TIDMFRES

RNS Number : 9678E

Fresnillo PLC

24 October 2018

Fresnillo plc

21 Upper Brook Street

London W1K 7PY

United Kingdom

www.fresnilloplc.com

24 October 2018

Production Report

for the three months ended 30 September 2018

Overview

-- Quarterly silver production of 15.5 moz (including

Silverstream), up 6.3% vs. 3Q17 due to the contribution of the new

Pyrites Plant, higher ore grades at Fresnillo, Herradura and

Ciénega, and higher volumes of ore milled at San Julián phase II.

3Q18 production in line with 2Q18.

-- Year to date silver production (including Silverstream) of

46.3 moz, up 8.5% vs. YTD17 mainly as a result of the start of

operations at San Julián JM (Phase II) in July 2017.

-- Quarterly gold production of 225 koz, down 3.5% vs. 3Q17 as a

result of higher than normal speed in the recovery rate at the

leaching pads in 3Q17 and the lower grade and volume of ore

deposited on the pads at Herradura in 3Q18.

-- Quarterly gold production down 3.7% vs. 2Q18 mainly due to a

lower speed in the recovery rate at the leaching pads at Herradura

in 3Q18, and the lower ore grade and recovery rate at Noche

Buena.

-- Year to date gold production of 690 koz, up 1.7% vs. YTD17

mainly due to higher ore grade at Saucito and a higher volume of

ore processed at Noche Buena.

-- Full year consolidated production guidance has been revised

marginally: total gold production to 920 - 940 koz (previously 900

- 930 koz) and total silver production to 62.0 - 64.5 moz

(previously 64.5 - 67.5 moz) including Silverstream due to

continued challenges at the Saucito and Fresnillo mines, which are

currently being addressed.

Octavio Alvídrez, Chief Executive Officer, said:

"Gold production continues to beat expectations and we are once

again revising our guidance upwards following another strong

quarter, in particular at our Saucito and Noche Buena mines where

volumes exceed targets. Though silver production is up against all

comparable periods, we are revising full year silver guidance

following continued challenges at the Fresnillo and Saucito mines.

These are world class, tier one silver assets, and we remain both

determined, and confident, given the actions we are taking, that we

will deliver a better performance in the last quarter and in

2019.

In line with our strategy, we continue to conservatively invest

in the business to deliver sustainable growth and returns to

shareholders. The Pyrites Plant in the Fresnillo district, which

will improve overall recoveries of both gold and silver from the

Fresnillo and Saucito mines, is progressing well. The first stage

of the project, the leaching plant at Saucito, is now ramping up

and already making a contribution to overall production. We expect

to complete construction of phase 2, the flotation plant at the

Fresnillo mine, by the end of 2019. We look forward to this project

making a positive impact on performance."

Total Production

3Q 18 3Q 17 % change 2Q 18 YTD 18 YTD 17 % change

Silver (koz) 14,738 13,529 8.9 14,459 43,432 39,281 10.6

-------- -------- --------- -------- -------- -------- ---------

Silverstream

(koz) 796 1,084 -26.6 884 2,865 3,376 -15.1

-------------- -------- -------- --------- -------- -------- -------- ---------

Total Silver

(koz) 15,533 14,613 6.3 15,343 46,297 42,657 8.5

-------------- -------- -------- --------- -------- -------- -------- ---------

Gold (oz) 225,202 233,311 -3.5 233,841 690,501 679,081 1.7

-------------- -------- -------- --------- -------- -------- -------- ---------

Lead (t) 13,076 12,472 4.8 13,223 37,928 35,318 7.4

-------------- -------- -------- --------- -------- -------- -------- ---------

Zinc (t) 22,935 17,688 29.7 22,014 63,989 46,413 37.9

-------------- -------- -------- --------- -------- -------- -------- ---------

Silver

Quarterly silver production (including Silverstream) increased

6.3% vs. 3Q17 due to the contribution of the new Pyrites Plant,

higher ore grades at Fresnillo, Herradura and Ciénega, and higher

volumes of ore milled at San Julián phase II compared to 3Q17 when

San Julián phase II production was still in the ramp-up phase.

These increases were partially offset by the lower ore grades at

Saucito and San Julián Veins (Phase I), and a lower Silverstream

contribution as a result of lower ore grade.

