TIDMEDV

EAVOUR INCREASES ITY'S M&I RESOURCES BY 17% TO 5.2MOZ

WITH FURTHER INCREASES EXPECTED IN 2023

HIGHLIGHTS:

-- Ity's M&I resource increased by 17% to reach 99Mt at

1.62 g/t Au containing 5.2Moz

-- Drilling confirmed continuity of the mineralised

system which hosts 7 deposits, located near the

processing plant, resulting in a new single resource

model for the area, with mineralisation remaining

open at the West Flotouo, Daapleu, Bakatouo, Colline

Sud and Walter deposits

-- Drilling confirmed the presence of a large

mineralised system covering the Plaque area, located

7km from the processing plant

-- Indicated resources delineated at the

Yopleu-Legaleu deposit which remains open to

the Southwest and at depth

-- Mineralised extensions confirmed at Delta

Extension deposit with resource delineation

expected next year

-- New discovery made at the Delta SE target with

maiden resource expected next year

-- Significant discovery made at the Gbampleu target,

located 22km from the processing plant, as several

high-grade and thick mineralised lenses were

identified

-- Endeavour is on track to achieve the previously

announced target of discovering between 3.5-4.5Moz of

Indicated resources at Ity over the 2021-2025 period,

of which 2.0Moz was discovered in the last 2 years

London, 29 November 2022 -- Endeavour Mining plc (LSE:EDV,

TSX:EDV, OTCQX:EDVMF) ("Endeavour" or the "Group" or the "Company")

is pleased to announce that its exploration programme at its Ity

mine in Côte d'Ivoire has resulted in the successful delineation of

0.75Moz of Measured and Indicated ("M&I") resources, lifting

the mine's M&I resources to over 5 million ounces, as presented

in Table 1 below.

Table 1: Ity Mine Updated Mineral Resource Estimate

PREVIOUS RESOURCE UPDATED RESOURCE

(As at 31 December 2021) (Excluding 2022 mine depletion) VARIANCE

----------------------------- ------------------------------------ --------

On a 100% basis. M&I Resources shown inclusive of Au

Reserves. Tonnage Grade Content Tonnage Grade Content Content

(Mt) (Au g/t) (Au koz) (Mt) (Au g/t) (Au koz) (Au koz)

-------- --------- -------- --------- ---------- ------------- --------

Measured Resource 12.1 0.88 344 11.2 0.78 283 -61

Indicated Resources 77.3 1.66 4,131 89.3 1.72 4,944 +814

M&I Resources 89.5 1.56 4,475 100.6 1.62 5,228 +753

Inferred Resources 27.1 1.47 1,279 15.9 1.59 810 -469

-------- --------- -------- --------- ---------- ------------- --------

Updated Resource is current as at 31 December 2021, as it

excludes 2022 mine depletion. Mineral Resources Estimates follow

the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM")

definitions standards for mineral resources and have been completed

in accordance with the Standards of Disclosure for Mineral Projects

as defined by National Instrument 43-101. Reported tonnage and

grade figures have been rounded from raw estimates to reflect the

relative accuracy of the estimate. Minor variations may occur

during the addition of rounded numbers. Mineral Resources that are

not Mineral Reserves do not have demonstrated economic viability.

Resources were constrained by MII Pit Shell and based on a cut-off

grade of 0.5 g/t Au and $1,500/oz gold price. Details for the

Updated Resource are provided in the Technical Notes section of

this press release. For details regarding the 31 December 2021

resources, please consult the press release dated [date] of

Endeavour.

In addition to the delineated resources, drilling conducted

during the year also confirmed mineralisation at extensions of

several known orebodies and at new targets, which will form the

basis for the 2023 drilling programme with the goal of delineating

further resources.

Sebastien de Montessus, President and CEO, said: "We are very

proud of our achievements at Ity following its successful build in

2019. The mine now ranks amongst the highest quality operations

within West Africa due to its low-cost production profile and long

mine life. This status has been underpinned by our significant

exploration success at Ity, which has led to a more than doubling

of the resource base since its feasibility study was published in

2016, coupled with a strong operating performance.

We are very pleased to demonstrate that now all three of our

flagship assets, Sabodala-Massawa, Houndé and Ity, boast M&I

resources above 5 million ounces each, with exploration remaining

an integral part of our capital allocation strategy as it underpins

our ability to maintain long mine lives and continually optimise

our portfolio. Looking ahead, we continue to see significant

exploration potential at Ity as we remain on track to achieve our

objective of discovering between 3.5 to 4.5Moz of Indicated

resources over the 2021-2025 period, with nearly 2.0Moz discovered

already. At a group level, we are pleased to also be on track to

discovering between 15 to 20Moz of Indicated resources over the

same period.

