TIDMFKE

RNS Number : 4901D

Fiske PLC

20 October 2022

20 October 2022

FISKE PLC

("Fiske" or the "Company" or the "Group")

Final Results, Posting of Annual Report and Notice of AGM

Fiske ( AIM:FKE ) is pleased to announce its final audited

financial results for the 13 month period ended 30 June 2022.

Highlights

2022 2021

GBP'000 GBP'000

------------------------------------- --------- ---------

Total Revenue 5,764 5,854

(Loss)/profit on ordinary activities

before taxation (349) 366

(Loss)/profit per ordinary share (1.5)p 2.8p

James Harrison, CEO, commenting on the results said:

" T his year has been a more difficult one to navigate with the

second half adversely impacted by Russia's incursion into Ukraine,

the knock-on effect on energy prices and the subsequent

acceleration in the tightening of global monetary policy. However,

we have continued to take cost out of the business, invest in our

people and focus our investment efforts on looking after our

clients in these uncertain times."

Our Annual General Meeting will be held on Thursday 24 November

2022 at 12.30pm at our new offices at 100 Wood Street, London EC2V

7AN.

Copies of the 2022 Report and Accounts, including the Notice of

AGM and Proxy Voting form will be posted to shareholders shortly

and in accordance with rule 26 of the AIM Rules for Companies, this

information is also available under the Investor Relations section

of the Company's website, www.fiskeplc.com .

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

For further information, please contact:

Fiske PLC

James Harrison (CEO) Tel: +44 (0) 20 8448 4700

100 Wood Street

London

EC2V 7AN

Grant Thornton UK LLP (Nominated Adviser) Tel: +44 (0) 20 7383

5100

Samantha Harrison / Harrison Clarke

Chairman's Statement

Trading and revenues

Equity market returns were positive in the latter part of 2021,

however it became clear in 2022 that much of the global economy had

to contend with yet further supply chain disruption as consumers

were released from their Covid restraints. This when coupled with

higher commodity and energy prices and exacerbated by the war in

Ukraine led to a steep sell-off in global indices. The performance

of stock markets across the world has been very variable. In the

UK, having remained lowly rated, indices have held up relatively

well.

For Fiske, the average monthly commissions were down by some 16%

as the market conditions led to a lower level of trading activity.

However, our monthly management fee revenue has been more resilient

moving up by nearly 1% on an average monthly basis.

Change of financial year-end

Note that during the period, the Company changed its financial

year end from May 31 to June 30. Reported revenue and expense items

in this financial period to 30 June 2022 thus relate to 13 months

of operations, whilst prior year comparatives to 31 May 2021,

relate to 12 months.

Costs

Staff costs amount to some 59% of total costs (2021: 58%).

During the period, efficiencies and more automation have meant that

at 30 June 2022, we employed two fewer staff in settlement and

administration, and meanwhile employed two more staff in

fee-earning, client facing roles compared to May 2021.

Nevertheless, total staff costs have increased.

At the end of November 2021, we moved to new offices at 100 Wood

Street after spending some 45 years at Salisbury House. The

relocation gave rise to overlap premises costs including rent,

rates, service charges and utilities for a period of just over

three months which amounted to some GBP181,000. We now enjoy lower

overall property costs and benefit from more modern offices.

Operating expenses rose to GBP6.3m in the 13-month period to 30

June 2022 (12 months to May 2021: GBP5.7m); overall, the increase

in the monthly run rate held to just under 2%.

Outturn

The Group made a pre-tax loss of GBP349,000 in the year. The

cash flow arising from this is better by some GBP218,000 that is

set aside annually for amortisation or impairment of goodwill or

customer bases arising from past acquisitions.

Euroclear

Euroclear's operating income increased from EUR1,479M to

EUR1,572M and its business income margin increased from 33% in 2020

to 37% in the year to December 2021. Their operating margin was

stable at 40% in 2021 and net earnings per share increased to

EUR146.9 in 2021 compared to EUR137.2 in 2020.

There were several private transactions in Euroclear shares

during the year and these have helped us to better assess the

appropriate carrying value of our holding in our financial

statements. Considering recent transaction prices in Euroclear

shares, we have marked the carrying value of our investment up to

EUR2,050 per share (2021: EUR1,600 per share) being GBP4.6m in

total. This continues to represent a significant store of value on

our balance sheet and the company paid us gross dividends amounting

to EUR185,000 in the period.

