TIDMGHH

RNS Number : 1990J

Gooch & Housego PLC

10 June 2014

For immediate release 10 June 2014

GOOCH & HOUSEGO PLC

INTERIM REPORT FOR THE SIX MONTHS ENDED 31 MARCH 2014

Gooch & Housego PLC (AIM:GHH), the specialist manufacturer

of optical components and systems, today announces its interim

results for the six months ended 31 March 2014.

Year ended 30 September HY2014 HY2013 Change FY2013

-------------------------- ------- ------- ------- -------

Revenue (GBPm) 34.4 29.0 18.6% 63.3

-------------------------- ------- ------- ------- -------

Adjusted profit before

tax (GBPm)(1) 5.1 3.8 34.2% 9.7

-------------------------- ------- ------- ------- -------

Adjusted basic earnings

per share (pence)(1) 15.9 12.7 25.2% 32.0

-------------------------- ------- ------- ------- -------

Interim dividend per

share (pence) 2.6 2.3 13.0% 6.3

-------------------------- ------- ------- ------- -------

Net cash (GBPm) 2.3 0.7 228.6% 5.7

-------------------------- ------- ------- ------- -------

Statutory profit before

tax (GBPm) 3.7 3.3 12.1% 8.3

-------------------------- ------- ------- ------- -------

Basic earnings per share

(pence) 11.0 11.2 (1.8%) 27.7

-------------------------- ------- ------- ------- -------

(1) Adjusted for amortisation of acquired intangible assets,

site closure costs, the impairment of goodwill and the gain on

bargain purchase in relation to Spanoptic Limited.

Operational highlights

-- Strong performance from Aerospace & Defence and Industrial divisions

-- Acquisition of Spanoptic in October 2013 adds complementary precision optics business

-- Acquisition of Constelex in November 2013 strengthens Systems Technology Group

-- Systems Technology Group successful in securing contracts and funded projects

-- Rationalisation of manufacturing and R&D sites initiated

-- Investment in R&D up 19%; 4 patents granted and 6 filed so far this year

-- Solid order book of GBP29.7 milion at the end of the period

-- Net cash of GBP2.3 million at period end after investing

GBP5.5 million (net) in acquisitions

Gareth Jones,Chief Executive of Gooch & Housego PLC,

commented on the results:

"Gooch & Housego's markets continue to exhibit attractive,

long-term structural growth drivers as photonic technology is

adopted across an increasingly wide range of application areas. We

continue to invest in our business with confidence to position it

for sustainable long-term growth."

For further information please contact:

Gareth Jones / Andrew

Gooch & Housego PLC Boteler 01460 256 440

Mark Court / Gabriella

Buchanan Clinkard 020 7466 5000

Investec Bank plc (Nomad Patrick Robb / David

& Broker) Anderson 020 7597 5169

Operating and Financial Review

Performance Overview

In the six months to 31 March 2014, the business has once again

delivered profitable growth and improving margins in less than

buoyant market conditions. The trend towards a more evenly balanced

business has continued, reflecting not only our strategy of

diversification and our efforts to develop new opportunities in

Aerospace & Defence and Life Sciences, but also our success in

growing the business in our "new industrial" markets.

REVENUE

Six months ended 2014 2013

31 March

----------------- -----------------

GBP'000 % of GBP'000 % of

total total

----------------------- -------- ------- -------- -------

Industrial 18,917 55% 16,404 56%

Aerospace and Defence 10,218 30% 7,437 26%

----------------------- -------- ------- -------- -------

Life Sciences 3,608 10% 3,142 11%

----------------------- -------- ------- -------- -------

Scientific Research 1,679 5% 2,006 7%

----------------------- -------- ------- -------- -------

Group Revenue 34,422 100% 28,989 100%

----------------------- -------- ------- -------- -------

Group revenue for the half year was a record GBP34.4 million, an

increase of GBP5.4 million, or 19% over the comparative period last

year. On a constant currency basis revenue was 22% higher.

Excluding the impact of acquisitions, Group revenue increased by 7%

compared with the same period last year.

In our industrial market, revenues were 15% up on the

corresponding period last year and up 5% excluding the impact of

acquisitions. A solid performance in our industrial laser market

was supplemented by better demand from the telecommunications and

semiconductor sectors.

Aerospace & Defence produced an excellent result with

revenues up 37% on an absolute basis and 22% after excluding the

impact of acquisitions. This growth has been driven by strong sales

of sub-assemblies for defence applications and continued buoyancy

in the sales of navigation components for the civil aerospace

market. Budgetary constraints in the US continue to create

headwinds, although these are having less of an impact on

established programmes.

Life Sciences revenues were up 15% in absolute terms compared

with the same period last year, but were flat excluding

acquisitions.

In line with our expectations, constrained government spending

continues to adversely affect our Scientific Research market

(economically the smallest part of our business) with revenues down

16%.

Order intake in the first half of the year has been solid. The

order book at 31 March 2014 was GBP29.7 million and the Company has

booked GBP34.5 million in orders since 1 October 2013.