On the operational front, Ity continues to perform well as it is

on track to beat its full-year production guidance of 255--270koz

and its AISC guidance of $850--900 per ounce."

Patrick Bouisset, Executive Vice President Exploration and

Growth said: "Today's resource additions are the culmination of

several years of exploration efforts which we are extremely proud

of. We first discovered the Bakatouo deposit in late 2016, which

was soon followed by exploration successes at the Walter and Ity

Flat deposits and the West Flotouo discovery. Today, we have

successfully proven that all seven of the previously thought

independent deposits located around the Ity intrusive are in fact a

continuous mineralised system. In addition to the resource

delineated, the benefit of this discovery is the creation of a

unique resource model which is expected to greatly improve our mine

planning capabilities.

Following the work this year to prove mineralised continuity of

known orebodies and to identify mineralisation at new targets, we

believe that we are well-positioned for continued success in 2023

as we look to delineate further resources. In addition to

discoveries made in both the near-mill area and in the Le Plaque

area, we are very excited about the discovery made at Gbampleu

where several high-grade and thick lenses of mineralisation were

identified."

ITY MINE 2022 EXPLORATION PROGRAM

In recent years, exploration efforts have focused on the PE26

mining permit (which hosts the processing plant and several

deposits including Walter, Bakatouo, West Flotouo, Ity-Flat, Verse

Est, and Zia NE), on PE49 mining permit (which hosts the Daapleu

and Gbeitouo deposits) and on the PE53 mining permit (which hosts

the Le Plaque and Yopleu-Legaleu deposits and other targets

including Delta South East).

Since the beginning of the year, a total of 51,181 meters of

drilling was completed at Ity, mainly within a 20km radius from the

plant, as shown in Figures 1 and 2 in the attached pdf. The

exploration programme mostly focused on extending resources at

several near mine deposits including Walter-Bakatouo, West Flotouo,

Delta Extension at Le Plaque and Yopleu-Legaleu, delineating

potential deposit extensions at Colline Sud, and on assessing the

potential of new greenfield targets including Gbampleu, and Delta

South East.

As detailed in Table 2 below, a total of 753koz of M&I

resources were delineated since the beginning of the year, with the

additions coming from West Flotouo, Yopleu-Legaleu, Ity-Ity Flat,

Verse Est, and Walter.

Table 2: Ity Resource Additions

PREVIOUS RESOURCE UPDATED RESOURCE

(As at 31 December 2021) (Excluding 2022 mine depletion) VARIANCE

----------------------------- ------------------------------------ --------

On a 100% basis. M&I Resources shown inclusive of Au

Reserves. Tonnage Grade Content Tonnage Grade Content Content

(Mt) (Au g/t) (Au koz) (Mt) (Au g/t) (Au koz) (Au koz)

