TIDMEOG

Europa Oil & Gas (Holdings) plc / Index: AIM / Epic: EOG / Sector: Oil & Gas

5 October 2015

Europa Oil & Gas (Holdings) plc ('Europa' or 'the Company')

Final Results for the year to 31 July 2015

Europa Oil & Gas (Holdings) plc, the AIM listed oil and gas exploration,

development and production company focused on Europe, announces its final

results for the 12 month period ended 31 July 2015.

The Company will be holding a conference call for analysts and investors later

today at 10:30 BST. To participate, please dial 0808 109 0701, or +44 (0) 20

3003 2701 if calling from outside of the UK, using access code 7796336#. Please

note that all lines will be muted with the exception of the Europa Oil & Gas

management. However the Company invites shareholders to submit questions to its

public relations advisers, St Brides Partners Ltd, ahead of the call via email

to shareholderenquiries@stbridespartners.co.uk. The management team will

strive to answer as many questions as possible during the course of the call.

To view a copy of the presentation online, please go to www.meetingzone.com/

presenter?partCEC=7796336 using 7796336 as the participant pin. On the right

hand side of the screen you will find an option to submit questions during the

call. The presentation and the Q&A will only be made live once the call has

commenced. Unfortunately the online presenter programme is not compatible with

iPads and iPhones but if you are listening to the call and would like to send

questions during this time, please email them to

shareholderenquiries@stbridespartners.co.uk referencing 'Europa Oil & Gas' in

the subject line and these will be passed onto the Company for you. If you

have any problems accessing the call, please contact St Brides Partners Ltd on

shareholderenquiries@stbridespartners.co.uk or on the telephone number +44 (0)

20 7236 1177.

The full Annual Report and Accounts will be available today on the Company's

website at www.europaoil.com and will be mailed to those shareholders who have

requested a paper copy later this month.

Operational highlights

* 141 boepd produced from four UK onshore fields (2014: 165 boepd from three

fields)

* Competent Persons Report ("CPR") produced by ERC Equipoise ("ERCE")

estimated gross mean unrisked Prospective Resources of 1.5 billion boe in

FEL 3/13 offshore Ireland

* 15% carried interest in FEL 3/13 assigned a net mean unrisked NPV10 of

US$1.6 billion by ERCE

* Discovered oil at Wressle in PEDL180, Lincolnshire, with aggregate

production from all payzones of 710 boepd during initial testing operations

* Prepared and submitted new licence applications in 14th Onshore Licensing

Round UK, award outcome expected Q4 2015

* Farmed out Tarbes val d'Adour permit in onshore France to Vermillion for a

100% carry on a EUR4.65 million work programme

* Drilled an exploration well at Kiln Lane on PEDL181 East Lincolnshire

* Awarded block 41/24 licence in southern North Sea

* Raised GBP2.2 million net proceeds via a placing and open offer

* Bill Adamson retired from the Board and Colin Bousfield, an existing

Director, was appointed Chairman

Financial performance

* Group revenue of GBP2.2 million (2014: GBP3.9 million)

* Pre-tax loss excluding exploration write-off and impairment of GBP0.8 million

(2014: profit GBP0.5 million)

* Pre-tax loss of GBP4.1 million after GBP2.2 million exploration write-off in

PEDL181 and GBP1.1 million impairment against the West Firsby field (2014:

loss GBP0.7 million after a GBP1.2 million impairment against the West Firsby

field)

* Post-tax loss for the year GBP1.8 million (2014: profit GBP0.6 million)

* Cash used in continuing operations GBP0.3 million (2014: cash generated GBP1.4

million)

* Net cash balance as at 31 July 2015 GBP3.2 million (31 July 2014: GBP4.5

million)

Post reporting date events

* Planning permission for the Holmwood exploration well surface site granted

in August 2015 following a Planning Inquiry in April and June 2015 with

planning permission for the underground well path granted in September 2015

* Wressle EWT completed at Penistone Flags oil zone with positive

implications for reservoir volumes

* Prepared and submitted multiple new licence applications for the Irish 2015

Atlantic Margin Licensing Round, award outcome anticipated in H1 2016

* Kosmos Energy decided to exercise its option to withdraw from both Irish

offshore licences, Europa has applied to assume 100% interest and

operatorship

Europa's CEO, Hugh Mackay said, "Drilling wells, issuing CPRs, farming out

licences, these are key value drivers for an oil and gas company. The year

under review has seen Europa participate in all of these high impact

activities: two wells drilled onshore UK; discovery in East Lincolnshire;

farm-out secured for one of our licences onshore France with Vermillion Energy;

and CPR issued estimating 1.5 billion barrels for one of our Irish Licences.

Equally importantly we have cash, we have revenue from production and we have

the opportunity to increase revenue through the Wressle development.

"The year ahead promises more high impact activity: we will look to bring the

Wressle discovery into production and in the process increase our revenues;

issue a CPR for Wressle which will significantly boost our reserves; advance

plans to drill the 5.6 mmboe Holmwood prospect, which we believe is one of the

best undrilled conventional prospects onshore UK; commence the farm-out of

Holmwood and our Irish licences and continue ongoing discussions with potential

partners for our Bearn des Gaves permit. We are also looking to add to our

exploration portfolio having participated in the latest onshore UK and Irish

Altantic Margin licensing rounds. We are working hard to generate value for

shareholders and look forward to the year ahead."

Chairman's Statement

Europa is an exploration and production company with a portfolio of multi-stage

projects in three areas: onshore UK; offshore Ireland; and onshore France. The

year under review has seen Europa:

* Participate in two wells drilled onshore UK as part of a multi-well

programme focused on proving up our prospect inventory via the drill bit;

* Receive planning approval for the Holmwood well, which is in an area of the

Weald Basin which has seen much press coverage in recent months for its

high prospectivity;

* Undertake a thorough review of our Irish licences, resulting in the

completion of a CPR over FEL 3/13 indicating a total of 1.5 billion barrels

of gross unrisked mean Prospective Resources with a net unrisked NPV10 (for

the equity and carry arrangements applicable at the time) of US$1.6

billion;

* Manage its exploration licences in France with completion of a farm-out of

our Tarbes licence to Vermillion and a continuation of the programme to

farm-out our Berenx licence;

* Continue our programme of adding to the licence inventory with new licence

applications in both the UK 14th onshore round and the Irish offshore

round. In addition we have been awarded block 41/24 offshore UK in the

southern North Sea. This is part of our continuing strategy to work up our

existing assets, whilst selectively adding new opportunities in locations

where we believe we have a good understanding of the geology, fiscal and

political risks and where we feel we can add value to the Company;

* Work towards delivering on our objective to build a top quartile AIM oil &

gas company in terms of market capitalisation. When this ojective was set

Europa was in the fourth quartile of the AIM oil & gas sector. As at 31

August 2015 we were ranked in the second quartile and are showing continued

progress towards our goal.

