Read the Truth About Saba’s Track Record,

Objectives, Nominees and Plan to Deliver Substantial Liquidity and

Long-Term Returns for All

Shareholders

Register for Webinar on 14 January at 1PM GMT Where Saba Founder &

CIO Boaz Weinstein Will Detail Plan to Deliver Shareholder Value at

All Seven Trusts and Answer Questions from the Audience:

www.bit.ly/saba-uk-webinar

Visit www.mindthegap-uktrusts.com to Learn How

to Vote FOR Saba’s Resolutions at Each

Trust

Saba Capital Management, L.P. (together with certain of its

affiliates, “Saba” or “we”), today addressed the misleading claims

made recently by Baillie Gifford US Growth Trust PLC (USA:LSE), CQS

Natural Resources Growth & Income PLC (CYN:LSE), Edinburgh

Worldwide Investment Trust PLC (EWI:LSE), European Smaller

Companies Trust PLC (ESCT:LSE), Henderson Opportunities Trust PLC

(HOT:LSE), Herald Investment Trust PLC (HRI:LSE) and Keystone

Positive Change Investment Trust PLC (KPC:LSE) (collectively, the

“Trusts”) with key facts that reinforce the need for

shareholder-driven change.

As a reminder, Saba has requisitioned General Meetings of these

seven Trusts to provide shareholders the opportunity to vote on

resolutions to remove the Trusts’ existing directors and appoint

highly qualified directors to replace them.1 Saba is convening the

General Meetings because we believe the current Boards of Directors

(the “Boards”) and investment managers have failed to perform

versus their benchmarks, resulting in deep trading discounts to net

asset value (“NAV”), which we believe have only recently narrowed

as a result of Saba’s investment.

Saba Founder and CIO Boaz Weinstein will be hosting a

live webinar on Tuesday, 14 January at

1:00 p.m. GMT to explain why the Boards must be replaced

immediately, outline Saba’s strategy to deliver substantial

liquidity and long-term returns for all shareholders and take

questions from the audience. To access the webinar, visit:

www.bit.ly/saba-uk-webinar.

Misleading Claims from the

Trusts Regarding Saba’s Campaign

The Facts

“Saba’s motives are self-serving and will

not benefit all shareholders.”

Link

- As the largest investor in each Trust, our interests are

directly aligned with those of all

shareholders.

- We have a proven track record of pursuing changes that return

discounted funds to their full NAV and create long-term value for

all shareholders.

- If Saba were selected as manager, our strategy of buying

undervalued trusts would accrue to the benefit of the very industry

(and shareholders) that managers are claiming we would hurt.

“Saba wishes to take control of your

Company for its own economic benefit rather than due to concerns

about the Company's performance.”

Link

- Saba’s investment and engagement in the U.K. investment trust

industry is already driving positive results for shareholders.

- The Trusts’ discounts to NAV have narrowed significantly over

the last six months, which we believe is due to Saba’s buying.

- Only after direct pressure from Saba and through growing our

holdings have the majority of the Trusts taken shareholder-friendly

actions – including offering full cash exits, increased buybacks

and tender offers.

“Saba has not offered a plan for the

benefit of all Shareholders.”

Link

- As disclosed in our 18 December letter, Saba’s plan is simple: with a reconstituted Board,

we intend to provide shareholders with liquidity options plus the

opportunity for greater long-term returns under a new investment

strategy and manager.

- For HRI shareholders, Saba announced its intent to encourage

the new Board to offer a full cash exit at 99% of NAV if

shareholders support Saba’s resolutions to reconstitute the HRI

Board.

“Saba brings uncertainty and risk.”

Link

- We’re giving shareholders the chance to get out of an

underperforming Trust if they so desire. If they want to remain

invested, we’re providing shareholders with the opportunity to

profit from this sector rather than be a casualty of it.

- If Saba is selected as manager, our plan is to offer a

U.K.-listed product that will mainly buy trusts at discounts and

encourage management to take action, so investors can profit.

- We intend to use the same proven investment process as the Saba

Capital Closed-End Funds ETF (“CEFS”), which invests in discounted

U.S. closed-end funds, to the extent shareholders agree. Material

changes to the investment policy would require the approval of the

relevant Trust’s shareholders.

“Saba wants to appoint a non-independent

board.”

Link

- Saba has put forth independent director candidates across the

seven Trusts. All nominees other than Paul Kazarian and Boaz

Weinstein are independent from Saba, meaning half of the Board of

each Trust will be independent if our proposed resolutions are

passed.

- To ensure compliance with the highest standards of governance,

our nominees intend to add one or more additional independent

directors to each Board as soon as reasonably possible following

the Trusts’ General Meetings.