-------- --------- -------- --------- ---------- ------------- --------

West Flotouo

Measured Resource 0.0 0.00 0 0.0 0.00 0 0

Indicated Resources 9.0 2.00 582 18.7 1.80 1,083 +501

M&I Resources 9.0 2.00 582 18.7 1.80 1,083 +501

Inferred Resources 7.3 1.84 430 4.7 1.73 263 -167

Verse Est

Measured Resource 0.0 0.00 0 0.0 0.00 0 0

Indicated Resources 0.0 0.00 0 1.1 1.80 64 +64

M&I Resources 0.0 0.00 0 1.1 1.80 64 +64

Inferred Resources 1.2 1.54 61 0.5 1.31 21 -40

Walter

Measured Resource 0.0 0.00 0 0.0 0.00 0 0

Indicated Resources 8.7 1.62 451 10.2 1.56 512 +61

M&I Resources 8.7 1.62 451 10.2 1.56 512 +61

Inferred Resources 4.8 1.44 222 2.2 1.28 90 -132

Bakatouo

Measured Resource 0.0 0.00 0 0.0 0.00 0 0

Indicated Resources 7.0 2.08 467 6.8 2.14 466 -2

M&I Resources 7.0 2.08 467 6.8 2.14 466 -2

Inferred Resources 1.3 1.47 63 1.3 1.70 73 10

Ity - Ity Flat

Measured Resource 0.0 0.00 0 0.0 0.00 0 0

Indicated Resources 5.2 1.82 306 7.0 2.09 468 +162

M&I Resources 5.2 1.81 306 7.0 2.09 468 +162

Inferred Resources 5.7 1.41 255 2.8 1.80 163 -92

Zia NE

Measured Resource 0.9 2.12 61 0.0 0.00 0 -61

Indicated Resources 7.2 1.03 238 4.2 1.47 197 -41

M&I Resources 8.1 1.15 299 4.2 1.47 197 -102

Inferred Resources 5.2 1.14 191 3.6 1.63 187 -4

Yopleu-Legaleu

Measured Resource 0.0 0.00 0 0.0 0.00 0 0

Indicated Resources 0.0 0.00 0 1.2 1.78 69 +69

M&I Resources 0.0 0.00 0 1.2 1.78 69 +69

Inferred Resources 1.0 1.61 52 0.1 1.91 7 -44

Total Additions

Measured Resource 0.9 2.13 61 0.0 0.00 0 -61

Indicated Resources 37.1 1.71 2,044 49.1 1.81 2,858 +814

M&I Resources 38.0 1.72 2,105 49.1 1.81 2,858 +753

Inferred Resources 26.5 1.50 1,274 15.3 1.64 805 -469

-------------------------------------------------- -------- --------- -------- --------- ---------- ------------- --------

Updated Resource is current as at 31 December 2021, as it

excludes 2022 mine depletion. Mineral Resources Estimates follow

the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM")

definitions standards for mineral resources and have been completed

in accordance with the Standards of Disclosure for Mineral Projects

as defined by National Instrument 43-101. Reported tonnage and

grade figures have been rounded from raw estimates to reflect the

relative accuracy of the estimate. Minor variations may occur

during the addition of rounded numbers. Mineral Resources that are

not Mineral Reserves do not have demonstrated economic viability.

Resources were constrained by MII Pit Shell and based on a cut-off

grade of 0.5 g/t Au and $1,500/oz gold price. Details for the

Updated Resource are provided in the Technical Notes section of

this press release. For details regarding the 31 December 2021

resources, please consult the press release dated [date] of

Endeavour.

NEAR MILL EXPLORATION EFFORTS

The resource model 3D views, in Figures 3 and 4 in the attached

pdf, illustrate the exploration success and improved understanding

achieved in the near-mill area between 2017 (when plant

construction was launched) and today. A maiden resource for the

Bakatouo deposit was delineated in 2016 and since then several new

deposits and extensions have been discovered, including Bakatouo

extension, West Flotouo, Walter and Ity-Ity Flat. The area, which

spans 7km long by 3km wide, today hosts 2.8Moz at 1.81g/t Au.

The drilling efforts conducted in 2022 successfully demonstrated

that all 7 of the previously thought independent deposits located

around the Ity intrusive are in fact a continuous mineralised

system. This finding has resulted in the creation of a single

resource model for the area which is expected to greatly improve

mine planning capabilities.

As shown in Figure 5 in the attached pdf, lithologies in the Ity

area comprise a series of lower Proterozoic (Birimian)

volcanosediments and carbonate lenses intruded by a granodiorite.

Skarn formations have been developed in the carbonate-bearing units

in the vicinity of the intrusion. The different Ity area deposits

are distributed all around the intrusion, in both

meta-volcanosediments (West Flotouo, Flotouo Extension, Verse East)

and skarns formations (Ity, Zia NE, Walter, Bakatouo). Gold

mineralisation occurred during a late Birimian orogenic

hydrothermal event, within transpressive shear zones that developed

at the margin of the intrusion.

The geological contexts of the Le Plaque and Daapleu deposits

differ from that of Ity; in the Le Plaque area, gold mineralisation

is essentially hosted in granodiorite, which was itself intruded by

several generations of diorite; at Daapleu, gold mineralisation

occurred at the contact between meta-volcanosediments and a

rhyolitic intrusion (different from granodiorite) locally named

Daaplite.

Junction between West Flotouo and Flotouo Extension ("West

Flotouo")

-- Following promising initial results from the 2021 campaign, 76 additional

holes amounting to 16,779 meters were drilled in 2022 to increase the

resources and to delineate the northeast mineralisation extension in the

area called Flotouo Extension.

-- The West Flotouo/Flotouo Extension deposit is now the Ity mine's largest

deposit and the mineralisation remains open along strike and at depth.

-- As shown in Figures 6 and 7 in the attached pdf, the general gold

mineralisation of the West Flotouo/Flotouo Extension is overall

northeast-southwest trending, moderately dipping to the northwest and has

been identified over a 1km strike length. Host rocks comprise sheared

clastic sediments in the southern part and skarns in the northern part of

the deposit.

-- The West Flotouo/Flotouo Extension deposit will be integrated into the

mine plan as soon as possible given it is an attractive discovery due to

its high grade and very close proximity to the plant.

