TIDMEUZ

RNS Number : 8526U

Europa Metals Ltd

31 March 2023

31 March 2023

Europa Metals Ltd

("Europa Metals", the "Company" or the "Group") (AIM, AltX:

EUZ)

Results for the Half-Year Ended 31 December 2022

Europa Metals, the European focused lead, zinc and silver

developer, is pleased to announce its unaudited results for the

half-year ended 31 December 2022 (the "Half-Year Financial

Report").

Please see below extracts from the Half-Year Financial Report,

being the:

- Chairman and Interim-CEO's Statement

- Directors' Report

- Consolidated Statement of Profit or Loss and Other Comprehensive Income

- Consolidated Statement of Financial Position

- Consolidated Statement of Changes in Equity

- Consolidated Statement of Cash Flows

A copy of the full Half-Year Financial Report is available on

the Company's website at www.europametals.com .

For further information on the Company, please visit

www.europametals.com or contact:

Europa Metals Ltd

Dan Smith, Non-Executive Director and Company Secretary

(Australia)

T: +61 417 978 955

Myles Campion, Executive Chairman and acting CEO (UK)

T: +44 (0)20 3289 9923

Linkedin: Europa Metals ltd

Twitter: @ltdeuropa

Vox: Europametals

Strand Hanson Limited (Nominated Adviser)

Rory Murphy/Matthew Chandler/Abigail Wennington

T: +44 (0)20 7409 3494

WH Ireland Limited (Broker)

Harry Ansell/Dan Bristowe/Katy Mitchell/Sarah Mather

T: +44 (0)20 7220 1666

Questco Corporate Advisory Proprietary Limited (JSE Sponsor)

Sharon Owens

T (direct): +27 (11) 011 9212

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended, by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

Key Extracts from the Company's unaudited Half-Year Financial

Report are set out below :

Chairman and Interim-CEO's Statement

During the reporting period and subsequently, we have continued

with our exploration and development activities to advance our

understanding of the Company's wholly-owned Toral lead, zinc and

silver project in the Castilla y Léon region, Spain ("Toral" or the

"Toral Project") as a potential future low capex, high margin, base

metals mine within the EU benefitting from the ongoing support of

regional governments and local communities.

The Company's latest metallurgical testwork programme,

undertaken by Wardell Armstrong Ltd ("WAI"), achieved excellent

results released in August 2022 on material from both the upper

siliceous zone and the lower carbonate zone. Both lead and zinc

recoveries to respective concentrates were very positive. The

grades achieved for both zinc and lead were better than previous

results with the siliceous showing that the upper levels can also

produce a high-grade concentrate.

In November 2022, we announced assay results from our targeted

2022 diamond drill resource expansion campaign conducted by

"Sondeos y Perforaciones Industriales del Bierzo SA" at Toral. Hole

TOD-042 intersected the highest grade mineralisation to be reported

by Europa Metals to date for Toral and over a significant width.

Both holes TOD-041 and TOD-042, taken in conjunction with nearby

previous drilling, provided additional support and confidence for

our current resource model and continuity of the high grade nature

of the deposit at depth.

On the back of the latest drill campaign results, the Company

commissioned an updated independent mineral resource estimate in

accordance with JORC (2012) from Addison Mining Services Limited,

which yielded a 19% increase in the Indicated mineral resource and

a 14% increase in grade. This positive result will enable our

project team to utilise a substantial tonnage of independently

reported Indicated resources in the mine plan for the forthcoming

mining licence application ("MLA") scheduled to be submitted by 31

July 2023 to the Junta of Castilla y Léon.

In late November 2022, we were also delighted to announce the

signing of a definitive option agreement with Denarius Metals Corp.

(TSXV: DSLV, OTCQB: DNRSF) ("Denarius"). Pursuant to such

agreement, which was approved by the Company's shareholders at a

general meeting held on 30 December 2022, Denarius has the right to

acquire up to 80 per cent. ownership in the Company's wholly owned

Spanish subsidiary, Europa Metals Iberia S.L. ("EMI"), which holds

the Toral Project, in return for funding and certain expenditure on

the project and certain consideration of up to, in aggregate,

US$6,000,000 over a four year period.

