TIDMGHH

RNS Number : 0041B

Gooch & Housego PLC

04 June 2019

4 June 2019

GOOCH & HOUSEGO PLC

INTERIM RESULTS FOR THE SIX MONTHSED 31 MARCH 2019

Gooch & Housego PLC (AIM:GHH) ("Gooch & Housego",

"G&H", the "Company" or the "Group"), the specialist

manufacturer of optical components and systems, today announces its

interim results for the six months ended 31 March 2019.

Key Financial Highlights

Period ended 31 March H1 2019 H1 2018 Change

Revenue GBP59.7m GBP55.6m 7.4%

----------- --------- -----------

Adjusted profit before

tax(1) GBP5.4m GBP7.0m (22.8%)

----------- --------- -----------

Adjusted basic earnings

per share (1) 16.4p 21.5p (23.7%)

----------- --------- -----------

Net (debt) / cash (GBP14.5m) GBP5.0m (GBP19.5m)

----------- --------- -----------

Statutory profit before

tax GBP1.5m GBP5.2m (71.8%)

----------- --------- -----------

Statutory basic earnings

per share 1.1p 18.6p (94.1%)

----------- --------- -----------

Interim dividend per share 4.3p 4.2p 2.4%

----------- --------- -----------

(1) Adjusted for amortisation of acquired intangible assets and

non-recurring items.

Highlights

-- Revenue growth of 7.4% compared with the same period last

year. This was despite a challenging industrial laser market, due

to cyclical downturn and continued US/ China trade dispute.

Excluding the impact of foreign exchange, an increase of 4.1% over

H1 last year

-- We anticipate non- industrial laser business will perform in

line with our expectations. Industrial laser orders have increased

since our last update, but we are now assuming that industrial

laser business will not return to 'normal' levels in FY 2019 and

instead we only supply known / high certainty orders.

-- Given revised industrial laser outlook, Board's expectations

for the Group's adjusted PBT for FY 2019 now reduced by circa

GBP3.5- 4.0 million

-- Hi- reliability fibre couplers to benefit from investment

made in H1 and to show step change in H2. Anticipating a threefold

increase in demand over the next three years, compared to FY

2018.

-- Life science business has more than doubled in size compared

to H1 last year, due to organic growth across all three main Life

Science areas and successful acquisition of ITL

-- Record half year order book of GBP93.2 million, as at 31

March 2019, an increase of 10.0% compared with the same period last

year. Excluding the impact of foreign exchange, an increase of

5.3%.

-- Interim dividend increased to 4.3p (2018:4.2p), reflective of

the Board's longer term confidence in the business, whilst

acknowledging challenging industrial laser trading conditions

Mark Webster, Chief Executive Officer of Gooch & Housego,

commented:

"Trading in the last six months has reflected trends previously

reported. G&H has long been aware of the risks associated with

the cyclical nature of the microelectronics sector and more

recently the continued impact of the US/ China trade dispute. Our

industrial laser order book has increased since our last update,

but we now forecast the industrial laser business will not return

to 'normal' levels in FY 2019.

"Technical innovation in microelectronic, semiconductor and

industrial manufacturing, coupled with our market leading position

means we expect supply of critical components to industrial lasers

to be an important source of growth for G&H for the foreseeable

future.

"The non- industrial laser business is expected to perform in

line with management's expectations. Our fibre optics business

generally is performing strongly and in particular we are investing

in further capacity to take advantage of the multi- year strong

demand growth for hi- reliability fibre couplers.

"We remain confident in the potential of the industrial laser

sector and our other markets to provide attractive long term

growth.

"G&H remains committed to further diversification and moving

up the value chain. We will continue to invest in R&D and where

appropriate make acquisitions in order to meet these strategic

objectives."

For further information please contact:

Mark Webster / Andrew

Gooch & Housego PLC Boteler 01460 256 440

Mark Court / Sophie

Buchanan Wills 020 7466 5000

Investec Bank plc (Nomad Patrick Robb / David

& Broker) Anderson 020 7597 5970

Notes to editors

1. Gooch & Housego is a photonics technology business with

operations in the USA and Europe. A world leader in its field, the

company researches, designs, engineers and manufactures advanced

photonic systems, components and instrumentation for applications

in the Aerospace & Defence, Industrial, Life Sciences and

Scientific Research sectors. World leading design, development and

manufacturing expertise is offered across a broad range of

complementary technologies. It is headquartered in Ilminster,

Somerset, UK.

2. This announcement contains certain forward-looking statements

that are based on management's current expectations or beliefs as

well as assumptions about future events. These are subject to risk

factors associated with, amongst other things, the economic and

business circumstances occurring from time to time in the countries

and sectors in which G&H operates. It is believed that the

expectations reflected in these statements are reasonable but they

may be affected by a wide range of variables which could cause

actual results, and G&H's plans and objectives, to differ

materially from those currently anticipated or implied in the

forward-looking statements. Investors should not place undue

reliance on any such statements. Nothing in this announcement

should be construed as a profit forecast.

Operating and Financial Review

Performance Overview

In sharp contrast to 2018, trading conditions in the first six

months of our 2019 financial year were challenging as adverse

macro-economic factors including the US/China trade dispute and a

downturn in the semiconductor equipment and microelectronics

sectors created a difficult business environment. The effect was

reduced demand for our critical components for industrial lasers

used to manufacture semiconductor equipment and microelectronics.