RECONCILIATION OF ADJUSTED PERFORMANCE MEASURES

Operating Net finance Taxation Earnings

Profit costs per share

-------------------- ------------------ ------------------ ------------------ ----------------

Half Year to 2014 2013 2014 2013 2014 2013 2014 2013

31 March GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 pence pence

-------------------- -------- -------- -------- -------- -------- -------- ------- -------

Reported 3,956 3,643 (293) (320) (1,031) (841) 11.0 11.2

-------------------- -------- -------- -------- -------- -------- -------- ------- -------

Amortisation

of acquired

intangible assets 775 427 - - (221) (113) 2.3 1.5

-------------------- -------- -------- -------- -------- -------- -------- ------- -------

Gain on bargain

purchase (1,039) - - - - - (4.4) -

-------------------- -------- -------- -------- -------- -------- -------- ------- -------

Impairment of

goodwill 1,538 - - - - - 6.5 -

-------------------- -------- -------- -------- -------- -------- -------- ------- -------

Restructuring

costs 172 - - - (58) - 0.5 -

-------------------- -------- -------- -------- -------- -------- -------- ------- -------

Adjusted 5,402 4,070 (293) (320) (1,310) (954) 15.9 12.7

-------------------- -------- -------- -------- -------- -------- -------- ------- -------

Adjusted profit before tax was GBP5.1 million, 34% better than

the GBP3.8 million reported last year. This reflects the overall

increased volume in our Aerospace & Defence business, which has

driven benefits in the operational gearing of this segment. The two

acquisitions that were made in the six months to 31 March 2014 have

contributed GBP0.6 million to the profit before tax in this

period.

Operational and Strategy Review

Products and Markets - Industrial

Gooch & Housego's principal industrial markets are

industrial lasers, telecommunications, metrology, sensing and

semiconductor manufacturing. Industrial lasers are used in a

diverse range of precision material processing applications ranging

from microelectronics to automotive.

Business in our industrial laser market was solid in the first

six months of the year, underpinned by good business in our

acousto-optic components for fibre lasers and in our semiconductor

businesses. Sales of precision optics and acousto-optics into the

semiconductor market were excellent in the six months to 31 March

2014, being 22% higher compared with the equivalent period last

year.

The industrial laser market is continuing to evolve and grow,

driven by the success of the fibre laser. Gooch & Housego

anticipated these changes with the development of a family of

products for fibre laser applications, including the Fibre-Q, with

the result that the Company today is benefitting from these market

trends. Recent innovations have enabled Gooch & Housego to keep

up with the demanding requirements of this cost sensitive

application, paving the way for greater market penetration. In

other applications, most notably fibre-optic sensing, the Fibre-Q

is proving to be a key enabling technology that is now being

deployed by a number of our key customers.

While sales of products for fibre laser applications have been

growing steadily, demand for the traditional acousto-optic Q-switch

products has remained solid, sales of which represented only 10% of

our total business during the period under review. A consequence of

these market dynamics is a consolidation in the variety of

acousto-optic products required to meet customer needs. In response

to these changes, and as a result of the steady improvements in

productivity that the Company has made to the production of these

products, Gooch & Housego no longer needs to maintain three

separate acousto-optic manufacturing facilities. The decision has,

therefore, been made to close the Melbourne, Florida, operation and

to transfer the business to the Company's facilities in Ilminster,

UK, and Palo Alto, California. It is expected that this process

will be largely complete by the end of the current financial year.

The closure of the Melbourne site is expected to entail a cash cost

of $1.2 million and deliver annual cash savings of $1.0

million.

In telecommunications, sales of lithium niobate wafers for

modulation applications exceeded our forecast and completely offset

weaker demand for high-reliability products for undersea cable

infrastructure projects that were again delayed due to

uncertainties over funding. Indications are that this market is

poised to recover as funding is released for new projects.

Products and Markets - Aerospace and Defence

The Aerospace & Defence market for Gooch & Housego is

characterised by high-value, long-term programmes involving the

main US and European defence contractors. During the first six

months of 2014, the Company has seen a healthy increase in its

Aerospace & Defence business, with a significant proportion of

revenues coming from sub-assemblies. Gooch & Housego's

precision optics and acousto-optic technologies have contributed

most to the Aerospace & Defence markets in the last six months,

with navigation, range finding and target designation being the

principal applications.

Gooch & Housego continues to regard Aerospace & Defence

as a growth market and we are investing accordingly. During the

past twelve months, Space Photonics has emerged as a significant

new application area in which Gooch & Housego has the

opportunity to develop a market leading position by leveraging its

unique expertise in fibre optics, semiconductor lasers and

precision optics. These skills are particularly sought after in the

rapidly evolving field of satellite laser communications, guidance

and control systems. With support and encouragement from UK,

European and US space agencies, Gooch & Housego has

successfully bid on several development programmes, and has more in

the pipeline. Our recently established Systems Technology Group

(STG) has been instrumental in realising these opportunities, which

are focussed on the application of our core component technologies

in complex sub-systems as we seek to move up the value chain. This

is consistent with our strategy of delivering growth by migrating

from component supplier to solutions provider at the systems level.

We expect Space Photonics to become an increasingly important

sub-set of the Aerospace & Defence market.

Products and Markets - Life Sciences

Gooch & Housego's three principal Life Sciences revenue

streams are derived from diagnostics (fibre-optic modules for

optical coherence tomography (OCT) applications), surgery

(Q-switches for surgical lasers) and biomedical research

(acousto-optics for microscopy applications). In each application

area the Company is making steady progress in moving up the value

chain and is currently selling sub-systems as well as components to

several of our larger customers.