Quarterly silver production increased 1.9% vs. 2Q18 mainly due

to the ramp up of the first phase of the new Pyrites Plant

following its commissioning at the end of 2Q18 and to a lesser

extent, a higher ore grade at Herradura and higher volumes of ore

processed at San Julián Veins (Phase I).

Year to date silver production (including Silverstream)

increased 8.5% vs. YTD17 mainly as a result of the start of

operations at San Julián JM (Phase II) in July 2017. This was

partially offset by a lower Silverstream contribution and lower ore

grades at Fresnillo, Saucito and San Julián Veins (Phase I).

Despite the above increases against all comparative periods,

third quarter silver production was not as high as anticipated due

to the lower than expected ore grade at Saucito and slightly lower

than expected ore throughput and ore grade at Fresnillo. As a

result, total silver production guidance for the full year has been

revised to 62.0 - 64.5 moz (previously 64.5 - 67.5 moz).

Gold

Quarterly gold production decreased 3.5% vs. 3Q17 primarily due

to higher than normal speed in the recovery rate at the leaching

pads in 3Q17, and the lower volume of ore processed at Herradura.

The lower ore grade and recovery rate at San Julián Veins (Phase I)

also contributed to the decrease in gold production. These

decreases were mitigated by a higher recovery rate and volume of

ore processed at Noche Buena and a higher ore grade at Saucito.

Quarterly gold production decreased 3.7% vs. 2Q18 due to lower

speed at the rate of recovery at the leaching pads in 3Q18 at

Herradura, the lower ore grades and recovery rates at Noche Buena

and at San Julián Veins (Phase I). These factors were mitigated by

higher ore grades at Saucito and Ciénega.

Year to date gold production increased 1.7% vs. YTD17 as a

result of the higher ore grade at Saucito and a higher volume of

ore processed and increased ore grade at Noche Buena. This was

partially offset by the expected lower ore grade at San Julián

Veins (Phase I).

Gold guidance was revised upwards to 920 - 940 koz (previously

900 - 930 koz) following strong performances at our Saucito and

Noche Buena mines.

By-products

Quarterly by-product lead production increased 4.8% vs. 3Q17

primarily due to the higher ore grade at Saucito. This more than

offset the lower ore grades and recovery rates at both Ciénega and

San Julián JM (Phase II).

Quarterly by-product lead production remained at similar levels

vs. 2Q18 (-1.1%).

Year to date by-product lead production increased 7.4% vs. YTD17

due to the contribution of San Julián JM (Phase II), higher ore

grade at Fresnillo and higher volume processed and recovery rate at

Saucito. This was partially offset by the lower ore grade at

Ciénega.

Quarterly by-product zinc production increased 29.7% vs. 3Q17 as

a result of higher volume of ore processed and improved ore grades

and recovery rates at Saucito and San Julián JM (Phase II), higher

ore grade at Fresnillo and higher recovery rates at Ciénega.

Quarterly by-product zinc production increased 4.2% vs 2Q18 as a

result of a higher recovery rate and ore grade at Ciénega and

higher recovery rates at Saucito. These factors were partly offset

by the lower recovery rate at San Julián JM (Phase II).

Year to date by-product zinc production increased 37.9% vs.

YTD17 due to the contribution of San Julián JM (Phase II) following

its commissioning in July 2017 and, to a lesser extent, higher ore

grades at Fresnillo and Saucito and increased recovery rates at

Saucito.

Fresnillo mine production

3Q 18 3Q 17 % change 2Q 18 YTD 18 YTD 17 % change

Ore Processed

(t) 613,794 596,544 2.9 620,906 1,872,110 1,855,036 0.9

-------- -------- --------- -------- ---------- ---------- ---------

Production

-------- -------- --------- -------- ---------- ---------- ---------

Silver (koz) 3,745 3,516 6.5 3,793 11,873 12,446 -4.6

-------- -------- --------- -------- ---------- ---------- ---------

Gold (oz) 10,469 8,819 18.7 10,953 31,853 29,547 7.8

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Lead (t) 4,917 4,905 0.2 5,052 15,752 15,058 4.6

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Zinc (t) 8,096 7,368 9.9 7,979 24,941 22,002 13.4

-------- -------- --------- -------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- ---------- ---------- ---------