Most recently, on 22 March 2023, the Company announced that an

initial budget for planned expenditure on Toral of approximately

US$1.8m had been agreed with Denarius for a 12 month period and

confirmed that, in aggregate, an initial sum of US$650k had been

received from Denarius to facilitate our planned MLA and enable

timely completion of the planned initial work programme.

As well as progressing our flagship project, our team has

continued to actively identify, evaluate and engage with third

parties with respect to our search for suitable additional assets

and new project opportunities with the potential to deliver value

for all of our stakeholders.

Myles Campion

Executive Chairman and Interim-CEO

31 March 2023

Directors' Report

Review and results of operations

Europa Metals is a European focused lead, zinc and silver

developer.

Operating Results

For the half-year from 1 July 2022 to 31 December 2022, the

Group recorded a net loss after tax of A$1,220,449 (1 July 2021 to

31 December 2021: net loss of A$1,357,379).

Toral Lead-Zinc-Silver Project, Spain ( "Toral" or the "Toral

Project")

The Toral Project is situated in northwest Spain in a world

class mining jurisdiction which provides the opportunity to create

new mines within well established environmental and mining

frameworks and with access to first class power and transport

infrastructure. Toral represents a limestone hosted, structurally

controlled deposit with the Pb, Zn, Ag mineralisation situated

within the limestone close to the boundary between footwall slates

and hanging wall limestones and dolomites. The mineralisation

occurs as semi-massive vein, breccia and carbonate replacement

styles of mineralisation.

Currently, the Company is progressing Toral towards potential

mine development with a mining licence application due for

submission by 31 July 2023.

The Toral deposit currently has a JORC (2012) compliant

indicated mineral resource estimate of approximately 7Mt @ 8.1% Zn

Equivalent (including Pb credits), 5% Zn, 3.7% Pb and 29g/t Ag,

containing approximately 349,000 tonnes of zinc, 260,000 tonnes of

lead and 6.6 million ounces of silver. This is contained within a

total mineral resource of 20Mt @ 6.8% Zn Equivalent (including Pb

credits), 4.4% Zn, 2.8% Pb and 23 g/t Ag.

During the reporting period, Europa Metals was pleased to

announce the signing of a definitive option agreement with Canadian

explorer and mine developer Denarius Metals Corp (TSXV:DSLV; OTCQB:

DNSRF) ("Denarius") whereby Denarius will spend US$4m to earn a 51%

stake in Europa Metals Iberia S.L. ("EMI"), Europa Metals'

wholly-owned Spanish subsidiary and owner of the Toral Project.

During the reporting period, Europa Metals' team has completed

several important work programmes to enhance our understanding of

Toral, namely:

-- completion of metallurgical testwork in conjunction with the

completed ore-sorting programme;

-- a targeted resource drilling campaign with the highest grade drill results to date; and

-- publication of an independent updated JORC (2012) mineral resource estimate.

Updated Mineral Resource E stimate

On 30 November 2022, the Company announced an updated

independent mineral resource estimate ("MRE"), for Toral. The

updated MRE showed a 19% increase in the Indicated Mineral resource

tonnes and a 14% increase in grade. In summary, the updated MRE

represented an approximate:

-- 19% increase in Indicated Mineral Resource tonnes;

-- 39% increase in Indicated contained tonnes of zinc to approximately 349,000 tonnes;

-- 33% increase in Indicated contained tonnes of lead to approximately 260,000 tonnes; and

-- 27% increase in Indicated contained ounces of silver to approximately 6.6 million ounces.

Image 1: 3-D Block Model looking North

Metallurgical work programme

On 4 August 2022, the Company announced further highly

encouraging results from its comprehensive metallurgical testwork

programme, summarised as follows:

-- Metallurgical testwork results received from Wardell

Armstrong International Ltd ("WAI") in respect of locked cycle

flotation tests ("LCT") on products from an ore sorted bulk

siliceous sample:

o Concentrate Grades 56.6% Zinc 69.6% Lead

o Overall recovery (Sort & Float) 78.6% Zinc 80.7% Lead

-- Metallurgical results received for LCT from WAI on a further two carbonate samples from:

Hole TOD-025D:

o Concentrate Grades 57.4% Zinc 75.2% Lead

o Overall recovery (Sort & Float) 81.4% Zinc 94.4% Lead

Hole TOD-028:

o Concentrate Grades 60.3% Zinc 64.1% Lead

o Overall recovery (Sort & Float) 84.0% Zinc 87.3% Lead

Ore sorting process

Samples from Ore Sorting undertaken by Tomra GmbH, were

submitted to WAI earlier in 2022. The samples tested were a bulk

sample of siliceous style mineralisation and two borehole

composites of carbonate style mineralisation. The siliceous sample

was a composite of intersections from boreholes TOD-029, TOD-029D,

TOD-029D2, TOD-029D3, TOD-034 and TOD-034D (a total of 701.09 kg).