Restatement of accounts

Following an internal review of the results in preparations for

reporting the first half of the period, the Directors of the

Company determined that certain one-off adjustments needed to be

made to its accounts for the prior financial period. The prior

period adjustment relates to the method of computation of accrued

management fee revenue. It was discovered that incorrect dates had

been used to calculate accrued revenue for a number of clients

which meant revenue was recognised when it should not have been.

There has been no impact on the client money or asset positions of

our clients, and no impact on the Company's cash position. As a

consequence of correcting this error group revenues for the year to

May 2021 have reduced by GBP244k, trade and other receivables as at

31 May 2021 have reduced by GBP303k and retained earnings brought

forward for the year ended 31 May 2021 have reduced by GBP59k.

Comparative data in this report has been restated and the

adjustments elaborated in notes to the accounts and the comments in

this statement reflect these changes.

Net assets

Shareholder's funds amount to some GBP8.3m (2021: GBP7.8m) and

within this we now hold some GBP3.2m (2021: GBP3.5m) of cash.

Dividend

The Board has resolved not to pay a dividend for the period to

30 June 2022 (2021: GBPnil).

Impact of Covid-19

The impact of Covid-19 on our operations is very minimal. What

is more important is the impact on the global economy as the world

recovers from Covid-19, and how changing demand patterns have

caused supply-chain and commodity shortage difficulties.

Staff

We would like to thank all members of staff for their continued

commitment and perseverance. As a Company we have worked very

effectively in both an entirely remote manner as well as adapting

quickly to a hybrid model when we were able to access our offices

again.

Board

Fiske was founded a little over forty-nine years ago in August

1973 such that we are now well into our 50th year of trading. In

August 2023 we will celebrate our 50th anniversary and as your

Founder and Chairman I have decided that this is an appropriate

moment to hand over the reins. Accordingly, I will be stepping down

as Chairman at the conclusion of the Annual General Meeting in

November 2023 and handing over my investment management

responsibilities for clients during the coming year.

In anticipation of this change the Board will appoint Tony

Pattison as Deputy Chairman from the conclusion of our Annual

General Meeting ('AGM') this year. Tony is a former Chairman of

Capital Gearing Trust plc and was the Chairman of Fieldings

Investment Management at the time of our acquisition of this

company in July 2017. Tony has been a director of the Company since

1 October 2018 and will be proposed as the new Chairman at our AGM

in November 2023. He and I will work together during this year of

transition to ensure a smooth handover of my clients and the

responsibilities of the Chairman.

Strategy

We continue to implement our ongoing strategy to welcome new

investment managers with established client relationships to

increase our assets under management and advice. We believe that

with our traditional values, modern systems and up to date

regulatory framework we provide an attractive place to work for

aspiring, independently minded private client investment

managers.

During the year we have refreshed our brand and completely

redeveloped our website to show-case our customer offerings and to

better communicate the experience of being a client of, or member

of staff at Fiske.

Markets

The inflationary pressures that we expressed concern about in

our half yearly report to shareholders have become solidly

entrenched. Not since the 1970's and 80's has inflation reached the

levels we are now seeing; the July CPI for year-on-year inflation

in the UK hit 10.6% and the Bank of England is forecasting that

this will rise further in the near term.

In addition to trying to control inflation with interest rate

rises central banks are also reigning in, or planning to, the

financial support provided to keep economies functioning during

Covid. The actions being taken are leading to expectations of

economic recession. Indeed, as Jerome Powell, Chairman of the US

Federal Reserve Bank, reiterated at the Jackson Hole Symposium in

August, controlling prices is the main objective even if it puts

growth at risk.

Over our thirteen-month period in review the first half was

relatively positive, though the gains were mostly given back in the

second half as the world became increasingly aware of the looming

problems of inflation which would bring to an end the unusually

protracted period of near zero interest rates. Then in February the

inflation problem was made even worse by the Russian invasion of

Ukraine which led to a sharp rise in commodity prices especially

oil & gas and in food. Central Banks rather belatedly began to

raise interest rates and are likely to continue doing so well into

next year.

The war in Ukraine shows no sign of ending soon and inflation

has yet to peak and so the economic outlook is one of significant

uncertainty and the markets are reacting predictably. Whilst the

United States is much better placed for the inflationary pressures

in energy and food, Wall Street is vulnerable because the

speculative excesses have been so prevalent there. The other main

driver of world economies has been the emergence of China as the

fastest growing major economy, but that has come to a sharp halt

and the outlook has changed radically.

Outlook

The first few months have seen softer trading volumes, in line

with more traditional summer levels. However, portfolio values have

generally held up despite market gyrations which is positive for

our fee revenues. We expect to benefit more fully from the

operational cost reductions made last year.