Junction between Walter -- Bakatouo deposit

-- A total of 51 holes amounting to 9,037 meters were drilled in 2022 to

convert the Inferred resources to Indicated status and increase the

resources at the junction between the Walter and Bakatouo skarn hosted

gold deposits.

-- As shown in Figure 8 in the attached pdf, the 2022 drill results have

returned significant intercepts with large thicknesses and high grades

which confirmed the continuity of the deposit.

-- Best selected intercepts include:

-- Hole WA22-119: 5 meters at 2.48g/t Au from 200m and 7 meters at

34.96 g/t Au from 207 meters

-- Hole WA22-134: 14 meters at 5.95g/t Au from 35 meters

-- The mineralised lenses are still open at depth and along strike.

Junction between Bakatouo Northwest - Zia Northest deposits

-- A total of 8 holes amounting to 1,008 meters were drilled in 2022 at the

junction between the Zia Northeast and Bakatouo deposits. The purpose was

to confirm the continuity of the mineralisation in this zone which is

located in proximity to the Ity plant.

-- As shown in Figure 9 in the attached pdf, the 2022 drill results returned

significant shallow mineralised intercepts, with best selected intercepts

including:

-- Hole BK22-337: 14 meters at 1.99g/t Au from 43.3 meters

-- Hole BK22-332: 10 meters at 1.24g/t from 26 meters

-- The resource additions will be quickly converted into reserves and

prioritised in the mine plan given the shallow nature of the orebody and

its proximity to the plant.

Verse Est deposit

-- A total of 16 holes amounting to 1,638 meters were drilled in 2022 at

Verse Est. The purpose was to follow-up on the positive drilling results

from the prior years' campaign, that identified the 500-meter long,

shallow lying, mineralised system, which is located in close proximity to

the Ity plant, adjacent to a former mining waste area on the Eastern side

of the Mont Ity pit.

-- As shown in Figure 10 in the attached pdf, the 2022 drill results

confirmed the continuity of the mineralisation with significant

shallow-lying intercepts with best selected intercepts including:

-- Hole VE22-105: 11 meters at 4.17g/t Au from the surface

-- Hole VE22-103: 7 meters at 1.69g/t Au from 37 meters

-- The resource additions will be quickly converted into reserves and

prioritised in the mine plan given the shallow nature of the orebody and

its proximity to the plant.

LE PLAQUE AREA EXPLORATION EFFORTS

Yopleu-Legaleu deposit

-- The Yopleu-Legaleu deposit is located 1km southeast of the previously

discovered Le Plaque deposit, where mining activities began in late 2021,

and less than 10km away from the Ity plant.

-- A maiden Inferred resource was delineated in 2021 while further drilling

in 2022, comprised of 85 holes amounting to 10,918 meters, led to the

conversion of the Inferred resource into Indicated resource status and

further resource delineation.

-- The 2022 infill drilling results confirmed the continuity of the

mineralisation within the 2021 Inferred resources pit shell and defined

significantly enhanced mineralisation potential with the discovery of

additional mineralised intervals including higher grade intervals

encountered both at depth and laterally. Some of the best selected

intercepts include:

-- Hole FL22-1746: 24 meters at 3.96g/t Au from 125 meters

-- Hole FL22-1765: 23 meters at 2.63g/t Au from 49 meters

-- The 2022 step-out drill results also confirmed that mineralisation

extends 200 meters along strike to the northeast and 450 meters to the

southwest, with high grade thick intercepts such as:

-- Hole FL22-1689: 14.0 meters at 2.49g/t Au from 81 meters and 9.0

at 6.83 g/t Au from 160 meters

Delta Extension at Le Plaque deposit

-- The Delta Extension deposit was delineated along a sub-parallel

south-eastern extension of the previously discovered Le Plaque deposit,

where mining activities began in late 2021, and is located less than 10km

away from the Ity mill. A total of 5 holes amounting to 635 meters were

drilled in 2022.

-- As shown in Figure 11 in the attached pdf, the drill results confirmed

the continuity, at shallow depth, of the Delta Extension mineralised vein

system, toward the southeast underneath the 2021 pit shell.

-- Best selected intercepts include:

-- Hole FL22-1675: 9 meters at 2.22g/t Au from 67 meters

-- Hole FL22-1675: 5 meters at 2.58g/t Au from 97 meters

Delta Sud-Est new discovery

-- The newly discovered Delta Sud-Est target covers a 1km by 700 meter area,

located 1km southwest and 300 meters Sout East from the Yopleu-Legaleu

and Delta deposits.

