RNS Number:1558L

Europa Oil & Gas (Holdings) PLC

18 April 2005

For immediate release

EUROPA OIL & GAS (HOLDINGS) PLC

("EUROPA")

2005 INTERIM RESULTS

ON TRACK TO MEET PRODUCTION TARGETS

18 APRIL 2005

Europa Oil & Gas (Holdings) plc, the independent oil & gas exploration and

production group with assets in the UK and continental Europe today announces

its interim results for the six months ended 31 January 2005.

Financial Highlights

* Turnover of #1.178m (18 months to 31 July 2004 #1.952m)

* Operating profit of #0.415m (18 months to 31 July 2004 #0.694m)

* Profit after tax of #0.162m (18 months to 31 July 2004 #0.298m)

* Net cash of #3.35 million at 31 January 2005

* Net assets of #8.09 million

* Earnings per share of 0.33p

Operational Highlights

* Production from the UK and Ukraine during the period averaged 308 barrels

of oil equivalent per day (boepd)

* Successful drilling of Bilca-2 in Romania to prove up additional reserves

to the west of the Bilca-1 well

* Secured approval for two development wells on the West Firsby Field, UK

Placing & Admission to AIM

* During November 2004 Europa successfully floated on AIM and completed a

placing of 20,000,000 shares at 25p each that raised #4.29m after

expenses. At the time of the placing, one warrant for every two shares

placed was also issued

Recent Events & Current Outlook

* Drilling of the West Firsby-8 well, UK

* Favourably revised terms on a loan from Gemini Oil & Gas to reflect the

100% funding by Europa on the West Firsby 8 well.

* Costisa-1 well in Romania spudded in early February 2005

* Fratauti-1 well in Romania spudded in late March 2005

* Geochemical survey on licence PEDL150 near the Whisby field, UK

* Development planning for the Bilca and Bilca West gas discoveries

underway

* Quad 41 preliminary engineering studies in progress

* Exercise of 1,065,000 warrants raising an additional #319,500 and

increasing the total ordinary shares in issue to 61,065,000

Chairman's Statement

The six months to 31 January 2005 have been an eventful and exciting period for

the Company. In November 2004, the Company was admitted to AIM and completed a

#5 million fundraising. This provided the Company with the funds to begin to

realise the value of its existing projects and secure additional opportunities

for future growth. Against this backdrop, the operating environment for Europa

has improved with the benefit of continued high commodity prices from its UK

onshore oil production, positive political changes in Ukraine and signs of a

more market orientated gas-pricing regime in Romania.

Romania

The Bilca-1 and Bilca-2 gas discoveries in the EIII-1 Brodina concession have

added 4bcf of net proven reserves and moved to the detailed development-planning

phase. The partners have identified a number of similar sized prospects close to

Bilca. One of these, Fratauti-1, has been drilled and is currently undergoing

testing. Results are expected shortly and, if successful, the well will be

included in the ongoing Bilca gas project. The development concept for Bilca

will allow for any future discoveries in the area to be tied into the proposed

facilities. The operator, Falcon, has indicated that full project consent will

be sought by late Summer 2005 with first production anticipated in early 2006.

Currently, Romanian domestic gas production is sold at a 20% discount to the

previous year's import price resulting in a 2006 price of $4.30 per thousand

cubic feet (mcf). There are strong signals that the 20% discount will reduce

substantially with Romanian entry into the European Union in 2007 resulting in

an improved gas price.

Seismic acquisition is planned to the south of the Bilca/ Fratauti area to

evaluate this low risk play further.

On the EPI-3 Brates concession, the Costisa-1 well is currently being drilled.

This is a deep well with an expected total depth of 4,100 metres and will take

some time to complete. This is an exciting large potential prospect, targeting

multiple reservoirs in the Carpathian sub thrust.

Additional seismic acquisition on EIII-3 Cuejdui and EIII-4 Bacau is expected in

late 2005.