Our drilling campaign got off to a good start in July 2014 with the Wressle-1

exploration well in East Lincolnshire, which was targeting a 2.1 mmbo

conventional oil prospect, finding hydrocarbons. We saw aggregate production

from all payzones of 710 boepd during testing operations. This was followed up

by an Extended Well Test ("EWT") which will aid the partners in determining the

optimal development scheme ahead of a formal application to the Oil and Gas

Authority ("OGA").

Wressle was followed by the drilling of the Kiln Lane prospect on the

neighbouring PEDL181 licence. The well was targeting a 2.9 mmboe prospect and

was the first well drilled on the licence. Whilst operations ran to budget and

timetable and there was evidence of hydrocarbons being present during drilling,

unfortunately the well was found to be water wet. The data recovered will

assist the further evaluation of the block ahead of any further activity.

We were delighted that our efforts to obtain planning approval in relation to

drilling a temporary exploratory well at the Holmwood prospect on the PEDL143

licence resulted in approval in September 2015. PEDL143 is located in the Weald

Basin, Surrey and with mean gross un-risked Prospective Resources of 5.6 mmbo,

as estimated in a CPR published in June 2012, and with a one in three chance of

success we rate Holmwood as being one of the best undrilled conventional

prospects onshore in the UK.

We see the UK as an excellent area in which to operate and we will be looking

to add to our existing production through development of Wressle and further

exploration activity. To underline this we have participated in the 14th

Onshore (Landward) Oil and Gas Licensing Round and await announcement of the

awards on the areas we have applied for.

Whilst the UK portfolio has seen most activity over the last 12 months, we

believe that there is significant potential value in Europa's Irish acreage.

Kosmos Energy Ireland, delivered a new prospect inventory based on a 2,650 km2

3D seismic acquisition programme in Q4 2014. We are particularly pleased that

(MORE TO FOLLOW) Dow Jones Newswires

October 05, 2015 02:00 ET (06:00 GMT)

the analysis of the state of the art 3D seismic shot in late 2013 confirmed the

presence of significant prospects, reducing risk prior to drilling decisions

being made. We have undertaken a thorough review of our Irish licences,

identifying a number of prospects leading to the issue of a CPR by ERCE which

indicated a total of 1.5 billion barrels of gross unrisked mean Prospective

Resources with a net unrisked NPV10 of US$1.6 billion based on the Kosmos carry

arrangements and Europa's 15% interest prevailing at that time. Since the

preparation of the CPR, Kosmos have informed Europa of their decision to

withdraw from Ireland which is expected to result in Europa assuming a 100%

interest. The Prospective Resources remain unchanged at 1.5 billion barrels,

but the value to Europa will need to be adjusted to reflect any new farm-in

arrangements. Europa intends to seek a new partner for each licence following

the announcement of the results of the 2015 Atlantic Margin Licensing Round

that closed on 16 September 2015.

In France, work continued to farm-out both of our onshore licences as a means

of funding exploration activity. Europa held 100% interests in the Béarn des

Gaves ('Béarn') and Tarbes val d'Adour ('Tarbes') permits, located in the

proven Aquitaine Basin. In February, we were able to announce that Vermillion

had agreed to join the Tarbes permit, taking an 80% interest in return for up

to EUR4.65m of exploration expenditure. In the current oil price environment it

has been challenging to find quality farm-in partners, but we are delighted

that Vermillion, as the leading operator onshore France, has seen the potential

of the Tarbes licence and we await their detailed plans for the licence with

interest.

Béarn holds two potential company making prospects: the Berenx Shallow gas

prospect and the Berenx Deep gas appraisal prospect. We continue to seek a

farm-in partner with an intention to drill the Shallow prospect and talks are

on-going with a number of interested parties, but the current economic climate

in the oil and gas sector has led to a reduction in appetite for farm-in

opportunities.

Outlook

The year under review has been particularly difficult for the oil and gas

sector with oil prices falling significantly from US$104.8/bbl on 1 August 2014

to US$52.2/bbl on 31 July 2015. We have seen many of our peers struggle at low

oil prices and overall exploration and development activity levels have dropped

off. A number of companies have seen their market capitalisation reduce

significantly as their finances have come under strain and I would like to

acknowledge the support we have received from shareholders through the placing

and open offer during the course of the year.

The CPR for offshore Ireland, which confirmed the company-making potential of

our licences both in terms of prospective resource and value, indicates that

the Company has the potential to see very material growth in its market

capitalisation in the near term. This is one example of the activities

management are pursuing to provide shareholders with tangible evidence of value

creation.

We are well positioned, through the combination of existing production, near

term development at Wressle and exploration opportunities at Holmwood in the UK

and in Ireland and France. We hope to build on our existing portfolio through

participation in the UK and Irish licensing rounds, and we will continue to

evaluate new projects and ventures that match our investment criteria. This is

a challenging time but shareholders can be assured that the Board and I will be

working hard to manage our resources carefully and maximise value from our

portfolio.

During the course of the year I took over the role of Chairman from Bill

Adamson, when he stepped down from the Board to enable him to concentrate on

his work in the voluntary sector. Bill had been Chairman for just under five

years, during which time he presided over a period of transition for the

Company, including the appointment of Hugh Mackay as Chief Executive. The

Board and I would like to thank Bill for his efforts during this period.

I would like to thank the management, operational teams, my fellow Board

members and our advisers for their hard work over the year.

Finally I would like to reiterate my thanks to our shareholders for their

continued support during what has been a challenging year for all of the oil

and gas sector, but particularly small exploration and production companies.

Colin Bousfield, Chairman

2 October 2015

Strategic report - Operations

Ireland

Exploration - Porcupine Basin Frontier Exploration Licences ("FELs") 2/13 and 3

/13 - Europa (15%); Kosmos (85% and operator). (Note that on 22 September 2015,

Europa announced that Kosmos intends to withdraw from the two licences. Europa

has applied to the Irish Authorities to assume 100% equity and operatorship).

The exploration model for these licences is the Cretaceous stratigraphic play:

comprising Early Cretaceous turbidite sandstone reservoirs; charged by mature

Late Jurassic and Early Cretaceous source rocks and contained in stratigraphic

traps with elements of structural closure. The Cretaceous play in Ireland is

essentially undrilled and is considered to be analogous to the same play in the

equatorial Atlantic Margin province that has delivered the Jubilee and Mahogany

oil fields.

