Foresight Slr Fnd Ld Foresight Solar Fund Limited : Trading Statement

April 23 2014 - 2:01AM

UK Regulatory

TIDMFSFL

Foresight Solar Fund Limited ("The Company")

Trading Update

Additional 16MW of solar capacity now operational and connected to the

grid, bringing the Company's total operating capacity to 100MW

-- The Company's 16MW Pitworthy (Holsworthy SPV) solar power plant is now

connected to the grid and operational.

-- The Company has to date invested 88% of its net IPO proceeds in

operational UK solar assets.

-- Construction finance for the Company's 37MW Kencot asset to be provided

by RWE reflecting the Company's preferred risk profile of acquiring

operating assets.

-- The Company confirms its intent to deliver a target dividend of 6p per

ordinary share in respect of its first financial year.

Foresight Solar Fund Limited ("the Company") is pleased to announce that

the 16MW Pitworthy (Holsworthy SPV) asset was grid connected on April

10(th) 2014 and is now producing electricity. Pitworthy is the fourth

and final asset of a total 55MW of operational large scale UK solar

power plant assets to be acquired from SunEdison as detailed in the

Company's IPO Prospectus. The plant was acquired for GBP19.2m and is

eligible for a 1.4 ROC rate. The lower price paid for Pitworthy reflects

the change in the ROC rate for the asset, resulting in 88% of net IPO

proceeds being invested in operational UK solar assets.

Pitworthy was identified in the Company's IPO Prospectus as part of the

"Committed Portfolio" with legally binding contracts in place for its

acquisition subject to certain conditions being met by the developer of

the plants. This included the plant being built to the required standard

and its successful connections to the grid. The Company, in line with

its low risk strategy, did not take the construction risk for the

project.

RWE Supply and Trading ("RWE") announced today that they will provide

the construction financing and technical support to construct the

Company's largest "Committed" asset. Reflecting the Company's preferred

risk profile of acquiring operating assets the 37MW Kencot power plant

in Oxfordshire is expected to become operational later this year and

will qualify under the 1.4 ROC rate.

The Company will not progress the Deptford Farm asset, the smallest of

the "Exclusive" assets identified in the IPO Prospectus, to a binding

sale and purchase status.

At IPO, the Company's GBP150 million of funds were fully allocated to a

"Committed Portfolio" of large scale UK solar assets. The 32MW, 2 ROC

accredited, Wymeswold plant has been operational and accruing revenues

for the Company since November 2013. The Company announced on 31(st)

March 2014 the operational status of a further 40MW and on April 2(nd)

2014 the acquisition of the operational Spriggs Farm 12MW plant,

qualifying 52MW of Company assets under the 1.6 ROC level.

In total the Company now manages an operational portfolio of 100MW of UK

solar assets.

As described in the IPO Prospectus the Company has in-principle

agreement for the provision of an acquisition facility of up to

GBP100million. This facility may be drawn to fund future acquisitions by

the Company and will be repaid through utilisation of one or more of

excess dividend cover, further equity issuance and/or refinancing with a

long-term debt facility.

The Company continues to confirm its intent to deliver a target dividend

of 6p per ordinary share in respect of its first financial year, rising

annually with RPI thereafter, and enabling the Company to support its

strategy to sustain the NAV, offering the potential for further capital

growth.

ENDS

For further information

Sarah Cole scole@foresightgroup.eu 01732 471 863

Notes to Editors

About Foresight Solar Fund Limited ("The Company" or "FSFL")

FSFL is a Jersey-registered closed-end investment company. The Company

invests in ground based UK solar power assets to achieve its objective

of providing Shareholders with a sustainable and increasing dividend

with the potential for capital growth over the long-term.

The Company raised proceeds of GBP150m through an initial public

offering ("IPO") of shares on the main market of the London Stock

Exchange in October 2013.

About Foresight Group

Foresight Group was established in 1984 and today is a leading

independent infrastructure and private equity investment manager with

over GBP1 billion of assets under management. As one of the UK's leading

solar infrastructure investment teams Foresight funds currently manage

over GBP650 million in 27 separate operating Photovoltaic ("PV") plants

in the UK, the USA, Italy and Spain.

In May 2013 Foresight executed an innovative refinancing of its existing

UK solar assets through the issue of a GBP60m London Stock Exchange

listed index-linked Solar Bond.

Foresight Group has offices in the UK, the USA and Italy.

www.foresightgroup.eu

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Foresight Solar Fund Limited via Globenewswire

HUG#1778793

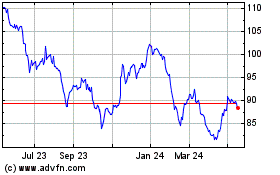

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jun 2024 to Jul 2024

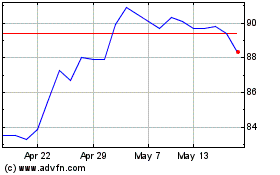

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Jul 2023 to Jul 2024