In contrast demand for fibre optic products and hi- reliability

fibre couplers used in undersea networks exhibited strong growth.

First half revenue growth was 7.4%; excluding the impact of foreign

exchange, growth was 4.1%; and excluding the impact of foreign

exchange and acquisitions revenue fell by 5.4%.

As previously stated, G&H has long been aware of the

potential risks associated with the cyclical nature of the

microelectronics sector and more recently the continued impact of

the US/China trade dispute. Our industrial laser order book has

improved since our last update, but we are now assuming that the

industrial laser business will not return to more 'normal' levels

in FY 2019 and we only supply orders that are known or where we

have a high level of certainty.

We expect the non- industrial laser business will be in line

with management expectations. Fibre optics is strong in general and

we believe that hi- reliability fibre couplers in particular are

about to experience a multi-year growth phase. As a result we are

investing in further capacity to take advantage of our market

leading position in this area. The benefits of the first phase of

this growth should become apparent in the second half of the

current financial year.

While there has been necessary investment in extra capacity in

the fibre optics business, cost reduction measures will deliver an

overall reduction in our cost base for FY 2019. These measures

include structural changes which will deliver a leaner, more

efficient organisation going forward.

Our order book stood at GBP93.2 million as at 31 March 2019, a

record for the half year period and which represents an increase of

10.0% compared with the same time last year. Trading conditions

improved in the second quarter as microelectronic customer

inventory levels began to improve and order activity picked up in

the Aerospace & Defense and Telecommunications sectors. Order

intake in the second quarter was 38% higher than in the first

quarter, though down overall in H1 compared with an historically

high comparative.

The increase in our interim dividend by 2.4% reflects a balance

between our longer term confidence in the business going forward

and our strong balance sheet, whilst acknowledging challenging

trading conditions in our industrial laser market.

REVENUE

Six months ended 2019 2018

31 March

----------------- -----------------

GBP'000 % of GBP'000 % of

total total

--------------------- -------- ------- -------- -------

Industrial 29,603 50% 32,457 58%

Aerospace & Defence 18,447 31% 18,130 33%

--------------------- -------- ------- -------- -------

Life Sciences 11,658 19% 5,021 9%

--------------------- -------- ------- -------- -------

Group Revenue 59,708 100% 55,608 100%

--------------------- -------- ------- -------- -------

Products and Markets - Industrial

Gooch & Housego's principal industrial markets are

industrial lasers, telecommunications, metrology, sensing and

semiconductor manufacturing. Industrial lasers are used in a

diverse range of precision material processing applications ranging

from microelectronics to automotive.

Business in our industrial market was polarised between

subsectors in the first six months of the year. Overall, sales of

products into our industrial markets in the six months to 31 March

2019 were 8.8% lower compared with the equivalent period last year;

excluding foreign exchange this represented a 10.9% decrease.

The industrial laser and semiconductor markets were 14.4% lower,

albeit against historically high comparators, due to adverse

cyclical macro-economic factors and the continuing US/China trade

dispute.

In telecommunications, we believe there will be continued strong

demand for fibre optic components used in under-sea

telecommunications applications, ultimately from Silicon Valley

based companies entering this market and looking to lay their own

undersea networks. Significant orders have been placed, ramp plans

are well progressed and we expect a strong performance from this

business in the second half of this year and into FY 2020 and FY

2021.

Products and Markets - Aerospace & Defence ("A&D")

Product quality, reliability and performance are paramount in

this sector, playing to G&H's strengths, along with our

commitment to provide value. We have solid, well established

positions in target designation and range finding, ring laser and

fibre optic gyroscope navigational systems, infrared and RF

countermeasures, periscopes and sighting systems, opto-mechanical

subsystems used in unmanned aerial vehicles ("UAVs") and space

satellite communications.

The A&D market for G&H is characterised by high-value,

long-term programmes involving the main US and European defence

contractors. Over the past three years, G&H has strengthened

its position in this market with the acquisition of four businesses

(Kent Periscopes, Alfalight, StingRay & Gould Fiber Optics)

whose focus is either entirely or mainly A&D. This reflects

G&H's commitment to this market which continues to represent an

attractive growth area as more applications seek photonics

solutions in a sector with high regulatory and compliance hurdles

and challenging expectations of its equipment.

Our Aerospace & Defence revenue grew by 1.7% during the

first six months of FY2019, compared to the equivalent period last

year. Aerospace & Defence reduced organically by 1.6%, compared

with the same period last year. This was primarily driven by

programme delays at our Boston site which will come on stream in H2

and should deliver a significantly improved H2 performance.

Products and Markets - Life Sciences / Biophotonics

G&H's three principal Life Sciences / Biophotonics revenue

streams are derived from diagnostics (fibre-optic modules for

optical coherence tomography ("OCT") applications, surgery /

treatments (electro-optics and acousto-optics for lasers) and

biomedical research (acousto-optics for microscopy applications).

In each application area the Company is making steady progress in

moving up the value chain and is currently selling sub-systems as

well as components to several larger customers. All areas

demonstrated good year on year organic growth.

Our Life Sciences / Biophotonics revenue grew by 132.2% in the

six months to 31 March 2019, compared with the equivalent period

last year. This was driven by the acquisition of VITL Ltd ("ITL")

in August 2018. On an organic basis, excluding acquisitions the

Life Sciences / Biophotonics sector grew by 4.2%.