The carbonate samples were taken from boreholes TOD-025D and

TOD-028 (96.36 kg and 50.7 kg respectively).

The ore sorting results announced previously by the Company in

March 2022 were as follows:

Siliceous bulk sample

-- Recovery of 95.7% Pb and 94.3% Zn metal

-- 43.7% mass rejection of waste

Carbonate composite from hole TOD-025D

-- Recovery of 98.9% Pb and 94.7% Zn metal

-- 46.8% mass rejection of waste

Carbonate composite from hole TOD-028

-- Recovery of 96.6% Pb and 96.1% Zn metal

-- 47.7% mass rejection of waste

The sorter products were the subject of a recently completed

campaign of locked cycle flotation with the metallurgical results

received from WAI comprising:

-- Siliceous bulk sample

o Flotation Recoveries 83.4% Zinc 84.3% Lead

o Flotation Concentrate Grades 56.6% Zinc 69.6% Lead

o Overall recovery (Sort & Float) 78.6% Zinc 80.7% Lead

-- Carbonate sample from hole TOD-025D

o Flotation Recovery 85.9% Zinc 95.4% Lead

o Flotation Concentrate Grades 57.4% Zinc 75.2% Lead

o Overall recovery (Sort & Float) 81.4% Zinc 94.4% Lead

-- Carbonate sample from hole TOD-028

o Flotation Recovery 87.4% Zinc 90.3% Lead

o Flotation Concentrate Grades 60.3% Zinc 64.1% Lead

o Overall recovery (Sort & Float) 84.0% Zinc 87.3% Lead

Comparison with the 2019 locked cycle flotation tests on

carbonate drill core

Locked cycle flotation tests simulate a full-scale plant

flowsheet. Each test at WAI's facilities was conducted in a series

of six cycles using the flowsheet shown in Figure 1 below. For the

second and subsequent cycles, lead and zinc cleaner tailings

products were combined with the feed to the previous stage of

flotation. For example, lead second cleaner tails were returned to

first cleaner feed. The final concentrates, zinc scavenger tailings

and zinc rougher tailings from the final two cycles, were weighed

and sent for independent analysis. The results were then used to

calculate recovery and concentrate grades.

Figure 1 : Locked Cycle Test Flowsheet

Results of the 2019 and 2022 testwork programmes are summarised

in Table 1 below. These results indicate that Toral could clearly

achieve excellent concentrate grades.

Table 1: Summarised Results of the 2019 and 2022 Testwork

(Note: recovery and concentration data are from the original

feed)

Test Lead Concentrate Zinc Concentrate

Lead Recovery CR Conc Zinc Recovery CR Conc

(%) (% Pb) (%) (% Zn)

-------------- ----- -------- -------------- ----- --------

2019 Carbonate

LCT1 Float 84.3 39.4 57.5 70.7 29.8 55.8

-------------- ----- -------- -------------- ----- --------

2019 Carbonate

LCT2 Float 83.7 34.9 60.0 77.0 24.9 59.1

-------------- ----- -------- -------------- ----- --------

2022

Carbonate

025D

Sort + Float 94.4 18.8 75.2 81.4 42.3 57.4

-------------- ----- -------- -------------- ----- --------

2022

Carbonate

028

Sort + Float 87.3 51.4 64.1 84.0 24.0 60.3

-------------- ----- -------- -------------- ----- --------

2022 Silicate

Sort + Float 80.7 59.7 69.6 78.6 52.9 56.6

-------------- ----- -------- -------------- ----- --------

Ore sorting and froth flotation are processes that concentrate

and recover metal values. The concentration ratio ("CR") is defined

as the weight of feed divided by the weight of concentrate.

Performance of an individual test can be judged in terms of

recovery and CR. For an operating plant, daily results for recovery

and CR continually vary. However, the results generally form a

trend when plotted on axes of recovery versus CR. The same type of

plot can be useful in comparing locked cycle test results.

