TIDMHAT

RNS Number : 5210F

H&T Group PLC

10 March 2020

H&T Group ("H&T" or the "Group") today announces its

final results for the year ended

31 December 2019.

John Nichols, chief executive of H&T Group, said:

"Following two successful acquisitions, a strong core operating

performance and a beneficial gold price we have produced an

exceptional year's trading performance.

"We have made good progress in delivering our strategic goals in

the past year, particularly in significantly growing our asset base

by acquiring trading sites and pledge books. I am delighted with

progress integrating these trading sites and assets, with financial

performance meeting our expectations. We continue to develop our

digital strategy complementing our enlarged store estate.

"Further growth in pawnbroking has primarily been driven by

increased customer transactions and the opportunity to serve more

customers following the acquisitions made during the year. The

ongoing refinement and rationalisation of our personal loan product

offering has improved lending return.

"We are improving retail through an expanded range of new

jewellery and the development both of click-and-collect and online

sales. We are pleased with the growth of our foreign exchange

proposition, cheque cashing and newly introduced money-wire

transfer operations.

"The Group's growing momentum demonstrates the success of our

strategy and the demand for our pawnbroking and related products

remains strong. We look forward with confidence whilst remaining

mindful of the external factors and current macro uncertainties.

"

2018 (Restated* Change

2019 for IFRS16) %

Financial highlights (GBPm

unless stated)

Gross profit 101.4 88.2 15.0%

EBITDA 30.0 22.9 31.0%

Operating profit 22.5 16.2 38.9%

Profit before tax 20.1 13.8 45.7%

Diluted EPS (p) 43.8p 29.6p 48.0%

Dividend per share 11.7p 11.0p 6.4%

Key performance indicators

Gross pledge book GBP72.2m GBP52.0m 38.8%

Redemption of annual lending

** 82.40% 82.80% (0.4%)

Retail gross profits GBP13.6m GBP13.2m 3.0%

Personal loan book GBP16.6m GBP20.5m (19.0%)

Personal loan revenue less impairment GBP10.8m GBP7.0m 54.3%

Number of stores 252 182 38.5%

* Certain comparative information in the financial statements

has been restated as a result of the initial application of IFRS 16

as discussed in note 12.

** This is the actual percentage of lending in each year which

was redeemed or renewed, the 2019 figure is an estimate based on

recent trend and early performance.

Operational highlights:

-- Pledge book increased 38.8% to GBP72.2m from GBP52.0m

-- Pawnbroking net revenue increased by 26.2% from GBP30.9m to

GBP39.0m, including core store growth of 15.4%

-- 70 new stores and 159 pledge books integrated into the

H&T estate following Money Shop and A&B acquisitions

-- Retail delivered sales growth of 8.4% with gross profits

increasing by 3.0% from GBP13.2m to GBP13.6m

-- Strong growth from foreign currency offering, with gross

profit increasing by 44.4% from GBP3.6m to GBP5.2m, including core

store growth of 19.5%

-- Personal loan net revenue increased by 54.3% from GBP7.0m to

GBP10.8m, due to reduced impairment charges

-- Traffic to the est1897.co.uk retail website has increased by

26% with GBP4.0m of online generated sales driven by higher volumes

of basket and click-and-collect store fulfilled sales

-- Strong returns from precious-metal scrappage reflecting the high gold price

Enquiries:

H&T Group plc

Tel: 020 8225 2797

John Nichols, Chief Executive

Richard Withers, Chief Financial Officer

Numis Securities (Broker and Nominated Adviser)

Tel: 020 7260 1000

Luke Bordewich, Nominated Adviser

Henry Slater

Haggie Partners (Public Relations)

Tel: 020 7562 4444

Damian Beeley

Caroline Klein

Chairman's statement

The Group has delivered a strong financial performance while

expanding its core pawnbroking estate of stores via the strategic

acquisitions of assets from The Money Shop and A&B during the

year. The integration of the 70 new stores, 159 pledge books and

248 new colleagues was enabled by committed, enthusiastic and

capable staff utilising well-established processes developed in

H&T. The acquisitions expand our presence in the UK market and

enable us to leverage investments made in recent years in our

people, systems and digital initiatives. As planned, we have

already made good progress in increasing the pawnbroking business

for these stores. We thank our core investors for supporting a

GBP6.0m equity placing that facilitated this expansion.

The Group saw more than 400,000 pawnbroking customer visits last

year and delivered solid revenue growth in our core pawnbroking

secured lending business. We improved overall store profitability

and made progress in streamlining our customer journey experiences

while developing our online channel in retail, although there is

more work to do. Our unsecured personal lending was scaled back

during the year as we focused on higher quality lending.

The opportunity to build further our digital and online

capability backed up by our store network will be an important part

of our future strategy.

These activities have repositioned the business within the wider

alternative credit market and have allowed the Group to access a

broader customer base. The Board continues to focus on the changing

risks, both regulatory and financial, that wider product and

channel diversification brings.

The growth in our retail and FX businesses, together with the

re-introduction of overseas money wire transfer via Western Union

provides a degree of resilience to changes in the pawnbroking and

lending marketplace.

FINANCIAL PERFORMANCE

The Group delivered profit after tax of GBP16.7m (2018:

GBP11.0m) and diluted earnings per share of 43.8 pence (2018: 29.6

pence). Subject to shareholder approval, a final dividend of 7.0

pence per ordinary share (2018: 6.6 pence) will be paid on 29 May

2020 to those shareholders on the register at the close of business

on 1 May 2020. This will bring the full year dividend to 11.7 pence

per ordinary share (2018: 11.0 pence).

The Group's financial position is strong with growth in the

pawnbroking loan book to GBP72.2m (2018: GBP52.0m). The growth

represents steady organic expansion supported by acquisition and

was funded by strong operating cashflow, with net debt increasing

by just GBP0.4m to GBP14.0m at 31 December 2019 (2018:

GBP13.6m).

At year end, the Group had available headroom of GBP9.0m on its

GBP35.0m borrowing facilities (2018: GBP10.0m).

OUR TEAM

One of the Group's greatest strengths is its people, reflected

in the loyalty of our high number of long-serving colleagues. Their

skills and expertise are at the core of our strong customer

relationships and we continue to invest in training, development

and progression of our valuable staff. We have enhanced our

technical in-store and e-learning training and will continue our

leadership development programme. The Group is proud of its culture

that fosters passion and enthusiasm to deliver exceptional customer

service and outcomes.

STRATEGY

The Group has an enlarged and growing customer base, a talented

team to serve them and a diversified business model. A strong asset

base and good cash generation leaves the Group able to exploit

further growth opportunities.

The demand for small-sum, short-term cash loans remains strong.