-- This area had been preliminarily outlined in 2020 with an initial Air

Core ("AC") drilling and in 2021 with 1 RC hole amounting to 152 meters

and 4 DD holes amounting to 712 meters with initial positive results.

This year, a more systematic drilling campaign with 28 RC holes drilled

amounting to 2,753 meters was focussed on Delta Sud-Est.

-- The 2022 drill results confirmed the presence of several parallel

mineralised veins within granodiorite that seem to be on a trend and

possibly continuous with the Yopleu-Legaleu vein system.

-- Best selected intercepts including:

-- Hole FL22-1710: 7 meters at 3.08g/t Au from 77 meters

-- Hole FL22-1723: 3 meters at 10.57g/t Au from 59 meters

-- These results confirm the potential of the Delta Sud-Est target and as

such a follow-up drilling program is planned for 2023.

OTHER NEAR-MILL DEPOSITS

Colline Sud deposit

-- The Colline Sud deposit is located 1 km southwest of the historical Mont

Ity deposit, and approximately 5km away from the processing plant.

-- Following the results of former exploration AC and grade control drilling

programmes, a further 34 holes amounting to 3,544 meters were drilled in

2022.

-- The 2022 drill results confirmed the along strike extension of the gold

mineralisation over 300 meters to the northeast, in addition to

identifying a 300 meter long parallel trend immediately to the southwest,

with best selected intercepts including:

-- Hole CS22-177: 4 meters at 6.30g/t Au from 77 meters, including 1

meter at 14.75 g/t Au from 79 meters, and 8.0 meters at 8.98 g/t

Au from 84, including 1 meter at 25.30 g/t Au from 87 meters, and

including 1 meter at 13.80 g/t Au from 89 meters, and including 1

meter at 20 g/t Au from 91 meters

-- Hole CS22-187: 9 meters at 1.39 g/t Au from 16 meters and 5 meters

at 1.41 g/t Au from 32 meters

Daapleu deposit

-- The Daapleu deposit is located approximately 5km from the processing

plant.

-- A total of 60 shallow depth holes amounting to 4,407 meters were drilled

in 2022 with a new mineralised vein system intercepted along the

continuity of the Daapleu deposit, over 350 meters to the northeast. Best

selected intercepts include:

-- Hole DA22-644: 2 meters at 1.00g/t Au from 25 meters and 7 meters

at 5.16g/t Au from 41 meters including 1.0 meter at 12.70g/t Au

-- Hole DA22-645: 7 meters at 1.30g/t Au from 90 meters and 4 meters

at 1.20g/t Au from 106 meters

-- These results will be included in the next resource update and will be

followed up with the 2023 drilling campaign.

GBAMPLEU NEW DISCOVERY

-- As shown in Figure 1 in the attached pdf, the Gbampleu discovery is

located in the Toulepleu exploration permit (PR462), located 22km south

of the Ity plant. Gbampleu sits in the central part of the Toulepleu-Ity

greenstone belt, on the southern border of the Guiamapleu granodioritic

mole.

-- Gbampleu was ranked as a highly prospective target based on a historic

gold-in-soil survey which highlighted a north-south striking, 1.3 km x

0.6km, anomaly (with >100ppb Au), which overlays steeply dipping,

southwest-northeast oriented, Birimian rocks composed of meta-volcanic

formations (dominantly mafic) and a set of gneissic rocks of more felsic

composition (Zeitouo gneiss).

-- A first RC drilling program, totalling 50 holes amounting to 4,920 meters

was completed in 2021. Following the promising results of this campaign,

a combined RC-DD program comprising 17 holes amounting to 3,212 meters

have been drilled so far this year, to define the controlling factors of

the mineralisation and to delineate the deposit over 450 meters along

strike, where drill results have confirmed high grade mineralisation.

Drilling is ongoing with the along strike extension remaining to be

tested.

-- Best selected intercepts include:

-- Hole GP22-051: 43.25 meters at 11.32 g/t Au from 175.8 meters,

including 4.3 meters at 29.81 g/t Au from 178.75 meters, including

3 meters at 61.68 g/t Au from 185 meters, including 2 meters at

31.18 g/t Au from 193 meters and including 2 meters at 10.95 g/t

Au from 206 meters

-- As shown in Figures 12 and 13 in the attached pdf, high gold grades

(notably with visible gold) have been intercepted in highly silicified

zones within Biotite Gneiss characterized by penetrative silicification

and abundant quartz pods or strongly deformed quartz-filled veins and

breccia. Some of these veins are also filled with chlorite and sulphides

(pyrite, sphalerite).