Silver (g/t) 211 202 4.4 211 218 227 -4.1

-------- -------- --------- -------- ---------- ---------- ---------

Gold (g/t) 0.68 0.61 11.5 0.70 0.68 0.65 5.3

-------- -------- --------- -------- ---------- ---------- ---------

Lead (%) 0.89 0.91 -1.7 0.90 0.93 0.90 4.2

-------- -------- --------- -------- ---------- ---------- ---------

Zinc (%) 1.81 1.70 6.4 1.74 1.82 1.66 9.9

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Quarterly silver production increased 6.5% vs. 3Q17 mainly as a

result of the higher ore grade from the San Alberto area and to a

lesser extent, higher volume of ore processed due to increased long

drilling activities at the Candelaria area.

Quarterly silver production remained broadly flat vs. 2Q18

(-1.3%), marginally impacted by a lower volume of ore

processed.

Year to date silver production decreased 4.6% vs. YTD17 due to

the lower ore grade. As initially reported in 2Q18 Production

Report, this was due to the limited access to higher ore grade

areas resulting from contractor-led ongoing delays in development

and preparation.

As previously reported, a new contractor has now begun

operating, and this is expected to increase future development

rates. Following the review of the maintenance programme, further

efficiencies to improve equipment availability were identified,

making additional equipment purchases unnecessary.

Third quarter silver production was lower than previosuly

anticipated as a result of the lower than expected ore throughput

and ore grade extracted in some areas of the mine. To address this,

an infill drilling programme has commenced with the aim of

enhancing the accuracy of the geological model, providing greater

certainty in short term production estimates.

Expected silver ore grade for the full year remains at 215-225

g/t.

Quarterly by-product gold production increased 18.7% and 7.8%

vs. 3Q17 and YTD17 respectively mainly as a result of the higher

ore grades and increased recovery rates. Quarterly gold production

decreased 4.4% when compared to 2Q18 due to lower ore grade and ore

processed.

Quarterly by-product lead production decreased 2.7% vs. 2Q18 as

a result of lower ore grade and volume of ore processed.

Year to date by-product lead and zinc production increased 4.6%

and 13.4% respectively vs. YTD17 as a result of higher ore

grades.

Quarterly by-product zinc production increased 9.9% vs. 3Q17 as

a result of higher ore grade and ore processed.

Saucito mine production

3Q 18 3Q 17 % change 2Q 18 YTD 18 YTD 17 % change

Ore Processed

(t) 713,441 693,269 2.9 711,463 2,098,449 2,031,639 3.3

-------- -------- --------- -------- ---------- ---------- ---------

Production

-------- -------- --------- -------- ---------- ---------- ---------

Silver (koz) 4,897 5,016 -2.4 5,162 14,890 15,837 -6.0

-------- -------- --------- -------- ---------- ---------- ---------

Gold (oz) 23,558 18,490 27.4 22,722 63,160 52,349 20.7

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Lead (t) 5,791 4,368 32.6 5,327 14,301 13,810 3.6

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Zinc (t) 7,909 5,357 47.6 7,549 19,374 15,418 25.7

-------- -------- --------- -------- ---------- ---------- ---------

Ore Grades

-------- -------- --------- -------- ---------- ---------- ---------

Silver (g/t) 250 264 -5.3 260 257 283 -9.3

-------- -------- --------- -------- ---------- ---------- ---------

Gold (g/t) 1.34 1.12 19.5 1.25 1.24 1.09 13.0

-------- -------- --------- -------- ---------- ---------- ---------

Lead (%) 0.95 0.76 25.4 0.86 0.80 0.81 -2.0

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Zinc (%) 1.61 1.26 28.4 1.64 1.41 1.26 12.3

--------------- -------- -------- --------- -------- ---------- ---------- ---------

Quarterly silver production decreased 2.4% and 5.1% vs. 3Q17 and

2Q18 respectively due to the lower than expected ore grade at two

high grade stopes in the upper levels of the mine. As at the

Fresnillo mine, an infill drilling programme has commenced to

increase the accuracy of the geological model to address these

grade issues.

Year to date silver production decreased 6.0% vs. YTD17 as a

result of the lower than expected ore grade at high grade stopes in

the upper levels of the mine, the increase in dilution and reduced

stope preparation of the mine. This was mitigated by the higher

volume of ore processed.