The Group continues to focus on strategies to grow its pawnbroking

business and its personal lending service, and to develop its

retail offering through digital and online strategies to complement

its store estate. We will continue to focus on operational

effectiveness to improve customer experiences.

Our network of stores supports this development, notably our

click-and-collect service from the est1897 and H&T websites.

This creates an important distinction between H&T and a purely

online business.

In developing our Personal Loan product, we have always

maintained a clear objective to provide our customers with a route

to lower interest rate credit products as their relationship with

H&T develops. We believe that this progression is beneficial to

the customer, builds loyalty and meets the high standards required

in this regulated marketplace. We are now working with the FCA on

our policies and procedures for providing affordable products in

the High-Cost-Short-Term unsecured credit market (HCSTC). During

this review we have voluntarily withdrawn from the HCSTC market. As

part of this review we will be examining strategically whether in

operating in HCSTC we are both able to provide our customers with

the affordable products within the regulatory framework that they

deserve and provide a sustainable appropriate return to our

shareholders commensurate with the risks undertaken.

REGULATION

We have always focused on meeting the needs of our customers by

ensuring that we carefully assess creditworthiness and

affordability and provide loans that achieve the best outcomes for

our customers. As set out in our market release of 18 November

2019, we are in the early stages of working with the FCA to review

our policies and procedures to enhance our affordability

assessments, using technology to streamline and improve the quality

of the decision-making. We understand that several other companies

in the industry are progressing such reviews. We will also be

carrying out a past business review under the supervision of a

Skilled Person during 2020.

PROSPECTS

During 2019, the Board regularly monitored the uncertainty

surrounding Brexit and now that the UK has left the EU we continue

to evaluate the further potential impacts on our staff, customers

and suppliers, of various possible outcomes, including no deal

scenarios by the end of 2020. We do have some EEA Nationals within

our workforce, but we have seen limited effect on them to date and

believe the potential impact of even unfavourable Brexit scenarios

is likely to be limited. No product supply issues are foreseen.

In recent weeks the risks relating to the spread of COVID-19 and

concern for the potential virus impact in the UK have increased.

H&T is continuously reviewing its contingency plans for the

various potential and highly uncertain developments that may impact

on our staff both at our operations centres and our stores, our

customers, and the suppliers and logistics partners on whom we

rely.

While the macroeconomic impact of these risks is uncertain, we

believe our range of products is well positioned in any eventuality

to support our clients' needs. The business has traded positively

throughout the recent period of heightened uncertainty as the gold

price has strengthened in response.

During 2019 the business has taken an unprecedented step forward

with the acquisitions of stores and assets from the Money Shop and

A&B. Although sizeable for H&T and significant within the

industry, these have been carefully structured, efficiently

financed and well-managed to date. They have greatly increased the

store presence of H&T across the UK.

We are pleased with progress of integration of our new

colleagues into our strong existing culture, our systems and our

business mix and, in particular, with our progress so far in

developing pawnbroking from the new customer base.

The enlarged footprint from which H&T now operates supported

by our digital offering represents a very strong platform for the

development of future profitable returns.

On behalf of the Board and our shareholders, I would like to

welcome our new colleagues to H&T and thank them and everyone

at H&T for their hard work and dedication over the past

year.

Peter D McNamara

Chairman

Chief executive's review

INTRODUCTION

The Group has continued to reap rewards from its investments

into people development and system improvements and via the

acquisitions of people, assets and new stores from The Money Shop

and A&B.

Core trading and performance from our 70 new stores was

strong.

Our goal was to get the best possible result from our core

operations, expand our geographic footprint and develop our digital

capabilities while expanding the online channel. We have delivered

against all those objectives in the past year.

The Group achieved profit before tax of GBP20.1m (2018:

GBP13.8m) due primarily to improved gross profits in the key

segments of pawnbroking, personal loans and other services.

THE MARKET

During 2019 despite political and economic uncertainties

elsewhere we experienced relative stability in terms of external

factors impacting our business, with an increasing gold price

assisting returns. The core strength of our business allowed us to

integrate new stores and welcome 248 new colleagues, while we

continued to refine our propositions and expand our customer

base.

STRATEGY

The Group's strategy is to serve a customer base whose access to

mainstream credit is limited and for whom small-sum loans can help

to address short-term financial challenges. The Group will continue

to deliver this strategy by developing a range of lending products,

both secured and unsecured. In expanding our credit products, we

aim to genuinely help our customers.

Our Vision: "H&T will be the premier provider of alternative

credit in the UK through a range of services that help our

customers protect and rebuild their credit rating and return to the

mainstream."

The development of a diversified suite of services including

retail, personal lending, FX and money wire transfer, improves

returns and reduces the Group's exposure to gold price

volatility.

We continue to innovate and explore how to interact most

effectively with our customers through the development of

introducer channels, our online capability and our brand. This

development is supported by our stores that provide our online

customers with the opportunity to speak to a trained member of

staff face to face or to collect an item that they have reserved

online.

REVIEW OF OPERATIONS

Pawnbroking

Pawnbroking is a small subset of the consumer credit market in

the UK and a simple form of asset-backed lending where an item of

value, known as a pledge (typically jewellery and watches), is

given in exchange for a cash loan. Customers who repay the capital

sum borrowed plus interest receive their pledged item back. If a

customer fails to repay the loan we sell (auction, retail or scrap)

the pledged item. The value of the item is set by auction, whether

it is the reserve, or the actual sale price should it sell. From

that price we deduct the interest accrued to date plus an admin

fee; the remainder is then given back to the customer should there

be a surplus resulting from this process. Title to the item then

passes to the company.

Pawnbroking is our core business, we are the largest UK

pawnbroker in terms of number of outlets, customers and amounts

lent. It is the key focus area for the business and where we invest

most resource in terms of training and development. Yields are

attractive, and the debt is always secured on the item pledged.

Gross profits from pawnbroking after impairment increased 26.2%

to GBP39.0m (2018: GBP30.9m) and the pledge book increased 38.8% to

GBP72.2m (31 December 2018: GBP52.0m) because of increased customer

numbers and growth in all categories of carat gold, diamond and

watches. The pledge book in the core estate (excluding 2019

acquired stores) grew by GBP13m, 25% driven by increased lending to

newly acquired customers and organic growth in transactions. We

have increased the pledge book in acquired stores from GBP5m to

GBP7m in just a few months.

The risk-adjusted margin (revenue as a percentage of the average

net pledge book) was 64.6% (2018: 63.1%). Redemption of annual

lending has remained consistently high at an estimated 82.4% for

lending in 2019 (2018 actual: 82.8%).

The Group has benefitted from the expertise provided by the

Expert Eye service that allows high quality images of assets in

store to be assessed remotely by our team of experts. This in turn

improves the quality of decisions made and extends the range of

assets on which we can lend.

