TIDMFRES

RNS Number : 0011M

Fresnillo PLC

25 April 2018

Fresnillo plc

21 Upper Brook Street

London W1K 7PY

United Kingdom

www.fresnilloplc.com

25 April 2018

First Quarter Production Report

for the three months ended 31 March 2018

Overview

-- Quarterly silver production of 15.4 moz (including

Silverstream), up 14.0% vs. 1Q17 mainly due to the contribution

from San Julián JM (phase II).

-- Quarterly silver production decreased 3.7% vs. 4Q17 mainly

due to the lower volume of ore processed and ore grade at

Saucito.

-- Quarterly gold production of 231.5 koz, up 4.1% vs. 1Q17

mainly due to the higher contribution from Herradura.

-- Construction of the Pyrites plant in the Fresnillo district

remains on track with the leaching plant at Saucito due to be

commissioned in 2Q18.

-- The commissioning of the second line of the Dynamic Leaching

Plant (DLP) at Herradura is expected at the end of 2Q18.

-- Outlook unchanged: on track to achieve 2018 production

guidance of 67-70 moz silver, (including Silverstream) and 870-900

koz gold.

Octavio Alvídrez, Chief Executive Officer, said:

"Fresnillo has started the year well and delivered a solid

operating performance during the period. In particular, first

quarter silver production rose to 14.2 moz, driven by the positive

contribution from the new San Julián JM (phase II) mine. I am also

pleased to report a positive quarter at the Fresnillo mine driven

by better access to the Candelaria and San Alberto areas as planned

which improved throughput at the mine.

We achieved a solid gold production performance during the

quarter, up 4.1% versus 1Q17, driven by strong results at the

Herradura mine.

We continue to make good progress with our key development

projects. Both the Pyrites plant and the second Dynamic Leaching

Plant projects have advanced on time and on budget. We expect to

commission both projects during the second quarter and for them to

make a positive contribution to full year production in 2018.

Overall, we remain confident in the outlook and today reiterate

our full year production guidance.

Sadly, in the first quarter 2018, a fatal accident of one of our

contractors occurred at the Saucito mine due to the lack of

adherence to our safety policies. We continue to reinforce our

safety measures for all our workforce in order to fulfill our zero

fatalities commitment".

Total Production

1Q 18 1Q 17 % change 4Q 17

Silver (koz) 14,235 12,424 14.6 14,957

-------- -------- --------- --------

Silverstream (koz) 1,186 1,105 7.3 1,059

-------------------- -------- -------- --------- --------

Total Silver (koz) 15,421 13,529 14.0 16,015

-------------------- -------- -------- --------- --------

Gold (oz) 231,458 222,290 4.1 232,051

-------------------- -------- -------- --------- --------

Lead (t) 11,629 11,461 1.5 12,836

-------------------- -------- -------- --------- --------

Zinc (t) 19,040 13,806 37.9 18,852

-------------------- -------- -------- --------- --------

Silver

Quarterly silver production (including Silverstream) increased

14.0% vs. 1Q17 primarily as a result of the start of operations at

San Julián (phase II) in July 2017; San Julián is now operating at

full capacity. This was partially offset by lower production at

Saucito due to a lower ore grade.

Compared to the previous quarter, silver production (including

Silverstream) decreased 3.7% as a result of: i) lower volume of ore

processed and ore grade at Saucito due to ground instability

temporarily restricting access to high grade areas of the Jarillas

vein which is now resolved, and ii) the lower ore grade at San

Julián JM (phase II) due to ground instability in certain areas

temporarily preventing access. These factors were mitigated by the

higher volume of ore processed from Fresnillo due to increased

access to the Candelaria and San Alberto areas and a higher

contribution from the Silverstream.

Our 2018 silver production target of 67-70 moz silver (including

Silverstream) remains on track, driven by increased production from

San Julián's (phase II) first year of full operations, the start-up

of the Pyrites plant and the increased contribution from

Fresnillo.