“The new Board would not meet the

standards of both the UK Corporate Governance Code and AIC Code of

Corporate Governance.”

Link

- If Saba’s nominees are elected, the Board of each Trust will be

legally compliant at all times under the FCA Listing Rules and will

ensure compliance with the highest standards of governance.

- Following the General Meetings, each Board will comply with the

AIC Code of Corporate Governance as soon as practicable, as the

nominees intend to appoint one or more additional independent

directors with suitable experience.

“We believe Saba’s plan […] may introduce

substantially inflated fees.”

Link

- This is a fear-mongering tactic being peddled by numerous

managers to distract from poor performance.

- Saba’s U.K. investment trust strategy – like its closed-end

fund strategy in the U.S. – is anchored in protecting shareholder

rights by:

- Pursuing changes that return discounted trusts to their full

NAV.

- Creating long-term value for shareholders through low fees and better

management.

- Saba maintains a highly competitive 1.1% management fee for

CEFS. The fund has experienced substantial demand from investors,

allowing it to issue new shares every year since its 2017

launch.2

Misleading Claims from

Herald

The Facts

“Since launch in 1994, Herald Investment

Trust's investment strategy has delivered outstanding investment

performance.”

Link

- HRI significantly underperformed its benchmark this past year

and the past three years, despite beginning 2024 with its largest

position in Super Micro Computer – a company that experienced a

huge surge, rising more than 300%.3

- This underperformance is attributed to Katie Potts’s

mismanagement of both the Super Micro Computer position and the

overall portfolio.

“The Board reiterates its belief that,

since Saba started investing in 2009, it has materially

underperformed Herald.”

Link

- This is a complete fabrication: Saba’s public funds did not

start investing in 2009. Saba’s CEFS inception was in 2017, and

Saba only became the manager of its two closed-end funds in 2023

and 2021. There is no way to compare performance to HRI since

2009.

- In stark contrast to CEFS delivering a 46.0% gain over the last

three years, HRI posted a 9.7% NAV loss.4

“If Saba gains control […] significant

value could be lost for Shareholders as a result of forced selling

of parts of [HRI’s] Portfolio.”

Link

- Given our 25.5% ownership of HRI (compared to the current Board

holding under 0.05%), it is illogical to suggest that Saba would

favour a fire sale that undervalues the very assets in which we are

the single largest shareholder.

Misleading Claims from Baillie

Gifford

The Facts

“The Keystone board accepts that the

company has been through a challenging period of performance

against a difficult backdrop and has already taken steps to address

this and provide certainty and options for all shareholders

[…]”

Link

- Since Baillie Gifford took over KPC four years ago, performance

has been abysmal. The Board’s own benchmark is up 38.3%, while

KPC’s NAV return is at -26.1%.5

- KPC Chair Karen Brade has overseen cumulative underperformance

of nearly 130% since assuming her role in 2018 – a staggering loss

and destruction of wealth for retail holders and retirees.6

“[USA] is successfully delivering on its

investment mandate, with strong long-term performance, and it

provides Shareholders with access to leading private companies of

this generation, such as SpaceX, Databricks and Stripe, at low

cost.”

Link

- We consider Saba’s buying to be the key driver of today’s

premium at USA. Without our buying, USA (and EWI) would continue to

trade at discounts – just like they did previously.

- Baillie Gifford’s Scottish Mortgage Investment Trust (SMT:LSE)

and Schiehallion Fund (MNTN:LSE) have similar positions in private

companies like SpaceX, yet they trade at double-digit

discounts.

Misleading Claims from Janus

Henderson

The Facts

“ESCT is a well-managed investment company

whose strategy has delivered long-term outperformance for you.”

Link

- Over the last three years, Janus Henderson’s ESCT and HOT have

both traded at a disappointing ~-13.5% average discount to

NAV.7

- These respective double-digit discounts demonstrate that the

Trusts’ Boards and portfolio managers have failed

shareholders.

“The Board of HOT is offering you a full

cash exit at NAV and/or the option to rollover into an open-ended

vehicle managed by Janus Henderson Investors. These opportunities

are at risk of being cancelled by Saba.”

Link

- This scheme is simply a last-ditch attempt to protect the

underperforming Board, continue lining the manager’s own pockets

with shareholder capital and distract from an indefensible track

record.

- We believe Janus Henderson’s proposed reconstruction scheme for

HOT is inferior to our nominees’ plan, which will deliver

substantial liquidity and long-term returns.

Misleading Claims from

Manulife | CQS

The Facts

“Your Board has overseen strong

performance.”

Link

- CYN Chair Christopher Casey cannot hide from poor performance.