The Group developed software during the year to assist the

management of customer enquiries in respect of pawnbroking as well

as the acquisition of new partners to introduce customers to the

business. This investment will allow further pawnbroking customer

expansion during 2020.

Pawnbroking summary:

2019 2018 Change

%

GBP'm GBP'm

Year-end net pledge

book(1) 72.2 52.0 38.8%

Average net pledge book 60.4 49.0 23.3%

------------------------------ ------- ------- -------

Revenue less impairment 39.0 30.9 26.2%

Risk-adjusted margin(2) 64.6% 63.1%

------------------------------ ------- ------- -------

Notes to table

1 - Includes accrued interest

and impairment

2 - Revenue as a percentage of the average

net pledge book

------------------------------------------------ -------

Retail

The Group offers a value-for-money proposition in new and

second-hand jewellery. We believe there is further growth potential

in this segment by leveraging our retail store estate and our

e-commerce operations as well as by cross-selling to customers of

other services.

Retail sales increased 8.4% to GBP41.5m (2018: GBP38.3m), gross

profits increased 3.0% to GBP13.6m (2018: GBP13.2m) and margin

reduced to 32.9 % (2018: 34.4%). Margin reduction was due to a

higher proportion of new items sold in 2019 as opposed to

pre-owned, higher costs of goods sold in respect of watch servicing

and repair costs, and discounting on aged jewellery during

2019.

The Group has reduced retail inventories during the year with

average monthly balances of GBP2.2m, 7% lower during 2019 than

2018. The stock decrease was driven by a desire to reduce aged

items. This was achieved by implementing targeted promotional

activity and discounts during the year.

It is pleasing that the development of both our www.handt.co.uk

and www.est1897.co.uk websites has led to a 48% increase in online

generated revenues over the year with revenue growing to GBP4.0m

(2018: GBP2.7m). The development of our on-line to store customer

journey has resulted in 85% of the on-line generated items sold

being fulfilled in-store. These are generally higher value watches

and jewellery, while opportunity exists to further develop our

direct basket sales.

Further improvements are planned for our est1897 website, which

holds more than 3,000 high-end pre-owned watches and jewellery

items, and to our Customer Relationship Management system. The

intention is to include a larger range of items on our site and to

drive a higher proportion of basket fulfilled sales as opposed to

in-store fulfilment. CRM enhancements are intended to improve the

online to in-store experience and conversion rates.

Personal loans

The net personal loans book has reduced by 19.0% to GBP16.6m (31

December 2018: GBP20.5m). Revenue less impairment has increased by

54.3% to GBP10.8m (2018: GBP7.0m) by the Group taking proactive

action in areas identified as not economically viable and the

expansion in our longer term, lower interest rate loan product,

delivered through our store estate.

In October we voluntarily and temporarily ceased offering

high-cost-short-term-credit unsecured (HCSTC) loans, while we work

with the FCA and appoint a skilled person to review our policies

and procedures for affordability assessment and review our past

business practices. As part of this review, we are examining

strategically whether in operating in HCSTC we are both able to

provide our customers with the affordable products that they

deserve and at the same time also provide a sustainable,

appropriate return to our shareholders commensurate with the risks

undertaken.

The increase in the risk-adjusted margin (RAM) to 56.3% (2018:

38.9%) is the result of improved credit risk assessments during the

year and the contraction in the book. The reduced book meant a

lower proportion of new customers compared with 2018 and

consequently lower impairment charged. Our absence from HCSTC

lending will have a financial impact in the future.

Impairment as a percentage of revenue has improved to 49.8%

(2018: 68.9%), reflecting the increased mix of lower yield, higher

quality loans.

In line with the strategy of providing larger loans over longer

terms at a lower interest rate, our 49.9% APR product launched in

May 2017 now represents GBP2.8m of the net loan book at year end

(31 December 2018: GBP1.2m). This product is designed to provide a

"near prime" option for our best customers. Due to these

initiatives, 90% (2018: 59%) of the personal loan book is

non-HCSTC.

New customer lending of GBP30.0m (2018: GBP38.0m) was made

through our stores during 2019.

Personal loans summary:

2019 2018 Change

---------------------------------

GBP'm GBP'm %

--------------------------------- ---------------------- ---------------------- -------

Year-end net loan book 16.6 20.5 -19.0%

Average monthly net loan book 19.2 18.0 6.7%

--------------------------------- ---------------------- ---------------------- -------

Revenue 21.5 22.5 -4.4%

Impairment (10.7) (15.5) -31.0%

Revenue less impairment 10.8 7.0 54.3%

--------------------------------- ---------------------- ---------------------- -------

Interest yield(1) 111.5% 125.0%

Impairment % of revenue 49.8% 68.9%

Impairment % of average monthly

net loan book 55.7% 86.1%

Risk-adjusted margin(2) 56.3% 38.9%

--------------------------------- ---------------------- ---------------------- -------

1 - Revenue as a percentage of

average loan book

2 - Revenue less impairment as a percentage

of average loan book

--------------------------------------------------------- ---------------------- -------

Pawnbroking scrap

The average gold price during 2019 was GBP1,094 per troy ounce

(2018: GBP950), a 15.2% increase. The gold price directly impacts

the revenue received on the sales of scrapped gold.

Gross profits increased by 78.6% to GBP2.5m (2018: GBP1.4m),

primarily due to an increase in gold price between the date the

title of the pledged item passed to H&T and the date

scrapped.

Gold purchasing

Gross profits increased by GBP1.9m to GBP5.7m (2018: GBP3.8m).

The increased margin contributed GBP1.1m to the GP increase with a

17% increase in the volume of gold sold attributing the remaining

GBP0.8m of the uplift.

Other services

Other services principally comprise FX, buyback, cheque cashing

and money-transfer. Gross profits from these services increased to

GBP9.0m (2018: GBP6.1m).

The key growth components of FX, cheque cashing and buyback

improved in the year with gross profits from FX increasing to

GBP5.2m (2018: GBP3.6m), cheque cashing increasing to GBP1.5m

(2018: GBP0.9m) and buyback increasing to GBP1.7m (2018:

GBP1.6m).

FX is a simple transactional product which attracts a new

customer base to the business. During the year we have offered a

wider currency choice in-store and introduced further digital rate

boards. Our website FX click and collect offering remains in its

infancy, with upside potential.

Buyback was introduced to enable the Group to service a customer

base without appropriate assets for a pawnbroking loan, the

principal assets purchased being mobile phones and tablets.

Following the year end, we decided to exit this line of business.

To manage the disposition risks in a fast-moving technology-based

marketplace required continuous investment in different valuation

and control technologies and our skilled staff can be better

deployed elsewhere within our other suite of products.

I would also like to add my great thanks to those of the

chairman, in welcoming our new colleagues to the group and

recognising all our people whose skills, commitment and enthusiasm

continue to drive our success, and who give us confidence in the

future.