Strategy

G&H's strategy is built around the twin pillars of

diversification and moving up the value chain. In order to ensure

its strategic goals are met management actively looks to invest in

R&D, acquisitions and strategic partnerships.

R&D: In the first six months of the current financial year,

G&H invested GBP4.0 million in targeted research &

development. Our main target areas are a new generation of

precision lasers and laser systems, optical sensing for harsh

environments, OCT medical diagnostics, laser surgery, space

satellite communications, opto-mechanical systems for UAVs and

armoured vehicles and laser directed energy weapons. This

represents 6.8% of revenue and is 2.2% lower than the same period

last year (2018: GBP4.1m), albeit this is impacted by the strength

of Sterling against the US Dollar. G&H's continued commitment

to investing in targeted R&D programmes is bearing fruit, with

24 new products launched in the period ended 31 March 2019.

Diversification: G&H seeks to develop, through R&D and

acquisition, a presence in new markets that offer the potential for

significant growth as a result of their adoption of photonic

technology, whilst also reducing exposure to cyclicality in any

particular sector. We will continue to invest in our key sectors in

order to ensure we maintain a balanced portfolio and over time

achieve critical mass in Life Sciences and further strengthen our

position in A&D. Our recent acquisitions have greatly improved

our position in Life Sciences / Biophotonics, which now represents

19.5% of our business (2018: 9.0%).

Moving up the Value Chain: G&H seeks to move up the value

chain to more complex sub-assemblies and systems through leveraging

its excellence in materials and components, and by providing

photonic design and engineering solutions for our customers. This

will enable G&H to transition from a components supplier to a

solutions provider. A significant proportion of our business in the

Aerospace & Defence market now comes from the sale of

sub-systems rather than discrete components. Our recent

acquisitions, particularly that of VITL Ltd ("ITL"), are design and

sub-assembly businesses and have helped to increase the proportion

of our business derived from sub- system or system revenues from

22.4% in H1 2018 to 31.7%, for H1 2019. G&H has a world class

capability in opto-mechanical design and this substantially

enhances our ability to offer "end to end" design and manufacturing

solutions to our customers.

As well as continuing to develop a leadership position in space

photonics, the global R&D team is actively engaged in

near-market developments in OCT, fibre lasers and fibre optic

sensing as the Company leverages its components expertise to move

up the value chain in these important areas.

Operations

As previously reported, Gooch & Housego's manufacturing

sites have been re-organised into three technical groups, namely

Acousto Optic/Electro Optic, Precision Optics/ Systems and Fibre

Optics. This is part of becoming a more scalable organisation able

to accommodate anticipated growth rates. There have already been

benefits, as we upgrade capacity and performance at Fibre Optic and

Acousto Optic sites.

Principal Risks and Uncertainties

The principal risks and uncertainties to which the Group is

exposed and our approach to managing those risks are unchanged from

those identified on page 27 of our 2018 Annual Report.

Acquisitions

G&H continues to evaluate various acquisition opportunities

that have the potential to accelerate delivery of the Company's

strategic objectives. Having established a presence in its target

markets, G&H is now focusing on moving up the value chain in

each of those markets. Whilst the business will continue to

evaluate bolt-on businesses in our core component technologies,

continued strong focus is being placed on acquisition opportunities

that enhance the Company's ability to wrap electronics and software

around core photonic products to yield system-level solutions. In

August 2018 G&H acquired VITL Ltd ("ITL"). This acquisition

expanded the Company's presence in the life sciences sector and

further enables G&H's move into system based products.

ITL is a UK based specialist in the design, development and

manufacture of high quality medical and in vitro diagnostic (IVD)

devices. ITL is a market leading supplier with an established group

of long standing multi-national customers. It provides full product

development, design, manufacturing and after sale service for the

commercialisation of medical diagnostic, analytical, precision

electro-mechanical and laboratory instruments. ITL has continued to

exceed our expectations.

In September 2018 G&H acquired the trade and assets of Gould

Technology LLC, trading as Gould Fiber Optics ("GFO"). This

acquisition strengthened G&H's position as the world leader in

fused fibre optic technology and provides enhanced access to

strategic US aerospace and defence customers. As anticipated action

is required to improve GFO's manufacturing capability before we can

take full advantage. GFO is performing below our expectations as

programme delays have impacted order intake, this will be reflected

in the earn out payments.

In November 2018, GBP2.1 million was paid in respect of the

final tranche of the 2016 Kent Periscopes acquisition. This

represented 84% of the maximum potential.

In February 2019, $3.3 million was paid in respect of the final

tranche of the 2017 StingRay acquisition. This represented 83% of

the maximum potential.

As part of its bi-annual review of the carrying value of

goodwill, the Board has taken the decision to impair the goodwill

relating to the Boston cash generating unit. This goodwill arose on

the acquisition of EM4, now referred to as Gooch & Housego

Boston, in January 2011 for consideration of $11.6 million and,

prior to the impairment, the carrying value of the associated

goodwill was GBP5.1m. Over the last eight years this acquisition

has played a vital role in Gooch & Housego's diversification

strategy, by providing the systems and critical mass needed for the

Company to become a credible player in the Aerospace & Defence

market. The duplication of Boston's technology in our Torquay

facility has also been a key factor in allowing Gooch & Housego

to address the European space market. However, on a stand-alone

basis, Boston has struggled to grow its engineering services

business. Whilst recent contract awards for this business are

encouraging signs for the future, nevertheless, the Board feels it

is appropriate to make an impairment of GBP2.6m to the carrying

value of Boston.