Figure 2 : Zinc Recovery vs Concentration Ratio Plot of LCT

Results

Overall results for zinc recovery (for 2022, sort & float

and for 2019, just float) are shown in Figure 2. At any given CR,

higher recovery indicates improved performance, and figure 2

illustrates that the combined sort plus float procedure has given

better performance than flotation alone for the zinc

concentrate.

In respect of the 2022 results, the best estimate of zinc

recovery is the trendline shown in Figure 2, which is "a least

squares fit" for the three different testwork data points. This

line intersects the recovery axis at 89.7%.

This intercept incorporates for zinc metal losses during the

sorting process of 3.9% and also a recovery loss during the

flotation process of a further 6.4% of zinc to lead

concentrate.

The equation of the trend line is as follows:

Recovery % = 89.7 - (0.21 * CR)

In practice, when a full-scale plant and concentrator are in

operation the aim is to produce a saleable zinc concentrate grade

of approximately 55% to 60% Zn. To achieve this target concentrate

grade, the required concentration ratio (and achievable recovery)

depends mainly on the headgrade from the deposit.

At Toral, the average resource grade (October 2021 Resource

Estimate, @ 4% Zn equivalent cut off) is 3.9% zinc, such that a

future potential processing plant could operate at a CR of 17 to

zinc concentrate, which would achieve a zinc recovery of 86.1% and

a concentrate grade of 57.1% zinc.

An approximate estimate of the zinc recovery improvement

resulting from sorting can be made from Figure 2 . Projecting the

two points from the 2019 testwork back to a CR of 17 and then

comparing with the best estimate of recovery trendline indicates a

recovery improvement of approximately 4 percentage points.

Figure 3: Lead Recovery vs Concentration Ratio Plot of LCT

Results

Overall results for lead recovery (for 2022, sort & float

and for 2019, just float) are shown in Figure 3, with the combined

sort plus float procedure again giving better performance than

flotation alone.

In respect of the 2022 results, the best estimate of lead

recovery is the trendline shown in Figure 3, which is "a least

squares fit" for the three testwork data points, intersecting the

recovery axis at 97.4%. This intercept allows for the average loss

of lead during sorting of 2.6% and the equation of the trend line

is as follows:

Recovery % = 97.4 - (0.24 * CR)

In practice, a concentrator would seek to produce a saleable

lead concentrate grade of approximately 70% lead. The average

resource grade at Toral (October 2021 Resource Estimate) is 2.7%

lead, such that a CR of 29 to lead concentrate would be required to

achieve a lead recovery of 90.4% and a concentrate grade of 70.8%

lead.

An approximate estimate of the lead recovery improvement

resulting from sorting can be made from Figure 2 . Projecting the

two points from the 2019 testwork back to a CR of 29 and then

comparing with the best estimate of recovery trendline indicates a

recovery improvement of approximately 3 percentage points.

In summary, the Europa Metals' team believes that ore sorting

followed by flotation has significant cost, performance and

operational advantages compared with flotation alone.

The Company will now consider how best to utilise ore sorter

rejects and flotation tailings. These waste products will be

valuable as potential cemented aggregate backfill and paste fill

for underground mining operations. Some tailings products could

also be used as landfill for reclamation of an existing quarry.

Analysis of Final Concentrates Produced in the 2022 Locked Cycle

Testwork

Final zinc and lead concentrates from the 2022 testwork were

sent for detailed chemical analyses. The analyses for commonly

applied penalty elements are shown in Table 2 below. The

concentrates were generally below penalty levels except for

mercury. High mercury levels are common for Spanish zinc

concentrates and local smelters are able to manage such feeds. As

an alternative, a future plant at Toral could incorporate a

concentrate treatment process in order to reduce the mercury to

below penalty levels.