Expected silver ore grade for the full year continues to be in

the range of 255-265 g/t.

Quarterly and YTD18 by-product gold production increased 27.4%

and 20.7% vs. 3Q17 and YTD17 respectively principally due to a

higher ore grade, increased volume of ore processed and higher

recovery rate.

Quarterly by-product gold production increased 3.7% vs. 2Q18 as

a result of higher ore grade which offset the lower recovery

rate.

Quarterly by-product lead and zinc production increased 32.6%

and 47.6% respectively vs. 3Q17 mainly as a result of higher ore

grade, and to a lesser extent higher recovery rates and volume of

ore processed.

Quarterly by-product lead production increased 8.7% vs. 2Q18 as

a result of a higher ore grade. Year to date by-product lead

production increased 3.6% vs. YTD17 as a result of higher volume of

ore processed and recovery rate, offsetting the lower ore

grade.

Quarterly by-product zinc production increased 4.8% vs. 2Q18 as

a result of the higher recovery rate. Year to date by-product zinc

production increased 25.7% vs. YTD17 as a result of higher ore

grade, higher recovery rate and to a lesser extent, volume of ore

processed.

Pyrites Plant (Phase I)

3Q 18 3Q 17 % change 2Q 18 YTD 18 YTD 17 % change

Ore Processed

(t) 63,336 0 N/A 11,745 75,081 0 N/A

------- ------ --------- ------- ------- ------- ---------

Production

------- ------ --------- ------- ------- ------- ---------

Silver (koz) 434 0 N/A 73 507 0 N/A

------- ------ --------- ------- ------- ------- ---------

Gold (oz) 1,418 0 N/A 186 1,604 0 N/A

--------------- ------- ------ --------- ------- ------- ------- ---------

Ore Grades

------- ------ --------- ------- ------- ------- ---------

Silver (g/t) 423 0 N/A 452 428 0 N/A

------- ------ --------- ------- ------- ------- ---------

Gold (g/t) 2.9 0 N/A 3.4 3.0 0 N/A

------- ------ --------- ------- ------- ------- ---------

Production at the leaching plant of the Pyrites Plant at Saucito

continued to ramp up during the period, contributing 434 koz of

silver and 1,418 oz of gold. In the first months of operation, the

plant has been mainly processing iron concentrate from the

inventory stock pile with high silver content which had been

produced from the iron flotation circuit during the past 18 months.

Once this stock pile is depleted, lower ore grade material will be

processed in 2019 and thereafter. Minor adjustments are being made

to fine tune the grinding process and further improve

efficiency.

Ciénega mine production

YTD YTD

3Q 18 3Q 17 % change 2Q 18 18 17 % change

Ore Processed

(t) 332,493 326,381 1.9 330,879 983,378 963,062 2.1

--------------- -------- -------- --------- -------- -------- -------- ---------

Production

--------------- -------- -------- --------- -------- -------- -------- ---------

Gold (oz) 18,214 17,395 4.7 16,689 51,281 53,753 -4.6

--------------- -------- -------- --------- -------- -------- -------- ---------

Silver (koz) 1,539 1,335 15.3 1,518 4,296 4,122 4.2

-------- -------- --------- -------- -------- -------- ---------

Lead (t) 1,105 1,537 -28.1 1,352 3,792 4,787 -20.8

--------------- -------- -------- --------- -------- -------- -------- ---------

Zinc (t) 1,889 1,682 12.3 1,231 4,125 5,711 -27.8

-------- -------- --------- -------- -------- -------- ---------

Ore Grades

-------- -------- --------- -------- -------- -------- ---------

Gold (g/t) 1.79 1.75 2.4 1.65 1.70 1.84 -7.7

-------- -------- --------- -------- -------- -------- ---------

Silver (g/t) 169 148 13.5 166 159 157 1.5

-------- -------- --------- -------- -------- -------- ---------

Lead (%) 0.57 0.72 -19.8 0.67 0.64 0.76 -16.0

-------- -------- --------- -------- -------- -------- ---------

Zinc (%) 0.95 0.95 0.4 0.77 0.81 1.04 -21.6

--------------- -------- -------- --------- -------- -------- -------- ---------

Quarterly gold production increased 4.7% vs. 3Q17 as a result of

a higher ore grade due to lower dilution, and a higher volume of

ore processed resulting from a more efficient maintenance programme

that has reduced the average maintenance downtime and thus

increasing equipment availability.