We are in a period of considerable economic uncertainty and that

is likely to prevail well into next year. World stock markets have

yet to fully recognise the problems and to adjust. This could prove

painful.

Annual General Meeting

We do believe that most shareholders would now be comfortable

with an in-person meeting. We would like to invite our shareholders

to attend the Annual General Meeting to be held at our new offices

at 100 Wood Street, London EC2V 7AN at 12.30 pm on Thursday 24

November 2022. We would like the opportunity to meet you and for

you to meet the management of the Company in which you are invested

and see our new offices.

The Board encourages shareholders to submit their votes via the

CREST system. Shareholders may also submit questions in advance of

the AGM to the Company Secretary via email to info@fiskeplc.com or

by post to the Company Secretary.

Consolidated Statement of Total Comprehensive Income

For 13 months ended 30 June 2022

Notes 13 months Year to

to 30 June

2022 31 May

2021

(restated)

GBP'000 GBP'000

---------------------------------------------------- ----- ----------- -----------

Revenues 2 5,764 5,854

Operating expenses (6,269) (5,716)

Operating (loss)/profit (505) 138

Investment revenue 185 237

Finance income - -

Finance costs (29) (9)

(Loss)/profit on ordinary activities before

taxation (349) 366

Taxation credit / (charge) 3 177 (43)

---------------------------------------------------- ----- ----------- -----------

(Loss)/profit on ordinary activities after

taxation (172) 323

---------------------------------------------------- ----- ----------- -----------

Other comprehensive income

Items that may subsequently be reclassified

to profit or loss

Movement in unrealised appreciation of investments 1,017 75

Deferred tax on movement in unrealised appreciation

of investments (443) (12)

---------------------------------------------------- ----- ----------- -----------

Net other comprehensive income 574 63

---------------------------------------------------- ----- ----------- -----------

Total comprehensive income attributable to

equity shareholders 402 386

---------------------------------------------------- ----- ----------- -----------

Loss per ordinary share

Basic 4 (1.5)p 2.8p

Diluted 4 (1.5)p 2.8p

---------------------------------------------------- ----- ----------- -----------

All results are from continuing operations.

Consolidated Statement of Financial Position

At 30 June 2022

As at 31 As at 31

May May

As at

30 June 2021 2020

Notes 2022 (restated) (restated)

GBP'000 GBP'000 GBP'000

--------------------------------------- ----- --------- ----------- -----------

Non-current Assets

Intangible assets 5 911 1,129 1,289

Right-of-use assets 6 250 - 101

Other intangible assets 7 - 32 65

Property, plant and equipment 8 21 24 53

Investments held at Fair Value Through

Other Comprehensive Income 9 4,621 3,604 4,962

Total non-current assets 5,803 4,789 6,470

--------------------------------------- ----- --------- ----------- -----------

Current Assets

Trade and other receivables 10 2,450 2,211 2,339

Cash and cash equivalents 3,248 3,498 2,239

--------------------------------------- ----- --------- ----------- -----------

Total current assets 5,698 5,709 4,578

--------------------------------------- ----- --------- ----------- -----------

Current liabilities

Trade and other payables 11 (2,147) (2,049) (2,924)

Short-term lease liabilities 12 (106) - (124)

Current tax liabilities - (43) -

Total current liabilities (2,253) (2,092) (3,048)

--------------------------------------- ----- --------- ----------- -----------

Net current assets 3,445 3,617 1,530

--------------------------------------- ----- --------- ----------- -----------

Non-current liabilities

Non-current lease liabilities 12 (155) 0 0

Deferred tax liabilities 13 (833) (573) (611)

--------------------------------------- ----- --------- ----------- -----------

Total non-current liabilities (988) (573) (611)

--------------------------------------- ----- --------- ----------- -----------

Net Assets 8,260 7,833 7,389

--------------------------------------- ----- --------- ----------- -----------

Equity

Share capital 14 2,957 2,939 2,923

Share premium 2,085 2,082 2,057

Revaluation reserve 3,128 2,553 3,597

Retained earnings/(losses) 90 259 (1,188)

--------------------------------------- ----- --------- ----------- -----------

Shareholders' equity 8,260 7,833 7,389

--------------------------------------- ----- --------- ----------- -----------

The financial statements were approved by the Board of Directors

and authorised for issue on 20 October 2022.

