: US$1,102 million). From continuing

operations (excluding Pakistan), sales revenue increased to

US$1,397.5 million from US$1,043.1 million for the prior year.

Cost of operations

Cost of operations comprises operating costs, changes in lifting

positions, inventory movements and royalties. Cost of operations

for the Group from continuing operations was US$500.0 million for

2018, compared to US$455.4 million for 2017.

Operating Costs 2018 2017

$ million $ million

Continuing operations 487.5 438.4

----------- -----------

Discontinuing operations (Pakistan) 9.5 9.6

----------- -----------

Operating costs 497.0 448.0

----------- -----------

Operating costs per barrel 16.9 16.4

----------- -----------

Amortisation and depreciation of oil and gas properties 2018 2017

$ million $ million

Continuing operations 386.5 409.0

----------- -----------

Discontinuing operations (Pakistan) - 7.2

----------- -----------

Total 386.5 416.2

----------- -----------

Depreciation, depletion and amortisation ('DD&A') per barrel 13.2 15.2

----------- -----------

The increase in absolute operating costs reflects a full year

production contribution from the Catcher field. Ongoing cost

reduction initiatives, successful contract renegotiations and

strict management of discretionary spend continue to deliver low

and stable operating costs. Full year 2018 total operating costs

were below the low end of US$17-US$18/boe guidance at US$16.9/boe

(2017: US$16.4/bbl). The DD&A charge has reduced to US$13.2/bbl

(2017: US$15.2/bbl).

Impairment of oil and gas properties

A non-cash net impairment reversal credit of US$35.2 million

(pre-tax) (US$25.0 million post-tax) has been recognised in the

income statement. This relates to the Solan field in the UK North

Sea as a result of a reduction in the expected gross

decommissioning cost attributable to the asset, giving rise to a

reversal of previously recognised impairment of US$55.7 million.

This reversal has been partially offset by an impairment charge of

US$20.5 million for the Huntington asset. After recognition of the

net impairment charge there is US$2,245.6 million capitalised in

relation to PP&E assets and US$240.8 million for goodwill.

Exploration expenditure and pre-licence costs

Exploration expense and pre-licence expenditure costs amounted

to US$35.2 million (2017: US$17.1 million), primarily relating to

historical costs incurred on the Block 2 licence in Mexico, the

Sunbeam prospect in the UK and Block 665 licence in Brazil. After

recognition of these expenditures, the exploration and evaluation

assets remaining on the balance sheet at 31 December 2018 amount to

US$812.6 million, principally for the Sea Lion asset and our share

of the Zama prospect and Block 30 in Mexico. US$224.5 million of

costs in relation to the Tolmount project previously recognised

within exploration assets, which mostly represents fair value

allocated to the project on acquisition from E.ON, have been

reclassified to PP&E in the year following sanction of the

project in 2018.

General and administrative expenses

Net G&A costs of US$14.0 million (2017: US$16.8 million)

were comparable with the prior year.

Finance gains and charges

Net finance gains and charges of US$372.8 million, have

increased compared to the prior year (US$316.4 million). The step

up in the interest margin on our financing facilities following the

completion of the refinancing in July 2017 has been partially

offset by a reduction in the fair value of the Group's outstanding

equity and synthetic warrants to US$31.8 million from US$59.8

million at 31 December 2017. Cash interest expense in the period

was US$228.7 million (2017: US$223.7 million).

Taxation

The Group's total tax charge for 2018 from continuing operations

is US$53.1 million (2017: credit of US$96.1 million) which

comprises a current tax charge for the period of US$90.6 million

and a non-cash deferred tax credit for the period of US$37.5

million.

The total tax charge represents an effective tax rate of 33.5

per cent (2017: 26.2 per cent). The effective tax rate for the year

is primarily impacted by three specific UK deferred tax items. The

first is the impact of ring fence expenditure supplement claims in

the UK during the year (US$76.6 million credit). The second is the

impact of the Babbage disposal resulting in a clawback of UK tax

allowances (US$30.4 million charge) and the third is foreign

exchange movements on historical deferred tax balances (US$17.8

million charge). After adjusting for the net impact of the above

items of US$28.4 million, the underlying Group tax charge for the

period is US$81.5 million and an effective tax rate of 51.5 per

cent.