The key activity during the year has been interpretation of more than 2,500 km2

of 3D seismic data over FEL 2/13 and 3/13. The data was acquired in H2 2013,

the final processed data set was delivered in Q2 2014 and the operator Kosmos

delivered a prospect inventory in Q4 2014 (see RNS of 8 December 2014).

Europa followed on from this work by Kosmos and conducted its own independent

prospect mapping over both licences. This mapping provided the basis for a CPR

by ERCE on the prospects and risks in FEL 3/13. A summary of the CPR is

tabulated below and was provided to the market in an RNS dated 12 May 2015.

The CPR identifies gross mean un-risked Prospective Resources of approximately

1.5 billion barrels of oil equivalent ("boe") across three prospects in FEL 3/

13 and gross mean risked Prospective Resources of 235 million boe.

FEL 3/13 Gross Prospective Resources mmboe*

Prospect Un-risked Mean Chance 1 in Gross mean

of Risked

Success

Low Best High

Wilde 61 239 952 428 19% 5.3 81

Beckett 109 424 1661 749 15% 6.7 112

Shaw 57 198 681 315 13% 7.7 41

Total 277 861 3,294 1,492 235

*million barrels of oil equivalent, using a conversion factor of 6 mscf per

stb. The hydrocarbon system is considered an oil play. However, due to

significant uncertainties in the available geological information, there is a

possibility of a gas charge.

Note: the Total row is a deterministic sum.

The three prospects Beckett, Wilde and Shaw have Cretaceous submarine fan

sandstone reservoirs and are part of the Cretaceous submarine fan hydrocarbon

play. These new prospects replaced the Kiernan prospect previously identified

by Europa on historic 2D seismic data (see RNS dated 16 January 2013). As a

consequence of its detailed work in preparation for the CPR, Europa has

identified both a prospect and shotpoint location for what would be a

play-opening first well in FEL 3/13.

The CPR represents the culmination of substantial work by three very

experienced technical teams: Kosmos, Europa and ERCE. The work has been

subjected to robust and in-depth technical challenge. Europa has utmost

confidence in the quality of the work and the Prospective Resources and risks

derived from the work. These are very significant volumes of hydrocarbons.

Europa considers the prospects to be at drillable prospect status. The CPR

provides a strong endorsement to Europa's long held view that the Porcupine

Basin has the potential to become a major new North Atlantic hydrocarbon

province.

In addition to the CPR Europa also commissioned ERCE to complete an independent

assessment of the value of its interests in FEL 3/13. Although it is

comparatively unusual for junior oil companies to commission such third party

valuation work at this early stage in the exploration cycle, in view of the

very large potential Prospective Resources Europa feels it is important that

investors are provided with an independent and credible valuation. As with the

CPR, the valuation has been subjected to rigorous technical challenge and

scrutiny by ERCE.

The results of the study were released to the market in an RNS on 16 June 2015

and ERCE estimated a mean Unrisked Net Present Value at a 10% discount

("NPV10") of approximately US$1.6 billion to Europa's 15% net interest in three

prospects; Wilde, Beckett and Shaw. On a risked basis the results of this study

estimate a mean risked NPV10 of US$251 million. These prospects are at the

pre-drill stage and realisation of this potential value will require the

drilling of exploration wells. Note that the valuation was based on the Kosmos

carry arrangements and Europa's 15% interest prevailing at the time. Since the

preparation of the CPR, Kosmos have informed Europa of their decision to

withdraw from Ireland which is expected to result in Europa assuming 100%

interest. The Gross Un-risked Prospective Resources remain unchanged at 1.5

billion barrels, but the value to Europa will need to be adjusted to reflect

any new farm-in arrangements. Nevertheless the work remains valid and the

Directors believe that it provides a valid benchmark for what a 15% carried

interest could be worth. The NPV10 of a 15% carried interest as at 1 January

2015 for the Low, Best and High estimates of Prospective Resources are

tabulated below:

(MORE TO FOLLOW) Dow Jones Newswires

October 05, 2015 02:00 ET (06:00 GMT)

Gross Prospective Net Un-risked NPV10 (US$ Chance Net Risked

Resources million) Of NPV10 (US$

mmboe* Success million)

Prospect Low Best High Low Best High Mean (%) Mean

Wilde 61 239 952 -10 109 1,227 408 19% 78

Beckett 109 424 1661 -10 400 2,366 867 15% 130

Shaw 57 198 681 -10 110 970 332 13% 43

Total 1,607 251

Notes:

1. The discounted cash flow analysis has been carried out assuming exploration

drilling results in discovery of oil. However, due to the significant

uncertainties in the available geological information, there is the possibility

that exploration drilling will result in the discovery of gas.

2. mmboe means millions of barrels of oil plus gas converted to oil using a

conversion rate of six thousand cubic feet of gas for each barrel of oil.

3. "Gross Oil and Gas Unrisked Prospective Resources" are 100% of the volumes

estimated to be recoverable from an undrilled prospect before applying the

geological chance of success ("COS").

4. The COS is an estimate of the probability that drilling the prospect would

result in a discovery.

5. Prospective Resources are "Unrisked" in that the volumes have not been

multiplied by the COS.

6. Net Unrisked NPV10 means the NPV10 at 10% discount rate as at 1 January 2015

attributable to Europa's assumed 15% working interest in the Prospect before

multiplying by the COS.

7. Net Risked NPV10 means the NPV10 at 10% discount rate as at 1 January 2015

attributable to Europa's assumed 15% working interest in the prospect after

multiplying by the COS; as under the Kosmos carry arrangements Europa did not

incur the cost of the exploration well, the Net Risked NPV10 is equal to the

Expected Monetary Value ("EMV").

8. The analysis for the Best and High cases assumes the successful drilling of

an exploration well on each prospect in 2017 followed in each case by appraisal

drilling and then development.

9. The Low estimates of NPV10 for each prospect comprise the net cost to Europa

of an exploration and appraisal well, after allowing for Europa's carry under

the terms of the Kosmos farm-in; this is because discounted cash flow modelling

of each of the Low cases resulted in a more negative NPV10.

10. The Mean estimate of the NPV10 for each prospect has been calculated by

adding the Low, Best and High estimates of NPV10 weighted by 0.3, 0.4 and 0.3

respectively (the Swanson's Mean).

11. The NPV10 estimates form an integral part of fair market value estimations;

without consideration for the exploration risk factor (COS) and other economic

criteria, including market perception of risk, they are not to be construed as

opinions of fair market value.

12. Assumes an oil price of US$60 bbl in 2015 rising to US$92 bbl by 2018 and

inflated at 2% thereafter.