Group Statement of Changes in Equity

For 13 months ended 30 June 2022

Share Share Revaluation Retained

capital premium reserve losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- --------- --------- ------------ --------- --------

Balance at 1 June 2020 as

reported 2,923 2,057 3,597 (1,129) 7,448

Adjustments - - - (59) (59)

------------------------------------- --------- --------- ------------ --------- --------

As restated 1 June 2020 2,923 2,057 3,597 (1,188) 7,389

Profit for the financial

year as restated - - - 323 323

Movement in unrealised appreciation

of investments - - 75 - 75

Deferred tax on movement

in unrealised appreciation

of investments - - (12) - (12)

Realised disposal of Fair

value through other comprehensive

income investments - - (1,107) 1,122 15

------------------------------------- --------- --------- ------------ --------- --------

Total comprehensive income

/ (expense) for the year - - (1,044) 1,445 401

------------------------------------- --------- --------- ------------ --------- --------

Share based payment transactions - - - 2 2

Issue of ordinary share

capital 16 25 - - 41

------------------------------------- --------- --------- ------------ --------- --------

Total transactions with

owners, recognised directly

in equity 16 25 - 2 43

------------------------------------- --------- --------- ------------ --------- --------

Balance at 31 May 2021 2,939 2,082 2,553 259 7,833

Loss for the financial period - - - (172) (172)

Movement in unrealised appreciation

of investments - - 1,017 - 1,017

Deferred tax on movement

in unrealised appreciation

of investments - - (443) - (443)

Realised disposal of Fair

value through other comprehensive

income investments - - 1 - 1

------------------------------------- --------- --------- ------------ --------- --------

Total comprehensive income

/ (expense) for the period - - 575 (172) 403

------------------------------------- --------- --------- ------------ --------- --------

Share based payment transactions - - - 3 3

Issue of ordinary share

capital 18 3 - - 21

------------------------------------- --------- --------- ------------ --------- --------

Total transactions with

owners, recognised directly

in equity 18 3 - 3 24

------------------------------------- --------- --------- ------------ --------- --------

Balance at 30 June 2022 2,957 2,085 3,128 90 8,260

------------------------------------- --------- --------- ------------ --------- --------

Group Statement of Cash Flows

For 13 months ended 30 June 2022

Notes 13 months Year to

to 30

June

2022 31 May

2021

(restated)

Group Group

GBP'000 GBP'000

--------------------------------------- ------ ---------- -----------

Operating (loss)/profit (505) 138

Amortisation of customer relationships

and goodwill 218 160

Amortisation of other intangible

assets 32 33

Depreciation of right-of-use

assets 79 101

Depreciation of property, plant

and equipment 31 33

Expenses settled by the issue

of shares 3 2

(Increase) / decrease in receivables 248 125

Increase / (decrease) in payables (389) (873)

----------------------------------------------- ---------- -----------

Cash generated from/(used) in

operations (283) (281)

Tax (paid) (49) -

----------------------------------------------- ---------- -----------

Net cash generated from/ (used

in) operating activities (332) (281)

Investing activities

Investment income received 185 237

Proceeds on disposal of investments

held at FVTOCI - 1,400

Purchases of property, plant

and equipment (28) (4)

Net cash generated from investing

activities 157 1,633

----------------------------------------------- ---------- -----------

Financing activities

Interest paid (29) (9)

Proceeds from issue of ordinary

share capital 22 40

Repayment of lease liabilities (68) (124)

----------------------------------------------- ---------- -----------

Net cash used in financing

activities (75) (93)

----------------------------------------------- ---------- -----------

Net increase/(decrease) in cash

and cash equivalents (250) 1,259

Cash and cash equivalents at

beginning of period 3,498 2,239

Cash and cash equivalents at

end of period 3,248 3,498

----------------------------------------------- ---------- -----------

Notes to the Accounts

For the period ended 30 June 2022

1. Basis of preparation

The financial statements have been prepared in accordance with

the requirements of IFRS implemented by the Group for the period

ended 30 June 2022 as adopted by the International Financial

Reporting Interpretations Committee and in conformity with the

Companies Act 2006 The Group financial statements have been

prepared under the historical cost convention, with the exception

of financial instruments, which are stated in accordance with IFRS

9 Financial Instruments: recognition and measurement.

The financial information included in this News Release does not

constitute statutory accounts of the Group for the period ended 30

June 2022 or year to 31 May 2020, but is derived from those

accounts. Statutory accounts for the year ended 31 May 2021 have

been reported on by the Group's auditor and delivered to the

Registrar of Companies. Statutory accounts for the period ended 30

June 2022 have been audited and will be delivered to the Registrar

of Companies. The report of the auditors for both years was (i)

unqualified and (ii) did not contain a statement under Section 498

(2) or (3) of the Companies Act 2006.

