Foresight Slr Fnd Ld Foresight Solar Fund Limited : Proposed Issue Of Equity Under The Placing Programme

May 18 2015 - 2:01AM

UK Regulatory

TIDMFSFL

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR INDIRECTLY, TO

U.S. PERSONS, OR IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, SOUTH

AFRICA OR JAPAN

This announcement does not constitute an offer to sell, or the

solicitation of an offer to subscribe for, or to buy shares in any

jurisdiction.

This announcement is neither an advertisement, a prospectus nor a

financial promotion. Any investment in any shares referred to in this

announcement may be made only on the basis of information in the

prospectus (the "Prospectus") published by Foresight Solar Fund Limited

on 25 September 2014, in connection with a placing programme (the

"Placing Programme") for ordinary shares of no par value each ("Ordinary

Shares"), to be admitted to the Premium Listing segment of the Official

List of the UK Listing Authority and to trading on the Main Market for

listed securities of the London Stock Exchange.

Proposed Placing under the Placing Programme

The Board of Foresight Solar Fund Limited (the "Company") is pleased to

announce a proposed further placing of new Ordinary Shares under the

Placing Programme announced on 25 September 2014 in accordance with the

Prospectus (the "Placing").

The Placing price will be based on an updated NAV per Ordinary Share to

be announced on 1 June 2015 plus a premium to cover the costs of the

Placing. New Ordinary Shares to be issued under the Placing will carry

an entitlement to the first quarterly dividend of 1.52 pence, as

announced on 27 April 2015, in respect of the period from 1 January to

31 March 2015, which will be paid on 30 June 2015.

Unless otherwise defined herein, terms used in this announcement shall

have the same meanings as those defined in the Prospectus.

Investment Update

-- Following financial completion of the Kencot asset and Wymeswold

extension, the Company has invested a further GBP50 million since the

GBP36.1 million raised during March 2015 under the Placing Programme.

-- The Company has secured exclusivity over a pipeline of assets totalling

more than 100MW, including a 51MW operational portfolio which was

connected to the Grid in Q1 2015 and thus qualifies for the 1.4 Renewable

Obligation Certificate ("ROC") rate.

-- The successful acquisition of all of the exclusive pipeline would

represent an increase in capacity of c. 50% for the Company.

-- The proceeds from the Placing will therefore be used towards repaying the

existing acquisition facility and enabling the Company to take advantage

of this exclusive pipeline of assets.

-- Performance of the portfolio remains in line with the expectations of the

Investment Manager.

Timetable

The expected timetable is as follows but is subject to change at the

discretion of the Company, Stifel Nicolaus Europe Limited ("Stifel") and

J.P. Morgan Cazenove.

Event Date

Announcement of NAV and Placing price 1 June 2015

Placing Opens 1 June 2015

Latest time and date for receipt of Placing 12:00pm on 11 June

commitments 2015

Results of Placing announced 12 June 2015

Admission and Settlement 16 June 2015

Crediting of CREST in respect of New Shares 8.00am on 16 June 2015

Share certificates in respect of New Shares despatched On or around 23 June

(if applicable) 2015

ENDS

For further information, please contact:

Foresight Group

Elena Palasmith epalasmith@foresightgroup.eu +44 (0)203 667 8100

Stifel Nicolaus Europe Limited (Sponsor and Joint

Bookrunner) +44 (0)20 7710 7600

Mark Bloomfield

Neil Winward

Tunga Chigovanyika

J.P. Morgan Cazenove (Joint Bookrunner)

William Simmonds +44 (0)20 7742 4000

Notes to Editors

About Foresight Solar Fund Limited ("The Company" or "FSFL")

FSFL is a Jersey-registered closed-end investment company. The Company

invests in ground based UK solar power assets to achieve its objective

of providing Shareholders with a sustainable and increasing dividend

with the potential for capital growth over the long-term. The Company's

233MW, ten asset portfolio is fully operational.

The Company raised proceeds of GBP150m through an initial public

offering ("IPO") of shares on the main market of the London Stock

Exchange in October 2013, and a further GBP96.2m through issues under

the Placing Programme in October 2014 and March 2015.

About Foresight Group

Foresight Group was established in 1984 and today is a leading

independent infrastructure and private equity investment manager with

over GBP1.3 billion of assets under management. As one of the UK's

leading solar infrastructure investment teams Foresight funds currently

manage c. GBP1 billion in over 40 separate operating Photovoltaic ("PV")

plants in the UK, the USA and southern Europe.

In May 2013 Foresight executed an innovative refinancing of its existing

UK solar assets through the issue of a GBP60m London Stock Exchange

listed index-linked Solar Bond.

Foresight Group has offices in London, Nottingham, Guernsey, Rome and

San Francisco.

www.foresightgroup.eu

This announcement is not for distribution, directly or indirectly, in or

into the United States of America (including its territories and

possessions, any state of the United States of America and the District

of Columbia) (the "United States"), Australia, Canada, Japan or South

Africa. This announcement does not constitute, or form part of, an offer

to sell, or a solicitation of an offer to purchase, any securities in

the United States, Australia, Canada, Japan or South Africa. The

securities of the Company have not been and will not be registered under

the U.S. Securities Act of 1933, as amended (the "Securities Act") or

the US Investment Company Act of 1940, as amended and may not be offered

or sold directly or indirectly in or into the United States or to or for

the account or benefit of any US Person (within the meaning of

Regulation S under the Securities Act). The securities referred to

herein have not been registered under the applicable securities laws of

Australia, Canada, Japan or South Africa and, subject to certain

exceptions, may not be offered or sold within Australia, Canada, Japan

or South Africa or to any national, resident or citizen of Australia,

Canada, Japan or South Africa.

This announcement has been issued by and is the sole responsibility of

the Company. No representation or warranty, express or implied, is or

will be made as to, or in relation to, and no responsibility or

liability is or will be accepted by, Stifel or J.P. Morgan Cazenove or

by any of their respective affiliates or agents as to or in relation to

the accuracy or completeness of this announcement or any other written

or oral information made available to or publicly available to any

interested party or their advisers and any liability therefore is

expressly disclaimed.

Stifel, which is authorised and regulated in the United Kingdom by the

Financial Conduct Authority, is acting as sponsor to the Company and is

acting for no-one else in connection with the Placing and the contents

of this announcement and will not be responsible to anyone other than

the Company for providing the protections afforded to clients of Stifel

nor for providing advice in connection with the Issues and the contents

of this announcement or any other matter referred to herein.

J.P. Morgan Cazenove which is authorised by the Prudential Regulation

Authority and regulated by the Prudential Regulation Authority and the

Financial Conduct Authority and Stifel (together, the "Joint

Bookrunners"), are each acting exclusively for the Company and no-one

else in connection with the Placing or the matters referred to in this

announcement, will not regard any other person as their respective

client in relation to the Placing and will not be responsible to anyone

other than the Company for providing the protections afforded to their

respective clients or for providing advice in relation to the Placing or

any transaction or arrangement referred to in this announcement.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Foresight Solar Fund Limited via Globenewswire

HUG#1921927

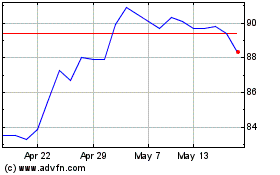

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From May 2024 to Jun 2024

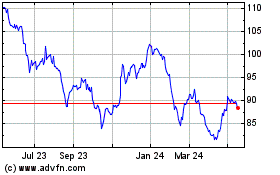

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jun 2023 to Jun 2024