The Beckett, Wilde and Shaw prospects are located SW of Ireland, approximately

125 km from shore. Due to water depths in excess of 1,000m each prospect would

be developed by a Floating, Production, Storage and Offloading unit ("FPSO") in

the event of successful exploration drilling. The prospects are located in

challenging environmental conditions, where high wave heights must be accounted

for in FPSO design. This in turn limits throughput rates. Discovery size will

also alter facility design, particularly with respect to produced gas

handling. ERCE has accounted for these aspects in its forecasting work. ERCE

conducted an independent review of the production, operating expenditure,

capital and abandonment expenditure and associated discounted cash flow

analysis of two Prospects; Beckett and Wilde and used that analysis to derive

value for the Shaw Prospect.

Europa notes that costs used in the NPV10 calculation reflect the US$100/bbl

oil price prevailing over much of the last five years. The Company hopes that

a continued period of lower oil prices might be reflected in lower costs.

Sensitivity analysis suggests that a 20% decrease in capital expenditure might

increase the net NPV10 by approximately 10-15%. Whilst it is too early in the

current low oil price cycle to provide direct evidence of lower costs for

development capital expenditure there has been an immediate reduction in day

rates for drilling rigs. For example, while the valuation assumed a rig rate of

US$600,000 per day, currently rigs capable of drilling offshore Ireland are

available for around US$300,000 per day.

During the course of its independent mapping of FEL 2/13, Europa has identified

new prospects and leads at additional stratigraphic levels. These are in

addition to the Doyle A and Doyle B prospects previously identified on the

licence in the RNS of 8 December 2014 and with gross mean unrisked Prospective

Resources of 123 mmbo for Doyle A and 69 mmbo for Doyle B.

The First Phase of both licences was for three years and is scheduled to end in

July 2016. The work programme obligation for Phase 1 has been fulfilled with

the acquisition of the 2013 3D seismic survey. The Second Phase would be for a

four year term from July 2016 until July 2020 and the work programme for each

licence would include drilling a commitment well. Europa is required to advise

the Irish Authorities of its intentions in April 2016.

The full CPR was not released into the public domain for reasons of

confidentiality arising from the 2015 Atlantic Margin Licensing Round that

closed in September 2015 and for which awards are anticipated during H1 2016.

Subsequent to the reporting period end Kosmos elected to withdraw from FEL 2/13

and 3/13 and to exit from Ireland. Subject to Irish Government approval Kosmos'

85% equity and operatorship will be returned to Europa bringing our interest to

100% in both licences. Europa will seek new partners with whom to take the

licences forward. As a consequence of the substantial independent proprietary

work already invested, Europa is fully prepared to take over operatorship and

to resume farm-out of these licences.

2015 Atlantic Margin Licensing Round

Europa has made multiple applications in the 2015 Atlantic Margin Licensing

Round. Europa has been actively working Atlantic Margin basins since 2011 and

we firmly believe in the technical and commercial case for exploration in this

basin. Our applications represent the culmination of all the technical and

commercial knowledge accumulated during this period. We have benefited from our

previous purchase of over 12,000 km of legacy 2D seismic data and of critical

importance are insights derived from our interpretation of over 2,500 km2 of 3D

seismic data acquired over FEL 2/13 and 3/13.

Our performance in the 2011 Atlantic Margin round was strong: within two years

of award of two Licensing Options we farmed out, converted to Frontier

Exploration Licences and acquired the biggest ever 3D survey offshore Ireland.

As a consequence of the very strong technical work supporting our 2015

applications we are confident that were we to be awarded any new Licensing

Options we would be able to rapidly progress and exceed our 2011 performance.

The round closed on 16 September 2015 and the Irish Authorities reported they

have received 43 applications from major, mid cap and small companies, the

largest number of applications ever received in any Irish offshore licensing

round. Given the record number of applications in the round, and the

significant values demonstrated by the CPR, the Board is confident there will

be interest in partnering with Europa in both our existing licences in the

Porcupine and any new awards.

France

Tarbes val d'Adour - Europa (20%), Vermilion (80% and operator)

In February 2015 Europa announced a farm-out of the Tarbes val d'Adour permit

('Tarbes'), to Vermilion REP SAS, a wholly owned subsidiary of Vermilion Energy

Inc (`Vermilion') a Calgary based international oil and gas producer. Post

farm-out, Europa holds a 20% interest in Tarbes, which is located in the

Aquitaine Basin, onshore France.

Under the terms of the farm-out, Vermilion acquires an 80% interest in, and

operatorship of, Tarbes with Europa holding the remaining 20% interest.

Vermilion will assume 100% of the cost of a work programme, which may include

seismic acquisition/reprocessing and drilling operations up to a total of EUR4.65

million. Once costs above this level are incurred, Europa will be responsible

for its 20% share of future costs.

The farm-out is subject to the relevant approvals being granted by the French

authorities - for the transfer of equity and operatorship to Vermilion and

obtaining an extension for the permit. Both these approval processes started in

H2 2014 and it is hoped that approvals will be granted during H1 2016.

Vermilion have commenced technical work beginning with review and compilation

of all existing seismic and well data into a consolidated database. Work will

proceed with seismic reprocessing and seismic interpretation leading to

delivery of a new prospect inventory in H2 2016. Further work will be

programmed according to the content of the prospect inventory and may include

drilling.

Tarbes contains several oil accumulations that were previously licensed by Elf

but were abandoned in 1985 due to a combination of technical issues and low oil

prices. Two fields, Jacque and Osmets, were drilled using vertical wells and

generated modest production.

Vermilion is the leading exploration and production company currently active in

France with net production of approximately 12,500 boepd. They have an

excellent technical and operational track record with specific experience of

workovers, infill drilling, and secondary recovery opportunities. They are the

ideal partner for us on this permit.

Béarn des Gaves 100%

(MORE TO FOLLOW) Dow Jones Newswires

October 05, 2015 02:00 ET (06:00 GMT)

Europa holds a 100% interest in the onshore Béarn des Gaves permit in the

Aquitaine basin. The permit contains two prospects: Berenx Deep and Berenx

Shallow. Berenx Deep is an appraisal project having previously been explored

and drilled by EssoRep with two wells, Berenx-1 (1969) and Berenx-2 (1972),

both encountering strong gas shows over a 500m thick gas bearing zone. In 1975

Berenx-2 was re-entered, drill stem tested and flowed gas to surface from the

same carbonate reservoir that delivered 9 tcf and 2 tcf from nearby fields at

Lacq and Meillon.