At CYN, he “delivered” a -14% discount for shareholders and -30%

underperformance versus its benchmark over the past three

years.8

Six of the seven

Trusts have scheduled their Requisitioned General

Meetings:

HRI: 22 January 2025 at 12p.m.

GMT USA: 3 February 2025 at 12p.m. GMT KPC: 3

February 2025 at 12p.m. GMT CYN: 4 February 2025 at 11a.m.

GMT HOT: 4 February 2025 at 10a.m. GMT ESCT: 5

February 2025 at 12:30p.m. GMT

Note: The voting

deadlines for each Trust will be earlier than the dates of the

General Meetings.

To learn how to vote FOR Saba’s resolutions at each Trust visit,

https://www.mindthegap-uktrusts.com/meeting-information.

***

About Saba

Saba Capital Management, L.P. is a global alternative asset

management firm that seeks to deliver superior risk-adjusted

returns for a diverse group of clients. Founded in 2009 by Boaz

Weinstein, Saba is a pioneer of credit relative value strategies

and capital structure arbitrage. Saba has offices in New York City

and London. Learn more at www.sabacapital.com.

DISCLAIMER

Saba Capital Management, L.P. (“Saba”) is publishing this

announcement solely for the information of other shareholders in

each of Baillie Gifford US Growth Trust PLC (USA:LSE), CQS Natural

Resources Growth & Income PLC (CYN:LSE), Edinburgh Worldwide

Investment Trust PLC (EWI:LSE), European Smaller Companies Trust

PLC (ESCT:LSE), Henderson Opportunities Trust PLC (HOT:LSE), Herald

Investment Trust PLC (HRI:LSE) and Keystone Positive Change

Investment Trust PLC (KPC:LSE) (the “Trusts”). This

announcement is not intended to be and does not constitute or

contain any investment recommendation as defined by Regulation (EU)

No 596/2014 (as it forms part of the domestic law in the United

Kingdom by virtue of the European Union (Withdrawal) Act 2018). No

information in this announcement should be construed as

recommending or suggesting an investment strategy. Nothing in this

announcement or in any related materials is a statement of or

indicates or implies any specific or probable value outcome in any

particular circumstance. This announcement is provided merely for

general informational purposes and is not intended to be, nor

should it be construed as (1) investment, financial, tax or legal

advice, or (2) a recommendation to buy, sell or hold any security

or other investment, or to pursue any investment style or strategy.

Neither the information nor any opinion contained in this

announcement constitutes an inducement or offer to purchase or sell

or a solicitation of an offer to purchase or sell any securities or

other investments in the Trusts or any other trust by Saba or any

of its affiliates in any jurisdiction. This announcement does not

consider the investment objective, financial situation, suitability

or the particular need or circumstances of any specific individual

who may access or review this announcement and may not be taken as

advice on the merits of any investment decision. This announcement

is not intended to provide the sole basis for evaluation of, and

does not purport to contain all information that may be required

with respect to, any potential investment in the Trusts. Any person

who is in any doubt about the matters to which this announcement

relates should consult an authorised financial adviser or other

person authorised under the UK Financial Services and Markets Act

2000. To the best of Saba’s ability and belief, all information

contained herein is accurate and reliable, and has been obtained

from public sources that Saba believes to be accurate and reliable.

However, such information is presented “as is”, without warranty of

any kind, whether express or implied, and Saba has not

independently verified the data contained therein. All expressions

of opinion are subject to change without notice, and Saba does not

undertake to update or supplement any of the information, analysis

and opinion contained herein.

The reference herein to CEFS (and Saba as its portfolio manager)

is solely provided for context in discussing the proposals related

to the Trusts and is not intended to be, nor is it, an offer to

sell interests of that fund or any other Saba-managed or subadvised

vehicle.

Saba may continue transacting in the shares and securities of

the Trusts, and/or derivatives referenced to them (which may

include those providing long and short economic exposure) for an

indefinite period following the date of this announcement and may

increase or decrease its interests in such shares, securities

and/or derivatives at any time.

FORWARD LOOKING STATEMENTS

This announcement contains certain forward-looking statements

and information that are based on Saba’s beliefs, as well as

assumptions made by, and information currently available to, Saba.