Whilst in absolute terms this market sector grew by 15% in the

six months to 31 March 2014, compared with the equivalent period

last year, when the impact of acquisitions is taken into account,

Life Sciences revenue was flat. The principal commercial

application of OCT systems is retinal imaging, and Gooch &

Housego continues to be the leading provider of fibre optic

solutions (products and design services) to this industry.

Following inconclusive discussions with potential commercial

partners earlier this year, it was decided to mothball the Group's

work on cancer diagnostics using hyperspectral imaging and to close

its research facility in New Jersey. The cost of closing this

facility was GBP0.8 million, of which GBP0.7 million related to

non-cash costs (GBP0.6 million of goodwill impairment). It is

expected that the closure of this facility will result in a cash

saving of GBP0.3 million per annum. Gooch & Housego will

continue to develop and manufacture hyperspectral imaging products

from its Orlando facility.

Products and Markets - Scientific Research

The key application in Scientific Research is laser inertial

confinement fusion ("laser fusion"), where lasers are used to

create the conditions found in the core of a star. In addition to

pure research in high energy and plasma physics, these vast laser

systems are being used to investigate whether this technology could

provide clean, carbon-free energy to reduce dependency on fossil

fuels. The first of these facilities is now complete, although

progress in demonstrating the potential of the technology as an

energy source has been slow. Gooch & Housego is continuing to

supply crystals for the second facility and expects ongoing

business to service replacement and maintenance requirements.

Strategy

Gooch & Housego has developed, and measures itself, on a set

of strategies to deliver long term, sustainable growth for its

shareholders. These can be categorised into two broad pillars:

"Diversification" and, "Moving up the Value Chain". In seeking to

achieve its strategic goals Gooch & Housego uses a variety of

tools, including investment in R&D to deliver organic growth,

acquisitions, market focused business development and strategic

partnerships.

In the first six months of the current financial year, Gooch

& Housego invested GBP2.9 million in R&D. This represents

8.4% of revenue and is 19% higher than the same period last year

(2013: GBP2.4m).

As the Company moves up the value chain, know-how and trade

secrets no longer provide adequate protection. As a result,

protecting intellectual property by means of patents is becoming

increasingly important. Gooch & Housego has an Intellectual

Property Committee, comprising senior R&D and management

personnel and chaired by the Chief Technology Officer, that meets

on a quarterly basis and whose remit is to identify and protect

commercially relevant intellectual property. So far this year four

patents have been granted and a further six inventions have patents

that are in the process of being filed.

Diversification: Gooch & Housego seeks to develop, through

R&D and acquisition, a presence in new markets that offer the

potential for significant growth as a result of their adoption of

photonic technology, whilst also reducing exposure to cyclicality

in any particular sector. In the current period Gooch & Housego

has grown its business in its core Industrial, Aerospace &

Defence and Life Sciences markets. Moreover, the business has

continued to invest in its quality systems and business development

in order to strengthen its position in these markets in the

future.

Moving up the Value Chain: Gooch & Housego seeks to move up

the value chain to more complex sub-assemblies and systems through

leveraging its excellence in materials and components, and by

providing photonic design and engineering solutions for our

customers. Gooch & Housego is progressively making the

transition from components supplier to solutions provider. A

significant proportion of our business in the Aerospace &

Defence market now comes from the sale of sub-systems rather than

discrete components.

Fifteen months ago the Company introduced a new initiative to

accelerate this process with the formation of the STG, which

provides design and engineering services and leads Gooch &

Housego's participation in a number of funded research programmes.

Its initial focus has been on opportunities to take Gooch &

Housego up the value-chain in the fields of Space Photonics and

optical coherence tomography for biomedical imaging applications.

During the period under review, Gooch & Housego has made

significant investments in the STG in the form of a dedicated new

facility at the Company's Torquay site, the acquisition of

Constelex and an increase in headcount to eleven with a broad range

of skills in project management, design and modelling of complex

optical and electronic systems.

Vertical integration: Vertical integration is a key strategic

objective, not merely a by-product of moving up the value chain. In

the field of photonics, certain materials (e.g. optical crystals),

and materials processing operations (polishing, thin-film coating,

fused-fibre processes etc.) have a critical bearing on the

performance, cost and reliability of the final product, whether it

is a component such as the Q-switch or a complex satellite

communications system. Gooch & Housego has established a

portfolio of world-class photonic products and capabilities that

enable it to provide uniquely integrated solutions for the most

demanding applications.

Gooch & Housego will continue to evaluate acquisition

opportunities that have the potential to accelerate delivery of the

Company's strategic objectives. Having established a presence in

its target markets, Gooch & Housego is now focussing on moving

up the value chain in each of those markets. Acquisition

opportunities that enhance the Company's ability to wrap

electronics and software around core photonic products to yield

system-level solutions are of greater relevance today than those

that merely broaden Gooch & Housego's range of component

capabilities. The acquisition of Constelex is a good example of

this strategy in action, paving the way to translate Gooch &

Housego's leadership in space qualified fibre optic components

(unit values typically in the $100 to $1,000 range) into a family

of erbium-doped fibre amplifier systems for satellite

communications with unit values up to $100,000.

Cash Flow and Financing

In the six months to 31 March 2014 Gooch & Housego generated

cash from operations of GBP4.9 million, compared with GBP2.8

million in the same period of 2013.