Gold

Quarterly gold production increased 4.1% vs. 1Q17 as a result of

the continued drawdown of inventories and higher ore grade at

Herradura and, to a lesser extent, the start of operations at San

Julián JM (Phase II - mid July 2017). This was partly offset by the

lower overall speed of recovery and volume of ore processed at

Noche Buena, lower recovery rate at Saucito, and lower ore grades

at Ciénega and San Julián Veins (Phase I).

Quarterly gold production remained broadly flat vs. the previous

quarter (-0.3%) as a result of the higher speed of recovery at

Herradura and increased volume of ore processed at Fresnillo

offsetting the unfavorable effect of the lower speed of recovery at

Noche Buena and lower ore grade at Ciénega.

Our 2018 gold production target of 870-900 koz gold remains on

track.

By-products

Quarterly by-product lead production slightly increased 1.5% vs.

1Q17 mainly as a result of San Julián JM (phase II) beginning

operations in July 2017 and subsequently operating at full capacity

and, to a lesser extent, the higher ore grade at Fresnillo. This

was partly offset by the lower ore grades at Saucito and

Ciénega.

Quarterly by-product lead production vs. the previous quarter

decreased 9.4% as a result of the lower ore grade and volume of ore

processed at Saucito and the lower ore grade and recovery rate at

San Julián JM (phase II).

By-product zinc production increased 37.9% vs. 1Q17 as a result

of San Julián JM (phase II) being in operation, and a higher ore

grade, recovery and volume of ore processed at Fresnillo. These

were partially offset by lower ore grades at both Saucito and

Ciénega and a lower recovery rate at the latter.

Quarterly by-product zinc production remained at similar levels

vs. 4Q17 as a result of higher ore grade and volume of ore

processed at San Julian JM (Phase II) and increased throughput and

recovery rate at Fresnillo, offsetting the lower ore grade,

recovery rate and volume of ore processed at Saucito.

Fresnillo mine production

1Q 18 1Q 17 % change 4Q 17

Ore Processed (t) 637,410 613,012 4.0 592,358

-------- ------------------ --------- --------

Production

-------- ------------------ --------- --------

Silver (koz) 4,336 4,439 -2.3 4,066

-------- ------------------ --------- --------

Gold (oz) 10,431 11,325 -7.9 9,237

------------------- -------- ------------------ --------- --------

Lead (t) 5,783 5,170 11.9 5,455

------------------- -------- ------------------ --------- --------

Zinc (t) 8,866 6,707 32.2 8,019

-------- ------------------ --------- --------

Ore Grades

-------- ------------------ --------- --------

Silver (g/t) 232 245 -5.2 236

-------- ------------------ --------- --------

Gold (g/t) 0.66 0.74 -11.1 0.64

-------- ------------------ --------- --------

Lead (%) 1.00 0.92 8.7 1.01

-------- ------------------ --------- --------

Zinc (%) 1.90 1.57 21.0 1.94

------------------- -------- ------------------ --------- --------

Quarterly silver production slightly decreased vs. 1Q17 as

expected due to the higher ore grade areas being processed in the

first quarter 2017. This was mitigated by the higher volume of ore

processed as a result of increased access to the Candelaria and San

Alberto areas.

Quarterly silver production increased 6.6% vs. the previous

quarter due to the higher volume of ore processed.

Quarterly by-product gold production decreased 7.9% vs. 1Q17

mainly as a result of lower ore grade. When compared to 4Q17,

by-product gold production increased 12.9% as a result of the

higher volume of ore processed and ore grade.

Quarterly by-product lead production increased 11.9% vs. 1Q17 as

a result of higher ore processed and ore grade. When compared to

4Q17, by-product lead production increased due to a higher volume

ore processed.

Quarterly by-product zinc production increased 32.2% vs. 1Q17 as

a result of higher ore grade, recovery rate and higher ore

processed. When compared to the previous quarter, zinc by-product

production increased 10.6% as a result of higher ore processed and

recovery rate.