All intercepts reported above are apparent thickness.

TECHNICAL NOTES

Ity Area Resource Modelling

The statistical analysis, geological modelling and resource

estimation were prepared by the Endeavour resource team, under the

direction of Kevin Harris (CPG) VP Resources for Endeavour as the

Qualified Person as defined by NI 43-101.

The Grand Ity resource update is based upon updated drilling

data and interpretations. The Ity Mineral Resource model was

developed in Seequent's Leapfrog Geo and Geovia's Surpac modelling

software. The database used to generate the Mineral Resources

comprised some 2,112 drill holes, with a total of 264,788 meters

drilled. The updated model is based upon 152 new drill holes

totalling 29,034 meters. The drilling data are supported by

industry standard quality assurance and quality control systems,

with quality control sampling comprising blanks, coarse blanks,

certified reference materials, and field and pulp duplicates. The

Resource team has reviewed the QAQC data and are confident they are

of high standard to be used in resource estimation.

146 mineralisation domains were modelled using geology and grade

continuity, by selecting intervals which forms part of each

mineralisation lenses; a nominal cut-off of 0.5g/t Au. The Grand

Ity deposit was divided into 7 resource areas named: Bakatouo NW,

West Flotouo, Verse Est, Walter, Bakatouo, Ity-Ity Flat and ZiaNE.

The gold assays from the drill holes were composited to 1.0 meter

intervals within the modelled zone. Capping varied depending on the

mineralised domain, between no cap and 45g/t Au.

Density measurements from 4,929 samples and covering each of the

material types and major lithology were averaged based on the

material type. Average density values were applied to the

associated portions of the block model as outlined below:

-- Laterite/Overburden: 1.80 g/cm3

-- Saprolite: 1.50 g/cm3

-- Saprock: 2.50 g/cm3

-- Fresh: 2.90 g/cm3

Gold grades were estimated using Ordinary Kriging for most of

the mineralised domains. Where it was not possible to define a

well-structured variogram for the smallest domains with low sample

support, an Inverse Distance Squared ("IDW2") estimator was used.

The grade was in multiple passes to define the higher confidence

areas and extend the grade to the interpreted mineralised zone

extents.

The grade estimation was validated with visual and statistical

analysis and comparison with the drilling data on sections with

swath plots comparing the block grades with the composites.

The quality and spatial distribution of the data used and the

geological continuity of the mineralisation and the quality of the

estimated block model for Grand Ity is sufficient for the reporting

of Indicated and Inferred Mineral Resources. Indicated Mineral

Resources have typically been defined in areas within a search

range of 40-45 meters, where there is a reasonable level of

confidence in geological and grade continuity. Inferred Mineral

Resources have typically been defined in areas outside the first

pass estimation range of 40-45 meters and where the continuity and

confidence is reduced.

Mineral Resources are reported within a Whittle optimised pit

shell using cut-off of grades of 0.5 g/t Au. Optimisation

parameters used are as below:

-- Mining cost: $2.66 - $3.66/t Oxide; $3.43 - $4.27/t Transition; $3.70 -

$4.39/t Fresh

-- Processing cost + G&A + Ore cost: Oxide: $16.56 - $20.67/t; Transition

$16.81 - 30.05/t; Fresh: $16.92 - $20.80/t

-- Selling cost: $9.15/oz Au Transportation and Refining; Royalty of 3.5%

-- Mining recovery: 95%

-- Mining dilution: 0%

-- Processing recovery: Oxide 80.2 - 93.6%; Transition 85.2 - 96.2%; Fresh

84.7 - 96.2%

-- Average slope angles: Oxide 33deg; Transition 33deg; Fresh 42.3deg-

58.4deg

Yopleu-Legaleu Resource Modelling

The statistical analysis, geological modelling and resource

estimation were prepared by the Endeavour resource team, under the

direction of Kevin Harris (CPG) VP Resources for Endeavour as the

Qualified Person as defined by NI 43-101.

The Yopleu-Legaleu resource update are based upon updated

drilling data and interpretations as of October 2022. The

Yopleu-Legaleu Mineral Resource model was developed in Seequent's

Leapfrog Geo and Geovia's Surpac modelling software. The database

used to generate the Mineral Resources comprised 357 drillholes,

with a total of drilling meters of 29,071 meters. The updated model

is based upon 85 new drillholes totalling 10,918 meters. The

drilling data are supported by industry standard quality assurance

and quality control systems, with quality control sampling

comprising blanks, coarse blanks, certified reference materials,

and field and pulp duplicates. Resource team has reviewed the QAQC

data and are confident they are of high standard to be used in

resource estimation.

