RNS Number:0951E

Gooch & Housego PLC

20 January 2000

GOOCH & HOUSEGO PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 30 SEPTEMBER 1999

Gooch & Housego PLC, the specialist manufacturer of precision

optical components and bespoke glass engineering items,

acousto-optic devices and instruments for measuring optical

radiation, today announces preliminary results for the year

ended 30 September 1999.

Highlights

* Completion of the acquisition of Cleveland Crystals Inc

which contributed to increased profits.

* Turnover increased by 45% to #10,377,000 (1998: #7,154,000)

* Operating profit increased by 18% to #2,001,000 (1998:

#1,701,000)

* Appointment of new Management team to the Board in

January 2000

* Recommended increase in final dividend of 1.3p per share

making a total for the year of 1.9p (1998 : 1.7p)

Archie Gooch, Chairman of Gooch & Housego commented, "In the

past year we have witnessed several significant changes within

the Group. We have already taken steps in our various

operations to meet the challenges of the markets in which we

operate. All of our subsidiaries are working closely together

to integrate their unique technical and marketing skills, and

I believe that, with the new management team in place, we

again have a solid foundation on which to develop the Group".

For further information:

Archie Gooch/Ian Bayer

Gooch & Housego PLC 01460 52271

Tim Thompson/Jennie Duschenes

Buchanan Communications 0171 466 500

CHAIRMAN'S STATEMENT

I am pleased to submit my report for the year ended 30th

September 1999. These results reflect the considerable

changes at Gooch & Housego PLC including the key strategic

acquisition of Cleveland Crystals Inc (CCI) in February 1999.

The acquisition was achieved against strong competition from

both French and German companies, but we were successful

because the Management of CCI perceived that under our

ownership there were considerable advantages in the product

range and Management structure.

RESULTS & DIVIDENDS

Overall Group results for the year, including a significant

eight-month contribution from CCI, are ahead of last year,

although below our initial expectations. Turnover increased

45% from #7,154,000 to #10,377,000. Operating profits, after

deducting the amortisation of goodwill arising on the

acquisition of CCI of #115,000, were #2,001,000 (1998 :

#1,701,000) an increase of 18%. Profits before tax were

#1,851,000 (1998 : #1,812,000). The reduction in earnings per

share to 6.5p (1998 : 7.5p) reflects the higher relative

contribution from the Group's US subsidiaries where tax rates

are higher.

As a measure of the Board's confidence in the current and

future prospects of the Group, it is recommending an increased

final dividend of 1.3p (1998 : 1.2p) which, together with the

interim dividend paid, totals 1.9p (1998 : 1.7p) for the year.

Subject to approval at the Annual General Meeting the final

dividend will be payable on 2 March 2000 to all shareholders

on the register on 4 February 2000.

UNITED KINGDOM

Although turnover was marginally higher than in the previous

financial year at #4,798 ,000 (1998: #4,565,000) there were

two problems that affected the UK business.

The first of these, which was beyond our control, was due to

the much publicised problems of the electronics industry in

Japan and the Far East. We suffered a 21% down turn in the

call off of Q-switches and this significantly affected the

profitability of our UK business. I am pleased to report that

sales and production have now returned to their 1998 levels

and are increasing. The forward order book is still buoyant

and there have been no cancellations of annual contracts.

The second problem was the delay in the installation and

implementation of the new computer system. A number of

measures have now been taken to improve the flexibility and

responsiveness of our manufacturing process, including the

introduction of a new computerised material requirements

planning and production control system. The introduction of

the computer system has taken longer than expected and

resulted in a number of the production difficulties already

referred to. I am pleased to report that following the

appointment of an experienced IT Manager all modules of the

new systems are expected to be fully operational by March 2000

with the resultant expected increases in efficiency.

Progress on the development of a fibre-optic switch for

telecommunications applications is ongoing. The research

laboratory dedicated to this project is now fully established,

and our new physicist is generating encouraging results. We

are pleased to report that one of the main problems has now

been overcome, which has given us encouragement that this

switch can be developed to the final stages.

Our traditional precision optics business has come through a

turbulent year when, as referred to in my interim report,

although orders increased significantly the complexity of work

resulted in less efficient production and a decline in

profitability. I am pleased to report that our new middle

management team has tackled the operational production

problems and the business looks strongly placed to develop in

the current financial year with a greater depth of skills

across the employee base. The optics business has the

opportunity of some significant orders in the current year

which should help return the business to its historic levels

of profitability.

UNITED STATES

CLEVELAND CRYSTALS INC

The Board is very pleased to have secured the #4,272,000

acquisition of CCI. In the period since acquisition CCI has

contributed profits of #927,000 on turnover of #3,247,000.

These excellent results, benefitted from the accomplishment of

certain milestones on contracts with The US Department of

Energys National Ignition Facility (NIF) at Lawerence

Livermore National Laboratories (LLNL) in California and the

ongoing supply of large crystals to Rochester University. In

comparison trading in CCIs core electro optics Q switches has

suffered in the same way as the UK business.