Saucito mine production

1Q 18 1Q 17 % change 4Q 17

Ore Processed (t) 673,545 670,914 0.4 722,237

-------- ------------------ --------- --------

Production

-------- ------------------ --------- --------

Silver (koz) 4,832 5,147 -6.1 5,378

-------- ------------------ --------- --------

Gold (oz) 16,880 17,964 -6.0 17,599

------------------- -------- ------------------ --------- --------

Lead (t) 3,183 4,754 -33.0 3,903

------------------- -------- ------------------ --------- --------

Zinc (t) 3,916 5,139 -23.8 4,930

-------- ------------------ --------- --------

Ore Grades

-------- ------------------ --------- --------

Silver (g/t) 260 279 -6.8 271

-------- ------------------ --------- --------

Gold (g/t) 1.12 1.12 0.1 1.08

-------- ------------------ --------- --------

Lead (%) 0.57 0.87 -34.9 0.66

------------------- -------- ------------------ --------- --------

Zinc (%) 0.96 1.26 -23.7 1.06

------------------- -------- ------------------ --------- --------

Quarterly silver production decreased 6.1% vs. 1Q17 due to the

lower ore grade resulting from ground instability temporarily

restricting access to a high grade area of the Jarillas vein. This

has since been resolved and by year end, we expect to recover the

production lost as a result. Similarly, quarterly silver production

vs. 4Q17 decreased 10.1% as a result of a lower volume of ore from

development areas being processed and a lower ore grade due to the

aforementioned factor.

Quarterly by-product gold production decreased 6.0% vs. 1Q17 as

a result of a lower recovery rate. When compared to the previous

quarter, by-product gold production decreased 4.1% as a result of

lower volume of ore processed which was mitigated by the higher ore

grade.

Quarterly by-product lead production decreased vs. 1Q17 and 4Q17

mainly as a result of lower ore grades.

Quarterly by-product zinc production decreased vs. 1Q17 as a

result of the lower ore grade. When compared to the previous

quarter, by-product zinc production decreased as a result of lower

ore grade, ore processed and recovery rate.

Ciénega mine production

1Q 18 1Q 17 % change 4Q 17

Ore Processed (t) 320,006 313,920 1.9 339,347

------------------- -------- ------------------ --------- --------

Production

------------------- -------- ------------------ --------- --------

Gold (oz) 16,377 17,453 -6.2 18,194

------------------- -------- ------------------ --------- --------

Silver (koz) 1,239 1,328 -6.7 1,272

-------- ------------------ --------- --------

Lead (t) 1,335 1,536 -13.1 1,541

------------------- -------- ------------------ --------- --------

Zinc (t) 1,006 1,960 -48.7 1,336

-------- ------------------ --------- --------

Ore Grades

-------- ------------------ --------- --------

Gold (g/t) 1.66 1.89 -12.2 1.76

-------- ------------------ --------- --------

Silver (g/t) 141 160 -12.2 137

-------- ------------------ --------- --------

Lead (%) 0.67 0.78 -14.4 0.70

-------- ------------------ --------- --------

Zinc (%) 0.72 1.07 -32.9 0.81

------------------- -------- ------------------ --------- --------

Quarterly gold production decreased 6.2% vs. 1Q17 as a result of

a lower ore grade due to a temporary access delay to higher ore

grade areas mainly at the Taspana satellite mine and the Rosario

Transversal development works. Notwithstanding, lost production is

expected to be recovered over the course of the year. This decrease

in gold production was mitigated by a higher recovery rate.

Quarterly gold production decreased 10.0% vs. 4Q17 as a result of

lower ore processed and lower ore grade due to the previously

mentioned factor.

Quarterly silver production decreased vs. 1Q17 for the reasons

previously described. When compared to the previous quarter, silver

production decreased 2.6% as a result of the lower ore processed

which was mitigated by a higher ore grade.

Quarterly by-product lead production decreased 13.1% vs. 1Q17 as

a result of a lower ore grade. When compared to the previous

quarter, by-product lead production decreased 13.3% as a result of

lower volume of ore processed, ore grade and recovery rate.

By-product zinc production decreased 48.7% and 24.8% vs. 1Q17

and 4Q17 respectively as a result of lower ore grades and recovery

rates.