RECONCILIATION OF ADJUSTED PERFORMANCE MEASURES

Operating Net finance Taxation Profit after Earnings

profit costs tax per share

-------------------- ------------------ ------------------ ------------------ ----------------

Half Year to 31 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018

March GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 pence pence

-------------------- -------- -------- -------- -------- -------- -------- -------- -------- ------- -------

Reported 2,976 5,692 (1,494) (444) (1,211) (668) 271 4,580 1.1 18.6

-------------------- -------- -------- -------- -------- -------- -------- -------- -------- ------- -------

Amortisation of

acquired

intangible assets 1,829 954 - - (74) (62) 1,755 892 7.0 3.6

Restructuring costs 639 502 - - (135) (103) 504 399 2.0 1.6

Site closure costs (521) - - - 99 - (422) - (1.7) -

Impairment of

goodwill 2,576 - - - - 2,576 - 10.3 -

Interest on

discounted

deferred

consideration - - 850 305 - - 850 305 3.5 1.2

Adjustment to

accrued

contingent

consideration (1,445) - - - - (1,445) - (5.8) -

Impact of US tax

rate

change on deferred

tax balances - - - - - (864) - (864) - (3.5)

-------------------- -------- -------- -------- -------- -------- -------- -------- -------- ------- -------

Adjusted 6,054 7,148 (644) (139) (1,321) (1,697) 4,089 5,312 16.4 21.5

-------------------- -------- -------- -------- -------- -------- -------- -------- -------- ------- -------

Adjusted profit before tax was GBP5.4 million, a reduction of

22.8% on the prior year (H1 2018: GBP7.0 million). This reduction

in profit reflects a combination of lower volumes in our

micro-electronics market, delays in placing a number of A&D

contracts and investment in the capacity expansion to address the

surge in demand for undersea telecommunications products.

Cash Flow and Financing

In the six months to 31 March 2019, G&H generated cash from

operations of GBP5.0 million, compared with GBP1.2 million in the

same period of 2018. Inventory has increased by GBP3.1 million

since the year end with the business investing in selected finished

goods inventory to both reduce customer lead times and to prepare

for the undersea telecommunications demand surge. As expected the

year end receivables position has largely unwound and is GBP5.8

million lower as at 31 March 2019.

Capital expenditure on property, plant and equipment was GBP2.8

million in the period (2018: GBP2.7 million). The main fixed asset

additions were in relation to increasing capacity in our sites.

Expenditure on upgrading our ERP system of GBP0.4m is included in

intangible capital expenditure.

The Company's net debt position remains comfortable at GBP14.5

million, up from GBP10.6 million at 30 September 2018, following

the payment of the StingRay & Kent Periscopes earn outs and the

investment in working capital.

Staff

The Company workforce reduced from 1,007 at 30 September 2018 to

990 at the end of March 2019.

Board Changes

As previously announced our Chief Financial Officer, Andrew

Boteler, will leave G&H in June 2019. His successor, Chris

Jewell, is expected to join in September 2019, and we look forward

to welcoming Chris to G&H. In the interim period between Andy

leaving and Chris' start date our Group Financial Controller Gareth

Crowe will lead the finance function.

Alex Warnock, our Chief Operating Officer, has decided to step

down from the Board, and will leave the Group after the end of the

current financial year. He has put in place a strong and

experienced management team based around three manufacturing

centres, which has been successfully operating in its current

structure for the best part of two years. We currently do not

intend to replace Alex and the three manufacturing heads will

report directly to the CEO.

Both Andy and Alex have been an important part of G&H's

success, and their hard work, commitment and experience will be

missed. We wish them both well for their future endeavours.

Dividends

The Directors have declared an interim dividend of 4.3p per

share (2018 : 4.2p per share), a 2.4% increase on the prior period,

which is reflective of the Directors' confidence in the business

going forward, is underpinned by our strong balance sheet, whilst

acknowledging challenging industrial laser trading conditions. This

dividend will be payable on 26 July 2019 to shareholders on the

register as at 21 June 2019.

Prospects and outlook

Trading in the last six months has reflected trends we have

previously reported. The business has seen a downturn in demand for

critical components used in industrial lasers for microelectronic

manufacturing, particularly from China. In contrast demand for

fibre optic products and hi- reliability fibre couplers used in

undersea networks is strong.

As previously stated, G&H has long been aware of the

potential risks associated with the cyclical nature of the

microelectronics sector and more recently the continued impact of

the US/ China trade dispute. Our industrial laser order book has

improved since our last update, but we are now assuming the

industrial laser market will not return to more 'normal' levels in

FY 2019 and instead we only supply known or high certainty orders.

This has resulted in a reduction in the Board's expectations for

the Group's adjusted PBT for FY2019 of circa GBP3.5 - GBP4.0

million.

That said, significant technological innovation in 5G, folding

phones and the greater use of industrial lasers in manufacturing,

coupled with our market leading position means supply of critical

components to industrial lasers will be an important source of

growth for G&H into the foreseeable future.