Copies of the Annual Report will be sent on 24 October 2022 to

shareholders and will also be available on our website at

www.fiskeplc.com

New and revised IFRSs in issue but not yet effective

A number of amendments to existing standards have also been

effective from 1 June 2021 but they do not have a material effect

on the Group financial statements. There are a number of standards,

amendments to standards, and interpretations which have been issued

by the IASB that are effective in future accounting periods that

the Group has decided not to adopt early. The following amendments

are effective for future periods:

IFRS/Std Description Issued Effective

IAS 1 Presentation Amendments regarding February Annual periods

of Financial Statements the disclosure of 2021 beginning on or

accounting policies after 1 January

2023

IAS 8 Accounting Amendments regarding February Annual periods

Policies, Changes the definition of 2021 beginning on or

in Accounting Estimates accounting estimates after 1 January

and Errors 2023

IFRS 3 Business Amendments updating May 2020 Annual periods

Combinations a reference to the beginning on or

Conceptual Framework after 1 January

2022

The Group do not expect these amendments to have a significant

impact on the financial statements.

There were no new standards adopted in the current financial

period.

2. Total revenue and segmental analysis

IFRS 8 requires operating segments to be identified on the basis

of internal reports about components of the Group that are

regularly reviewed by management to allocate resources to the

segments and to assess their performance. Following the acquisition

of Fieldings Investment Management Limited in August 2017, their

staff and operations have been integrated into the management team

of Fiske plc. Pursuant to this, the Group continues to identify a

single reportable segment, being UK-based financial intermediation.

Within this single reportable segment, total revenue comprises:

13 months Year to

to 30 June 31 May

2022 2021

(restated)

GBP'000 GBP'000

--------------------------- ----------- -----------

Commission receivable 2,576 2,854

Investment management fees 3,186 2,920

--------------------------- ----------- -----------

5,762 5,774

Other income / (loss) 2 80

--------------------------- ----------- -----------

5,764 5,854

--------------------------- ----------- -----------

Substantially all revenue in the current period and prior year

is generated in the UK and derives solely from the provision of

financial intermediation.

3. Tax

Analysis of tax on ordinary activities:

30 June 31 May

2022 2021

GBP'000 GBP'000

----------------------------------------------- ------- -------

Current tax

Current period 6 43

Prior year adjustment - -

----------------------------------------------- ------- -------

6 43

Deferred tax

Current period (183) -

Prior year adjustment - -

----------------------------------------------- ------- -------

Total tax charge to Statement of Comprehensive

Income (177) 43

----------------------------------------------- ------- -------

Factors affecting the tax charge for the period

The standard rate of tax for the year, based on the United

Kingdom standard rate of corporation tax, is 19.00% (2021:

19.00%).

Changes to the UK corporation tax rate were substantively

enacted on 24 May 2021. At the date of this report it was

anticipated that the main corporation tax rate would increase to

25% from 19% on 1 April 2023. The deferred tax liability has been

calculated using this expected corporation tax rate of 25%.

The charge/(credit) for the year can be reconciled to the profit

per the Statement of Comprehensive Income as follows:

30 June 31 May

2022 2021

GBP'000 GBP'000

------------------------------------------------- ------- -------

(Loss)/profit before tax (349) 366

------------------------------------------------- ------- -------

Charge/(credit) on profit on ordinary activities

at standard rate (66) 70

Effect of:

Expenses not deductible in determining taxable

profit - 3

Non-taxable income (35) (45)

Carry back tax relief (76) 15

(177) 43

------------------------------------------------- ------- -------

4. Earnings per share

Basic earnings per share has been calculated by dividing the

profit on ordinary activities after taxation by the weighted

average number of shares in issue during the period. Diluted

earnings per share is basic earnings per share adjusted for the

effect of conversion into fully paid shares of the weighted average

number of share options during the period.