Table 2: Penalty Element Analyses of Concentrates Produced in

the 2022 testwork

Concentrate As (ppm) Bi (ppm) Cd (ppm) Fe Mg Mn Hg (ppm) F (ppm)

From Testwork (%) (%) (ppm)

Siliceous

Lead Conc 513 2.6 87 4.32 0.08 80 234 120

--------- --------- --------- ----- ------ ------- --------- --------

Siliceous

Zinc Conc 104 0.2 1,325 2.72 0.06 120 2,970 40

--------- --------- --------- ----- ------ ------- --------- --------

Carbonate

025D Lead

Conc 80 2.6 60.8 1.04 0.29 60 96 <20

--------- --------- --------- ----- ------ ------- --------- --------

Carbonate

025D Zinc

Conc 33 0.1 1,445 1.83 0.28 70 1,745 30

--------- --------- --------- ----- ------ ------- --------- --------

Carbonate

028 Lead

Conc 212 7.9 177.5 5.6 0.17 60 197 30

--------- --------- --------- ----- ------ ------- --------- --------

Carbonate

028 Zinc

Conc 16 0.1 1,635 1.75 0.08 50 1,085 20

--------- --------- --------- ----- ------ ------- --------- --------

Penalty

Level for

Zinc Conc 2,000 200 2,500 8% 0.18% 5,000 50 200

--------- --------- --------- ----- ------ ------- --------- --------

Drilling Results

In November 2022, the Company announced the completion of its

latest diamond drilling programme. The drilling campaign aimed to

expand on the pre-existing indicated resource envelope of 5.9Mt @

7.1% ZnEq (including Pb credits) and 27 g/t Ag at depth. Hole

TOD-042 intersected the highest grade mineralisation to be reported

by Europa Metals to date at Toral and over a significant width. The

two holes (TOD-041 and TOD-042) taken in conjunction with nearby

previous drilling provided both support and confidence to our

current resource model and the continuity of the high grade nature

of the deposit at depth.

The drilling parameters for the assay results reported for hole

TOD-042 are presented in the table below:

HOLE_ID EASTING NORTHING ELEVATION LENGTH COOR_SYS

TOD-042 681864 4710064 601.473 876.5 ETRS89utm29

-------- --------- ---------- ------- ------------

Hole TOD-042 was drilled with a PQ-HQ-NQ diameter, with half of

the core being sent for independent analysis at ALS Laboratories.

The assay results received are set out in the table below:

Hole_ID From To Interval Zn_% Pb_% Ag_ppm Cu_% ZnEq(PbAg)%*

(m)

TOD-042 866.35 871.6 5.25 17.87 4.46 55.69 0.03 23.24

------- ------ --------- ------ ----- ------- ----- -------------

TOD-042

(included) 868.7 871.2 2.50 36.82 5.77 101.01 0.05 44.55

------- ------ --------- ------ ----- ------- ----- -------------

* - ZnEq (PbAg)% is the calculated Zn equivalent incorporating

lead and silver credits; (ZnEq (PbAg)% = Zn + Pb*0.926 + Ag*0.019).

Zn equivalent calculations were based on 3-year trailing average

price statistics obtained from the London Metal Exchange and London

Bullion Market Association giving an average Zn price of

US$2,680/t, Pb price of US$2,100/t and Ag price of US$16.2/oz.

Significant Zn Eq intercepts were generated using a 1% Zn Eq

trigger value, minimum width of 1m, maximum consecutive waste

interval of 1m and minimum average Zn Eq grade >2%.

The cross section image above illustrates the positioning of

hole TOD-042. The high grade nature of the intersection is

consistent with our current resource model and provides further

support for extending the known estimated indicated resource at

that depth.

CDTI Loan Funding

On 19 October 2020, the Company announced that following an

extensive submission process, an interest -free loan by way of a

grant of EUR466,801.50 (the "Grant") had been awarded to the

Company by the Centre for the Development of Industrial Technology

("CDTI") for use towards research and development ("R&D") at

Toral.

The CDTI is a public business entity in Spain, under the

auspices of the Ministry of Science and Innovation, which fosters

the technological development and innovation of Spanish companies.

The Grant is categorised as a partly refundable loan (with a nil

per cent. interest rate) with the funds received to be allocated

towards the development of R&D technologies relating to the

recording and correction of drillhole deviation at the Toral

Project. Application for the Grant was made by Europa Metals and

the AIR Institute, linked to the Salamanca University,

inconjunction with drilling contractors Sondeos y Perforaciones

Industriales de Bierzo SA ("SPI").