John G Nichols

Chief Executive

Chief financial officer's review

FINANCIAL RESULTS

For the year ended 31 December 2019, gross profit increased

15.0% from GBP88.2m to GBP101.4m driven by growth in the main

income streams and above-expected returns from precious metal

scrappage, reflecting the high gold price.

Total direct and administrative expenses increased by 9.6% to

GBP78.9m from GBP72.0m. This principally reflects an increase in

staff costs to support the growth of the business and costs

associated with new stores offset by a GBP5.1m reduction in

impairment charges. Pawnbroking impairment is down GBP0.2m, on a

larger book and personal lending impairment reduced by GBP4.8m on a

smaller, improved quality book.

The GBP12.0m, 26.0% increase in costs (excluding impairment) to

GBP58.1m from GBP46.1m is principally a result of investment in

staff to support business volumes and costs associated with new

stores acquired during the year. Newly acquired store costs

comprise GBP5.3m of the increase. The Board considers the continued

investment in people and systems to be vital in repositioning the

business to take advantage of the market conditions.

Debt finance costs remained at GBP0.8m, as internal cash

resources were used in the main to fund capital and acquisition

investment made during the year.

Profit before tax increased by GBP6.3m to GBP20.1m, up 45.7%

from GBP13.8m in 2018.

ACQUISITIONS AND DISPOSALS

During the year the Group invested to increase the core estate

via two significant acquisitions. First, via the GBP11.0m asset

purchases from Instant Cash Loans Ltd and TM Sutton Ltd (t/a The

Money Shop) which contributed to a net increase of 64 fully-fitted

stores, together with cash of GBP1.0m and pledge value of GBP6.0m.

Of the consideration paid, GBP1.6m remains in escrow pending

certain performance conditions. Subsequently from Speedloan Finance

Ltd (t/a Albermarle & Bond or A&B) we acquired, for

GBP8.7m, its entire pawnbroking estate from its 107 closed stores.

These books were predominantly incorporated into our core

(including newly acquired Money Shop) stores. Additionally, we

selectively took over leases from six closed A&B stores filling

customer supply gaps in our core estate.

CASH FLOW

The growth in profit for the year resulted in an increase in

operating cash flows (before movements in working capital) of 32.6%

to GBP30.5m (2018: GBP23m).

The Group accelerated the growth in its pawnbroking secured

lending book, through acquisition and organic growth, and reduced

the rate of growth in personal loans during 2019 resulting in a net

increase in receivables of GBP5.5m in the year (2018: GBP9.9m).

After working capital movements, the Group's cash inflow from

operating activities of GBP25.8m outstripped last year's inflow of

GBP7.2m.

BALANCE SHEET

As at 31 December 2019, the Group had net assets of GBP122.6m

(2018: GBP103.8m) with year-end net debt of GBP14.0m (2018:

GBP13.6m) delivering a reduction in gearing to 11.4% (2018:

13.1%).

During the year the Group renewed its facility with Lloyds Bank

plc. This allows for maximum borrowings of GBP35.0m, subject to

covenants, at a margin of between 1.75% and 2.75% above LIBOR. At

year end GBP26.0m was drawn on the facility (2018: GBP25.0m) and

the Group was well within the covenants with a net debt to EBITDA

ratio of 0.47x (2018: 0.59) and an EBITDA to interest ratio of 30.4

(2018: 28.9) (see note 3 for the definition of EBITDA). The

facility has a termination date of 12 June 2022.

The combination of low gearing and a secure credit facility

provides the Group with the ability to make selective investments

in the future while maintaining appropriate headroom.

IFRS 16

IFRS 16 is a new standard on lease accounting which the Group

adopted with effect from 1 January 2019. The standard requires the

recognition of significant leases on the balance sheet, increasing

both the asset and liability and changes the nature of costs on the

income statement, with a positive impact on EBITDA. The overall

impact on profit for 2019 is favourable by GBP0.1m. Further

information is provided in note 12.

IMPAIRMENT REVIEW

The Group performs an annual review of the expected earnings of

each acquired store and considers whether the associated goodwill

and other property, plant and equipment are impaired. There was no

impairment charge during 2019 (2018: GBPnil).

SHARE PRICE AND EPS

At 31 December 2019, the share price was 338p (2018: 264p) and

market capitalisation was GBP134.3m (2018: GBP99.4m). Basic

earnings per share were 43.9p (2018: 29.7p), diluted earnings per

share were 43.8p (2018: 29.6p).

Richard Withers

Chief Financial Officer

Group statement of comprehensive income

For the year ended 31 December 2019

Continuing operations: Note 2019 2018

GBP'000 (Restated*)

GBP'000

Revenue 2 160,213 143,025

Cost of sales (58,852) (54,781)

Gross profit 2 101,361 88,244

Other direct expenses (60,842) (58,736)

Administrative expenses (18,031) (13,272)

Operating profit 22,488 16,236

Investment revenues - 3

Financing costs (2,405) (2,468)

Profit before taxation 20,083 13,771

Tax charge on profit 4 (3,393) (2,818)

Profit for the financial year and total

comprehensive income 16,690 10,953

2019 2018

Earnings per share from continuing operations Pence Pence

Basic 5 43.88 29.68

Diluted 5 43.80 29.58

All profit for the year is attributable to equity

shareholders.

*Certain comparative information has been restated because of

the initial application of IFRS 16 as discussed in note 12

Group statement of changes in equity

For the year ended 31 December 2019

Employee

Benefit

Trust

Share premium shares Retained

Share capital account reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2018 1,872 26,641 (35) 71,223 99,701

Adjustment from the adoption

of IFRS 16 - - - (3,297) (3,297)

Adjusted balance at 1 January

2018 1,872 26,641 (35) 67,926 96,404

Profit for the year* - - - 10,953 10,953

Total comprehensive income - - - 10,953 10,953

Share capital 11 511 - - 522

Share option movement - - - (72) (72)

Dividends paid - - - (3,986) (3,986)

At 31 December 2018 1,883 27,152 (35) 74,821 103,821

At 1 January 2019 1,883 27,152 (35) 74,821 103,821

Profit for the year - - - 16,690 16,690

Total comprehensive income - - - 16,690 16,690

Issue of share capital 104 6,026 - - 6,130

Share option movement - - - 328 328

Dividends - - - (4,363) (4,363)

At 31 December 2019 1,987 33,178 (35) 87,476 122,606

* Certain comparative information has been restated as a result

of the initial application of IFRS 16 as discussed in note 12.