Diluted

13 Months to 30 June 2022 Basic Basic

GBP'000 GBP'000

------------------------------------------------ ------------ ------------

Loss on ordinary activities after taxation (172) (172)

Adjustment to reflect impact of dilutive share

options - -

------------------------------------------------ ------------ ------------

Loss (172) (172)

------------------------------------------------ ------------ ------------

Weighted average number of shares (000's) 11,809 11,809

------------------------------------------------ ------------ ------------

Earnings per share (pence) (1.5) (1.5)

------------------------------------------------ ------------ ------------

Diluted

Year to 31 May 2021 Basic Basic

GBP'000 GBP'000

(restated) (restated)

------------------------------------------------ ------------ ------------

Profit on ordinary activities after taxation 323 323

Adjustment to reflect impact of dilutive share

options - -

------------------------------------------------ ------------ ------------

Profit 323 323

------------------------------------------------ ------------ ------------

Weighted average number of shares (000's) 11,724 11,769

------------------------------------------------ ------------ ------------

Profit per share (pence) 2.8 2.8

------------------------------------------------ ------------ ------------

30 June 31 May

2022 2021

--------------------------------------- ------- ------

Number of shares (000's):

Weighted average number of shares 11,809 11,725

Dilutive effect of share option scheme - 44

--------------------------------------- ------- ------

11,809 11,769

--------------------------------------- ------- ------

5. Intangible assets arising on consolidation

Customer

relationships Goodwill Total

----------------------------------------

GBP'000 GBP'000 GBP'000

---------------------------------------- --------------- ----------- --------

Cost

At 1 June 2020 1,312 1,311 2,623

Additions - - -

---------------------------------------- --------------- ----------- --------

At 31 May 2021 1,312 1,311 2,623

Additions - - -

---------------------------------------- --------------- ----------- --------

At 30 June 2022 1,312 1,311 2,623

---------------------------------------- --------------- ----------- --------

Accumulated amortisation or impairment

---------------------------------------- --------------- ----------- --------

At 1 June 2020 (395) (939) (1,334)

Charge in year (130) (30) (160)

---------------------------------------- --------------- ----------- --------

At 31 May 2021 (525) (969) (1,494)

Charge in period (131) (87) (218)

---------------------------------------- --------------- ----------- --------

At 30 June 2022 (656) (1,056) (1,712)

---------------------------------------- --------------- ----------- --------

Net book value

At 30 June 2022 656 255 911

---------------------------------------- --------------- ----------- --------

At 1 June 2021 787 342 1,129

---------------------------------------- --------------- ----------- --------

Goodwill arising through business combinations is allocated to

individual cash-generating units ('CGUs') being acquired

subsidiaries, reflecting the lowest level at which the Group

monitors and test goodwill for impairment purposes. The CGUs to

which goodwill is attributed are as follows:

2022 2021

CGU GBP'000 GBP'000

-------------------------------- --------- ---------

Ionian Group Limited 129 176

Vor Financial Strategy Limited 126 166

--------------------------------- --------- ---------

Goodwill allocated to CGUs 255 342

--------------------------------- --------- ---------

The impairment charge arises from a prudent assessment that

customer relationships and goodwill change over time and are not of

indefinite life. Based on analyses of the relevant customer base

segments, a determination was made as to the expected income

streams arising over the next 6 years. The recoverable amounts of

the goodwill in Ionian Group Limited and in Vor Financial Strategy

Limited are determined based on value-in-use calculations. These

calculations use projections of marginal profit contributions over

the expected remaining stream of attributable value. The key

assumptions used for value-in-use calculations are as follows:

Direct and indirect costs

as % of revenues 60%

Growth rate 0 %

12.5

Discount rate %

Had the discount rate used gone up / down by 1%, impairment

would have been GBP8,000 higher/lower and the carrying amount

commensurately adjusted. Management determined margin contribution

and growth rates based on past performance of those units, together

with current market conditions and its expectations of development

of those CGUs. The discount rate used is pre-tax, and reflects

specific risks relating to the relevant CGU.

6. Right-of-use assets

Property

Group GBP'000

-------------------------- ---------

Cost

At 1 June 2020 274

Additions -

At 1 June 2021 274

Additions 329

Disposals (274)

--------------------------- ---------

At 30 June 2022 329

--------------------------- ---------

Accumulated amortisation

At 1 June 2020 (173)

Charge for the year (101)

---------

At 1 June 2021 (274)

Charge for the period (79)

Disposals 274

--------------------------- ---------

At 30 June 2022 (79)

--------------------------- ---------

Net book value

At 30 June 2022 250

--------------------------- ---------

At 1 June 2021 -

--------------------------- ---------

A ten-year lease of office premises at Salisbury House came to

an end at December 2021. Since then the company has moved to new

office premises commencing a new lease to 21 February 2025.

The Group used the following practical expedients when applying

IFRS16 to leases previously classified as operating leases under

IAS17.