San Julián mine production

1Q 18 1Q 17 % change 4Q 17

Ore Processed Phase

I Veins (t) 310,742 306,082 1.5 325,032

--------------------- -------- -------- --------- --------

Ore Processed Phase

II JM (t) 531,459 - N/A 496,907

--------------------- -------- -------- --------- --------

Production Phase

I Veins

--------------------- -------- -------- --------- --------

Gold (oz) 19,111 20,129 -5.1 19,248

--------------------- -------- -------- --------- --------

Silver (koz) 1,445 1,386 4.3 1,462

-------- -------- --------- --------

Production Phase

II

JM

--------------------- -------- -------- --------- --------

Gold (oz) 680 - N/A 784

--------------------- -------- -------- --------- --------

Silver (koz) 2,123 - N/A 2,595

-------- -------- --------- --------

Lead (t) 1,328 - N/A 1,937

-------- -------- --------- --------

Zinc (t) 5,252 - N/A 4,567

-------- -------- --------- --------

Ore Grades Phase

I Veins

-------- -------- --------- --------

Gold (g/t) 1.97 2.18 -9.7 1.92

-------- -------- --------- --------

Silver (g/t) 158.35 156.68 1.1 153.43

-------- -------- --------- --------

Ore Grades Phase

II

JM

-------- -------- --------- --------

Gold (g/t) 0.09 - N/A 0.11

-------- -------- --------- --------

Silver (g/t) 146.64 - N/A 190.32

-------- -------- --------- --------

Lead (%) 0.40 - N/A 0.51

-------- -------- --------- --------

Zinc (%) 1.31 - N/A 1.23

-------- -------- --------- --------

San Julián Veins (Phase I)

Quarterly silver production increased 4.3% vs. 1Q17 as a result

of a higher recovery rate due to the optimisation of the plant

process, higher volume of ore processed and a higher ore grade.

Quarterly silver production remained at similar levels vs. 4Q17

(-1.2%).

Quarterly gold production decreased 5.1% vs. 1Q17 as a result of

the expected lower ore grade which was mitigated by the higher

recovery rate. Quarterly gold production vs. 4Q17 remained at

similar levels (-0.7%).

San Julián (Phase II - JM disseminated ore body)

Quarterly silver production decreased 18.2% vs. 4Q17 as a result

of a lower ore grade due to ground instability in certain areas

temporarily preventing access. This resulted in the extraction of

ore from lower grade areas of the mine as well as processing ore

from the development stockpile, extracted during the pre-operative

period. This factor has the potential to impact Phase II from April

to May though we expect production to recover by 3Q18 and for

budgeted production to be met by year end.

Quarterly gold production decreased 13.2% vs. 4Q17 as a result

of lower ore grade which was mitigated by the higher volume of ore

processed.

Similarly, quarterly lead production decreased 31.4% vs. the

previous quarter as a result of the lower ore grade and recovery

rate which was mitigated by a higher volume of ore processed.

Quarterly zinc production increased 15.0% vs. 4Q17 due to the

higher ore grade and volume of ore processed.

Herradura total mine production

1Q 18 1Q 17 % change 4Q 17

Ore Processed (t) 5,984,641 6,764,370 -11.5 6,373,732

--------------------- ----------- ------------------ --------- -----------

Total Volume Hauled

(t) 34,153,768 30,908,154 10.5 34,620,672

--------------------- ----------- ------------------ --------- -----------

Production

--------------------- ----------- ------------------ --------- -----------

Gold (oz) 125,243 107,742 16.2 117,891

--------------------- ----------- ------------------ --------- -----------

Silver (koz) 241 118 104.2 172

----------- ------------------ --------- -----------

Ore Grades

----------- ------------------ --------- -----------

Gold (g/t) 0.68 0.63 6.9 0.68

----------- ------------------ --------- -----------

Silver (g/t) 1.86 0.95 95.0 1.28

----------- ------------------ --------- -----------

Quarterly gold production increased 16.2% vs. 1Q17 due to an

increase in the inventory reduction at the leaching pads which

resulted from an intensive targeted irrigation programme and, to a

lesser extent, a higher speed of recovery at the DLP. This increase

was partially offset by a lower volume of ore processed.