Group balance sheet

As at 31 December 2019

Note 31 December 31 December

2019 2018

GBP'000 (Restated*)

GBP'000

Non-current assets

Goodwill 19,580 17,643

Other intangible assets 3,889 343

Property, plant and equipment 7,739 6,032

Right-of-use assets 21,147 20,159

Deferred tax assets 2,180 1,683

54,535 45,860

Current assets

Inventories 29,157 29,262

Trade and other receivables 90,606 73,379

Other current assets 714 877

Cash and bank balances 12,003 11,414

132,480 114,932

Total assets 187,015 160,792

Current liabilities

Trade and other payables (10,578) (6,015)

Lease liability (253) (249)

Current tax liabilities (2,066) (842)

(12,897) (7,106)

Net current assets 119,583 107,826

Non-current liabilities

Borrowings (25,715) (24,888)

Lease liability (24,307) (23,724)

Long term provisions (1,490) (1,253)

(51,512) (49,865)

Total liabilities (64,409) (56,971)

Net assets 122,606 103,821

Equity

Share capital 8 1,987 1,883

Share premium account 33,179 27,152

Employee Benefit Trust shares

reserve (35) (35)

Retained earnings 87,475 74,821

Total equity attributable

to equity holders 122,606 103,821

* Certain comparative information has been restated as a result

of the initial application of IFRS 9 as discussed in note 12.

The financial statements of H&T Group plc, registered number

05188117, were approved by the Board of Directors and authorised

for issue on 9 March 2020. They were signed on its behalf by:

J G Nichols

Chief Executive

Group cash flow statement

For the year ended 31 December 2019

Note 2019 2018 (Restated*)

GBP'000 GBP'000

Net cash generated from operating activities 6 25,829 7,182

Investing activities

Interest received - 3

Purchases of intangible assets (9) -

Purchases of property, plant and equipment (3,316) (2,102)

Acquisition of trade and assets of

businesses (18,740) (575)

Acquisition of Right-of-use assets (5,592) (1,275)

Net cash used in investing activities (27,657) (3,949)

Financing activities

Dividends paid (4,363) (3,986)

Increase in borrowings 1,000 3,000

Debt restructuring costs (350) (31)

Proceeds on issue of shares 6,130 522

Net cash generated / (used in) from

financing activities 2,417 (495)

Net increase in cash and cash equivalents 589 2,738

Cash and cash equivalents at beginning

of the year 11,414 8,676

Cash and cash equivalents at end of

the year 12,003 11,414

* Certain comparative information has been restated as a result

of the initial application of IFRS 16 as discussed in note 12.

Notes to the preliminary announcement

For the year ended 31 December 2019

1. Finance information and significant accounting policies

The financial information has been abridged from the audited

financial statements for the year ended 31 December 2019.

The financial information set out above does not constitute the

company's statutory accounts for the years ended 31 December 2019

or 2018 but is derived from those accounts. Statutory accounts for

2018 have been delivered to the Registrar of Companies and those

for 2019 will be filed with the Registrar in due course. The

auditors have reported on those accounts: their reports were

unqualified, did not draw attention to any matters by way of

emphasis and did not contain statements under s498 (2) or (3)

Companies Act 2006 or equivalent preceding legislation.

Whilst the financial information included in this preliminary

announcement has been prepared in accordance with International

Financial Reporting Standards (as adopted for use in the EU)

('IFRS'), this announcement does not itself contain sufficient

information to comply with IFRS. The Group will be publishing full

financial statements that comply with IFRS in April 2020.

Impact of initial application of IFRS 16 Leases

In the current year, the Group has applied IFRS 16 (as issued by

the IASB in January 2016) that is effective for annual periods that

begin on or after 1 January 2019.

IFRS 16 introduces new or amended requirements with respect to

lease accounting. It introduces significant changes to lessee

accounting by removing the distinction between operating and

finance lease and requiring the recognition of a right-of-use asset

and a lease liability at commencement for all leases, except for

short-term leases and leases of low value assets. In contrast to

lessee accounting, the requirements for lessor accounting have

remained largely unchanged. The impact of the adoption of IFRS 16

on the Group's consolidated financial statements is described

below.

The date of initial application of IFRS 16 for the Group is 1

January 2019.

The Company has applied IFRS 16 using the full retrospective

approach, with restatement of the comparative information.

(a) Impact of the new definition of a lease

The Company has made use of the practical expedient available on

transition to IFRS 16 not to reassess whether a contract is or

contains a lease. Accordingly, the definition of a lease in

accordance with IAS 17 and IFRIC 4 will continue to be applied to

those contracts entered or modified before 1 January 2019.

The change in definition of a lease mainly relates to the

concept of control. IFRS 16 determines whether a contract contains

a lease on the basis of whether the customer has the right to

control the use of an identified asset for a period of time in

exchange for consideration. This is in contrast to the focus on

'risks and rewards' in IAS 17 and IFRIC 4.

The Group applies the definition of a lease and related guidance

set out in IFRS 16 to all contracts entered into or changed on or

after 1 January 2019. In preparation for the first-time application

of IFRS 16, the Group has carried out an implementation project.

The project has shown that the new definition in IFRS 16 will not

significantly change the scope of contracts that meet the

definition of a lease for the Group.

(b) Impact on Lessee Accounting

(i) Former operating leases

IFRS 16 changes how the Group accounts for leases previously

classified as operating leases under IAS 17, which were off balance

sheet.

Applying IFRS 16, for all leases (except as noted below), the

Group:

(a) Recognises right-of-use assets and lease liabilities in the

consolidated statement of financial position, initially measured at

the present value of the future lease payments;

(b) Recognises depreciation of right-of-use assets and interest

on lease liabilities in profit or loss;

(c) Separates the total amount of cash paid into a principal

portion (presented within financing activities) and interest

(presented within financing activities) in the consolidated

statement of cash flows.

Lease incentives (e.g. rent-free period) are recognised as part

of the measurement of the right-of-use assets and lease liabilities

whereas under IAS 17 they resulted in the recognition of a lease

incentive, amortised as a reduction of rental expenses generally on

a straight-line basis.

Under IFRS 16, right-of-use assets are tested for impairment in

accordance with IAS 36.

(c) Financial impact of the initial application of IFRS 16

Please see note 12 for the adjustments for each financial

statement line item affected by the application of IFRS 16 for the

current and prior years.

Revenue recognition

Revenue is measured at the fair value of the consideration

received or receivable and represents amounts receivable for goods

and services and interest income provided in the normal course of

business, net of discounts, VAT and other sales-related taxes.

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the Group and the revenue can be

reliably measured. The following specific recognition criteria must

also be met before The Group recognises revenue from the following

major sources:

-- Pawnbroking, or Pawn Service Charge (PSC);

-- Retail;

-- Pawnbroking scrap and gold purchasing;

-- Personal loans interest income; and

-- Other services.