The Group has a net deferred tax asset of US$1,294.6 million at

31 December 2018 (2017: US$1,297.5 million), which is broadly

comparable with the prior year.

Profit after tax

Profit after tax is US$133.4 million (2017: loss of US$253.8

million) resulting in a basic earnings per share of 17.3 cents from

continuing and discontinued operations (2017: loss of 49.4 cents).

The profit after tax in the year is driven principally by the

increased sales revenue and consequent impact on operating

profits.

Cash flows

Cash flow from operating activities was US$777.2 million (2017:

US$475.3 million) after accounting for tax payments of US$128.8

million (2017: US$69.6 million) and before the movement in joint

venture cash balances in the period of US$54.4 million. The

increase in operating cash flows was largely driven by higher

production, sales volumes and realised prices.

Capital expenditure in 2018 totalled US$279.8 million (2017:

US$275.6 million).

Capital expenditure 2018 2017

$ million $ million

Fields/development projects 234.3 236.8

----------- -----------

Exploration and evaluation 43.6 37.6

----------- -----------

Other 1.9 1.2

----------- -----------

Total 279.8 275.6

----------- -----------

The principal development project was the Catcher field in the

UK. The majority of exploration spend was related to the

commencement of the appraisal drilling programme on the Zama

prospect in Mexico and the licence payment on Block 30. In

addition, cash expenditure for decommissioning activity in the

period was US$72.7 million (2017: US$25.7 million). Further to

this, US$17.7 million (2017: US$16.7 million) of cash was placed

into long-term abandonment escrow accounts for future

decommissioning activities.

Total 2019 development and exploration capex is expected to be

US$290 million of which c. US$70 million relates to the BIG-P

development and c. US$100 million to exploration and appraisal

(including US$60 million for the Zama appraisal programme and US$20

million for the Tolmount East appraisal well). Abandonment spend in

2019 is expected to be US$50 million, before taking into account

the benefits of tax relief, and primarily relates to abandonment

activities in the UK North Sea.

Discontinued operations, disposals and assets held for sale

During the year, Premier completed the previously announced

sales of its interests in the Babbage field in the UK, the Kakap

field in Indonesia and its 30 per cent non-operated interest in the

Esmond Transportation System (ETS). A net gain on disposal of

US$42.3 million has been recognised in the period.

During 2018, Premier received a further US$10 million cash

deposit from Al-Haj, in addition to the US$25 million deposit

received in 2017. Due to the expectation of the completion of the

disposal, the business unit continued to be classified as a

disposal group held for sale and presented separately in the

current and prior year balance sheet. Results for the disposal

group in both the current and prior periods have been presented as

a discontinued operation. Subsequent to the year-end, Premier

received a further US$5 million deposit from Al-Haj, bringing total

cash received to date of US$40 million, against the headline

consideration of US$65.6 million.

Balance sheet position

Net debt

Net debt at 31 December 2018 amounted to US$2,330.7 million (31

December 2017: US$2,724.2 million), with cash resources of US$244.6

million (31 December 2017: US$365.4 million). The maturity of all

of Premier's facilities at year-end is May 2021.

Following completion of the Wytch Farm disposal in December

2017, net cash proceeds received of US$176 million were used to pay

down and cancel the equivalent value of the RCF debt facility in

January 2018. Furthermore, the total available RCF facility was

reduced by a further US$39 million in December 2018 by the cash

proceeds received from the Babbage disposal. Following these two

disposals, the total available RCF facility reduced from US$2,050

million to US$1,835 million at year-end.

In January 2018, Premier invited convertible bondholders to

exercise their exchange rights in respect of any and all of their

bonds. 87.5 per cent or US$205.8 million of the US$235.2 million

bonds outstanding were accepted for early exchange with an

incentive amount of US$50 per US$1,000 in principal of bonds. The

exchange resulted in the issue of 231,882,091 Ordinary Shares,

which included 7,578,343 incentive shares. Completion of this

offer, resulted in a remaining convertible bond liability of

US$28.8 million.

