Foresight Slr Fnd Ld Foresight Solar Fund Limited : Connection Of Bournemouth And Kencot Assets & Proposed Initial Placing An...

September 25 2014 - 2:01AM

UK Regulatory

TIDMFSFL

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR INDIRECTLY, TO

U.S. PERSONS, OR IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, SOUTH

AFRICA OR JAPAN

This announcement does not constitute an offer to sell, or the

solicitation of an offer to subscribe for, or to buy shares in any

jurisdiction.

This announcement is neither an advertisement, a prospectus nor a

financial promotion. Any investment in any shares referred to in this

announcement may be made only on the basis of information in a

prospectus (the "Prospectus") to be published by Foresight Solar Fund

Limited in connection, inter alia, with the proposed admission of its to

be issued ordinary shares of no par value each to the Premium Listing

segment of the Official List of the UK Listing Authority and to trading

on the Main Market for listed securities of the London Stock Exchange.

Foresight Solar Fund Limited

Connection of Bournemouth and Kencot Assets & Proposed Initial Placing

and Offer for Subscription and Placing Programme

25 September 2014

The Board of Foresight Solar Fund Limited (the "Company") is pleased to

confirm the successful connection to the grid of the 37MW Bournemouth

and the 37MW Kencot, Oxfordshire assets. The Company hereby announces

its intention to raise up to a target amount of approximately GBP100

million, by way of an Initial Placing and Offer for Subscription (the

"Initial Placing and Offer") of new Ordinary Shares ("New Shares") and

to create a Placing Programme in relation to its New Shares (the Initial

Placing and Offer and Placing Programme, together known as the

"Issues"). The Initial Placing and Offer Price is based on the NAV per

Share as at 30 September 2014 plus a premium of two per cent. to cover

the costs of the Initial Placing and Offer.

Background and Reasons for the Issues

Following the Company's successful launch in October 2013, the Company

has acquired, or agreed to acquire, subject only to the assets receiving

ROC Accreditation, nine operational assets with an aggregate value of

approximately GBP239 million. To enable the Board to take advantage of

the prevailing market conditions and investment opportunities, the Board

is proposing an Initial Placing and Offer with the proceeds, together

with existing debt facilities, to be used to complete the acquisition of

two assets which the Group has already contracted to acquire. The two

assets are the 37MW Bournemouth solar power plant in Dorset, and the

37MW Kencot, Oxfordshire asset which are both now connected to the grid.

The Company is also proposing a Placing Programme to fund, together with

its existing debt facilities, further acquisition opportunities which

support the Company's investment objective and acquisition criteria, as

and when they arise. This will provide the flexibility to enable the

Investment Manager to act opportunistically, by making a series of

accretive acquisitions whilst also mitigating the risk of cash drag on

Shareholders' funds.

The Board further believes that the Issues offer significant benefits

for all Shareholders as noted below:

-- any proceeds raised under the Issues would increase the net assets of the

Group and provide flexibility in managing the Group's leverage;

-- the Issues offer the Company the potential opportunity to benefit from

further acquisitions which will diversify the Group's portfolio;

-- the Issues would significantly increase the market capitalisation of the

Company which should therefore increase liquidity in the Ordinary Shares;

and

-- as a result of the Issues, the fixed costs of the Group would be spread

over a larger asset base and therefore the total expense ratio of the

Group would be reduced.

Details of the Issues

The Initial Placing and Offer

Following the announcement of connection and commencement of operations

of the Bournemouth and Kencot solar power plants, the Company is

proposing to target an initial issue of up to 100 million New Shares at

the Initial Placing and Offer Price, to raise Gross Proceeds of

approximately GBP100 million.

The Placing Programme

Following the Initial Placing and Offer, the Board intends to implement

the Placing Programme. Under the Placing Programme, subject to

shareholder approval, the Company intends to issue up to 200 million New

Shares less any such shares issued pursuant to the Initial Placing and

Offer. The Placing Programme is being implemented to enable the Company

to raise additional capital in the period to 24 September 2015 as and

when it identifies suitable assets for acquisition.

Extraordinary General Meeting

The Issues are subject to Shareholder approval to be sought at an

extraordinary general meeting ("EGM") to be held at 1.00 p.m. on 13

October 2014 at Elizabeth House, 9 Castle Street, St. Helier, Jersey JE4

2QP. A circular and notice of EGM (the "Circular") to approve by special

resolution the issue of the New Shares without having to first offer

those New Shares to existing Shareholders, and to approve by ordinary

resolution the Related Party Transaction that may arise if any of

BlackRock, Inc. and its Associates, including funds controlled by it or

any of them (the "BlackRock Related Parties") wish to take part in the

Issues, is expected to be posted later today.

The Related Party Transaction

As the BlackRock Related Parties have held more than ten per cent. of

the voting rights in the Company in the past 12 months, they are

considered to be a "related party" for the purposes of the Listing

Rules. Subject to the paragraph below, the issue of New Shares to any

of the BlackRock Related Parties pursuant to the Issues would constitute

a "related party transaction" and requires the approval of the

Shareholders.

The BlackRock Related Parties can subscribe for New Shares issued

pursuant to the Issues, without the approval of the Shareholders, if the

aggregate gross proceeds of the New Shares issued to the BlackRock

Related Parties pursuant to the Issues over a 12 month period represent

five per cent. or less of the market capitalisation of the Company at

the time of allocation to the BlackRock Related Parties and the number

of New Shares issued to the BlackRock Related Parties in the 12 month

period does not exceed five per cent. of the issued share capital.