Pawnbroking, or Pawn Service Charge (PSC)

PSC comprises interest on pledge book loans, plus auction profit

and loss, less any auction commissions payable and less surplus

payable to the customer. Revenue is recognised over time in

relation to the interest accrued by reference to the principal

outstanding and the effective interest rate applicable as governed

by IFRS 9.

Retail

Retail comprises revenue from retail jewellery sales, with

inventory sourced from unredeemed pawn loans, newly purchased

inventory and inventory refurbished from the Group's gold

purchasing operation. For sales of goods to retail customers,

revenue is recognised when control of the goods has transferred,

being at the point the customer purchases the goods at the store.

Payment of the transaction price is due immediately at the point

the customer purchases the goods.

Under the Group's standard contract terms, customers have a

right of return within 30 days. At the point of sale, a refund

liability and a corresponding adjustment to revenue is recognised

for those products expected to be returned. At the same time, the

Group has a right to recover the product when customers exercise

their right of return so consequently recognises a right to

returned goods asset and a corresponding adjustment to cost of

sales.

The Group uses its accumulated historical experience to estimate

the number of returns. It is considered highly probable that a

significant reversal in the cumulative revenue recognised will not

occur given the consistent and immaterial level of returns over

previous years.

Pawnbroking scrap and gold purchasing

Scrap revenue comprises proceeds from gold scrap sales. Revenue

is recognised when control of the goods has transferred, being at

the point the smelter purchases the relevant metals.

Personal loans interest income

This comprises income from the Group's unsecured lending

activities. Personal loan revenues are shown stated before

impairment when in stages 1 and 2 of the expected credit loss model

and net of impairment when in stage 3. The impairment charge is

included within other direct expenses in the Group statement of

comprehensive income. Revenue is recognised over time in relation

to the interest accrued, as dictated by IFRS 9.

Other services

Other services comprise revenues from third party cheque

cashing, foreign exchange income, buyback, Western union and other

income. Commission receivable on cheque cashing, foreign exchange

income and other income is recognised at the time of the

transaction as this is when control of the goods has transferred.

Buyback revenue is recognised at the point of sale of the item back

to the customer, when control of the goods has transferred.

The Group recognises interest income arising on secured and

unsecured lending within trading revenue rather than investment

revenue on the basis that this represents most accurately the

business activities of the Group.

Gross profit

Gross profit is stated after charging inventory, pledge and

other services provisions and direct costs of inventory items sold

or scrapped in the year.

Other direct expenses

Other direct expenses comprise all expenses associated with the

operation of the various shops and collection centre of the Group,

including premises expenses, such as rent, rates, utilities and

insurance, all staff costs and staff related costs for the relevant

employees.

Inventories provisioning

Where necessary provision is made for obsolete, slow moving and

damaged inventory or inventory shrinkage. The provision for

obsolete, slow moving and damaged inventory represents the

difference between the cost of the inventory and its market value.

The inventory shrinkage provision is based on an estimate of the

inventory missing at the reporting date using historical shrinkage

experience.

Impairment of goodwill and other intangibles

Determining whether goodwill is impaired requires an estimation

of the value in use of the cash-generating units (stores) to which

goodwill has been allocated. The value in use calculation requires

the Group to estimate the future cash flows expected to arise from

the cash-generating unit (CGU) and a suitable discount rate in

order to calculate present value. The review is conducted annually,

in the final quarter of the year. The impairment review is

conducted at the level of each CGU, which for acquisitions

represents the specific store or stores acquired.

There was no impairment loss recorded in the current year (2018:

GBPnil). The principal assumptions applied by management in

arriving at the value in use of each cash generating unit (CGU) are

as follows:

The Group prepares cash flow forecasts over a five-year period

for each CGU. Forecast EBITDA (used as a proxy for cashflows) has

been derived by applying the Board approved base budget assumption

to each individual stores' results for the twelve months to

September 2019. For impairment review purposes, we have used

conservative growth assumptions after 2019, even in this scenario

there is still significant headroom on each CGU. A perpetuity

formula has been applied to the cashflows i.e. we have made the

assumption that periodic cashflows will be received indefinitely.

The Group has discounted the cash flows at a pre-tax, risk adjusted

rate of 9% (2018: 11%).

While the impairment review has been conducted based on the best

available estimates at the impairment review date, the Group notes

that actual events may vary from management expectation but are

comfortable that no impairment exists at the balance sheet date

based on reasonably possible sensitivities.

2. Operating segments

Business segments

For reporting purposes, the Group is currently organised into

six segments - pawnbroking, gold purchasing, retail, pawnbroking

scrap, personal loans and other services.

The principal activities by segment are as follows:

Pawnbroking:

Pawnbroking is a loan secured against a collateral (the pledge).

In the case of the Group, over 99% of the collateral against which

amounts are lent comprises precious metals (predominantly gold),

diamonds and watches. The pawnbroking contract is a six-month

credit agreement bearing a monthly interest rate of between 1.99%

and 10.00%. The contract is governed by the terms of the Consumer

Credit Act 2008 (previously the Consumer Credit Act 2002). If the

customer does not redeem the goods by repaying the secured loan

before the end of the contract, the Group is required to dispose of

the goods either through public auctions if the value of the pledge

is over GBP75 (disposal proceeds being reported in this segment)

or, if the value of the pledge is GBP75 or under, through public

auctions or the retail or pawnbroking scrap activities of the

Group.

Purchasing:

Jewellery is bought direct from customers through all of the

Group's stores. The transaction is simple with the store agreeing a

price with the customer and purchasing the goods for cash on the

spot. Gold purchasing revenues comprise proceeds from scrap sales

on goods sourced from the Group's purchasing operations.

Retail:

The Group's retail proposition is primarily gold and jewellery

and the majority of the retail sales are forfeited items from the

pawnbroking pledge book or refurbished items from the Group's gold

purchasing operations. The retail offering is complemented with a

small amount of new or second-hand jewellery purchased from third

parties by the Group.

Pawnbroking scrap:

Pawnbroking scrap comprises all other proceeds from gold scrap

sales of the Group's inventory assets other than those reported

within gold purchasing. The items are either damaged beyond repair,

are slow moving or surplus to the Group's requirements, and are

smelted and sold at the current gold spot price less a small

commission.

Personal loans:

Personal loans comprises income from the Group's unsecured

lending activities. Personal loan revenues are stated at amortised

cost after taking into consideration an assessment on a

forward-looking basis of expected credit losses.

Other services:

This segment comprises:

-- Third party cheque encashment which is the provision of cash

in exchange for a cheque payable to our customer for a commission

fee based on the face value of the cheque.

-- Buyback which is a service where items are purchased from

customers, typically high-end electronics, and may be bought back

up to 31 days later for a fee.

-- The foreign exchange currency service where the Group earns a

margin when selling or buying foreign currencies.

-- Western Union commission earned on the Group's money transfer service.