Following this, in July 2018, the Group announced its intention

to exercise the mandatory conversion option in the remaining

outstanding convertible bonds. The exercise of this option

converted all of the remaining US$28.8 million outstanding

convertible bonds into approximately 31.4 million new Ordinary

Shares of Premier. This resulted in Premier's convertible bond

liability being fully extinguished in September 2018.

At 31 December 2018, after the exclusion of US$30.2 million of

cash held on behalf of our JV partners, Premier retained cash of

US$214.4 million. Combined with undrawn facilities of US$355.2

million, the Group had liquidity of US$569.6 million at the

year-end (31 December 2017: US$541.2 million). Subsequent to the

year-end, in January 2019, a further US$100.3 million of the

Group's RCF debt facility was cancelled by Premier, which will

result in reduced commitment fee costs for the Group in 2019.

Provisions

The Group's decommissioning provision decreased to US$1,214.5

million at 31 December 2018, down from US$1,432.1 million at the

end of 2017. The reduction is driven by a reduction in the forecast

for the gross cost estimate for the Solan asset and expenditure in

the year.

Non-IFRS measures

The Group uses certain measures of performance that are not

specifically defined under IFRS or other generally accepted

accounting principles. These non-IFRS measures used within this

Financial Review are EBITDAX, Operating cost per barrel, DD&A

per barrel, Net Debt and Liquidity and are defined in the

glossary.

Financial risk management

Commodity prices

Premier took advantage of the improved oil price environment

observed at times during 2018 to increase its hedging position in

2019 and 2020 to protect future free cash flows and covenant

compliance. The Group's current hedge position to the end of 31

December 2019 is as follows:

Oil swaps/forwards 2019 1H 2019 2H

Volume (mmbbls) 3.77 3.84

------- -------

Average price 68.5 69.2

------- -------

The fair value of open oil swaps at 31 December 2018 was an

asset of US$102.0 million (2017: liability of US$31.7 million),

which is expected to be released to the income statement during

2019 as the related barrels are lifted. During 2018, forward oil

swaps of 5.9 mmbbls expired resulting in a net charge of US$71.2

million (2017: US$11.4 million) which has been included in sales

revenue for the year.

In addition, the Group currently has forward UK gas sales of

48.8 mm therms at an average price of 61 pence/therm that will be

physically settled during 2019. Furthermore, Premier has hedged

part of its Indonesian gas production through the sale of 330,000

MT of HSFO Sing 180 in 2019 and 2020 at an average price of

US$378/MT.

Foreign exchange

Premier's functional and reporting currency is US dollars.

Exchange rate exposures relate only to local currency receipts, and

expenditures within individual business units. Local currency needs

are acquired on a short-term basis. At the year-end, the Group

recorded a mark-to-market loss of US$17.2 million on its

outstanding foreign exchange contracts (2017: gain of US$32.5

million). The Group currently has GBP150.0 million retail bonds,

EUR63.0 million long-term senior loan notes and a GBP100.0 million

term loan in issuance which have been hedged under cross currency

swaps in US dollars at average fixed rates of US$1.64:GBP and

US$1.37:EUR.

Interest rates

The Group has various financing instruments including senior

loan notes, convertible bonds, UK retail bonds, term loans and

revolving credit facilities. Currently, approximately 60 per cent

of total borrowings are fixed or have been fixed using interest

rate options. On average, the cost of drawn funds for the year was

7.6 per cent.

Insurance

The Group undertakes a significant insurance programme to reduce

the potential impact of physical risks associated with its

exploration, development and production activities. Business

interruption cover is purchased for a proportion of the cash flow

from producing fields for a maximum period of 18 months. During

2018, US$1.4 million of cash proceeds were received (net to

Premier) in relation to settled insurance claims (2017: US$7.2

million).

Going concern

The Group monitors its funding position and its liquidity risk

throughout the year to ensure it has access to sufficient funds to

meet forecast cash requirements. Cash forecasts are regularly

produced based on, inter alia, the Group's latest life of field

production and expenditure forecasts, management's best estimate of

future commodity prices (based on recent forward curves, adjusted

for the Group's hedging programme) and the Group's borrowing

facilities. Sensitivities are run to reflect different scenarios

including, but not limited to, changes in oil and gas production

rates, possible reductions in commodity prices and delays or cost

overruns on major development projects. This is done to identify

risks to liquidity and covenant compliance and enable management to

formulate appropriate and timely mitigation strategies.