United Kingdom

In the UK North Sea, the Company is moving forward with the 100% operated gas

condensate discoveries in blocks 41/24 and 41/25 offshore Scarborough and

presently undertaking engineering studies. The Company is tendering for a vessel

to acquire 3D seismic in the second half of 2005 that will be used to identify

development well locations.

The Company has also been active on the recently awarded acreage from the 12th

onshore licensing round completing the acquisition of a geochemical survey on

PEDL 150 over the exploration area adjacent to the Whisby Field. The results of

this survey are expected shortly and will aid in investigating the extent of the

Loxley Edge oil accumulation discovered in the 2003 Whisby 4 well. The Holmwood

prospect, on PEDL 143, also awarded in the 12th round, is ready to drill. The

Company is currently progressing various planning issues and has identified a

suitable drilling location for testing Holmwood. Each of these prospects has the

potential to more than double the existing proven reserve base of the Company.

The excellent number 4 well on the Whisby field produced an average net 136

barrels of oil per day (bopd) during the six month period. Europa recently

completed a sidetrack of the West Firsby 8 well. It is too early to quantify the

results of the new well, but 330ft of net reservoir sands were penetrated and we

expect the new well to contribute to field production from April.

Ukraine

The pilot production on the Horodok gas field averaged a net 38 boepd during the

six months and the Company is currently awaiting the transition to a full

production licence. Further low risk but high reward opportunities are being

pursued to take advantage of our experience and operating capability in the

region.

Future prospects

The Company is well on the way to its targeted production of 1,000 boepd in 2006

and the exploration programme is also moving forward. The Directors feel

confident about the Company's future prospects.

Sir Michael Oliver

Chairman

18 April 2005

For further information, contact:

Europa Oil & Gas (00 33 563 33 18 97)

Paul Barrett

Citigate Dewe Rogerson (020 7638 9571)

Martin Jackson/George Cazenove/Rachel Lankester

Westhouse Securities LLP (020 7601 6100)

Tim Feather

Also see www.europaoil.com

CONSOLIDATED PROFIT AND LOSS ACCOUNT

For the period ended 31 January 2005

18

6 Months Ended

Months Ended 31 31 July

January 2004

2005

# #

Turnover 1,177,682 1,952,051

Cost of sales

- Operating costs (249,580) (476,745)

- Depletion and amortisation (323,778) (665,722)

Gross profit 604,324 809,584

Administrative expenses (189,278) (115,900)

Operating profit 415,046 693,684

Interest receivable 120,742 493

Interest payable and similar charges (372,375) (375,594)

Profit on ordinary activities before taxation 163,413 318,583

Tax on profit on ordinary activities (1,416) (20,539)

Retained profit for the financial year 161,997 298,044

Basic Earnings per share 0.33p 0.75p

Diluted Earnings per share 0.33p 0.75p

CONSOLIDATED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

For the period ended 31 January 2005

18

6 Months Ended

Months Ended 31 July

31 January 2004

2005

# #

Profit on ordinary activities after taxation 161,997 298,044

Currency translation difference on foreign currency net investment 8,005 (2,462)

Total recognised gains and losses relating to the period 170,002 295,582

CONSOLIDATED BALANCE SHEET as at 31 January 2005

18

6 Months Ended 31

Months Ended 31 July

January 2004

2005

# #

Fixed assets

Intangible assets 3,329,177 2,958,861

Tangible assets 2,823,699 3,019,071

6,152,876 5,977,932

Current assets

Debtors 347,475 284,433

Cash at bank and in hand 3,347,651 48,789

3,695,126 333,222

Creditors: amounts falling due within one year (287,736) (3,792,621)

Net current assets/ (liabilities) 3,407,390 (3,459,399)

Total assets less current liabilities 9,560,266 2,518,533

Creditors: amounts falling due after more than one year (1,203,513) (1,191,158)

Provision for liabilities and charges (263,286) (300,000)