-- Applied a single discount rate to a portfolio of leases with similar characteristics

-- Excluded initial direct costs from measuring the right-of-use

asset at the date of initial application

-- Used hindsight when determining the lease term if the

contract contains options to extend or terminate the lease.

7. Other intangible assets

Systems

licence

Group GBP'000

-------------------------- ---------

Cost

At 1 June 2020 192

Additions -

At 1 June 2021 192

Additions -

-------------------------- ---------

At 30 June 2022 192

--------------------------- ---------

Accumulated amortisation

At 1 June 2020 (127)

Charge for the year (33)

At 1 June 2021 (160)

Charge for the period (32)

--------------------------- ---------

At 30 June 2022 (192)

--------------------------- ---------

Net book value

At 30 June 2022 -

-------------------------- ---------

At 1 June 2021 32

--------------------------- ---------

8. Property, plant and equipment

Office

furniture Computer Office

and equipment equipment refurbishment Total

Group GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------------- ------------ ---------------- --------

Cost

At 1 June 2020 164 274 175 613

Additions - 4 - 4

Disposals - - - -

-------------------------- --------------- ------------ ---------------- --------

At 1 June 2021 164 278 175 617

Additions 3 25 - 28

Disposals (162) (197) (175) (534)

-------------------------- --------------- ------------ ---------------- --------

At 30 June 2022 5 106 - 111

-------------------------- --------------- ------------ ---------------- --------

Accumulated depreciation

At 1 June 2020 (156) (229) (175) (560)

Charge for the year (7) (26) - (33)

At 1 June 2021 (163) (255) (175) (593)

Charge for the period (1) (30) - (31)

Disposals 162 197 175 534

-------------------------- --------------- ------------ ---------------- --------

At 30 June 2022 (2) (88) - (90)

-------------------------- --------------- ------------ ---------------- --------

Net book value

At 30 June 2022 3 18 - 21

-------------------------- --------------- ------------ ---------------- --------

At 30 June 2021 1 23 - 24

-------------------------- --------------- ------------ ---------------- --------

9. Investments held at Fair Value Through Other Comprehensive Income

2022 2021

Group GBP'000 GBP'000

--------------------------------------------- ------- -------

Opening valuation 3,604 4,962

Opening fair value gains on investments held (3,127) (4,303)

--------------------------------------------- ------- -------

Cost 477 659

Cost of disposals - (182)

--------------------------------------------- ------- -------

Cost 477 477

Gains on investments 4,144 3,127

--------------------------------------------- ------- -------

Closing fair value of investments held 4,621 3,604

--------------------------------------------- ------- -------

being:

Listed - -

Unlisted 4,621 3,604

--------------------------------------------- ------- -------

FVTOCI investments carried at fair value 4,621 3,604

--------------------------------------------- ------- -------

Gains / (losses) on investments in period 2022 2021

------------------------------------------ ------- -------

Group GBP'000 GBP'000

------------------------------------------ ------- -------

Realised gains on sales - 1,250

Increase in fair value 1,017 1,877

------------------------------------------ ------- -------

Gains on investments 1,017 3,127

------------------------------------------ ------- -------

The investments included above are represented by holdings of

equity securities. These shares are not held for trading.

10. Trade and other receivables

2022 2021

Group

Group (restated)

Group and Company GBP'000 GBP'000

----------------------------------- -------- ------------

Counterparty receivables 407 1,065

Trade receivables 891 -

----------------------------------- -------- ------------

1,298 1,065

Amount owed by group undertakings - -

Other debtors 57 86

Prepayments and accrued income 1,095 1,060

----------------------------------- -------- ------------

2,450 2,211

----------------------------------- -------- ------------

Due to the short-term nature of the current receivables, their

carrying amount is considered to be the same as their fair

value.

Trade receivables

Included in the Group's trade receivables are debtors with a

carrying amount of GBPnil (2021: GBPnil) which are past due at the

reporting date for which the Group has not provided.

Counterparty receivables

Included in the Group's counterparty receivables balance are

debtors with a carrying amount of GBP407,000 (2021: GBP1,065,000)

which are past due but not considered impaired.