Sixteen mineralisation domains were modelled using geology and

grade continuity, by selecting intervals which forms part of each

mineralisation lenses; a nominal cut-off of 0.4g/t Au. The gold

assays from the drill holes were composited to 1.0 meter intervals

within the modelled zone. Capping varied depending on the

mineralised domain, between no cap and 10g/t Au.

Density measurements from 294 samples and covering each of the

material types and major lithology were averaged based on the

material type. Average density values were applied to the

associated portions of the block model as outlined below:

-- Laterite/Overburden: 1.70 g/cm3

-- Saprolite: 1.58 g/cm3

-- Saprock: 2.36 g/cm3

-- Fresh: 2.71 g/cm3

Gold grades were estimated using Inverse Distance Squared and

Ordinary Kriging for all of the mineralised domains. Generally, it

was not possible to define a well-structured variogram models for

most of the domains. The two methods produced similar results so

the Inverse Distance Squared method was chosen. The grade was in

multiple passes to define the higher confidence areas and extend

the grade to the interpreted mineralised zone extents.

The grade estimation was validated with visual and statistical

analysis and comparison with the drilling data on sections with

swath plots comparing the block grades with the composites.

The quality and spatial distribution of the data used and the

geological continuity of the mineralisation and the quality of the

estimated block model for Yopleu-Legaleu is sufficient for the

reporting of Indicated and Inferred Mineral Resources. Indicated

Mineral Resources have typically been defined in areas within a

search range of 40 m, where there is a reasonable level of

confidence in geological and grade continuity. Inferred Mineral

Resources have typically been defined in areas outside the first

pass estimation range of 40 meters and where the continuity and

confidence is reduced.

Mineral Resources are reported within a Whittle optimised pit

shell using cut-off of grades of 0.5 g/t Au. Optimisation

parameters used are as below:

-- Mining cost: $2.80/t Oxide; $3.50/t Transition; $3.69/t Fresh

-- Processing cost + G&A + Ore cost: Oxide: $21.85/t; Transition $21.85/t;

Fresh: $21.92/t

-- Selling cost: $70/oz Au gold

-- Mining recovery: 95%

-- Mining dilution: 0%

-- Processing recovery: Oxide 95%; Transition 93%; Fresh 88%

-- Average slope angles: 40deg

Drilling, Assay, Quality Assurance / Quality Control

Procedures

Reverse Circulation ("RC") and Air Core ("AC") drilling delivers

material to the surface via percussion hammer pushing pulverized

rock into dual tube rods which evacuate the material to the surface

via high pressure compressed air. The samples are collected from

the cyclone at surface at 1-meter intervals. The cyclone is cleaned

after every 6-meter rod by flushing the hole. Additional manual

cleaning is required in saprolitic or wet ground, closely monitored

by the site geologist / geotechnician to ensure no sample to sample

contamination occurs.

Samples are split at the drill site using several different

riffle splitters, based on bulk sample weight. 2-5kg laboratory and

a second 2-5kg reference sample are collected. Bulk and laboratory

sample weights, in addition to moisture levels are recorded.

Representative samples for each interval were collected with a

spear, sieved into chip trays and retained for reference.

Drill core (PQ, HQ and NQ size) samples are selected by

Endeavour geologists and sawn in half with a diamond blade at the

project site. Half of the core is retained at the site for

reference purposes. Sample intervals are generally 1 meter in

length.

All samples are transported to the ALS preparation laboratory at

the Exploration office site at the Ity Mine. Each laboratory sample

is secured in poly-woven bags ensuring that there is a clear record

of the chain of custody. On arrival samples are weighed. Complete

samples are crushed to 2mm (70% passing) with 1 kg split out for

pulverization. The entire 1 kg is pulverized 75<MU>m (85%

passing). A 250 gram final pulp sample is prepared. These 250 gram

pulps are packaged in cardboard boxes and shipped to ALS

Ouagadougou. At ALS Ouagadougou a 50 gram pulp sample is extracted

from the final 25 gram pulp and analysed for gold (Au) using

standard fire assay techniques. An Atomic Absorption ("AA") finish

provides the final Au value.

Blanks, field duplicates and certified reference material

("CRM's") are inserted into the sample sequence by Endeavour

geologists at a rate of 1 of each samples type per 20 samples. This

ensures that there is a 5% Quality Assurance / Quality Control

("QA/QC") sample insertion rate applied to each fire assay batch.

The sampling and assaying are monitored through analysis of these

QA/QC samples. This QA/QC program was audited by a consultant,

independent from Endeavour Mining and has been verified to follow

industry best practices.