As the aggregate gross proceeds and the number of any New Shares over a

12 month period issued to the BlackRock Related Parties pursuant to the

Issues may breach the thresholds described above, the Listing Rules

require the approval of the Related Party Transaction by Independent

Shareholders to enable the BlackRock Related Parties to participate in

the Issues.

Should the BlackRock Related Parties choose to participate in any

Placing under the Placing Programme (including the Initial Placing)

and/or the Offer for Subscription, their participation will be on the

same terms as other placees in that placing (including the Initial

Placing) and/or other subscribers in the Offer for Subscription (as

applicable). In addition, any commissions paid by the Company to Oriel

in respect of subscribers for New Shares procured by Oriel will be the

same whether or not such subscriber is one of the BlackRock Related

Parties.

The BlackRock Related Parties are not permitted to subscribe for New

Shares pursuant to the Issues if the aggregate gross proceeds in respect

of their participation over the course of the Issues represent more than

GBP37.5 million (being approximately 24.10 per cent. of the market

capitalisation of the Company as at 23 September 2014 or 24.13 per cent.

of the Net Asset Value of the Company as at 30 June 2014).

In addition the Prospectus in relation to the Issues is expected to be

published on or around today's date.

Words and expressions that are defined in the Prospectus and the

Circular shall have the same meaning where they are used in this

announcement, except where the context requires otherwise.

Timetable

The expected timetable for the Issues is as follows:

Event Date

Initial Placing and Offer

Initial Placing and Offer opens 25 September 2014

Latest time and date for return of Forms of Proxy 1.00pm on 9 October 2014

for the Extraordinary General Meeting

Extraordinary General Meeting 1.00pm on 13 October 2014

Initial Placing and Offer Price announced 13 October 2014

Latest time and date for receipt of Application Forms 11.00 a.m. on 15 October 2014

under the Offer

Latest time and date for commitments under the Initial 12.00 p.m. on 16 October 2014

Placing

Results of Initial Placing and Offer announced 17 October 2014

Admission and dealings in New Shares commence 8.00 a.m. on 22 October 2014

Crediting of CREST accounts in respect of the New 22 October 2014

Shares

Share certificates in respect of New Shares despatched on or around 29 October 2014

(if applicable)

Placing Programme

Placing Programme opens 22 October 2014

Publication of Placing Programme Price in respect At the time of each Issue

of each Issue

Admission and dealings in New Shares commence 8.00 a.m. on each day New Shares are issued

Crediting of CREST in respect of New Shares 8.00 a.m. on each day New Shares are issued

Share certificates in respect of New Shares despatched Approximately one week following the issue of any

(if applicable) New Shares

Last date for New Shares to be issued under the Placing 24 September 2015

Programme

The dates and times specified above are subject to change.

ENDS

For further information, please contact:

Foresight Group

Sarah Cole +44 (0)203 667 8154

Oriel Securities (Sponsor and Bookrunner) +44 (0)20 7710 7600

Mark Bloomfield

Neil Winward

Tunga Chigovanyika

This announcement is not for distribution, directly or indirectly, in or

into the United States of America (including its territories and

possessions, any state of the United States of America and the District

of Columbia) (the "United States"), Australia, Canada, Japan or South

Africa. This announcement does not constitute, or form part of, an offer

to sell, or a solicitation of an offer to purchase, any securities in

the United States, Australia, Canada, Japan or South Africa. The

securities of the Company have not been and will not be registered under

the U.S. Securities Act of 1933, as amended (the "Securities Act") or

the US Investment Company Act of 1940, as amended and may not be offered

or sold directly or indirectly in or into the United States or to or for

the account or benefit of any US Person (within the meaning of

Regulation S under the Securities Act). The securities referred to

herein have not been registered under the applicable securities laws of

Australia, Canada, Japan or South Africa and, subject to certain

exceptions, may not be offered or sold within Australia, Canada, Japan

or South Africa or to any national, resident or citizen of Australia,

Canada, Japan or South Africa.

This announcement has been issued by and is the sole responsibility of

the Company. No representation or warranty, express or implied, is or

will be made as to, or in relation to, and no responsibility or

liability is or will be accepted by, Oriel Securities Limited, or by any

of their respective affiliates or agents as to or in relation to the

accuracy or completeness of this announcement or any other written or

oral information made available to or publicly available to any

interested party or their advisers and any liability therefore is

expressly disclaimed.

Oriel Securities Limited, which is authorised and regulated in the

United Kingdom by the Financial Conduct Authority, is acting as sponsor

and bookrunner to the Company and is acting for no-one else in

connection with the Issues and the contents of this announcement and

will not be responsible to anyone other than the Company for providing

the protections afforded to clients of Oriel Securities Limited nor for

providing advice in connection with the Issues and the contents of this

announcement or any other matter referred to herein.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Foresight Solar Fund Limited via Globenewswire

HUG#1858177

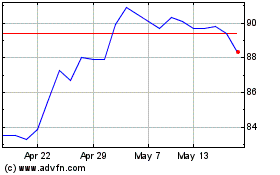

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jun 2024 to Jul 2024

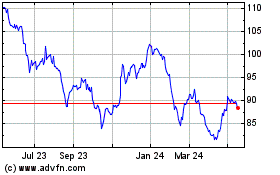

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jul 2023 to Jul 2024