Europa's in-house technical work indicates that the Berenx deep appraisal

prospect could hold in excess of 500 bcf of recoverable gas resources. In a CPR

dated 31 May 2012, ERC Equipoise estimated gross mean un-risked resources of

277 bcf for the Berenx deep gas play. The difference between Europa's and ERC's

assessment of resources reflects the confidence of each party in mapping in a

geologically complex terrain. Europa was able to map a larger area of closure

and as a consequence larger resources.

Thorough re-evaluation and interpretation of existing seismic and well data on

the permit has resulted in the definition of a new shallow gas prospect, Berenx

Shallow with potential gross mean un-risked resources of 107 bcf. Scoping

economics suggests a value of US$11.5/boe and NPV10 of US$170 million.

The Company's strategy for Béarn des Gaves is to farm-out, drill a well on

Berenx Shallow with the aim of delivering a commercial flow rate and, on the

back of commercial success, to further appraise the shallow prospectivity and

undertake work to de-risk the Berenx Deep appraisal prospect. The Berenx

Shallow prospect can be tested with a comparatively simple exploration well

with an anticipated total depth of 2,500m.

The permit has been renewed for a period of five years from 22 March 2012 and

carries an expenditure commitment of approximately EUR2.5 million. A farm-out

process for the permit is currently underway in tandem with well planning and

permitting for a well location on Berenx Shallow ahead of drilling in the next

18 months. A wellsite has been identified and a lease has been prepared.

United Kingdom

NE Lincolnshire - PEDL180 33.3% (Wressle)

Following a partial relinquishment under the terms of the licence, in June

2015, PEDL180 covers an area of 40 km2 of the East Midlands Petroleum Province

5 km southeast of the Europa operated Crosby Warren field which has been

producing oil for 29 years. Europa has a 33.3% working interest in the block

with its partners Egdon Resources (operator, 25%), Celtique Energie Petroleum

Ltd (33.3%) and Union Jack Oil (8.3%).

The Wressle-1 exploration well was spudded in July 2014 and targeted a

conventional oil prospect, estimated by the operator to hold mean gross

un-risked recoverable resources of 2.1 mmbo. The well reached a total depth of

2,240 metres (1,814 metres TVDSS) in August 2014.

Both the stratigraphy and reservoir horizons encountered by the well were in

accordance with the pre-drill geological forecast which was based on 49 km2 of

3D seismic acquisition acquired in 2012. Petro-physical evaluation indicated

over 30 metres measured thickness of potential hydrocarbon pay in three main

intervals: Penistone Flags with up to 19.8 metres measured thickness (15.9

metres vertical thickness) of potential hydrocarbon pay; Wingfield Flags with

up to 5.6 metres measured thickness (5.1 metres vertical thickness) of

potential hydrocarbon pay; and Ashover Grit with up to 6.1 metres measured

thickness (5.8 metres vertical thickness) of potential hydrocarbon pay.

Wressle was production tested with a dedicated test rig during Q1 2015 and

achieved the following results:

* 710 boepd aggregate from 4 tests in three sandstone reservoirs

* Ashover Grit - 80 bopd and 47 mcfd, free flow

* Wingfield Flags - up to 182 bopd and 0.456 mmcfd, free flow

* Zone 3 Penistone Flags - up to 1.7 mmcfd and up to 12 bopd, free

flow

* Zone 3a Penistone Flags - 77 bopd, swabbed

During June 2015 Extended Well Test ("EWT") operations commenced. The Penistone

Flags Zone 3A interval was pumped for a period of time and achieved average

rates over a three day period of 131 barrels of oil per day ("bopd") and

222,000 cubic feet of gas, equating to 168 boepd. The average producing gas oil

ratio ("GOR") was 1,700 cubic feet of gas per barrel of oil ("scf/stb"). Due to

increasing gas rates the pump was stopped and the well allowed to naturally

flow to surface on a series of decreasing choke sizes from 12/64" down to 8/64"

(being the smallest available). Average rates over a two day period on the 8/

64" choke were 105 bopd with 465,000 cubic feet of gas per day, equating to 182

boepd with an average producing GOR of 4,450 scf/stb. During the course of this

flow testing no associated formation water was produced. The gas production

rate increased to the point where it approached the limits allowed under the

environmental permit and production from the interval was now been halted.

During initial testing in Q1 2015, the Ashover Grit interval achieved free

flowing oil production rates equivalent to 80 bopd and 47 thousand cubic feet

("mcf") of gas per day during a 16 hour main flow period. Analysis of the well

test data indicates that the flow rates were impaired due to a high 'Skin

Factor' and therefore were not representative of the flow rates that could be

attained from this interval when 'cleaned up'. Unfortunately it was not

possible to re-establish flow rates from the Ashover Grit interval during the

EWT, due to either a mechanical problem with the down-hole completion, an

annular blockage, or an impairment of the perforations caused by the well

completion operation. . The partners are examining options that could be

implemented to reduce the Skin Factor and increase production.

In parallel with this activity the partnership is reprocessing the 3D to enable

more detailed geophysical evaluation of the producing horizons. This work will

help inform both a new CPR for the Wressle discovery and the Field Development

Plan. Subject to favourable outcomes to this work the intention is to commence

early production from Wressle.

NE Lincolnshire - PEDL182 33.3% (Broughton)

Following a partial relinquishment under the terms of the licence, in June

2015, PEDL182 covers an area of 19 km2. The Broughton prospect was previously

drilled by BP and flowed oil. Broughton is located on structural trend with

the producing Crosby Warren oil field and the Wressle prospect on PEDL180. The

partnership is reprocessing the 2012 3D survey and will be remapping the Crosby

Warren-Wressle trend. Interpretation of the 3D together with the results of the

Wressle discovery may result in new drillable propects being matured on this

trend.

NE Lincolnshire - PEDL181 50% (Kiln Lane)

Europa has a 50% interest in and is the operator of the PEDL181 licence, with

Egdon Resources UK Limited and Celtique Energie Petroleum Ltd, each holding a

25% interest. PEDL181 is located in the Carboniferous petroleum play and

covers an area of over 540 km2 in the Humber Basin.

Following acquisition of 2D seismic in 2013 and subsequent interpretation and

mapping, a conventional exploration well was drilled at the Kiln Lane prospect

in February 2015 and reached a total depth of 2,291m in March 2015. Whilst

Carboniferous sandstone reservoirs were penetrated in accordance with the

pre-drill geological forecast these proved to be water wet. The well was

plugged and abandoned and the site has now been restored and returned to

agriculture. Whilst a disappointing outcome, the well was drilled safely, on

schedule, on budget and demonstrated fast-track performance in terms of

navigating the planning and permissions process.

Europa is completing post-well analysis of the Kiln Lane-1 well, in particular

the impact of the well result on the remaining prospectivity in the licence.

