DP Poland PLC Trading Update (5670E)

February 11 2015 - 2:00AM

UK Regulatory

TIDMDPP

RNS Number : 5670E

DP Poland PLC

11 February 2015

DP Poland PLC ("DP Poland" or the "Company")

Update on Store Performance for the full year to 31 December

2014, unaudited.

System sales up 35%. 9 consecutive quarters of double digit

like-for-like system sales growth. Step change in store EBITDA

performance.

DP Poland, through its wholly owned subsidiary DP Polska S.A.,

has the exclusive right to develop, operate and sub-franchise

Domino's Pizza stores in Poland. It currently operates 12 corporate

stores in Warsaw and Krakow and sub-franchises 6 stores in

Warsaw.

Highlights

-- System sales(1) PLN 20.4m 2014 vs PLN 15.1m 2013 up 35%

-- Strong like-for-likes(2)

o Like-for-like system sales (PLN) up 19%

o Like-for-like gross profit(3) (PLN) up 18%

o Like-for-like order count(4) up 19%

-- Total stores(5) EBITDA positive for each month of Q4 2014

-- Top 3 corporate stores averaged +GBP24k(6) EBITDA each in 2014 vs -GBP12k(6) each in 2013

-- Oldest corporate store delivers EBITDA of +GBP34k(6) in 2014

-- Franchisees reporting growing sales and profitability

-- Significant new store openings targeted for 2015

Peter Shaw, Chief Executive of DP Poland said:

"Sustained double digit like-for-like system sales growth

coupled with continuing reductions in food and operational costs

resulted in significant improvements in store EBITDA

performance.

Our top 3 stores averaged GBP24k EBITDA profit each in 2014,

compared to an average loss of -GBP12k each in 2013. This

transformation in store performance is set to continue in 2015 as

we focus on providing our customers with great product, great

service and attractive promotions, supported by continuing

improvements in food costs.

We reached a milestone in Q4 2014 with total store EBITDA

becoming positive for each month during the quarter. This total

includes our newest stores in Krakow as we grow customer numbers

and progress towards EBITDA breakeven.

I am delighted to report that the stores recently acquired by

our first franchisees are performing well, exhibiting strong sales

growth and generating profitable commissary sales of food and

non-food items for DP Polska.

This strong sales performance continued into January 2015 with

like-for-like system sales at +18%."

11 February 2015

(1) System Sales - total retail sales including sales from

corporate and sub-franchised stores

(2) Like-for-like growth in PLN, matching trading periods for

the same stores between 1 January and 31

December, 2013 and 1 January and 31 December, 2014

(3) Sales minus food costs. This figure excludes sub-franchised

stores

(4) Order count for corporate and sub-franchised stores

(5) Total stores include corporate and sub-franchised stores

(6) Exchange rate average for 2014 GBP1:PLN 5.1924

Enquiries:

DP Poland PLC

Peter Shaw, Chief Executive

www.dppoland.com 020 3393 6954

Peel Hunt LLP

Dan Webster/ Richard Brown/George

Sellar 020 7418 8900

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTDMGMZVGLGKZM

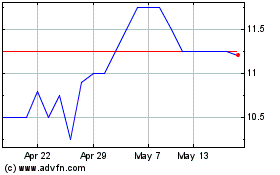

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Dp Poland (LSE:DPP)

Historical Stock Chart

From Jul 2023 to Jul 2024