The prospects for the current year are encouraging as CCI

continues work on the growth and fabrication of crystals for

the new laser facility at LLNL as part of a $5 million

incrementally funded contract, although the relative level of

profitability on the current stages of the contract is

expected to be less.

OPTRONICS LABORATORIES Inc

As reported in my interim statement trading conditions at

Optronic Laboratories Inc ("OLI") continue to be difficult.

Turnover for the twelve months was #2,562,000 (1998:

#2,723,000) down 6% with a resultant fall in operating

profits to #66,000 (1998 : #277,000).

Trading in the first quarter of the current financial year has

started ahead of the same period of 1998 and I am particularly

encouraged by the increased level of enquiries. New products

launched earlier in the year are experiencing an increasing

level of interest and we are anticipating that sales will

increase in the latter part of 2000.

I am pleased to report that the optics facility is now fully

operational in Orlando and sales have commenced. The facility

will allow G&H to penetrate the US market as a local supplier

as well as providing a secondary specialist production

facility to satisfy the high levels of demand being

experienced in the UK.

DIRECTORS

It was with much sadness that I reported the resignation of

Tony Heals through ill health. He had been a loyal servant of

the Group for 30 years, latterly as Financial Director. He

will be much missed by all our staff. Gareth Jones who had

been Managing Director has also moved on to further his career

outside of the industry. His unique skills as a physicist in

acousto optics helped establish G&H as a leader in the Q

switch market several years ago.

I am delighted since the year-end to have appointed a new team

to the Board, who I believe have the proven ability to drive

the Group forward.

Paul Kenrick joined at the start of January as replacement for

Gareth Jones as Managing Director. Paul has over thirty years

experience in the optical industry and has been responsible

for several major optical catalogue businesses. His

operational experience at Corning together with his market

knowledge gained at Melles Griot and OptoSigma will be an

invaluable asset to the Group.

Ian Bayer has replaced Tony Heals as Finance Director. He

brings with him a wealth of operational and financial

experience as a Finance Director within the public company

arena. His experience of controlling US subsidiaries will be

particularly helpful, as this part of the group has become

increasingly important. Bill Pooles appointment as Director

of Production is bringing further success.

I am delighted to announce that Eugene Arthurs the former

president of CCI has joined the Board as Non-Executive

Director. He has been involved in the optical industry across

both sides of the Atlantic for over thirty years in both a

commercial and senior management role. He is currently

Executive Director of SPIE the International Society for

Optical Engineering in the US. His vast knowledge of the

optics industry will bring considerable strength to the Board.

He joins Jan Melles who also has world wide respect in our

industry.

MANAGEMENT AND STAFF

The past year has been challenging for the Group. I am

grateful for the effort and dedication shown by the management

and staff without whom these results announced today would not

have been possible.

PROSPECTS

In the past year we have witnessed several significant changes

within the Group. We have already taken steps in our various

operations to meet the challenges of the markets in which we

operate. All of our subsidiaries are working closely together

to integrate their unique technical and marketing skills, and

I believe that, with the new management team in place, we

again have a solid foundation on which to develop the Group.

The current year has begun with strong order books and in line

with expectations, and we look forward to a year of increased

growth.

Archie Gooch MBE JP

Executive Chairman

20th January 2000

GROUP PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED

30 SEPTEMBER 1999

Existing Acquisitions

Operations 1999 1998

# 000 # 000 # 000 # 000

Turnover 7,130 3,247 10,377 7,154

Trading expenditure (6,056) (2,320) (8,376) (5,453)

------ ------- ------- -------

Operating profit 1,074 927 2,001 1,701

====== ======

Exceptional item: Profit

on disposal of fixed

assets - 85

------ ------

Profit on ordinary

activities before interest 2,001 1,786

Other interest receivable

and similar income 41 88

Interest payable and

similar charges (191) (62)

------ -------

Profit on ordinary

activities before taxation 1,851 1,812

Tax on profit on ordinary

activities (756) (569)

------- ------

Profit on ordinary

activities after taxation 1,095 1,243

Dividends on equity shares (321) (288)

------- -------

Retained profit for the

financial year 774 955

====== =======

Earnings per 20p ordinary share 6.5p 7.5p

All operations undertaken by the Group during the current year

are continuing.

STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

For the year ended 30 September 1999

1999 1998

# 000 # 000

Profit for the financial year 1,095 1,243

Currency translation difference on foreign

currency net investments 16 (55)

----- ------

Total recognised gains and losses for the 1,111 1,188

financial year ===== ======

No note of historical cost profit for the group or the company

has been presented as the difference between the reported

profit is immaterial.