The Company's strategies of diversifying into industries such as

Aerospace & Defence and Life Sciences and moving up the value

chain inherently put demands on working capital. Our customers in

Aerospace & Defence require safety stocks to be held and the

move to systems and sub-systems lead to Gooch & Housego

managing longer supply chains and carrying higher levels of

inventory. In recognising these upward pressures on working

capital, Gooch & Housego has introduced a number of initiatives

to help reduce this impact. Excluding the impact of acquisitions,

inventories have remained stable and trade debtors have reduced by

GBP0.9 million. Capital expenditure on property, plant and

equipment was GBP0.9 million in the period (2013: GBP1.0 million).

The main fixed asset additions were in relation to expanding our

Torquay facilities and equipment to accommodate the STG.

During the period to 31 March 2014, GBP5.5 million, net of cash

acquired, was invested in relation to the acquisitions of Spanoptic

Limited and Constelex Limited.

Cash, cash equivalents and bank overdrafts as at 31 March 2014

amounted to a net positive cash position of GBP12.0 million,

compared to GBP12.1 million at 30 September 2013.

Since 30 September 2013, the Company's net cash position has

reduced from GBP5.7 million to GBP2.3 million, following the

acquisition of Spanoptic Limited and Constelex Limited

At 31 March 2014, the Group's banking facilities with its

bankers, the Royal Bank of Scotland, comprise an $18 million dollar

denominated term loan (of which $4.5 million is drawn), a GBP3.1

million sterling denominated term loan (of which GBP1.8 million is

drawn), an $8 million revolving credit facility (undrawn as at 31

March 2014) and a fully drawn $8 million capital expenditure

facility. All facilities are committed until April 2015, subject to

certain covenant provisions.

Staff

The Company workforce increased from 581 at 30 September 2013 to

644 at the end of March 2014. This increase is was largely due to

the acquisitions of Spanoptic Limited and Constelex Limited.

Dividends

The Directors have declared an interim dividend of 2.6p per

share (2013: 2.3p per share), a 13% increase on the prior period,

which is reflective of the Directors' confidence in the Company's

long term growth. This will be payable on 21 July 2014 to

shareholders on the register as at 27 June 2014.

Prospects

Whilst the strengthening of sterling in recent months represents

a headwind to growth, Gooch & Housego's markets continue to

exhibit attractive, long-term structural growth drivers as photonic

technology is adopted across an increasingly wide range of

application areas. We continue to invest in our business with

confidence to position it for sustainable long-term growth.

Julian Blogh Gareth Jones Andrew Boteler

Chairman Chief Executive Officer Chief Financial Officer

10 June 2014 10 June 2014 10 June 2014

Unaudited interim results for the 6 months ended 31 March

2014

Group Income Statement Half Year Half Year Full Year

to to to

31 Mar 2014 31 Mar 2013 30 Sep 2013

Note (Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------- -------------- -------------

Revenue 5 34,422 28,989 63,252

Cost of revenue (20,960) (17,674) (37,635)

-------------- -------------- -------------

Gross profit 13,462 11,315 25,617

Research and Development (2,577) (2,423) (4,913)

Sales and Marketing (2,301) (2,218) (4,666)

Administration and other

expenses (5,179) (4,078) (8,814)

Other income 551 1,047 1,727

-------------- -------------- -------------

Operating profit 5 3,956 3,643 8,951

Net finance costs (293) (320) (608)

-------------- -------------- -------------

Profit before income tax

expense 3,663 3,323 8,343

Income tax expense 6 (1,031) (841) (2,151)

-------------- -------------- -------------

Profit for the period 2,632 2,482 6,192

Earnings per share 7 11.0p 11.2p 27.7p

-------------- -------------- -------------

Reconciliation of operating profit to adjusted operating

profit:

Half Year Half Year Full Year

to to to 30 Sep

2013

31 Mar 2014 31 Mar 2013 (Audited)

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Operating profit 3,956 3,643 8,951

Amortisation of acquired

intangible assets 775 427 875

Acquisition costs - - 164

Restructuring costs 172 - 278

Gain on bargain purchase: (1,039) - -

Spanoptic Limited

Impairment of goodwill (including 1,538 - -

CDI closure)

-------------- -------------- ------------

Adjusted operating profit 5,402 4,070 10,268

-------------- -------------- ------------

Group Statement of Comprehensive Half Year Half Year Full Year

Income to to to 30 Sep

2013

31 Mar 31 Mar 2013 (Audited)

2014

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Profit for the period 2,632 2,482 6,192

Other comprehensive income

Fair value adjustment of interest

rate swap net of tax 5 41 90

Currency translation difference (837) 1,841 (364)

-------------- -------------- ------------

Other comprehensive (expense)/income

for the period (832) 1,882 (274)

Total comprehensive income for

the period 1,800 4,364 5,918

-------------- -------------- ------------

Unaudited interim results for the 6 months ended 31 March

2014

Group Balance Sheet 31 Mar 2014 31 Mar 2013 30 Sep 2013

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Non-current assets

Property, plant and equipment 24,339 21,523 21,456

Intangible assets 20,697 21,130 19,821

Deferred income tax assets 3,462 4,203 3,830

-------------- -------------- ------------

48,498 46,856 45,107

Current assets

Inventories 13,976 14,188 13,390

Income tax assets 508 - 420

Trade and other receivables 14,106 13,515 12,706

Cash and cash equivalents 12,016 11,672 14,558

40,606 39,375 41,074

Current liabilities

Trade and other payables (9,929) (10,569) (10,461)

