RNS No 7564h

GOOCH & HOUSEGO PLC

14 June 1999

The issuer has made the following alteration to the

GOOCH & HOUSEGO PLC - INTERIM RESULTS

announcement released today.

Under the "DIVIDEND" section of the announcement the interim dividend should

read "0.6p", not "0.66p".

All other details remain unchanged.

Interim results for the six months ended 31 March 1999

Gooch & Housego PLC ("G&H"), the specialist manufacturer

of precision optical components and bespoke glass engineering

items, acoustic-optic devices and instruments for measuring

optical radiation, today announces interim results for the

six months ended 31 March 1999.

HIGHLIGHTS

* Pre tax profits of #833,000 (1998: #826,000)

* Turnover marginally lower at #2,296,000 (1998: #2,326,000)

* Q-Switch sales down by 18%, whilst RF Driver sales

increased by 122%

* Positive start from Cleveland Crystals

* Interim dividend of 0.6p (1998: 0.5p) per ordinary share

For further information:

Archie Gooch/ Gareth Jones

Gooch & Housego PLC Tel: 01460 52271

Tim Thompson/ Jennie Roberts

Buchanan Communications Tel: 0171 4665000

CHAIRMAN'S STATEMENT

I am pleased to submit my report on a period when

Gooch & Housego has achieved similar pre-tax profits to

last year and completed the key strategic acquisition of

Cleveland Crystals Inc. ("CCI").

GROUP

The Group has performed satisfactory for the six months

ended 31 March 1999. Pre-tax profits, including a two

month contribution from the acquisition of CCI, were

#833,000 (1998: #826,000) after charging amortisation

of goodwill, of #28,000 arising on the acquisition.

These are satisfactory results in a period when difficult

trading conditions in the Far East, and turmoil in the

semi-conductor market led to a reduction in demand for

acousto-optics products - albeit partially offset by an

increase in demand for our conventional optics products

in the UK.

The acquisition of CCI, along with new products under

development and a strong order book for the United Kingdom

business, give grounds for cautious optimism for the long

term future, although it is very difficult to predict the

contributions from individual businesses in the shorter term.

UNITED KINGDOM

Turnover was marginally lower than in the same period last year

at #2,296,000 (1998: #2,326,000). The reduced demand for

Q-switches, attributable to the problems in the semi-conductor

industry referred to in my last Annual Report Statement has

continued, with sales down by 18%. The trend for major

customers to renew their contracts on an annual basis has

continued with the result that the Q-switch order book

actually increased by 2% during the period. The downturn in

sales therefore reflects a reduced order call-off rather

than any significant change in our competitive position

in the market.

RF driver sales increased by 122% for the equivalent period

and now account for 10% of UK sales, representing considerable

added value to the Q-switch business. The sluggishness of the

laser market in general has, however, resulted in a slightly

reduced demand for our other acousto-optic products with sales

down by 7%. In contrast, demand for precision optics, lenses,

prisms and waveplates has increased considerably with orders

on hand up by 74%.

This represents not only a shift in the type of work, but also the

complexity of the manufacturing process. This has more recently

resulted in less efficient production and a decline in

profitability as well as a need for more labour with optical

engineering skills. Due to the shortage of skilled workers

available for recruitment, we have increased the training of

employees with the assistance of our skilled staff, who

have been very willing to share their knowledge.

A number of measures are being taken to improve our flexibility

and responsiveness, including the progressive introduction of new

computerised material requirements planning and production control

systems. In addition, we have opened new facilities in the USA at

the O.L.I factory, which will allow direct supply of conventional

optics to our overseas customers.

Progress on the development of a fibre-optic switch for

telecommunications applications is ongoing. The research laboratory

dedicated to this project is now fully established, and our new

physicist is generating encouraging initial results. An intensive

programme of work lies ahead.

UNITED STATES

Cleveland Crystals Inc

The Board is very pleased to have secured the $6,500,000 acquisition

of CCI at an exciting time in that Company's development. The

acquisition of 100% of the share capital was financed by new bank

loans of #3.3 million and cash from reserves. CCI have recently

commenced work on a new incrementally funded $5 million contract

to grow and fabricate crystal plates for the new laser under

construction at the US Department of Energy's National Ignition

Facility (NIF) at Lawrence Livermore National Laboratory in

California. This contract is expected to contribute over

$1,000,000 of sales in the current financial year. Lawrence

Livermore is investing in a new specially equipped facility

at CCI and it is anticipated that this and similar projects

will play an important role in CCI's future.

