Fresnillo Shares Drop After It Forecasts Challenging 2018 -- Update

February 27 2018 - 5:29AM

Dow Jones News

(Updates with stock movements and Fresnillo's expectations for

2018.)

By Oliver Griffin

Shares in silver-and-gold miner Fresnillo PLC (FRES.LN) fell

Tuesday after the Mexico-based company said that 2018 is set to be

a challenging year.

The mining company said it expects inflationary pressures will

increase this year, and that it is uncertain as to whether precious

metals prices have bottomed out or will continue to drift.

Mexico's 2018 general election will bring unwelcome volatility

to exchange rates, Fresnillo said.

The company said that net profit for the year ended Dec. 31 rose

31% to $560.8 million from $427 million in 2016. Pretax profit

increased 3.2% to $741.5 million, while revenue grew 9% to $2.09

billion, the company said.

Fresnillo declared a final dividend of 29.8 cents a share, up

from the 2016 final dividend of 21.5 cents a share.

The company, which in January reported that it produced 58.7

million ounces of silver in 2017, forecast silver production in

2018 in a range between 67 million ounces and 70 million

ounces.

Gold production for 2018 is forecast to be in a range of 870,000

ounces and 900,000 ounces, the company said.

Shares at 0941 GMT were down 3.2% at 1,290 pence a share.

Write to Oliver Griffin at oliver.griffin@dowjones.com

(END) Dow Jones Newswires

February 27, 2018 05:14 ET (10:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

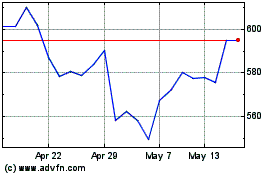

Fresnillo (LSE:FRES)

Historical Stock Chart

From Jun 2024 to Jul 2024

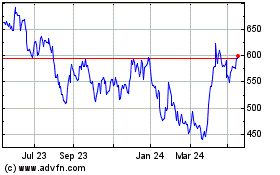

Fresnillo (LSE:FRES)

Historical Stock Chart

From Jul 2023 to Jul 2024