The Grant monies are drawable in up to three tranches, with the

prior agreement of the CDTI, with the initial tranche, comprising

an amount of EUR163,380 (A$261,872), received by the Company

towards the end of 2020. The second tranche of EUR158,629

(A$241,554) was received during the previous reporting period. The

Company has submitted a request to drawdown the remaining third

tranche, and awaits approval. The core objectives of the Innovation

Programme were to retrieve and process data from Toral's drilling

campaigns in order to develop algorithmic software for use in

exploration campaigns to correct drilling deviation. Biannual

repayments of EUR21,822 (A$33,230) begin in 2024, running for 7

years until 2031, with a fixed interest rate of nil per cent.

Accordingly, on 8 November 2021, the Company announced that the

CDTI had approved the requisite work documentation submitted in

relation to the Stage 1 milestone and that the Company had

therefore drawn down and received the second tranche of the Grant

being EUR158,629 (A$241,554).

Stage 2 involved Toral continuing to be used as a live testing

environment by the partnership as the University of Salamanca

continued its analysis and any future commercial benefit from an

eventual product will be shared by the partners. The Stage 2 work

was completed post the reporting period end such that the third,

and final, tranche of EUR144,792 (A$220,483) should be made

available for draw down following a review by the CDTI and its

confirmation that the requisite criteria of the innovation

programme have been met.

Once the funds advanced have demonstrably been spent on

appropriate R&D exploration activity at the Toral Project by

the Company, 70 per cent. of the total Grant will be repayable with

the balancing 30 per cent. then not required to be repaid.

Corporate

Definitive Agreement with Denarius Metals Corp. ( " Denarius "

)

On 23 November 2022, the Company announced that, further to its

announcement of 5 October 2022, it had entered into a de nitive

option agreement (the "Option Agreement") with Denarius.

Pursuant to the Option Agreement, conditional on, inter alia,

the approval of Europa Metals' shareholders (which was obtained at

a general meeting held on 30 December 2022), Denarius has the right

to acquire in two stages up to an 80 per cent. ownership interest

in the Company's wholly owned Spanish subsidiary, EMI, which holds

the Toral Project.

Key Terms of the Definitive Agreement

The agreement involved the formation of a joint venture via EMI

between Denarius and Europa Metals for the development of Toral,

which covers both the project's existing and any expanded

investigation permit area and potentially the adjacent historic

Antonina Mine area, the former licence for which is currently

terminated by the Junta de Castilla y León (the "Junta"). In return

for funding certain expenditure on the project and consideration of

up to, in aggregate, US$6,000,000, Denarius will be a orded the

exclusive right to acquire up to an 80 per cent. interest in the

Toral Project by way of a two-stage option arrangement.

Subsequent to Europa Metals' shareholders approving the

transaction an initial US$100,000 payment became due to the Company

which is included in receivables as at 31 December 2022. This

payment was subsequently received in January 2023.

Capital Raising

On 8 August 2022, the Company issued 906,265 shares at a blended

issue price of approximately 3.64 pence per share to settle

deferred/accrued remuneration for certain of the Company's

directors totalling A$58,420.

On 23 November 2022, the Company announced that it had

conditionally raised, in aggregate, gross proceeds of GBP0.58

million (A$1.03 million) through the subscription of 12,888,888 new

ordinary shares by certain institutional and other investors at a

price of 4.5 pence per share (the "Subscription"). The Subscription

price represented a 60.7 per cent premium to the then last traded

price of the Company's shares on AIM.

Shareholder Meetings

On 30 November 2022, the Company held its Annual General Meeting

whereby all resolutions were duly approved by shareholders by way

of a poll.

On 30 December 2022, the Company held a General Meeting whereby

a resolution in respect of the grant of a two stage option for the

disposal of a majority interest in the Toral Project to Denarius

was duly approved by shareholders by way of a poll.

Events subsequent to the reporting date

On 24 January 2023, the Company announced, further to its

announcement of 26 January 2022, the conversion by certain of its

directors of an aggregate amount of GBP42,880 (A$62,702) of

deferred/accrued remuneration for the six month period ended 31

December 2022 into new ordinary shares of no par value in the

capital of the Company (the "Fee Conversions"). Pursuant to the Fee

Conversions, the Company issued, in aggregate, 1,245,988 new

ordinary shares at a blended issue price of approximately 3.44

pence per share.