Borrowings (7,972) (6,082) (5,726)

Income tax liabilities (131) (841) (307)

Provision for other liabilities

and charges (272) (324) (271)

-------------- -------------- ------------

(18,304) (17,816) (16,765)

Net current assets 22,302 21,559 24,309

-------------- -------------- ------------

Non-current liabilities

Borrowings (1,698) (4,879) (3,113)

Deferred income tax liabilities (2,536) (618) (1,330)

Derivative financial instruments (32) (83) (34)

-------------- -------------- ------------

(4,266) (5,580) (4,477)

Net assets 66,534 62,835 64,939

-------------- -------------- ------------

Shareholders' equity

Capital and reserves

attributable to equity

shareholders

Called up share capital 4,760 4,491 4,620

Share premium account 15,420 14,757 15,213

Merger reserve 2,671 2,671 2,671

Hedging reserve (74) (128) (79)

Cumulative translation

reserve (1,697) 1,347 (860)

Retained earnings 45,454 39,697 43,374

-------------- -------------- ------------

Equity Shareholders' Funds 66,534 62,835 64,939

-------------- -------------- ------------

Unaudited interim results for the 6 months ended 31 March

2014

Statement of Changes in Share Share

Equity capital premium Merger Hedging Retained Total

account account reserve reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- --------- --------- ---------- ----------- ---------

At 1 October 2012 4,382 14,311 2,671 (169) 37,371 58,566

Profit for the period - - - - 2,482 2,482

Other comprehensive income

for the period - - - 41 1,841 1,882

--------- --------- --------- ---------- ----------- ---------

Total comprehensive income

for the period - - - 41 4,323 4,364

--------- --------- --------- ---------- ----------- ---------

Dividends - - - - (712) (712)

Proceeds from shares issued 109 446 - - (33) 522

Fair value of employee services - - - - 235 235

Tax charge relating to share

option schemes - - - - (140) (140)

109 446 - - (650) (95)

At 31 March 2013 (unaudited) 4,491 14,757 2,671 (128) 41,044 62,835

At 1 October 2013 4,620 15,213 2,671 (79) 42,514 64,939

Profit for the period - - - - 2,632 2,632

Other comprehensive income

for the period - - - 5 (837) (832)

--------- --------- --------- ---------- ----------- ---------

Total comprehensive income

for the period - - - 5 1,795 1,800

--------- --------- --------- ---------- ----------- ---------

Dividends - - - - (950) (950)

Proceeds from shares issued 140 207 - - (120) 227

Fair value of employee services - - - - 122 122

Tax credit relating to share

option schemes - - - - 396 396

140 207 - - (549) (202)

At 31 March 2014 (unaudited) 4,760 15,420 2,671 (74) 43,757 66,534

Unaudited interim results for the 6 months ended 31 March

2014

Group Cash Flow Statement Half Year Half Year Full Year

to to to 30 Sep

2013

31 Mar 31 Mar (Audited)

2014 2013

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Cash flows from operating activities

Cash generated from operations 4,905 2,794 10,130

Income tax paid (582) (53) (882)

-------------- -------------- ------------

Net cash generated from operating

activities 4,323 2,741 9,248

-------------- -------------- ------------

Cash flows from investing activities

Acquisition of subsidiaries

(net of cash acquired) (5,532) (20) (22)

Purchase of property, plant

and equipment (853) (896) (2,032)

Sale of property, plant and

equipment 88 - 67

Purchase of intangible assets (74) (56) (202)

Interest received 3 6 15

-------------- -------------- ------------

Net cash used in investing

activities (6,368) (966) (2,174)

-------------- -------------- ------------

Cash flows from financing activities

Drawdown of acquisition borrowing 4,971 - -

facility

Repayment of borrowings (1,704) (1,694) (3,394)

Proceeds from issues of share

capital 123 522 1,044

Dividends paid to ordinary

shareholders (950) (712) (1,229)

Interest paid (230) (269) (505)

Net cash generated by / (used

in) financing activities 2,210 (2,153) (4,084)

-------------- -------------- ------------

Net increase / (decrease) in

cash, cash equivalents and

revolving credit facility 165 (378) 2,990

Cash, cash equivalents and

revolving credit facility at

beginning of the period 12,088 9,235 9,235

Exchange (losses) / gains on

cash and revolving credit facility (237) 180 (137)

-------------- -------------- ------------

Cash, cash equivalents and

revolving credit facility at

the end of the period 12,016 9,037 12,088

-------------- -------------- ------------

Cash, cash equivalents and revolving credit facility at the end

of the period are made up of:

Half Year Half Year Full Year

to to to

31 Mar 31 Mar 30 Sep

2014 2013 2013

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Cash and cash equivalents 12,016 11,672 14,558

Revolving credit facility - (2,635) (2,470)

Cash, cash equivalents and

revolving credit facility

at the end of the period 12,016 9,037 12,088

-------------- -------------- ------------

Notes to the Group Cash Half Year Half Year Full Year

Flow Statement to to to

31 Mar 2014 31 Mar 2013 30 Sep 2013

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Profit before income tax 3,663 3,323 8,343