These statements include, but are not limited to, statements about

strategies, plans, objectives, expectations, intentions,

expenditures and assumptions and other statements that are not

historical facts. When used herein, words such as “anticipate,”

“believe,” “estimate,” “expect,” “intend,” “plan” and “project” and

similar expressions (or their negative) are intended to identify

forward-looking statements. These statements reflect Saba’s current

views with respect to future events, are not guarantees of future

performance and involve risks and uncertainties that are difficult

to predict. Further, certain forward-looking statements are based

upon assumptions as to future events that may not prove to be

accurate. Actual results, performance or achievements may vary

materially and adversely from those described herein. There is no

assurance or guarantee with respect to the prices at which any

securities of the Trusts or any other trust will trade, and such

securities may not trade at prices that may be implied herein. Any

estimates, projections or potential impact of the opportunities

identified by Saba herein are based on assumptions that Saba

believes to be reasonable as of the date hereof, but there can be

no assurance or guarantee that actual results or performance will

not differ, and such differences may be material and adverse. No

representation or warranty, express or implied, is given by Saba or

any of its officers, employees or agents as to the achievement or

reasonableness of, and no reliance should be placed on, any

projections, estimates, forecasts, targets, prospects or returns

contained herein. Neither Saba nor any of its directors, officers,

employees, advisers or representatives shall have any liability

whatsoever (for negligence or misrepresentation or in tort or under

contract or otherwise) for any loss howsoever arising from any use

of information presented in this announcement or otherwise arising

in connection with this announcement. Any historical financial

information, projections, estimates, forecasts, targets, prospects

or returns contained herein are not necessarily a reliable

indicator of future performance. Nothing in this announcement

should be relied upon as a promise or representation as to the

future. Nothing in this announcement should be considered as a

profit forecast.

PERMITTED RECIPIENTS

In relation to the United Kingdom, this announcement is being

issued only to, and is directed only at, (i) investment

professionals specified in Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 as amended

(the “Order”), (ii) high net worth entities, and other

persons to whom it may lawfully be communicated, falling within

Article 49(2)(a) to (d) of the Order and (iii) persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of section 21 of the Financial Services and Markets Act

2000) in connection with the issue or sale of any securities of the

Trusts or any member of their respective groups may otherwise

lawfully be communicated or caused to be communicated (all such

persons together being referred to as “Permitted

Recipients”). Persons who are not Permitted Recipients must not

act or rely on the information contained in this announcement.

DISTRIBUTION

Not for release, publication or distribution, in whole or in

part, directly or indirectly, in, into or from any jurisdiction

where to do so would constitute a violation of the relevant laws of

that jurisdiction. The distribution of this announcement in certain

countries may be restricted by law and persons who access it are

required to inform themselves and to comply with any such

restrictions. Saba disclaims all responsibility where persons

access this announcement in breach of any law or regulation in the

country of which that person is a citizen or in which that person

is residing or is domiciled.

1 For USA, there will be a third resolution to reduce the

minimum permitted board size from three to two directors. 2 Saba

Closed-End Funds ETF Annual Reports and public disclosures. Link. 3

The referenced HRI benchmark is the Russell 2000 Technology Index,

which is one of HRI’s two self-selected benchmarks and which Saba

believes is a more appropriate benchmark than the Deutsche Numis SC

+ AIM (ex. ICs) Index given HRI’s focus on smaller companies in the

technology and communications sector. 4 Bloomberg. Data is as of 13

December 2024. Past performance is no guarantee of future results.

Any information pertaining to CEFS is for illustrative purposes

only and is in response to HRI’s previous statements with respect

to Saba’s track record. This communication does not constitute an

offer to sell or a solicitation of an offer to buy interests in

CEFS. 5 Bloomberg. Data is as of 13 December 2024. KPC’s benchmark

is the MSCI ACWI Index. 6 Bloomberg. Total shareholder return data

is in GBP and runs from 18 January 2018 to 13 December 2024. KPC’s

benchmark is the MSCI ACWI Index. 7 Bloomberg. Data is in GBP and

as of 13 December 2024. 8 Bloomberg. Data is in GBP and as of 13

December 2024. CYN’s benchmark is the MSCI World Energy Sector

Index.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250112475354/en/

Investor Contact Alliance

Advisors Timothy Marshall / Adam Riches, 0800-102-6570

saba@allianceadvisors.com

Media Contact Longacre

Square Partners Charlotte Kiaie / Kate Sylvester, +1-646-386-0091

ckiaie@longacresquare.com / ksylvester@longacresquare.com

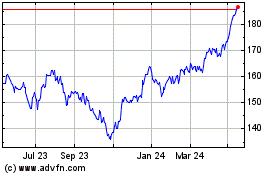

The European Smaller Com... (LSE:ESCT)

Historical Stock Chart

From Dec 2024 to Jan 2025

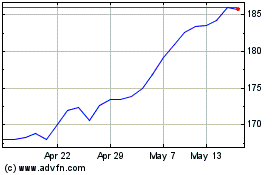

The European Smaller Com... (LSE:ESCT)

Historical Stock Chart

From Jan 2024 to Jan 2025