On 24 January 2023, the Company also announced that it had

issued, in aggregate, 2,000,000 options exercisable in three

tranches to two of the Company's Directors, Daniel Smith and Myles

Campion (or their nominees). In addition, a total of 3,500,000

performance rights ("Performance Rights") were issued to Myles

Campion and Daniel Smith. The Performance Rights are exercisable

for nil consideration and are subject to various performance

milestone conditions and expiry dates relating to specific

share-price hurdles and the continued development of Toral.

On 22 March 2023, the Company announced that an initial budget

for planned expenditure on the Toral Project of approximately

US$1.8m for a 12 month period had recently been agreed between the

Company and its joint venture ("JV") partner, Denarius. The budget

will principally be applied to a combination of confirmatory and

infill drilling utilising up to two rigs. In addition, further to

the receipt of shareholder approval in respect of the definitive

option agreement in relation to the JV at a general meeting of the

Company held on 30 December 2022, a sum of US$100,000 had been paid

to EMI, which had facilitated the advancement of the planned mining

licence application. Following a successful capital raising by

Denarius earlier in March 2023, a further US$550,000 had recently

been advanced to EMI by Denarius to enable timely completion of the

planned initial work programme in accordance with the timeframe set

out under the definitive agreement.

No other matters or circumstances have arisen since the

reporting date that may significantly affect the operations of the

Company, the results of those operations, or the Company's state of

affairs in future financial years.

Daniel Smith

Director

31 March 2023

Consolidated Statement of Profit or Loss and Other Comprehensive

Income

for the half-year ended 31 December 2022

6 months 6 months

to to

31 December 31 December

2022 2021

Note $ $

--------------------------------------------- ----- ------------- -------------

Revenue from continuing operations

Other Income 2 177,279 -

177,279 -

Exploration expenditure (853,355) (711,643)

Foreign exchange (loss)/gain (7,553) 22,477

Other expenses 2 (536,820) (668,213)

Loss before income tax (1,220,449) (1,357,379)

Income tax (expense)/benefit - -

------------- -------------

Net loss after income tax (1,220,449) (1,357,379)

------------- -------------

Other comprehensive income

Items that may be reclassified subsequently

to profit or loss:

Net exchange (loss)/gain on translation of

foreign operation 34,859 8,844

Other comprehensive (loss)/profit

for the period, net of tax 34,859 8,844

Total comprehensive loss for the

period (1,185,590) (1,348,535)

------------- -------------

Net (loss) for the period attributable

to shareholders of the Company: (1,220,449) (1,357,379)

------------- -------------

(1,220,449) (1,357,379)

------------- -------------

Total comprehensive (loss) for the

period attributable to shareholders

of the Company: (1,185,590) (1,348,535)

------------- -------------

(1,185,590) (1,348,535)

------------- -------------

(Loss) per share attributable to the ordinary equity holders of

the Company

Cents per Cents per

Loss per share share share

- basic (loss) per share (1.48) (2.31)

- diluted (loss) per share (1.48) (2.31)

The above Consolidated Statement of Profit or Loss and Other

Comprehensive Income should be read in conjunction with the

accompanying notes in the full Half-Year Financial Report.

Consolidated Statement of Financial Position as at 31 December

2022

31 December 30 June

2022 2022

Note $ $

------------------------------- ----- ------------- -------------

Current Assets

Cash and short-term deposits 1,451,312 1,650,056

Trade and other receivables 3 418,356 85,420

Total Current Assets 1,869,668 1,735,476

------------- -------------

Non-current Assets

Plant and equipment 37,270 46,877

Other receivables - 63,018

Right of use assets 42,292 42,292

Capitalised exploration 4 1,268,953 1,229,196

Total Non-current Assets 1,348,515 1,381,383

------------- -------------

Total Assets 3,218,183 3,116,859

------------- -------------

Current Liabilities

Trade and other payables 348,581 139,119

Lease liabilities 22,796 22,796

Unearned income - 20,937

Total Current Liabilities 371,377 182,852

------------- -------------

Non-current Liabilities

Lease liability 1,462 12,507

Borrowings 5 205,216 186,925

Total Non-current Liabilities 206,678 199,432

------------- -------------

Total Liabilities 578,055 382,284

------------- -------------

NET ASSETS 2,640,128 2,734,575

------------- -------------

Equity

Contributed equity 6 49,316,155 48,227,649

Accumulated losses (50,064,122) (48,843,673)

Reserves 3,388,095 3,350,599

TOTAL EQUITY 2,640,128 2,734,575

------------- -------------

The above Consolidated Statement of Financial Position should be

read in conjunction with the accompanying notes in the full

Half-Year Financial Report.