Adjustments for:

- Amortisation of acquired

intangible assets 775 427 875

- Impairment of goodwill 1,538 - -

- Gain on bargain purchase: (1,039) - -

Spanoptic Limited

- Amortisation of other

intangible assets 79 84 168

- Depreciation 1,227 1,042 1,949

- Profit on disposal of

property, plant

and equipment 25 - 91

- Share based payment obligations 122 235 341

- Finance income (3) (6) (15)

- Finance costs 296 326 623

-------------- -------------- -------------

Total adjustments 3,020 2,108 4,032

Changes in working capital

- Inventories (72) (786) (1,328)

- Trade and other receivables 877 (562) (1,208)

- Trade and other payables (1,507) (1,189) (538)

- Provisions for liabilities

and charges (1,076) (100) 829

-------------- -------------- -------------

Total changes in working

capital (1,778) (2,637) (2,245)

Cash generated from operating

activities 4,905 2,794 10,130

-------------- -------------- -------------

Reconciliation of net cash flow to movements in net debt

Half Year Half Year Full Year

to to to

31 Mar 2014 31 Mar 2013 30 Sep

2013

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Increase / (decrease) in

cash in the period 165 (378) 2,990

Drawdown of acquisition (4,971) - -

facility

Repayment of borrowings 1,704 1,694 3,394

Changes in net debt resulting

from cash flows (3,102) 1,316 6,384

Finance leases acquired (257) - -

Translation differences (14) (282) (342)

-------------- -------------- ------------

Movement in net debt in

the period / year (3,373) 1,034 6,042

Net cash/(debt) at start

of period 5,719 (323) (323)

Net cash at end of period 2,346 711 5,719

-------------- -------------- ------------

Analysis of net debt

At 1 Oct Exchange Non-cash At 31

2013 Cash flow movement movement Mar

2014

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- ----------- ---------- ---------- --------

Cash at bank and

in hand 14,558 (2,305) (237) - 12,016

Revolving credit

facility (2,470) 2,470 - - -

12,088 165 (237) - 12,016

Debt due within 1

year (3,256) (4,971) 346 - (7,881)

Debt due after 1

year (3,113) 1,605 (123) - (1,631)

Finance leases - 99 - (257) (158)

--------- ----------- ---------- ---------- --------

Net cash 5,719 (3,102) (14) (257) 2,346

--------- ----------- ---------- ---------- --------

Notes to the Interim Report

1. Basis of Preparation

The unaudited Interim Report has been prepared under the

historical cost convention and in accordance with International

Financial Reporting Standards ("IFRS"), as adopted by the European

Union.

The Interim Report was approved by the Board of Directors and

the Audit Committee on 10 June 2014. The Interim Report does not

constitute statutory financial statements within the meaning of the

Companies Act 2006 and has not been audited.

Comparative figures in the Interim Report for the year ended 30

September 2013 have been taken from the Group's audited statutory

financial statements on which the Group's auditors,

PricewaterhouseCoopers LLP, expressed an unqualified opinion. The

comparative figures to 31 March 2013 are unaudited.

The Interim Report will be announced to all shareholders on the

London Stock Exchange and published on the Group's website on 10

June 2014. Copies will be available to members of the public upon

application to the Company Secretary at Dowlish Ford, Ilminster,

Somerset, TA19 0PF.

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 30 September 2013,

as described in those financial statements.

2. Application of IFRS

Adoption of new standards

During the current reporting period there were no new standards

or amendments which had a material impact on the net assets of the

Group. In addition, standards or amendments issued but not yet

effective are not expected to have a material impact on the net

assets of the Group. However, the Group is closely monitoring the

IASB projects on Contract Revenue recognition and the Lease

accounting overhaul as they could potentially have a material

impact on the Group's results.

3. Estimates

The preparation of interim financial statements requires

management to make estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expense. Actual results may

differ from these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgments made by management in

applying the Company's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the year ended 30 September

2013.

4. Financial risk management

The Company's activities expose it to a variety of financial

risks, market risk (including currency risk, cash flow interest

rate risk and price risk), credit risk and liquidity risk.

The interim condensed consolidated financial statements do not

include all financial risk management information and disclosures

required in the annual financial statements and should be read in

conjunction with the Company's annual financial statements as at 30

September 2013.

There have been no changes to the risk management policies since

the year end.

5. Segmental analysis

Aerospace Scientific

& Defence Life Sciences Industrial Research Corporate Total

For half year to 31 March GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

2014

Revenue

Total revenue 10,218 3,608 20,935 1,679 - 36,440

Inter and intra-division - - (2,018) - - (2,018)

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

External revenue 10,218 3,608 18,917 1,679 - 34,422

Divisional expenses (8,460) (3,023) (14,591) (1,592) (222) (27,888)

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

EBITDA(1) 1,758 585 4,326 87 (222) 6,534

EBITDA % 17.2% 16.2% 22.9% 5.2% - 19.0%

Depreciation and Amortisation (286) (129) (765) (45) (79) (1,304)

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

Operating profit before

amortisation of acquired

intangible assets and

impairment of goodwill 1,472 456 3,561 42 (301) 5,230

Amortisation of acquired

intangible assets and

impairment of goodwill - - - - (1,274) (1,274)