Net assets 8,093,467 1,027,375

Capital and reserves

Called up share capital 600,000 1,000

Share premium 4,098,483 669,425

Merger Reserve 2,868,032 -

Profit and loss account 526,952 356,950

Shareholders' funds 8,093,467 1,027,375

CONSOLIDATED CASH FLOW STATEMENT

For the period ended 31 January 2005

18

6 Months Ended

Months Ended 31 31 July

January 2004

2005

# #

Net cash inflow from operating activities 249,201 1,005,076

Returns on investments and servicing of finance

Interest received & similar income 120,743 493

Interest paid & similar charges (372,376) (375,594)

Net cash outflow from returns on investments and servicing of (251,633) (375,101)

finance

Taxation

Tax paid (2,023) (29,343)

Net cash outflow from taxation (2,023) (29,343)

Capital expenditure

Purchase of fixed assets (469,926) (3,379,586)

Net cash outflow from capital expenditure (469,926) (3,125,576)

Net cash outflow before financing (474,381) (2,778,954)

Financing

Loans (redeemed)/ received (2,820,567) 2,511,478

Issue of share capital 6,896,090 -

Net cash inflow from financing 4,075,523 2,511,478

Increase/ (decrease) in cash in the year 3,601,142 (267,476)

CONSOLIDATED CASH FLOW STATEMENT

For the period ended 31 January 2005

Reconciliation of operating profit to net cash outflow from operating activities

18

6 Months Ended

Months Ended 31 July

31 January 2004

2005

# #

Operating profit 415,046 693,684

Depreciation 325,324 665,722

(Increase)/ decrease in debtors (63,045) 93,391

(Decrease) in creditors (391,410) (747,721)

Increase/ (decrease) in Provision (36,714) 300,000

Net cash inflow from operating activities 249,201 1,005,076

Reconciliation of net cash flow to movement in net (debt) /funds

# #

Increase/ (decrease) in cash in the period 3,601,142 (267,476)

Cash inflow/ (outflow) from Movement in debt 2,645,647 (2,577,362)

Change in net funds resulting from cash flows 6,245,511 (2,844,838)

Currency translation adjustment 92,805 251,548

Net debt at 1 August 2004/ 1 February 2003 (4,237,032) (1,643,742)

Net funds/ (debt) at 31 January 2005/ 31 July

2004 2,102,562 (4,237,032)

NOTES TO THE ACCOUNTS

For the period ended 31 January 2005

1. The results for the period are all derived from continuing operations.

2. The unaudited results have been prepared on the basis of the accounting

policies adopted in the annual accounts for the 18 month period ended 31

July 2004.

3. The interim report for the 6 months to 31 January 2005 was approved by

the Directors on the 15 April 2005.

4. The calculation of basic earnings per share is based on the weighted

average shares in issue throughout the 6 month period. The diluted

earnings per share include employee share options.

5. The interim results are unaudited and do not constitute statutory

financial statements as defined in section 240 of the Companies Act

1985.

6. At the time of the placing and admission to AIM the shareholders of

Europa Oil & Gas Limited exchanged their entire shareholding for

39,999,998 ordinary shares in Europa Oil & Gas (Holdings) plc. Merger

accounting has been adopted in respect of this transaction.

Accordingly, the interim accounts have been prepared as if Europa Oil &

Gas (Holdings) plc had been in existence throughout the period.

The comparative figures for the prior 18 month period are based on those

consolidated figures published for Europa Oil & Gas Limited. The profit and loss

account for the current 6 month period reflects the result of Europa Oil & Gas

(Holdings) plc from the date of its incorporation on 31 August 2004 and those of

its subsidiaries for the 6 month period to 31 January 2005.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UWONRVORSARR

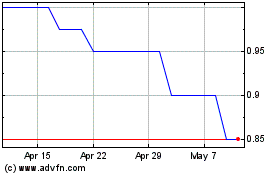

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Sep 2024 to Oct 2024

Europa Oil & Gas (holdin... (LSE:EOG)

Historical Stock Chart

From Oct 2023 to Oct 2024