During FY 2019 we have prepared for significant capacity growth

in fibre optics generally and hi- reliability fibre couplers

specifically, as they undergo a multi-year growth phase.

We remain confident in the potential of the industrial laser

sector and our other target markets to provide attractive long term

growth.

G&H remains committed to the twin pillars of our strategy,

namely diversification and moving up the value chain. As

demonstrated by the acquisition of ITL, our acquisition strategy is

targeting opportunities that enhance the Company's ability to wrap

electronics and software around core photonic products to yield

system-level solutions and to deliver 'critical mass' in Life

Sciences and further strengthen our position in A&D.

Mark Webster Andrew Boteler

Chief Executive Officer Chief Financial Officer

4 June 2019

Unaudited interim results for the 6 months ended 31 March

2019

Group Income Statement Half Year Half Year Full Year

to to to

31 Mar 2019 31 Mar 2018 30 Sep 2018

Note (Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------- -------------- -------------

Revenue 5 59,708 55,608 124,883

Cost of revenue (39,512) (33,886) (74,811)

-------------- -------------- -------------

Gross profit 20,196 21,722 50,072

Research and Development (3,552) (3,739) (8,229)

Sales and Marketing (4,554) (4,551) (9,237)

Administration (10,378) (8,507) (22,317)

Other income and expenses 1,264 767 507

-------------- -------------- -------------

Operating profit 5 2,976 5,692 10,796

Net finance costs (1,494) (444) (683)

-------------- -------------- -------------

Profit before income tax

expense 1,482 5,248 10,113

Income tax expense 6 (1,211) (668) (2,893)

-------------- -------------- -------------

Profit for the period 271 4,580 7,220

Basic earnings per share 7 1.1p 18.6p 29.3p

-------------- -------------- -------------

Reconciliation of profit before tax to adjusted profit before

tax:

Half Year Half Year Full Year

to to to 30 Sep

2018

31 Mar 2019 31 Mar 2018 (Audited)

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Profit before tax 1,482 5,248 10,113

Amortisation of acquired

intangible assets 1,829 954 2,141

Adjustment to accrued contingent

consideration (1,445) - 417

Impairment of goodwill 2,576 - 2,708

Site closure costs (521) 1,569

Restructuring costs 639 502 864

Transaction fees - - 605

Interest on discounted deferred

consideration 850 305 340

Adjusted profit before tax 5,410 7,009 18,757

-------------- -------------- ------------

Group Statement of Comprehensive Half Year Half Year Full Year

Income to to to 30 Sep

2018

31 Mar 31 Mar 2018 (Audited)

2019

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Profit for the period 271 4,580 7,220

Other comprehensive income

Currency translation differences 11 (1,496) 1,657

-------------- -------------- ------------

Other comprehensive income /

(expense) for the period 11 (1,496) 1,657

Total comprehensive income for

the period 282 3,084 8,877

-------------- -------------- ------------

Unaudited interim results for the 6 months ended 31 March

2019

Group Balance Sheet 31 Mar 2019 31 Mar 2018 30 Sep 2018

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Non-current assets

Property, plant and equipment 37,942 34,445 38,320

Intangible assets 62,146 38,926 65,734

Deferred income tax assets 1,725 1,502 1,944

-------------- -------------- ------------

101,813 74,873 105,998

Current assets

Inventories 27,570 23,968 24,445

Income tax assets - 638 -

Trade and other receivables 29,205 26,691 35,028

Cash and cash equivalents 15,566 16,053 19,433

72,341 67,350 78,906

Current liabilities

Trade and other payables (19,778) (21,747) (25,262)

Borrowings (76) (6) (75)

Income tax liabilities (491) - (309)

Provision for other liabilities

and charges (1,445) (884) (988)

Deferred consideration (6,059) (4,256) (5,774)

-------------- -------------- ------------

(27,849) (26,893) (32,408)

Net current assets 44,492 40,457 46,498

-------------- -------------- ------------

Non-current liabilities

Borrowings (30,009) (11,002) (29,964)

Deferred income tax liabilities (6,602) (4,438) (6,322)

Deferred consideration (2,806) - (8,363)

(39,417) (15,440) (44,649)

Net assets 106,888 99,890 107,847

-------------- -------------- ------------

Shareholders' equity

Capital and reserves

attributable to equity

shareholders

Called up share capital 5,008 4,950 4,982

Share premium account 16,000 15,530 15,530

Merger reserve 7,262 4,640 7,262

Cumulative translation

reserve 7,242 4,078 7,231

Retained earnings 71,376 70,692 72,842

-------------- -------------- ------------

Equity Shareholders' Funds 106,888 99,890 107,847

-------------- -------------- ------------

Unaudited interim results for the 6 months ended 31 March

2019

Statement of Changes in Share Share Cumulative

Equity capital premium Merger Retained translation Total

account account reserve earnings reserve equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- --------- --------- ----------- ------------- ---------

At 1 October 2017 4,903 15,530 4,640 67,489 5,574 98,136

Profit for the period - - - 4,580 - 4,580

Other comprehensive expense

for the period - - - - (1,496) (1,496)

--------- --------- --------- ----------- ------------- ---------

Total comprehensive income

/ (expense) for the period - - - 4,580 (1,496) 3,084

--------- --------- --------- ----------- ------------- ---------

Dividends - - - (1,608) - (1,608)