Management's base case forecast assumes an oil price of

US$60/bbl and US$65/bbl in 2019 and 2020, respectively and

production in line with prevailing rates. The Group has run

downside scenarios, where oil and gas prices are reduced by a flat

US$5/bbl throughout the going concern period and where total group

production is forecast to reduce by 10 per cent.

At 31 December 2018 the Group continued to have significant

headroom on its financing facilities and cash on hand. The base

case forecasts show that the Group will have sufficient financial

headroom for the 12 months from the date of approval of the 2018

Annual Report and Accounts. In the downside scenarios ran, no

covenant breach is forecasted in the going concern period. If more

severe sustained downside cases were to materialise then, in the

absence of any mitigating actions, a breach of one or more of the

financial covenants may arise during the 12 month going concern

assessment period. Potential mitigating actions could include

further non-core asset disposals, additional hedging activity or

deferral of expenditure.

Accordingly, after making enquiries and considering the risks

described above, the Directors have a reasonable expectation that

the Company has adequate resources to continue in operational

existence for the foreseeable future. Accordingly, the Directors

continue to adopt the going concern basis of accounting in

preparing these consolidated financial statements.

Business risks

Premier's business may be impacted by various risks leading to

failure to achieve strategic targets for growth, loss of financial

standing, cash flow and earnings, and reputation. Not all of these

risks are wholly within the Company's control and the Company may

be affected by risks which are not yet manifest or reasonably

foreseeable.

Effective risk management is critical to achieving our strategic

objectives and protecting our personnel, assets, the communities

where we operate and with whom we interact and our reputation.

Premier therefore has a comprehensive approach to risk

management.

A critical part of the risk management process is to assess the

impact and likelihood of risks occurring so that appropriate

mitigation plans can be developed and implemented. Risk severity

matrices are developed across Premier's business to facilitate

assessment of risk. The specific risks identified by project and

asset teams, business units and corporate functions are

consolidated and amalgamated to provide an oversight of key risk

factors at each level, from operations through business unit

management to the Executive Committee and the Board.

For all the known risks facing the business, Premier attempts to

minimise the likelihood and mitigate the impact. According to the

nature of the risk, Premier may elect to take or tolerate risk,

treat risk with controls and mitigating actions, transfer risk to

third parties, or terminate risk by ceasing particular activities

or operations. Premier has a zero tolerance to financial fraud or

ethics non-compliance, and ensures that HSES risks are managed to

levels that are as low as reasonably practicable, whilst managing

exploration and development risks on a portfolio basis.

The Group has identified its principal risks for the next 12

months as being:

-- Further oil price weakness and volatility.

-- Underperformance of Catcher asset.

-- Failure to maintain schedule of Tolmount project.

-- Negative drilling results from key appraisal assets.

-- Ability to fund existing and planned growth projects.

-- Breach of banking covenants if oil prices fall or assets

underperform.

-- Timing and uncertainty of decommissioning liabilities.

-- Continued ability to maintain core competencies.

-- Political and security instability in countries of current

and planned activity.

-- Rising costs if oil prices recover could limit access to

services.

Further information detailing the way in which these risks are

mitigated is provided on the Company's website

www.premier-oil.com.

Richard Rose

Finance Director

Consolidated Income Statement

For the year ended 31 December 2018

2018 2017

$ million $ million

---------------------------------------------

Continuing operations

Sales revenues 1,397.5 1,043.1

Other operating (costs)/income (1.2) 18.8

Costs of operation (500.0) (455.4)

Depreciation, depletion, amortisation

and impairment (358.4) (667.8)

Exploration expense and pre-licence costs (35.2) (17.1)

Profit on disposal of non-current assets 42.3 129.0

General and administration costs (14.0) (16.8)

------------ ------------

Operating profit 531.0 33.8

Interest revenue, finance and other gains 27.8 12.6

Finance costs, other finance expenses

and losses (400.6) (329.0)

Loss on substantial modification - (83.7)

Profit/(loss) before tax from continuing

operations 158.2 (366.3)