Quarterly gold production increased 6.2% vs. 4Q17 as a result of

the increase in inventory reduction mentioned above which was

partially offset by the lower volume of ore processed.

Noche Buena total mine production

1Q 18 1Q 17 % change 4Q 17

Ore Processed (t) 4,414,790 4,613,684 -4.3 4,445,313

--------------------- ----------- ------------------ --------- -----------

Total Volume Hauled

(t) 20,521,239 20,918,657 -1.9 20,921,652

--------------------- ----------- ------------------ --------- -----------

Production

--------------------- ----------- ------------------ --------- -----------

Gold (oz) 42,735 47,678 -10.4 49,098

--------------------- ----------- ------------------ --------- -----------

Silver (koz) 19 7 171.4 12

----------- ------------------ --------- -----------

Ore Grades

----------- ------------------ --------- -----------

Gold (g/t) 0.52 0.51 2.8 0.54

----------- ------------------ --------- -----------

Silver (g/t) 0.22 0.09 138.6 0.14

----------- ------------------ --------- -----------

Quarterly gold production decreased vs. 1Q17 as a result of the

expected lower overall speed of recovery from the leaching pads

(increase in inventories) and the lower volume of ore

processed.

Similarly, gold production decreased 13.0% vs. 4Q17 as a result

of the expected lower speed of recovery from the leaching pads

(increase in inventories) and lower ore grade.

Update on development projects

Pyrites Plant

Construction of the Pyrites plant in the Fresnillo district

remains on track. The leaching plant at Saucito is expected to be

commissioned in late 2Q18 and will process tailings from the

Saucito mine and its current stockpile while the historical and

ongoing tailings from the Fresnillo mine are expected to start

being processed in 2019.

The Company expects to conclude tests for the vertical mills and

agitation tanks during May 2018.

The plant is expected to improve overall recoveries of both gold

and silver by processing historical and ongoing tailings from the

Fresnillo and Saucito mines.

This US$155 million project is expected to contribute an annual

production of c. 3.5 moz of silver and c. 13 koz of gold once it

reaches full capacity in 2019.

Second Dynamic Leaching Plant

We expect to commission the second line of the Dynamic Leaching

Plant (DLP) at Herradura by the end of 2Q18. This project will

enable sulphides occurring deeper in the pit to be processed more

efficiently. We expect to continue testing the electrical,

instrumentation and control installation over the next two

months.

At the time of analysis, this US$110 million project was

expected to extend the life of mine at Herradura to 12 years with

an average annual gold production of 390 koz over the life of

mine.

Juanicipio

Work to progress the Juanicipio project remains on track. The

joint venture partners are working collaboratively and currently

reviewing an advanced draft of the feasibility study. Once the

final report is completed, the project will be submitted for Board

approval. There are no changes to the project delivery

timeline.

Update on exploration

In 1Q18, 111,258 metres of drilling was completed at our

operating mines with the aim of converting resources into reserves.

Ore shoots were extended near the Fresnillo mine and east of the

Ciénega mine. At exploration projects, 79,626 metres of drilling

was carried out across 15 projects with interesting results at San

Julián South, Guazapares, San Juan and Guanajuato.

Through mapping and sampling, we have located new areas in the

Fresnillo, San Julián and Guanajuato districts that merit drill

testing. Exploration teams working out of the Hermosillo,

Chihuahua, Zacatecas, Toluca, Lima-Peru and Santiago de Chile

offices have identified several new areas with gold and silver

potential that are now under evaluation. Additional staff have been

hired to help with the permitting processes in addition to

supporting the Company's community relations activities.

Safety Performance

As previously mentioned during our 2017 Preliminary Results, we

deeply regret the fatal accident of one of our contractors at the

Saucito mine as a result of the lack of adherence to our safety

policies. We continue to reinforce our safety measures throughout

the Company, with our management systems and organisational

programmes focused on personnel safety. We remain committed to our

zero fatalities target on an ongoing basis. Safety remains our main

priority.