Quarterly gold production increased 9.1% vs. 2Q18 mainly as a

result of the higher ore grade driven by a reduction in the

dilution.

Year to date gold production decreased 4.6% vs. YTD17 as a

result of a lower ore grade due to depletion of higher gold ore

grade veins at las Casas-Rosario, Taspana and Jessica areas. This

was mitigated by the higher volume of ore processed and the higher

recovery rate.

Quarterly silver production increased 15.3% vs. 3Q17 as a result

of a higher ore grade due to increased access to higher silver ore

grade areas at Taspana and Rosario and to a lesser extent, the

higher volume of ore processed. When compared to 2Q18, quarterly

silver production increased 1.4% as a result of a slightly higher

ore grade and volume of ore processed, which offset the lower

recovery rate.

Year to date silver production increased 4.2% vs. YTD17 as a

result of higher volume of ore processed due to the previously

mentioned improvement in the maintenance programme and a higher ore

grade.

Expected gold grade for 2018 is now at 1.7 g/t and expected

silver ore grade continues to be around 160 g/t.

By-product lead production decreased against all comparative

periods as a result of lower ore grade and recovery rates,

mitigated by a marginally higher volume of ore processed.

Quarterly by-product zinc production increased 12.3% vs. 3Q17 as

a result of higher recovery rate, and to a lesser extent, higher

volume of ore processed. Quarterly by-product zinc production

increased 53.4% vs. 2Q18 as a result of higher recovery rate and

higher ore grade. Year to date by-product zinc production decreased

27.8% vs. YTD17 as a result of lower ore grade and recovery

rate.

San Julián mine production

YTD

3Q 18 3Q 17 % change 2Q 18 YTD 18 17 % change

Ore Processed Phase

I Veins (t) 332,836 333,674 -0.3 289,775 933,353 948,097 -1.5

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Ore Processed Phase

II JM (t) 561,808 448,150 25.3 540,261 1,633,528 448,150 264.5

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Total production

at San Julián

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Gold (oz) 19,452 23,460 -17.1 20,097 59,341 64,501 -8.0

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Silver (koz) 3,626 3,498 3.7 3,533 10,726 6,477 65.6

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Production Phase

I Veins

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Gold (oz) 18,458 22,493 -17.9 19,584 57,153 63,534 -10.0

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Silver (koz) 1,347 1,495 -9.9 1,263 4,054 4,473 -9.4

-------- -------- --------- -------- ---------- -------- ---------

Production Phase

II

JM

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Gold (oz) 994 967 2.8 513 2,188 967 126.3

--------------------- -------- -------- --------- -------- ---------- -------- ---------

Silver (koz) 2,279 2,004 13.7 2,270 6,672 2,004 232.9

-------- -------- --------- -------- ---------- -------- ---------

Lead (t) 1,263 1,661 -24.0 1,493 4,083 1,661 145.8

-------- -------- --------- -------- ---------- -------- ---------

Zinc (t) 5,041 3,282 53.6 5,254 15,548 3,282 373.7

-------- -------- --------- -------- ---------- -------- ---------

Ore Grades Phase

I Veins

-------- -------- --------- -------- ---------- -------- ---------

Gold (g/t) 1.84 2.12 -13.1 2.12 1.97 2.16 -8.9

-------- -------- --------- -------- ---------- -------- ---------

Silver (g/t) 137.19 148.09 -7.4 144.58 146.53 158.50 -7.6

-------- -------- --------- -------- ---------- -------- ---------

Ore Grades Phase

II

JM

-------- -------- --------- -------- ---------- -------- ---------

Gold (g/t) 0.11 0.13 -17.6 0.07 0.09 0.13 -32.7

-------- -------- --------- -------- ---------- -------- ---------

Silver (g/t) 155.54 169.26 -8.1 156.71 153.03 169.26 -9.6

-------- -------- --------- -------- ---------- -------- ---------

Lead (%) 0.40 0.52 -23.3 0.42 0.41 0.52 -21.6

-------- -------- --------- -------- ---------- -------- ---------

Zinc (%) 1.33 1.13 18.0 1.26 1.30 1.13 15.1

-------- -------- --------- -------- ---------- -------- ---------

San Julián Veins (Phase I - Veins System)

Quarterly silver production decreased 9.9% vs. 3Q17 as a result

of the lower ore grade due to the depletion of the higher grade

areas and, to a lesser extent, lower recovery rate.