The partnership will make a decision regarding its continued activity in the

licence during the upcoming year.

Dorking area - PEDL143 40% (Holmwood)

The PEDL143 licence covers an area of 92 km2 of the Weald Basin, Surrey. Europa

is the operator and has a 40% working interest in the licence with partners

Warwick Energy (20%), UK Oil & Gas (20% subject to approval), Egdon Resources

(18.4%), and Altwood Petroleum (1.6%).

The Holmwood prospect is a conventional Jurassic sandstone reservoir with a low

geological risk. The May 2012 CPR estimated Holmwood to hold gross mean

recoverable resources of 5.64 mmbo. Europa considers Holmwood to be one of the

best undrilled conventional exploration prospects in the UK.

The prospect lies south of Dorking within the Surrey Hills Area of Outstanding

Natural Beauty. An application to construct a temporary exploration well on the

site was originally made in 2008. This application was refused in 2011 by

Surrey County Council contrary to their planning officer's recommendation to

approve. An appeal to overturn the decision was heard at a public inquiry in

July 2012. The appeal was dismissed on 26 September 2012.

Europa, along with its partners, applied for an order to quash the decision of

the Secretary of State for Communities and Local Government's appointed

Inspector to dismiss the appeal. On 25 July 2013, the Royal Courts of Justice

gave judgment in favour of Europa and quashed the Inspector's decision. An

appeal was submitted to the Court of Appeal which was subsequently dismissed by

the Court on 19 June 2014. As a result, Europa's appeal against Surrey County

Council's refusal to grant planning permission to drill one exploratory

borehole and undertake a short-term test for conventional hydrocarbons at the

Holmwood prospect was remitted to the Planning Inspectorate for

redetermination. A further planning inquiry was conducted in April and June

2015 and the Planning Inspectorate issued a decision to allow the appeal on 7

August 2015.

(MORE TO FOLLOW) Dow Jones Newswires

October 05, 2015 02:00 ET (06:00 GMT)

The intended Holmwood exploration well is a deviated well and as a consequence

of changes in regulations since submitting the original planning application in

2008 planning permission is also required for the underground well path. A

planning application for the underground well path only was submitted in May

2014 and was heard by the planning committee on 23 September 2015 who approved

the application.

Europa and its joint venture partners will now commence detailed well planning

with the intent of conducting drilling operations in 2016/17. Europa and

Warwick Energy will jointly farm-out some of their combined 60% interest in the

licence. This process has already started.

Production (West Firsby 100%; Crosby Warren 100%; Whisby W4 well 65%)

The three UK fields, plus a small contribution from Wressle, produced an

average of 141 boepd (2014: 165 boepd) during the year under review. The fields

are in decline and whilst we are maximizing opportunities to reduce downtime

and decrease cost we feel the best way to access more production is through the

exploration drill bit. The Wressle discovery offers an opportunity to increase

production.

14th Landward Licensing Round

Europa has submitted bids in the 14th Landward Licensing Round in onshore UK.

None of Europa's applications were for blocks awarded in Tranche 1 and

announced in August 2015. We understand that Tranche 2 will be announced later

in 2015 and we hope that we will be successful.

Southern North Sea - block 41/24 50%

Europa bid with Arenite Petroleum Limited (50%) a private Scottish company in

the 28th Seaward Licensing Round and was conditionally awarded a Promote

Licence on block 41/24 in the Southern North Sea in July 2015. The block lies

immediately offshore the town of Scarborough on the Yorkshire coast. Block 41/

24 was previously partly licensed to Europa Oil & Gas (100%) as a Traditional

Licence (P.1131) in the 21st Round. The licence was relinquished at the end of

the Initial Term as the Zechstein discoveries were assessed as being small and

sub-economic. The focus of work during the Promote Licence phase is to

investigate the potential of the Carboniferous sequence which has largely been

overlooked as a viable target to date within block 41/24 but there are numerous

hydrocarbon accumulations in the onshore extension of the Cleveland Basin and

further south in the East Midlands.

Financials

With a small contribution from Wressle our production this year averaged 141

boepd and generated GBP2.2 million in revenues (2014: 165 boepd and GBP3.9

million). The average oil price achieved in the year was $68.2/bbl (2014:

$107.7/bbl) with the second half of the year $58.3/bbl (H1 $77.8/bbl) which we

believe is more representative of what we might expect next year.

As announced in January 2015, the West Firsby 9 production well requires a

recompletion, but at the prevailing oil price it remains uneconomic to work the

well over for an incremental 8 bopd. While most of the costs associated with

our production are fixed in nature we have implemented various cost saving

measures to help mitigate the effect of the falling oil price and cost of sales

excluding exploration write-off and impairment was GBP1.9 million (2014: GBP2.3

million). We will continue to review and implement cost saving initiatives

across our whole business over the coming year.

Administrative expenses of GBP977,000 (2014: GBP832,000) included: GBP267,000 of

expenditure on new licence applications in the UK 14th Landward Licensing Round

and the Irish Atlantic Margin Licensing Round (2014: GBP97,000); and GBP106,000 of

costs associated with the Tarbes farm-out.

Cash used in continuing operations for the year was GBP0.3 million (2014: cash

generated GBP1.4 million).

In July 2015, we completed a placing of shares and an open offer to existing

shareholders which together raised GBP2.2 million after expenses. Our cash

balance at the period end stood at GBP3.2 million (2014: GBP4.5 million).

We recorded a GBP1.1 million (2014: GBP1.2 million) impairment of the West Firsby

field which arises from lower assumed oil prices and lower recoverable reserves

used in the cash flow model.

We also recorded a GBP2.2 million (2014: nil) write-off of exploration

expenditure associated with the Kiln Lane exploration well on PEDL181.

Results for the year

The Group loss for the year after taxation from continuing activities was GBP

1,784,000 (2014 loss: GBP368,000, with a profit from discontinued operations of GBP

933,000).

Conclusion

This has been an active year. In the UK we have participated in two exploration

wells, made one oil discovery and obtained planning permission for the Holmwood

exploration well. We have successfully farmed out our Tarbes permit in France

and are working to farm-out the Bearn des Gaves permit. We have completed

substantial work on our Irish licences leading to a CPR for FEL 3/13 with gross

mean un-risked Prospective Resources of 1.5 billion boe and for which a 15%

carried interest was ascribed a net mean un-risked NPV10 of US$1.6 billion by

ERCE. Further information will emerge over the coming months as we progress our

application to assume 100% interest and operatorship and commence farm-out

activities. Europa is determined to expand its position in Ireland and has

submitted multiple applications in the 2015 Atlantic Margin licensing Round

with the intention of building a strategic position. Irish awards are

anticipated in H1 2016. Europa has submitted several applications in the 14th

Landward Licensing Round onshore UK with award anticipated in Q4 2015. We are

evaluating plans for the commercialization of the Wressle oil discovery. We are

commencing well planning for the Holmwood prospect. Together with our recently

awarded promote licence in Block 41/24 2016 promises to be an exciting year as

we realise the potential in our existing licences and build our portfolio

through new licence awards. In parallel with this we will continue to actively

review consolidation opportunities and we will not hesitate to act provided

this makes a valid investment proposition for Europa shareholders.