There will be a conference call for analysts and investors on

Wednesday 25th April at 9:00am (London time). The dial in details

are as follows:

UK: +44 (0) 808 109 0700

USA: +1 866 966 5335

Mexico: +1 866 966 8830

All other locations: +44 (0) 20 3003 2666

Participant password: Fresnillo

A replay of the call will also be available for seven days after

the event. The replay can be accessed via the following

details:

Replay dial-in number: +44 (0) 208 196 1998

Replay PIN: 4302051#

For further information, please visit our website

www.fresnilloplc.com or contact:

Fresnillo plc Tel: +44 (0)20 7399 2470

London Office

Gabriela Mayor, Head of Investor

Relations

Patrick Chambers

Mexico City Office Tel: +52 55 52 79 3206

Ana Belem Zárate

Powerscourt Tel: +44 (0)20 7250 1446

Peter Ogden

About Fresnillo plc

Fresnillo plc is the world's largest primary silver producer and

Mexico's largest gold producer, listed on the London and Mexican

Stock Exchanges under the symbol FRES.

Fresnillo plc has seven operating mines, all of them in Mexico -

Fresnillo, Saucito, Ciénega (including the San Ramón satellite

mine), Herradura, Soledad-Dipolos(1) , Noche Buena and San Julián

(phase I and II), two development projects - the Pyrites Plant, and

second line of DLP at Herradura, and four advanced exploration

projects - Orisyvo, Juanicipio, Las Casas Rosario & Cluster

Cebollitas and Centauro Deep, as well as a number of other long

term exploration prospects. In total, Fresnillo plc has mining

concessions covering approximately 1.8 million hectares in

Mexico.

Fresnillo plc has a strong and long tradition of mining, a

proven track record of mine development, reserve replacement, and

production costs in the lowest quartile of the cost curve for

silver.

Fresnillo plc's goal is to maintain the Group's position as the

world's largest primary silver company, producing 65 million ounces

of silver per year by 2018, having already surpassed the gold

target of 750,000 ounces.

(1) Operations at Soledad-Dipolos are currently suspended.

Forward Looking Statements

Information contained in this announcement may include

'forward-looking statements'. All statements other than statements

of historical facts included herein, including, without limitation,

those regarding the Fresnillo Group's intentions, beliefs or

current expectations concerning, amongst other things, the

Fresnillo Group's results of operations, financial position,

liquidity, prospects, growth, strategies and the silver and gold

industries are forward-looking statements. Such forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances. Forward-looking statements are not

guarantees of future performance and the actual results of the

Fresnillo Group's operations, financial position and liquidity, and

the development of the markets and the industry in which the

Fresnillo Group operates, may differ materially from those

described in, or suggested by, the forward-looking statements

contained in this document. In addition, even if the results of

operations, financial position and liquidity, and the development

of the markets and the industry in which the Fresnillo Group

operates are consistent with the forward-looking statements

contained in this document, those results or developments may not

be indicative of results or developments in subsequent periods. A

number of factors could cause results and developments to

differ

materially from those expressed or implied by the

forward-looking statements including, without limitation, general

economic and business conditions, industry trends, competition,

commodity prices, changes in regulation, currency fluctuations

(including the US dollar and Mexican Peso exchanges rates), the

Fresnillo Group's ability to recover its reserves or develop new

reserves, including its ability to convert its resources into

reserves and its mineral potential into resources or reserves,

changes in its business strategy and political and economic

uncertainty.

LEI: 549300JXWH1UV5J0XV81

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLDZLFLVZFXBBZ

(END) Dow Jones Newswires

April 25, 2018 02:00 ET (06:00 GMT)

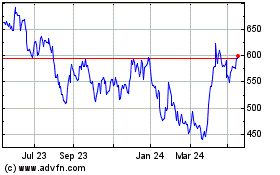

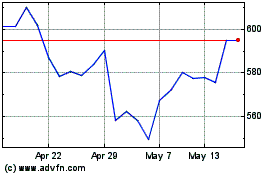

Fresnillo (LSE:FRES)

Historical Stock Chart

From Jun 2024 to Jul 2024

Fresnillo (LSE:FRES)

Historical Stock Chart

From Jul 2023 to Jul 2024