Foresight Slr Fnd Ld Foresight Solar Fund Limited : Net Asset Value & Trading Update

July 10 2014 - 2:01AM

UK Regulatory

TIDMFSFL

10 July 2014

Foresight Solar Fund Limited ("FSFL")

NAV Update & Trading Update

NAV UPDATE AS AT 30 JUNE 2014

-- The Company is pleased to report that its unaudited Net Asset Value (NAV)

increased from GBP148.6m to GBP155.43m as at June 30 2014 equivalent to

an NAV per ordinary share of 103.62p, an increase of 4.52p from 31 March

2014.

OPERATIONAL STATUS

-- The Company's 111MW, seven asset UK solar portfolio is fully operational

following the recent grid connection of the 10.7MW Hunters Race asset in

West Sussex.

DIVIDEND

-- The Company confirms its intent to deliver a target dividend of 6p per

ordinary share in respect of its first financial year with the maiden

interim dividend to be announced in August 2014.

RISK PROFILE

-- The Company maintains the lowest risk approach to the sector by seeking

to avoid blind pool, development, construction and accreditation risk in

its acquisition of assets. This deliberate strategy minimises the

exposure of our investments to changes in regulation such as the recent

accelerated introduction of a cliff-edge deadline in March 2015 for

Renewable Obligation Certificate (ROC) projects greater than 5MWs.

SCALE

-- The Company, already the largest dedicated UK listed solar investment

company, will grow to GBP250m of assets through the agreed acquisition,

when operational, of the Kencot and Bournemouth plants, totalling a

further 74MW. These acquisitions will be financed utilising a GBP100m

bank facility previously announced in May 2014. Both assets are expected

to become operational later in 2014 and qualify under the 1.4 ROC regime,

consistent with the risk profile detailed above.

-- The anticipated gearing, being borrowings as a percentage of the

Company's Gross Asset Value, is not expected to exceed 40 per cent at the

time of drawdown.

ENDS

For further information

Sarah Cole scole@foresightgroup.eu 0203 667 8154

Notes to Editors

About Foresight Solar Fund Limited ("The Company" or "FSFL")

FSFL is a Jersey-registered closed-end investment company. The Company

invests in ground based UK solar power assets to achieve its objective

of providing Shareholders with a sustainable and increasing dividend

with the potential for capital growth over the long-term.

The Company raised proceeds of GBP150m through an initial public

offering ("IPO") of shares on the main market of the London Stock

Exchange in October 2013.

About Foresight Group

Foresight Group was established in 1984 and today is a leading

independent infrastructure and private equity investment manager with

over GBP1.2 billion of assets under management. As one of the UK's

leading solar infrastructure investment teams Foresight funds currently

manage over GBP900 million in 29 separate operating Photovoltaic ("PV")

plants in the UK, the USA and Southern Europe.

In May 2013 Foresight executed an innovative refinancing of its existing

UK solar assets through the issue of a GBP60m London Stock Exchange

listed index-linked Solar Bond.

Foresight Group has offices in the UK, the USA and Italy.

http://www.foresightgroup.eu/ www.foresightgroup.eu

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Foresight Solar Fund Limited via Globenewswire

HUG#1819952

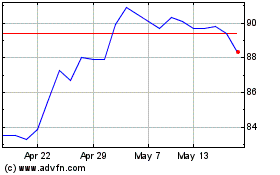

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jun 2024 to Jul 2024

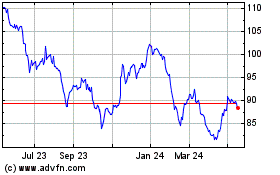

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jul 2023 to Jul 2024