Quarterly silver production increased 6.7% vs. 2Q18 as a result

of the higher volume of ore processed now that sufficient water

volumes are available (after a shortage of water as reported in the

Q2 Production Report). This positive effect was partly offset by

the lower ore grade and recovery rate.

Year to date silver production decreased 9.4% vs. YTD17 as a

result of lower ore grade and lower volume of ore processed.

The expected silver ore grade for the full year 2018 is in the

range of 150-160 g/t.

Quarterly and YTD18 gold production decreased 17.9% and 10.0%

vs. 3Q17 and YTD17 respectively, mainly as a result of a lower ore

grade due to the depletion of higher ore grade veins.

Quarterly gold production decreased 5.7% vs. 2Q18 as a result of

lower ore grade and an increase in inventory levels during 3Q18 as

opposed to a reduction in inventory levels during 2Q18 when there

was a shortage of water supply. This was mitigated by an increase

in the volume of ore processed.

Expected average gold grade for the full year 2018 remains

unchanged at 1.9-2.1 g/t.

During the period, the Group successfully concluded the

indigenous consultation required to obtain the permits for the

construction of a water reservoir that will provide a consistent

source of water. Permits have been granted and the construction of

this facility, which is expected to take one year, has begun.

San Julián (Phase II - JM disseminated ore body)

Quarterly and year to date silver production increased vs. 3Q17

and YTD17 respectively as a result of higher volumes of ore

processed following the start of operations at San Julián JM (Phase

II) in July 2017. This offset the lower ore grade.

Quarterly by-product gold production slightly increased 2.8% vs.

3Q17 as a result of higher volume of ore processed, offsetting a

lower ore grade.

Year to date by-product gold production increased vs. YTD17 as a

result of the ramp-up of operations, which more than compensated

for the lower ore grade and recovery rate.

Quarterly gold production increased significantly vs. 2Q18 due

to higher ore grade, recovery rate and higher volume of ore

processed.

Expected silver ore grade for 2018 continues to be in the range

of 145-155 g/t.

Quarterly by-product lead production decreased 24.0% and 15.4%

vs. 3Q17 and 2Q18 respectively as a result of lower ore grades and

recovery rates. Year to date lead production increased due to

higher volume of ore processed, which was partly offset by the

lower ore grade and recovery rate.

Quarterly and year to date by-product zinc production increased

vs. 3Q17 and YTD17 respectively driven by the higher volume of ore

processed, ore grades and recovery rates. Quarterly by-product zinc

production decreased 4.1% vs. 2Q18 due to a lower recovery

rate.

Herradura total mine production

3Q 18 3Q 17 % change 2Q 18 YTD 18 YTD 17 % change

Ore Processed

(t) 5,859,579 6,337,573 -7.5 5,605,427 17,449,647 19,653,734 -11.2

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Total Volume

Hauled (t) 29,718,422 33,433,070 -11.1 33,560,118 97,432,307 95,404,767 2.1

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Production

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Gold (oz) 109,630 131,738 -16.8 117,886 352,759 355,747 -0.8

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Silver (koz) 492 157 213.4 363 1,097 380 188.7

----------- ----------- --------- ----------- ----------- ----------- ---------

Ore Grades

----------- ----------- --------- ----------- ----------- ----------- ---------

Gold (g/t) 0.76 0.75 1.0 0.76 0.73 0.68 7.6

----------- ----------- --------- ----------- ----------- ----------- ---------

Silver (g/t) 3.05 1.20 152.9 2.60 2.50 1.01 147.8

----------- ----------- --------- ----------- ----------- ----------- ---------

Quarterly gold production decreased 16.8% vs. 3Q17 as a result

of: i) a higher than normal speed in the recovery rate due to new

layers at the leaching pads which allowed for a rapid decrease in

inventories in 3Q17 compared to 3Q18 where normal conditions

prevailed; and ii) the lower grade and volume of ore deposited at

the leaching pads in 3Q18 resulting from heavy rains causing

haulage equipment to temporarily be stopped. These adverse effects

were mitigated by a higher ore grades which were processed at the

dynamic leaching plant. The heavy rains have continued in October,

temporarily impacting operations at the Merrill Crowe plant as

electric lines were affected.