There has already been interaction between G&H and CCI in the

areas of marketing and technology, targeting key customers with

each company's complementary product range. There will be significant

benefits to be derived from a united approach. In this respect we

warmly welcome CCI's President, Dr Eugene Arthurs, and look forward

to a successful future with him.

CCI has made an impressive start since acquisition into the G&H

group contributing turnover of $1,207,000 and profit before tax of

$265,000 after adjusting for the amortisation of goodwill and interest

on loans. The business of CCI provides larger and more individually

significant sales. The timing of sales is difficult to predict.

This makes it more difficult to forecast both turnover and profits

in any given period.

Optronic Laboratories Inc

Trading at Optronic Laboratories Inc (OLI) continues to be difficult

and the Company has recorded a profit of $154,000 for the half year,

which represents a drop of 14% on the same period last year.

However, diversification is continuing and new products were

introduced at the CLEO Exhibition in Baltimore USA in May

and will also be exhibited at the forthcoming Laser '99

Exhibition in Munich. The new RF driver business has shown

encouraging growth and the new optics manufacturing unit

has recently begun production.

We appreciate the effort that is being made by Steve Denomme,

President of OLI.

DIVIDEND

The Board has declared an interim dividend of 0.6p (1998: 0.5p)

per Ordinary Share. The dividend will be payable on 22 July 1999

to all shareholders registered on 25 June 1999.

Archie Gooch M.B.E. J.P.

Executive Chairman

Copies of the statement will be sent to shareholders

during the week of 14 June 1999, and will be available from

The Old Magistrates Court, Ilminster, Somerset.

CONSOLIDATED PROFIT AND LOSS ACCOUNT

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

1999 1998 1998

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Turnover - existing 3,511 3,662 7,154

- acquisitions 743 - -

--------- --------- ------

4,254 3,662 7,154

--------- --------- -------

Operating profit

- existing 658 826 1,701

- acquisitions 194 - -

-------- --------- -------

Operating profit before

exceptional item 852 826 1,701

Exceptional item:

Profit on disposal

of fixed assets - - 85

-------- --------- -------

Profit on ordinary activities

before interest 852 826 1,786

Net interest

receivable/(payable) (19) - 26

-------- --------- -------

Profit on ordinary activities

before taxation 833 826 1,812

Tax on profit on

ordinary activities (291) (249) (569)

-------- --------- ---------

Profit on ordinary activities

after taxation 542 577 1,243

Dividends on

equity shares (101) (85) (288)

-------- --------- --------

Retained profit for the

financial period 441 492 955

--------- --------- -------

Earnings per

ordinary share 3.2p 3.6p 7.5p

--------- --------- --------

All of the amounts above are in respect of continuing operations.

Earnings per ordinary share is calculated on profit on

ordinary activities after taxation, using the weighted average

number of shares in issue for the period, of which there were

16,904,162 (1998: 16,150,630).

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

1999 1998 1998

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Profit for the financial period 542 577 1,243

Currency translation differences on

foreign currency net

investments 112 (71) (55)

---------- ---------- -----

Total gains and losses for

the financial period 654 506 1,188

---------- ---------- -----

CONSOLIDATED BALANCE SHEET

31 March 31 March 30 September

1999 1998 1998

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Fixed assets

Intangible assets 3,412 5 4

Tangible assets 3,337 2,862 2,955

------------ ----------- ------

6,749 2,867 2,959

------------ ----------- -------

Current assets

Stocks 1,777 918 1,178

Debtors 2,302 1,736 1,591

Cash at bank and in hand 735 1,337 1,416

------------ ----------- -------

Total current assets 4,814 3,991 4,185

------------ ----------- -------

Creditors: amounts falling due

within one year (2,443) (1,622) (1,571)

------------ ----------- --------

Net current assets 2,371 2,369 2,614

------------ ----------- --------

Total assets less

current liabilities 9,120 5,236 5,573

creditors: amounts

falling due after more

than one year (3,299) (412) (305)