Proceeds from shares issued 47 - - (47) - -

Fair value of employee

services - - - 338 - 338

Tax credit relating to

share option schemes - - - (60) - (60)

At 31 March 2018 (unaudited) 4,950 15,530 4,640 70,692 4,078 99,890

At 1 October 2018 4,982 15,530 7,262 72,842 7,231 107,847

Profit for the period - - - 271 - 271

Other comprehensive expense

for the period - - - - 11 11

--------- --------- --------- ----------- ------------- ---------

Total comprehensive income

for the period - - - 271 11 282

--------- --------- --------- ----------- ------------- ---------

Dividends - - - (1,767) - (1,767)

Proceeds from shares issued 26 470 - (19) - 477

Fair value of employee

services - - - 338 - 338

Tax debit relating to

share option schemes - - - (289) - (289)

--------- --------- --------- ----------- ------------- ---------

At 31 March 2019 (unaudited) 5,008 16,000 7,262 71,376 7,242 106,888

--------- --------- --------- ----------- ------------- ---------

Unaudited interim results for the 6 months ended 31 March

2019

Group Cash Flow Statement Half Year Half Year Full Year

to to to 30 Sep

2018

31 Mar 31 Mar (Audited)

2019 2018

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Cash flows from operating activities

Cash generated from operations 5,029 1,151 11,949

Income tax paid (628) (1,646) (2,779)

-------------- -------------- ------------

Net cash generated from / (used

by) operating activities 4,401 (495) 9,170

-------------- -------------- ------------

Cash flows from investing activities

Acquisition of subsidiaries,

net of cash acquired (3,906) (4,414) (24,029)

Disposal of trade and assets - - 384

Purchase of property, plant

and equipment (2,799) (2,739) (5,849)

Sale of property, plant and 1,480 - -

equipment

Purchase of intangible assets (791) (922) (1,377)

Interest received 9 7 9

Interest paid (518) (111) (304)

-------------- -------------- ------------

Net cash used in investing

activities (6,525) (8,179) (31,166)

-------------- -------------- ------------

Cash flows from financing activities

Drawdown of acquisition borrowing

facility - - 17,272

Repayment of borrowings (37) (3) (16)

Dividends paid to ordinary

shareholders (1,733) (1,608) (2,647)

Net cash (used in) / generated

from financing activities (1,770) (1,611) 14,609

-------------- -------------- ------------

Net decrease in cash (3,894) (10,285) (7,387)

Cash at beginning of the period 19,433 26,425 26,425

Exchange gains / (losses) on

cash 27 (87) 395

-------------- -------------- ------------

Cash at the end of the period 15,566 16,053 19,433

-------------- -------------- ------------

Notes to the Group Cash Half Year Half Year Full Year

Flow Statement to to to

31 Mar 2019 31 Mar 2018 30 Sep 2018

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Profit before income tax 1,482 5,248 10,113

Adjustments for:

- Amortisation of acquired

intangible assets 1,829 954 2,141

- Amortisation of other

intangible assets 54 67 683

- Profit on disposal of (902) - -

the Orlando building

- Proceeds from sale of

trade and assets - - (384)

* Impairment of goodwill 2,576 - 2,708

- Adjustment to accrued

contingent consideration (1,445) - 417

- Depreciation 2,224 1,933 4,009

- Share based payment obligations 338 338 675

- Amounts claimed under

the RDEC (195) (195) (370)

- Finance income (5) (7) (16)

- Finance costs 1,499 451 699

-------------- -------------- -------------

Total adjustments 5,973 3,541 10,562

Changes in working capital

- Inventories (3,122) (3,376) (1,295)

- Trade and other receivables 5,828 (2,272) (7,847)

- Trade and other payables (5,132) (1,990) 416

Total changes in working

capital (2,426) (7,638) (8,726)

Cash generated from operating

activities 5,029 1,151 11,949

-------------- -------------- -------------

Reconciliation of net cash flow to movements in net (debt) /

cash

Half Year Half Year Full Year

to to to

31 Mar 2019 31 Mar 2018 30 Sep

2018

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Decrease in cash in the

period (3,894) (10,285) (7,387)

Borrowings - - (17,272)

Repayment of borrowings 37 2 16

Changes in net (debt) /

cash resulting from cash

flows (3,857) (10,283) (24,643)

Finance leases and borrowings

acquired - - (355)

Translation differences (56) 401 (535)

-------------- -------------- ------------

Movement in net (debt) /

cash in the period / year (3,913) (9,882) (25,533)

Net (debt) / cash at start

of period (10,606) 14,927 14,927

Net (debt) / cash at end

of period (14,519) 5,045 (10,606)

-------------- -------------- ------------

Analysis of net debt

At 1 Exchange At 31 Mar

Oct 2018 Cash flow movement 2019

GBP'000 GBP'000 GBP'000 GBP'000

---------- ----------- ---------- ----------

Cash at bank and

in hand 19,433 (3,894) 27 15,566

Debt due within 1

year (60) - - (60)

Debt due after 1

year (29,947) 32 (83) (29,998)

Finance leases (32) 5 - (27)

---------- ----------- ---------- ----------

Net debt (10,606) (3,857) (56) (14,519)

---------- ----------- ---------- ----------

Notes to the Interim Report

1. Basis of Preparation

The unaudited Interim Report has been prepared under the

historical cost convention and in accordance with International

Financial Reporting Standards ("IFRS"), as adopted by the European

Union.