Quarterly gold production decreased 7.0% vs. 2Q18 as a result of

the lower speed of the rate of recovery at the leaching pads in

3Q18 when ore was deposited in a phase of the leaching pads with

higher altitude increasing the residence time of the solution in

the pads. This adverse effect was mitigated by the higher volume of

ore processed.

Year to date gold production remained at similar levels, down

0.8% vs. YTD17 due to a lower volume of ore processed, mitigated by

a higher ore grade and recovery rate.

Expected gold ore grade for the full year continues to be c.

0.75 g/t.

Noche Buena total mine production

3Q 18 3Q 17 % change 2Q 18 YTD 18 YTD 17 % change

Ore Processed

(t) 4,834,512 4,362,684 10.8 4,550,915 13,800,217 13,375,504 3.2

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Total Volume

Hauled (t) 20,489,682 20,918,713 -2.1 22,073,319 63,084,240 64,274,348 -1.9

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Production

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Gold (oz) 42,460 33,409 27.1 45,308 130,503 123,184 5.9

--------------- ----------- ----------- --------- ----------- ----------- ----------- ---------

Silver (koz) 5 6 -16.7 18 42 20 110.0

----------- ----------- --------- ----------- ----------- ----------- ---------

Ore Grades

----------- ----------- --------- ----------- ----------- ----------- ---------

Gold (g/t) 0.52 0.53 -0.9 0.54 0.53 0.51 2.5

----------- ----------- --------- ----------- ----------- ----------- ---------

Silver (g/t) 0.05 0.07 -34.4 0.18 0.14 0.08 70.5

----------- ----------- --------- ----------- ----------- ----------- ---------

Quarterly gold production increased 27.1% vs. 3Q17 as a result

of higher speed of recovery due to the ore's composition and the

higher volume of ore processed. Quarterly gold production decreased

6.3% vs. 2Q18 as a result of lower speed of recovery and, to a

lesser extent, lower ore grade. These factors were partially offset

by the higher volume of ore processed.

Year to date gold production increased 5.9% vs. YTD17 due to

higher volume of ore processed and higher ore grade.

Expected gold ore grade for the full year is 0.50 g/t.

Update on development projects

Pyrites Plant at the Fresnillo mine

The first stage of the Pyrites Plant project (leaching plant at

Saucito) was completed in Q2. The 14,000 tpd tailings flotation

project to process the historical and ongoing tailings from the

Fresnillo mine continued with further progress in the detailed

engineering and the modelling of the structure of different areas.

This project is expected to be concluded by the end of 2019. This

facility is expected to incur a capex of US$51.4 million, which is

part of the total US$155 million capex authorised for this

project.

Second Dynamic Leaching Plant

Construction of the second line of the dynamic leaching plant

was completed in 2Q18.

Final tests at the second line of the Dynamic Leaching Plant at

Herradura continued during the period. However, the process took

longer than expected due to some minor technical adjustments and

the heavy rains which further complicated the commissioning

activities. Commercial production is now expected to begin in 4Q18.

This US$110 million project will process high ore grade material

from the Herradura pit.

Update on exploration

During 3Q18, 172,000 metres of drilling were completed at our

operating mines mainly to convert resources into reserves, and

113,000 metres were carried out at exploration projects. The

cumulative drilling achieved in the first nine months of 2018 is

427,000 metres at the operating mines and 294,000 metres at the

exploration projects.

Presently 11 areas are in drilling and interesting results were

obtained at the Herradura, Fresnillo and Guanajuato districts.

Mapping and sampling have been intensified in the mining districts

controlled by Fresnillo to generate new targets and areas with

potential. Exploration teams are working out of the Hermosillo,

Chihuahua, Zacatecas, Toluca, Lima-Peru and Santiago de Chile

offices in selected areas of favorable silver-gold belts in Mexico,

Peru, Chile and Argentina.

Juanicipio

The project is in the final stages of its approval process, with

discussions currently focused on the construction agreement. The

project is expected to be fully approved before year end and orders

for long term delivery equipment are ready to be placed.