Tax (charge)/credit (53.1) 96.1

------------ ------------

Profit/(loss) for the year from continuing

operations 105.1 (270.2)

------------ ------------

Discontinued operations

Profit for the year from discontinued

operations 28.3 16.4

------------ ------------

Profit/(loss) after tax 133.4 (253.8)

------------ ------------

Earnings/(loss) per share (cents):

From continuing operations

Basic 13.6 (52.6)

Diluted 12.2 (52.6)

------------ ------------

From continuing and discontinued operations

Basic 17.3 (49.4)

Diluted 15.5 (49.4)

------------ ------------

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2018

2018 2017

$ million $ million

--------------------------------------------------- ------------

Profit/(loss) for the year 133.4 (253.8)

--------------------------------------------------- ------------ ------------

Cash flow hedges on commodity swaps:

Gains/(losses) arising during the year 85.7 (25.6)

Add: reclassification adjustments for

losses in the year 71.2 11.4

------------ ------------

156.9 (14.2)

Cash flow hedges on interest rate and

foreign exchange swaps:

Gains/(losses) arising during the year 21.5 (33.9)

Less: reclassification adjustments for

(gains)/losses in the

year (11.4) 23.1

------------ ------------

10.1 (10.8)

Tax relating to components of other comprehensive

income (33.8) 7.5

Exchange differences on translation of

foreign operations 7.4 (4.9)

Other comprehensive income/(expense) 140.6 (22.4)

Total comprehensive income/(expense)

for the year 274.0 (276.2)

------------ ------------

All comprehensive income is attributable to the equity holders

of the parent.

Consolidated Balance Sheet

As at 31 December 2018

2018 2017

$ million $ million

---------------------------------------

Non-current assets:

Intangible exploration and evaluation

assets 812.6 1,061.9

Property, plant and equipment 2,245.6 2,381.0

Goodwill 240.8 240.8

Long-term receivables 159.8 160.8

Deferred tax assets 1,434.1 1,461.5

------------ ------------

4,892.9 5,306.0

------------ ------------

Current assets:

Inventories 12.5 13.5

Trade and other receivables 282.3 340.6

Derivative financial instruments 127.4 14.5

Cash and cash equivalents 244.6 365.4

Assets held for sale 55.2 96.6

------------ ------------

722.0 830.6

------------ ------------

Total assets 5,614.9 6,136.6

------------ ------------

Current liabilities:

Trade and other payables (375.6) (572.9)

Short-term provisions (46.0) (91.2)

Derivative financial instruments (41.4) (99.8)

Deferred income (11.0) (13.1)

Liabilities directly associated with

assets held for sale (21.9) (46.6)

------------ ------------

(495.9) (823.6)

------------ ------------

Net current assets 226.1 7.0

------------ ------------

Non-current liabilities:

Long-term debt (2,552.0) (2,972.6)

Deferred tax liabilities (139.5) (164.0)

Deferred income (76.0) (80.3)

Derivative financial instruments (129.4) (108.3)

Long-term provisions (1,196.1) (1,370.9)

------------ ------------

(4,093.0) (4,696.1)

------------ ------------

Total liabilities (4,588.9) (5,519.7)

------------ ------------

Net assets 1,026.0 616.9

------------ ------------

Equity and reserves:

Share capital 154.2 109.0

Share premium account 491.7 284.5

Other reserves 380.1 223.4

------------ ------------

1,026.0 616.9

------------ ------------

Consolidated Statement of Changes in Equity

For the year ended 31 December 2018

Share premium

Share capital account Other reserves Total

$ million $ million $ million $ million

------------------------------

At 1 January 2017 106.7 275.4 427.0 809.1

Issue of Ordinary Shares 2.3 9.1 1.1 12.5

Purchase of ESOP Trust shares - - (0.2) (0.2)

Provision for share-based

payments - - 14.5 14.5

Incremental equity component

of revised convertible bonds - - 57.2 57.2

Loss for the year - - (253.8) (253.8)

Other comprehensive expense - - (22.4) (22.4)

------------------------------ ------------- ------------- -------------- ----------

At 31 December 2017 109.0 284.5 223.4 616.9

------------- ------------- -------------- ----------

Adjustment on adoption of

IFRS 9(1) - - (82.0) (82.0)