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

Operating profit 1,472 456 3,561 42 (1,575) 3,956

Operating profit margin

% 14.4% 12.6% 18.8% 2.5% - 11.5%

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

Aerospace Scientific

& Defence Life Sciences Industrial Research Corporate Total

For half year to 31 March GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

2013

Revenue

Total revenue 7,437 3,142 18,430 2,006 - 31,015

Inter and intra-division - - (2,026) - - (2,026)

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

External revenue 7,437 3,142 16,404 2,006 - 28,989

Divisional expenses (6,658) (2,617) (12,799) (1,433) (286) (23,793)

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

EBITDA(1) 779 525 3,605 573 (286) 5,196

EBITDA % 10.5% 16.7% 22.0% 28.6% - 17.9%

Depreciation and Amortisation (281) (124) (558) (80) (83) (1,126)

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

Operating profit before

amortisation of acquired

intangible assets 498 401 3,047 493 (369) 4,070

Amortisation of acquired

intangible assets - - - - (427) (427)

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

Operating profit 498 401 3,047 493 (796) 3,643

Operating profit margin

% 6.7% 12.8% 18.6% 24.6% - 12.6%

------------------------------- ----------- -------------- ----------- ----------- ---------- ---------

(1)EBITDA = Earnings before interest, tax, depreciation and

amortisation.

All of the amounts recorded are in respect of continuing

operations.

5. Segmental analysis continued

Analysis of revenue by destination

Half year Half year

to to

31 Mar 2014 31 Mar 2013

(Unaudited) (Unaudited)

GBP'000 GBP'000

------------- -------------

United Kingdom 6,807 4,093

America 14,604 12,940

Continental Europe 7,733 7,491

Asia-Pacific 5,278 4,465

34,422 28,989

------------- -------------

6. Income tax expense

Analysis of tax charge in the period

Half Year Half Year Full Year

to to to 30 Sep

2013 (Audited)

31 Mar 2014 31 Mar

2013

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

--------------

Current taxation

UK Corporation tax 526 740 1,263

Overseas tax 404 52 238

Adjustments in respect of prior

year tax charge - 86 (304)

-------------- -------------- ----------------

Total current tax 930 878 1,197

Deferred tax

Origination and reversal of temporary

differences 101 (1) 677

Adjustments in respect of prior

year deferred tax - (36) 234

Impact of tax rate change in 2013

to 20% - - 43

-------------- -------------- ----------------

Total deferred tax 101 (37) 954

Income tax expense per income

statement 1,031 841 2,151

The tax charge for the six months ended 30 March 2014 is based

on the estimated effective rate of the tax for the Group for the

full year to 30 September 2014. The estimated rate is applied to

the profit before tax.

7. Earnings per share

The calculation of earnings per 20p Ordinary Share is based on

the profit for the period using as a divisor the weighted average

number of Ordinary Shares in issue during the period. The weighted

average number of shares is given below.

Half Year Half Year Full Year

to to to 30 Sep

2013

31 Mar 2014 31 Mar (Audited)

2013

(Unaudited) (Unaudited)

No. No. No.

-------------- -------------- ------------

Number of shares used for basic

earnings per share 23,864,426 22,123,658 22,376,650

Dilutive shares 125,595 1,652,880 1,097,927

Number of shares used for dilutive

earnings per share 23,990,021 23,776,538 23,474,577

-------------- -------------- ------------

A reconciliation of the earnings used in the earnings per share

calculation is set out below:

Half Year Half Year Full Year

to to to

31 Mar 2014 31 Mar 2013 30 Sep 2013

(Unaudited)

(Unaudited) (Audited)

p per p per p per

GBP'000 share GBP'000 share GBP'000 share

-------- ------- -------- ------- -------- -------

Basic earnings per share 2,632 11.0p 2,482 11.2p 6,192 27.7p

Adjustments net of income

tax expense:

Amortisation of acquired

intangible assets 554 2.3p 329 1.5p 650 2.9p

Goodwill impairment 1,538 6.5p - - - -

Gain on bargain purchase:

Spanoptic Limited (1,039) (4.4)p - - - -

Acquisition costs - - - - 122 0.5p

Restructuring costs 114 0.5p - - 206 0.9p

Total adjustments net of

income tax expense 1,167 4.9p 329 1.5p 978 4.3p

Adjusted basic earnings per

share 3,799 15.9p 2,811 12.7p 7,170 32.0p

-------- ------- -------- ------- -------- -------

Basic diluted earnings per

share 2,632 11.0p 2,482 10.4p 6,192 26.4p

Adjusted diluted earnings

per share 3,799 15.8p 2,811 11.8p 7,170 30.5p

------ ------ ------ ------ ------ ------

Adjusted earnings per share before amortisation and adjustments

has been shown because, in the opinion of the Directors, it more

accurately reflects the trading performance of the Group.

8. Dividend

The Directors have declared an interim dividend of 2.6 pence per

share for the half year ending 31 March 2014. This dividend has not

been accounted for within the period to 31 March 2014 as it is yet

to be paid.