CONSOLIDATED BALANCE SHEET AS AT 30 SEPTEMBER 1999

1999 1998

# 000 # 000 # 000 # 000

FIXED ASSETS

Intangible assets 3,336 4

Tangible assets 3,497 2,955

----- ------

6,833 2,959

CURRENT ASSETS

Stocks 1,440 1,178

Debtors 3,238 1,591

Cash at bank and in hand 269 1,416

----- ------

4,947 4,185

CREDITORS : amounts falling

due within one year (2,806) (1,571)

------ --------

NET CURRENT ASSETS 2,141 2,614

------ -------

TOTAL ASSETS LESS CURRENT 8,974 5,573

LIABILITIES

CREDITORS : amounts falling

due after more than one year (2,916) (305)

------- -------

6,058 5,268

======= =======

CAPITAL AND RESERVES

Called up share capital 3,381 3,381

Share premium account 1,113 1,113

Revaluation reserve 308 308

Profit and loss account 1,256 466

------ ------

EQUITY SHAREHOLDERS FUNDS 6,058 5,268

====== ======

Note; The 1998 Balance Sheet, has been restated following the

implementation of FRS10 "Goodwill and Intangible Assets".

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 September 1999

Note 1999 1998

# 000 # 000 # 000 # 000

Cash flow from operating

activities (i) 1,592 1,423

Returns on investments

and servicing

of finance

Interest received 41 88

Interest paid (173) (67)

Interest element of

hire purchase

contracts (1) (7)

------- --------

Net Cash (outflow)/inflow

from returns on investments

and servicing of finance (133) 14

Taxation

UK tax paid (522) (374)

Overseas tax paid (251) (68)

------- --------

Cash outflow from taxation (773) (442)

Capital expenditure and financial

investment

Purchase of tangible fixed assets (612) (1,193)

Sale of tangible fixed assets 15 286

------ --------

Net cash outflow from capital

expenditure and financial

investment (597) (907)

Acquisition

Acquisition of subsidiary (4,272) -

Cash acquired on acquisition 55 -

-------- --------

Net cash outflow from acquisition (4,217) -

Equity dividends paid (304) (111)

------ ------

Cash inflow before financing (4,432) (23)

Financing

New bank loans 3,411 -

Cash inflow from flotation - 1,495

Repayment of bank loan (202) (219)

Capital element of hire purchase

contracts (49) (11)

-------- -------

Net cash inflow from financing 3,160 1,265

----- -----

(Decrease)/increase in cash in the

year (iii) (1,272) 1,242

======= =====

CONSOLIDATED CASH FLOW STATEMENT

Notes to the cash flow statement

(i) Reconciliation of operating profit to operating cash flows

1999 1998

Continuing Acquisitions Total

# 000 # 000 # 000 # 000

Operating profit 1,074 927 2,001 1,701

Amortisation of goodwill - 115 115 -

Depreciation 318 44 362 258

Decrease/(increase)

in stock 21 182 203 (362)

(Increase) in debtors (605) (685) (1,290) (95)

(Decrease)/increase in

creditors 139 62 201 (79)

----- ----- ----- -----

947 645 1,592 1,423

===== ===== ===== ======

(ii) Cash flow relating to exceptional items

The cash inflows in the year ended 30 September 1998

included a cash inflow of #286,000 received from the new

proceeds of selling the Orlando factory.

(iii) Reconciliation of net cash inflow to movement in net

funds/(debt)

1999 1998

# 000 # 000

(Decrease)/increase in cash in the (1,272) 1,242

year

Cash (inflow)/outflow from

(increase)/decrease in

debt and lease financing (3,159) 230

------- ------

Changes in net debt resulting from

cash flows (4,431) 1,472

New hire purchase contracts (66) -

Translation difference 22 (12)

------- -------

Movement in net debt in the year (4,475) 1,460

Net funds/(debt) at 1 October 1998 893 (567)

------- ------

Net (debt)/funds at 30 September 1999 (3,582) 893

======= ======

Liquid resources comprise short-term deposits with banks.

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 30 September 1999

(iv) Analysis of net (debt)/funds

At 1 At 30

October Cash Exchange Non-cash September

1998 flow Movement Movement 1999

# 000 # 000 # 000 # 000 # 000

Cash in hand at

bank 1,416 (1,158) 11 - 269

Overdrafts - (114) - - (114)

-------

(1,272)

Debt due after

1 year (280) (2,632) 12 - (2,900)

Debt due within

1 year (186) (577) - - (763)

Hire Purchase (57) 50 (1) (66) (74)

-------

(3,159)

------ ------- ---- ----- -----

893 (4,431) 22 (66) (3,582)

====== ======= ==== ===== ======

Copies of this statement will be sent to shareholders on

4 February 2000 and will be available from The Old

Magistrates Court, Ilminster, Somerset.

END

FR KKCKQFBKDBDD

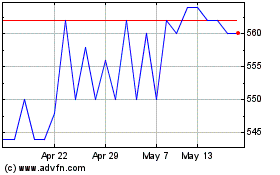

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From May 2024 to Jun 2024

Gooch & Housego (LSE:GHH)

Historical Stock Chart

From Jun 2023 to Jun 2024