------------- ------------- -------------- ----------

At 1 January 2018 109.0 284.5 141.4 534.9

Issue of Ordinary Shares 45.2 207.2 7.7 260.1

Purchase of ESOP Trust shares - - (1.5) (1.5)

Provision for share-based

payments - - 14.6 14.6

Conversion of convertible

bonds - - (56.1) (56.1)

Profit for the year - - 133.4 133.4

Other comprehensive income - - 140.6 140.6

------------------------------ ------------- ------------- -------------- ----------

At 31 December 2018 154.2 491.7 380.1 1,026.0

------------- ------------- -------------- ----------

(1) As described in note 1.

Consolidated Cash Flow Statement

For the year ended 31 December 2018

2018 2017

$ million $ million

-------------------------------------------------------------------------------------------------------------------------------------------

Net cash from operating activities 722.8 496.0

----------- -----------

Investing activities:

Capital expenditure (279.8) (275.6)

Decommissioning pre-funding (17.8) (16.7)

Decommissioning expenditure (72.7) (25.7)

Proceeds from disposal of oil and gas properties 73.4 202.3

Net cash used in investing activities (296.9) (115.7)

Financing activities:

Issuance of Ordinary shares 13.8 0.8

Net purchase of ESOP Trust shares (1.5) (0.2)

Proceeds from drawdown of long-term bank loans 105.0 45.0

Repayment of long-term bank loans (415.3) -

Debt arrangement fees - (86.0)

Interest paid (228.7) (223.7)

----------- -----------

Net cash from financing activities (526.7) (264.1)

----------- -----------

Currency translation differences relating to cash and cash equivalents (20.0) (6.7)

----------- -----------

Net (decrease)/increase in cash and cash equivalents (120.8) 109.5

----------- -----------

Cash and cash equivalents at the beginning of the year 365.4 255.9

----------- -----------

Cash and cash equivalents at the end of the year 244.6 365.4

----------- -----------

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2018

1. General information

Premier Oil plc is a limited liability company incorporated in

Scotland and listed on the London Stock Exchange. The address of

the registered office is 4th Floor, Saltire Court, 20 Castle

Terrace, Edinburgh, EH1 2EN, United Kingdom. This preliminary

announcement was authorised for issue in accordance with a

resolution of the Board of Directors on 6 March 2019.

The financial information for the year ended 31 December 2018

set out in this announcement does not constitute statutory accounts

within the meaning of Section 434 of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2017 were

approved by the Board of Directors on 7 March 2018 and delivered to

the Registrar of Companies and those for 2018 will be delivered

following the Company's Annual General Meeting ('AGM'). The auditor

has reported on the 2018 accounts and their audit report was

unqualified.

Basis of preparation

The financial information has been prepared in accordance with

the recognition and measurement criteria of International Financial

Reporting Standards ('IFRS') adopted for use in the European Union.

However, this announcement does not itself contain sufficient

information to comply with IFRS. The Company will publish full

financial statements that comply with IFRS in April 2019.

The financial information has been prepared under the historical

cost convention except for the revaluation of financial instruments

and certain oil and gas properties at the transition date to IFRS.

These financial statements are presented in US dollars since that

is the currency in which the majority of the Group's transactions

are denominated. The financial information has been prepared on the

going concern basis.

Accounting Policies

The accounting policies applied in these condensed financial

statements are consistent with those of the annual financial

statements for the year ended 31 December 2017, as described in

those annual financial statements, except for the adoption of IFRS

9 Financial Instruments and IFRS 15 Revenue from Contracts with

Customers.

IFRS 9 'Financial Instruments'

The overall impact on transition to IFRS 9 was an US$82 million

increase in long-term debt and corresponding reduction in net

assets. This adjustment relates entirely to an adjustment to the

Group's accounting for its refinancing that completed in July 2017.

On adoption of IFRS 9, additional interest charges for facilities

that were not deemed to be substantially modified have been

expensed at the point of completion of the refinancing. Under the

previous accounting policies these additional interest charges had

been expected to be amortised to the income statement on an

effective interest rate basis over the life of the facilities.