Half Year Half Year Full Year

to to to 30 Sep

2013

31 Mar 2014 31 Mar (Audited)

2013

(Unaudited) (Unaudited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Final 2013 dividend paid : 4.0p

per share 950 712 -

2013 Interim dividend paid :

2.3p per share - - 517

Final 2012 dividend paid in 2013

: 3.2p per share - - 712

-------------- -------------- ------------

950 712 1,229

-------------- -------------- ------------

9. Borrowings

The group's banking facilities with the Royal Bank of Scotland

comprise an $18 million dollar denominated term loan (fully drawn

down), a GBP3.1 million sterling denominated term loan (fully drawn

down). The term loan balances at 31 March 2014 were $4.5 million

and GBP1.8 million sterling respectively.

In addition, the Company has an undrawn revolving credit

facility of $8.0 million and a fully drawn capital expenditure

facility of $8.0 million.

All facilities are committed until April 2015 and attract an

interest rate of between 2.25% and 3.00% above LIBOR dependent upon

the Company's leverage ratio.

10. Called up share capital

2014 2013 2014 2013

No. No. GBP'000 GBP'000

---------

Allotted, issued and fully

paid

Ordinary share of 20p

each 23,797,999 22,456,965 4,760 4,491

------------- ------------- --------- ---------

11. Derivative financial instruments

Half Year Half Year Full Year

to to to

31 Mar 31 Mar 30 Sep

2014 2013 2013

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

-------------- -------------- ------------

Interest rate swap 96 166 103

-------------- -------------- ------------

Current liability portion 64 83 69

Non-current liability portion 32 83 34

-------------- -------------- ------------

96 166 103

The notional principal amount of the outstanding interest swap

contract at 31 March 2014 was $6.75 million (2013: $11.25 million).

The end date for the interest rate swap is 1 April 2015. At 31

March 2014, the fixed rate of the interest rate swap was 2.14% and

the floating rate was US dollar LIBOR. The fair value of the swap

is a mark to market calculation based on future interest rate

expectations over the life of the swap. This is a level 2 method of

determining fair value as defined by IFRS 7.

12. Acquisition of Spanoptic Limited

On 15 October 2013, the Group completed the acquisition of the

entire issued share capital of Spanoptic Limited, a Glenrothes,

Scotland based manufacturer of precision optical components.

The consideration for the acquisition was GBP6.6m, paid in cash

on completion.

The fair value of the assets acquired is summarised as

follows:

Provisional

fair value

GBP'000

------------------------------- ------------

Property, plant and equipment 3,575

Intangible assets 2,631

Cash 1,006

Trade and other receivables 1,768

Inventory 923

Trade and other payables (866)

Current and deferred tax

liabilities (1,141)

Hire purchase and finance

lease liabilities (257)

------------------------------- ------------

Net assets acquired 7,639

------------------------------- ------------

Consideration paid:

Cash 6,600

------------------------------- ------------

Gain on bargain purchase (1,039)

------------------------------- ------------

The fair value of the net assets acquired are provisional

pending finalisation of the fair value exercise in relation to

those assets.

The fair value of the intangible assets represents the estimated

fair value of Spanoptic's customer relationships and its brand.

These have been valued using a discounted cash flow model.

The gain on bargain purchase of GBP1.0 million has been credited

to the income statement.

Post-acquisition, the acquired business contributed GBP3.4

million of revenue and GBP0.5 million of profit after tax to the

consolidated income statement.

13. Acquisition of Constelex Technology Enablers Limited

On 26 November 2013, the Group completed the acquisition of the

entire issued share capital of Constelex Technology Enablers

Limited, designer and manufacturer of advanced photonic systems

based in Athens, Greece.

The consideration for the acquisition was EUR650,000

(GBP539,000), comprising EUR400,000 (GBP333,000) in cash, followed

by EUR250,000 (GBP207,000) in Gooch & Housego shares when the

activities are relocated to the UK.

The fair value of the assets acquired is summarised as

follows:

Provisional

fair value

GBP'000

------------------------------- ------------

Property, plant and equipment 18

Intangible assets 327

Cash 401

Trade and other receivables 813

Trade and other payables (1,202)

Current and deferred tax

liabilities (65)

Net assets acquired 292

------------------------------- ------------

Consideration paid:

Cash 333

Deferred share consideration 207

------------------------------- ------------

Total consideration 540

------------------------------- ------------

Goodwill 248

------------------------------- ------------

The deferred share consideration is payable to the vendors when

they relocate to the UK. EUR125,000 of the deferred consideration

was issued on 24 February 2014.

The fair value of the net assets acquired are provisional

pending finalisation of the fair value exercise in relation to

those assets.

The fair value of the intangible assets represents the estimated

fair value of future secured grant funding based on a discounted

cash flow valuation.

Goodwill reflects items not separately recognised.

Post-acquisition, the acquired business contributed GBP96,000 of

revenue and GBP21,000 of profit after tax to the consolidated

income statement.

14. Post balance sheet events

On 16 April 2014, management announced the proposed closure of

the Group's Melbourne, Florida facility in connection with the

consolidation of acousto-optic development and manufacturing into

two of the Group's existing sites.

The costs of the proposed closure will be recorded in the

results for the second half of 2014.

On 31 May 2014 Terry Scribbins retired as Chief Operating

Officer.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR SSEFMUFLSEFM

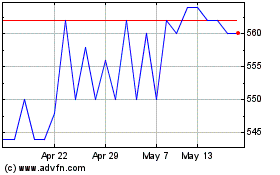

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jul 2023 to Jul 2024