In February 2022, 1,017 samples from the 2021 drilling program

were sent to ALS Ouagadougou for umpire (referee) analysis.

Comparison of the Original analysis against the umpire analysis

revealed a moderate Correlation Coefficient of 72% for all samples.

When the Au data was capped at 20 ppm the Correlation Coefficient

increased to a strong 92.8 %. It is not unusual for very high grade

samples to show highly variable results even when the same samples

are analysed at the same lab a second time. Endeavour accepts these

Umpire assay results from ALS Ouaga and have confidence that the

original assays provided by are accurate.

Core sampling and assay data were monitored through a quality

assurance/quality control program designed to follow NI 43-101 and

industry best practice.

Full drill results are available by clicking here

https://www.globenewswire.com/Tracker?data=wABg9rjs36C1PNW_Mjt7smLKXyIVCu-ZRVLu0rOXcXWYysh7uiObsf_chYn4Uyar7Ra1Do6jHwFMcwJGYQuUyTueYlAX5OVbJDwS5C_s5HUE4_fVJWLfiUC99EiUIy7q5DVvm5Ycyl5rk4UESgReFkgp7Dn8FdGusGNzFJDQGLs=

.

QUALIFIED PERSONS

The scientific and technical content of this news release has

been reviewed, verified and compiled by Silvia Bottero,

Professional Natural Scientist, VP Exploration Côte d'Ivoire for

Endeavour Mining. Silvia Bottero has more than 20 years of mineral

exploration and mining experience and is a "Qualified Person" as

defined by National Instrument 43-101 -- Standards of Disclosure

for Mineral Projects ("NI 43-101"). The resource estimation was

completed by Kevin Harris, CPG, VP Resources for Endeavour Mining

and "Qualified Person" as defined by National Instrument

43-101.

CONTACT INFORMATION

Martino De Ciccio Brunswick Group LLP in London

VP -- Strategy & Investor Relations Carole Cable, Partner

+44 203 640 8665 +44 7974 982 458

mdeciccio@endeavourmining.com ccable@brunswickgroup.com

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is one of the world's senior gold producers and

the largest in West Africa, with operating assets across Senegal,

Cote d'Ivoire and Burkina Faso and a strong portfolio of advanced

development projects and exploration assets in the highly

prospective Birimian Greenstone Belt across West Africa.

A member of the World Gold Council, Endeavour is committed to

the principles of responsible mining and delivering sustainable

value to its employees, stakeholders and the communities where it

operates. Endeavour is listed on the London and Toronto Stock

Exchanges, under the symbol EDV.

For more information, please visit

https://www.globenewswire.com/Tracker?data=eC7sbdFK2E7EVFn585CuajdC3zQOve-Hme9x15XXrm1c23GiZwYheLDfd5Fg0dcmzJmEGvQvotpnCcQJShNkH7Dee-a3BGf8LhU_2wxIw4g=

www.endeavourmining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release contains "forward-looking statements"

including but not limited to, statements with respect to

Endeavour's plans for further exploration of the Ity property, the

ability of Endeavour to convert Inferred resources into Indicated

resources, the integration of the West Flotouo deposit into the

mine plan, improvements to Endeavour's mine planning capabilities,

the extent and timing of Endeavour's drilling campaign, estimation

of mineral resources, and the success of exploration activities.

Generally, these forward-looking statements can be identified by

the use of forward-looking terminology such as "expects",

"expected", "budgeted", "forecasts", and "anticipates".

Forward-looking statements, while based on management's best

estimates and assumptions, are subject to risks and uncertainties

that may cause actual results to be materially different from those

expressed or implied by such forward-looking statements, including

but not limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business.

Attachment

Attachment

-- 221129 - NR - Ity Resource Update

https://ml-eu.globenewswire.com/Resource/Download/eb079bb0-6ef3-4242-a5da-f94233559ae6

(END) Dow Jones Newswires

November 29, 2022 02:00 ET (07:00 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

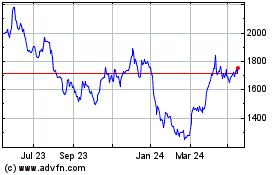

Endeavour Mining (LSE:EDV)

Historical Stock Chart

From Oct 2024 to Nov 2024

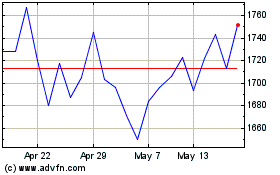

Endeavour Mining (LSE:EDV)

Historical Stock Chart

From Nov 2023 to Nov 2024