Under IFRS 9, this would have increased the interest charge

recognised in 2017 by US$82 million, with a corresponding reduction

in net assets at 31 December 2017. Going forward, this reduces

Premier's forecast interest charges by c. US$20 million per annum.

The impact on the current period balance sheet is to increase

long-term debt and reduce retained earnings by US$82 million. As

permitted by IFRS 9 comparatives have not been restated.

For certain line items in the balance sheet the closing balance

at 31 December 2017 as previously reported and the opening balance

at 1 January 2018 therefore differ (see statement of changes in

equity). The Group's accounting policy has been revised to reflect

the requirements of IFRS 9. However, excluding the impact on the

accounting treatment applied to the Group's 2017 refinancing, the

Standard has not had a significant impact. The Group's accounting

policy for IFRS 9 is set out below:

(a) Classification of financial assets and financial

liabilities

IFRS 9 requires the use of two criteria to determine the

classification of financial assets: the entity's business model for

the financial assets and the contractual cash flow characteristics

of the financial assets. The Standard goes on to identify three

categories of financial assets - amortised cost; fair value through

profit or loss (FVTPL); and fair value through other comprehensive

income (FVOCI). The accounting for the Group's financial

liabilities remains largely the same as it was under IAS 39.

Similar to the requirements of IAS 39, IFRS 9 requires contingent

consideration liabilities to be treated as financial instruments

measured at fair value, with the changes in fair value recognised

in the statement of profit or loss.

Under IFRS 9, embedded derivatives are no longer separated from

a host financial asset. Instead, financial assets are classified

based on their contractual terms and the Group's business model.

The accounting for derivatives embedded in financial liabilities

and in non-financial host contracts has not changed from that

required by IAS 39.

(b) Impairment

IFRS 9 mandates the use of an expected credit loss model to

calculate impairment losses rather than an incurred loss model, and

therefore it is not necessary for a credit event to have occurred

before credit losses are recognised. The new impairment model

applies to the Group's financial assets and loan commitments. No

changes to the impairment provisions were made on transition to

IFRS 9.

The IFRS 9 impairment model requiring the recognition of

'expected credit losses', in contrast to the requirement to

recognise 'incurred credit losses' under IAS 39, has not had a

material impact on the Group's financial statements.

Trade receivables are generally settled on a short time frame

and the Group's other financial assets are due from counterparties

without material credit risk concerns at the time of

transition.

(c) Hedge accounting

The hedge accounting requirements of IFRS 9 have been simplified

and are more closely aligned to an entity's risk management

strategy. Under IFRS 9 all existing hedging relationships will

qualify as continuing hedging relationships and the Group also

intends to apply hedge accounting prospectively to certain of its

commodity price risk management activities for which hedge

accounting was not possible under IAS 39. This had no impact on the

2018 opening balance sheet.

IFRS 15 'Revenue from Contracts with Customers'

Premier has elected to apply the 'modified retrospective'

approach to transition permitted by IFRS 15 under which comparative

financial information is not restated. The Standard did not have a

material effect on the Group's financial statements as at 1 January

2018 and so no transition adjustment has been made. The standard

has not had a material impact on the Group's accounting policy in

respect to revenue as previously disclosed in the 2017 financial

statements.

Revenue from contracts with customers for the 2018 period is

presented in Note 2. Amounts presented for comparative periods in

2017 include revenues determined in accordance with the Group's

previous accounting policies relating to revenue. The total amounts

presented do not, therefore, represent the revenue from contracts

with customers that would have been reported for those periods had

IFRS 15 been applied using a fully retrospective approach to

transition but the differences are not material.

The Group's accounting policy for IFRS 15 is set out below:

Under IFRS 15, revenue from contracts with customers is

recognized when or as the Group satisfies a performance obligation

by transferring a promised good or service to a customer. A good or

service is transferred when the customer obtains control of that

good or service. The transfer of control of oil, natural gas,

natural gas liquids, and other items sold by the Group usually

coincides with title passing to the customer and the customer

taking physical possession. The Group principally satisfies its

performance obligations at a point in time and the amounts of

revenue recognized relating to performance obligations satisfied

over time are not significant.

A number of additional new standards, amendments to existing