-------- -------- ---------

Net assets 5,821 4,824 5,268

-------- -------- ----------

Capital and reserves

Called up share capital 3,381 3,381 3,381

Share premium 1,113 1,115 1,113

Revaluation reserve 308 308 308

Profit and loss account 1,019 20 466

-------- -------- -------

Equity shareholders'funds 5,821 4,824 5,268

======= ======= =======

CONSOLIDATED CASH FLOW STATEMENT

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

1999 1998 1998

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Cash flow from operating activities

(note 1) 672 786 1,423

Returns on investments

and servicing of finance

Interest received 31 33 88

Interest paid (33) (37) (67)

Interest element of

hire purchase contracts (2) (3) (7)

------------ ------------ -----------

Net cash (outflow/inflow

from returns on investments and

servicing of finance (4) (7) 14

Taxation

UK tax paid (51) (11) (374)

Overseas tax paid (40) (20) (68)

----------- ---------- -----------

Cash outflow from taxation (91) (31) (442)

Capital expenditure

and financial investment

Acquisition of subsidiary (4,089) -

Cash acquired on acquisition 55 - -

Purchase of tangible

fixed assets (245) (933) (1,193)

Sale of tangible fixed assets 3 1 286

---------- ------------ ----------

Net cash outflow

from capital expenditure

and financial investment (4,276) (932) (907)

Equity dividends paid (203) (26) (111)

------------ ------------ ---------

Net cash (outflow)

/inflow before financing (3,902) (210) (23)

Financing

Cash inflow from flotations - 1,495 1,495

New bank loans 3,338 - -

Repayment of bank loan (105) (119) (219)

Hire purchase repayment (28) (5) (11)

------------ -------- ----------

Net cash inflow/(outflow)

from financing 3,205 1,371 1,265

Increase/(decrease)

in cash in the period (note 2) (697) 1,161 1,242

------------ ------------ -------------

NOTES TO THE CASH FLOW STATEMENT

Reconciliation of operating profit to operating cash flows

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

1999 1998 1998

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Operating profit 852 826 1,701

Depreciation 165 141 258

Amortisation of goodwill 28 - -

Increase in stock (115) (97) (362)

Increase in debtors (282) (86) (95)

Increase in creditors 24 2 (79)

------- --------- -------

672 786 1,423

-------- --------- -------

(2) Reconciliation of net cash inflow to movement

in net debt

6 months 6 months 12 months

ended ended ended

31 March 31 March 30 September

1999 1998 1998

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

(Decrease)/increase

in cash in the period (697) 1,161 1,242

Cash outflow from

decrease in debt and lease

financing 133 124 230

----------- ---------- -----------

Changes in net debt

resulting from cashflows (564) 1,285 1,472

New bank loans (3,338) - -

Translation difference (17) (8) (12)

------------ ---------- -----------

Movement in net debt

in the period (3,919) 1,277 1,460

Net debt at

1 October 1998 893 (567) (567)

------------ ---------- -----------

Net debt at

31 March 1999 (3,026) 710 893

------------ ---------- -----------

The comparative figures for the year to 30 September 1998

are an abridged version of the Accounts filed with the Registrar

of Companies, on which unqualified audit opinion has been given.

BASIS OF PREPARATION AND ACCOUNTING POLICIES

The unaudited results for the half year to 31 March 1999

have been prepared in accordance with UK generally accepted

accounting principles. The accounting policies applied are those

set out in the Group's 1998 Annual Report and Account except for

changes in accounting arising from the adoption of Financial

Standard Number 10 Goodwill and intangible assets (FRS 10).

Under FRS10 goodwill arising on acquisitions made after 1 October 1998

is capitalised and amortised over its estimated useful life.

Previously, all goodwill was written off to a goodwill reserve

on acquisition. On adoption of FRS10 the goodwill reserve of

#1,335,000 has been transferred to the profit and loss reserve.

There has been no impact on the net assets of the Group.

The amortisation charge in respect of capitalised goodwill for

the first half of 1999 was #28,000.

END

IR GIGBLLXBCCCS

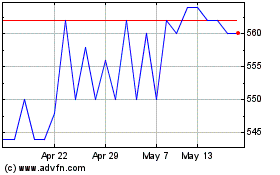

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jul 2023 to Jul 2024