Ageing of counterparty receivables:

2022 2021

GBP'000 GBP'000

------------- ------- -------

0 - 15 days 291 1,025

16 - 30 days 40 22

31 - 60 days 57 18

------------- ------- -------

Over 60 days 19 -

------------- ------- -------

407 1,065

------------- ------- -------

11. Trade and other payables

2022 2021

Group Group

GBP'000 GBP'000

------------------------------------- -------- --------

Counterparty payables 1,214 623

Trade payables 19 436

------------------------------------- -------- --------

1,233 1,059

Other sundry creditors and accruals 914 990

------------------------------------- -------- --------

2,147 2,049

------------------------------------- -------- --------

12. Lease liabilities

2022 2021

Group Group

GBP'000 GBP'000

---------------------------------- -------- --------

Current 106 -

Non-current 155 -

---------------------------------- -------- --------

261 -

---------------------------------- -------- --------

Maturity analysis:

---------------------------------- -------- --------

Not later than one year 106 -

Later than one year and not later

than 5 years 155 -

---------------------------------- -------- --------

261 -

---------------------------------- -------- --------

The cash flow impact is summarised as:

2022 2021

Group Group

GBP'000 GBP'000

------------------------------------ -------- --------

Lease liabilities at beginning

of period - 124

New lease entered into in period 329 -

Repayment of lease liabilities (68) (124)

------------------------------------ -------- --------

Lease liabilities at end of period 261 -

------------------------------------ -------- --------

The lease liability is retired over time by the contrasting

interest expense and lease payments.

13. Deferred taxation

Capital Tax Deferred

allowances Investments Losses tax liability

Group GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ------------- ------------ --------- ----------------

At 1 June 2021 (1) 574 - 573

Charge for the period - 443 - 443

Deferred tax asset - - (183) (183)

Charge to Statement of Comprehensive

Income

* in respect of current year - - - -

At 30 June 2022 (1) 1,017 (183) 833

---------------------------------------- ------------- ------------ --------- ----------------

Deferred tax assets and liabilities are recognised at a rate

which is substantively enacted at the balance sheet date. The rate

to be taken in this case is 25%, being the anticipated rate of

taxation applicable to the Group and Company in the following year.

A potential deferred tax asset of GBP178,000 relating to trading

losses arising before 1 April 2017 has not been recognised.

14. Called up share capital

2022 2021

No. of No. of

shares GBP'000 shares GBP'000

-------------------------- ----------- -------- ----------- --------

Allotted and fully paid:

Ordinary shares of 25p

Opening balance 11,754,859 2,939 11,693,790 2,923

Shares issued 75,000 18 61,069 16

-------------------------- ----------- -------- ----------- --------

Closing balance 11,829,859 2,957 11,754,859 2,939

-------------------------- ----------- -------- ----------- --------

Included within the allotted and fully paid share capital were

9,490 ordinary shares of 25p each (2021: 9,490 ordinary shares of

25p each) held for the benefit of employees.

At 30 June 2022 there were 125,000 (2021: 200,000) outstanding

options to subscribe for ordinary shares at a weighted average

exercise price of 70p (2021: 55p) and a weighted average remaining

contractual life of 4 years, 7 months. (2021: 3 years, 5 months).

Ordinary shares are entitled to all distributions of capital and

income.

15. Financial commitments

Lease - classified as an IFRS 16 lease

At 30 June 2022 the Group had outstanding commitments for future

minimum lease payments under non-cancellable operating leases which

fall due as follows:

2022 2021

Land Land and

and buildings Other buildings Other

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------------- -------- ----------- --------

In the next year 111 - - 5

In the second to fifth years

inclusive 185 - - -

------------------------------ --------------- -------- ----------- --------

Total commitment 296 - - 5

------------------------------ --------------- -------- ----------- --------

On 31 December 2021 a 10-year lease over the Company's premises

at Salisbury House expired. In September 2021 the Company entered

into a lease over new premises at Wood Street for a period of some

3 years to 21 February 2025.

16. Clients' money

At 30 June 2022 amounts held by the Company on behalf of clients

in accordance with the Client Money Rules of the Financial Conduct

Authority amounted to GBP66,435,793 (2021: GBP63,153,533). The

Company has no beneficial interest in these amounts and accordingly

they are not included in the consolidated statement of financial

position.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DXBDGXBBDGDC

(END) Dow Jones Newswires

October 20, 2022 02:00 ET (06:00 GMT)

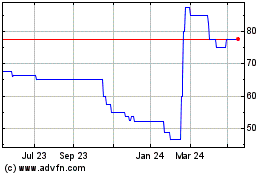

Fiske (LSE:FKE)

Historical Stock Chart

From Nov 2024 to Dec 2024

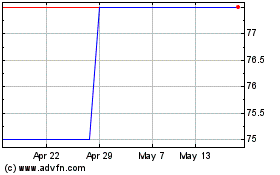

Fiske (LSE:FKE)

Historical Stock Chart

From Dec 2023 to Dec 2024