The Interim Report was approved by the Board of Directors and

the Audit Committee on 4 June 2019. The Interim Report does not

constitute statutory financial statements within the meaning of the

Companies Act 2006 and has not been audited.

Comparative figures in the Interim Report for the year ended 30

September 2018 have been taken from the Group's audited statutory

financial statements on which the Group's auditors,

PricewaterhouseCoopers LLP, expressed an unqualified opinion. The

comparative figures to 31 March 2018 are unaudited.

The Interim Report will be announced to all shareholders on the

London Stock Exchange and published on the Group's website on 4

June 2019. Copies will be available to members of the public upon

application to the Company Secretary at Dowlish Ford, Ilminster,

Somerset, TA19 0PF.

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 30 September 2018,

as described in those financial statements.

2. Application of IFRS

Adoption of new standards

In preparing the interim financial statements, the Group has

adopted IFRS15 "Revenue from contracts with customers". This

standard deals with revenue recognition and establishes principles

for reporting useful information to users of financial statements

about the nature, timing and uncertainty of revenue and cash flows

arising from contracts with customers. Revenue is recognised when a

customer obtains control of a good or service and thus has the

ability to direct the use and obtain the benefits from the good or

service. The implementation of IFRS15 has not led to any material

change in the recognition of the Group's revenue.

3. Estimates

The preparation of interim financial statements requires

management to make estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Actual results may

differ from these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgments made by management in

applying the Company's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the year ended 30 September

2018.

4. Financial risk management

The Company's activities expose it to a variety of financial

risks, market risk (including currency risk, cash flow interest

rate risk and price risk), credit risk and liquidity risk.

The interim condensed consolidated financial statements do not

include all financial risk management information and disclosures

required in the annual financial statements and should be read in

conjunction with the Company's annual financial statements as at 30

September 2018.

There have been no changes to the risk management policies since

the year end.

5. Segmental analysis

Aerospace Life Sciences

& Defence / Biophotonics Industrial Corporate Total

For half year to 31 March GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

2019

Revenue

Total revenue 18,451 12,044 33,107 - 63,602

Inter and intra-division (4) (386) (3,504) - (3,894)

------------------------------- ----------- ---------------- ----------- ---------- ---------

External revenue 18,447 11,658 29,603 - 59,708

Divisional expenses (17,245) (9,374) (26,416) 2,986 (50,049)

------------------------------- ----------- ---------------- ----------- ---------- ---------

EBITDA(1) 1,202 2,284 3,187 2,986 9,659

EBITDA % 6.5% 19.6% 10.8% - 16.2%

Depreciation and amortisation (460) (303) (1,248) (267) (2,278)

------------------------------- ----------- ---------------- ----------- ---------- ---------

Operating profit before

amortisation of acquired

intangible assets 742 1,981 1,939 2,719 7,381

Amortisation of acquired

intangible assets and

goodwill impairment - - - (4,405) (4,405)

------------------------------- ----------- ---------------- ----------- ---------- ---------

Operating profit 742 1,981 1,939 (1,686) 2,976

Operating profit margin

% 4.0% 17.0% 6.6% 5.0%

------------------------------- ----------- ---------------- ----------- ---------- ---------

Add back non-recurring

items 454 30 235 2,360 3,079

Operating profit excluding

non-recurring items 1,196 2,011 2,174 674 6,055

------------------------------- ----------- ---------------- ----------- ---------- ---------

Adjusted operating profit

margin % 6.5% 17.2% 7.3% - 10.1%

------------------------------- ----------- ---------------- ----------- ---------- ---------

Aerospace Life Sciences

& Defence / Biophotonics Industrial Corporate Total

For half year to 31 March GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

2018

Revenue

Total revenue 18,130 5,021 36,176 - 59,327

Inter and intra-division - - (3,719) - (3,719)

------------------------------- ----------- ---------------- ----------- ---------- ---------

External revenue 18,130 5,021 32,457 - 55,608

Divisional expenses (15,701) (4,513) (26,733) (15) (46,962)

------------------------------- ----------- ---------------- ----------- ---------- ---------

EBITDA(1) 2,429 508 5,724 (15) 8,646

EBITDA % 13.4% 10.1% 17.6% - 15.5%

Depreciation and amortisation (367) (201) (1,141) (291) (2,000)

------------------------------- ----------- ---------------- ----------- ---------- ---------

Operating profit before

amortisation of acquired

intangible assets 2,062 307 4,583 (306) 6,646

Amortisation of acquired

intangible assets - - - (954) (954)

------------------------------- ----------- ---------------- ----------- ---------- ---------

Operating profit 2,062 307 4,583 (1,260) 5,692

Operating profit margin

% 11.4% 6.1% 14.1% - 10.2%

------------------------------- ----------- ---------------- ----------- ---------- ---------

Add back non-recurring

items - - - 1,456 1,456

Operating profit excluding

non-recurring items 2,062 307 4,583 196 7,148

------------------------------- ----------- ---------------- ----------- ---------- ---------

Adjusted operating profit

margin % 11.4% 6.1% 14.1% - 12.9%

------------------------------- ----------- ---------------- ----------- ---------- ---------

(1)EBITDA = Earnings before interest, tax, depreciation and

amortisation.