Safety Performance

We are pleased to announce that during the quarter there were no

fatal accidents. We continue to reinforce our safety measures

throughout the Company, with our management systems and

organisational programmes centered on personnel safety. We remain

committed to our zero fatalities target.

There will be a conference call for analysts and investors on

Wednesday 24th October at 9:00am (London time). The dial in details

are as follows:

UK: +44 (0) 808 109 0700

Standard International Access: +44 (0) 20 3003 2666

Participant password: Fresnillo

For further information, please visit our website

www.fresnilloplc.com or contact:

Fresnillo plc Tel: +44 (0)20 7399 2470

London Office

Gabriela Mayor, Head of Investor

Relations

Patrick Chambers

Mexico City Office Tel: +52 55 52 79 3206

Ana Belem Zárate

Powerscourt Tel: +44 (0)20 7250 1446

Peter Ogden

About Fresnillo plc

Fresnillo plc is the world's largest primary silver producer and

Mexico's largest gold producer, listed on the London and Mexican

Stock Exchanges under the symbol FRES.

Fresnillo plc has seven operating mines, all of them in Mexico -

Fresnillo, Saucito, Ciénega (including the San Ramón satellite

mine), Herradura, Soledad-Dipolos(1) , Noche Buena and San Julián

(phase I and II), one development project - the Pyrites Plant at

Fresnillo, and four advanced exploration projects - Orisyvo,

Juanicipio, Las Casas Rosario & Cluster Cebollitas and Centauro

Deep, as well as a number of other long term exploration prospects.

In total, Fresnillo plc has mining concessions covering

approximately 1.8 million hectares in Mexico and 700 thousands

hectares in Peru.

Fresnillo plc has a strong and long tradition of exploring,

mining, a proven track record of mine development, reserve

replacement, and production costs in the lowest quartile of the

cost curve for silver.

Fresnillo plc's goal is to maintain the Group's position as the

world's largest primary silver company, producing 65 million ounces

of silver per year by 2018, having already surpassed the gold

target of 750,000 ounces.

(1) Operations at Soledad-Dipolos are currently suspended.

Forward Looking Statements

Information contained in this announcement may include

'forward-looking statements'. All statements other than statements

of historical facts included herein, including, without limitation,

those regarding the Fresnillo Group's intentions, beliefs or

current expectations concerning, amongst other things, the

Fresnillo Group's results of operations, financial position,

liquidity, prospects, growth, strategies and the silver and gold

industries are forward-looking statements. Such forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Forward-looking statements are not

guarantees of future performance and the actual results of the

Fresnillo Group's operations, financial position and liquidity, and

the development of the markets and the industry in which the

Fresnillo Group operates, may differ materially from those

described in, or suggested by, the forward-looking statements

contained in this document. In addition, even if the results of

operations, financial position and liquidity, and the development

of the markets and the industry in which the Fresnillo Group

operates are consistent with the forward-looking statements

contained in this document, those results or developments may not

be indicative of results or developments in subsequent periods. A

number of factors could cause results and developments to differ

materially from those expressed or implied by the forward-looking

statements including, without limitation,

general economic and business conditions, industry trends,

competition, commodity prices, changes in regulation, currency

fluctuations (including the US dollar and Mexican Peso exchanges

rates), the Fresnillo Group's ability to recover its reserves or

develop new reserves, including its ability to convert its

resources into reserves and its mineral potential into resources or

reserves, changes in its business strategy and political and

economic uncertainty.

LEI: 549300JXWH1UV5J0XV81

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLFZLBLVBFXFBF

(END) Dow Jones Newswires

October 24, 2018 02:00 ET (06:00 GMT)

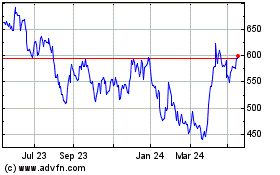

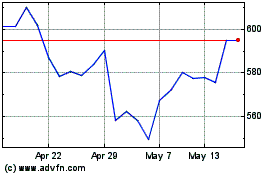

Fresnillo (LSE:FRES)

Historical Stock Chart

From Jun 2024 to Jul 2024

Fresnillo (LSE:FRES)

Historical Stock Chart

From Jul 2023 to Jul 2024