Hugh Mackay, CEO

2 October 2015

The financial information set out below does not constitute the company's

statutory accounts for 2015 or 2014. The financial information has been

prepared in accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union on a basis that is consistent with the

accounting policies applied by the group in its audited consolidated financial

statements for the year ended 31 July 2015. Statutory accounts for the years

ended 31 July 2015 and 31 July 2014 have been reported on by the Independent

Auditors.

The Independent Auditors' Report on the Annual Report and Financial Statements

for 2015 and 2014 were unqualified, did not draw attention to any matters by

way of emphasis, and did not contain a statement under 498(2) or 498(3) of the

Companies Act 2006.

Statutory accounts for the year ended 31 July 2014 have been filed with the

Registrar of Companies. The statutory accounts for the year ended 31 July 2015

will be delivered to the Registrar in due course.

Consolidated statement of comprehensive income

For the year ended 31 July 2015 2014

Note GBP000 GBP000

Revenue 2,205 3,878

Other cost of sales (1,900) (2,301)

Exploration write-off 1 (2,205) -

Impairment of producing fields 2 (1,100) (1,203)

Total cost of sales (5,205) (3,504)

------------- -------------

Gross (loss)/ profit (3,000) 374

Administrative expenses (977) (832)

Finance income 55 20

Finance expense (208) (244)

------------- -------------

Loss before taxation (4,130) (682)

Taxation credit 2,346 314

------------ -------------

Loss for the year from continuing operations (1,784) (368)

------------- -------------

Discontinued operations

Profit for the year from discontinued operations - 933

------------- -------------

(Loss)/profit for the year attributable to the (1,784) 565

equity shareholders of the parent

Other comprehensive loss

Those that may be reclassified to profit and

loss:

Recycling of foreign currency translation reserve - (417)

on disposal of operations

-------------- -------------

Total comprehensive (loss)/income for the year (1,784) 148

attributable to the equity shareholders of the

parent

========== ==========

(Loss)/earnings per share (LPS/EPS) attributable Note Pence per Pence per

to the equity shareholders of the parent share share

Basic and diluted LPS from continuing operations (0.86)p (0.21)p

Basic and diluted EPS from discontinued operations - 0.53p

Basic and diluted (LPS)/EPS from continuing and (0.86)p 0.32p

discontinued operations

(MORE TO FOLLOW) Dow Jones Newswires

October 05, 2015 02:00 ET (06:00 GMT)

Consolidated statement of financial position

As at 31 July 2015 2014

Note GBP000 GBP000

Assets

Non-current assets

Intangible assets 1 4,839 3,553

Property, plant and equipment 2 1,562 3,046

------------- -------------

Total non-current assets 6,401 6,599

------------- -------------

Current assets

Inventories 13 32

Trade and other receivables 374 456

Cash and cash equivalents 3,151 4,501

------------- -------------

3,538 4,989

------------- -------------

Total assets 9,939 11,588

========== ==========

Liabilities

Current liabilities

Trade and other payables (1,043) (970)

Current tax liabilities (141) (220)

Derivative (32) (35)

Short-term borrowings (23) (22)

Short-term provisions - (4)

------------- -------------

Total current liabilities (1,239) (1,251)

------------- -------------

Non-current liabilities

Long-term borrowings (141) (164)

Deferred tax liabilities (109) (2,371)

Long-term provisions (2,143) (1,959)

------------- -------------

Total non-current liabilities (2,393) (4,494)

------------- -------------

Total liabilities (3,632) (5,745)

------------- -------------

Net assets 6,307 5,843

========== ==========

Capital and reserves attributable to equity

holders

of the parent

Share capital 3 2,449 2,049

Share premium 15,901 14,080

Merger reserve 2,868 2,868

Retained deficit (14,911) (13,154)

------------- -------------

Total equity 6,307 5,843

========== ==========

These financial statements were approved by the Board of Directors and

authorised for issue on 2 October 2015 and signed on its behalf by:

P Greenhalgh, Finance Director

Company registration number 5217946

Consolidated statement of changes in equity

Attributable to the equity holders of the parent

Share Share premium Merger Foreign Retained Total

capital reserve exchange deficit equity

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 August 1,379 13,160 2,868 417 (15,921) 1,903

2013

Issue of share 670 920 - - 2,120 3,710

capital (net of

costs, note 20)

Profit for the year - - - - 565 565

attributable to the

equity shareholders

of the parent

Other comprehensive -

loss for the year - - (417) - (417)

Share based payment - - - - 82 82

(note 21)

------------- ------------- ------------- ------------- ------------- -------------

Balance at 31 July 2,049 14,080 2,868 - (13,154) 5,843

2014

========== ========== ========== ========== ========== ==========

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 August 2,049 14,080 2,868 - (13,154) 5,843

2014

Issue of share 400 1,821 - - - 2,221

capital (net of

costs, note 20)

Loss for the year - - - - (1,784) (1,784)

attributable to the

equity shareholders

of the parent

Share based payment - - - - 27 27

(note 21)

------------- ------------- ------------- ------------- ------------- -------------

Balance at 31 July 2,449 15,901 2,868 - (14,911) 6,307

2015

========== ========== ========== ========== ========== ==========

Consolidated statement of cash flows

For the year ended 31 July 2015 2014

Note GBP000 GBP000

Cash flows from operating activities

Loss after tax from continuing operations (1,784) (368)

Adjustments for:

Share based payments 27 82

Depreciation 386 475

Exploration write-off 1 2,205 -

Impairment of property, plant & equipment 2 1,100 1,203

Disposal of fixed asset 2 2 -

Finance income (55) (20)

Finance expense 208 244

Taxation credit (2,346) (314)

Decrease in trade and other receivables 79 184

Decrease in inventories 19 1

Decrease in trade and other payables (102) (60)

------------- -------------

Cash (used in)/generated from continuing (261) 1,427

operations

Profit after taxation from discontinued - 933

operations

Adjustments for:

Profit on disposal - (1,034)

------------- -------------

Cash used in discontinued operations - (101)