All of the amounts recorded are in respect of continuing

operations.

5. Segmental analysis continued

Analysis of revenue by destination

Half year Half year

to to

31 Mar 2019 31 Mar 2018

(Unaudited) (Unaudited)

GBP'000 GBP'000

------------- -------------

United Kingdom 15,121 8,656

America 21,595 20,468

Continental Europe 12,412 13,051

Asia-Pacific 10,580 13,433

59,708 55,608

------------- -------------

6. Income tax expense

Analysis of tax charge in the period

Half Year Half Year Full Year

to to to 30 Sep

2018 (Audited)

31 Mar 2019 31 Mar

2018

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

--------------

Current taxation

UK Corporation tax 917 544 1,895

Overseas tax 262 868 1,381

Total current tax 1,179 1,412 3,276

Deferred tax

Origination and reversal of temporary

differences 32 120 481

Impact of change in the US tax

rate - (864) (864)

Total deferred tax 32 (744) (383)

Income tax expense per income

statement 1,211 668 2,893

The tax charge for the six months ended 31 March 2019 is based

on the estimated effective rate of the tax for the Group for the

full year to 30 September 2019. The estimated rate is applied to

the profit before tax.

7. Earnings per share

The calculation of earnings per 20p Ordinary Share is based on

the profit for the period using as a divisor the weighted average

number of Ordinary Shares in issue during the period. The weighted

average number of shares is given below.

Half Year Half Year Full Year

to to to 30 Sep

2018

31 Mar 2019 31 Mar (Audited)

2018

(Unaudited) (Unaudited)

No. No. No.

-------------- -------------- ------------

Number of shares used for basic

earnings per share 24,926,574 24,660,697 24,629,591

Dilutive shares 208,823 252,099 265,817

Number of shares used for dilutive

earnings per share 25,135,397 24,912,796 24,895,408

-------------- -------------- ------------

A reconciliation of the earnings used in the earnings per share

calculation is set out below:

Half Year Half Year Full Year

to to to

31 Mar 2019 31 Mar 2018 30 Sep 2018

(Unaudited)

(Unaudited) (Audited)

p per p per p per

GBP'000 share GBP'000 share GBP'000 share

-------- ------- -------- ------- -------- -------

Basic earnings per share 271 1.1p 4,580 18.6p 7,220 29.3p

Adjustments net of income

tax expense:

Amortisation of acquired

intangible assets 1,755 7.0p 892 3.6p 1,865 7.6p

Goodwill impairment 2,576 10.3p - - 2,708 11.0p

Adjustment to accrued contingent

consideration (1,445) (5.8p) - - 417 1.7p

Site closure costs (422) (1.7p) 1,210 4.9p

Restructuring costs 504 2.0p 399 1.6p 695 2.8p

Transaction fees - - - - 489 2.0p

Interest on discounted deferred

consideration 850 3.5p 305 1.2p 340 1.4p

Tax credit due to US tax

rate change - - (864) (3.5p) (864) (3.5p)

Total adjustments net of

income tax expense 3,818 15.3p 732 2.9p 6,860 27.9p

Adjusted basic earnings per

share 4,089 16.4p 5,312 21.5p 14,080 57.2p

-------- ------- -------- ------- -------- -------

Basic diluted earnings per

share 271 1.1p 4,580 18.4p 7,220 29.0p

Adjusted diluted earnings

per share 4,089 16.3p 5,312 21.3p 14,080 56.5p

------ ------ ------ ------ ------- ------

Adjusted earnings per share before amortisation of acquired

intangible assets and adjustments has been shown because, in the

opinion of the Directors, it more accurately reflects the trading

performance of the Group.

8. Dividend

The Directors have declared an interim dividend of 4.3 pence per

share for the half year ended 31 March 2019. This dividend has not

been accounted for within the period to 31 March 2019 as it is yet

to be paid.

Half Year Half Year Full Year

to to to 30 Sep

2018

31 Mar 2019 31 Mar (Audited)

2018

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Final 2018 dividend paid: 7.1p 1,733 - -

per share

Final 2017 dividend paid: 6.5p

per share - 1,608 1,608

2018 Interim dividend paid :

4.2p per share - - 1,039

-------------- -------------- ------------

1,733 1,608 2,647

-------------- -------------- ------------

9. Borrowings

The group's banking facilities with NatWest Bank comprise a

committed revolving credit facility of $40m and an uncommitted

flexible acquisition facility of $20m both available until 31

August 2021.

The revolving credit facility attracts an interest rate of

between 1.2% and 1.7% above LIBOR dependent upon the Company's

leverage ratio.

10. Called up share capital

2019 2018 2019 2018

No. No. GBP'000 GBP'000

---------

Allotted, issued and fully

paid

Ordinary share of 20p

each 25,036,397 24,907,831 5,008 4,950

------------- ------------- --------- ---------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFEARFIVIIA

(END) Dow Jones Newswires

June 04, 2019 02:00 ET (06:00 GMT)

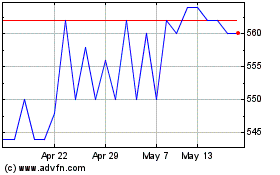

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jul 2024 to Aug 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Aug 2023 to Aug 2024