Cheque cashing is subject to bad debt risk which is reflected in

the commissions and fees applied.

Further details on each activity are included in the Chief

Executive's review.

Segment information for these businesses is presented below:

2019 Gold Retail Pawnbroking Personal Other Total

Revenue Pawnbroking purchasing GBP'000 scrap loans services GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External revenue 49,102 24,229 41,516 14,944 21,459 8,963 160,213

Total revenue 49,102 24,229 41,516 14,944 21,459 8,963 160,213

Gross profit 49,102 5,736 13,639 2,462 21,459 8,963 101,361

Impairment (10,142) - - - (10,656) - (20,798)

Segment result 38,960 5,736 13,639 2,462 10,803 8,963 80,563

Other direct expenses excluding impairment (40,044)

Administrative expenses (18,031)

Operating profit 22,488

Interest receivable -

Finance costs (2,405)

Profit before taxation 20,083

Tax charge on profit (3,393)

Profit for the financial year and

total comprehensive income 16,690

2018 (restated) Gold Retail Pawnbroking Personal Other Total

Revenue Pawnbroking purchasing GBP'000 scrap loans services GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External revenue 41,278 20,745 38,338 14,059 22,472 6,133 143,025

Total revenue 41,278 20,745 38,338 14,059 22,472 6,133 143,025

Gross profit 41,278 3,757 13,203 1,401 22,472 6,133 88,244

Impairment (10,366) - - - (15,515) - (25,881)

Segment result 30,912 3,757 13,203 1,401 6,957 6,133 62,363

Other direct expenses excluding impairment (32,855)

Administrative expenses (13,272)

Operating profit 16,236

Investment revenues 3

Finance costs (2,468)

Profit before taxation 13,771

Tax charge on profit (2,818)

Profit for the financial year and

total comprehensive income 10,953

Gross profit is stated after charging the direct costs of

inventory items sold or scrapped in the period. Other operating

expenses of the stores are included in other direct expenses. The

Group is unable to meaningfully allocate the other direct expenses

of operating the stores between segments as the activities are

conducted from the same stores, utilising the same assets and

staff. The Group is also unable to meaningfully allocate Group

administrative expenses, or financing costs or income between the

segments. Accordingly, the Group is unable to meaningfully disclose

an allocation of items included in the consolidated statement of

comprehensive income below gross profit, which represents the

reported segment results.

The Group does not apply any inter-segment charges when items

are transferred between the pawnbroking activity and the retail or

pawnbroking scrap activities .

2019 Pawn-broking Gold Retail Pawn-broking Personal Other Unallocated For the

GBP'000 purchasing GBP'000 scrap loans services assets/ year

GBP'000 GBP'000 GBP'000 GBP'000 (liabilities) ended

GBP'000 GBP'000

Other information

Capital

additions

(*) 15,716 15,716

Depreciation

and

amortisation

(*) 7,467 7,467

Balance sheet

Assets

Segment

assets 72,199 1,414 27,391 1,067 16,628 - 118,699

Unallocated

corporate

assets 45,133 45,133

Consolidated total

assets 187,015

Liabilities

Segment

liabilities - - (657) - - (209) (866)

Unallocated corporate

liabilities (63,543) (63,543)

Consolidated total

liabilities (64,409)

Gold Retail Pawn-broking Personal Unallocated Total

Pawn-broking purchasing GBP'000 scrap loans Other assets/ GBP'000

2018 (restated) GBP'000 GBP'000 GBP'000 GBP'000 services (liabilities)

GBP'000 GBP'000

Other information

Capital additions

(*) 3,554 3,554

Depreciation and

amortisation (*) 6,671 6,671

Balance sheet

Assets

Segment assets 51,991 720 28,876 543 20,491 - 102,621

Unallocated corporate

assets 47,946 47,946

Consolidated total

assets 160,792

Liabilities

Segment liabilities - - (647) - - (33) (680)

Unallocated corporate

liabilities (56,291) (56,291)

Consolidated total

liabilities (56,971)

(*) The Group cannot meaningfully allocate this information by

segment due to the fact that all the segments operate from the same

stores and the assets in use are common to all segments.

Geographical segments

The Group's revenue from external customers by geographical

location are detailed below:

2019 2018

GBP'000 GBP'000

United Kingdom 158,582 141,273

Other 1,631 1,755

160,213 143,028

The Group's non-current assets are located entirely in the

United Kingdom. Accordingly, no further geographical segments

analysis is presented.

3. Financing costs

2019 2018

GBP'000 GBP'000

Interest on bank loans 693 656

Other interest 1 1

Interest expense on the

lease liability 1,524 1,702

Amortisation of debt issue

costs 187 109

Total interest expense 2,405 2,468

4. Tax charge on profit

(a) Tax on profit on ordinary activities

Current tax 2019 2018 (Restated)

GBP'000 GBP'000

United Kingdom corporation tax charge at 19% (2018:

19%)

based on the profit for the year 3,634 2,678

Adjustments in respect of prior years 195 (94)

Total current tax 3,829 2,584

Deferred tax

Timing differences, origination and reversal 262 201

Adjustments in respect of prior years (698) 33

Total deferred tax (436) 234

Tax charge on profit 3,393 2,818

(b) Factors affecting the tax charge for the year

The tax assessed for the year is higher than that resulting from

applying a standard rate of corporation tax in the UK of 19% (2018:

19%). The differences are explained below:

2019 2018 (Restated)

GBP'000 GBP'000

Profit before taxation 20,083 13,771

Tax charge on profit at standard rate 3,816 2,616

Effects of:

Disallowed expenses and non-taxable income 150 11

Non-qualifying depreciation (80) 115

Movement in short-term timing differences 11 136

Adjustments to tax charge in respect of

prior years (504) (60)

Tax charge on profit 3,393 2,818

In addition to the amount charged to the income statement and in

accordance with IAS 12, the excess of current and deferred tax over

and above the relative related cumulative remuneration expense

under IFRS 2 has been recognised directly in equity. The amount

released from equity in the current period was GBP61,000 (2018:

taken to GBP72,000).

5. Earnings per share

Basic earnings per share is calculated by dividing the profit

for the year attributable to equity shareholders by the weighted

average number of ordinary shares in issue during the year.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

dilutive potential ordinary shares. With respect to the Group these

represent share options and conditional shares granted to employees

where the exercise price is less than the average market price of

the Company's ordinary shares during the year.