Consolidated Statement of Changes in Equity for the half-year

ended 31 December 2022

Employee

Share Foreign

Issued Accumulated Incentive Option Exchange Total

Capital Losses Reserve Reserve Reserve Equity

$ $ $ $ $ $

---------------------------------- ----------- ------------- ----------- ---------- ---------- ------------

At 1 July 2021 45,695,303 (46,380,604) 491,577 2,520,528 102,048 2,428,852

----------- ------------- ----------- ---------- ---------- ------------

(Loss) for the period - (1,357,379) - - - (1,357,379)

Other comprehensive income (net

of tax) - - - - 8,844 8,844

Total comprehensive loss (net

of tax) - (1,357,379) - - 8,844 (1,348,535)

Transaction with owners in their

capacity as owners

Shares issued net of transaction

costs 2,532,346 - - - - 2,532,346

Options issued to directors and

management - - - 28,848 - 28,848

Options issued to brokers and

corporate advisers - - - 154,314 - 154,314

At 31 December 2021 48,227,649 (47,737,983) 491,577 2,703,690 110,892 3,795,825

At 1 July 2022 48,227,649 (48,843,673) 567,997 2,720,044 62,558 2,734,575

----------- ------------- ----------- ---------- ---------- ------------

(Loss) for the period - (1,220,449) - - - (1,220,449)

Other comprehensive income (net

of tax) - - - - 34,859 34,859

Total comprehensive loss (net

of tax) - (1,220,449) - - 34,859 (1,185,590)

Transaction with owners in their

capacity as owners

Shares issued net of transaction

costs 1,033,155 - - - - 1,033,155

Shares issued to management 55,351 - (76,420) - - (21,069)

Shares to be issued - - 62,702 - - 62,702

Options issued to directors and

management - - - 16,355 - 16,355

----------- ------------- ----------- ---------- ---------- ------------

At 31 December 2022 49,316,155 (50,064,122) 554,279 2,736,399 97,417 2,640,128

=========== ============= =========== ========== ========== ============

The above Consolidated Statement of Changes in Equity should be

read in conjunction with the accompanying notes in the full

Half-Year Financial Report.

Consolidated Statement of Cash Flows for the half-year ended 31

December 2022

6 months to 6 months

31 December to 31 December

2022 2021

$ $

------------------------------------------ ------------- ----------------

Cash flows from operating activities

Payments to suppliers and employees (399,487) (567,590)

Payment for exploration and evaluation

costs (822,588) (890,067)

Net cash flows used in operating

activities (1,222,075) (1,457,657)

------------- ----------------

Cash flows from investing activities

Payments for plant and equipment - (616)

Net cash flows used in investing

activities - (616)

------------- ----------------

Cash flows from financing activities

Lease principal repayments (16,601) (12,853)

Proceeds from issue of shares 1,033,155 2,760,272

Costs of capital raising - (138,369)

Proceeds from borrowings - 251,705

Net cash flows from financing activities 1,016,554 2,860,755

------------- ----------------

Net increase / (decrease) in cash

and cash equivalents (205,521) 1,402,482

Cash and cash equivalents at beginning

of period 1,650,056 1,180,768

Effect of foreign exchange on cash

and cash equivalents 6,777 (58,220)

------------- ----------------

Cash and cash equivalents at end

of the period 1,451,312 2,525,030

============= ================

The above Consolidated Statement of Cash Flows should be read in

conjunction with the accompanying notes in the full Half-Year

Financial Report.

- ENDS -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SDUFASEDSEDD

(END) Dow Jones Newswires

March 31, 2023 02:00 ET (06:00 GMT)

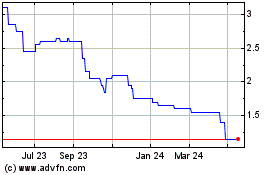

Europa Metals (LSE:EUZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

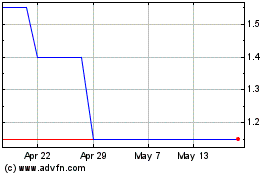

Europa Metals (LSE:EUZ)

Historical Stock Chart

From Nov 2023 to Nov 2024