Income tax payment - (537)

------------- -------------

Net cash (used in)/from operating activities (261) 789

========== ==========

Cash flows from investing activities

Purchase of property, plant and equipment (4) (3)

Purchase of intangible assets (3,394) (514)

Receipt of back costs in connection with farm-in - 300

Expenditure on well decommissioning (4) (363)

Interest received 7 6

------------- -------------

Net cash used in investing activities (3,395) (574)

========== ==========

Cash flows from financing activities

Proceeds from issue of share capital (net of 3 2,221 3,710

issue costs)

Increase in payables relating to share capital 71 -

issue costs

Repayment of borrowings (22) (22)

Finance costs (18) (25)

------------- ------------

Net cash from financing activities 2,252 3,663

========== ==========

Net (decrease)/increase in cash and cash (1,404) 3,878

equivalents

(MORE TO FOLLOW) Dow Jones Newswires

October 05, 2015 02:00 ET (06:00 GMT)

Exchange gain/(loss) on cash and cash equivalents 54 (49)

Cash and cash equivalents at beginning of year 4,501 672

------------- -------------

Cash and cash equivalents at end of year 3,151 4,501

========== ==========

Notes

1 Intangible assets

Intangible assets - Group 2015 2014

GBP000 GBP000

At 1 August 3,553 2,446

Additions 3,491 1,107

Exploration write-off (2,205) -

------------- -------------

At 31 July 4,839 3,553

========== ==========

Intangible assets comprise the Group's pre-production expenditure on licence

interests as follows:

2015 2014

GBP000 GBP000

France (Béarn des Gaves permit) 1,160 1,083

Ireland (FEL 2/13) 149 59

Ireland (FEL 3/13) 318 106

UK PEDL143 (Holmwood) 681 519

UK PEDL180 (Wressle) 2,270 842

UK PEDL181 43 729

UK PEDL182 (Broughton) 218 215

------------- -------------

Total 4,839 3,553

========== ==========

Exploration write-off

PEDL181 (Kiln Lane) 2,205 -

- -------------

Total 2,205 -

========== ==========

The UK PEDL143 exploration licence carries a well commitment in 2016. If the

Group elects to continue with this licence, it will need to fund the drilling

of a well by raising funds or by farming down. If the Group is not able to

raise funds, farm-down, or extend the PEDL143 licence; or elects not to

continue in any other licence, then the impact on the financial statements will

be the impairment of some or all of the intangible assets disclosed above.

In PEDL181, the Kiln Lane exploration well spudded in February 2015 and reached

a total depth of 2,291m in March 2015. Sandstone reservoirs were penetrated in

accordance with the pre-drill geological forecast but these proved to be water

wet. The well was plugged and abandoned and the accumulated cost of seismic and

the well have been written off.

2 Property, plant and equipment

Property, plant & equipment - Group

Furniture & Leasehold Producing Total

computers building fields

GBP000 GBP000 GBP000 GBP000

Cost

At 1 August 2013 45 - 10,785 10,830

Additions 3 - - 3

Transfer from assets held for - 437 - 437

resale

------------- ------------- ------------- -------------

At 31 July 2014 48 437 10,785 11,270

Additions 4 - - 4

Disposal (2) - - (2)

------------- ------------- ------------- -------------

At 31 July 2015 50 437 10,785 11,272

========== ========== ========== ==========

Depreciation, depletion and

impairment

At 1 August 2013 31 - 6,416 6,447

Charge for year 9 - 466 475

Impairment in year - - 1,203 1,203

Transfer from assets held for - 99 - 99

resale

------------- ------------- ------------- -------------

At 31 July 2014 40 99 8,085 8,224

Charge for year 4 23 359 386

Impairment - - 1,100 1,100

------------- ------------- ------------- -------------

At 31 July 2015 44 122 9,544 9,710

========== ========== ========== ==========

Net Book Value

At 31 July 2013 14 - 4,369 4,383

========== ========== ========== ==========

At 31 July 2014 8 338 2,700 3,046

========== ========== ========== ==========

At 31 July 2015 6 315 1,241 1,562

========== ========== ========== ==========

The producing fields referred to in the table above are the production assets

of the Group, namely the oilfields at Crosby Warren and West Firsby, and the

Group's interest in the Whisby W4 well, representing three of the Group's cash

generating units.

The carrying value of each producing field was tested for impairment by

comparing the carrying value with the value in use. The value in use was

calculated using a discounted cash flow model with production decline rates of

7-10%, Brent crude prices rising from $65/bbl in 2016 to $110 in 2020 and a

pre-tax discount rate of 37%. The pre-tax discount rate is derived from a

post-tax rate of 10%, and is high because of the applicable rate of tax in the

UK. Cash flows were projected over the expected life of the fields which is

expected to be longer than 5 years.

There was an impairment of GBP1,100,000 (2014: GBP1,203,000) relating to the West

Firsby site but no impairment at the Crosby Warren site or in respect of the

Whisby W4 well. The main reason for the impairment of the West Firsby site was

lower assumed oil prices combined with reduced reserves and production rate.

Sensitivity to key assumption changes

Variations to the key assumptions used in the value in use calculation would

cause further impairment of the producing fields as follows:

Impairment of

producing

fields

GBP000

Production decline rate (current assumption 7-10%)

10% 112

15% 521

Brent crude price per barrel (current assumption

US$65/bbl in 2016 rising to US$110 in 2020)

10% reduction in the assumed forward price 275

20% reduction in the assumed forward price 617

3 Called up share capital

2015 2014

GBP000 GBP000

Allotted, called up and fully paid ordinary shares of

1p

At 1 August 204,883,024 shares (2014: 137,855,504) 2,049 1,379

Issued in the year 40,004,987 shares (2014: 400 670

67,027,520)

------------- -------------

At 31 July 244,888,011 shares (2014: 204,883,024) 2,449 2,049

========== ==========

Date Type of Number of Issue Raised Nominal

issue shares price net value

of costs

GBP000 GBP000

Ordinary shares issued 10 July 2015 Placing 20,000,000 6p 1,059 200

2015

24 July 2015 Placing 2,630,000 6p 150 26

24 July 2015 Open offer 17,374,987 6p 1,012 174

========== ========= =========

= =

40,004,987 2,221 400

========== ========= =========

(MORE TO FOLLOW) Dow Jones Newswires

October 05, 2015 02:00 ET (06:00 GMT)

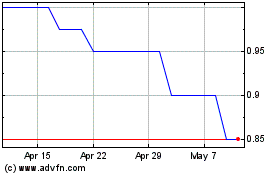

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Nov 2023 to Nov 2024