Reconciliations of the earnings per ordinary share and weighted

average number of shares used in the calculations are set out

below:

Year ended 31 December Year ended 31 December

2019 2018 (Restated)

Weighted Weighted

average Per-share average Per-share

Earnings number amount Earnings number amount

GBP'000 of shares pence GBP'000 of shares pence

Earnings per share: basic 16,690 38,039,328 43.88 10,953 36,895,316 29.68

Effect of dilutive securities

Options and conditional

shares - 68,197 (0.08) - 126,277 (0.10)

Earnings per share: diluted 16,690 38,107,525 43.80 10,953 37,021,593 29.58

6. Notes to the Cash Flow Statement

2019 2018 (Restated)

GBP'000 GBP'000

Profit for the year 16,690 10,953

Adjustments for:

Investment revenues - (3)

Finance costs 2,405 2,468

Increase/(Decrease) in provisions 237 (60)

Income tax expense 3,393 2,818

Depreciation of property, plant and equipment 2,272 2,333

Depreciation of Right-of-use assets 4,604 4,189

Amortisation of intangible assets 591 150

Share based payment expense 266 -

Loss on disposal of property, plant and equipment 70 133

Operating cash flows before movements in working

capital 30,528 22,981

Decrease in inventories 105 4,884

Decrease/(Increase) in other current assets 163 (212)

Increase in receivables (5,500) (9,947)

Increase/(Decrease) in payables 5,347 (5,405)

Cash generated/(used in) from operations 30,643 12,301

Income taxes paid (2,604) (2,776)

Interest paid on Loan Facility (686) (642)

Interest paid on Lease Liability (1,524) (1,701)

Net cash generated from operating activities 25,829 7,182

Cash and cash equivalents (which are presented as a single class

of assets on the face of the balance sheet) comprise cash at bank

and other short-term highly liquid investments with a maturity of

three months or less.

7. Earnings before interest, tax, depreciation and amortisation ("EBITDA")

EBITDA

EBITDA is defined as earnings before interest, taxation,

depreciation and amortisation. It is calculated by adding back

depreciation and amortisation to the operating profit as

follows:

2019 2018 (Restated)

GBP'000 GBP'000

Operating profit 22,488 16,236

Depreciation and amortisation 2,862 2,482

Depreciation of the Right-of-use

assets 4,604 4,189

EBITDA 29,954 22,907

The Board consider EBITDA to be a key performance measure as the

Group borrowing facility includes a number of loan covenants based

on it.

8. Share capital

2019 2018

GBP'000 GBP'000

Issued, authorised and fully paid

39,736,476 (2018: 37,658,511) ordinary

shares of GBP0.05 each 1,987 1,883

The Group has one class of ordinary shares which carry no right

to fixed income.

The Group issued share capital amounting to GBP104,000 (2018:

GBP11,000) during the year. GBP94,000 related to the issue of share

capital via a new equity placement and GBP10,000 in relation to

share options exercised in

the year. Associated share premium of GBP6,026,000 (2018: GBP511,000) was created.

9. Acquisitions

The following acquisitions were made during the year:

Total Total

Acq 1 Acq 2 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

Financial assets

Goodwill 1,937 - 1,937 -

Intangible assets 2,056 1,835 3,891 163

Property, plant and equipment 1,185 - 1,185 25

Inventory - - - 44

Trade receivables 4,821 6,906 11,727 343

Cash 1,012 - 1,012 280

Total assets acquired 11,011 8,741 19,752 855

Total consideration:

Cash 11,011 8,741 19,752 855

Net cash outflow arising

on acquisition

Cash consideration 11,011 8,741 19,752 855

Less: cash balances acquired (1,012) - (1,012) (280)

Total assets acquired 9,999 8,741 18,740 575

Acquisition 1

On 1 July 2019, the Company acquired trade and assets from TM

Sutton Ltd (t/a The Money Shop) for total consideration of

GBP11.0m. The fair value of financial assets includes trade

receivables measured in accordance with IFRS 9 and intangible

assets which have been valued by the Group based on discounted cash

flow. Of the consideration paid, GBP1.6m remains in escrow pending

certain performance conditions.

Acquisition 2

On 7 October 2019, the Company acquired trade and assets from

Speedloan Finance Ltd (t/a Albermarle & Bond or A&B) f or

total consideration of GBP8.7m. The fair value of financial assets

includes trade receivables measured in accordance with IFRS 9 and

intangible assets which have been valued by the Group based on

discounted cash flow. Other than the consideration paid, there are

no material cash flows relating to the acquisition.

10. Contingent Liabilities

As set out in our market release of 18 November 2019, we will be

working with a skilled person appointed in conjunction with the FCA

on a past-book review of our lending since April 2014 within the

High Cost Short Term unsecured lending (HCSTC) market. A skilled

person is in the course of being appointed. At this stage, under

the criteria in IAS 37 Provisions, contingent liabilities and

contingent assets it is possible that a liability may exist, but

H&T is unable to estimate the quantum of any such possible

liability.

11. Events after the balance sheet date

The Directors have proposed a final dividend for the year ended

31 December 2019 of 7.0p (2018: 6.6p).

12. Explanation of transition to IFRS 16

On transition to IFRS 16, the Group previously classified leases

as operating leases based on its assessment of whether the lease

transferred significantly all of the risks and rewards. Under IFRS

16, the Group recognises right-of-use assets and lease liabilities

- these leases are on the Balance Sheet.

The Group has applied the recognition exemption to short-term

leases of machinery and leases of IT equipment.

The tables below show the amount of adjustment for each

financial statement line item affected by the

application of IFRS 16 for the current and prior year.

Impact on profit or loss, other comprehensive

income and total comprehensive income as at GBP'000

31 December 2018

Decrease in administrative expenses (6,126)

Increase in Depreciation of right-of-use assets 4,189

Increase in Interest on Lease liability 1,701

Increase in tax charged on profit 112

Increase in profit for the year 124

Impact on assets, liabilities and equity as

at 1 January

2018

Decrease in trade and other receivables (1,389)

Increase in trade and other payables 1,370

Increase in Lease liabilities (27,026)

Increase in Right-of-use assets 23,073

Increase in deferred tax assets 675

Total effect on net assets (3,297)

Retained earnings (3,297)

Impact on assets, liabilities and equity as

at 31 December 2019

Decrease in trade and other receivables (1,342)

Increase in trade and other payables 1,143

Increase in Lease liabilities (24,560)

Increase in Right-of-use assets 21,147

Increase in deferred tax assets 540

Decrease in tax liabilities (68)

Total effect on net assets (3,140)

Retained earnings (3,140)

The application of IFRS 16 has had no impact on the cash flows

of the Group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR DDGDXSXGDGGC

(END) Dow Jones Newswires

March 10, 2020 03:00 ET (07:00 GMT)

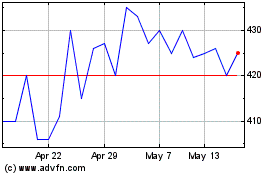

H&t (LSE:HAT)

Historical Stock Chart

From Oct 2024 to Nov 2024

H&t (LSE:HAT)

Historical Stock Chart

From Nov 2023 to Nov 2024